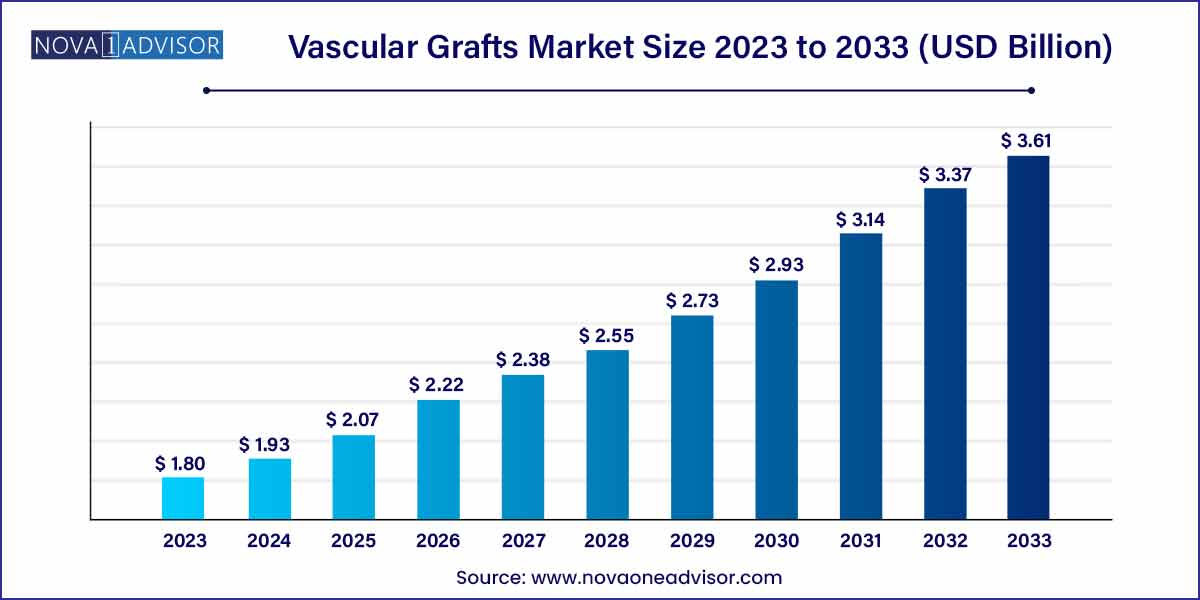

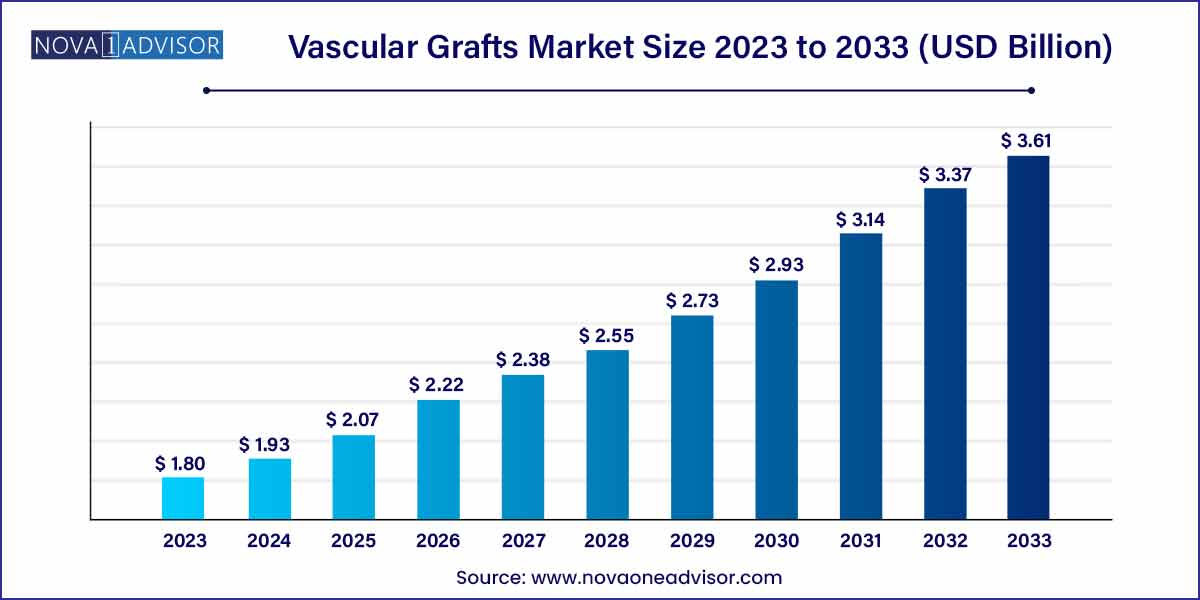

The global vascular grafts market size was exhibited at USD 1.80 billion in 2023 and is projected to hit around USD 3.61 billion by 2033, growing at a CAGR of 7.2% during the forecast period of 2024 to 2033.

Key Takeaways:

- In 2023, the endovascular stent-grafts product segment dominated the market with a share of 63.8%.

- In 2023, the cardiac aneurysm segment held the largest market share at 51.9%.

- The polytetrafluoroethylene segment held a market revenue share of 47.0% in 2023.

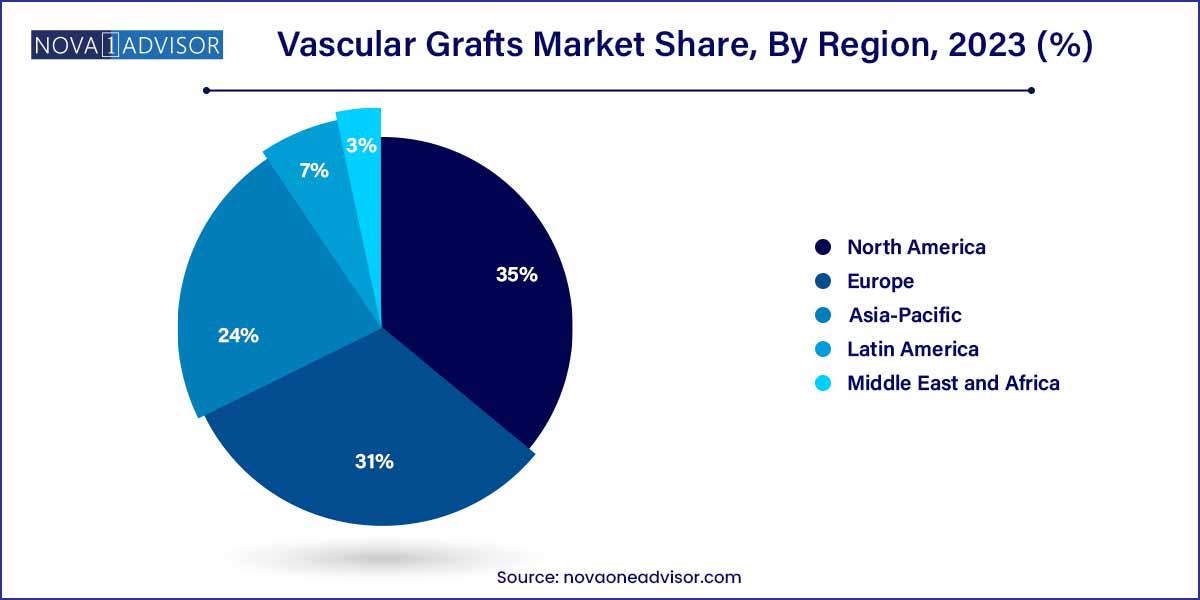

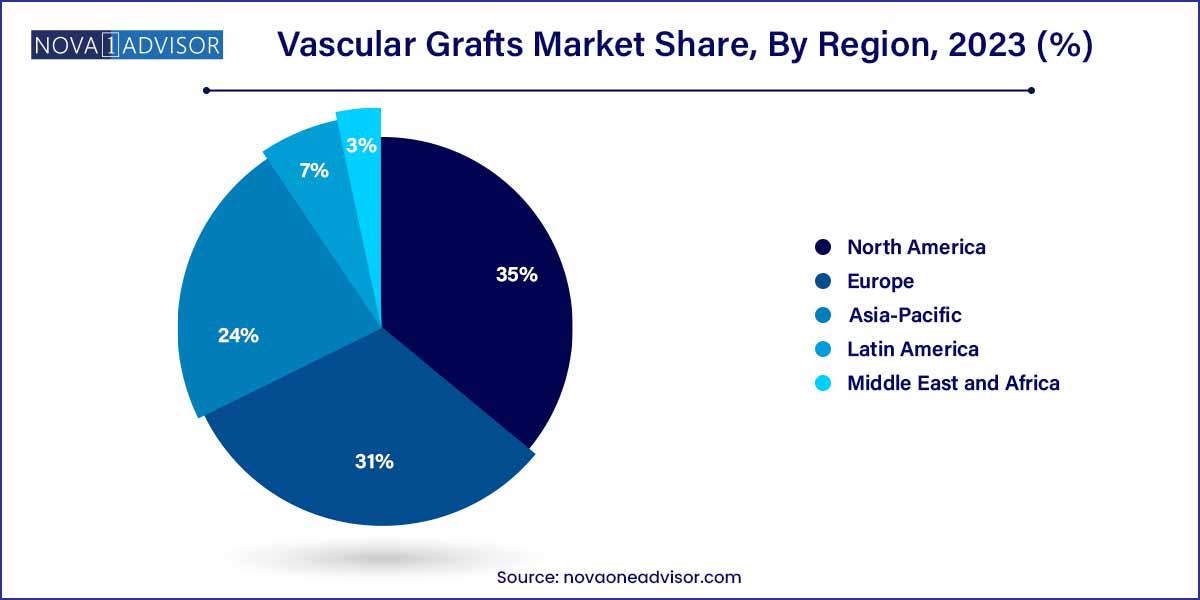

- North America held the largest market share of 31.0% in 2023, owing to the rising health awareness and availability of health care facilities for cardiovascular treatment in the region.

Market Overview

The Vascular Grafts Market plays a pivotal role in the treatment of various cardiovascular diseases, which continue to be the leading cause of mortality worldwide. Vascular grafts are medical devices used to replace, repair, or bypass sections of blood vessels. They are critical in surgical procedures addressing arterial blockages, aneurysms, and vascular occlusions associated with kidney failure, coronary artery disease, and peripheral vascular diseases.

As the global burden of cardiovascular disorders escalates—driven by aging populations, sedentary lifestyles, diabetes, and hypertension—the demand for vascular grafts is expanding. Advancements in biomaterials, minimally invasive surgical techniques, and the development of tissue-engineered grafts are revolutionizing this market. Moreover, the increasing success rates of endovascular procedures and growing awareness about early disease intervention are boosting adoption rates.

Key industry players like Medtronic, W. L. Gore & Associates, and Terumo Corporation are heavily investing in product innovation, focusing on biocompatibility, durability, and infection resistance. The market is poised for robust growth, driven by technological evolution, greater healthcare expenditure, and global initiatives targeting vascular health improvement.

Major Trends in the Market

-

Shift Toward Minimally Invasive and Endovascular Procedures: Higher preference for endovascular stent grafts over open surgeries.

-

Rise of Tissue-Engineered and Biological Vascular Grafts: Focus on improving biocompatibility and reducing rejection risks.

-

Growth in Dialysis-Related Vascular Access Grafts: Driven by the increasing incidence of end-stage renal disease (ESRD).

-

Advancements in Synthetic Material Technology: Development of better polyester and polytetrafluoroethylene (PTFE) vascular grafts.

-

Expansion of Peripheral Artery Disease (PAD) Treatments: Increasing use of grafts for peripheral revascularization.

-

Customization and Personalized Vascular Grafts: 3D printing technologies enabling patient-specific designs.

-

Emergence of Drug-Eluting Vascular Grafts: Reducing restenosis and improving graft patency.

Vascular Grafts Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.80 Billion |

| Market Size by 2033 |

USD 3.61 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Raw Material, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic plc; Terumo Corporation; LeMaitre Vascular, Inc.; Getinge AB; Cook; C.R. Bard; W.L. Gore and Associates, Inc.; Shanghai Suokang Medical Implants Co. Ltd. |

Key Market Driver

Rising Prevalence of Cardiovascular Diseases and Chronic Kidney Diseases

The increasing global incidence of cardiovascular diseases (CVDs) and chronic kidney diseases (CKD) is the primary driver propelling the vascular grafts market. According to the World Health Organization (WHO), CVDs account for nearly 32% of all global deaths annually. Furthermore, rising rates of diabetes and hypertension, leading risk factors for vascular diseases, have created substantial demand for graft-based interventions. In March 2024, the Centers for Disease Control and Prevention (CDC) reported a 15% increase in peripheral artery disease diagnoses over the past five years in the U.S., underlining the expanding patient pool requiring vascular grafts.

Key Market Restraint

High Cost of Procedures and Stringent Regulatory Approval Processes

The cost-intensive nature of vascular graft surgeries, coupled with long, complex regulatory pathways for device approval, poses a significant barrier to market growth. Developing countries, where healthcare expenditure per capita remains low, often face limited adoption of advanced graft solutions. Additionally, strict regulatory frameworks, such as the FDA’s PMA (Premarket Approval) and CE Marking in Europe, require extensive clinical data, delaying product launches and increasing developmental costs. As a result, market penetration in emerging regions remains relatively slower compared to developed economies.

Key Market Opportunity

Innovation in Biocompatible and Tissue-Engineered Vascular Grafts

The development of biocompatible, tissue-engineered vascular grafts presents a promising opportunity. These grafts mimic natural blood vessels more closely, reducing complications such as thrombosis, infection, and rejection. Companies investing in regenerative medicine approaches—combining bio-scaffolds, stem cells, and 3D printing—stand to gain significant competitive advantages. In February 2024, Humacyte announced positive clinical trial results for its bioengineered human acellular vessels (HAVs), showcasing the immense potential of tissue-engineered grafts to redefine the vascular surgery landscape.

Product Insights

Endovascular Stent Grafts dominated the product segment in 2024. The preference for less invasive procedures with quicker recovery times, reduced hospital stays, and lower complication rates has driven the popularity of endovascular stent grafts, particularly for treating aortic aneurysms. Technological advancements have improved the flexibility, conformability, and precision deployment of stent grafts, making them the first choice in many vascular interventions.

Hemodialysis Access Grafts are witnessing the fastest growth. As the global burden of chronic kidney disease (CKD) rises, particularly in aging populations, the need for vascular access in hemodialysis patients has surged. In April 2024, the American Society of Nephrology highlighted a 10% increase in ESRD cases in the U.S., signaling strong growth prospects for dialysis-related vascular grafts.

Application Insights

Endovascular Stent Grafts dominated the cardiac aneurysm application segment. Endovascular aneurysm repair (EVAR) using stent grafts has become the standard of care for abdominal and thoracic aortic aneurysms due to its minimally invasive nature and reduced perioperative mortality compared to open surgery. Growing awareness and improved screening programs are also supporting early detection and intervention.

Vascular Grafts for Cardiac Aneurysm are also growing steadily, particularly in cases where stent graft placement is not feasible due to complex anatomical considerations. In February 2024, Medtronic expanded its surgical graft portfolio for aortic arch reconstructions, indicating continued relevance of traditional grafts.

Kidney Failure remains a high-growth application for vascular grafts, driven by the increasing incidence of ESRD requiring durable hemodialysis access grafts. With millions of dialysis sessions occurring globally every year, vascular access grafts are becoming indispensable in nephrology care.

Vascular Grafts play a critical role in managing vascular occlusions and coronary artery disease (CAD), where autologous veins are often used, supplemented by synthetic or biological grafts when needed. Rising incidence of CAD, fueled by sedentary lifestyles and obesity, continues to generate strong demand for coronary artery bypass grafts (CABG).

Raw Material Insights

Polyester Vascular Grafts dominated the raw material segment in 2024. Polyester grafts are widely used for their strength, durability, and ease of handling during surgery, particularly in large-diameter vessel repairs such as aortic aneurysms. Companies have improved polyester graft coatings to enhance hemocompatibility and reduce postoperative complications.

Biological Material-Based Vascular Grafts are the fastest-growing segment. The growing adoption of human saphenous veins, umbilical veins, and tissue-engineered materials offers superior biocompatibility and reduces the risk of thrombosis and infection. In January 2024, LeMaitre Vascular launched a new biologically derived peripheral vascular graft in Europe, highlighting this segment's momentum.

Regional Insights

North America dominated the global vascular grafts market in 2023. High prevalence of cardiovascular diseases, advanced healthcare infrastructure, favorable reimbursement policies, and continuous technological innovation contribute to the region’s leadership. In March 2024, the American Heart Association emphasized the need for greater vascular disease management initiatives, further supporting market expansion.

Asia-Pacific is the fastest-growing region. Rapid economic development, increasing healthcare investments, rising prevalence of lifestyle diseases, and growing medical tourism are key drivers. Countries like China, India, and Japan are witnessing higher demand for vascular surgeries and minimally invasive interventions. In April 2024, India’s Ministry of Health launched a national cardiovascular health strategy, aiming to double early detection rates by 2030, signaling robust growth prospects.

Some of the prominent players in the Vascular Grafts Market include:

- Medtronic plc

- Getinge AB

- LeMaitre Vascular, Inc.

- W. L. Gore and Associates, Inc.

- Cook Medical

- C. R. Bard

- Terumo Corporation

- Shanghai Suokang Medical Implants Co. Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global Vascular grafts market.

Product

- Hemodialysis Access Grafts

- Endovascular Stent Grafts

- Coronary Artery By-Pass Grafts

- Vascular Grafts for Aorta Disease

- Peripheral Vascular Grafts

Application

-

- Endovascular Stent Graft

- Vascular Graft

- Kidney Failure

- Vascular Occlusion

- Coronary Artery Disease

Raw Material

- Polyester Vascular Grafts

- Polytetrafluoroethylene Vascular Grafts

- Polyurethane Vascular Grafts

- Biological Material-Based Vascular Grafts

-

- Human Saphenous and Umbilical Veins

- Tissue-engineered materials

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)