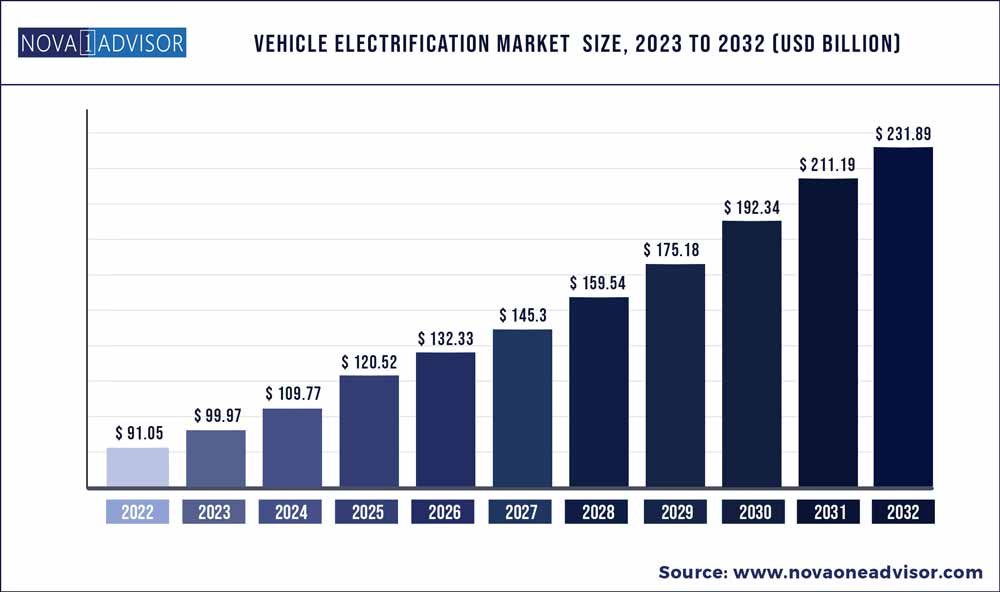

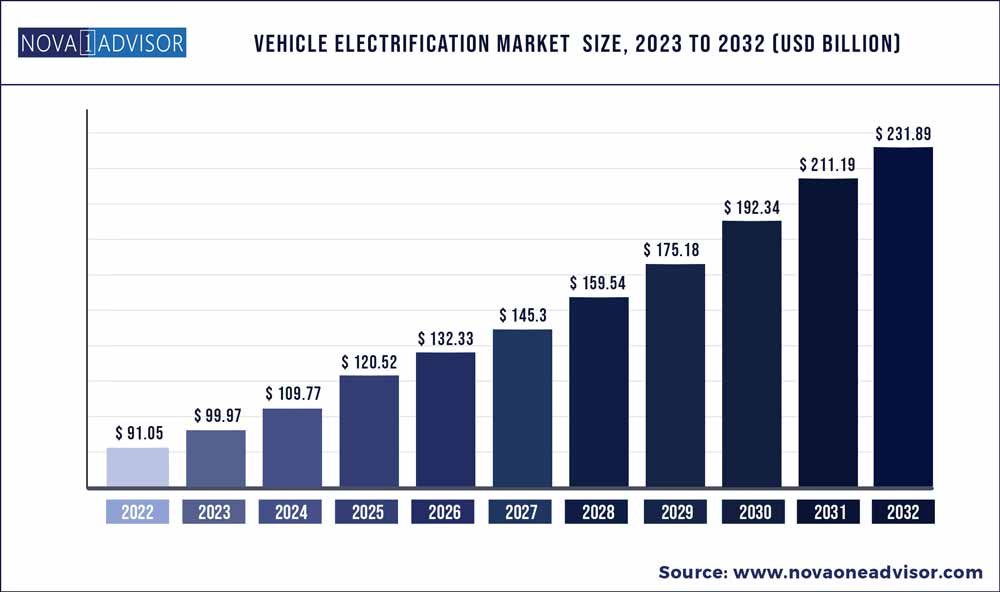

The global Vehicle Electrification market size was exhibited at USD 91.05 billion in 2022 and is projected to hit around USD 231.89 billion by 2032, growing at a CAGR of 9.8% during the forecast period 2023 to 2032.

Key Pointers:

- The demand for the electric power steering (EPS) segment held the third-highest market share of around 13.9% in 2022.

- The electric vacuum pump segment is expected to witness a significant CAGR of 12.2% during the forecast period.

- The market is segmented into Internal Combustion Engine (ICE) & Micro-Hybrid Vehicle, HEV, PHEV, and BEV. ICE segment held the highest market share of around 61.9% in2022.

- The PHEV segment is anticipated to expand at the highest CAGR of 14.6% during the forecast period.

- North America is anticipated to expand at the highest CAGR of 10.8% during the forecast period.

- The Asia- Pacific accounted for the highest market share and was valued at USD 46.51 billion in 2022.

The market is witnessing tremendous growth owing to several benefits such as reduced vehicle weight, higher fuel efficiency, improved driving comfort, and safety features in an electric vehicle.

The increasing conventional fossil fuel prices and rising electric vehicle sales are prompting the electrification of automobiles. The increasing customer demand for fuel-efficient automobiles, stringent emission rules, and growing environmental concerns are all expected to drive the growth of the market for vehicle electrification.

The vehicle generally uses diesel or electricity as its power source. However, due to the growing environmental concerns over carbon emissions and rising crude oil prices. Governments of the countries such as India, China, and the U.S. are pivoting toward complete vehicle electrification. It encourages heavy investments from the government and private entities that are used for the development of electric vehicles and their infrastructure. These factors are further driving the market growth.

The electric system is replacing several hydraulic or mechanical systems in a vehicle. For instance, hydraulic power steering is replaced with electric power steering, mechanical or hydraulic pumps are replaced with electric pumps, etc. Furthermore, vehicle electrification decreases reliance on oil, which is a finite resource. All of these factors are projected to drive the global vehicle electrification market.

Clean energy generation in such vehicles has a significant environmental impact since it decreases harmful emissions from tailpipes and the power grid. Additionally, the electrification process incurs fewer operating costs and requires low maintenance as it eliminates the use of lubricant or coolant in the vehicle. The mechanical integration through electrification enhances overall functioning and efficiency, which is expected to drive the market further during the forecast period.

Vehicle Electrification Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 99.97 Billion

|

|

Market Size by 2032

|

USD 231.89 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 9.8%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Product, hybridization, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Robert Bosch GmbH; Continental AG; Denso Corporation; Delphi Automotive PLC; Johnson Electric and Mitsubishi Electric Corporation

|

Market Dynamics

DRIVER: Rising need for 48V architecture

The concept of 48 V architecture or mild hybrids is rapidly gaining traction around the globe, which is consequently expected to drive the demand for vehicle electrification in the near future. Full hybrid vehicles offer a better fuel economy as compared to mild hybrids. According to the International Council on Clean Transportation, full hybrid vehicles reduce fuel consumption by 30–35%. However, factors such as the higher cost and weight of vehicles are major challenges for full hybrid vehicle manufacturers. Mild hybrid systems with a 48 V battery are not as efficient as full hybrid systems but are cost-effective. Hence, OEMs prefer the mild hybrid concept. This involves the use of a conventional ICE engine and the addition of an electric motor with a power of up to 15 kW. The only addition to the cost is that of the electric motor, which is balanced by the removal of the starter motor and alternator from the conventional ICE engine.

RESTRAINT: Difficulty in achieving and maintaining an optimum power-to-weight ratio

The power-to-weight ratio is a calculation commonly applied to engines and power sources to enable the comparison of one vehicle to another. The power-to-weight ratio applies to the vehicle power in kW divided by the weight of the vehicle in kilograms. The lesser the weight of the vehicle, it is observed to have more power, better efficiency, and high range. Advanced, lightweight components and materials are required to achieve optimum power-to-weight ratio. OEMs and Tier I companies are working hard to improve the power-to-weight ratio by implementing lightweight materials and different advanced products such as e-CVT and e-axles, albeit still on a developmental stage.

OPPORTUNITY: Electrification of commercial vehicles

Globally, buses and trucks are used for public transportation and logistics purposes. In Europe and Asia Oceania, public transportation is used more than private transportation. While in North America, transportation is primarily through private vehicles. The demand for public transportation is triggered by the growing population in urban areas where the existing transportation infrastructure is proving to be insufficient. As each OEM is now focusing on reducing the global carbon footprint, they are promoting the use of electric vehicles. With the rising trend toward mobility on demand, taxis and passenger cars are focused more on greener technologies. Most of the efforts in the field of vehicle electrification are for passenger cars. There are very limited electrical systems and components for commercial vehicles that can replace conventional mechanical systems because of the higher loads. Developing electric powertrains for commercial vehicles is a costly affair as it involves a great amount of R&D. Governments from various countries are taking initiatives to increase the use of electric vehicles in their public transportation to reduce CO2 emissions by providing incentives and tax rebates on using e-trucks and e-buses. Some of the electric vehicle models are the Mercedes Benz electric truck, and BYD K9 and Tata Starbus Hybrid e-buses. As of now, there are a few commercial vehicle manufacturers that have introduced electric buses. However, the electric driveline for trucks and buses is still a challenge for system developers.

As with the wide-scale adoption of these vehicles, the demand for more reliable and better-performing systems would increase. This is where e-drive systems would help in vehicle weight reduction. This offers a good opportunity for manufacturers of electric components and electric drivelines to develop and launch products for the commercial vehicle segment.

CHALLENGE: Developing fail-safe electronic and electrical components

Electric vehicles signify the introduction of advanced technologies along with electric power components in vehicles. There are several risks associated with these technologies, such as thermal runaway of battery bank and fire, which need to be cautiously assessed. Numerous safety aspects need to be considered regarding vehicle electrification, including electric system safety, functional system safety, battery charging safety, and vehicle maintenance, operation, and training. The current challenges that hinder the popularity of electric vehicles are high battery cost, overheating, the total energy storage capacity of the battery, and the development of batteries for vehicles. Additionally, it is essential to examine the vehicle behavior as these systems often fail, making them inefficient when compared to ICE vehicles. Thus, automobile manufacturers need to ensure that customers use systems that operate efficiently in varied conditions to effectively promote the use of these electrical systems and their components.

Product Insights

The demand for the electric power steering (EPS) segment held the third-highest market share of around 13.9% in 2022. The EPS segment is given a higher preference between the end-users than other steering systems. It offers many advantages, such as energy economy, decreased mechanical complications, and the ability to adjust a simpler interface. EPS is smaller and lighter than HPS resulting in an energy-efficient vehicle option. The lack of dependability in hydraulic power steering contributes to the market's growth.

The electric vacuum pump segment is expected to witness a significant CAGR of 12.2% during the forecast period. Technological developments are being carried out in the automotive industry to save fuel, gaining prominence on account of increased energy efficiency in engines. The reliable performance of electric vacuum pumps in vehicles helps automakers meet new emission marks by fulfilling the vacuum required for the brake booster. The rise in demand for electric vacuum pumps can be attributed to their ability to deliver a smooth and consistent break-pedal feel to customers.

Hybridization Insight

By hybridization, the market is segmented into Internal Combustion Engine (ICE) & Micro-Hybrid Vehicle, HEV, PHEV, and BEV. ICE segment held the highest market share of around 61.9% in2022. Technological advancements in the automotive industry have led to the introduction of battery electric vehicles. Demand for the product is increasing across the industry such as agriculture, construction, mining, and power generation. The lack of global EV infrastructure availability is also responsible for the uptake of the ICE market. Also, the growing popularity of vehicles using gasoline along with the growing shale gas production is the additional factors driving the market growth.

The PHEV segment is anticipated to expand at the highest CAGR of 14.6% during the forecast period. Collaborations between private and government agencies to develop smart cities across the nation and growing charging infrastructure are the factors expected to increase the demand for plug-in hybrid electric vehicles. Additionally, plug-in hybrid electric vehicles have witnessed substantial growth in technologically advanced nations. Integrated electrification systems for all kinds of transport vehicles, such as freight delivery vehicles, public transport, and 2-wheelers, are being encouraged by government agencies across the globe to reduce reliance on fossil fuels. All these factors add to the market’s growth.

Regional Insights

The Asia- Pacific accounted for the highest market share and was valued at USD 46.51 billion in 2022. The government’s initiatives to promote electric vehicles and give subsidies for the purchases are the factors driving demand in the market within this region. The rising population in the countries coupled with increasing per capita income stimulates the demand for the personal transport automobile that is supportive of a sustainable environment.

Europe is expected to see considerable growth in the vehicle electrification industry due to the government’s focus on implementing sustainable infrastructure growth. Furthermore, future investment because of the government support is expected to boost the expansion of the vehicle electrification market during the forecast period.

North America is anticipated to expand at the highest CAGR of 10.8% during the forecast period. The expansion of charging infrastructure and major expenditures by OEMs in the development of vehicle electrification are the factors driving this region's growth. The evolution of the car electrification sector, notably in the United States is accelerated by federal tax credits and rebate incentives.

For instance, in 2022, General Motors, a major American automaker, had revealed plans to introduce electric automobiles designed for personal usage, in the next years. By 2025, the business plans to release 30 electric vehicles worldwide, with around two-thirds of them accessible in North America. The lucrative nature of the market is projected to inspire more traditional vehicle manufacturers to enter the product market, thus, boosting the growth of the market for vehicle electrification.

Some of the prominent players in the Vehicle Electrification Market include:

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Delphi Automotive PLC

- Johnson Electric

- Mitsubishi Electric Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Vehicle Electrification market.

By Product

- Start/Stop System

- Electric Power Steering

- Liquid Heater Ptc

- Electric Air Conditioner Compressor

- Electric Vacuum Pump

- Electric Oil Pump

- Electric Water Pump

- Starter Motor & Alternator

- Integrated Starter Generator

- Actuators

By Hybridization

- Internal Combustion Engine(ICE) & Micro-Hybrid Vehicle

- HEV

- PHEV

- BEV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)