U.S. wound closure devices market Size and Trends

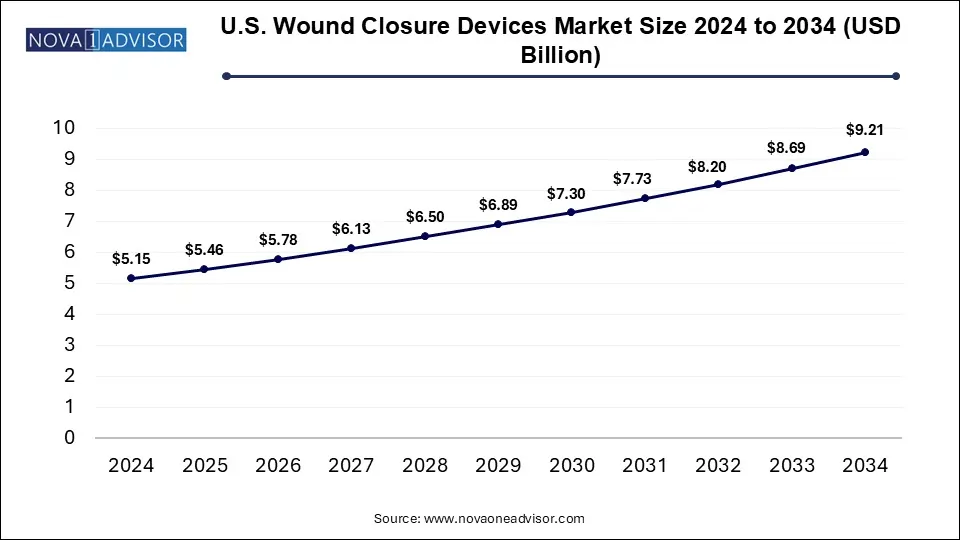

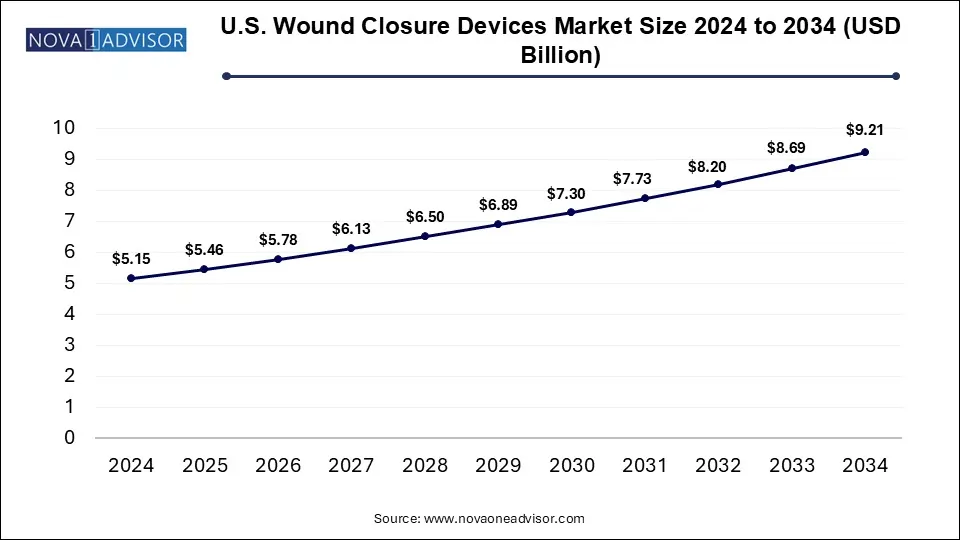

The U.S. wound closure devices market size was exhibited at USD 5.15 billion in 2024 and is projected to hit around USD 9.21 billion by 2034, growing at a CAGR of 5.98% during the forecast period 2025 to 2034.

Key Takeaways:

- Sutures led the market in 2024, contributing to 40% of the total revenue.

- In 2024, acute wounds represented the largest share of the U.S. wound closure devices sector.

- Acute care hospitals emerged as the primary end-users, generating the highest revenue in the market during 2024.

- The prescribed mode of purchase remained the predominant method within the U.S. wound closure devices market in 2024.

- Institutional sales held the top position in 2024, securing the largest portion of revenue in the U.S. wound closure devices industry.

Market Overview

The U.S. wound closure devices market represents a critical component of the nation’s healthcare infrastructure, offering indispensable solutions for surgical wound healing, trauma management, and chronic wound treatment. Wound closure devices encompass a broad range of products such as sutures, staples, adhesives, strips, clips, and sealants used to approximate the edges of wounds and facilitate healing. As surgical procedures become more advanced and minimally invasive techniques grow in popularity, the need for effective, safe, and rapid wound closure solutions has never been greater.

Driven by the rising prevalence of chronic conditions such as diabetes and obesity, an increasing aging population, and the growing number of surgeries performed annually, the market has expanded significantly. In 2024 alone, an estimated 21 million surgical procedures were performed in the U.S., contributing directly to the demand for sutures, staples, and surgical adhesives. Moreover, the surging popularity of cosmetic and reconstructive surgeries is further fueling the use of specialized closure materials, particularly barbed sutures and flexible adhesive strips.

Emerging technologies, including bioengineered sealants and smart wound closure devices with integrated antimicrobial and biosensing capabilities, are redefining the traditional wound closure paradigm. The shift from inpatient to outpatient surgical care and a surge in home healthcare services are also transforming how these devices are distributed and used across the U.S.

Major Trends in the Market

-

Shift toward minimally invasive procedures: These require advanced closure devices such as barbed sutures and absorbable adhesives, offering reduced tissue trauma and faster recovery.

-

Rise in outpatient surgeries: The movement to Ambulatory Surgery Centers (ASCs) increases demand for easy-to-use, time-efficient closure methods.

-

Increased use of absorbable and antimicrobial sutures: These reduce the need for removal and lower infection risks, ideal for chronic wound patients.

-

Adoption of tissue adhesive products: Especially in pediatric and cosmetic applications where aesthetics and patient comfort are prioritized.

-

Surge in demand for home-use wound closure kits: Facilitated by growth in home healthcare services and self-treatment preferences.

-

Technological innovation in sealants and smart closure systems: Integration of nanotechnology and biosensors is enabling monitoring of healing and infection.

-

Greater focus on biocompatible and eco-friendly materials: Particularly in synthetic sealants and absorbable sutures.

Report Scope of U.S. Wound Closure Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.46 Billion |

| Market Size by 2034 |

USD 9.21 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.98% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Wound type, End use, Mode of Purchase, and Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Ethicon (Johnson & Johnson), Medtronic plc, 3M Health Care, Smith & Nephew plc, B. Braun Melsungen AG, Baxter International Inc., Integra LifeSciences Holdings Corporation, Derma Sciences (Integra subsidiary), Teleflex Incorporated, Advanced Medical Solutions Group plc |

Market Driver: Rising Incidence of Chronic and Surgical Wounds

A key driver for the U.S. wound closure devices market is the rising prevalence of chronic wounds and the growing number of surgical interventions. According to the Centers for Disease Control and Prevention (CDC), over 34 million Americans are living with diabetes, a condition strongly associated with chronic wounds such as diabetic foot ulcers. These wounds are persistent and often require sophisticated closure methods, especially in patients with poor healing responses.

In parallel, the number of surgeries performed annually continues to grow, with outpatient procedures accounting for over 60% of all surgical volumes in the U.S. Each surgical event necessitates reliable wound closure to prevent complications such as dehiscence, infection, and scarring. This dual burden chronic and acute surgical wounds intensifies the need for diverse wound closure solutions, particularly those that enhance healing and minimize complications.

Market Restraint: High Cost of Advanced Closure Devices

Despite technological advancements and clinical efficacy, the cost of advanced wound closure devices remains a significant barrier, particularly for underinsured patients and smaller healthcare facilities. Bioengineered sealants, barbed sutures, and smart wound closure systems can cost substantially more than traditional closure methods, limiting their accessibility.

In addition, reimbursement constraints in outpatient and home healthcare settings can discourage providers from adopting premium products. Smaller ASCs and SNFs often operate within tight budgetary frameworks and may favor cost-effective but less advanced closure solutions, which can influence adoption trends.

Market Opportunity: Growing Adoption of Wound Closure in Home Healthcare

The U.S. home healthcare market is projected to witness robust growth, with wound care being a primary service offered. This shift presents a significant opportunity for manufacturers to develop user-friendly, non-prescription, over-the-counter (OTC) wound closure kits tailored for home settings.

Innovative products such as reinforced adhesive strips, topical cyanoacrylate sealants, and simplified clip systems are being designed for non-professional use without compromising safety or efficacy. The COVID-19 pandemic accelerated the preference for remote care, and this momentum has persisted. Companies offering durable, sterile, and easy-to-apply wound closure devices stand to benefit immensely from this transformation in care delivery.

Segmental Analysis

By Product Outlook

Sutures dominated the U.S. wound closure devices market in 2024, accounting for the largest revenue share. Among sutures, absorbable surgical sutures gained strong preference due to their degradation properties, eliminating the need for removal and reducing post-op visits especially beneficial in outpatient settings. Barbed sutures, particularly bi-directional ones, are being increasingly utilized in laparoscopic and cosmetic surgeries due to their time-saving and knotless application. The microsutures segment is flourishing in ophthalmic and plastic surgery procedures, offering high precision and minimal tissue trauma.

Meanwhile, staples are witnessing rapid adoption, especially powered stapling systems, which provide consistent wound closure with minimal user variability. The demand for adhesives and sealants is also growing, driven by applications in pediatric, facial, and burn care where aesthetics and minimized scarring are critical. Topical cyanoacrylate sealants are preferred for their rapid polymerization and bacteriostatic properties. Similarly, reinforced and flexible strips are gaining popularity in outpatient and home-use scenarios.

By Wound Type Outlook

Acute wounds led the market segment, primarily because of their association with a higher volume of surgical procedures. Surgeries particularly in cardiovascular, colorectal, and orthopedic domains—account for a substantial portion of acute wound closures. For instance, cardiovascular surgeries frequently utilize non-absorbable sutures for long-term tensile strength, while bariatric procedures benefit from powered staplers and absorbable sealants to manage large incisions efficiently. Cosmetic surgeries, which often prioritize scar minimization, have driven demand for barbed sutures and flexible strips.

Conversely, chronic wounds are the fastest-growing segment, spurred by the increasing prevalence of diabetic foot ulcers and pressure ulcers in aging populations. Closure solutions for chronic wounds must account for slow healing and high infection risks, leading to the growing use of collagen-based sealants and antimicrobial adhesives. These wounds are often managed in SNFs and home settings, further promoting easy-to-use, long-wearing products.

By End Use Outlook

Acute care hospitals currently dominate the end-use segment due to the concentration of surgical procedures and trauma care. These facilities utilize a full range of closure devices from basic sutures to advanced powered staplers and bio-sealants across diverse surgical disciplines. The high patient volume and need for efficient perioperative workflows make these hospitals the primary consumers of wound closure technologies.

However, the fastest-growing end users are Ambulatory Surgery Centers (ASCs) and home healthcare providers. ASCs prefer cost-effective and easy-to-apply closure devices that support rapid turnover and minimal recovery time. Meanwhile, home healthcare growth is prompting a surge in demand for OTC and prescribed wound kits that are portable, sterile, and patient-friendly, including strips and synthetic sealants. These care settings align closely with consumer trends emphasizing convenience and outpatient care.

By Distribution Channel

Institutional sales dominate the distribution channel due to large-volume procurements by hospitals, ASCs, and SNFs through group purchasing organizations (GPOs). Institutional buyers focus on contract pricing, product efficacy, and regulatory compliance.

Retail sales are gaining traction, particularly through e-commerce platforms and pharmacies that offer wound closure kits for home use. Consumers increasingly purchase flexible strips, topical adhesives, and sterile dressings for minor injuries or post-op care at home. The retail model is supported by growing awareness and the accessibility of non-prescription devices.

By Mode of Purchase

Prescribed wound closure products account for the largest share, as most surgical and chronic wound treatments involve physician-prescribed sutures, sealants, and adhesives. These are critical in controlled clinical settings where oversight is necessary.

Non-prescribed (OTC) wound closure solutions are the fastest-growing mode of purchase, largely driven by home healthcare, self-care trends, and increased availability through retail and online channels. Consumers seek convenient, sterile, and effective closure products for minor lacerations and post-op maintenance, particularly reinforced and flexible strips.

Country-Level Analysis: United States

Within the United States, wound closure device usage varies based on the density of surgical centers, prevalence of chronic diseases, and healthcare infrastructure. States with high concentrations of hospitals and ASCs such as California, Texas, and Florida exhibit substantial demand for surgical sutures and powered staplers. These states also have significant aging populations and high chronic wound prevalence, driving growth in the use of advanced closure systems.

Urban centers show increased adoption of novel products like smart adhesives and collagen-based sealants, while rural regions rely more on cost-effective, multipurpose sutures and strips due to access limitations. Additionally, the Veterans Health Administration (VHA) and public healthcare initiatives have driven the uptake of wound closure technologies for underserved populations.

Some of The Prominent Players in The U.S. wound closure devices market Include:

- Ethicon (Johnson & Johnson)

- Medtronic plc

- 3M Health Care

- Smith & Nephew plc

- B. Braun Melsungen AG

- Baxter International Inc.

- Integra LifeSciences Holdings Corporation

- Derma Sciences (Integra subsidiary)

- Teleflex Incorporated

- Advanced Medical Solutions Group plc

Recent Developments

-

Ethicon (Johnson & Johnson) launched a new barbed suture product line for laparoscopic surgeries in April 2025, emphasizing reduced operation times and improved wound healing outcomes.

-

Medtronic plc introduced an updated powered stapler with integrated tissue sensing technology in February 2025, aiming to improve surgical consistency and patient safety.

-

3M Health Care expanded its line of skin-friendly adhesive strips and topical sealants in March 2025, targeting pediatric and cosmetic wound care segments.

-

Smith & Nephew completed the acquisition of a regional wound care distributor in the Midwest in January 2025, enhancing its distribution network across ASCs and SNFs.

-

B. Braun Medical Inc. collaborated with a home healthcare provider in May 2025 to pilot a distribution model for OTC wound closure kits tailored for chronic wound patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

-

-

- Absorbable

- Non-Absorbable

-

- Barbed Suture (only Absorbable)

-

-

- Uni-directional barbed suture

- Bi-directional barbed suture

-

-

- Reinforced Strips

- Flexible Strips

-

- Non-Synthetic

- Collagen Based

- Synthetic

-

-

- Topical Cyanoacrylates

- Others

By Wound Type

-

-

- Obstetrics / Gynecology

- Colorectal

- Cardiovascular

- Bariatric and Upper GI

- Plastic and Reconstructive Surgery

- Urology

- Hepato-pancreato-biliary (HPB)

- Dermatology

- Others (ENT, Ortho trauma, Neuro, etc.)

-

- Lacerations & Minor Cuts

- Burns

-

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Other Chronic Wounds

By End Use

- Acute Care Hospital

- Ambulatory Surgery Center (ASC)

- Hospital Outpatient Wound Care Clinic

- Home Healthcare

- Skilled Nursing Facility (SNF)

- Physician Office

- Burn Center

- Inpatient Rehabilitation Facility (IRF)

- Long-term Acute Care Hospital (LTACH)

- Long-term Care (residential living setting)

By Distribution Channel

- Institutional Sales

- Retail Sales

By Mode of Purchase

- Prescribed

- Non-prescribed (OTC)