Veterinary Care Market Size and Research

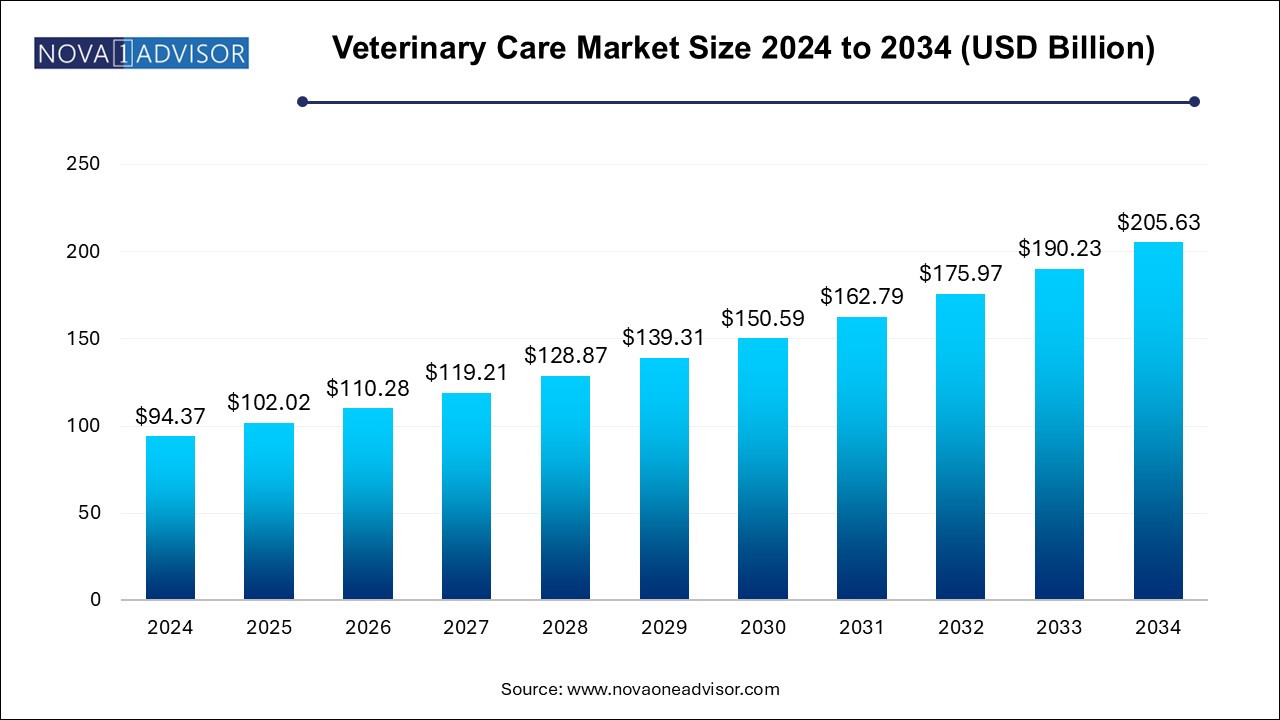

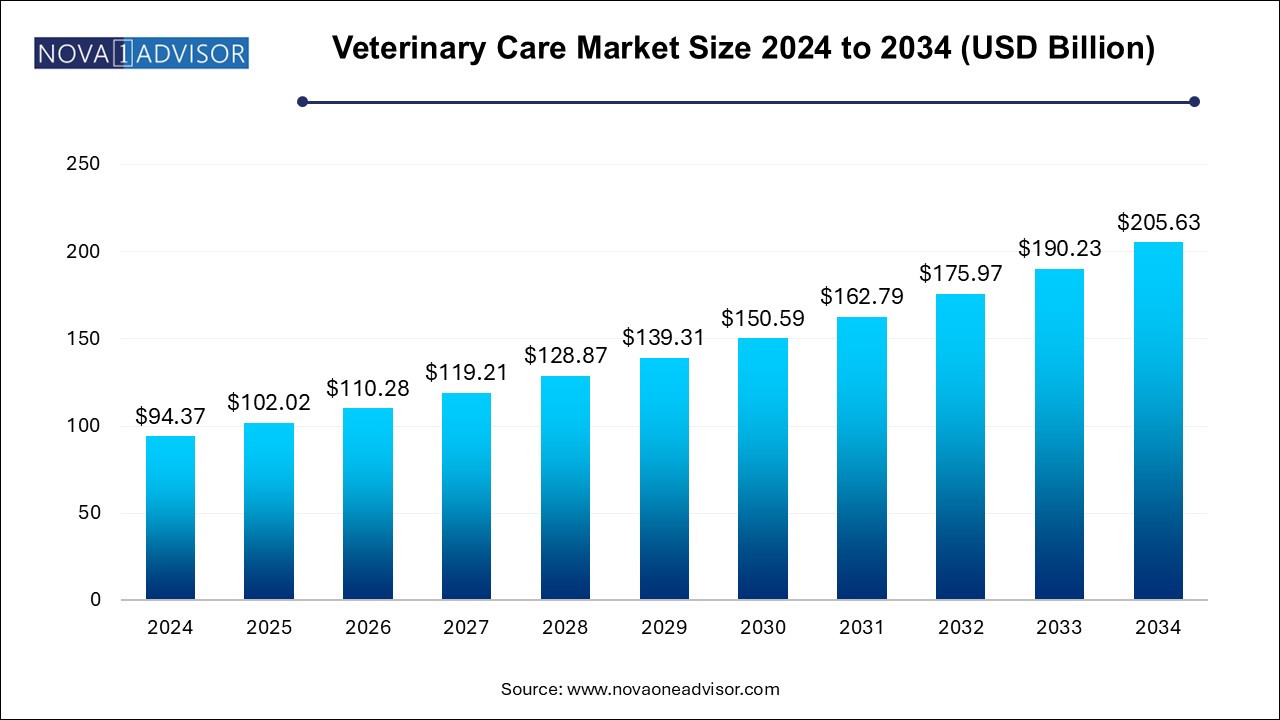

The veterinary care market size was exhibited at USD 94.37 billion in 2024 and is projected to hit around USD 205.63 billion by 2034, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

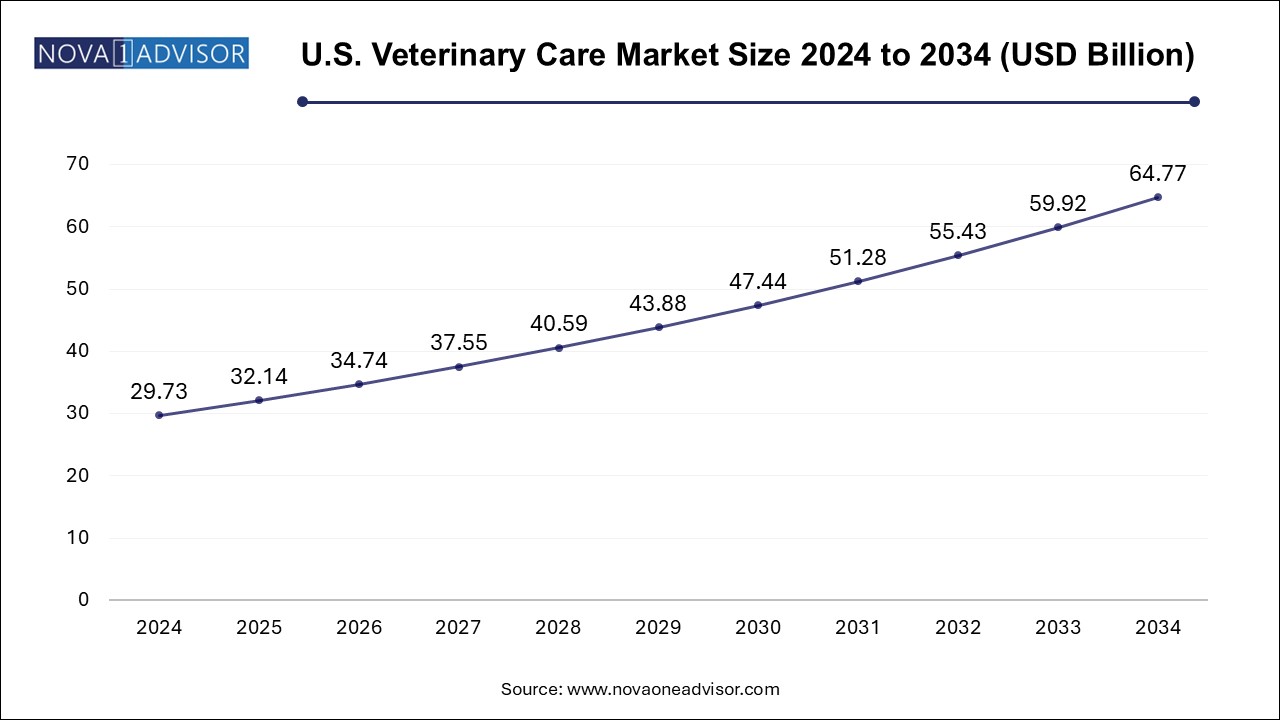

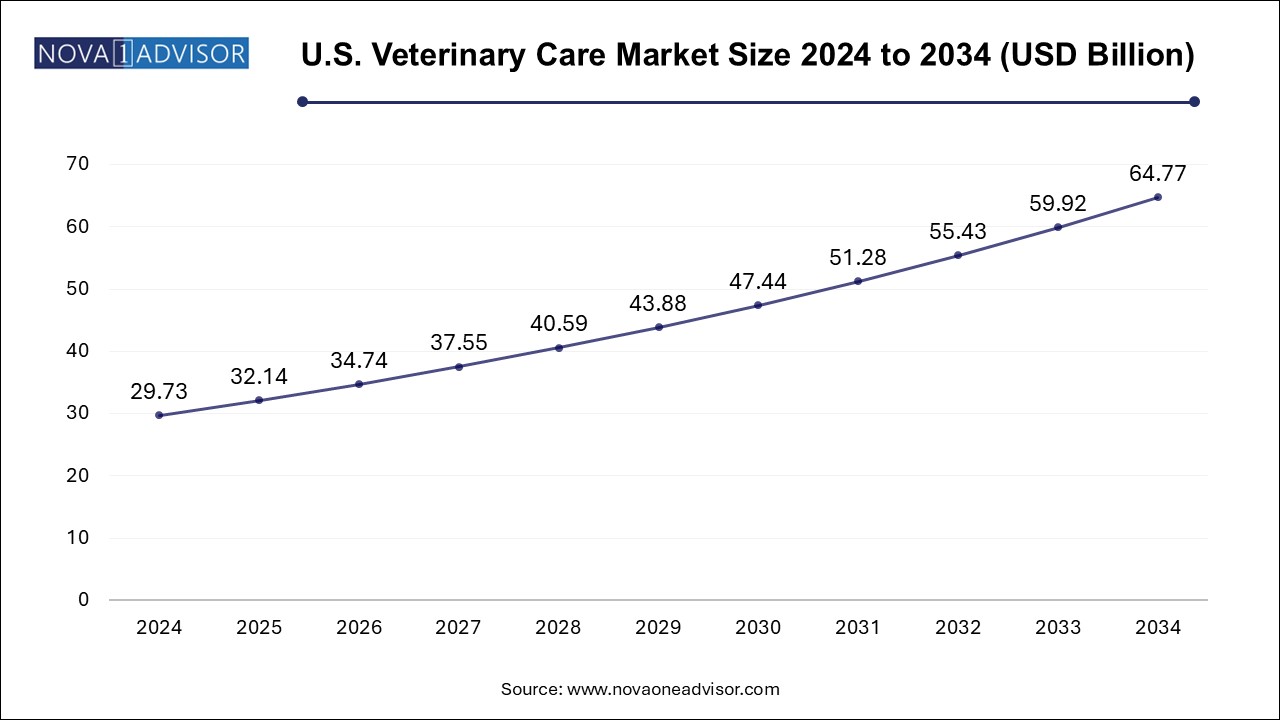

U.S. Veterinary Care Market Size and Growth 2025 to 2034

The U.S. veterinary care market size is evaluated at USD 29.73 billion in 2024 and is projected to be worth around USD 64.77 billion by 2034, growing at a CAGR of 7.33% from 2025 to 2034.

North America, led by the United States, dominates the veterinary care market in terms of revenue and service sophistication. The U.S. has a highly developed companion animal health ecosystem, supported by a dense network of veterinary clinics, academic veterinary hospitals, and corporate veterinary chains like Banfield, VCA Animal Hospitals, and BluePearl Specialty + Emergency Pet Hospital. The region also boasts the highest rate of pet insurance penetration, facilitating access to high-end services such as MRI, radiation therapy, and oncology. Moreover, a strong culture of pet humanization and preventive care drives frequent veterinary visits and product sales.

The U.S. is also a pioneer in veterinary innovation, with startups and established players introducing tele-veterinary services, AI-assisted diagnostics, and genomic screening for pets. The presence of organizations such as the American Veterinary Medical Association (AVMA) and government funding for zoonotic disease research further reinforce market maturity. Canada follows similar trends, with rising pet ownership and a robust companion animal care infrastructure.

Asia Pacific is the fastest-growing region in the veterinary care market, propelled by rising pet ownership in urban centers, increasing livestock populations, and improving veterinary infrastructure. Countries like China, India, Japan, South Korea, and Australia are witnessing a surge in both companion and production animal healthcare spending. Urban middle-class households are adopting more pets, and awareness about pet health, vaccinations, and grooming is steadily increasing.

Governments are also investing in veterinary public health to tackle zoonotic threats like avian flu, brucellosis, and rabies. China and India, with massive livestock bases, are focusing on disease surveillance, veterinary training, and improved breeding programs. The emergence of domestic pet care brands, mobile clinics, and e-pharmacy platforms is enhancing accessibility and affordability. In Southeast Asia, veterinary tourism and specialty care are gaining attention, especially in veterinary universities and referral hospitals in Thailand, Malaysia, and Singapore.

Market Overview

The veterinary care market is witnessing a significant evolution, driven by heightened awareness of animal health, the increasing emotional bond between pet owners and companion animals, and the economic importance of production animals in food supply chains. Veterinary care encompasses a range of services including primary diagnostics, preventive care, surgical intervention, emergency care, and specialty services for both companion and production animals. As veterinary medicine becomes more sophisticated—mirroring trends in human healthcare—the market is expanding rapidly, offering diverse opportunities across geographies and care segments.

Veterinary practices have evolved from basic treatment and vaccinations to include complex surgical procedures, oncology, cardiology, orthopedics, neurology, and dental care for pets. Similarly, the production animal sector has grown to prioritize herd health management, infectious disease control, productivity enhancement, and food safety compliance. Technological advancements such as digital imaging, telemedicine, point-of-care diagnostics, and wearable sensors for animals are enhancing the precision, efficiency, and reach of veterinary services.

The increasing global pet population, particularly in urban and high-income households, has fueled demand for preventive and therapeutic care. On the other hand, the commercial livestock industry, facing challenges from zoonotic diseases and regulatory pressures, is investing in veterinary health to improve yield and reduce losses. With growing investments from corporate veterinary chains, rising adoption of pet insurance, and innovations in animal health IT systems, the veterinary care market is expected to witness robust growth through 2034.

Major Trends in the Market

-

Rising Adoption of Preventive Veterinary Care and Wellness Plans for Pets

-

Expansion of Corporate-Owned Veterinary Clinics and M&A Activity

-

Digital Transformation with Tele-Veterinary Services and EMR Integration

-

Increasing Pet Insurance Penetration Improving Access to Advanced Care

-

Emergence of Specialized Veterinary Practices in Oncology, Neurology, and Orthopedics

-

Point-of-Care Diagnostics and In-Clinic Lab Testing Gaining Traction

-

Personalized Nutrition and Lifestyle-Based Veterinary Consultations

-

Wearable Technologies and Remote Monitoring Devices for Companion Animals

-

Growth of Mobile Veterinary Clinics and At-Home Services

-

Rising Awareness About Antimicrobial Resistance (AMR) in Livestock Healthcare

Report Scope of Veterinary Care Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 102.02 Billion |

| Market Size by 2034 |

USD 205.63 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Animal Type, Type of Care, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Zoetis Inc.; Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Elanco Animal Health Inc.; IDEXX Laboratories, Inc.; Ceva Santé Animale S.A.; Dechra Pharmaceuticals PLC; Virbac S.A.; Vetoquinol S.A.; Phibro Animal Health Corp. |

Market Driver: Humanization of Pets and Surge in Companion Animal Healthcare Demand

A prominent driver shaping the veterinary care market is the humanization of pets, which has significantly elevated expectations for their healthcare. Today’s pet owners—especially in North America, Europe, and urban Asia—view pets as family members and are willing to invest heavily in their health, comfort, and longevity. This trend has led to the emergence of a robust companion animal health ecosystem, covering everything from routine checkups and vaccinations to specialty surgeries, dental care, physical therapy, and behavioral training.

Spending on pet healthcare has seen a consistent uptick, even during economic downturns, highlighting its resilience. According to market observations, procedures such as MRI scans, chemotherapy, and joint replacement—once limited to human medicine—are now being routinely administered in advanced veterinary settings. Furthermore, with the rise in pet adoption post-pandemic and growing awareness of zoonotic risks, preventive veterinary visits have surged. These trends continue to fuel demand across general and specialty veterinary care segments.

Market Restraint: Shortage of Skilled Veterinarians and High Treatment Costs

Despite its growth, the veterinary care market is constrained by a shortage of skilled veterinary professionals, particularly in rural regions and specialty domains. In many countries, there is an imbalance between the increasing demand for advanced veterinary care and the availability of trained personnel. This is especially pronounced in large-animal veterinary services, where lifestyle challenges and limited infrastructure discourage practitioners.

Additionally, rising treatment costs, especially for diagnostics, surgery, and chronic disease management, are limiting access for many pet owners. Unlike human healthcare systems, veterinary services are often paid out-of-pocket, and while pet insurance is growing, coverage remains limited in many markets. High equipment costs, combined with the operational challenges of maintaining 24/7 emergency services or specialty centers, further inflate the price of veterinary care. These barriers impact care-seeking behavior and reduce the reach of sophisticated veterinary services.

A key opportunity for market expansion lies in the growth of veterinary telemedicine and digital health platforms, which have gained strong traction in the post-pandemic environment. Tele-veterinary services allow pet owners to consult veterinarians via video, audio, or chat platforms, enabling greater accessibility, especially in remote areas. These services are instrumental in triaging cases, offering second opinions, and conducting routine wellness checks, thereby easing the burden on brick-and-mortar clinics.

Moreover, the integration of Electronic Medical Records (EMRs), AI-driven diagnostic support, and mobile apps for scheduling and prescription refills is transforming customer experience and operational efficiency. Digital platforms are also enhancing client engagement through wellness reminders, teletriage tools, and behavior monitoring apps. As regulatory frameworks evolve and client comfort with virtual consultations grows, telehealth is expected to become a standard component of veterinary practices—bridging the accessibility gap and unlocking new revenue streams.

Veterinary Care Market By Animal Type Insights

The production animal type segment dominated the market and accounted for a share of 58.20% in 2024. This dominance is attributed to the growing urbanization, increased nuclear family setups, and the emotional and psychological benefits associated with pet ownership. Dogs remain the most widely cared-for species, requiring frequent vet visits for vaccinations, grooming, dental care, and orthopedic interventions. In particular, large breeds often require specialized care for joint issues, skin allergies, and cardiac conditions, driving demand for orthopedic and dermatological services.

Cats, though slightly less frequent visitors to clinics, are also contributing significantly to veterinary revenues due to increasing awareness about feline-specific diseases and preventive care protocols. Urban clinics are seeing a rise in complex feline cases including chronic kidney disease (CKD), feline diabetes, and thyroid disorders. Moreover, equine care, although a niche subsegment, commands a premium in veterinary services, particularly in sports medicine, rehabilitation, and preventive nutrition for racing and show horses. The “others” category includes exotic pets like rabbits, birds, and reptiles, which are seeing increased care demand, especially in urban centers.

Production animals, on the other hand, are seeing rising veterinary investment due to concerns over zoonotic disease control, livestock productivity, and global food security. Countries with large agricultural economies—such as the U.S., China, Brazil, and India—are prioritizing veterinary interventions for herd management, AI (artificial insemination), and preventive vaccination programs. Although production animal care has traditionally been cost-sensitive, increasing consumer awareness about antibiotic-free and organic meat is prompting farmers to invest in sophisticated veterinary protocols. This is making the production animal segment one of the fastest-growing segments, particularly in regions with a strong livestock export economy.

Veterinary Care Market By Type of Care Insights

The primary care segment led the market with a revenue share of 61.0% in 2024. These services include general health checks, vaccinations, wound care, deworming, and preventive screenings. They form the backbone of veterinary clinics and are the first point of contact for most pet owners and livestock handlers. With rising awareness of preventive health and affordable wellness packages, primary veterinary visits have surged. For production animals, primary care includes herd health assessments, dehorning, breeding evaluations, and nutritional counseling.

The critical care segment is expected to witness the fastest CAGR of 8.2% over the forecast period. For companion animals, these include veterinary oncology, cardiology, neurology, dermatology, dentistry, and rehabilitative services such as hydrotherapy and physiotherapy. The growing availability of board-certified specialists and dedicated referral hospitals is facilitating this trend. Advanced procedures like cataract surgery, laser therapy, and 3D imaging diagnostics are becoming more common in urban clinics. In the production animal sector, specialty care such as genetic counseling, reproductive services, and nutritional optimization is also expanding, supported by precision livestock farming technologies.

Some of the prominent players in the veterinary care market include:

Veterinary Care Market Recent Developments

-

March 2025: VCA Animal Hospitals, a Mars Veterinary Health company, announced the expansion of its specialty services in oncology and rehabilitation across 20 major urban clinics in the U.S.

-

February 2025: Boehringer Ingelheim Animal Health launched a new AI-driven predictive disease modeling tool for livestock, helping farms pre-empt outbreaks and optimize veterinary interventions.

-

January 2025: IDEXX Laboratories introduced a next-generation in-clinic diagnostic analyzer for companion animals, improving turnaround times and diagnostic accuracy.

-

December 2024: Petco Health and Wellness Company expanded its in-store veterinary services to 300 locations across North America, focusing on affordable primary and wellness care.

-

November 2024: Covetrus Inc. launched a cloud-based veterinary practice management software designed for mobile veterinarians and multi-location clinics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary care market

By Animal Type

By Type of Care

-

- Primary

- Emergency

- Critical

- Specialty Services

-

- Primary

- Emergency

- Critical

- Specialty Services

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)