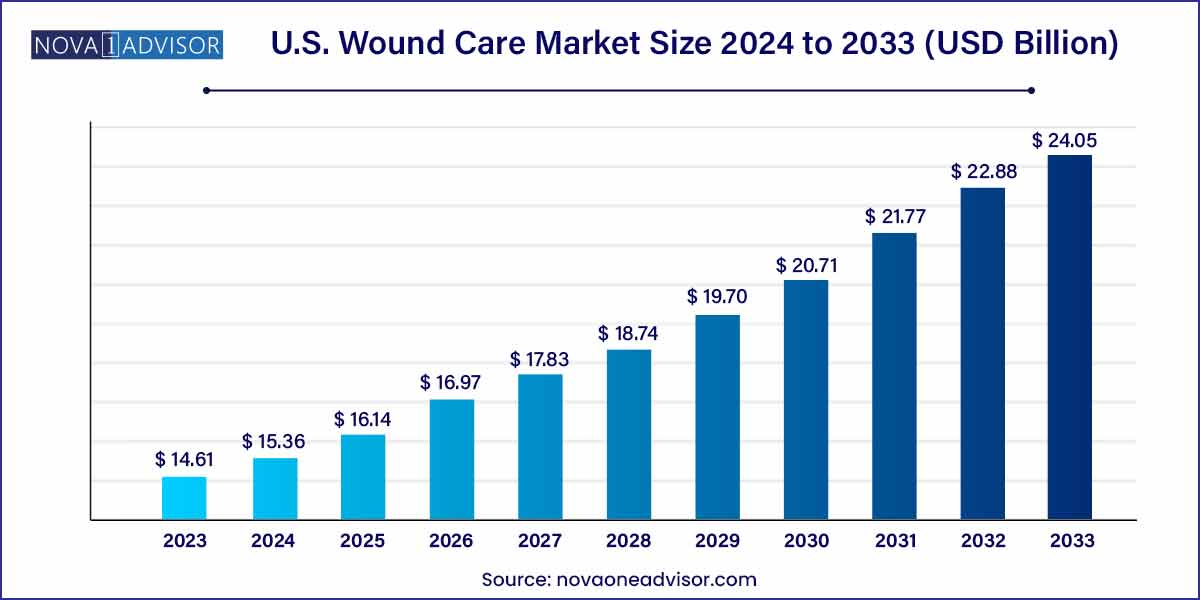

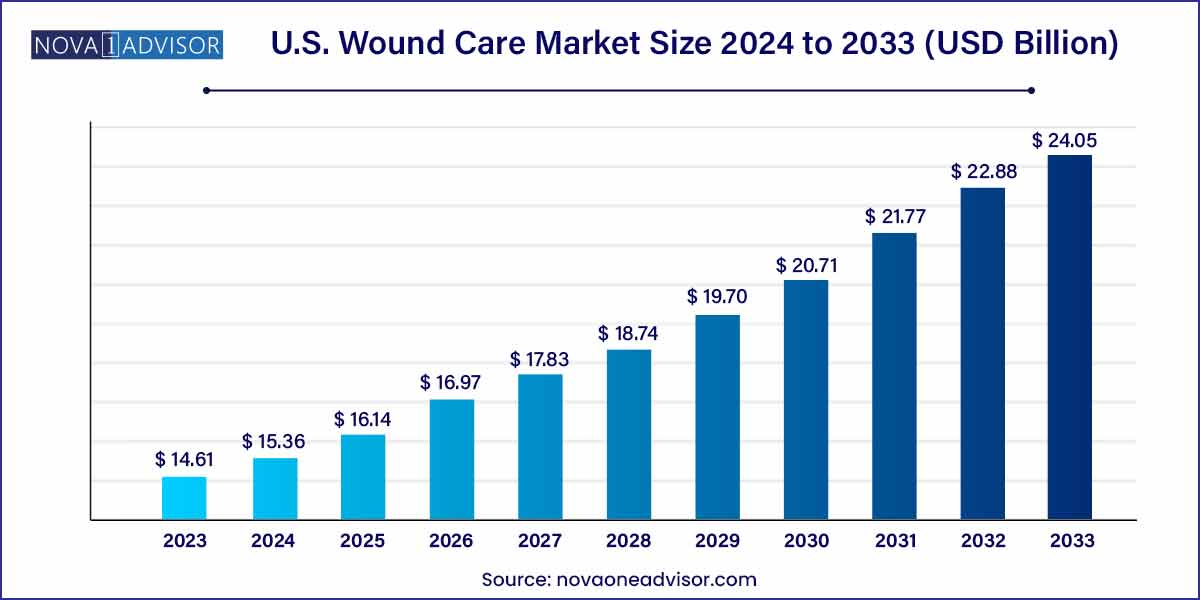

The U.S. wound care market size was estimated at USD 14.61 billion in 2023 and is projected to hit around USD 24.05 billion by 2033, growing at a CAGR of 5.11% during the forecast period from 2024 to 2033.

Key Takeaways:

- The institutional sales segment dominated the market with a market share of 82.06% in 2023.

- The retail sales segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.49% in 2024 to 2033.

- The market with the highest market share of around 34.94% in 2023 and is also expected to grow at the highest compound annual growth rate (CAGR) of 4.37% from 2024 to 2033.

- The chronic wounds segment dominated the market with a market share of 60.13% in 2023.

- The acute wounds segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.23% in 2024 to 2033.

- The hospitals segment held the largest share of 45.17% in the market in 2023.

- The home care segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.82% from 2024 to 2033.

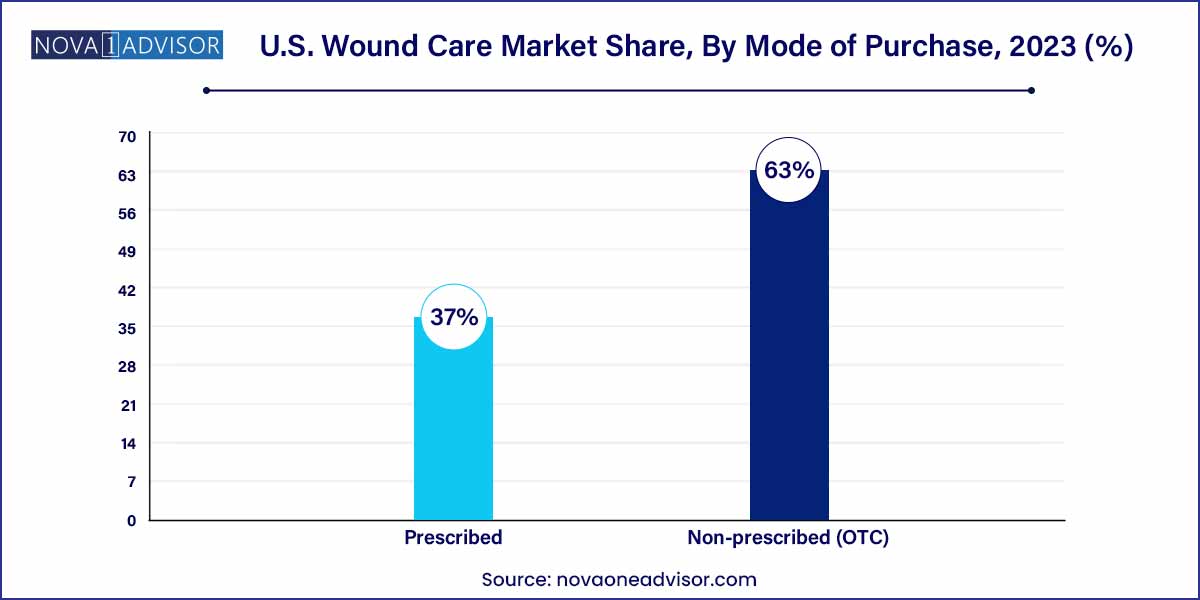

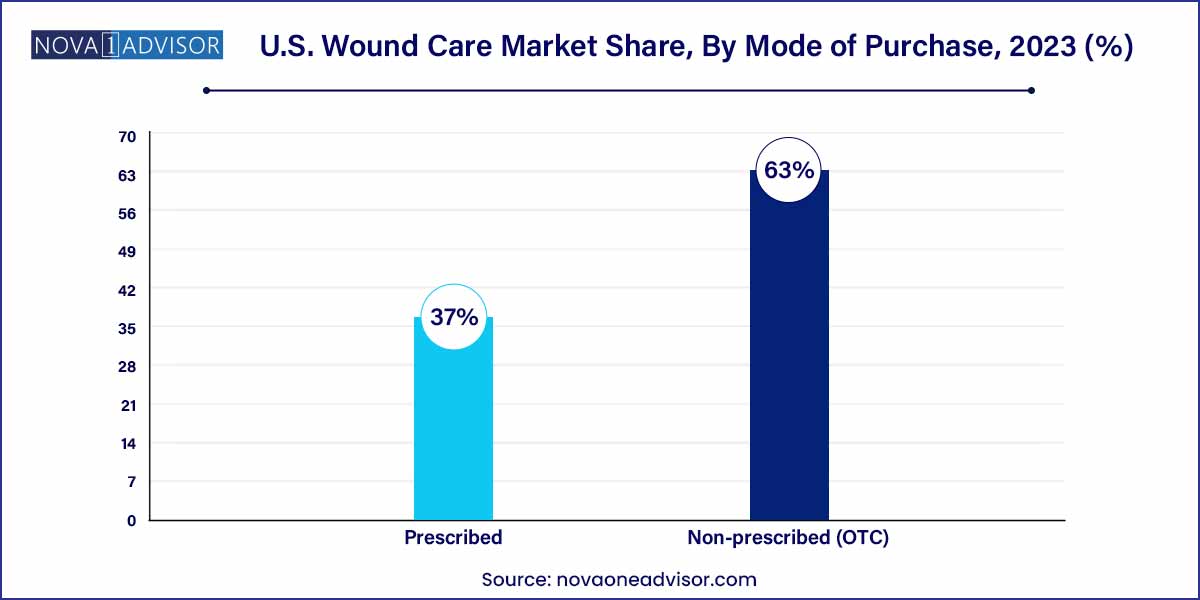

- The prescribed segment dominated the market with a market share of 63% in 2023.

- The prescribed segment is expected to grow at the highest compound annual growth rate (CAGR) of 4.93% in 2024 to 2033.

Market Overview

The U.S. wound care market is a robust and rapidly evolving sector, reflecting the growing medical need to treat acute and chronic wounds effectively across diverse care settings. Wound care encompasses a wide spectrum of products and services designed to promote healing, prevent infections, and enhance patient outcomes. This includes advanced wound dressings, surgical wound care products, traditional gauze-based dressings, and cutting-edge wound therapy devices.

In the U.S., wound care is a high-priority clinical area due to the aging population, rising incidence of diabetes and obesity, and increasing number of surgical procedures and traumatic injuries. Chronic wounds alone affect nearly 6.5 million Americans, according to healthcare studies, imposing a heavy burden on both patients and the healthcare system.

The market continues to witness expansion fueled by technological innovations, such as smart wound dressings, bioengineered skin substitutes, and negative pressure wound therapy (NPWT) systems. Simultaneously, trends like home-based care, telemedicine integration, and personalized wound care kits are reshaping care delivery.

Hospitals, outpatient facilities, long-term care centers, and home health agencies are major stakeholders in the ecosystem. Furthermore, the rise in over-the-counter (OTC) wound care for minor injuries has spurred retail sales growth, enhancing consumer engagement with preventive care.

Major Trends in the Market

-

Rising Demand for Advanced Wound Dressings with Antimicrobial and Moisture-Retentive Properties

-

Adoption of Negative Pressure Wound Therapy (NPWT) in Both Acute and Chronic Wound Management

-

Increased Focus on Bioactive and Smart Wound Products (e.g., Skin Substitutes, Growth Factor Dressings)

-

Shift Toward Home Care and Remote Monitoring of Wound Progress

-

Expansion of Wound Care Services in Outpatient Clinics and Retail Pharmacies

-

Integration of Digital Imaging and AI Tools for Wound Assessment and Documentation

-

Surge in OTC Sales Driven by Consumer Awareness and Self-treatment

-

Rise in Collaborations Between Tech Startups and Medical Device Companies for Smart Devices

U.S. Wound Care Market Report Scope

U.S. Wound Care Market Dynamics

Drivers

Technological Advancements in Wound Care Products:

Ongoing innovations in wound care products, including advanced dressings and therapeutic devices, are key drivers for market growth. Technological advancements enhance the efficacy of treatments, offering more efficient and patient-friendly solutions for wound management.

Increasing Incidence of Diabetes:

The rising prevalence of diabetes is closely associated with chronic wounds, such as diabetic foot ulcers. This heightened incidence amplifies the demand for specialized wound care solutions, emphasizing the need for targeted products and treatment approaches in the market.

Restraints

Cost Constraints:

The cost associated with advanced wound care solutions poses a significant restraint. Access to high-quality wound care products may be limited due to financial considerations, impacting the adoption of these solutions and potentially hindering optimal patient care

Market Fragmentation:

The U.S. Wound Care Market is characterized by the presence of numerous products and providers, leading to market fragmentation. This fragmentation can result in challenges related to standardization, making it more complex for healthcare professionals to choose and implement the most effective wound care solutions.

Addressing these restraints requires a delicate balance between providing cost-effective solutions, navigating regulatory complexities, and streamlining market dynamics for more efficient and standardized practices in the U.S. Wound Care Market.

Opportunities

Technological Advancements:

The continual advancements in technology open doors for new opportunities within the market. The integration of digital solutions, smart dressings, and telemedicine in wound management creates avenues for more efficient and patient-centric care approaches.

Focus on Sustainability:

The growing emphasis on sustainability in healthcare practices presents an opportunity for the development of eco-friendly wound care products. Companies exploring environmentally responsible materials and manufacturing processes can align with this trend and cater to an environmentally conscious market.

Challenges

Intense Competition:

The competitive landscape within the U.S. Wound Care Market is intense. Numerous companies vie for market share, leading to challenges in differentiation and market positioning. This competitive environment may pose hurdles for newer entrants and smaller players.

Integration of Technological Innovations:

While technological advancements offer opportunities, their integration also presents challenges. Implementing and adopting new technologies in wound care practices require significant investments, training, and adjustments to existing workflows, posing challenges for some healthcare institutions.

Segments Insights

Mode of Purchase Insights

Prescribed Wound Care Products Dominate

Prescribed wound care products, including those used for chronic wounds and surgical recovery, dominate due to physician involvement and insurance coverage. These include NPWT, antimicrobial dressings, collagen-based products, and skin substitutes that require professional assessment and follow-up.

Healthcare providers often prescribe a combination of products tailored to the wound stage, patient history, and comorbidities. Prescriptions also facilitate Medicare and private insurance reimbursement, making these products more financially accessible to patients.

Non-prescribed (OTC) is the Fastest-growing Purchase Mode

Non-prescribed (OTC) wound care products—such as bandages, ointments, antiseptics, and hydrocolloid patches—are growing rapidly due to increased consumer awareness and self-care trends. Pharmacies, grocery chains, and online platforms offer a broad range of OTC products for treating minor cuts, abrasions, and burns.

Millennials and Gen Z consumers, in particular, are turning to OTC wound care for sports injuries and household incidents. New brands offering natural, sustainable, and aesthetic-first wound products are further expanding this market.

By Distribution Channel

Institutional Sales Dominate

Institutional sales through bulk procurement by hospitals, outpatient surgery centers, and home healthcare agencies dominate the U.S. wound care market. These institutions purchase through group purchasing organizations (GPOs) and long-term vendor agreements.

Institutional buyers prioritize clinical efficacy, volume discounts, and supply chain reliability, often engaging in multi-year supply contracts with leading manufacturers. Clinical training, post-sale service, and EHR integration further strengthen these relationships.

Retail Sales are the Fastest-growing Distribution Channel

Retail sales, encompassing pharmacies, grocery stores, e-commerce platforms, and retail health clinics, are growing swiftly. The convenience of 24/7 availability, home delivery, and telehealth support is encouraging consumers to purchase wound care products online or in-store.

The growing role of retail pharmacies in primary care, vaccination, and minor wound treatment is expanding this channel’s influence. Online platforms also allow consumers to access detailed product information, customer reviews, and bundled care kits, enhancing purchasing confidence.

By Product

Advanced Wound Dressing Dominated the Product Segment

Advanced wound dressings hold the largest share in the U.S. wound care market. These include products such as hydrocolloids, foam dressings, alginates, hydrogels, and antimicrobial dressings, which maintain optimal moisture levels, control bacterial load, and support autolytic debridement.

Their clinical versatility makes them suitable for managing both acute and chronic wounds, including burns, pressure ulcers, surgical incisions, and diabetic foot ulcers. Hospitals and long-term care centers favor these dressings due to their extended wear time, reduced dressing changes, and patient comfort. The increasing preference for antimicrobial-infused options, especially silver and iodine-based products, further drives growth.

Wound Therapy Devices are the Fastest-growing Product Category

Wound therapy devices, led by negative pressure wound therapy (NPWT), represent the fastest-growing product category. NPWT applies controlled suction to a wound, improving blood flow, reducing edema, and accelerating granulation tissue formation. These devices are widely adopted for complex surgical wounds, large trauma injuries, and diabetic ulcers.

Recent innovations have introduced portable, wearable NPWT systems, making the technology more accessible in outpatient and home environments. The growth is also supported by studies demonstrating cost-effectiveness of NPWT in reducing hospital stays and preventing infections.

By Application

Chronic Wounds Dominate the Application Segment

Chronic wounds particularly diabetic foot ulcers, venous leg ulcers, and pressure ulcers dominate the wound care application segment in the U.S. The increasing prevalence of diabetes, vascular disease, and immobility in the elderly population contributes to the chronic wound burden.

These wounds require long-term management strategies involving advanced dressings, wound cleansing solutions, and regular debridement. Specialized wound care clinics, home care nurses, and dermatologists are central to chronic wound care protocols. Reimbursement support for chronic wound treatments under Medicare has further strengthened this segment’s growth trajectory.

Acute Wounds are the Fastest-growing Segment

Acute wounds, such as surgical wounds, lacerations, abrasions, and burn injuries, are the fastest-growing application category. The growth is driven by rising surgical volumes across orthopedic, cardiovascular, and cosmetic procedures, as well as trauma cases from accidents or sports injuries.

Hospitals prioritize infection control, faster wound closure, and aesthetic outcomes, thereby fueling demand for advanced surgical dressings, antimicrobial coverings, and adjunct therapies like NPWT. Innovations in surgical site infection prevention and minimally invasive wound closures have also contributed to this segment’s expansion.

By End-use Insights

Hospitals Lead the End-use Segment

Hospitals are the primary users of wound care products, given the volume of inpatient and outpatient procedures and the prevalence of post-surgical and trauma wounds. Acute care hospitals utilize a wide range of products from surgical dressings and NPWT systems to traditional gauze and tape.

Their in-house wound care teams often handle complex wounds requiring multidisciplinary interventions. Institutional purchasing contracts and formulary access also enable hospitals to procure products in bulk, contributing to their dominant market share.

Home Care is the Fastest-growing End-use Segment

Home care is the fastest-growing segment, owing to the rise of aging-in-place models and increasing hospital discharge rates. Patients with chronic wounds, such as pressure sores or diabetic ulcers, are managed by home health agencies or family caregivers using prescribed dressings, NPWT kits, and digital monitoring tools.

Home care also aligns with the broader healthcare goal of reducing hospital readmissions, particularly in high-risk populations. The market is witnessing rising demand for easy-to-use wound care kits, telehealth consultations, and mobile nurse visits, supporting continued growth.

Country-Level Analysis

In the United States, wound care is a national healthcare priority due to the financial burden of chronic wounds estimated at over $25 billion annually and rising surgical volumes. The U.S. market benefits from a well-structured reimbursement system, advanced medical technology, and a strong pipeline of wound care research and development.

Major cities have dedicated wound care centers, multidisciplinary outpatient clinics, and rehabilitation facilities equipped with specialized wound teams. Meanwhile, smaller towns and rural areas rely on home health services and mobile clinics, creating geographic diversity in product demand.

Public health initiatives, such as Medicare Advantage expansion and bundled payment models, are aligning incentives toward early intervention and cost-effective wound healing, encouraging the use of evidence-based wound care products.

Some of the prominent players in the U.S. Wound Care Market include:

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences (Integra LifeSciences)

- Medline Industries, Inc.

- Ethicon (Johnson & Johnson)

- B. Braun SE

- Cardinal Health, Inc.

- Organogenesis Inc

- MIMEDX Group, Inc.

Recent Developments

-

April 2025 – 3M Health Care announced the U.S. launch of a next-generation silver-impregnated foam dressing designed for chronic wound infection prevention and faster healing.

-

March 2025 – Smith+Nephew introduced a mobile wound care solution integrated with AI for assessing wound depth and healing progression in home care settings.

-

February 2025 – ConvaTec Group expanded its partnership with the American Home Health Association to provide NPWT systems in rural markets via mobile delivery units.

-

January 2025 – Mölnlycke Health Care opened a new distribution center in Texas to enhance delivery timelines for wound care kits across the Southern U.S.

-

December 2024 – Medline Industries announced an acquisition of a digital wound care platform, enhancing its analytics and reporting tools for outpatient settings.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Wound Care market.

By Product

- Advanced Wound Dressing

- Surgical Wound Care

- Traditional Wound Care

- Wound Therapy Devices

By Application

- Acute Wounds

- Chronic Wounds

By End-use

- Hospitals

- Outpatient Facilities

- Home Care

- Research & Manufacturing

Mode of Purchase

- Prescribed

- Non-prescribed (OTC)

By Distribution Channel

- Institutional Sales

- Retail Sales