Vaccines Market Size and Research

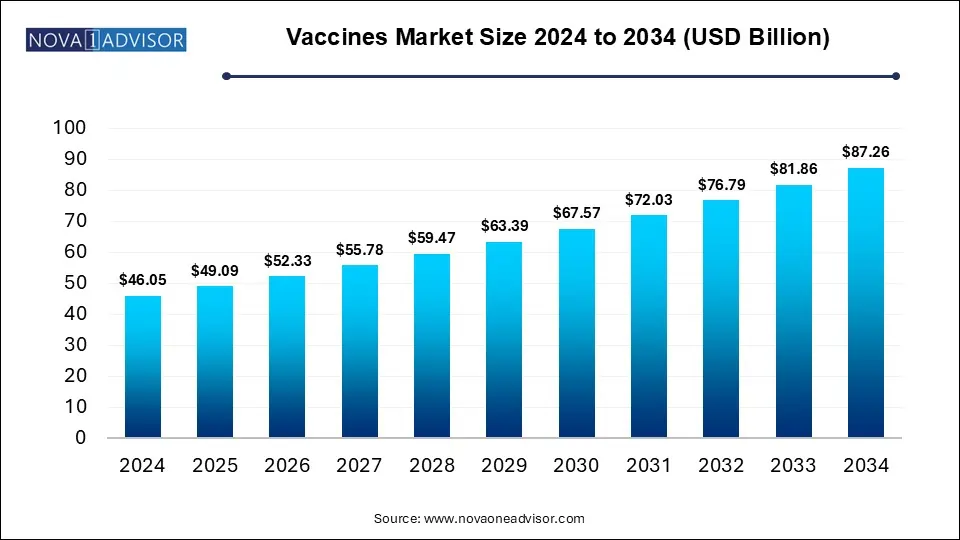

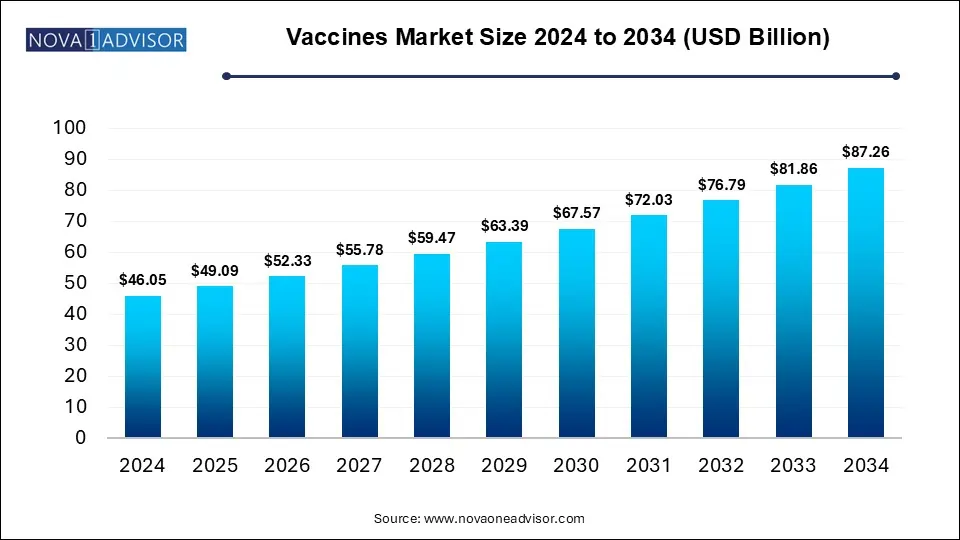

The global vaccines market size is calculated at USD 46.05 billion in 2024, grows to USD 49.09 billion in 2025, and is projected to reach around USD 87.26 billion by 2034, growing at a CAGR of 6.6% from 2025 to 2034 The vaccines market growth can be linked to the factors such as ongoing scientific advancements, unmet medical needs and rising global demand.

Key Takeaways

- North America dominated the vaccines market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market over the forecast period.

- By technology, the recombinant and conjugate vaccines segment held the major market share in 2024 and is anticipated to register the fastest growth over the forecast period.

- By indication, the human papilloma virus segment contributed the biggest market share in 2024 and is expected to show the fastest growth during the forecast period.

- By end user, the pediatric segment accounted for the largest market share in 2024.

What is the Potential for Expansion of Vaccines Market?

Vaccines are most sought after and the foremost preventive measure for protecting populations and avoiding the potential consequences through the spread of infectious diseases, further preserving millions of lives across the globe leading to comprehensive public health and economic benefits. Approaching the vaccines market is different compared to other medicines and depends on success of a vaccination program which is affected by factors such as readiness of policy makers for the expansion and financing of the immunisation programme, procurement and delivery of vaccines as well as assessment of the vaccine program reach and coverage.

The continuous advancements in vaccine designing and manufacturing by utilizing novel platforms such as mRNA technology as well as rising innovations in next-generation of vaccines such as recombinant protein, virus-like-particle (VLP) and subunit vaccine technologies are driving the market expansion. Increased emphasis on immunizing new patient populations such as maternal vaccinations and adult vaccinations, expansion of immunization programs in low- and middle-income countries (LMICs), rising public health awareness, surge in global outbreaks are the factors significantly contributing to the market growth. Furthermore, efforts for improving supply chain resilience by geographically diversifying vaccine manufacturing, and focus on developing innovative vaccine delivery methods and thermostable vaccines is potentially expanding the future of the global vaccines market.

What are the Key Trends in the Vaccines Market in 2025?

- In April 2025, the Center for Infectious Disease Research and Policy (CIDRAP), University of Minnesota launched the Vaccine Integrity Project which is an initiative committed towards safeguarding vaccine policy, information and utilization across the U.S.

- In February 2025, Zydus Lifesciences, launched India’s first quadrivalent influenza vaccine, VaxiFlu-4 for the 2025 southern hemisphere season. The Quadrivalent Inactivated Influenza vaccine approved by the Central Drug Laboratory and marketed by Zydus Vaxxicare provides broader protection by covering strains of both influenza A and influenza B, further significantly mitigating the risk of vaccine mismatch.

How Will Artificial Intelligence Shape the Next-Generation of Vaccines?

AI integration can significantly transform the vaccines market by accelerating vaccine development times, reducing costs, improving safety and efficacy of vaccines leading to enhanced pandemic preparedness. AI algorithms can be applied for various applications in vaccinology such as for antigen discovery and epitope prediction, for designing of novel vaccine candidates, in adjuvant discovery as well as for optimization of clinical trials. The ability of AI-powered tools for analysing an individual’s genetic makeup and immune system can potentially enable the development of personalized vaccines based on an individual’s specific needs.

Additionally, leveraging AI for vaccine production processes, for demand prediction and inventory management can lead to streamlined vaccine manufacturing and supply chain workflows, ensuring efficient and timely delivery of vaccines.

Report Scope of Vaccines Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 49.09 Billion |

| Market Size by 2034 |

USD 87.26 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Technology Type, By Indication, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bharat Biotech, Bavarian Nordic, CSL Limited, Emergent Bio Solutions Inc., GlaxoSmithKline Plc., Merck & Co., Sanofi, Serum Institute of India Pvt. Ltd., Pfizer, Zhi Fei Biological |

Market Dynamics

Drivers

Rising Incidences and Threat of Infectious Diseases

Several infectious diseases, continuous threat of new bacterial and viral infections, rising antimicrobial resistance among individuals is creating the demand for novel and established vaccines for preventing potential outbreaks. Furthermore, rising investments by governments for expansion of routine immunization and pandemic preparedness as well as ongoing advancements and innovation in vaccine development are driving the market growth.

Restraints

High Costs and Stringent Regulatory Pathways

Development of a new vaccine is a complex and lengthy process, often requiring 10-15 years for market reach and requires significant financial investments and involves high risks due to failure of various vaccine candidates in clinical trials. Moreover, demand of high safety and efficacy standards set by regulatory bodies such as the FDA, EMA and WHO can lead to extensive testing and submission of detailed data regarding the vaccines which can be time-consuming hurdle for manufacturers.

Opportunities

Exploitation of Innovative Vaccine Platforms

Various pharmaceutical and biopharmaceutical companies are focused on implementing advanced technologies and innovative platforms such as mRNA technology for expanding their market presence, boosting product pipelines and addressing the globally rising demand for potential vaccines. High unmet needs in various regions, expansion of adult and maternal vaccination sectors, focus on developing personalized vaccines, and creation of combination and universal vaccines is expected to create lucrative opportunities for market expansion.

Segmental Insights

The Recombinant and Conjugate Vaccines Major Share

By technology, the recombinant and conjugate vaccines held the largest market share in 2024 and is anticipated to show the fastest growth during the forecast period. The globally rising prevalence of infectious diseases such as bacterial and viral infections, growing public awareness about vaccinations, rising demand for pediatric immunization, increased investments in R&D activities and favourable regulatory environments are the factors driving the market growth. Ongoing advancements in vaccine technology such as using genetic engineering for creating recombinant vaccines, rapid and large-scale production technologies, development of multivalent recombinant and conjugate vaccines as well as focus on innovative vaccine delivery systems such as advanced adjuvants and needle-free devices are further enhancing the efficacy and appeal of these vaccines.

Vaccine manufacturers are focused on developing strong product pipeline of new vaccines and accelerating the development of novel vaccines by forming strategic partnerships, mergers and acquisitions to boost their market presence and global outreach. Furthermore, global immunization initiatives led by various governments and key leading organizations such as the World Health Organization (WHO), UNICEF, Gavi (the Vaccine Alliance) and the Bill & Melinda Gates Foundation are helping address challenge in vaccine supply, logistics and delivery.

The Human Papilloma Virus Segment’s Largest Share

By indication, the human papilloma virus segment held the largest market share in 2024 and is expected to show the fastest growth during the forecast period. Human papilloma virus (HPV) is the one biggest contributor for cervical cancers and other HPV-related cancers such as anal, oropharyngeal, vagina and vulvar cancers in both men and women, especially in low- and middle-income countries (LMICs) creating widespread demand for HPV vaccination. Growing awareness and educational initiatives about HPV transmission, expansion of immunization coverage through school-based vaccination programs and catch-up vaccinations due to continuous advancements in healthcare infrastructure in emerging economies enhancing accessibility and distribution of vaccines is opening up revenue streams for manufacturers in new markets.

Progress in development of next-generation of vaccines such as nonavalent vaccines (Gardasil 9) protecting against wide range of HPV strains, utilization of mRNA platforms and exploration of therapeutic vaccines focus on treating existing HPV infections are fuelling innovation of safe and effective vaccines. Global initiatives such as WHO’s Global Strategy for cervical cancer elimination focuses in meeting the 90–70–90 targets by each country till 2030 for eliminating cervical cancer within the next century.

The Pediatric Segment: Biggest Share

By end user, the pediatric segment accounted for the largest market share in 2024. Increased emphasis on preventive healthcare, rising parental awareness for immunization, surging incidences of new infectious diseases and outbreaks, re-emergence of vaccine preventable diseases and enhanced accessibility to vaccines through expansion of healthcare infrastructure in various regions are the factors driving the market growth. Digitalization of vaccination records through online platforms such as the U-WIN platform which is India’s Universal Immunization Programme (UIP) streamlining immunization process by offering cost free vaccinations to pregnant women and children.

Regional Insights

What Factors Are Driving North America’s Global Dominance in Vaccines Market?

North America dominated the global vaccines market with the largest share in 2024. The presence of advanced research infrastructure, robust healthcare facilities, rising investments in R&D activities driving technological innovations and growing demand for preventive healthcare are the factors fuelling the region’s market dominance. Additionally, stringent regulations set by agencies like the U.S. Food and Drug Administration (FDA), well-established cold chain infrastructure for temperature-sensitive vaccines, and major contributions made by the key market players through their high production capacities and extensive distribution capacities fosters the development significantly contributes to the market expansion.

For instance, In May 2025, the U.S. Department of Health and Human Services (HHS) and the National Institutes of Health (NIH), launched a new initiative, Generation Gold Standard which is a next-generation universal vaccine platform which is built using a beta-propiolactone (BPL)- inactivated, whole-virus platform. The initiative launched for enabling comprehensive preparedness funds the NIH’s in-house development of universal influenza and coronavirus vaccines which includes candidates BPL-1357 and BPL-24910. These vaccines are focused on offering broad-spectrum protection against several strains of pandemic-prone viruses such as avian influenza, H5N1 and coronaviruses like SARS-CoV-2, SARS-CoV-1, and MERS-CoV.

Asia Pacific: Fastest Growing Region

Asia Pacific is anticipated to witness lucrative growth in the market over the forecast period. The region’s market growth is driven by the rising incidences of infectious diseases, continuous progress in vaccine technology, ongoing innovative vaccines launches, increased vaccination awareness leading to high demand and supportive regulatory frameworks. Furthermore, rising investments by various governments for expansion of immunization programs, increased collaborations among pharmaceutical companies and governments, growing focus on vaccine equity, diverse demographics and large population as well as increasing disposable incomes are the factors fuelling the region’s market expansion.

Global Immunization Efforts Led by UNICEF in 2024

|

Vaccine Type

|

Vaccine Doses Delivered

|

Number of Countries Benefitted

|

|

Human Papillomavirus Vaccine (HPV)

|

35.9 million

|

49

|

|

Measles-Containing Vaccines (MCV)

|

253.4 million

|

80

|

|

Malaria Vaccines

|

10.5 million

|

17

|

|

Pentavalent Vaccines

|

202.1 million

|

76

|

|

Bivalent Oral Polio Vaccine (bOPV)

|

787.1 million

|

79

|

|

Novel Oral Polio Vaccine type 2 (nOPV2)

|

563.5 million

|

26

|

|

Inactivated Polio Vaccine (IPV)

|

109.8 million

|

77

|

|

Rotavirus Vaccine

|

126.6 million

|

61

|

Top Companies in the Vaccines Market

- Bharat Biotech

- Bavarian Nordic

- CSL Limited

- Emergent Bio Solutions Inc.

- GlaxoSmithKline Plc.

- Merck & Co.

- Sanofi

- Serum Institute of India Pvt. Ltd.

- Pfizer

- Zhi Fei Biological

Recent Developments in the Vaccines Market

- In March 2025, the Republic of Burundi introduced malaria vaccine in its routine immunization programme. The launch event was led by the Ministry of Health in collaboration with UNICEF, the World Health Organization (WHO), Dalberg and Gavi, the Vaccine Alliance.

- In October 2024, Chad, officially known as the Republic of Chad, introduced three crucial new vaccines which include malaria, pneumococcal infections and rotavirus diarrhea vaccines through its Expanded Programme on Immunization, further making Chad one of the first nations for launching three new vaccines at once. The Ministry of Health is implementing the introductions with support from UNICEF, WHO and Gavi, the Vaccine Alliance.

- In August 2024, Pfizer Inc., launched a user-friendly platform, PfizerForAll, which is designed for streamlining access healthcare and management of health and wellness for people across the U.S. The new is developed for supporting millions of Americans who are affected annually with COVID-19, migraine or flu, as well as for adults seeking vaccines for preventable diseases which includes COVID-19, RSV, flu and pneumococcal pneumonia.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Technology Type

- Inactivated Vaccines

- Toxoid Vaccines

- Others

- Recombinant and Conjugate Vaccines

- Live Attenuated Vaccines

By Indication

- Pneumococcal Disease

- Influenza

- Human Papilloma Virus

- Meningococcal Disease

- Rotavirus

- Varicella

- Measles, Mumps, and Rubella

- Diphtheria, Pertussis, and Tetanus (DTP)

- Polio

- Hepatitis

- Other Indications

By End User

- Pediatric

- Adults

- Travelers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)