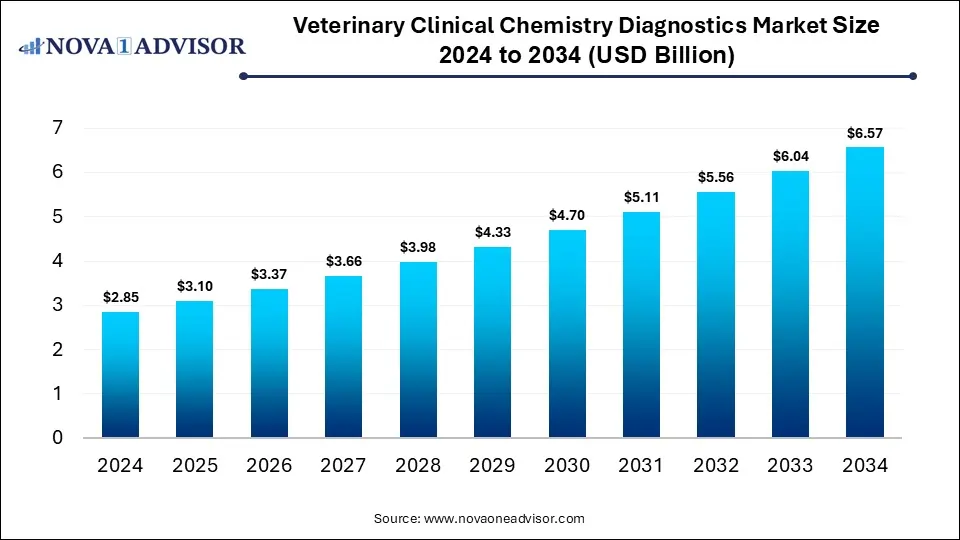

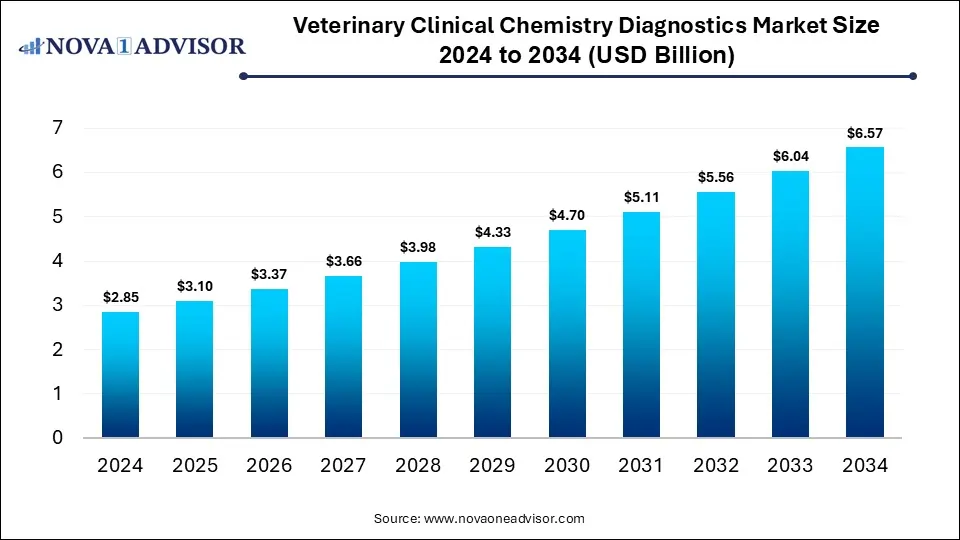

Veterinary Clinical Chemistry Diagnostics Market Size and Growth 2025 to 2034

The global veterinary clinical chemistry diagnostics market size is calculated at USD 2.85 billion in 2024, grows to USD 3.10 billion in 2025, and is projected to reach around USD 6.57 billion by 2034, growing at a CAGR of 8.71% from 2025 to 2034. The market is growing due to rising pet ownership and increasing demand for early disease detection in animals. Technological advancements and expanding veterinary healthcare infrastructure further drive its adoption.

Veterinary Clinical Chemistry Diagnostics Market Key Takeaways

- North America dominated the veterinary clinical chemistry diagnostics market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the consumables, reagents & kits segment led the market with the largest revenue share in 2024 and is expected to grow at the fastest CAGR in the market during the forecast period.

- By animal type, the companion animals segment held the largest market share in 2024.

- By animal type, the production animal segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By test type, the renal function test segment held the highest market share in 2024.

- By test type, the electrolyte panel segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By sample type, the blood/plasma/serum segment dominated the market with a major revenue share.

- By sample type, the urine segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the veterinarians segment held the highest market share in 2024.

- By end user, the animal owners/producers segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Veterinary Clinical Chemistry Diagnostics?

Veterinary clinical chemistry diagnostics refer to laboratory tests that measure biochemical markers in animal blood or body fluids to assess organ function, detect diseases, and monitor overall health. The veterinary clinical chemistry diagnostics market is expanding as veterinarians increasingly rely on evidence-based approaches for precise treatment decisions. Growth in animal-derived food industries has created demand for regular health monitoring of livestock to ensure productivity and food safety. Moreover, the rising incidence of zoonotic diseases is pushing the adoption of diagnostic tools to prevent cross-species transmission. The availability of portable diagnostic devices and telemedicine support is also boosting accessibility, driving usage across both urban and rural veterinary practices.

- For Instance, In January 2024, Zoetis enhanced its Vetscan Imagyst platform by introducing AI-based Urine Sediment Analysis, allowing veterinarians to conduct quicker and more accurate urinalysis directly at the point of care. (Source: https://news.zoetis.com/)

What are the Key trends in the Veterinary Clinical Chemistry Diagnostics Market in 2024?

- In July 2024, EKF Diagnostics introduced the Biosen C-Line, a benchtop analyzer with touchscreen and connectivity features for smooth integration with hospital and lab IT systems. It delivers precise glucose and lactate readings, supporting diabetes care in clinical settings and monitoring lactate levels for professional sports teams during training. (Source: https://www.ekfdiagnostics.com/)

- In February 2024, MiDOG Animal Diagnostics launched an All-in-One Diagnostic Test that quickly identifies bacterial and fungal infections, along with antibiotic resistance, in different animal species. This molecular-based tool improves veterinary care by offering a faster and more effective alternative to conventional methods, enabling better treatment planning for pets and exotic animals alike. (Source: https://www.midogtest.com/)

How Can AI Affect the Veterinary Clinical Chemistry Diagnostics Market?

AI is driving growth in the market by enabling smarter laboratory workflows and streamlined sample management. Machine learning algorithms can identify subtle patterns in biochemical data that may be missed by conventional analysis, supporting early disease detection. AI also facilitates remote monitoring and tele-diagnostics, allowing veterinarians to provide care in underserved areas. By optimizing resource use and reducing operational costs, AI adoption is making advanced diagnostic testing more accessible and efficient across veterinary practices.

Report Scope of Veterinary Clinical Chemistry Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.10 Billion |

| Market Size by 2034 |

USD 6.57 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.71% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Animal Type, Test Type, Sample Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Cormay Diagnostics; FUJIFILM Corporation |

Market Dynamics

Driver

Rising Pet Ownership

The increase in pet ownership fuels the veterinary clinical chemistry diagnostics market by creating higher demand for routine health monitoring and specialized testing. As more people adopt pets, veterinarians face a greater need for rapid and reliable diagnostic solutions to manage diverse health conditions. This trend encourages clinics to adopt advanced analyzers and point-of-care testing, ensuring timely treatment. Additionally, growing awareness of preventive care and longevity for pets further drives the adoption of veterinary diagnostic services.

Restraint

High Cost of Advanced Diagnostic Equipment and Consumables

The expensive nature of advanced diagnostic tools and consumables limits their accessibility for any veterinary practice. High upfront costs for equipment, along with ongoing maintenance and specialized training requirements, make it challenging for smaller clinics to adopt these technologies. This financial barrier slows the expansion in rural areas and emerging markets, where budgets are constrained, reducing the overall market penetration of modern, efficient, and accurate diagnostic solutions.

Opportunity

Rising Trend of Pet Ownership

The growing adoption of pet insurance creates opportunities for the veterinary clinical chemistry diagnostic market by making advanced testing more affordable for pet owners. Insurance coverage motivates owners to seek routine and preventive diagnostics, increasing the volume of lab tests performed. This trend encourages veterinary clinics to invest in modern analyzers and point-of-care devices, expanding the use of clinical chemistry tests. As a result, diagnostic services become more accessible, supporting market expansion and innovation in animal healthcare.

- For Instance, In 2024, the American Veterinary Medical Association reported that 6.4 million pets in the U.S. were insured, up from 5.7 million in 2023, boosting demand for advanced veterinary diagnostics.(Source: https://www.avma.org/)

Segmental Insights

What made the Consumables, reagents & kits Segment Dominant in the Veterinary Clinical Chemistry Diagnostics Market in 2024?

The consumables, reagents & kits segment dominated the market because they enable quick, accurate, and standardized testing across veterinary laboratories and clinical. Frequent test volumes in both routine check-ups and disease monitoring drive constraint demand. Additionally, the rising adoption of automated analyzers and point-of-care devices increases reliance on specialized kits and reagents. As veterinary practices expand and focus on preventive care, the need for these consumables grows consistently, positioning the market for growth.

How did the Companion Animals Segment Dominate the Veterinary Clinical Chemistry Diagnostics Market in 2024?

The companion animal segment leads the market because veterinary clinics focus heavily on pets, which require routine monitoring and advanced diagnostics for chronic conditions like diabetes, kidney, and liver disorders. Urbanization and higher disposable incomes have increased spending on pet healthcare, prompting more frequent use of clinical chemistry tests. Moreover, innovations in pet-specific diagnostic kits and point-of-care devices make testing more accessible, driving adoption in this segment and ensuring it maintains the largest share in the veterinary diagnostics market.

The production animal segment is projected to grow rapidly because rising concerns about animal welfare, food safety, and disease outbreaks are pushing farmers to adopt advanced diagnostics. Routine biochemical testing helps detect infections, metabolic disorders, and nutritional deficiencies early, improving herd health and reducing losses. Moreover, technological improvements, such as portable analyzers and automated testing systems, allow faster, on-farm diagnostics. These factors, combined with increasing demand for high-quality livestock products, are expected to drive the segment’s fastest CAGR during the forecast period.

How did the Renal Function Test Segment Dominate the Veterinary Clinical Chemistry Diagnostics Market?

The renal function test segment leads the market because kidney-related issues often go undetected until advanced stages, making early biochemical testing essential. Veterinarians rely on these tests to monitor toxin buildup, electrolyte balance, and overall metabolic health in animals. Increasing awareness among pet owners and livestock managers about the importance of kidney health, combined with the availability of precise and rapid diagnostic kits, is driving higher adoption of renal function tests, securing this segment’s top position in the veterinary clinical chemistry diagnostics market.

The electrolyte panel segment is projected to grow rapidly as veterinarians increasingly use these tests to manage dehydration, metabolic disorders, and organ dysfunction in animals. Rising adoption of intensive livestock farming and high-value companion animal care requires frequent monitoring of electrolyte balance to ensure optimal health and productivity. Innovations in portable analyzers and automated testing systems allow faster, on-site assessment, making electrolyte panels more accessible and efficient, which is expected to drive the fastest CAGR in the veterinary clinical chemistry diagnostics market during the forecast period.

Why the blood/plasma/serum Segment Dominated the Veterinary Clinical Chemistry Diagnostics Market in 2024?

The blood/plasma/serum segment leads the market because these samples offer rapid and accurate results for multiple diagnostic tests, making them highly practical for veterinary clinics and laboratories. Their ability to detect infections, monitor treatment responses, and assess overall health in both companion and production animals drives consistent usage. Additionally, the widespread availability of standardized collection and processing protocols ensures reliability, increasing adoption across practices. This consistent demand positions blood, plasma, and serum as the highest-revenue segment in the market.

The urine segment is projected to grow rapidly as veterinarians increasingly rely on urinalysis for early detection of diseases like diabetes, liver disorders, and infections. Its non-invasive nature makes it suitable for frequent monitoring in both pets and livestock. Technological innovations, including portable urine analyzers and automated dipstick readers, enhance efficiency and accuracy, encouraging wider adoption. Rising demand for preventive care and routine health checks in animals further drives the segment’s fastest CAGR in the veterinary clinical chemistry diagnostics market during the forecast period.

What made the Veterinarians Segment Dominant in the Veterinary Clinical Chemistry Diagnostics Market in 2024?

In 2024, veterinarians dominated the market as they serve as the central point for animal healthcare, conducting most diagnostic tests in clinics and hospitals. Their need for accurate, timely, and diverse biochemical analyses to manage both routine check-ups and complex cases drives high usage of clinical chemistry diagnostics. Additionally, the expansion of veterinary services and specialized care for pets and livestock further reinforces veterinarians as the largest end-user segment in the market.

The animal owner/producer segment is projected to grow rapidly as owners increasingly seek direct control over their animals’ health. Growing concerns about disease outbreaks, food safety, and livestock productivity encourage investment in diagnostic tests at farms or home settings. The availability of affordable, easy-to-use kits and mobile testing devices allows owners to perform timely monitoring, making this segment the fastest-growing end-user category in the veterinary clinical chemistry diagnostics market during the forecast period.

Veterinary Clinical Chemistry Diagnostics Market By End Use, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Reference Laboratories |

1.31 |

1.42 |

1.54 |

1.66 |

1.80 |

1.95 |

2.11 |

2.28 |

2.47 |

2.67 |

2.89 |

| Veterinarians |

1.17 |

1.28 |

1.39 |

1.52 |

1.66 |

1.82 |

1.99 |

2.17 |

2.37 |

2.59 |

2.82 |

| Animal Owners/ Producers |

0.37 |

0.40 |

0.44 |

0.48 |

0.52 |

0.56 |

0.61 |

0.66 |

0.72 |

0.79 |

0.85 |

Regional Insights

How is North America contributing to the Expansion of the Veterinary Clinical Chemistry Diagnostics Market?

In 2024, North America led the market because of well-established veterinary services and a high focus on animal health research. The region benefits from strong government initiatives promoting animal welfare, advanced laboratory infrastructure, and widespread availability of point-of-care and automated diagnostic devices. Growing demand for livestock productivity monitoring and the rising trend of pet health insurance further fueled the adoption of clinical chemistry diagnostics, enabling North America to secure the largest revenue share in the market.

How is Asia-Pacific Accelerating the Veterinary Clinical Chemistry Diagnostics Market?

Asia Pacific is expected to register the fastest CAGR as emerging economies invest in modern veterinary care and diagnostics. Rapid urbanization, increasing focus on food safety, and the expansion of commercial livestock and poultry farming are driving demand for regular health monitoring. Additionally, growing awareness among pet owners, improving healthcare infrastructure, and the entry of global diagnostic companies offering affordable and innovative solutions are accelerating adoption, positioning the region for the highest growth in the market during the forecast period.

Veterinary Clinical Chemistry Diagnostics Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

1.00 |

1.08 |

1.16 |

1.25 |

1.35 |

1.45 |

1.56 |

1.68 |

1.81 |

1.95 |

2.10 |

| Europe |

0.80 |

0.86 |

0.94 |

1.01 |

1.10 |

1.19 |

1.29 |

1.40 |

1.51 |

1.64 |

1.77 |

| Asia Pacific |

0.66 |

0.73 |

0.81 |

0.90 |

1.00 |

1.10 |

1.22 |

1.36 |

1.50 |

1.66 |

1.84 |

| Latin America |

0.20 |

0.21 |

0.23 |

0.25 |

0.26 |

0.28 |

0.30 |

0.32 |

0.34 |

0.37 |

0.39 |

| Middle East and Africa (MEA) |

0.20 |

0.22 |

0.24 |

0.26 |

0.28 |

0.30 |

0.33 |

0.36 |

0.39 |

0.42 |

0.46 |

Top Companies in the Veterinary Clinical Chemistry Diagnostics Market

Recent Developments in the Veterinary Clinical Chemistry Diagnostics Market

- In June 2025, bioMérieux (France) introduced VETFIRE, a ready-to-use PCR kit designed for horses. The kit enables simultaneous detection of seven infectious respiratory pathogens, streamlining diagnosis and improving disease management in equine respiratory infections. (Source: https://www.biomerieux.com/)

- In March 2025, Antech Diagnostics, Inc. (US) launched truRapid FOUR, an in-house test for dogs that screens for vector-borne diseases. Using lateral flow technology, it detects antibodies for Anaplasma spp., Ehrlichia spp., Lyme C6 (Borrelia burgdorferi), and antigens for heartworm (Dirofilaria immitis), enabling quick and efficient disease detection in canines. (Source: https://www.antechdiagnostics.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary clinical chemistry diagnostics market.

By Product

- Consumables, Reagents & Kits

- Equipment & Instruments

By Animal Type

-

- Dogs

- Cats

- Horses

- Other Companion Animals

-

- Cattle

- Poultry

- Swine

- Other Production Animals

By Test Type

- Renal Function Test (RFT)

- Liver Function Test (LFT)

- Electrolyte Panel

- Other Tests

By Sample Type

- Blood/Plasma/Serum

- Urine

- Other Samples

By End Use

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Veterinary Clinical Chemistry Diagnostics Market Size (USD Million) by Product, 2024–2034

- Table 2: Global Veterinary Clinical Chemistry Diagnostics Market Size (USD Million) by Animal Type, 2024–2034

- Table 3: Global Veterinary Clinical Chemistry Diagnostics Market Size (USD Million) by Test Type, 2024–2034

- Table 4: Global Veterinary Clinical Chemistry Diagnostics Market Size (USD Million) by Sample Type, 2024–2034

- Table 5: Global Veterinary Clinical Chemistry Diagnostics Market Size (USD Million) by End Use, 2024–2034

- Table 6: North America Market Size (USD Million) by Product, 2024–2034

- Table 7: North America Market Size (USD Million) by Animal Type, 2024–2034

- Table 8: North America Market Size (USD Million) by Test Type, 2024–2034

- Table 9: North America Market Size (USD Million) by Sample Type, 2024–2034

- Table 10: North America Market Size (USD Million) by End Use, 2024–2034

- Table 11: U.S. Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 12: Canada Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 13: Mexico Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 14: Europe Market Size (USD Million) by Product, 2024–2034

- Table 15: Europe Market Size (USD Million) by Animal Type, 2024–2034

- Table 16: Germany Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 17: France Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 18: UK Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 19: Italy Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 20: Asia Pacific Market Size (USD Million) by Product, 2024–2034

- Table 21: Asia Pacific Market Size (USD Million) by Animal Type, 2024–2034

- Table 22: China Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 23: Japan Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 24: India Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 25: South Korea Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 26: Southeast Asia Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 27: Latin America Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 28: Brazil Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 29: Middle East & Africa Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 30: GCC Countries Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 31: Turkey Market Size (USD Million) by Product & Animal Type, 2024–2034

- Table 32: Africa Market Size (USD Million) by Product & Animal Type, 2024–2034

- Figure 1: Global Market Share by Product, 2024

- Figure 2: Global Market Share by Animal Type, 2024

- Figure 3: Global Market Share by Test Type, 2024

- Figure 4: Global Market Share by Sample Type, 2024

- Figure 5: Global Market Share by End Use, 2024

- Figure 6: North America Market Share by Product, 2024

- Figure 7: North America Market Share by Animal Type, 2024

- Figure 8: North America Market Share by Test Type, 2024

- Figure 9: North America Market Share by Sample Type, 2024

- Figure 10: North America Market Share by End Use, 2024

- Figure 11: U.S. Market Share by Product, 2024

- Figure 12: U.S. Market Share by Animal Type, 2024

- Figure 13: Canada Market Share by Product, 2024

- Figure 14: Canada Market Share by Animal Type, 2024

- Figure 15: Mexico Market Share by Product, 2024

- Figure 16: Mexico Market Share by Animal Type, 2024

- Figure 17: Europe Market Share by Product, 2024

- Figure 18: Europe Market Share by Animal Type, 2024

- Figure 19: Germany Market Share by Product, 2024

- Figure 20: Germany Market Share by Animal Type, 2024

- Figure 21: France Market Share by Product, 2024

- Figure 22: France Market Share by Animal Type, 2024

- Figure 23: UK Market Share by Product, 2024

- Figure 24: UK Market Share by Animal Type, 2024

- Figure 25: Italy Market Share by Product, 2024

- Figure 26: Italy Market Share by Animal Type, 2024

- Figure 27: Asia Pacific Market Share by Product, 2024

- Figure 28: Asia Pacific Market Share by Animal Type, 2024

- Figure 29: China Market Share by Product, 2024

- Figure 30: China Market Share by Animal Type, 2024

- Figure 31: Japan Market Share by Product, 2024

- Figure 32: Japan Market Share by Animal Type, 2024

- Figure 33: India Market Share by Product, 2024

- Figure 34: India Market Share by Animal Type, 2024

- Figure 35: South Korea Market Share by Product, 2024

- Figure 36: South Korea Market Share by Animal Type, 2024

- Figure 37: Southeast Asia Market Share by Product, 2024

- Figure 38: Southeast Asia Market Share by Animal Type, 2024

- Figure 39: Latin America Market Share by Product, 2024

- Figure 40: Latin America Market Share by Animal Type, 2024

- Figure 41: Brazil Market Share by Product, 2024

- Figure 42: Brazil Market Share by Animal Type, 2024

- Figure 43: Middle East & Africa Market Share by Product, 2024

- Figure 44: Middle East & Africa Market Share by Animal Type, 2024

- Figure 45: GCC Countries Market Share by Product, 2024

- Figure 46: GCC Countries Market Share by Animal Type, 2024

- Figure 47: Turkey Market Share by Product, 2024

- Figure 48: Turkey Market Share by Animal Type, 2024

- Figure 49: Africa Market Share by Product, 2024

- Figure 50: Africa Market Share by Animal Type, 2024