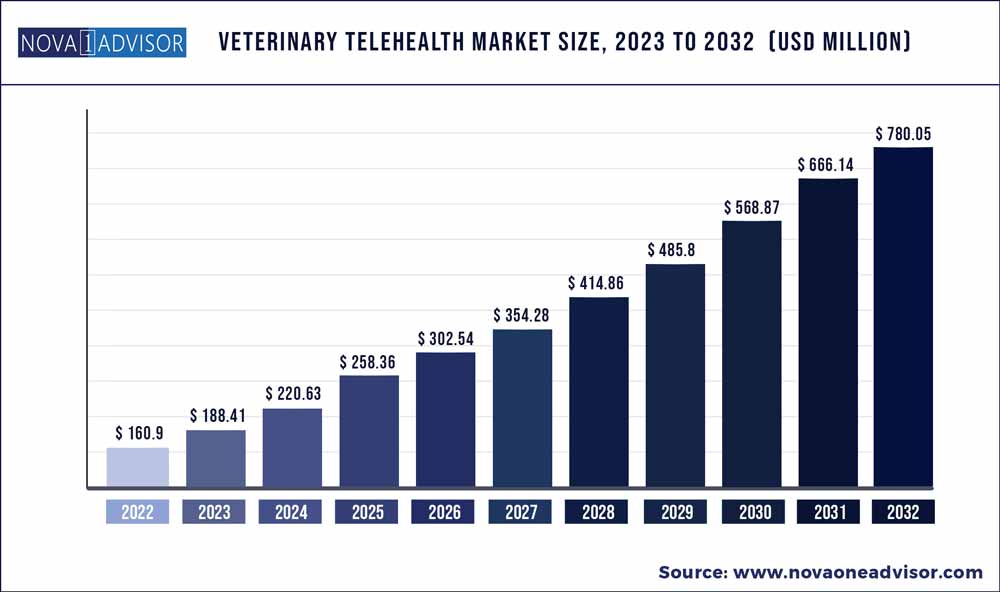

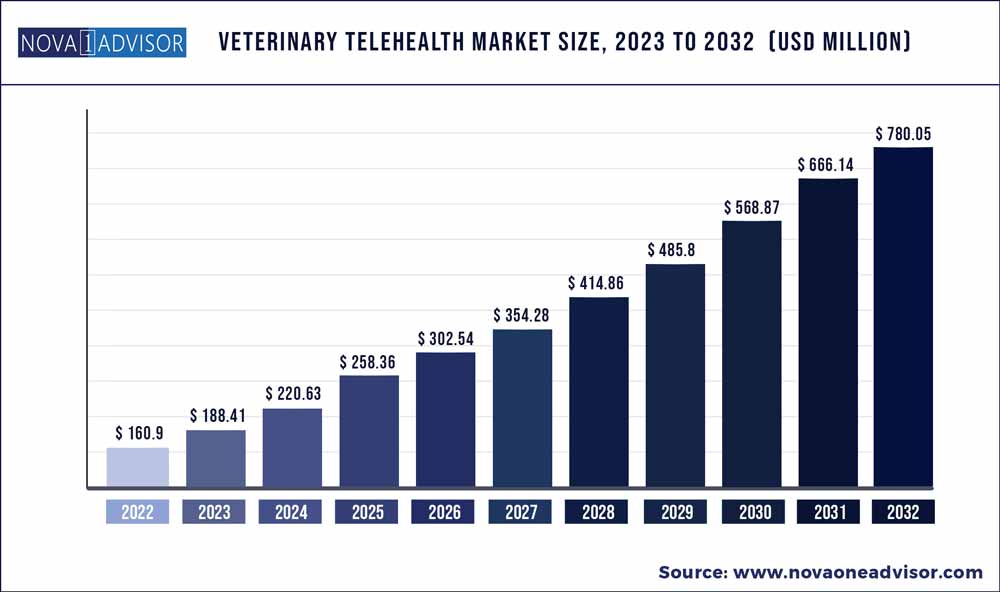

The global veterinary telehealth market size was estimated at USD 160.90 million in 2022 and is expected to surpass around USD 780.05 million by 2032 and poised to grow at a compound annual growth rate (CAGR) of 17.1% during the forecast period 2023 to 2032.

Key Takeaways:

- North America dominated the market for veterinary telehealth and accounted for the largest revenue share of 36.0% in 2022.

- In Asia Pacific, the market for veterinary telehealth is predicted to witness a CAGR of 18.1% over the forecast period

- The other animal segment accounted for the largest revenue share of around 28.0% in 2022.

- The feline segment is anticipated to be the fastest-growing segment with a rate of over 17.1% over the forecast period.

- The teleconsulting segment held the majority of the revenue share of 29% in 2022.

- Telemedicine is anticipated to be the fastest-growing segment with a CAGR of about 17.1% over the forecast period

Veterinary Telehealth Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 188.41 million |

| Market Size by 2032 |

USD 780.05 million |

| Growth Rate From 2023 to 2032 |

CAGR of 17.1% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Animal type, Service type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Airvet; Activ4Pets; BabelBark,Inc.; GuardianVets; PetDesk; Petzam; TeleTails; Televet; Vetster, Inc.; VitusVet; Whiskers Worldwide, LLC; Virtuwoof, LLC; FirstVet; PawSquad; Petriage Inc. |

The growing adoption of these management systems can be attributed to the steady growth in the focus on veterinary telehealth along with disease detection. Furthermore, the prevalence of zoonotic and chronic diseases in animals and the rising adoption of IoT & AI by pet parents are some of the major drivers for the market. The increasing prevalence of diseases such as diabetes, kidney diseases, spinal disc problems, and blood pressure-related issues is further fueling the market.

The increasing incidence of obesity in pets due to conditions such as joint diseases & osteoarthritis is fueling the demand for better treatment options. Further, disease outbreaks in the livestock can be major socioeconomic threats, resulting in disruption of local markets, international trade, and rural markets as well as production loss. Such factors are driving the market for veterinary. The COVID-19 pandemic is confidently influencing the market for veterinary telehealth. The interest in veterinary telehealth is increasing during the ongoing crisis. According to a 2020 article published by the Veterinary Medical Association, the use of telemedicine has grown to monitor and protect the health of veterinary teams and veterinary patients.

For instance, in March 2021, a leading integrated healthcare company in India, Practo, announced the launch of a veterinary telemedicine service. Likewise, in May 2020, TeleTails launched a new software solution in response to the COVID-19 pandemic, called TeleTails Instant which is a video conferencing tool. However, government restrictions on veterinary telemedicine are expected to limit how liberally veterinary professionals use telemedicine. This is due to the increased availability of COVID-19 vaccines provides individuals more latitude to take their animals to practitioners in person. For instance, The U.K. has proclaimed in November 2021 that they ended waivers of their telemedicine restrictions. Thus, limiting the adoptions to some extent. However, increasing awareness and associated benefits with the use of telehealth platforms are supporting the growth.

The increasing prevalence of zoonotic diseases and chronic animal diseases is also contributing to the telehealth market. According to WHO statistics, in 2021, it was estimated that millions of deaths and about 1 million cases of illness occur each year from zoonotic diseases and around 60% of emerging infections worldwide are the result of zoonotic diseases. Thus, the increase in infections is compelling pet owners and farm animal owners to adopt telehealth services for improving and monitoring the health of their pets and animals. The upsurge in animal healthcare spending is anticipated to boost the market growth. According to the 2021 report by APPA - American Pet Products Association, the cumulative spending in the U.S. pet industry has increased by 1.06% from 2019 to 2020.

Moreover, the rising concern of owners about their animals has resulted in an increase in pet care expenditure which is further fueling the growth.Furthermore, in 2021, approximately 1,09,600 miilions was spent on pets and 1,03,600 millions in 2020 in U.S.The increasing demand for animal healthcare is propelling the market growth. Furthermore, there is high demand and an increasing rate of consumption for animal-derived products is anticipated to drive the market for veterinary telehealth. This growing demand is eventually increasing the need to protect animals from diseases. According to the International Service for the Acquisition of Agri-biotech Applications (ISAAA), the demand for meat and milk production is anticipated to double by 2050 in developing countries. Such factors are propelling the adoption of telehealth for animal healthcare.

Animal Type Insights

The other animal segment accounted for the largest revenue share of around 28.0% in 2022. The others segment comprises poultry, sheep and goats, etc. High consumption of poultry and cattle products on a daily basis is a major factor contributing to the growth of this segment. Sheep are also required for other commodities such as wool. Furthermore, an increase in the prevalence of chronic diseases in sheep & goats is a high-impact rendering driver for this segment, which may lead to the adoption of veterinary telehealth for preventive care and disease control.

The feline segment is anticipated to be the fastest-growing segment with a rate of over 17.1% over the forecast period. The dominant share captured by the segment is a consequence of increasing animal healthcare spending, specifically in developed nations. As per the statistics released by the American Pet Product Association, it was found that 44,100millions were spent on pet food and treats, whereas 32,300 was on veterinary care and product sale in 2021.

Service Type Insights

The teleconsulting segment held the majority of the revenue share of 29% in 2022. The segment growth is attributed to the rising usage among veterinarians to seek consultation from the veterinary specialist via telehealth tools to gain advice & insights regarding the care of the animal. Further, teleconsultation saves transportation costs and reduces ancillary expenses. Thus, expert advice can be taken on an immediate basis without wasting the time for long waiting hours. Such factors are propelling the growth of the segment.

Based on the service type, the market is also segmented into telemedicine, telemonitoring &others. Telemedicine is anticipated to be the fastest-growing segment with a CAGR of about 17.1% over the forecast period due to the increased internet penetration. The upsurge in the number of internet users has led to an increase in the usage of animal telehealth. The increasing initiatives by market players is anticipated to fuel the telemedicine segment market growth. For instance, in April 2021, Guardian Vets, the industry leader in veterinary client communications technology and telemedicine launched Virtual CRS, Overflow Protection and Callback Support, three innovative services. These services had reduced burdens on veterinary practices.

Regional Insights

North America dominated the market for veterinary telehealth and accounted for the largest revenue share of 36.0% in 2022. The market growth can be attributed to various factors such as the presence of key players in the region and high investment in animal health care expenditure. Besides, technological advancements and high disposable income are some of the factors expected to fuel the market over the forecast period. For instance, as per the United States Department of Agriculture, National Agricultural Statistics Service, 2021, the number of cattle and calves in the United States is 93.6 million approximately.

In Asia Pacific, the market for veterinary telehealth is predicted to witness a CAGR of 18.1% over the forecast period due to the constant up-gradation of the healthcare infrastructure. The rising adoption of veterinary healthcare facilities coupled with the rapid expansion of manufacturing facilities in emerging countries such as China and India is further propelling the market growth. For instance, in June 2021, the government of Andhra Pradesh, one of state in India launched veterinary telemedicine facility. Moreover, the significantly high cattle population in the region is driving the telehealth market. For instance, China and India constitute more than 30% of the global population of cattle.

Key Companies & Market Share Insights

Industry players are involved in business activities such as strategic collaborations, new product launches, and regional expansion as emerging countries are still in the loop of adopting veterinary telehealth. For instance, in August 2020, Televet partnered with Cornell University Hospital for Animals. With this, the company would deploy its telehealth platform for the University’s veterinary telehealth operations. This extended the company’s market growth. Additionally, in July 2020, Zoetis partnered with telemedicine companies such as Vet-AI and Video With My Vet. The telemedicine platforms follow telemedicine guidelines for the U.K. and allow veterinarians to acquire information from clients on their smartphones through virtual consultations, thereby driving the market. Some of the prominent players in the veterinary telehealth market include:

- Airvet

- Activ4Pets

- BabelBark, Inc.

- GuardianVets

- PetDesk, Petzam

- TeleTails

- Televet

- Vetster, Inc.

- VitusVet

- Whiskers Worldwide, LLC

- Virtuwoof, LLC

- FirstVet

- PawSquad

- Petriage Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Veterinary Telehealth market.

By Animal Type

- Canine

- Feline

- Equine

- Bovine

- Swine

- Others

By Service Type

- Telemedicine

- Teleconsulting

- Telemonitoring

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)