Veterinary Wound Cleansers Market Size and Growth Report, 2034

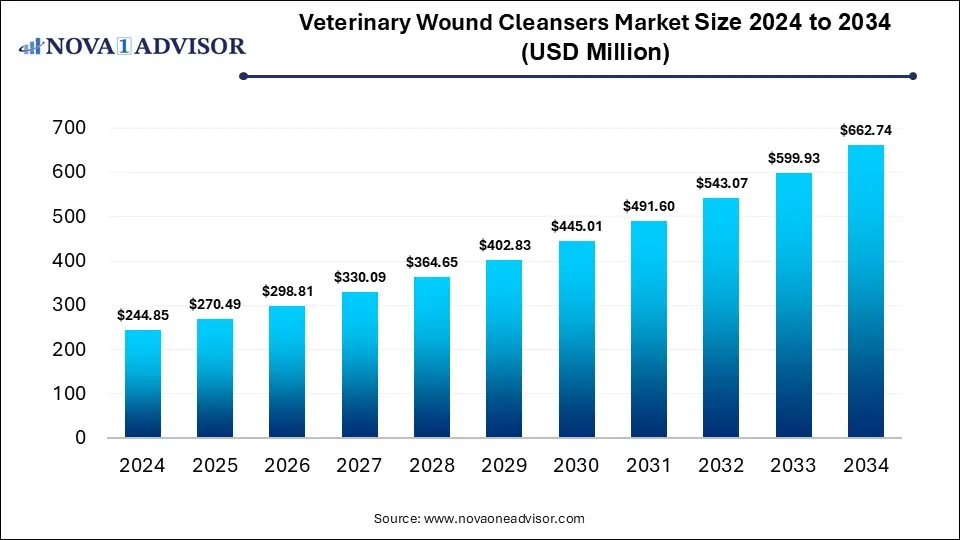

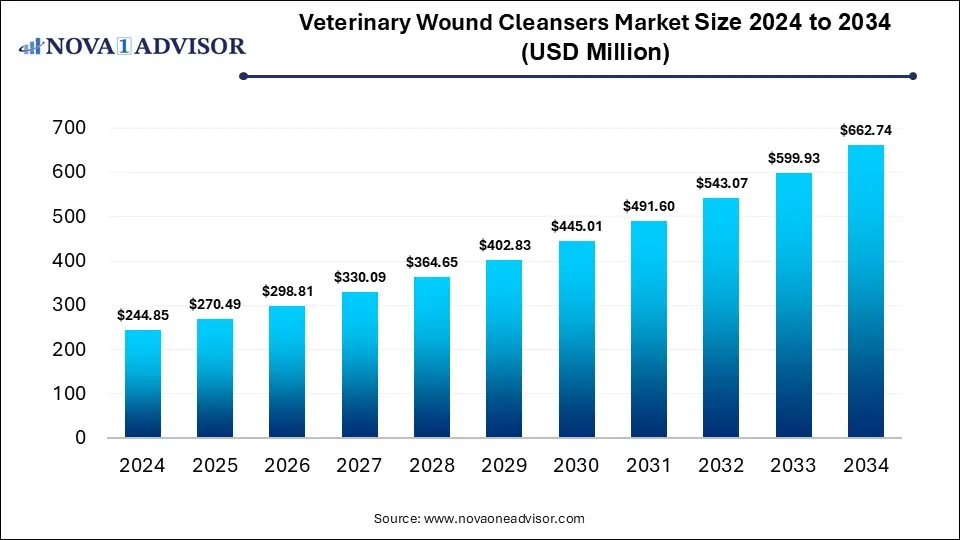

The global veterinary wound cleansers market size was valued at USD 244.85 million in 2024 and is anticipated to reach around USD 662.74 million by 2034, growing at a CAGR of 10.47% from 2025 to 2034. The growth of the veterinary wound cleansers market is driven by the rising pet ownership, increasing emphasis on maintaining pet health, and advancements in veterinary care products.

Veterinary Wound Cleansers Market Key Takeaways

- Based on type, the companion animal segment led the market with the largest revenue share of 59% in 2024.

- The livestock animal segment is anticipated to grow at the fastest CAGR during the forecast period.

- Based on end use, the veterinary hospitals and clinics segment led the market with the largest revenue share of 68% in 2024.

- The homecare segment expected to grow at the fastest CAGR during the forecast period

- The homecare segment expected to grow at the fastest CAGR during the forecast period

Market Overview

The veterinary wound cleansers market plays a crucial role within the broader veterinary healthcare industry, providing essential solutions for the effective treatment and management of wounds in both companion and livestock animals. Wound cleansers are specialized formulations used to clean, disinfect, and prepare animal wounds for healing by removing debris, bacteria, and exudate without causing irritation or damage to healthy tissue. These products form the first line of defense against infection, promote tissue regeneration, and are critical in preventing complications from minor injuries to post-surgical care.

With the global increase in pet adoption and the intensification of livestock farming, the demand for veterinary wound management products has grown steadily. In the case of companion animals, pet owners are becoming increasingly aware of the importance of at-home wound care and are seeking over-the-counter solutions that are both safe and effective. Meanwhile, livestock farmers are concerned with maintaining animal productivity and minimizing economic losses due to untreated wounds, injuries, or infections.

Moreover, advancements in veterinary medicine have pushed the market towards more specialized wound care products, including enzymatic, antimicrobial, and natural cleansers designed for sensitive or chronic wounds. A growing emphasis on animal welfare, coupled with government regulations promoting responsible veterinary practices, is further propelling market demand. The veterinary wound cleansers market is therefore experiencing a wave of innovation, investment, and globalization, transforming from a niche product category into a critical segment of veterinary therapeutics.

Major Trends in the Market

-

Shift Toward Advanced Wound Care Solutions: Growing preference for hydrogel-based, enzymatic, and antimicrobial cleansers that offer faster healing with minimal tissue disruption.

-

Rise in Natural and Organic Formulations: Increased demand for botanical and chemical-free wound cleansers that appeal to environmentally conscious pet owners and livestock handlers.

-

E-commerce Expansion in Veterinary Products: Surge in online retailing of veterinary wound care products, offering convenience, product variety, and better pricing.

-

Increased Pet Humanization: Pet owners now treat their animals more like family members, resulting in higher spending on premium healthcare products, including wound cleansers.

-

Innovation in Veterinary Packaging: Development of spray nozzles, applicator tips, and portable single-use sachets to improve hygiene, dosing accuracy, and convenience.

-

Growth of Preventative Veterinary Care: Rising adoption of routine health monitoring and first-aid kits for pets and livestock, contributing to increased sales of wound cleansers.

-

Integration of Tele-Veterinary Services: Teleconsultations are enabling remote diagnosis and prescription of wound cleansers, expanding market accessibility.

-

Collaborations Between Pharma and Agro-industrial Firms: Partnerships are emerging to improve product outreach for livestock care in rural and agricultural zones.

Artificial intelligence (AI) is widely being implemented in veterinary wound management. AI algorithms such as deep learning can be applied for analyzing wound images for classifying their type, severity, and stage of healing, enabling veterinarians to choose the appropriate cleanser and treatment approach. Personalized treatment plans can be devised with the help of AI tools for assessing wound data and other patient information, including age, breed, health status, further allowing selection of specific cleaners designed to the individual animal's needs. Remote monitoring of wounds with AI-powered telemedicine platforms is allowing veterinarians to track progress of wound healing and provide proper guidance to pet owner without the need for frequent in-person visits.

Veterinary Wound Cleansers Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 270.49 Million |

| Market Size by 2034 |

USD 662.74 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 10.45% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Type, Product, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Elanco; Vetoquinol; Virbac; Innovacyn, Inc.; Axio Biosolutions Pvt Ltd; Jorgen Kruuse; Dechra Pharmaceuticals; Neogen Corporation; Ethicon (Johnson & Johnson Services, Inc.) |

Key Market Driver

The most significant driver for the veterinary wound cleansers market is the increasing global pet population coupled with heightened healthcare spending on companion animals. In urban and semi-urban settings, pets are increasingly considered integral family members, and their health and wellbeing receive substantial attention. In countries like the United States, Canada, Japan, and Australia, pet ownership rates are exceptionally high, with households allocating significant portions of their income toward pet healthcare, including routine wound care products.

The American Pet Products Association (APPA) reported that U.S. pet owners spent over $136 billion on their animals in 2024, with medical and wellness products accounting for a significant portion. Pet owners now proactively stock first-aid supplies for minor injuries, post-surgical wound care, and skin infections, leading to consistent demand for wound cleansers in retail and e-commerce channels. This consumer behavior, driven by the emotional connection between humans and their pets, is leading to robust growth in advanced wound cleansing products, particularly those with natural ingredients, antimicrobial properties, or specialized delivery formats.

Key Market Restraint

Despite growth potential, the veterinary wound cleansers market faces a notable challenge in the form of limited access to quality veterinary healthcare in rural and economically challenged regions. In developing nations, veterinary services are often underfunded or limited to urban centers, leaving vast agricultural and rural communities underserved. The absence of trained professionals, diagnostic equipment, and veterinary pharmacies significantly hampers wound care interventions for livestock and domestic animals.

Moreover, low-income farmers and pet owners may prioritize essential feeding and shelter over medical care, perceiving wound cleansers as non-essential expenditures. Even when products are available, inadequate education on proper wound care practices can lead to misuse or underuse of cleansers, affecting treatment outcomes. This disparity creates a bottleneck for manufacturers trying to penetrate emerging markets or expand outreach in underdeveloped regions. Bridging this gap requires extensive investment in veterinary infrastructure, training, and awareness programs that can facilitate wider adoption and utilization of veterinary wound cleansers.

Key Market Opportunity

A promising opportunity lies in the increasing global demand for organic, herbal, and chemical-free wound cleansers, particularly in the companion animal segment. Pet owners are becoming more conscious of the ingredients in healthcare products, opting for natural alternatives that are less likely to cause allergic reactions, toxicity, or long-term health issues. Natural wound cleansers made from substances such as aloe vera, calendula, tea tree oil, and honey-based formulations are gaining traction for their antimicrobial and soothing properties.

This trend is especially relevant in North America and Europe, where clean-label, cruelty-free, and eco-friendly products are seeing double-digit growth. Companies that can offer effective, plant-based formulations supported by scientific research are likely to capture significant market share. Furthermore, these natural products appeal not only to individual pet owners but also to veterinary clinics and homeopathic veterinary practitioners. As regulatory frameworks for animal wellness products evolve, manufacturers launching certified organic wound cleansers can expect to capitalize on a rapidly growing, loyal customer base.

Veterinary Wound Cleansers Market By Type Insights

Companion animals dominate the veterinary wound cleansers market, driven by increased household pet adoption and rising expenditure on pet healthcare. Dogs, cats, rabbits, and exotic animals frequently require wound care due to surgeries, skin infections, insect bites, or injuries. The emotional connection between pets and their owners has translated into higher investment in wound care products, particularly in developed countries. As a result, manufacturers are prioritizing pet-safe, non-toxic cleansers with attributes such as painless application, antibacterial properties, and soothing natural ingredients. Companies often launch pet-specific product lines to cater to varying animal skin sensitivities, sizes, and treatment needs.

Livestock animals, though secondary in market size, represent the fastest-growing segment. This growth is attributed to the increasing recognition of animal health's economic impact in livestock farming. Open wounds in cattle, pigs, sheep, and poultry can lead to infections, reduced productivity, and higher mortality, thus affecting a farmer’s profitability. With the expansion of commercial dairy and meat industries in Asia-Pacific and Latin America, livestock owners are gradually adopting routine wound management practices. Government-sponsored veterinary health schemes, bulk procurement of wound care products, and mobile veterinary services in rural areas are improving access, thereby accelerating segment growth.

Veterinary Wound Cleansers Market By Product

Traditional cleansers, including saline solutions and iodine-based preparations, remain the dominant product segment, especially in veterinary clinics and rural settings. Their low cost, broad-spectrum antimicrobial action, and wide availability make them the first line of wound cleaning in both companion and livestock animals. These cleansers are often prescribed post-surgery or for treating superficial wounds. Despite the rise of more advanced products, traditional cleansers continue to hold significant market share due to trust among veterinarians, familiarity in usage, and consistent efficacy.

Advanced cleansers are projected to be the fastest-growing product category. These include enzymatic cleansers, silver-based antimicrobials, and hydrogel formulations that offer improved wound healing outcomes with minimal irritation. They are particularly useful for chronic, infected, or deep wounds and are often recommended in post-surgical recovery protocols. Advanced cleansers are being developed with biocompatible ingredients and smart delivery systems, such as slow-release antimicrobials or pH-sensitive applications. Their growing use in specialized veterinary hospitals and research institutions is expected to fuel rapid expansion, particularly as pet owners seek more premium and effective treatment options.

Veterinary Wound Cleansers Market By End Use Insights

Veterinary hospitals and clinics dominate the end-use segment, accounting for a substantial share of wound cleanser usage. These facilities cater to a wide range of wound types, from routine injuries to post-operative care and chronic conditions, requiring expert application and sterile environments. The presence of trained staff, diagnostics, and immediate access to follow-up care contributes to the high demand for professional-grade cleansers. Furthermore, hospitals serve as referral centers for complex cases and are often early adopters of new or advanced wound care products, enhancing their role in market leadership.

Homecare is the fastest-growing segment, enabled by a surge in pet home treatment products and the rise of direct-to-consumer veterinary brands. Pet owners, particularly in urban areas, prefer to manage minor wounds and skin conditions at home using over-the-counter wound cleansers. Online tutorials, tele-veterinary consultations, and doorstep delivery services have empowered consumers to administer first aid effectively. Products tailored for easy home use, such as sprays, wipes, and non-stinging formulations, are becoming increasingly popular. The trend of home-based pet care is expected to continue, especially as more people seek to avoid unnecessary clinic visits and reduce healthcare costs.

Veterinary Wound Cleansers Market By Regional Insights

North America currently leads the veterinary wound cleansers market, thanks to its high pet ownership rate, advanced veterinary infrastructure, and strong consumer awareness. The United States, in particular, accounts for the largest revenue share due to well-established veterinary hospitals, a robust pet insurance industry, and the presence of global veterinary pharmaceutical companies. In Canada, supportive government initiatives for animal health and a growing equine and livestock care sector contribute further to regional growth. Retail and e-commerce penetration is strong in this region, allowing easy access to a broad spectrum of wound cleansing products.

U.S. Veterinary Wound Cleansers Market Trends

U.S. is a major contributor to the veterinary wound cleansers market in North America. The rising pet population and various households owing pet like cats and dogs as well as the increasing focus on pet health is driving the demand for veterinary wound care products like cleansers. The well-established veterinary healthcare infrastructure in U.S. with a strong presence of veterinary hospitals, clinics, and professionals is enabling access to advanced wound care solutions. Additionally, increased expenditure by pet owners on preventative care and wound management as well as availability of pet insurance are boosting the market potential.

Asia-Pacific is poised to be the fastest-growing region, bolstered by rapid urbanization, increasing disposable incomes, and expanding veterinary services. Countries such as India, China, and South Korea are witnessing a boom in pet adoption and modernization of animal husbandry practices. Additionally, regional manufacturers are launching cost-effective wound care solutions tailored for livestock needs in rural and semi-urban areas. The shift toward preventative care and animal hygiene, combined with technological advancements and government-sponsored veterinary outreach programs, is expected to drive explosive growth in the region over the next decade.

China Veterinary Wound Cleansers Market Trends

China is experiencing significant growth in the market in Asia Pacific. The market growth is driven by factors such as increased awareness of animal, improvement in veterinary medicine, rapid urbanization and lifestyle changes driving the demand for companion animals. China’s expanding livestock industry is contributing to the demand for advanced wound care products for preventing infections and to improve herd health. Furthermore, the increasing pet population, availability of advanced cleansers, expanding veterinary infrastructure, rising disposable incomes, and favourable insurance coverages for pet care are the factors driving the market growth.

Veterinary Wound Cleansers Market Top Key Companies:

- Elanco

- Vetoquinol

- Virbac

- Innovacyn, Inc.

- Axio Biosolutions Pvt Ltd

- Jorgen Kruuse

- Dechra Pharmaceuticals

- Neogen Corporation

- Ethicon (Johnson & Johnson Services, Inc.)

Veterinary Wound Cleansers Market Recent Developments

- In June 2025, Pawprint Oxygen entered into an exclusive partnership agreement with BC3 Technologies, a leading innovative medical solutions proivider. The partnership focuses on launching the HemoSEAL Pet Wound Spray which to the veterinary market, further strengthening Pawprint Oxygen’s EMS Animal Rescue Products line.

- In May 2024, epiq Animal Health, a leading distributor formed a strategic alliance with KeraVet Bio for enhancing product offering for distributors and veterinarians by launching an innovative wound care animal product in the market.

Veterinary Wound Cleansers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Veterinary Wound Cleansers market.

By Type

- Companion Animal

- Livestock Animal

By Product

- Traditional Cleansers

- Advanced Cleansers

- Natural Cleansers

By End Use

- Veterinary Hospitals & Clinics

- Homecare

- Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)