Veterinary Diagnostics Market Size and Research

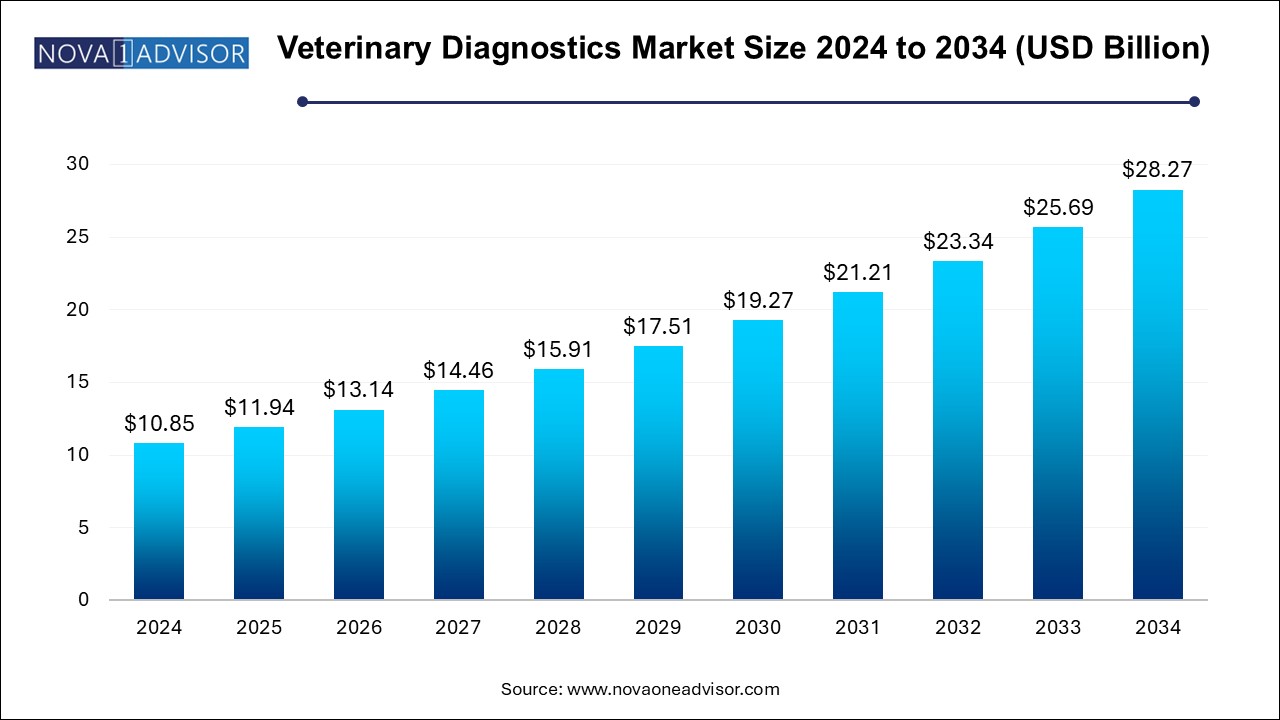

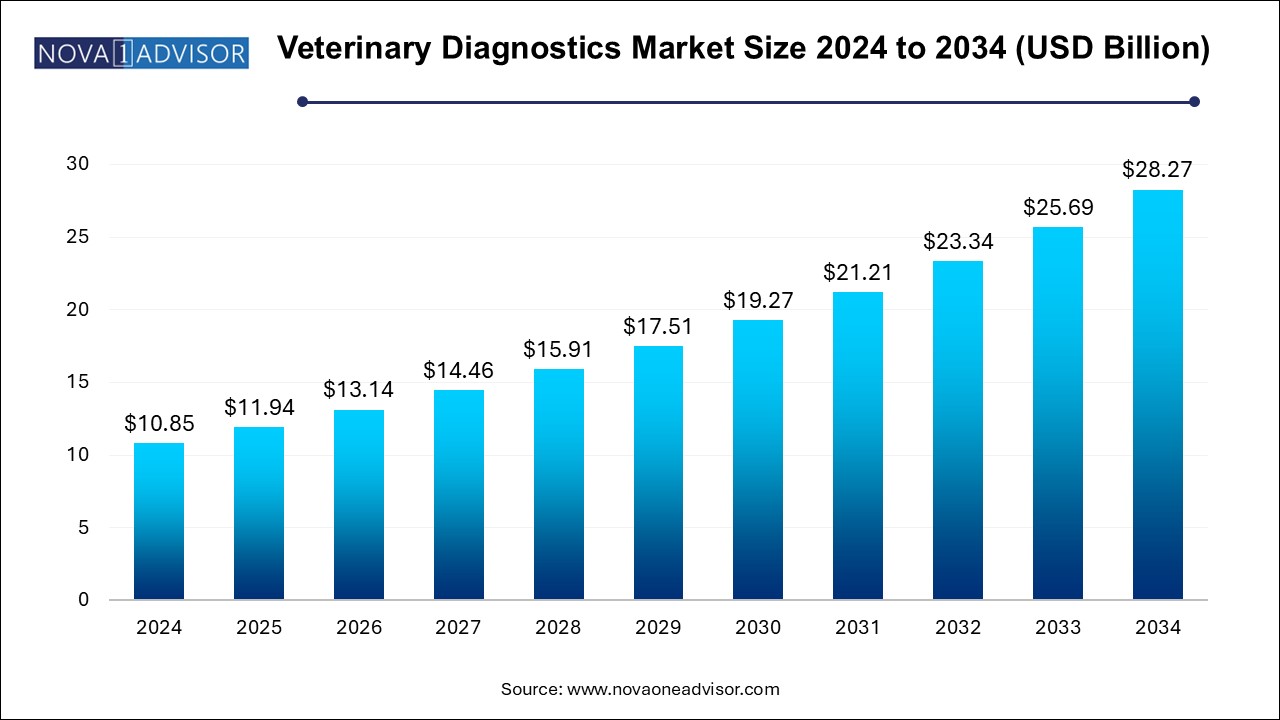

The veterinary diagnostics market size was exhibited at USD 10.85 billion in 2024 and is projected to hit around USD 28.27 billion by 2034, growing at a CAGR of 10.05% during the forecast period 2024 to 2034.

Veterinary Diagnostics Market Key Takeaways:

- Based on testing category, the clinical chemistry segment led the market with the largest revenue share of 23.21% in 2024.

- Based on animal type, the companion animals segment led the market with the largest revenue share of 59.26% in 2024.

- The production animals segment is expected to register at the fastest CAGR from 2024 to 2034.

- The consumables, reagents & kits segment led the market with the largest revenue share of 52.96% in 2024.

- The equipment & instruments segment is projected to grow at the fastest CAGR during the forecast period.

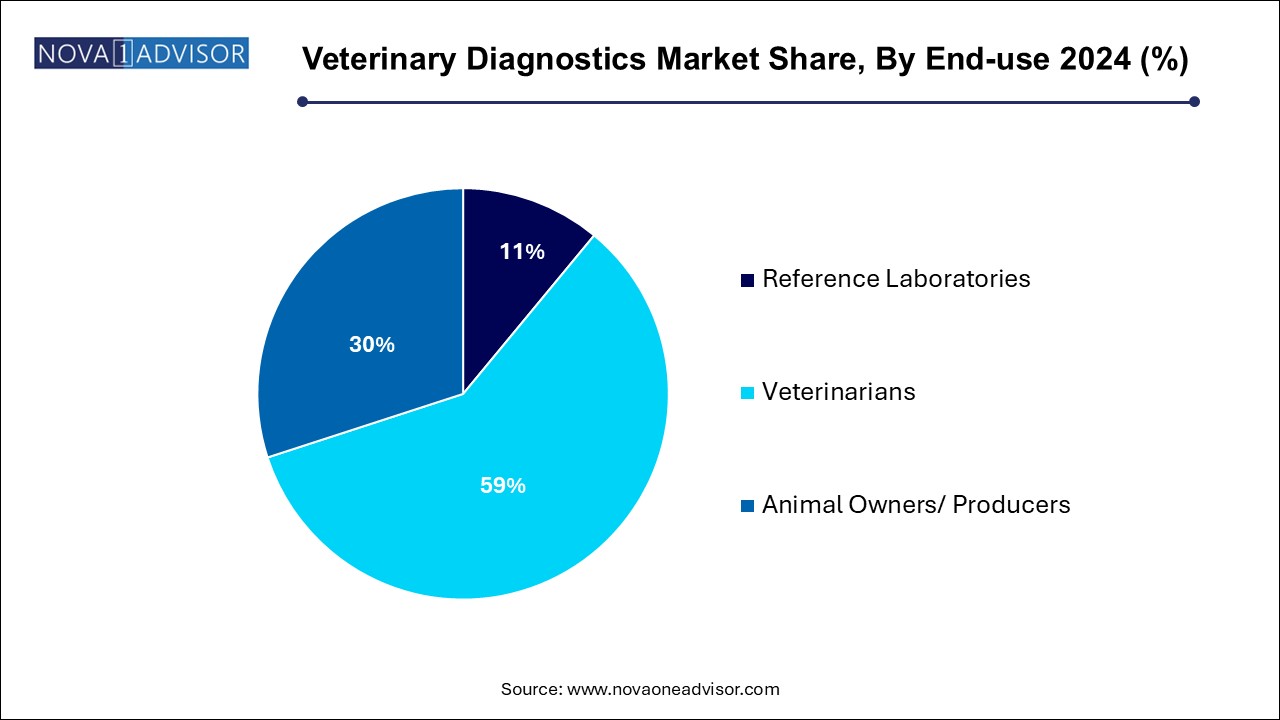

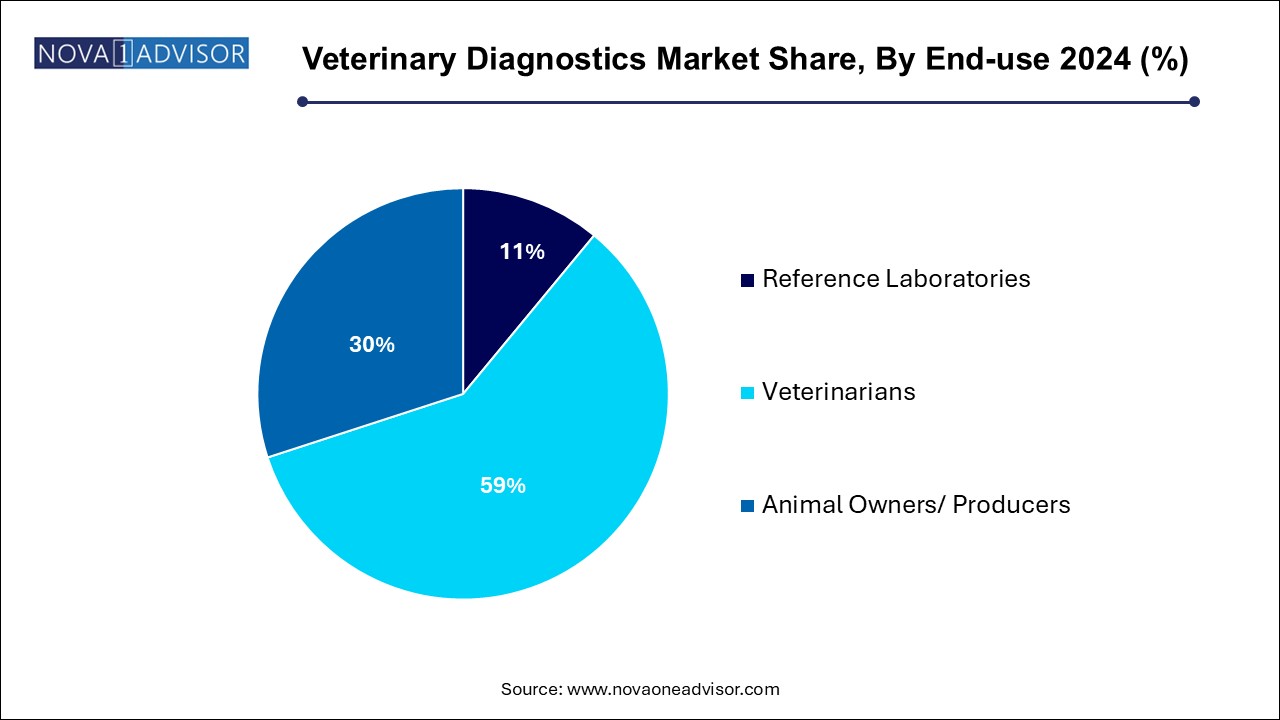

- Based on end use, the veterinarian segment led the market with the largest revenue share of 59.0% in 2024.

- The animal owners/producers segment is estimated to grow at the fastest CAGR during the forecast period.

- North America veterinary diagnostics market dominated the global market with the largest revenue share of 38.25% in 2024.

Market Overview

The veterinary diagnostics market has gained substantial momentum over the past decade as animal health becomes increasingly intertwined with global food security, public health, and pet ownership trends. Veterinary diagnostics involve tests and procedures that identify diseases, infections, and health conditions in animals both production and companion species. These diagnostics encompass a range of technologies including imaging, hematology, molecular testing, and immunology.

A critical element fueling this market is the rising awareness of zoonotic diseases diseases transmitted from animals to humans such as avian flu, rabies, and more recently, COVID-19 (with suspected animal origins). Early and accurate diagnosis of such infections has become vital to controlling outbreaks at their source. Moreover, as pet ownership continues to climb, particularly in North America, Europe, and parts of Asia, companion animal diagnostics have also seen rapid growth. High-value diagnostics for pets now include genetic testing, cancer detection, and allergy panels.

Moreover, the growing emphasis on food quality and safety has spurred investments in livestock diagnostics. Ensuring herd health through regular screening for diseases like bovine tuberculosis, swine flu, or avian influenza helps maintain productivity and ensures regulatory compliance for meat, dairy, and egg producers. With biotechnology advancements and the miniaturization of diagnostic equipment, veterinary care is now more accessible at the point-of-care, even in field settings.

Major Trends in the Market

-

Rise of Point-of-Care (PoC) Testing: Portable, rapid diagnostics are enabling veterinarians to make quick clinical decisions at the farm or clinic.

-

Increased Use of Molecular Diagnostics: PCR and gene sequencing technologies are enhancing early and precise disease detection.

-

Integration of Artificial Intelligence (AI): AI-based imaging and pathology software are assisting veterinarians in faster, more accurate diagnoses.

-

Expansion in Companion Animal Health: Growing pet humanization is fueling demand for specialized diagnostics for conditions like cancer and genetic diseases.

-

Public Health Surveillance Initiatives: Governments are funding animal health diagnostics to monitor zoonotic diseases and food chain risks.

-

Growth of Tele-veterinary Services: Remote diagnostics combined with telemedicine platforms are transforming veterinary consultations.

-

Emergence of Multiplex Assays: Single tests that can detect multiple pathogens simultaneously are gaining popularity in production animal health.

-

Personalized Veterinary Medicine: Diagnostic data are increasingly being used to tailor treatment plans for individual animals, especially in oncology and dermatology.

Report Scope of Veterinary Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 11.94 Billion |

| Market Size by 2034 |

USD 28.27 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 10.05% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Testing Category, Animal Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

IDEXX Laboratories, Inc.; Zoetis; Antech Diagnostics, Inc. (Mars Inc.); Agrolabo S.p.A.; Embark Veterinary, Inc.; Esaote SPA; Thermo Fisher Scientific, Inc.; Innovative Diagnostics SAS; Virbac; FUJIFILM Corporation |

Key Market Driver: Increasing Prevalence of Zoonotic and Infectious Diseases

One of the most compelling drivers of the veterinary diagnostics market is the rising incidence of zoonotic diseases and infectious outbreaks. Diseases such as avian influenza, bovine spongiform encephalopathy (mad cow disease), rabies, brucellosis, and leptospirosis present serious threats to both animal and human populations. The global COVID-19 pandemic further underlined the interconnectedness of human and animal health, spotlighting the concept of “One Health”—an integrated approach to health that includes people, animals, and the environment.

Veterinary diagnostics play a vital role in early detection, containment, and eradication efforts. For instance, during an avian influenza outbreak, quick identification of infected poultry flocks through diagnostic testing is crucial to prevent widespread culling and economic loss. Governments, agricultural agencies, and private producers alike are investing heavily in diagnostic infrastructure, driving market growth.

Key Market Restraint: High Cost of Advanced Diagnostic Tests and Equipment

Despite the critical importance of diagnostics, high costs associated with advanced testing serve as a significant barrier, particularly in developing countries and among small-scale farmers. Molecular diagnostics, high-resolution imaging equipment, and specialized pathology services come with steep price tags that are often out of reach for veterinarians operating in resource-limited settings.

Additionally, there are ancillary costs related to training personnel, maintaining laboratory equipment, and procuring reagents, which further increase the financial burden. This pricing dynamic leads to underdiagnosis and late intervention in many cases, ultimately affecting animal health outcomes. Cost-effective solutions and low-cost rapid tests are gradually emerging but affordability remains a challenge across much of the global market.

Key Market Opportunity: Expansion of Companion Animal Diagnostics

The growing humanization of pets creates a lucrative opportunity for the veterinary diagnostics market. Pet owners are increasingly willing to invest in sophisticated healthcare services for their animals, including preventive diagnostics, chronic disease management, and genetic screening. Companion animals, particularly dogs and cats, are being diagnosed with conditions such as diabetes, arthritis, and cancer at rising rates, necessitating advanced diagnostic solutions.

Moreover, insurance penetration for pets is increasing in North America and Europe, making expensive diagnostic services more accessible. Companies are responding with specialized offerings like point-of-care blood analyzers for veterinary clinics and at-home diagnostic test kits for pet owners. As the pet adoption rate climbs globally—especially post-pandemic—this segment is expected to contribute significantly to future market growth.

Veterinary Diagnostics Market By Testing Category Insights

Clinical chemistry tests dominate the testing category, as blood chemistry panels are routine diagnostic procedures across all veterinary practices. These tests assess organ function, electrolyte balance, and metabolic status, helping diagnose conditions ranging from liver disease to diabetes. Clinical chemistry analyzers tailored for veterinary use are widespread in both reference laboratories and mid-sized clinics.

Molecular diagnostics are the fastest-growing category, offering unparalleled accuracy and early detection. Techniques like PCR, next-generation sequencing (NGS), and microarrays are used for detecting viral, bacterial, and genetic diseases with high specificity. The ability to detect emerging pathogens or latent infections early makes molecular tools increasingly essential, particularly in managing zoonotic risks and breeding programs.

Veterinary Diagnostics Market By Animal Type Insights

Production animals currently dominate the market, driven by the sheer volume of animals requiring routine health screening to ensure food safety and productivity. Diagnostics for cattle, swine, and poultry focus heavily on infectious disease control, reproductive health, and nutrition monitoring. In emerging economies, government programs supporting livestock health further enhance demand for production animal diagnostics.

Companion animals are the fastest-growing segment, reflecting the global surge in pet ownership and shifting perceptions of pets as family members. Diagnostics tailored for companion animals now include panels for allergies, endocrine disorders, infectious diseases, and cancer screening. Specialized veterinary diagnostic labs and point-of-care systems designed exclusively for pets are thriving, especially in urban centers.

Veterinary Diagnostics Market By Product Insights

Consumables, reagents, and kits dominate the veterinary diagnostics market, mainly due to their recurring use in routine testing. Diagnostic assays, PCR reagents, culture media, and immunoassay kits are essential components for every diagnostic procedure, whether in reference labs or point-of-care settings. Veterinary practices often require a constant supply of these materials for hematology, parasitology, and serological testing. Companies like IDEXX Laboratories and Zoetis have robust portfolios of diagnostic consumables tailored to small and large animal applications.

Equipment and instruments are growing the fastest, driven by technological innovation and miniaturization. Handheld blood analyzers, portable ultrasound machines, and digital radiography systems are becoming increasingly common in veterinary clinics. Mobile diagnostic units now allow on-farm testing for diseases like mastitis or respiratory infections in livestock, significantly enhancing veterinarian productivity and accuracy. Rapid adoption of point-of-care devices, particularly in companion animal health, is propelling this segment’s expansion.

Veterinary Diagnostics Market By End-use Insights

Reference laboratories dominate the veterinary diagnostics end-use landscape, largely because of their comprehensive test menus, advanced equipment, and professional staff. Major players like IDEXX Reference Laboratories and Antech Diagnostics offer an extensive array of services ranging from microbiology to histopathology, serving both large animal hospitals and solo practitioners.

Veterinarian clinics are the fastest-growing end users, empowered by compact, easy-to-use diagnostic instruments. Modern clinics now perform in-house hematology, chemistry panels, and urinalysis with rapid turnaround times. The decentralization of diagnostics allows veterinarians to provide immediate results to pet owners, enhancing patient outcomes and client satisfaction.

Veterinary Diagnostics Market By Regional Insights

North America is the dominant region in the veterinary diagnostics market, underpinned by a mature veterinary healthcare infrastructure, high pet adoption rates, and substantial livestock industries. The U.S., in particular, boasts widespread insurance coverage for pets, growing awareness of zoonotic diseases, and a strong culture of preventive animal care. The presence of major companies like IDEXX Laboratories, Zoetis, and Thermo Fisher Scientific further strengthens North America’s leadership position.

Moreover, stringent regulations regarding food animal health and safety require routine diagnostics for livestock. Companion animal spending has skyrocketed in recent years, leading to investments in specialty veterinary services, including diagnostics for oncology, dermatology, and internal medicine.

Asia-Pacific is the fastest-growing market, fueled by increasing disposable incomes, rising livestock populations, and expanding pet ownership. Countries like China, India, and Australia are witnessing a surge in veterinary healthcare infrastructure, government-led zoonotic disease surveillance programs, and private sector investment in diagnostic technologies.

Veterinary diagnostics adoption is particularly pronounced in urban areas where rising middle-class populations seek better healthcare for their pets. Additionally, outbreaks of diseases like avian influenza and African swine fever have prompted governments to prioritize animal health diagnostics, creating significant market opportunities across the region.

Some of the prominent players in the veterinary diagnostics market include:

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Veterinary Diagnostics Market Recent Developments

-

March 2025: IDEXX Laboratories launched a new next-generation PCR testing platform for veterinary clinics, enabling rapid on-site detection of infectious diseases.

-

February 2025: Zoetis acquired a veterinary diagnostic software startup to enhance its cloud-based diagnostic solutions for companion animals.

-

January 2025: Antech Diagnostics expanded its histopathology services across Europe, providing more comprehensive testing for equine and companion animals.

-

December 2024: Thermo Fisher Scientific unveiled a new veterinary-specific ELISA kit for early detection of avian influenza in poultry.

-

November 2024: Heska Corporation introduced a point-of-care molecular diagnostic system designed for use in mixed-animal veterinary practices.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the veterinary diagnostics market

Product

- Consumables, Reagents & Kits

- Equipment & Instruments

Testing Category

- Clinical Chemistry

- Microbiology

- Parasitology

- Histopathology

- Cytopathology

- Hematology

- Immunology & Serology

- Imaging

- Molecular Diagnostics

- Other Categories

Animal Type

-

- Cattle

- Poultry

- Swine

- Other Production Animals

-

- Dogs

- Cats

- Horses

- Other Companion Animals

End-use

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)