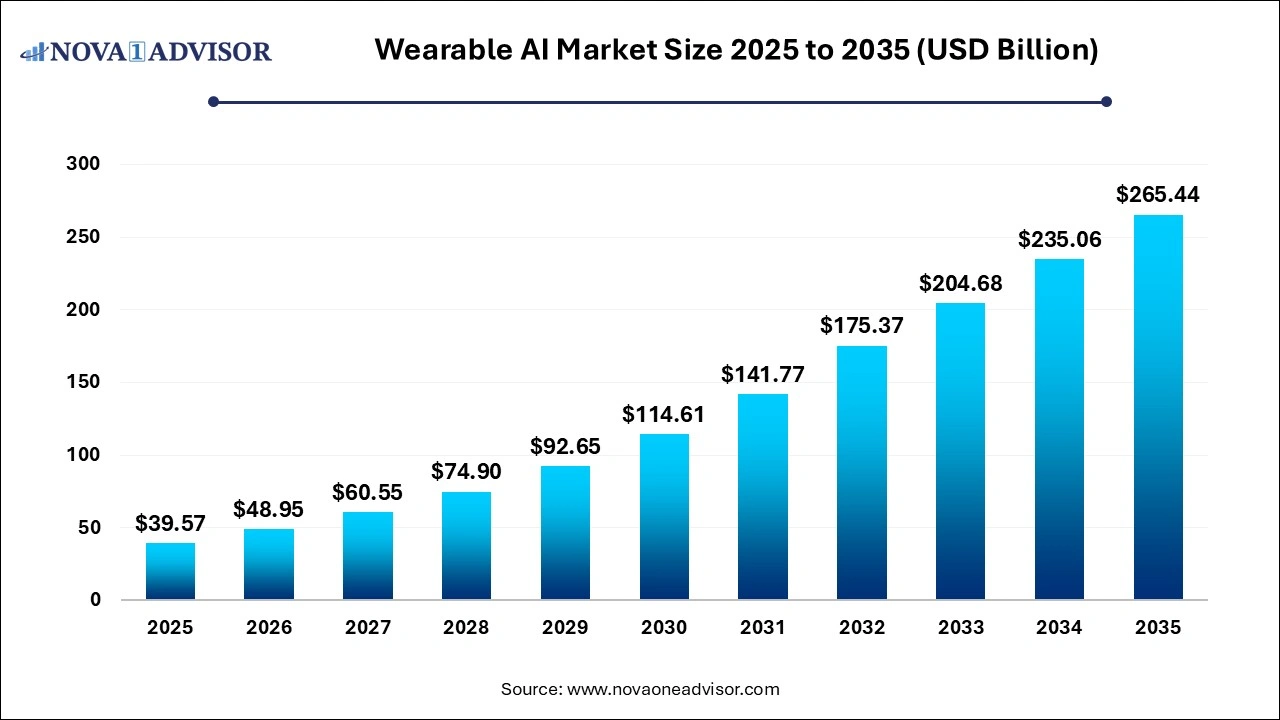

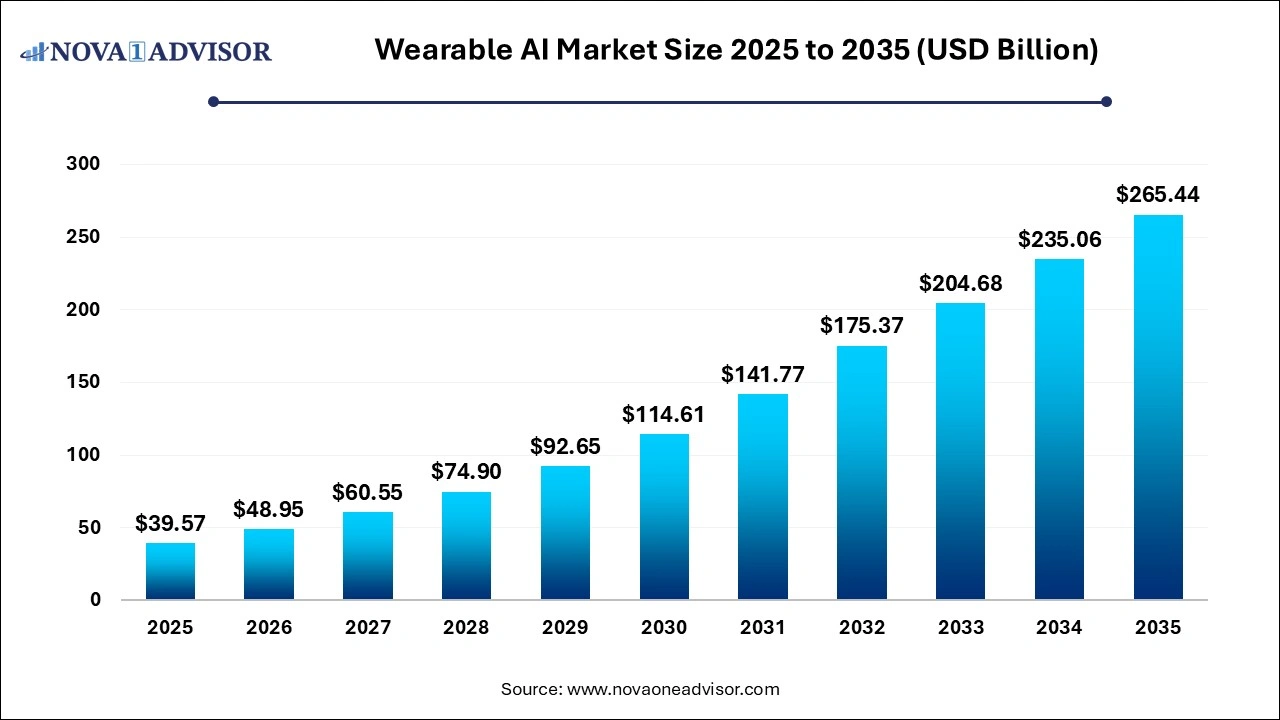

Wearable AI Market Size and Growth 2026 to 2035

The global wearable AI market size was exhibited at USD 39.57 billion in 2025 and is projected to hit around USD 265.44 billion by 2035, growing at a CAGR of 20.97% during the forecast period 2026 to 2035.

Key Pointers:

- The smartwatches segment accounted for the largest revenue share of over 31.19% in 2025.

- Smart earwear is expected to exhibit the fastest CAGR of 30.9% over the forecast period.

- The consumer electronics segment accounted for the largest revenue share of over 31.8% in 2025.

- The on-device AI segment dominated the market with a share of over 56.4% in 2025.

- The sensors segment dominated the market in 2022 with a revenue share of over 51.9%

- North America held the largest market share of 38.9% in terms of revenue in 2025.

- Asia Pacific is expected to register the fastest growth rate over the forecast period .

Wearable AI Market Outlook

- Market Growth Overview: The wearable AI market is expected to grow significantly between 2025 and 2034, driven by the rising health awareness and preventive care, advancement in AI and sensors, and integration of IoT and 5G technologies.

- Sustainability Trends: Sustainability trends involve sustainable materials and eco-design, energy harvesting and efficiency, and modular and durable design.

- Major Investors: Major investors in the market include Apple, Google, Meta Platforms, Samsung Electronics, Amazon, and Sony Corporation.

Wearable AI Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 48.95 Billion |

| Market Size by 2035 |

USD 265.44 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 20.97% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Type, By Application, By Component |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Wearable AI Market Segmental Insights

By Type Insights

The smartwatches segment growth is driven by evolving into indispensable, medical-grade diagnostic tools that offer real-time monitoring of complex biometrics like stress and blood oxygen. This growth is accelerated by the robust ecosystems of market leaders like Apple and Huawei, who are integrating on-device predictive analytics to deliver hyper-personalized fitness and health interventions.

The smart earwear segment is driven by the shift to meeting the high-stakes productivity demands of hybrid workers while attracting Gen Z and Millennial users through integrated biometric tracking for heart rate and cognitive health. By leveraging Edge AI for low-latency, on-device processing, brands like Sony and Google are ensuring user privacy and superior performance without constant cloud reliance.

By Application Insights

The AI transformers segment growth is driven by successfully positioning smartwatches and earbuds as both essential health monitors and fashionable lifestyle accessories. This dominance is sustained by on-device AI innovations from leaders like Apple and Samsung, which enable privacy-centric, real-time biometric tracking without cloud dependency.

The segment is driven by integrating continuous vitals, including ECG and glucose monitoring, directly into Electronic Health Records (EHR). These devices enable proactive intervention for chronic conditions and significantly reduce hospital readmissions. This transition is fortified by strategic FDA clearances for high-stakes features like sleep apnea and AFib detection, effectively turning consumer smartwatches into medical-grade diagnostic hubs.

By Component Insights

The sensors segmentation growth is fueled by integrating Intelligent Sensor Processing Units (ISPU) for on-device edge computing. Manufacturers like STMicroelectronics are enabling real-time, privacy-centric health analytics that reduce latency and cloud dependency.

The processor segment is driven by the deployment of specialized neural processing units (NPUs), and ASICs have unlocked high-performance "TOPS" capabilities on battery-constrained hardware, enabling continuous medical-grade monitoring like ECG and blood pressure. As smart glasses and hearables demand real-time visual processing and voice translation, these low-power chipsets have become the architectural foundation for the next generation of autonomous wearables.

Regional Insights

Based on regions, North America held the largest market share of 38.9% in terms of revenue in 2022 owing to heavy investment by private players and supportive government initiatives for the adoption of AI technology. In June 2020, Fitbit announced Fitbit Flow, a wearable AI device in response to the lack of ventilators in hospitals and medical facilities around the world that are required to treat critically ill patients. The equipment was intended to serve as an alternative to more expensive traditional ventilators when those are not an option. Similarly, in August 2020, Amazon announced the launch of its flagship fitness tracker the Halo in the U.S., Halo is a smart wearable fitness tracker that tracks mood through voice and scans the wearer's body to measure body fat and provides analysis for the same.

Asia Pacific is expected to register the fastest growth rate over the forecast period owing to collaborations, high investment by private players, and government initiatives for the use of AI wearables for contactless payments. For instance, in 2022, Monarch Technologies partnered with Canna Group LLC to launch Helox, a cashless contactless payment platform for the cannabis industry. It offers a hassle-free way of accepting payments.

Key Players in the Wearable AI Market

- Amazon.com, Inc.: Amazon contributes through the integration of Alexa into wearables like Echo Frames and by acquiring AI-powered hardware startups like Bee to develop "ambient intelligence" for personal, on-the-go assistance.

- Fitbit, Inc. (Google): Fitbit leverages AI to transform biometric data into personalized insights, focusing on health tracking features such as stress management, advanced sleep analytics, and daily readiness scores.

- Garmin Ltd.: Garmin utilizes AI to analyze user data from its 24/7 wearables, offering predictive analytics for training, recovery, and Body Battery energy monitoring, catering largely to athletes and wellness enthusiasts.

- Google, Inc.: Google drives the wearable AI market through its Wear OS platform, which combines advanced machine learning for health tracking on Pixel Watches with Google Assistant for voice-based functionality. Google also integrates its Gemini AI models into wearable devices, enabling more conversational, predictive, and proactive user assistance.

- Huawei Technologies Co. Ltd.: Huawei contributes by incorporating AI-powered features into its HarmonyOS-powered smartwatches, focusing on advanced health monitoring, such as non-invasive blood pressure trends, and precise, actionable fitness analytics.

- IBM: IBM contributes by developing hybrid cloud environments and AI algorithms, such as IBM Watson, designed for the secure processing of health, location, and performance data from enterprise wearables.