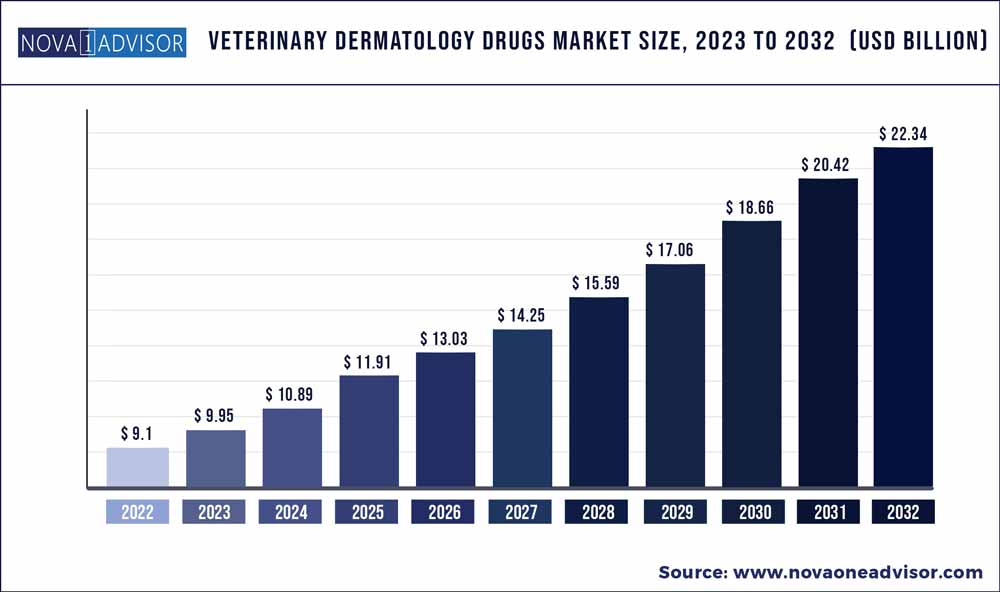

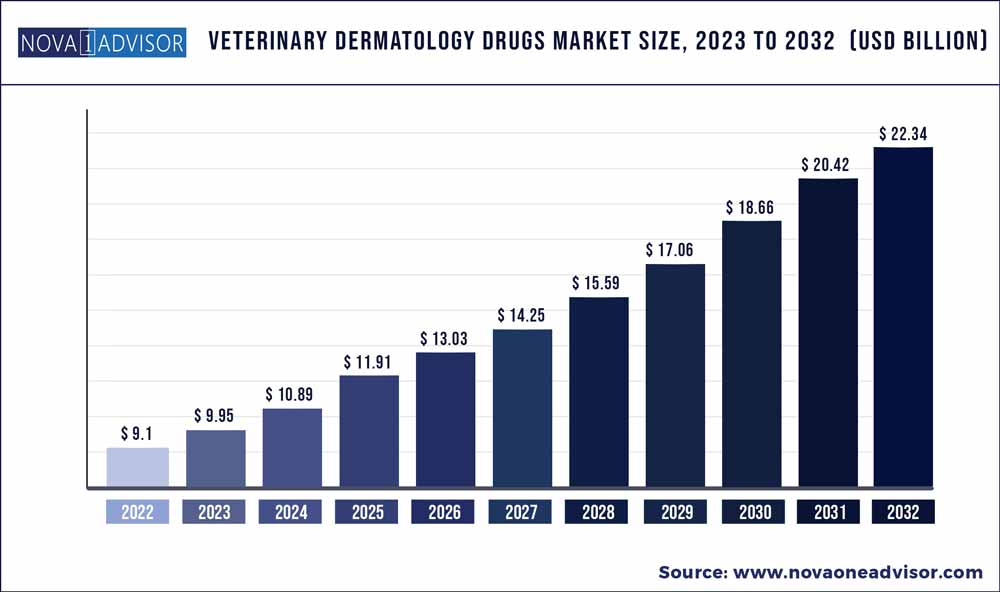

The global veterinary dermatology drugs market size was estimated at USD 9.10 billion in 2022 and is expected to surpass around USD 22.34 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 9.4% during the forecast period 2023 to 2032.

Key Pointers:

- North America dominated the market and held the largest revenue share of over 35.0% in 2022.

- In Asia Pacific, the veterinary dermatology drugs market is anticipated to witness significant growth over the forecast period

- The companion animal segment dominated the market and held the largest revenue share of more than 73.0% in 2022.

- The cattle segment is expected to witness the fastest CAGR of 9.2% during the forecast period.

- The oral segment dominated the market and held the largest revenue share of 39.0% in 2022.

- The injectable segment is expected to witness the fastest CAGR of over 10.6% during the forecast period.

- The parasitic infections segment dominated the market and held the largest revenue share of more than 48.0% in 2022.

- The allergic infections segment is expected to witness the fastest CAGR of over 10.3% during the forecast period.

- The hospital pharmacies segment dominated the market and held the largest revenue share of 45.4% in 2022.

- The e-commerce segment is expected to witness the fastest CAGR of over 10.6% during the forecast period.

Veterinary Dermatology Drugs Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 9.95 Billion |

| Market Size by 2032 |

USD 22.34 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 9.4% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Animal type, route of administration, indication, distribution channel, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Elanco; Vetoquinol S.A.; Ceva; Merck & Co., Inc.; Zoetis; Virbac; Bimeda, Inc.; Vivaldis; Bioiberica S.A.U; Indian Immunologicals Ltd. |

The rising prevalence of skin diseases in animals, as well as high investments by market players in the segment, are the factors expected to drive the market growth. The sector has witnessed a trend of pet owners making more pet care decisions, which is expected to boost the market growth.

During the COVID-19 pandemic, most of the market players did not report any negative effect on their revenue. This was because animal health was considered an essential business, due to the high demand for animal protein. In May 2020, Jeffrey N. Simmons, CEO of Elanco stated that the industry is going into an economic slowdown. However, he also stated that its manufacturing facilities in China are actively running in full swing. The company also reported an increase of 5.1% in its therapeutics segment. On the other hand, Merck & Co., Inc. reported a loss of USD 50.0 million in its animal health segment. Through this, it is evident that the overall impact of COVID-19 on Veterinary Dermatology Drugs was neutral.

An increase in the number of pet owners is driving the need for better treatment options for companion animals, which is resulting in rising health expenditure on pets. According to The American Pet Products Association, the overall spending in the U.S. pet industry increased to USD 95.7 billion in 2019 from USD 90.5 billion in 2018, and it is estimated to reach USD 99.0 billion in 2020. Moreover, in 2019-2020, about 67.0% of households in the U.S. owned a pet, which is equal to approximately 84.9 million homes. This percentage had increased by about 11% since 1988, where 56% of the households in the U.S. owned a pet.

Key players are investing to launch new products, which is also boosting the market. For instance, in May 2021, Elanco launched its first oral flea and tick product for cats. The product is called Credelio CAT (lotilaner) and it increases Elanco’s product portfolio as well as helps it to gain a competitive edge in the market.

Animal Type Insights

The companion animal segment dominated the market and held the largest revenue share of more than 73.0% in 2022. Rising pet ownership is expected to boost the market growth. The segment is further divided into dogs, cats, horses, and others. The dogs' segment is anticipated to hold the largest market share due to high product availability for the treatment of dogs.

The livestock animal segment held the second-largest revenue share in 2022. It is further classified into cattle and others. The market for veterinary dermatology drugs is expected to be driven by rising demand for animal protein and the prevalence of parasitic diseases in livestock animals. Furthermore, the cattle segment is expected to witness the fastest CAGR of 9.2% during the forecast period.

Route Of Administration Insights

The oral segment dominated the market and held the largest revenue share of 39.0% in 2022. The high availability of oral drugs in the form of tablets, pills, and feed additives, among others, is expected to boost the market growth. Initiatives by market players related to this segment are also expected to boost the market growth. For instance, in September 2020, Bioiberica launched an oral and topical range of dermatological products - Atopivet thus expanding its dermatological solutions portfolio.

The injectable segment is expected to witness the fastest CAGR of over 10.6% during the forecast period as injectable drugs allow convenient administration in a much smaller number of doses as compared to oral drugs. For instance, Convenia by Zoetis treats the animal in only one dose as compared to 28 doses of pills. The topical segment is also expected to grow significantly owing to its high adoption.

Indication Insights

The parasitic infections segment dominated the market and held the largest revenue share of more than 48.0% in 2022. According to WebMD, a study conducted by Colorado State University in May 2021, found Lyme disease-carrying ticks, abundantly near beaches of Northern California, the U.S. Therefore, high incidences of such parasitic diseases are expected to boost the market growth.

The allergic infections segment is expected to witness the fastest CAGR of over 10.3% during the forecast period. The high prevalence of diseases such as atopic dermatitis and other itching disorders, especially in companion animals is expected to contribute to market growth. Furthermore, pet owners making more pet care decisions are also expected to boost the growth of the market.

Distribution Channel Insights

The hospital pharmacies segment dominated the market and held the largest revenue share of 45.4% in 2022. The rising number of hospital pharmacies is expected to boost the growth of the segment. Moreover, animal owners tend to reach out to veterinary hospitals first for the treatment of their pets or farm animals. This makes hospital pharmacies primary centers for buying the prescribed medications, hence the leading market share.

The e-commerce segment is expected to witness the fastest CAGR of over 10.6% during the forecast period. This growth is attributable to the growing penetration of veterinary products specific e-commerce websites and veterinary telehealth platforms. The segment is also expected to take over the retail segment by 2028 in terms of its market share.

Regional Insights

North America dominated the market and held the largest revenue share of over 35.0% in 2022. The key factors driving this growth include initiatives by the government and private sector, rising pet care expenditure, and the presence of key players. Furthermore, the rising incidence of zoonotic diseases is expected to boost the market growth.

In Asia Pacific, the veterinary dermatology drugs market is anticipated to witness significant growth over the forecast period owing to factors such as the growing demand for veterinary dermatology drugs and slowly growing awareness regarding the availability of such products in emerging economies such as India and China. Also, Asia Pacific is home to manufacturing facilities of many major players in the market, such as Elanco, which further boosts growth.

Key Companies & Market Share Insights

Vendors are investing in product launches, geographical expansions, collaborative agreements, and acquisitions, to sustain in the market. The market is expected to become highly competitive as many startups are seeking opportunities in this sector. For instance, in June 2021, Elanco announced an agreement to acquire Kindred Biosciences for approximately USD 440 million. With this, Elanco accelerated its expansion of the pet health market, especially advancing its presence in the fast-growing dermatology industry. Kindred Biosciences has 3 new dermatology blockbuster drugs in the pipeline, which are expected to launch by 2025. Some of the prominent players in the global veterinary dermatology drugs market include:

- Elanco

- Vetoquinol S.A.

- Ceva

- Merck & Co., Inc.

- Zoetis

- Virbac

- Bimeda, Inc.

- Vivaldis

- Bioiberica S.A.U

- Indian Immunologicals Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Veterinary Dermatology Drugs market.

By Animal Type

- Companion Animal

- Livestock Animal

By Route Of Administration

By Indication

- Parasitic Infections

- Allergic Infections

- Others

By Distribution Channel

- Retail

- E-Commerce

- Hospital Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)