U.S. Wound Irrigation Systems Market Size and Growth 2026 to 2035

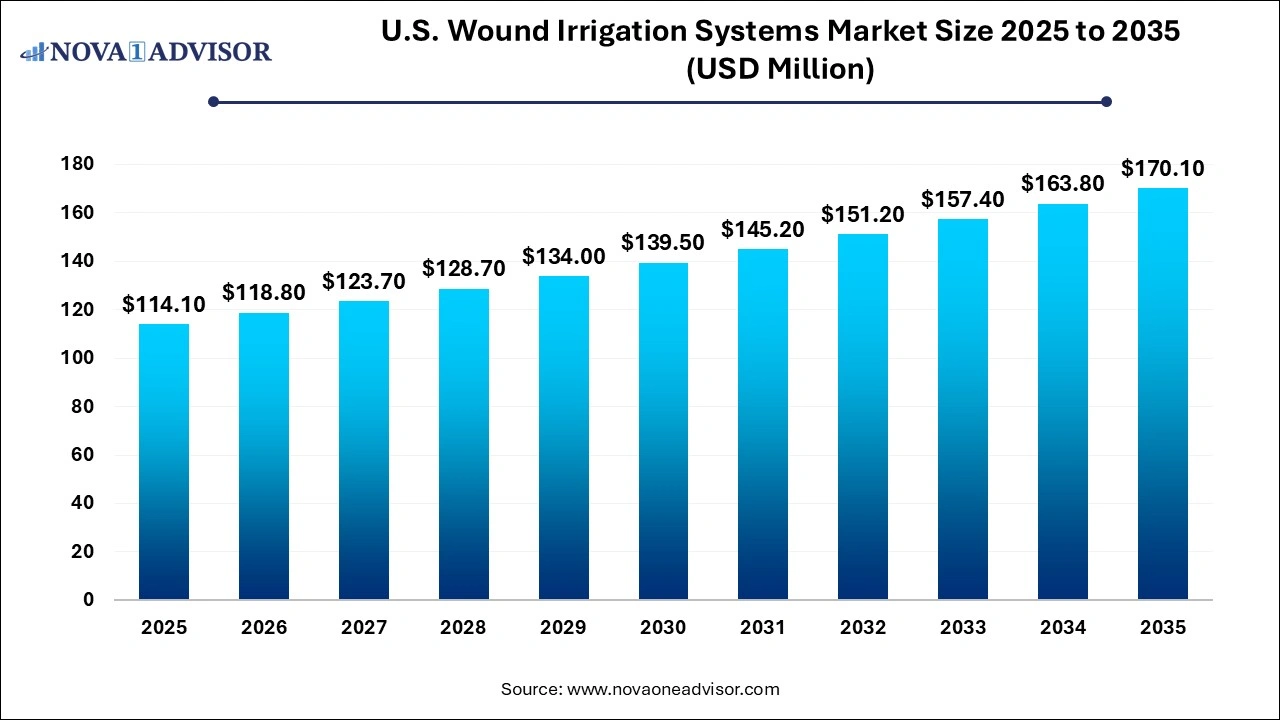

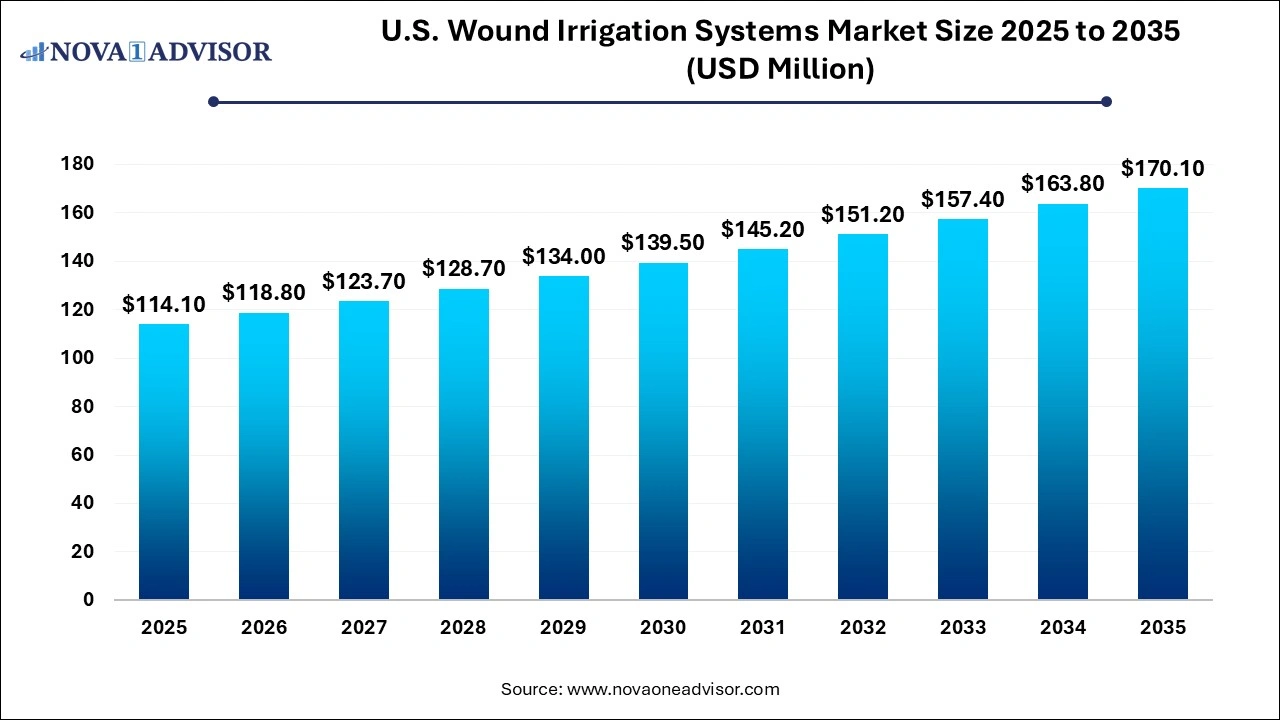

The U.S. wound irrigation systems market size was exhibited at USD 114.1 million in 2025 and is projected to hit around USD 170.1 million by 2035, growing at a CAGR of 4.07% during the forecast period 2026 to 2035. The growth of the U.S. wound irrigation systems market is driven by rising prevalence of acute and chronic wounds, increased emphasis in infection control, advanced healthcare infrastructure and presence of major pharmaceutical companies.

U.S. Wound Irrigation Systems Market By Key Takeaways:

- Manual irrigation held the largest revenue share of 55.0% in 2025.

- The battery-operated segment is expected to grow at the fastest CAGR of 4.1% over the forecast period.

- Chronic wounds led the market in terms of revenue share in 2024, accounting for 33.7% of the global market.

- The surgical wounds segment is expected to grow at the fastest CAGR of 3.9% over the forecast period.

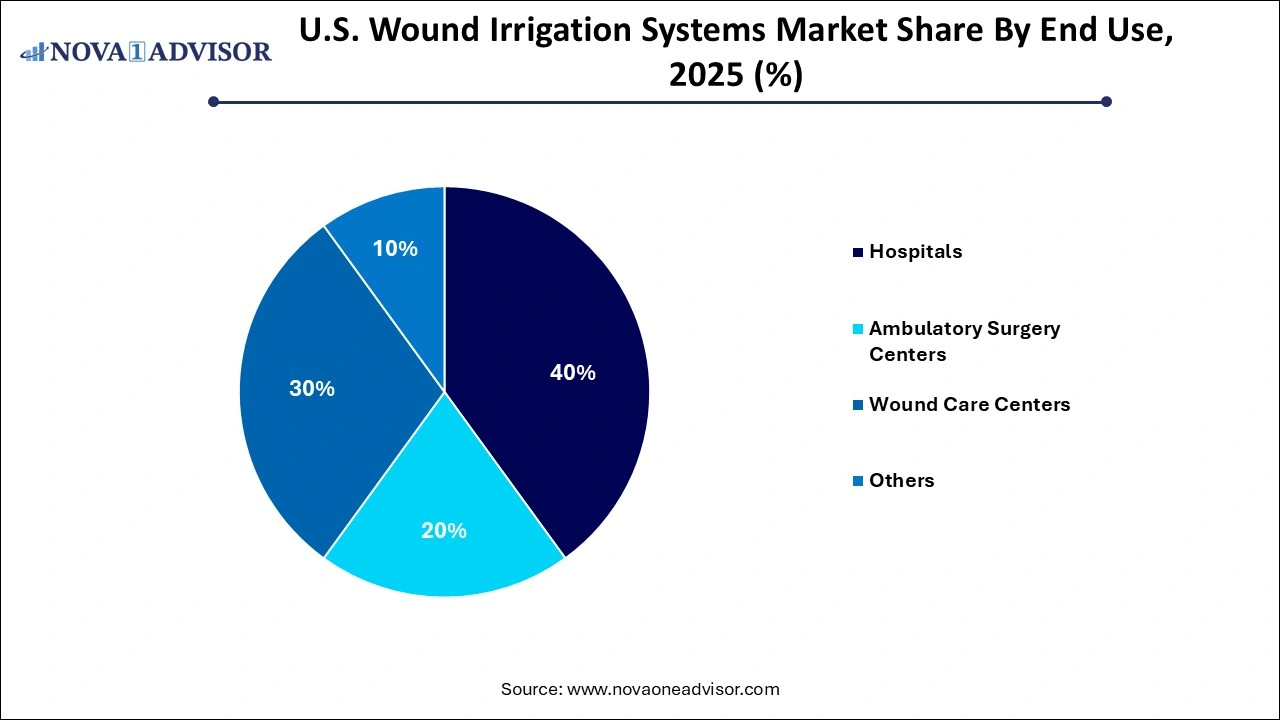

- Hospitals led the market with a revenue share of 40.0% in 2025.

- Wound care centers are projected to grow at the fastest rate of 4.2% over the forecast period.

U.S. Wound Irrigation Systems Market Overview

The U.S. wound irrigation systems market represents a critical component within the country’s broader wound management sector, underpinning effective healing processes and infection prevention strategies in both acute and chronic care settings. Wound irrigation systems are specialized medical devices designed to deliver controlled streams of sterile fluids—commonly saline or antiseptic solutions into wound beds to cleanse debris, necrotic tissue, bacteria, and biofilms. These devices serve as an indispensable tool for clinicians across emergency rooms, operating theaters, outpatient clinics, and long-term care environments.

As the U.S. grapples with a rising incidence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure sores exacerbated by the aging population and growing prevalence of diabetes and obesity the demand for advanced and efficient wound irrigation solutions has become paramount. Moreover, the increase in surgical procedures, both elective and emergency, further propels the necessity of proper intraoperative and postoperative wound cleansing to minimize infection rates and reduce hospital readmissions.

The transition from conventional wound management to evidence-based, outcome-driven care has also led to a growing emphasis on integrated irrigation systems that support faster healing, reduce microbial contamination, and improve patient comfort. Battery-operated and automated devices are replacing manual squeeze bottles in many U.S. healthcare facilities, offering greater precision, pressure control, and fluid volume management.

Additionally, the market is seeing innovation through ergonomic designs, disposable tips, antimicrobial additives, and compatibility with advanced wound dressings. With a highly regulated but innovation-friendly healthcare environment, the U.S. wound irrigation systems market is poised for sustained growth, driven by clinical need, technological evolution, and healthcare policy support.

Major Trends in the U.S. Wound Irrigation Systems Market

-

Shift Toward Battery-Operated Devices: Increasing adoption of battery-powered irrigation systems due to superior pressure regulation and clinician ease-of-use.

-

Integration with Advanced Wound Care Protocols: Wound irrigation is being increasingly integrated into standardized treatment pathways for diabetic foot ulcers and pressure injuries.

-

Focus on Biofilm Disruption: New irrigation devices and solutions are being optimized for biofilm removal, a leading cause of chronic wound non-healing.

-

Single-Use and Disposable Designs: Rising preference for sterile, disposable components to prevent cross-contamination and support infection control practices.

-

Increased Use in Outpatient and Home Settings: Growing utility of portable irrigation systems in ambulatory surgery centers (ASCs), wound clinics, and home care environments.

-

Customized Application Tips: Development of specialized tips and nozzles for targeted cleansing of different wound types and anatomical locations.

-

Emphasis on Education and Training: Hospitals and care providers are investing in clinician training programs for optimal irrigation technique and pressure application.

Artificial Intelligence (AI) Integration in the U.S. Wound Irrigation Systems Market

AI-powered wound irrigation systems can potentially transform and broaden the approach for wound management strategies in U.S. AI algorithms can be applied for objective wound measurement and classifying types of tissue within a wound for better and targeted irrigation planning. Infection detection and prediction of risks can be achieved with the deployment of AI for analyzing wound images and data from integrated sensors. AI can facilitate development of personalized irrigation protocols by evaluating large amounts of patient data.

Emergence of telemedicine platforms integrated with AI are enabling remote wound monitoring and guidance for healthcare providers. Furthermore, AI-powered simulations and virtual reality tools can be implemented for training healthcare professionals on proper use of wound irrigation techniques.

Report Scope of U.S. Wound Irrigation Systems Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 114.1 Million |

| Market Size by 2035 |

USD 170.1 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 4.07% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Application, By End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

U.S. |

| Key Companies Profiled |

WestMed Products; BIONIX LLC; BD; CooperSurgical Inc.; Stryker; Essity Health & Medical; Medline Industries, LP; Zimmer Biomet |

U.S. Wound Irrigation Systems Market Dynamics

Driver

Rising Prevalence of Chronic Wounds and Related Comorbidities

The increasing prevalence of chronic wounds in the U.S. population is one of the strongest driving forces shaping the wound irrigation systems market. Chronic wounds—including diabetic foot ulcers (DFUs), venous leg ulcers (VLUs), and pressure ulcers—represent a significant burden on both patients and the healthcare system. According to recent estimates, over 6.5 million individuals in the United States suffer from chronic wounds, with an annual treatment cost exceeding $25 billion.

These wounds often result from comorbidities like diabetes, vascular disease, and immobility in elderly patients. Effective wound irrigation is a cornerstone of chronic wound management, removing bacteria and slough that impede healing. Devices that can deliver controlled irrigation with appropriate pressure are particularly valuable for maintaining a moist wound environment and preventing infections such as cellulitis or osteomyelitis. With DFUs linked to more than 80,000 amputations annually in the U.S., the clinical imperative for precise and effective wound cleansing has never been higher.

Restraint

High Cost and Accessibility Constraints in Out-of-Hospital Settings

Despite its critical benefits, the relatively high cost and limited availability of advanced wound irrigation systems in outpatient and home settings present a key market restraint. While hospitals and specialty centers typically possess the budget and infrastructure to procure battery-operated or automated systems, smaller clinics and rural care centers often rely on manual irrigation methods due to cost limitations.

Furthermore, reimbursement for wound irrigation procedures—especially when performed outside of acute care environments—can be inconsistent under Medicare and private insurers. Patients with chronic wounds frequently require daily or weekly irrigation, and the lack of affordable, portable solutions or standardized reimbursement may lead to underutilization of best-practice care. These financial and logistical constraints can delay wound healing, increase complications, and ultimately inflate long-term care costs.

Opportunity

Technological Innovation for Outpatient and Home-Based Use

The expansion of wound care services into outpatient, ambulatory, and home-based settings offers a compelling growth opportunity for manufacturers. As healthcare delivery models shift toward decentralized care, there is a growing demand for compact, cost-effective, and easy-to-use irrigation devices that can be safely used by clinicians, caregivers, or even patients themselves under supervision.

Innovative companies are already developing lightweight battery-operated systems with intuitive interfaces, rechargeable power sources, and disposable nozzles that reduce infection risk. Integration with digital wound monitoring platforms and cloud-based tracking systems can further enhance home wound care by enabling remote supervision from clinicians. Such solutions can extend quality care into non-hospital environments, improve healing outcomes, and reduce hospital admissions—aligning with value-based care initiatives promoted across U.S. healthcare systems.

U.S. Wound Irrigation Systems Market Segmental Insights

By Product Insights

Manual irrigation held the largest revenue share of 55.0% in 2025, the U.S. market, primarily due to their affordability, simplicity, and widespread use across a broad spectrum of care settings. These systems ranging from bulb syringes to piston syringes and squeeze bottles—are commonly used in hospitals, wound clinics, and emergency rooms. They require minimal training and can be used without dependence on electricity or batteries, making them an economical option, particularly for routine or low-risk wounds.

In facilities with tight budgets or high procedural volumes, manual devices are preferred for initial wound cleansing, especially in trauma cases and first-aid scenarios. Moreover, in many outpatient settings, such systems are used for preliminary irrigation before more complex interventions. While limited in pressure control and ergonomics, their durability and cost-efficiency continue to drive significant adoption.

The battery-operated segment is expected to grow at the fastest CAGR of 4.1% over the forecast period. propelled by their ability to provide consistent pressure, adjustable flow rates, and ergonomic convenience. These devices significantly reduce clinician fatigue and offer better wound coverage, making them suitable for deep or complex wounds, surgical debridement, and chronic ulcer care. Hospitals are increasingly adopting battery-powered systems in operating rooms and wound care centers to enhance procedural outcomes and reduce infection rates.

Several devices on the market now feature single-use, disposable components and automatic pressure adjustment to optimize cleansing while minimizing tissue trauma. The rise in ambulatory surgical procedures, increased patient volumes in wound care clinics, and a growing emphasis on procedural efficiency are contributing to the rapid growth of this segment.

By Application Insights

Chronic wounds led the market in terms of revenue share in 2025, accounting for 33.7% of the global market, owing to their prevalence, treatment complexity, and economic impact. Diabetic foot ulcers, venous leg ulcers, and pressure injuries are among the most persistent and difficult-to-treat wounds. These wounds often harbor biofilms, necrotic tissue, and microbial contamination, necessitating aggressive and routine irrigation to promote healing and prevent complications.

For example, diabetic patients with foot ulcers require precise wound cleaning multiple times a week, often over several months. In such cases, wound irrigation not only accelerates healing but also prevents progression to infection or amputation. Wound care centers and home health agencies are particularly reliant on efficient irrigation systems to support chronic wound treatment plans, making this the largest and most critical application area.

The surgical wounds segment is expected to grow at the fastest CAGR of 3.9% over the forecast period, driven by the rising number of elective and emergency surgeries in the U.S., particularly among the aging population. Postoperative wound care is essential to prevent surgical site infections (SSIs), a leading cause of hospital readmissions and complications. Intraoperative and postoperative irrigation is increasingly used to cleanse incisions and remove residual contaminants or debris.

Surgeons and perioperative nurses are adopting battery-operated irrigation systems during orthopedic, abdominal, and cardiovascular surgeries for more controlled and sterile wound cleansing. Additionally, surgical centers and ambulatory facilities are integrating irrigation into enhanced recovery after surgery (ERAS) protocols to reduce complications and speed healing. This trend is fueling rapid growth in the use of advanced irrigation systems in surgical care environments.

By End Use Insights

Hospitals led the market with a revenue share of 40.0% in 2025. owing to their comprehensive wound management programs, access to advanced technology, and treatment of high-acuity cases. From emergency trauma and surgery to critical care and infection control, hospitals rely on both manual and battery-operated irrigation systems to address a wide range of wound types. They also serve as the primary centers for chronic wound referrals and surgical site monitoring.

The presence of specialized wound care teams, budget for capital equipment, and adherence to evidence-based protocols ensures that hospitals are consistent adopters of new irrigation technologies. Moreover, the Joint Commission and CDC guidelines emphasize sterile wound irrigation in hospitals, reinforcing its importance in institutional care settings.

Wound care centers are projected to grow at the fastest rate of 4.2% over the forecast period. Supported by the increasing prevalence of chronic wounds and the shift of wound treatment from hospitals to specialized outpatient environments. These centers are often part of hospital networks or operated independently, providing focused care to patients with hard-to-heal wounds such as diabetic foot ulcers and pressure injuries.

These facilities use irrigation systems extensively for mechanical debridement, biofilm disruption, and routine cleaning procedures. As the demand for wound care services rises, particularly among aging and diabetic populations, wound care centers are expanding across urban and suburban areas in the U.S. Their investment in battery-operated and disposable irrigation technologies is driving innovation and segmental growth.

Country-Level Insights

The U.S. wound irrigation systems market is shaped by a combination of demographic, clinical, and regulatory factors that make it one of the most mature yet high-potential markets globally. An aging population, high prevalence of diabetes, and increasing surgical procedures are creating a large and recurring demand for efficient wound management solutions. According to the CDC, more than 37 million Americans live with diabetes, placing them at risk of developing non-healing ulcers.

The U.S. healthcare system's strong emphasis on infection control, value-based outcomes, and Medicare reimbursement for wound care services supports widespread adoption of advanced irrigation technologies. Regulatory approval pathways via the FDA and evolving standards from the Centers for Medicare & Medicaid Services (CMS) provide a structured environment for product innovation and adoption.

Wound care is also becoming a central focus in telehealth and home healthcare models, encouraging manufacturers to introduce portable, user-friendly irrigation systems tailored to these settings. With growing clinician awareness, ongoing technological advancements, and institutional investment in wound prevention programs, the U.S. market is set to maintain robust growth over the next decade.

Some of the prominent players in the U.S. wound irrigation systems market include:

U.S. Wound Irrigation Systems Market Recent Developments

- In November 2024, Niterra Ventures Company invested $18 million in Neoplas Med GmbH through an additional funding round, further strengthening their partnership. The funding aims at expanding the market for innovative wound care technology products.

- In August 2024, ARCHIMED, an international private equity healthcare specialist, completed acquisition of Irrimax Corporation.

- In August 2024, Irrimax Corporation, a medical device manufacturer, announced the launch of second phase of its innovative product pipeline by introducing two new kits, namely the IRRISEPT Accessory Kit and IRRISEPT Wound Solution Kit which are designed for use in combination with the original IRRISEPT Antimicrobial Wound Lavage product launched in Phase one.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. wound irrigation systems market

Product

Application

-

- Diabetic Foot Ulcer

- Venous Leg Ulcer

- Pressure Ulcer

- Surgical Wounds

- Traumatic Wounds

End Use

- Hospitals

- Ambulatory Surgery Centers

- Wound Care Centers

- Others