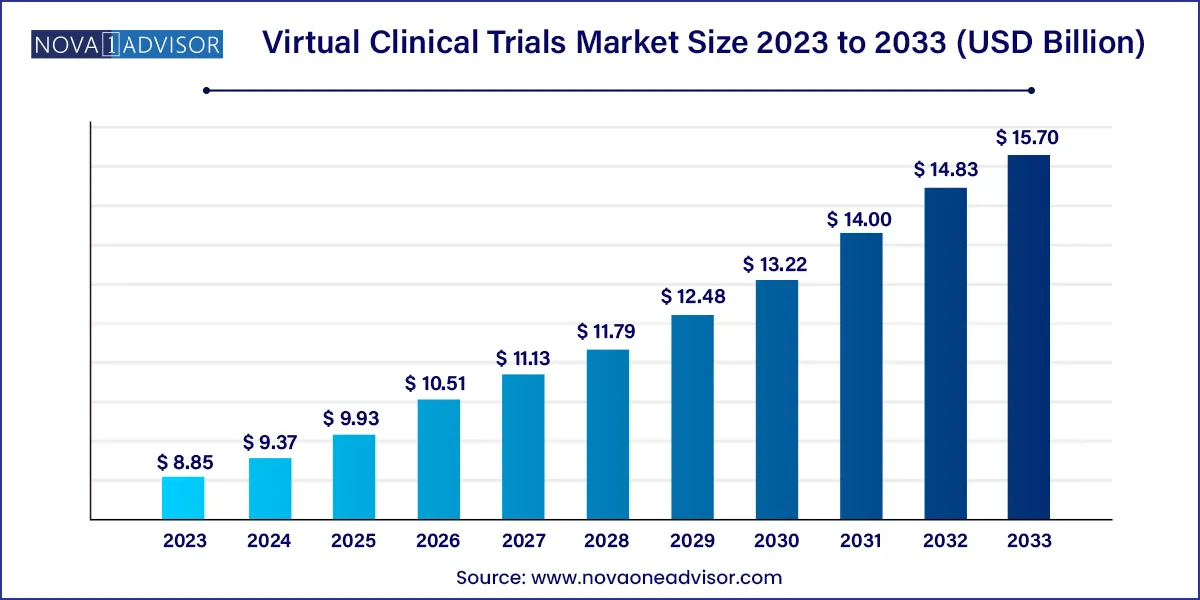

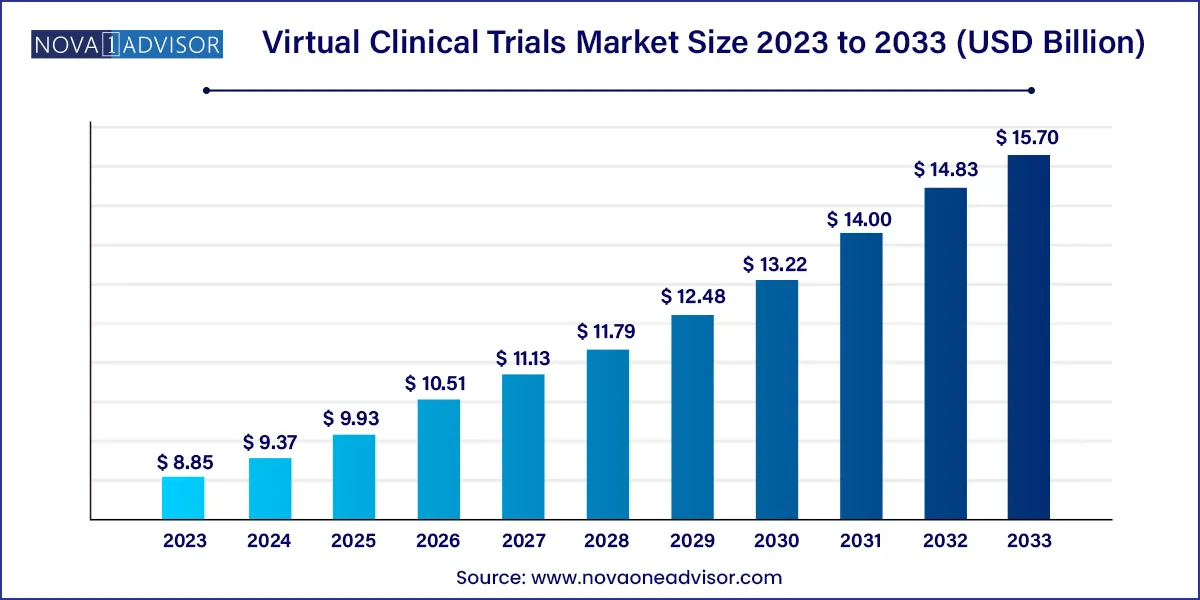

The global virtual clinical trials market size was exhibited at USD 8.85 billion in 2023 and is projected to hit around USD 15.70 billion by 2033, growing at a CAGR of 5.9% during the forecast period 2024 to 2033.

Key Takeaways:

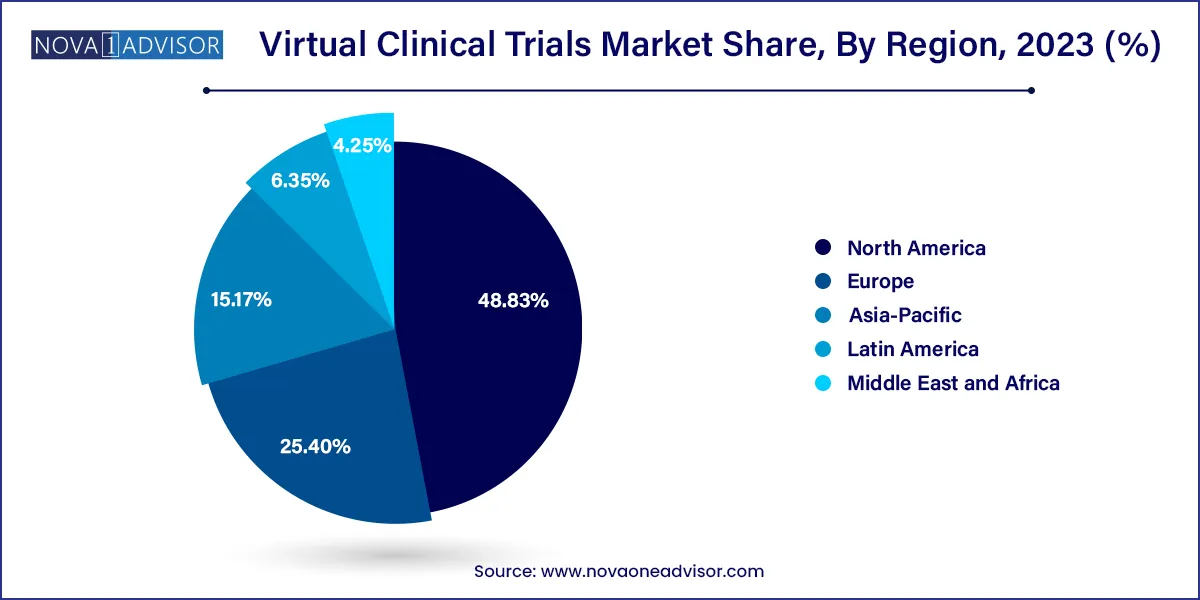

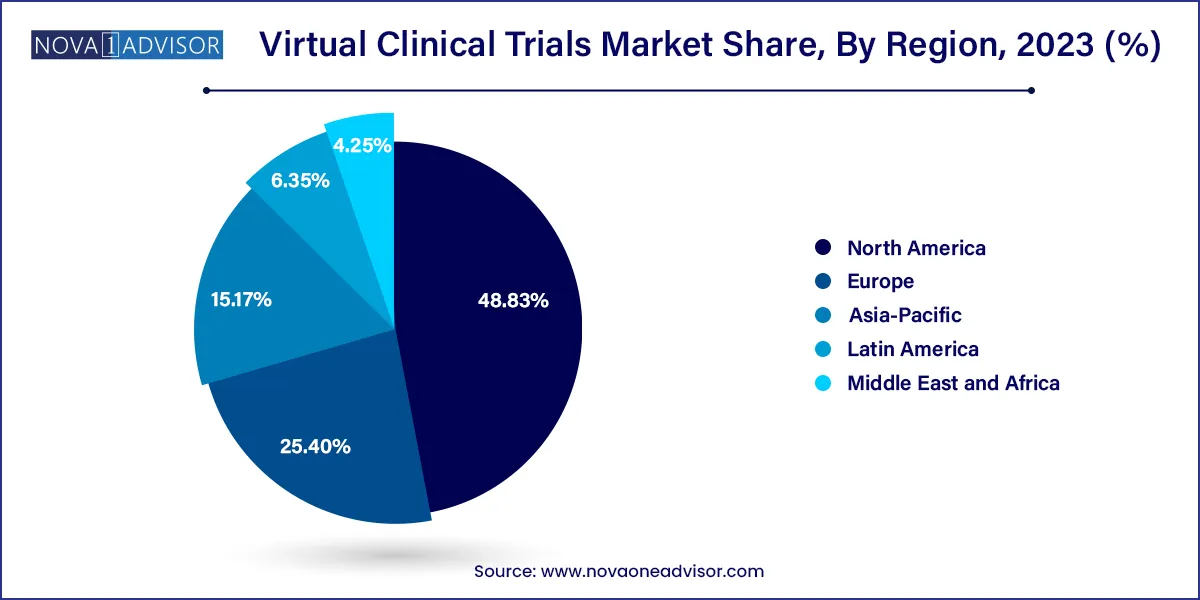

- North America accounted for a largest regional revenue share of 48.83% in 2023 and is expected to continue its dominance over the forecast period.

- Asia Pacific is expected to witness exponential growth of 6.8% over a forecast period.

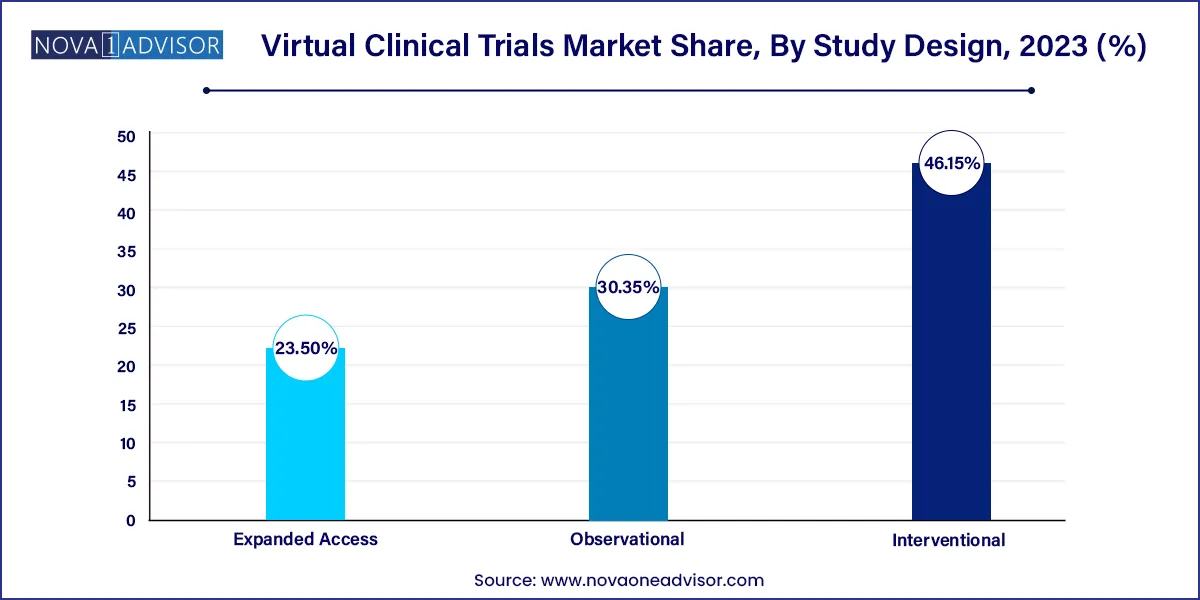

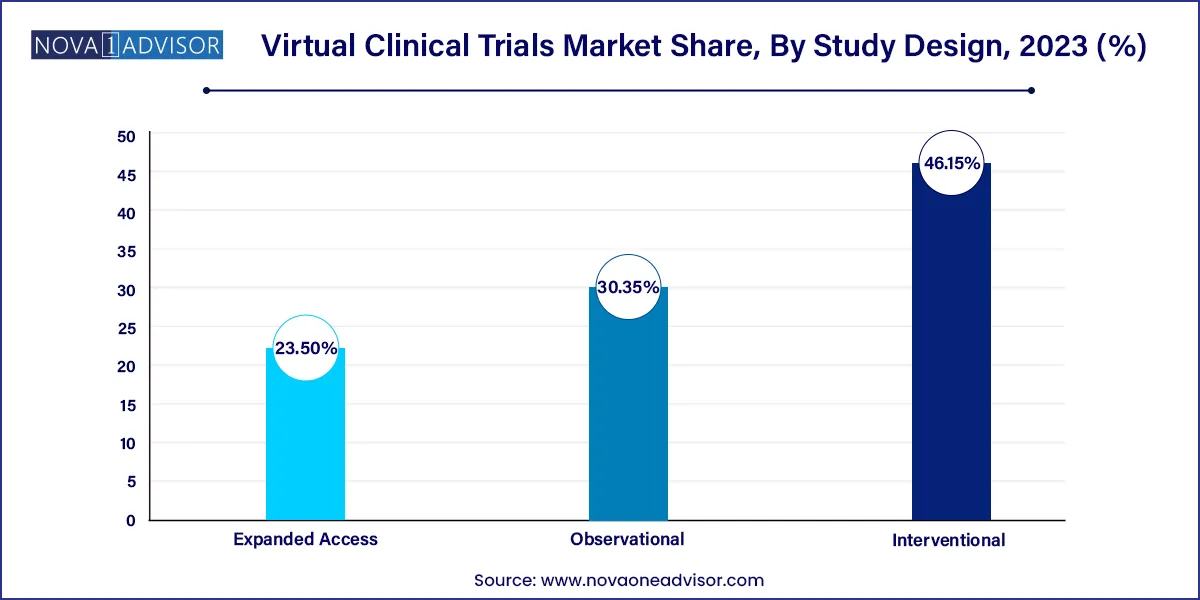

- The interventional design segment led the virtual clinical trials market with largest revenue share of 46.15% in 2023.

- The expanded access segment is projected to witness a rapid growth of 5.9% during a forecast period.

- The oncology segment dominated a market for virtual/decentralized clinical trials and accounted for a largest revenue share of over 25.0% in 2023.

- The cardiovascular segment is anticipated to witness a significant growth rate over a forecast period.

- Phase II segments dominated virtual clinical trials market and accounted for largest revenue share of over 30% in 2023.

- The Phase III segment is anticipated to register a fastest CAGR of over 5.0% over the forecast period.

Market Overview

The global Virtual Clinical Trials (VCTs) Market is undergoing a paradigm shift as the healthcare and pharmaceutical sectors increasingly turn toward digital transformation. VCTs utilize technologies such as remote monitoring tools, mobile health applications, telemedicine platforms, and wearable devices to conduct clinical trials outside of traditional healthcare or laboratory settings. This emerging approach enhances trial efficiency, promotes participant diversity, and reduces logistical barriers.

VCTs gained rapid traction following the COVID-19 pandemic, which underscored the importance of remote healthcare solutions. While traditional clinical trials often suffer from high dropout rates and delays due to geographic, economic, and operational constraints, virtual trials offer a flexible and cost-effective alternative. This has led to accelerated adoption by pharmaceutical companies, contract research organizations (CROs), and biotech firms globally. With increasing regulatory backing and the widespread integration of digital health infrastructure, the market for virtual clinical trials is set for robust growth through 2034.

Report Scope of the Virtual Clinical Trials Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.37 Billion |

| Market Size by 2033 |

USD 15.70 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Study Design, Indication, Phase, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ICON, plc; Parexel International Corporation; IQVIA; Covance; PRA Health Sciences; LEO Innovation Lab; Medidata; Oracle; CRF Health; Clinical Ink; Medable, Inc; Clinical Ink; Halo Health Systems; Croprime |

Market Driver: Rising Demand for Cost-Effective and Rapid Clinical Trials

The most prominent driver fueling the growth of the VCT market is the need for faster, more economical clinical research processes. Traditional clinical trials can take years and cost millions of dollars. Virtual models, by contrast, reduce costs significantly by minimizing or eliminating the need for physical trial sites, site monitoring visits, and manual data entry. VCTs also accelerate patient recruitment through digital channels and enable real-time data collection via wearables and mobile apps. These benefits have made VCTs an appealing option for pharmaceutical firms eager to bring products to market quicker and more efficiently.

Market Restraint: Regulatory and Data Privacy Challenges

Despite the momentum, regulatory inconsistencies and data privacy concerns pose challenges. Each country or region has unique guidelines governing data sharing, patient consent, and digital communications in healthcare. Compliance with HIPAA in the U.S., GDPR in the EU, and other local regulations often requires tailored strategies. Additionally, the transfer and storage of sensitive health data over digital platforms make VCTs susceptible to cyber threats. A lack of standardized global frameworks can hinder multinational trials and limit market scalability unless harmonization efforts are intensified.

Market Opportunity: Real-World Data and Longitudinal Patient Monitoring

VCTs present a unique opportunity to incorporate real-world evidence (RWE) and longitudinal patient data into trial designs. This extends beyond the capabilities of traditional clinical trials by enabling real-time and long-term monitoring of treatment efficacy, adherence, and side effects. For instance, in chronic illness studies like those targeting diabetes or cardiovascular diseases continuous monitoring via wearable devices can yield highly granular datasets. Regulatory bodies have begun to recognize RWE for label expansion and decision-making, offering a new growth channel for companies investing in digital trial ecosystems.

Segments

Virtual Clinical Trials Market By Study Design Insights

Interventional studies dominate the study design segment due to their critical role in assessing the efficacy and safety of new therapies. These trials often require robust monitoring protocols, which can be effectively implemented through digital platforms. For example, Pfizer's collaboration with Medable in 2023 streamlined remote data collection for a Phase III oncology trial using telemedicine and eConsent features. Interventional VCTs also benefit from adaptive protocols that allow for real-time adjustments based on digital feedback loops.

Expanded access trials are the fastest-growing segment, driven by the increased need to provide investigational drugs to patients with serious conditions who lack other treatment options. Virtual platforms enable broader geographic reach and efficient coordination between patients, physicians, and regulatory agencies. This accessibility makes expanded access programs more feasible, especially in low-resource or remote settings. Pharmaceutical firms are leveraging digital platforms to ensure faster approvals and track patient outcomes in real-time.

Virtual Clinical Trials Market By Indication Insights

Oncology is the dominant indication, propelled by the complexity and cost of traditional cancer trials. Virtual platforms allow remote consultations, self-administration of drugs, and electronic patient diaries, which are particularly helpful for immunocompromised patients. In 2024, Science 37 facilitated a multinational decentralized breast cancer trial with over 1,000 participants using digital touchpoints to improve retention and engagement.

Central Nervous System (CNS) disorders are the fastest-growing segment, owing to the long duration and intensive follow-ups required for these trials. Diseases like Alzheimer’s and Parkinson’s necessitate continuous cognitive assessments, which are now increasingly conducted through digital neurocognitive tools and mobile apps. Virtual trials offer a low-stress environment for patients with mental health challenges, improving participation rates and trial outcomes.

Virtual Clinical Trials Market By Phase Insights

Phase II trials dominate the virtual clinical trials market because they are pivotal in establishing the efficacy and optimal dosing of new drugs. These trials involve larger participant groups and require consistent monitoring—criteria well-suited to virtual environments. In 2023, a major pharma company conducted a fully decentralized Phase II trial for a new diabetes medication across five countries, demonstrating time savings of over 30% compared to traditional methods.

Phase IV trials are the fastest-growing, as post-marketing surveillance is increasingly conducted using real-world data collected through digital health platforms. These trials help monitor long-term safety, adherence, and patient satisfaction post-commercialization. Companies are using mobile apps to gather ongoing patient feedback and detect rare adverse events, aligning with regulatory mandates for continuous drug monitoring.

Virtual Clinical Trials Market By Regional Insights

North America is the dominant region in the global VCT market, owing to its advanced healthcare IT infrastructure, strong regulatory support, and high digital literacy rates. The U.S. Food and Drug Administration (FDA) has issued multiple guidance documents supporting the decentralized trial model, making it easier for companies to implement virtual strategies. Major players like Medable, Parexel, and IQVIA are headquartered in this region, further solidifying North America’s leadership. In 2024, over 50% of all new U.S.-based clinical trials adopted some form of decentralized methodology.

Asia-Pacific is the fastest-growing region, with countries like China, India, Australia, and South Korea rapidly embracing virtual trial models. This is driven by a combination of expanding patient populations, cost advantages, and improving digital infrastructure. For example, India’s Ministry of Health introduced draft guidelines in early 2025 to support telemedicine-enabled trials. Similarly, Australia's clinical research networks have initiated pilot programs to assess the viability of decentralized trial ecosystems. This regional momentum is further boosted by partnerships between local CROs and global pharma companies seeking to tap into diverse participant pools.

Recent Developments

-

March 2025: Science 37 partnered with Medidata to integrate their platform with Medidata Rave for improved data interoperability in virtual trials.

-

January 2025: IQVIA launched an AI-powered virtual assistant for participant follow-ups, enhancing patient retention by 20%.

-

December 2024: Parexel opened its DCT Innovation Hub in the UK to develop hybrid trial models tailored for rare diseases.

-

October 2024: Oracle Health Sciences upgraded its CTMS with real-time analytics and integrated telehealth features.

-

August 2024: Medable raised $100 million to scale operations in Asia-Pacific and Latin America.

Some of the prominent players in the Virtual clinical trials market include:

- ICON, plc

- Parexel International Corporation

- IQVIA

- Covance

- PRA Health Sciences

- LEO Innovation Lab

- Medidata

- Oracle

- CRF Health

- Clinical Ink

- Medable, Inc.

- Signant Health

- Halo Health Systems

- Croprime

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global virtual clinical trials market.

Study Design

- Interventional

- Observational

- Expanded Access

Indication

- CNS

- Autoimmune/Inflammation

- Cardiovascular Disease

- Metabolic/Endocrinology

- Infectious Disease

- Oncology

- Genitourinary

- Ophthalmology

- Others

Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)