Vascular Access Procedures Market Size and Trends

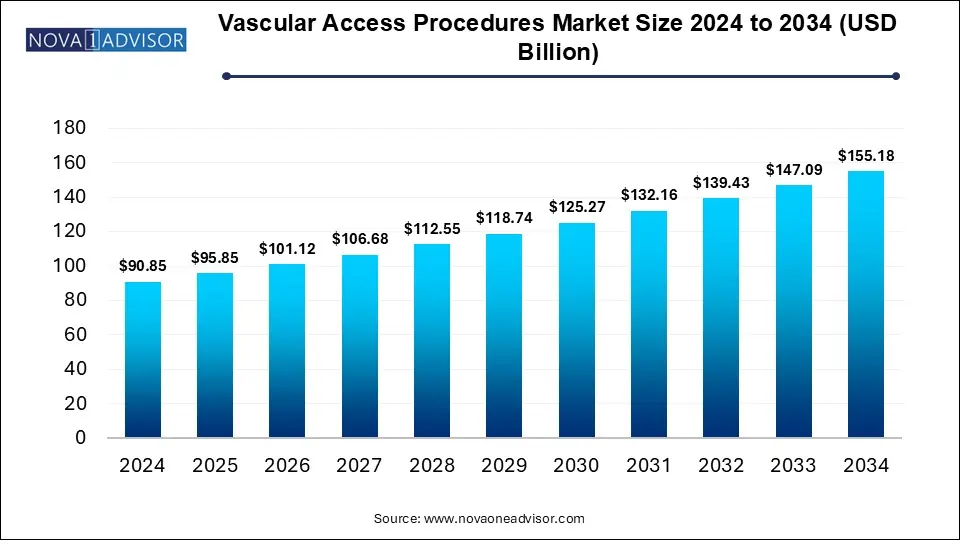

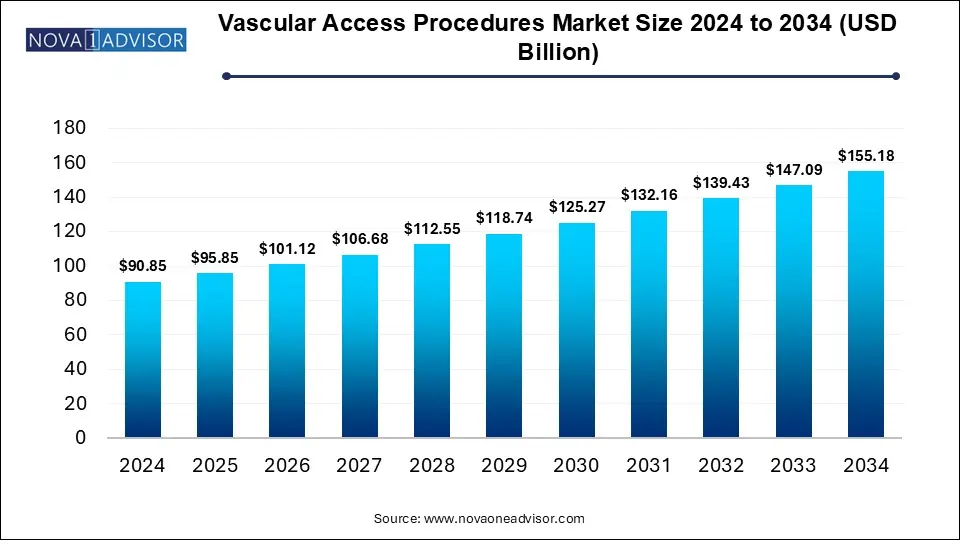

The vascular access procedures market size was exhibited at USD 90.85 billion in 2024 and is projected to hit around USD 155.18 billion by 2034, growing at a CAGR of 5.5% during the forecast period 2025 to 2034.

Key Takeaways:

- The arteriovenous fistulas segment led the market with the largest revenue share of 72% in 2024.

- The hemodialysis segment led the market with the largest revenue share of 54% in 2024,

- North America dominated the vascular access procedures market with the largest revenue share of 40% in 2024.

Market Overview

The vascular access procedures market is a vital segment of the global healthcare landscape, providing essential support for a wide range of clinical interventions, from emergency medicine to chronic disease management. Vascular access refers to the process of gaining access to a patient's bloodstream through veins or arteries for the administration of fluids, medication, nutrition, blood products, or to facilitate procedures like dialysis. This is achieved through various methods such as arteriovenous fistulas (AVFs), arteriovenous grafts (AVGs), central venous catheters (CVCs), and other evolving techniques.

The market is underpinned by an increase in chronic conditions such as end-stage renal disease (ESRD), cancer, and infectious diseases all of which require long-term or repetitive vascular access. According to the Global Dialysis Census, more than 3 million people worldwide receive dialysis, and this number is expected to rise significantly in the next decade. Chemotherapy and intravenous antibiotic treatments also heavily rely on dependable vascular access devices.

As patient-centric care models advance and healthcare systems aim to improve outcomes while minimizing complications, the demand for reliable, minimally invasive, and durable vascular access solutions is steadily increasing. Technological innovations such as antimicrobial-coated catheters, ultrasound-guided access techniques, and new biomaterials are contributing to the market’s sophistication. Additionally, the growing use of vascular access devices in ambulatory settings, driven by cost-efficiency and the need for timely treatment, is reshaping care delivery models.

Major Trends in the Market

-

Increasing preference for minimally invasive and image-guided vascular access techniques, reducing the risk of complications and enhancing procedural accuracy.

-

Growing use of antimicrobial-coated central venous catheters (CVCs) to combat hospital-acquired infections.

-

Integration of artificial intelligence and ultrasound navigation tools to assist in catheter placement and reduce complications.

-

Expansion of outpatient hemodialysis clinics which use arteriovenous fistulas and grafts for long-term access.

-

Rise in home-based care and self-administration treatments, boosting demand for user-friendly vascular access devices.

-

Emergence of hybrid access solutions that combine features of both catheters and grafts for patients with complex vascular anatomies.

-

Increased attention to pediatric and geriatric vascular access challenges, leading to specialized device designs for fragile or narrow veins.

Report Scope of Vascular Access Procedures Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 95.85 Billion |

| Market Size by 2034 |

USD 155.18 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Procedure Type, Application, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Teleflex Medical; BD; B. Braun; Smith’s Medical (ICU Medical, Inc.); Cook Medical; AngioDynamics; Medtronic; Medical Components, Inc.; Terumo Medical Corporation; Access Vascular, Inc. |

Market Driver: Rising Prevalence of Chronic Diseases Requiring Long-Term Vascular Access

One of the most powerful drivers propelling the vascular access procedures market is the rising global burden of chronic diseases such as cancer, chronic kidney disease (CKD), and congestive heart failure. These conditions often require prolonged therapies that involve regular infusion or blood purification processes.

For instance, patients undergoing chemotherapy typically need central venous access for months, if not years. Likewise, individuals on hemodialysis require vascular access three to four times per week. The growing number of diabetic and hypertensive patients, particularly in aging populations, contributes to an expanding base of end-stage renal disease patients requiring dialysis. These clinical demands have spurred the continuous evolution and adoption of durable and low-risk vascular access options, especially in high-volume healthcare facilities.

Market Restraint: Complications and Risks Associated with Vascular Access Devices

Despite their clinical utility, vascular access devices are associated with a number of potential complications that act as barriers to broader market adoption. These include catheter-related bloodstream infections (CRBSIs), thrombosis, device malfunctions, and dislodgment. According to the CDC, over 250,000 CRBSIs occur annually in the U.S. alone, leading to longer hospital stays, increased costs, and higher mortality rates.

In particular, central venous catheters, although frequently used for their ease and rapid placement, carry a higher infection risk compared to arteriovenous fistulas or grafts. Repeated procedures also place physical and psychological stress on patients, especially among the elderly or immunocompromised. This leads many clinicians to be cautious in device selection and limits the rapid uptake of newer, unfamiliar vascular access techniques or products without proven long-term safety data.

Market Opportunity: Technological Innovation in Catheter Materials and Coatings

As the medical device industry embraces advanced biomaterials and nanotechnology, a significant opportunity lies in developing next-generation vascular access devices that reduce infection, promote biocompatibility, and improve longevity. Innovations such as silver-impregnated or antibiotic-embedded catheters, anti-thrombogenic polymer coatings, and flexible silicone-based designs are rapidly transforming vascular access procedures.

Additionally, combining sensor technology with vascular access tools can facilitate real-time tracking of device performance, helping detect occlusions or misplacements early. These smart devices could revolutionize post-procedural monitoring and enable preventive care, especially for patients undergoing long-term treatment. Companies that prioritize R&D in these domains stand to gain a competitive advantage and reshape standard clinical protocols.

Segmental Analysis

By Procedure

Central venous catheters (CVCs) dominate the vascular access procedures market, owing to their widespread use in both acute and chronic care settings. CVCs are preferred in intensive care units (ICUs), oncology wards, and for emergency vascular access due to their ease of placement and compatibility with high-flow infusions. They are essential in administering chemotherapy, total parenteral nutrition, and long-term antibiotics. Despite known risks, they remain the most practical option for many critically ill patients or those with limited vascular sites.

Arteriovenous fistulas (AVFs) are emerging as the fastest-growing segment, primarily due to their superior long-term patency and lower infection rates in patients undergoing hemodialysis. AVFs, which are surgically created connections between arteries and veins, are now considered the gold standard for chronic dialysis patients. Encouraged by nephrology guidelines and government initiatives aimed at reducing dialysis-related complications, healthcare providers increasingly recommend AVFs over temporary catheters. Additionally, advancements in endovascular AVF creation are expanding access to this technique for patients who previously lacked suitable anatomy.

By Application

Hemodialysis remains the dominant application in the vascular access procedures market, reflecting the global rise in renal diseases. Each dialysis patient requires consistent and reliable vascular access, often with surgical interventions for AVFs or AVGs. The frequency of treatment typically multiple times per week demands devices that minimize infection risk and provide efficient blood flow. With the global dialysis population expected to cross 5 million by 2030, this application continues to be a cornerstone of vascular access demand.

Meanwhile, intravenous antibiotic treatment is gaining rapid momentum, especially in managing sepsis, osteomyelitis, and drug-resistant bacterial infections. With the growing prevalence of antimicrobial resistance (AMR), healthcare providers are prescribing prolonged IV antibiotic courses that necessitate dependable access. Home-based outpatient antimicrobial therapy (OPAT) programs are also growing in popularity, making PICC lines and tunneled catheters essential tools. The rising demand for hospital-at-home programs further fuels this trend, especially in aging populations and resource-strained healthcare systems.

Regional Analysis

North America Leads the Market

North America remains the dominant region in the vascular access procedures market, accounting for the largest revenue share due to its advanced healthcare infrastructure, high prevalence of chronic illnesses, and early adoption of innovative technologies. In the United States, the presence of extensive dialysis and oncology networks, along with reimbursement coverage for vascular access procedures, contributes to market strength. Moreover, the strong presence of leading companies such as Becton, Dickinson and Company (BD), Teleflex, and Medtronic drives product availability and innovation.

Additionally, North America has a robust clinical research ecosystem that supports the introduction of new vascular access technologies, including antimicrobial coatings and endovascular AVF systems. The region’s commitment to quality improvement initiatives such as the Fistula First Breakthrough Initiative further ensures continuous market growth.

Asia Pacific Emerges as the Fastest Growing Region

Asia Pacific is the fastest-growing region in the vascular access procedures market, fueled by rapidly expanding healthcare systems, an aging population, and a rising incidence of lifestyle-related diseases. Countries like India, China, and Japan are witnessing increasing cases of CKD and cancer, both of which necessitate frequent vascular access interventions.

Government investments in health infrastructure, especially in rural and semi-urban areas, are improving access to dialysis centers and cancer care units. Additionally, as surgical capabilities improve and medical tourism expands, the demand for vascular access devices in the region is surging. Local manufacturing and distribution partnerships also make cost-effective products more accessible, which encourages further adoption.

Some of The Prominent Players in The Vascular access procedures market Include:

- Teleflex Medical

- BD

- B. Braun

- Smith’s Medical (ICU Medical, Inc)

- Cook Medical

- AngioDynamics

- Medtronic

- Medical Components, Inc.

- Cook Medical

- Terumo Medical Corporation

- Access Vascular, Inc.

Recent Developments

-

April 2025: Teleflex Inc. launched a new version of its Arrow® PICC with chlorhexidine-based antimicrobial protection in global markets to address catheter-related infections.

-

January 2025: Medtronic announced the expansion of its Ellipsys Vascular Access System in the Asia Pacific region, enhancing minimally invasive AVF creation.

-

October 2024: BD introduced a smart vascular access system integrated with AI-guided ultrasound navigation in pilot hospitals across Europe and North America.

-

August 2024: Fresenius Medical Care signed agreements with multiple dialysis centers in Latin America to provide end-to-end vascular access management, including surgical support and device supply.

-

May 2024: Access Vascular Inc. completed a successful clinical trial of its HydroPICC® catheter, showcasing significantly lower thrombosis rates compared to traditional catheters.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Procedure

- Arteriovenous Fistulas

- Arteriovenous Grafts

- Central Venous Catheters

- Others

By Application

- Chemotherapy

- Hemodialysis

- Blood Transfusions

- Intravenous Antibiotics Treatment

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)