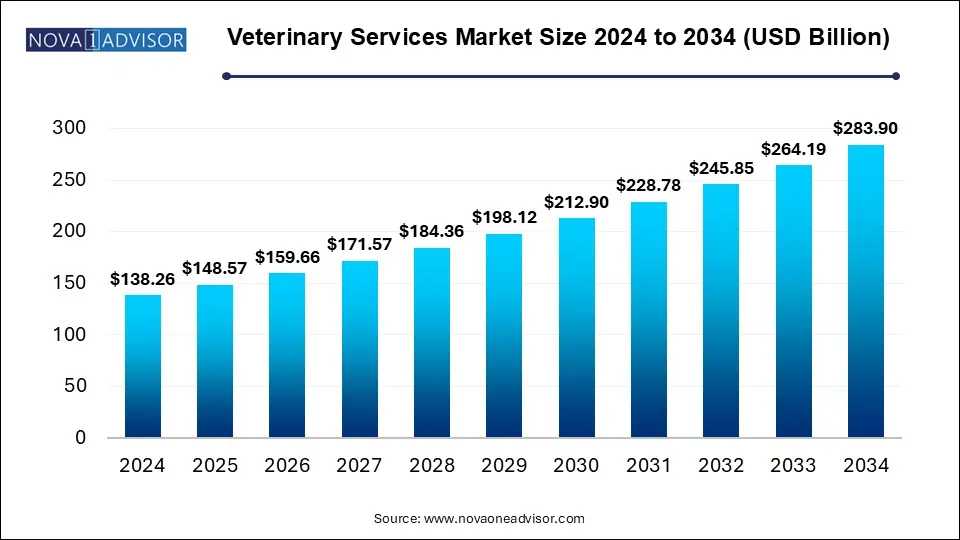

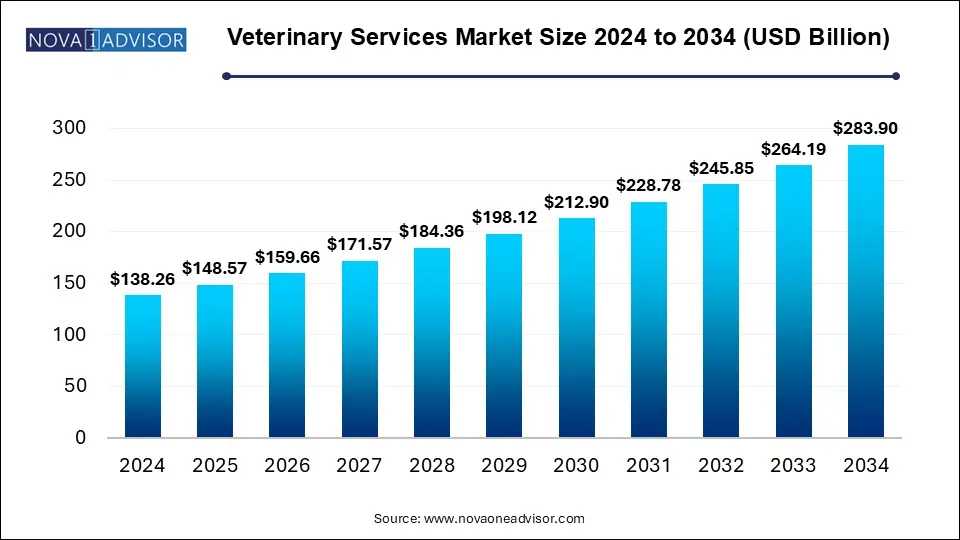

Veterinary Services Market Size and Growth

The global veterinary services market was valued at USD 138.26 billion in 2024 and is projected to reach USD 283.9 billion by 2034, registering a CAGR of 7.46% from 2025 to 2034.The global veterinary services market growth is attributed to the increasing consumption of animal-derived products.

Veterinary Services Market Key Takeaways

- By region, North America dominated the veterinary services market in 2024.

- By region, Asia Pacific is expected to grow fastest during the forecast period.

- By animal type insights, the production animal segment dominated the market share in 2024.

- By animal type insights, the companion animal segment is expected to grow fastest during the forecast period.

- By service type insights, the medical service segment dominated the veterinary services market in 2024.

- By service type insights, the non-medical services segment is expected to grow fastest during the forecast period.

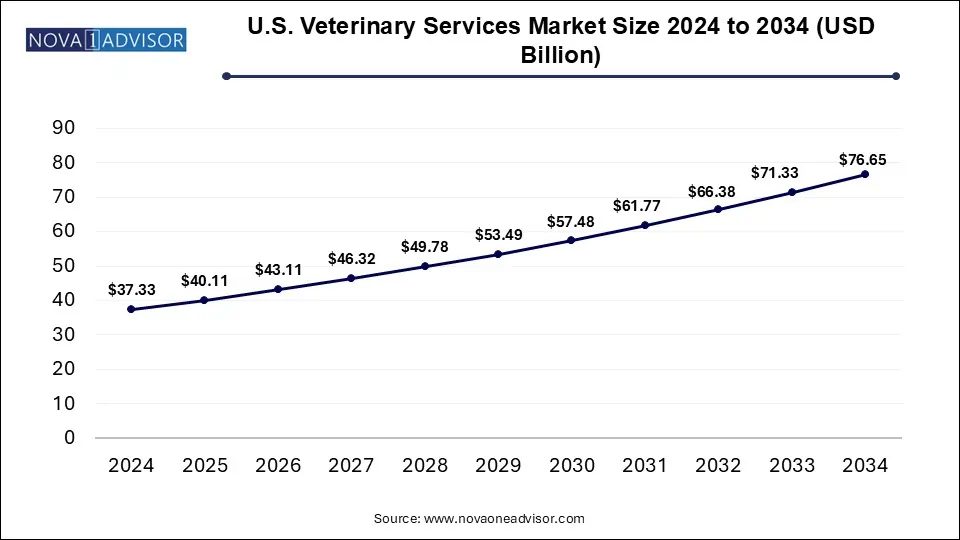

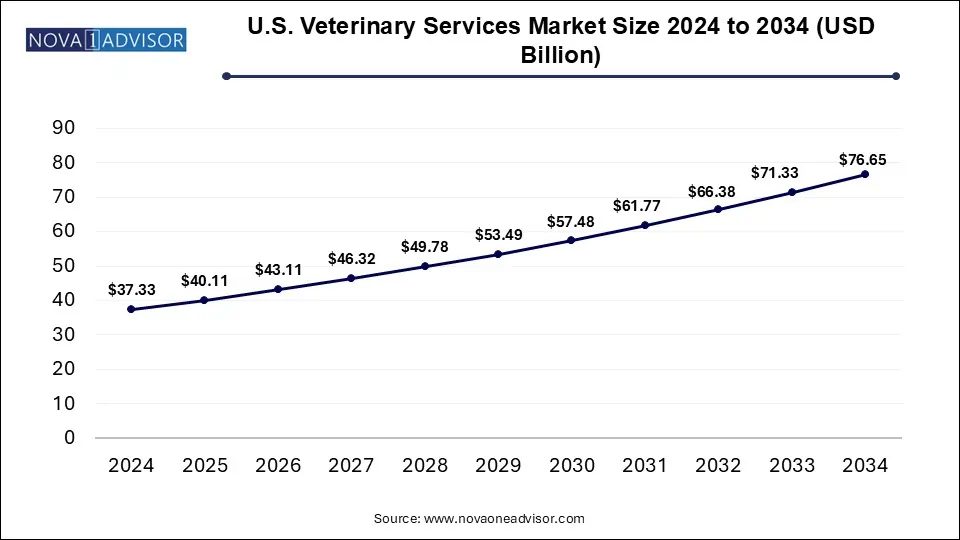

U.S. Veterinary Services Market Size and Growth 2025 to 2034

The U.S. veterinary services market size was valued at USD 37.33 billion in 2024 and is expected to reach around USD 76.65 billion by 2034, growing at a CAGR of 6.75% from 2025 to 2034.

North America dominated the veterinary services market in 2024. The market growth in the region is attributed to the increasing presence of high veterinary expenditure major market players and high adoption of pet insurance in the region. In addition, increasing adoption of various animal healthcare services, strong veterinary infrastructure, rising expenditure on animal care, and high rates of ownership, coupled with the availability of advanced care services are further expected to drive the market growth. The U.S. and Canada are dominating countries driving the market growth.

For instance, in December 2024, a global leader in veterinary healthcare, IDEXX Laboratories launched significant updates reflecting its commitment to excellence and innovation. The company continues to enhance the health and well-being of pets, people, and livestock, from leadership changes to groundbreaking diagnostic tools.

Asia Pacific Veterinary Services Market Trends

Asia Pacific is expected to grow fastest during the forecast period. The market growth in the region is driven by the growing awareness about livestock disease preventative care, increasing prevalence of zoonotic diseases, high availability of food production animals, and growing livestock and pet population in the developing and developed countries in the region.

China, India, Japan, and South Korea are the fastest growing countries. India is the fastest growing country in the veterinary industry. The rising pet population, increasing demand for veterinarians and their services, and high demand for pet products such as milk and meat are expected to drive the growth of the veterinary services market in India.

For instance, in July 2024, Dr Pawan Kotwal, Advisor to Hon’ble Lieutenant Governor LG, UT Ladakh launched 9 Mobile Veterinary Clinic Services of the Animal Husbandry Department in India. The aim behind this launch was to provide quality and doorstep veterinary services to livestock in remote and inaccessible areas of UT Ladakh.

Veterinary Services Market Overview

The veterinary services market deals with the treatment and care of all animals where veterinary services mainly include minor medical processes and outpatient care involving the hospitalization of less than four days. In addition, veterinary medicine is a medical specialty that deals with the treatment, diagnosis and prevention of diseases affecting the health of both wild and domestic animals and with the prevention of transmission of animal diseases to people. The increasing awareness about animal health and rising pet adoption across the globe are expected to drive market growth.

The veterinary services market is witnessing significant growth due to factors such as the growing trend of pet humanization, increasing economic prosperity in developing regions, and growing per capita animal healthcare expenditure. In addition, increasing focus on sustainable animal husbandry, increasing initiatives by key market players, and increasing animal population across the globe are further expected to drive the market growth.

Key Trends Contributing to Veterinary Services Market Growth

- Rising implementation of digital solutions: The increasing implementation of digital solutions is enabling veterinarians to efficiently offer quality care to different types of animals and is expected to drive market growth.

- Increasing affection: The increasing affection between pet parents and their pets paired with increasing disposable income and increasing market expansion of various pet insurance are expected to drive the growth of the veterinary services market.

- Availability of advanced medical facilities: The availability of advanced medical facilities for pet grooming, vaccination, advanced diagnostic and treatment modalities, animals, and daycare facilities further contributed to propelling the market growth.

Report Scope of Medical Veterinary Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 148.57 Billion |

| Market Size by 2034 |

USD 283.9 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.46% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Animal Type, Service Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

CVS Group Plc; Mars Inc.; National Veterinary Associates; Pets at Home Group PLC; Greencross Vets; Fetch! Pet Care; IVC Evidensia; A Place for Rover, Inc.; PetSmart LLC; Airpets International |

Market Dynamics

Opportunity

Government Programs for Animal Care Create

To establish programs that guarantee the best inventory availability in sectors for treating domestic animals, government institutions working with veterinary associations may present growth opportunities. The increasing need for veterinary supplies is a reflection of veterinary services market developments. In addition, the increasing animal health consciousness and rising per capita spending on animal healthcare are further expected to enhance the growth of the veterinary services market in the coming years. In addition, several technological advancements such as point-of-care diagnostics, telemedicine platforms and enhanced imaging modalities for animals have also revolutionized market growth.

Restraint

Lack of Awareness may Hamper the Market Growth

Lack of awareness in under-developed or developing countries may create challenges that may restrain market growth. As dogs and cats are the two most common household animals that can be an indirect or direct source of zoonotic infections. In addition, the high cost of veterinary services is further expected to restrain the growth of the veterinary services market.

Segment Insights

Veterinary Services Market By Animal Type

The production animal segment dominated the veterinary services market in 2024. The segment growth in the market is attributed to the increasing consumption and production of animal-derived products, rising focus on sustainable agriculture practices, increasing demand for animal protein, and production of safe and high-quality food products for human consumption.

Whereas the companion animal segment is expected to grow fastest during the forecast period. Companion animals, such as small mammals, horses, birds, cats, and dogs are an important part of many households across the globe, owing to an increasing demand for companion animal veterinary services. The rising pet humanization, growing awareness about pet health and nutrition and increasing pet ownership are expected to drive the segment growth in the market.

Veterinary Services Market By Service Type

The medical services segment dominated the veterinary services market in 2024. The segment growth in the market is driven by increased uptake of diagnostic and preventative care services, increased access to veterinary medical services in emerging countries, and the prevalence of zoonotic diseases. In addition, the non-medical services segment is expected to grow fastest during the forecast period. The segment comprises various non-medical services, such as travel, grooming, sitting, boarding and funeral, which may drive the segment growth.

Some of The Prominent Players in The Veterinary Services Market Include:

- CVS Group Plc

- Mars Inc.

- National Veterinary Associates

- Pets at Home Group PLC

- Greencross Vets

- Fetch! Pet Care

- IVC Evidensia

- A Place for Rover, Inc.

- PetSmart LLC

- Airpets International

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Veterinary Services Market

By Animal Type

-

- Cattle

- Poultry

- Swine

- Others

By Service Type

-

-

- In-vitro Diagnosis

- In-vivo Diagnosis

-

- Preventative Care

- Treatment

-

-

- Consultation

- Surgery

- Others

-

- Pet Services

- Livestock Services

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)