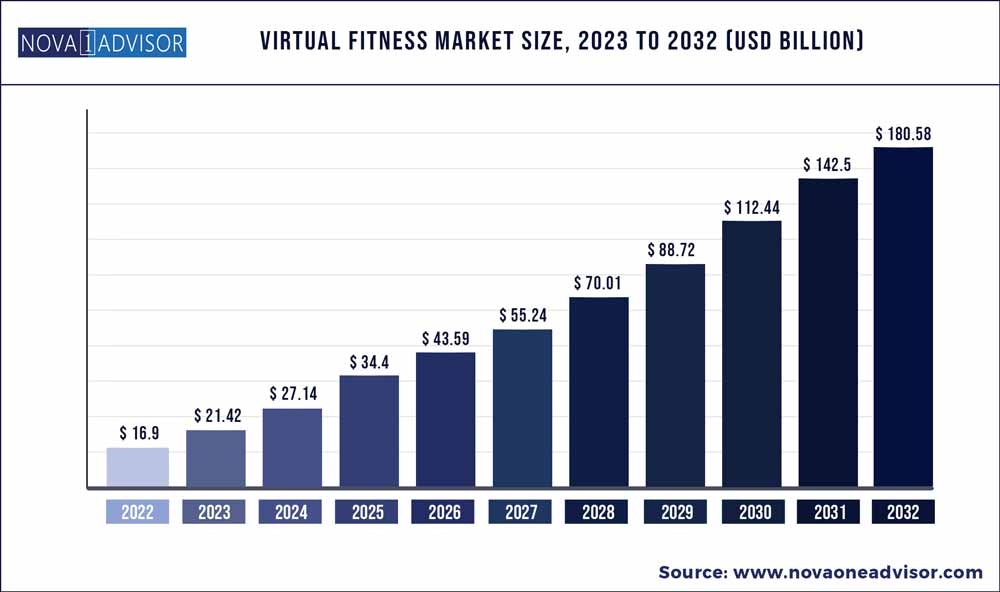

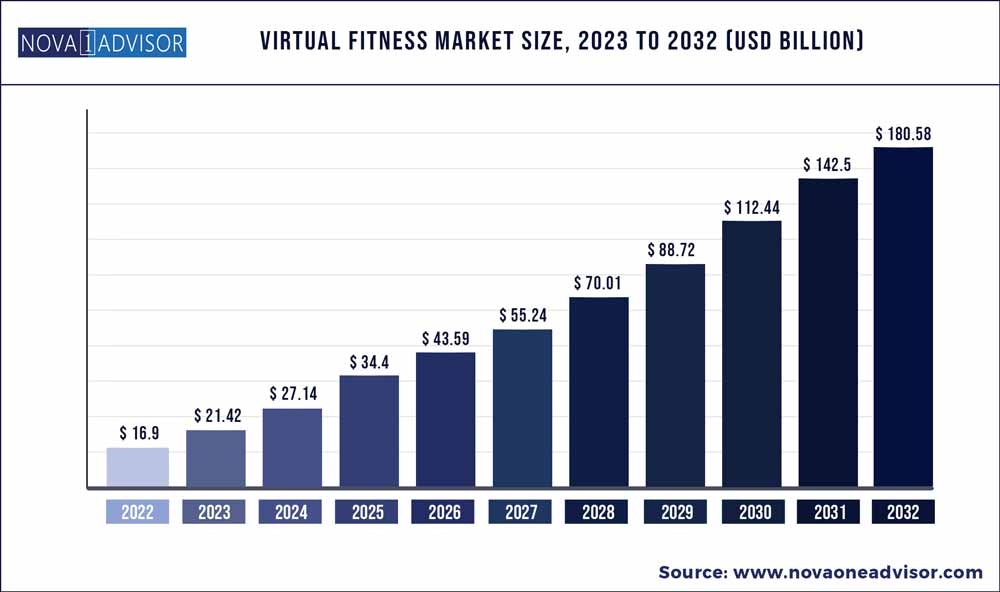

The global virtual fitness market size was exhibited at USD 16.9 billion in 2022 and is projected to hit around USD 180.58 billion by 2032, growing at a CAGR of 26.73% during the forecast period 2023 to 2032.

Key Pointers:

- The group segment dominated the market with a share of 59.1% in 2022.

- North America led the overall market with a revenue share of 40.3% in 2022.

- The on-demand segment dominated the market in 2022, owing to its popularity among customers as it offers access to a variety of workout classes at their convenience

- Based on device type, the smartphone segment dominated the market in 2022. The rising number of smartphone users, easy access, and increasing focus on health and wellness are factors responsible for the prominent share of the segment

- North America dominated the global market in 2022 owing to a growing number of health clubs and gym memberships. According to IHRSA, there were 64.9 million health club members in the U.S. in 2019

- ClassPass, is among the largest distributors of remote class options to health clubs. They presently have around 30,000 club associates in the U.S., with a presence in over 27 other countries

- In March 2020, International Ltd. and TVNZ partnered to provide virtual exercise classes during the COVID-19 lockdown in New Zealand. These online workouts include HIIT workouts, meditation, and many other types of exercises

Virtual Fitness Market Report Scope

The rising demand for personalized workout sessions, increased adoption of virtual reality, and growing demand for live and on-demand streaming videos are primary factors driving the market growth.

In addition, the increasing trend of home workouts and fitness influencers on social media platforms are increasing the demand for workout videos. According to Mindbody, 70% of its users were using pre-recorded videos during COVID, which was just 17% in 2019. Similarly, 75% of its users were using live-streaming videos during COVID, up from 7% before COVID.

Virtual fitness trainers encourage people of all ages, including the elderly, to exercise regularly to stay healthy and prevent various health problems. The millennial generation is increasingly turning to healthier lifestyles and various exercise and nutrition regimes, by seeking advice from qualified professionals.

The adoption of online physical activity training is gaining more importance among millennials due to the myriad of benefits it offers. It provides flexibility to choose time, location, and trainers; making it the preferred option for consumers with hectic schedules. According to Health Club Industry Data & Consumer Trends from the IHRSA report in 2021, 35% of millennial gym members were also paying for online services.

On-demand fitness and activity trackers are some of the popular market trends. Additionally, prerecorded workout sessions are expected to become more popular as many corporations include fitness services in their wellness programs. Based on the second-quarter earnings release of Peloton in 2020, the streaming fitness models of Peloton have experienced huge growth. Its subscribers grew by 96% yearly to 712,000 and subscription revenue grew by 107%. Moreover, many large gym brands, such as Crunch, are now extending on-demand exercises, and most of them are taking the hybrid model to a new level.

The pandemic had a significant impact on the fitness industry. The imposition of lockdowns led to the closure of many fitness centers and gyms. As a result, in-person workouts were replaced by digital at-home exercises. Owing to increasing demand for online classes, many gyms and health club providers adopted online services. In the coming years, health club providers will be required to adopt a hybrid or multichannel approach which will include both in-person and remote exercise sessions for the customers.

Virtual Fitness Market Segmentation