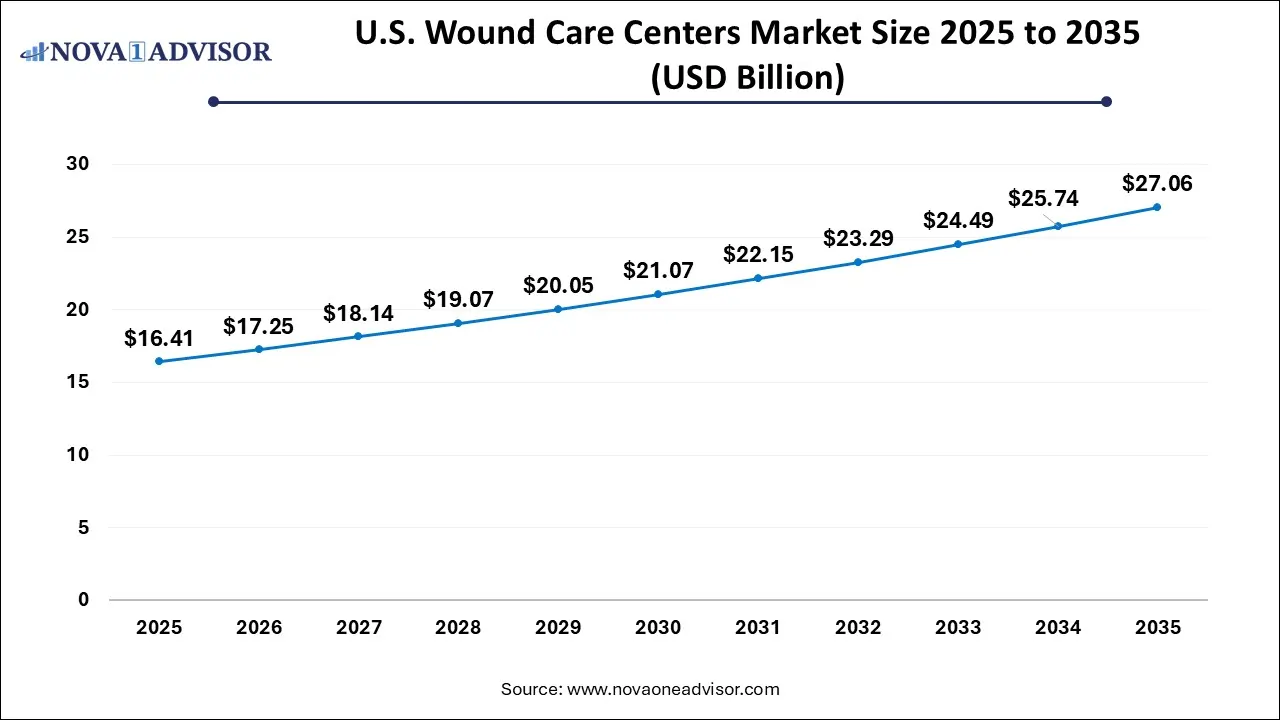

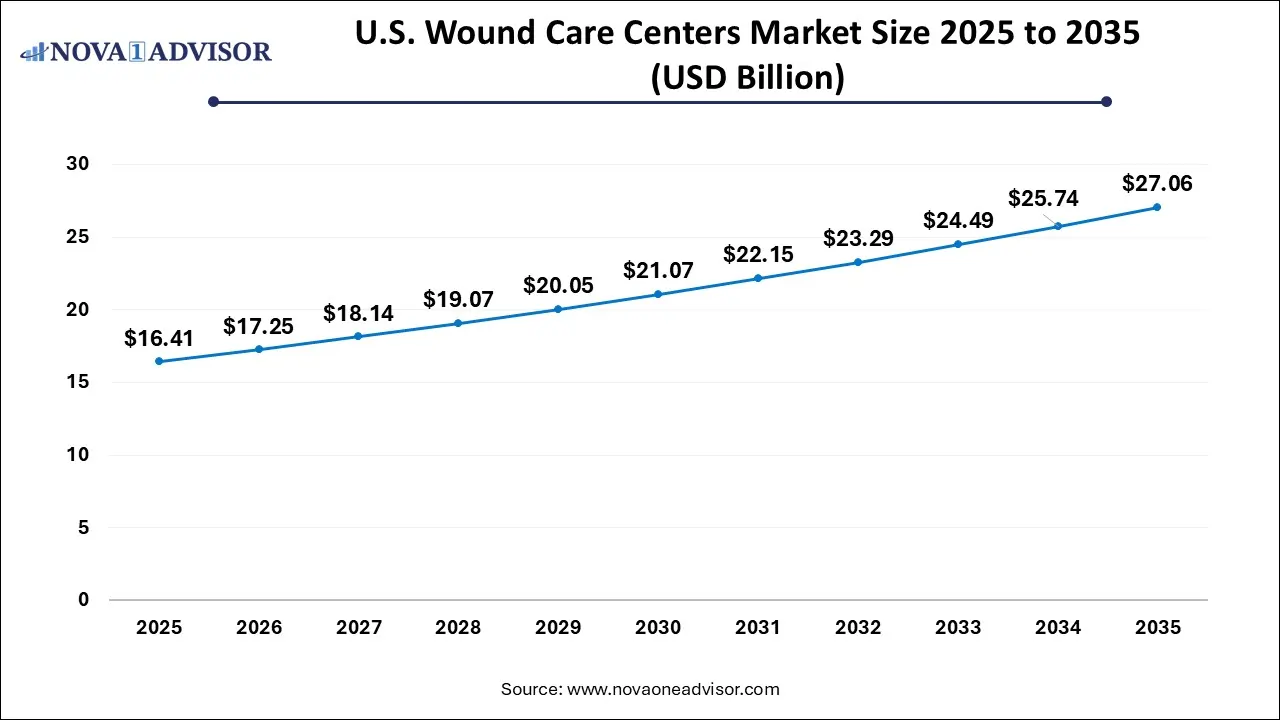

U.S. Wound Care Centers Market Size and Growth

The U.S. wound care centers market size was exhibited at USD 16.41 billion in 2025 and is projected to hit around USD 27.06 billion by 2035, growing at a CAGR of 5.13% during the forecast period 2026 to 2035.

Market Outlook

Market Growth Overview: The U.S. wound care centers market is expected to grow significantly between 2025 and 2034, driven by the increasing aging population, high prevalence of chronic diseases, and growing preference for convenient, efficient outpatient wound care centers.

Sustainability Trends: Sustainability trends involve digitalization and AI integration, telehealth and remote monitoring, and advanced and bioactive dressings.

Major Investors: Major investors in the market include Smith & Nephew, 3M (now Solventum), Convatec, Mölnlycke Health Care, and Cardinal Health.

Startup Economy: The startup economy is focused on bioengineered skin substitutes and regenerative medicine, digital health and AI integration, and portable and homecare solutions.

Strategic Overview of the Global U.S. Wound Care Centers Industry

The U.S. wound care centers market represents a vital segment of the nation’s healthcare ecosystem, providing specialized treatment for acute, chronic, and non-healing wounds. These dedicated centers combine advanced technologies, multidisciplinary clinical expertise, and coordinated care strategies to treat complex wound cases such as diabetic ulcers, pressure sores, and post-surgical infections. With the rising incidence of chronic conditions like diabetes, vascular disease, and obesity conditions that increase the risk of wound complications wound care centers have become indispensable in improving patient outcomes, reducing hospital readmissions, and optimizing resource utilization.

In recent years, the demand for wound care centers in the U.S. has surged due to the aging population, increasing prevalence of chronic illnesses, and growing awareness of advanced wound management techniques. Medicare and private payers are acknowledging the cost-saving potential of outpatient wound care services, further driving market growth. Moreover, the COVID-19 pandemic accelerated the adoption of telehealth services and remote wound monitoring, especially among immobile or elderly patients. Integrated care models supported by real-time data sharing and AI-driven analytics have also emerged as crucial enablers of wound healing efficiency.

Key market participants, including Healogics, RestorixHealth, and Woundtech, have been expanding their clinical footprints and digital capabilities to address the needs of both urban and rural populations. As hospitals prioritize value-based care and seek to prevent complications that increase costs and prolong recovery times, the strategic importance of wound care centers continues to rise.

Impact of AI on the U.S. Wound Care Centers Market?

Artificial Intelligence: The Next Growth Catalyst in U.S. Wound Care Centers

AI is significantly impacting the U.S. wound care industry by transforming traditional, subjective assessment methods into objective, data-driven processes. AI-powered solutions, particularly mobile apps and integrated platforms utilizing computer vision, automate precise wound measurement and tissue classification, which reduces manual errors and documentation time for clinicians. The technology enables the development of predictive models that forecast healing trajectories and identify high-risk patients for conditions like diabetic foot ulcers, allowing for early intervention and personalized treatment plans. Furthermore, AI facilitates remote patient monitoring and telehealth integration, expanding access to specialist care and helping to alleviate the substantial economic burden of chronic wounds on the U.S. healthcare system.

Major Trends in the Market

-

Rise of Multidisciplinary Care Models: Wound care centers are increasingly adopting collaborative care involving vascular surgeons, endocrinologists, podiatrists, and nutritionists to deliver holistic treatment.

-

Integration of Artificial Intelligence: AI-based platforms are being used for wound image analysis, predicting healing timelines, and automating documentation for EHRs.

-

Shift to Outpatient Settings: Hospitals are transforming underutilized departments into dedicated outpatient wound clinics to enhance accessibility and reduce inpatient burden.

-

Use of Smart Dressings: Next-gen dressings with embedded sensors that monitor pH, temperature, and exudate levels are gaining traction.

-

Telemedicine and Remote Wound Monitoring: Virtual consultations and app-based wound tracking tools have become essential, particularly for rural and home-bound patients.

-

Hyperbaric Oxygen Therapy (HBOT) Modernization: Wound centers are investing in newer HBOT chambers that are safer, quieter, and more patient-friendly.

Report Scope of The U.S. Wound Care Centers Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 17.25 Billion |

| Market Size by 2035 |

USD 27.06 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.13% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Procedure |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Baptist Health South Florida; TOWER Wound Care Center; SNF Wound Care; Wound Care Center NYC; Wound Institute of America; EmergeOrtho; North Shore Health and Hyperbarics; Natchitoches Regional Medical Center; Schoolcraft Memorial Hospital; Clarion Hospital; Healogics, Inc. |

Market Driver: Increasing Chronic Disease Burden

A significant driver of the U.S. wound care centers market is the escalating burden of chronic diseases that impair natural wound healing. According to the American Diabetes Association, approximately 11.6% of the U.S. population had diabetes as of 2023, and up to 25% of these patients are at risk of developing diabetic foot ulcers. Similarly, vascular diseases and immobility from obesity often result in venous leg ulcers or pressure injuries. These chronic wounds are complex and require specialized treatment protocols that cannot be effectively addressed through general healthcare services. Wound care centers offer advanced diagnostics, debridement, pressure offloading, and infection control services tailored to individual wound etiologies. Their ability to accelerate healing and prevent amputations not only improves quality of life but also reduces the long-term costs associated with chronic wound management.

Market Restraint: High Operational Costs and Reimbursement Limitations

Despite growing demand, one of the major challenges faced by wound care centers is the high cost of operations, including advanced technologies, specialist staff, and regulatory compliance. Many wound care procedures, such as hyperbaric oxygen therapy and biologic dressings, involve substantial expenditures. Additionally, reimbursement policies vary significantly across states and payers. For instance, some insurance providers may not fully cover certain procedures or limit the number of sessions reimbursed, placing financial strain on both providers and patients. These inconsistencies can deter smaller healthcare providers from establishing wound care centers and may delay access to care for patients in underserved areas. Moreover, the administrative burden of billing and coding for complex wound treatments adds another layer of complexity for facilities aiming to maintain profitability.

Market Opportunity: Technological Integration for Remote Wound Management

The integration of digital health solutions presents a compelling growth opportunity in the U.S. wound care centers market. With the expansion of telemedicine, wearable wound sensors, and mobile apps, providers can now remotely monitor wound progression, detect early signs of infection, and engage patients in self-care. This model significantly enhances care for patients in rural settings or those with mobility limitations. Companies like Swift Medical have pioneered smartphone-based wound imaging and analytics platforms that help clinicians assess wound severity remotely. Furthermore, AI-driven tools that integrate with EHRs can suggest personalized treatment plans, flag deteriorating cases, and streamline documentation. As healthcare shifts towards value-based reimbursement, digital integration supports both clinical efficacy and operational efficiency, making it a crucial opportunity for wound care centers aiming to scale and differentiate.

U.S. Wound Care Centers Market By Procedure Insights

Debridement has long been the most widely performed procedure within U.S. wound care centers due to its foundational role in promoting wound healing. Whether performed surgically, enzymatically, or via autolysis, debridement is essential for removing necrotic tissue and preparing the wound bed for recovery or additional treatments. The frequency with which this procedure is required, especially in chronic wounds like diabetic ulcers and venous leg ulcers, cements its position as the dominant segment. Furthermore, many wound care centers offer debridement as part of their initial care protocol, reinforcing its relevance in first-line treatment strategies. Patients often require multiple sessions, ensuring sustained demand and revenue generation for providers.

Negative Pressure Wound Therapy (NPWT), on the other hand, is emerging as the fastest-growing procedural segment. NPWT uses a vacuum dressing to remove exudate and promote perfusion, proving especially effective for deep, complex, or post-surgical wounds. With the introduction of portable NPWT devices, this therapy has extended into home-care settings, allowing for continuous treatment even after discharge from hospitals. Companies like 3M (KCI) and Smith & Nephew have launched compact, user-friendly NPWT systems that are gaining popularity across wound care centers. The increased adoption of NPWT stems from its demonstrated ability to reduce healing time, minimize infection risk, and decrease the need for more invasive interventions.

Hyperbaric Oxygen Therapy and Specialized Dressings also contribute significantly. Hyperbaric Oxygen Therapy (HBOT) is especially useful for radiation-induced injuries and refractory osteomyelitis, while specialized dressings with antimicrobial, hydrophilic, or growth factor properties enhance wound closure outcomes. While not as frequent as debridement, these procedures are pivotal in treating hard-to-heal wounds.

By Infection Control & Others: Infection control procedures, including topical antimicrobial application and advanced diagnostic assessments, form a critical part of ongoing wound management. They serve as both preventive and reactive interventions, especially in patients with compromised immune systems or histories of recurrent infections. As antimicrobial resistance becomes a larger issue in the U.S., wound care centers are investing in innovative pathogen-specific diagnostics and treatments.

Country-Level Analysis

Strategic Overview of the Global U.S. Wound Care Centers Industry

Within the United States, wound care centers are unevenly distributed, with higher concentrations in metropolitan and suburban regions. States such as California, Florida, and Texas lead in the number of wound care centers due to their large elderly populations and advanced healthcare infrastructure. Urban centers benefit from access to experienced clinicians, advanced equipment, and partnerships with tertiary hospitals. Meanwhile, rural regions often face challenges such as limited specialist availability and long travel distances. However, this has prompted the emergence of hybrid models combining in-clinic care with telehealth support. Public health initiatives and grants have also encouraged the establishment of wound care centers in underserved areas.

Value Chain Analysis of the U.S. Wound Care Centers Market

In terms of policy, states with Medicaid expansion and supportive telehealth laws have witnessed faster growth in outpatient wound care services. The increasing adoption of accountable care organizations (ACOs) and bundled payment models has further incentivized hospitals to reduce chronic wound complications. As such, state-level policy and payer collaboration remain key to unlocking further market potential in the U.S.

Some of the prominent players in the U.S. wound care centers market include:

- Healogics, Inc.

- TOWER WOUND CARE CENTER

- Wound Care Center NYC

- SNF Wound Care

- WOUND INSTITUTE OF AMERICA

- Schoolcraft Memorial Hospital

- EmergeOrtho

- Clarion Hospital

- North Shore Health and Hyperbarics

- Baptist Health South Florida

- Natchitoches Regional Medical Center

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. wound care centers market.

Procedure

- Debridement

- Negative Pressure Wound Therapy

- Compression Therapy

- Hyperbaric Oxygen Therapy

- Specialized Dressings

- Infection Control & Others