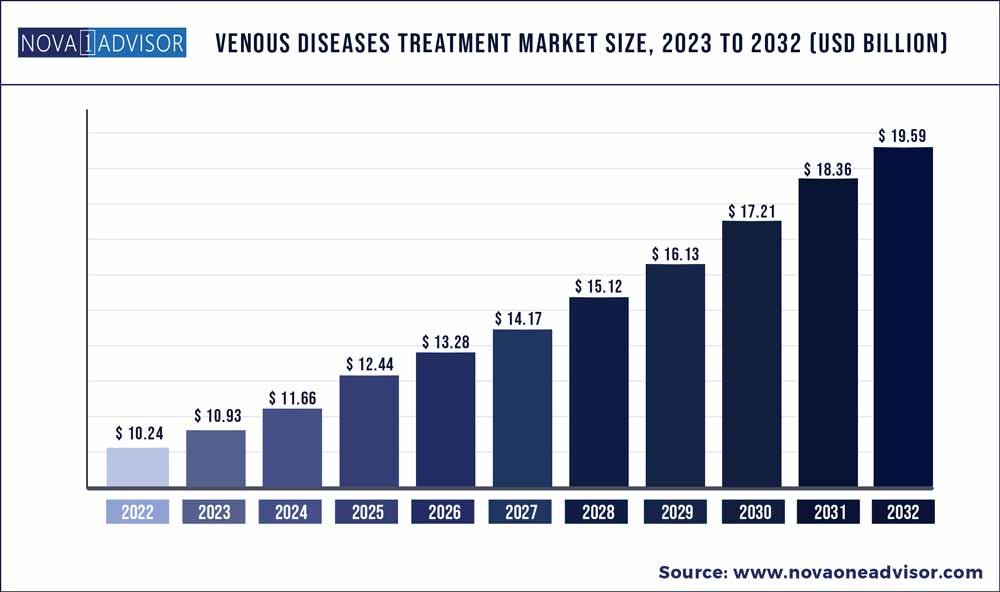

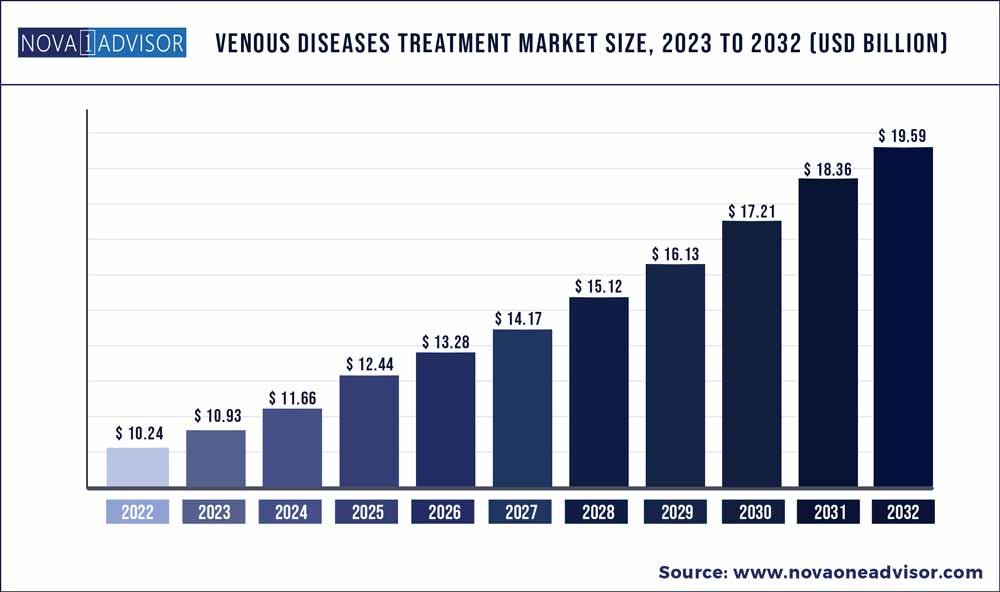

The global venous diseases treatment market size was estimated at USD 10.24 billion in 2022 and is expected to surpass around USD 19.59 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 6.7% during the forecast period 2023 to 2032.

Key Takeaways:

- North America dominated the global venous diseases treatment market in 2022. The market in the region is anticipated to grow at a CAGR of 6.9% from 2023 to 2032

- In terms of treatment type, the surgeries segment is projected to dominate the global market with 61% share by 2032.

- Based on disease type, the varicose veins segment dominated the global market with around 27% share in 2022.

- In terms of product type, the ablation devices segment led the global market with around 30% share in 2022.

- In terms of end-user, the hospitals segment is projected to dominate the global market with 45% share by 2032.

Venous disorders are diseases that affect the veins in the body. Damaged vein walls obstruct the circulatory system, enabling the blood to collect and flow backward when the muscles relax. This causes an unusually high buildup of pressure in the veins. The accumulation causes stretching and twisting of the veins, increased swelling, valve incompetence, sluggish blood flow, and formation of blood clots. This condition can eventually lead to various disorders known as venous disease. Varicose veins, also known as varicoses or varicosities, are enlarged, twisted veins that can occur anywhere in the body, but are more common in the legs. Varicose veins is one of the most common diseases caused due to damaged vein walls and valves. Rise in prevalence of varicose veins is anticipated to drive the global venous diseases treatment market. According to an article published in the Journal of the American Heart Association, around 23% of adults in the U.S. have varicose veins. Annually, organizations such as the British Association of Sclerotherapies (BAS) launch initiatives to raise awareness and encourage the use of various venous disease treatments. Rise in awareness about deep vein thrombosis treatment, chronic venous occlusions treatment, venous insufficiency treatment, and leg ulcer treatment; and growth in number of product approvals are driving the market. For instance, in November 2020, Vascular Barcelona Devices (VB Devices) received the CE mark approval for Varixio Pod Air, as a Class 1s medical device intended for automated foam preparation for varicose veins sclerotherapy.

Venous Diseases Treatment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 10.93 Billion |

| Market Size by 2032 |

USD 19.59 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 6.7% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Treatment Type, Disease Type, Product Type, End-user And Geography |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic, AngioDynamics, Alma Lasers, biolitec AG Untere Viaduktgasse, Becton Dickinson and Company, Boston Scientific Corporation, Abbott Laboratories, B. Braun Melsungen Ag, Teleflex Incorporated, Lumenis, and Philips. |

Growth in Preference for Laser Ablation Treatments to Drive Global Market

Laser ablation treatment does not require lengthy hospital stays. It also does not cause discomfort during the recovery process. Adoption of lasers in varicose vein treatment has increased due to the development of novel technologies and advancements in research activities by key players in the market. Doctors are using laser ablation technology to close smaller varicose and spider veins. This treatment involves directing intense bursts of light at the affected veins, causing them to fade or disappear. The usage of laser treatment is increasing in developed countries due to the rise in healthcare costs and growth in preference for non-invasive procedures.

According to a study published in the British Journal of Surgery in May 2022 titled, "Compression following treatment of superficial venous incompetence: systematic review," laser ablation therapy was cost-effective and the preferred initial treatment for symptomatic venous diseases with a diameter of at least 3 mm and evidence of saphenous vein reflux.

Technological Advancements in Vascular Stents and Introduction of New Products to Propel Global Market

Technological advancements in vascular stents, increase in demand for minimally invasive procedures, and rise in geriatric population are some of the factors driving the global market. Companies are expanding their product portfolio to offer the best services for venous diseases. For instance, in March 2022, Cordis, a global cardiovascular technology company, announced that the FDA approved the S.M.A.R.T. RADIANZ Vascular Stent System, a self-expanding stent designed specifically for radial peripheral procedures. The S.M.A.R.T. RADIANZ Vascular Stent System enables accurate and efficient placement of a stent in the iliac and superficial femoral (SFA) arteries.

In December 2021, Royal Philips, a global leader in health technology, announced that it had agreed to acquire Vesper Medical Inc., a medical technology company based in the U.S., which develops minimally invasive peripheral vascular devices. Vesper Medical would add an advanced venous stent portfolio for the treatment of deep venous disease to Philips' portfolio of diagnostic and therapeutic devices.

Increase in Number of Vascular Surgeries Augmenting Global Venous Diseases Treatment Market

In terms of treatment type, the surgeries segment is projected to dominate the global market with 61% share by 2032. Vascular surgery is a surgical subspecialty that treats diseases of the vascular system, which includes arteries, veins, and lymphatic circulation, through medical therapy, minimally invasive catheter procedures, and surgical reconstruction. Vascular diseases are treated using both open surgery and endovascular techniques. Rise in prevalence of varicose veins due to obesity, phlebitis, congenital abnormalities in veins, and blood clots is driving the demand for new treatments. Therefore, companies are offering innovative products, which in turn is propelling the market.

Rise in Cases of Varicose Veins to Boost Global Venous Diseases Treatment Market

Based on disease type, the varicose veins segment dominated the global market with around 27% share in 2022. Rise in prevalence of small and greater saphenous vein, reticular varicose vein, and genital area varicose veins have prompted people to be more aware and educated about varicose vein warning signals and the importance of a prompt response. In July 2019, India Medtronic Private Limited, a subsidiary of Medtronic plc, launched VenaSeal Closure System in India. This led to an improvement in the quality of life of patients living with varicose veins.

Surge in Adoption of Ablation Devices to Create Lucrative Opportunities for Manufacturers

In terms of product type, the ablation devices segment led the global market with around 30% share in 2022. Ablation devices are medical devices used in minimally invasive procedures to remove or excise abnormal body tissues for therapeutic purposes. These systems use the heat generated by radio frequency, energy, extreme cold, or a laser to cause small burns. Rise in adoption of robotic technologies for product application expansion and integration of cutting-edge technologies in ablation devices to improve patient safety and procedural efficiency are expected to drive the segment. Increase in adoption of ablation devices is creating lucrative opportunities for manufacturers in the global venous diseases treatment market.

Increase in Number of Vascular Surgeries Bolstering Hospitals Segment

In terms of end-user, the hospitals segment is projected to dominate the global market with 45% share by 2032. Several hospitals provide treatments for venous diseases. These treatments include endovenous ablation or endovenous laser ablation, radiofrequency ablation, and stripping or surgical ligation. Most surgeons adopt traditional approaches due to high success rates and increase in number of patients preferring traditional approaches. Surge in number of hospitals across the globe along with comparatively higher performance and adoption of minimally invasive surgeries (MISs) in these settings is driving the hospitals segment.

Regional Outlook of Global Venous Diseases Treatment Market

North America dominated the global venous diseases treatment market in 2022. The market in the region is anticipated to grow at a CAGR of 6.9% from 2023 to 2032. It is expected to witness strong growth due to various strategies adopted by key players for market expansion such as product launches, mergers and acquisitions, and collaborations. For instance, in April 2021, Medtronic began an Investigation Device Exemption (IDE) study to determine the efficacy and safety of the Abre venous self-expanding stent device, which is used to treat deep venous disorders.

According to a study titled "Risk assessment for varicose veins among city Police-A cross-sectional study" that was published in Clinical Epidemiology and Global Health in December 2021, in the U.S., around 23% of adults have varicose veins. The prevalence increases to 80% in males and 85% in women when spider telangiectasias and reticular veins are considered. Thus, rise in prevalence of varicose veins among the population of the U.S. is projected to augment the venous diseases treatment market in North America during the forecast period.

Key Developments in Global Venous Diseases Treatment Market

- In May 2022, THERACLION, a cutting-edge company developing a scalable robotic platform for non-invasive echotherapy, launched SONOVEIN HD. This new system combines the cutting-edge imaging capabilities of SuperSonic Imagine (recently acquired by Hologic) with the first and only extracorporeal therapeutic ultrasound solution.

- In April 2022, I-VASC, an Italy-based manufacturer of medical devices, closed a EUR 1.8 Mn Series A investment for the introduction of its VELEX product. VELEX is a device that can be used in an operation called Empty Vein Ablation to treat CVI and varicose veins. It obtained its CE Mark in May 2021.

- In August 2019, Boston Scientific Corporation acquired BTG plc., a London-based company that develops and commercializes products used in minimally invasive procedures targeting cancer and vascular diseases, as well as specialty pharmaceuticals. The addition of the BTG Interventional Medicine portfolio has reinforced Boston Scientific Corporation’s market leadership strategy. It has also enabled the company to offer best-in-class technologies, unparalleled clinical evidence, and a strengthened commercial infrastructure to support physicians treating some of the most challenging diseases.

- Some of the prominent players in the Venous Diseases Treatment Market include:

- Medtronic

- AngioDynamics

- Alma Lasers

- Biolitec AG Untere Viaduktgasse

- Becton Dickinson and Company

- Boston Scientific Corporation

- Abbott Laboratories

- B. Braun Melsungen Ag

- Teleflex Incorporated

- Lumenis

- Philips

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Venous Diseases Treatment market.

By Treatment Type

- Surgeries

- Angioplasty or Stenting

- Vein Ligation and stripping

- Vena Cava Filter

- Ambulatory Phlebectomy

- Others

- Therapies

- Sclerotherapy

- Radiofrequency Ablation Therapy

- Laser Treatment

By Disease Type

- Deep-vein Thrombophlebitis

- Varicose Veins

- Superficial Thrombophlebitis

- Chronic Venous Insufficiency

- Venous Ulcers

- Others

By Product Type

- Ablation Devices

- Venous Stents

- Venous Closure Products

- Sclerotherapy Injection

- Others

By End-user

- Hospitals

- Clinics

- Ambulatory Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)