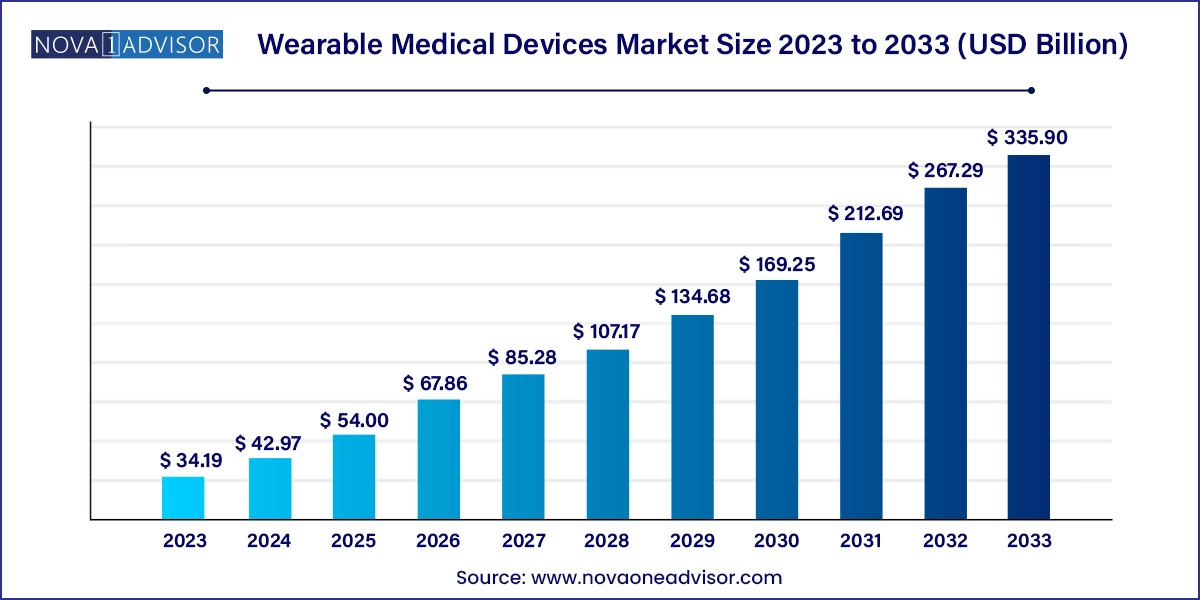

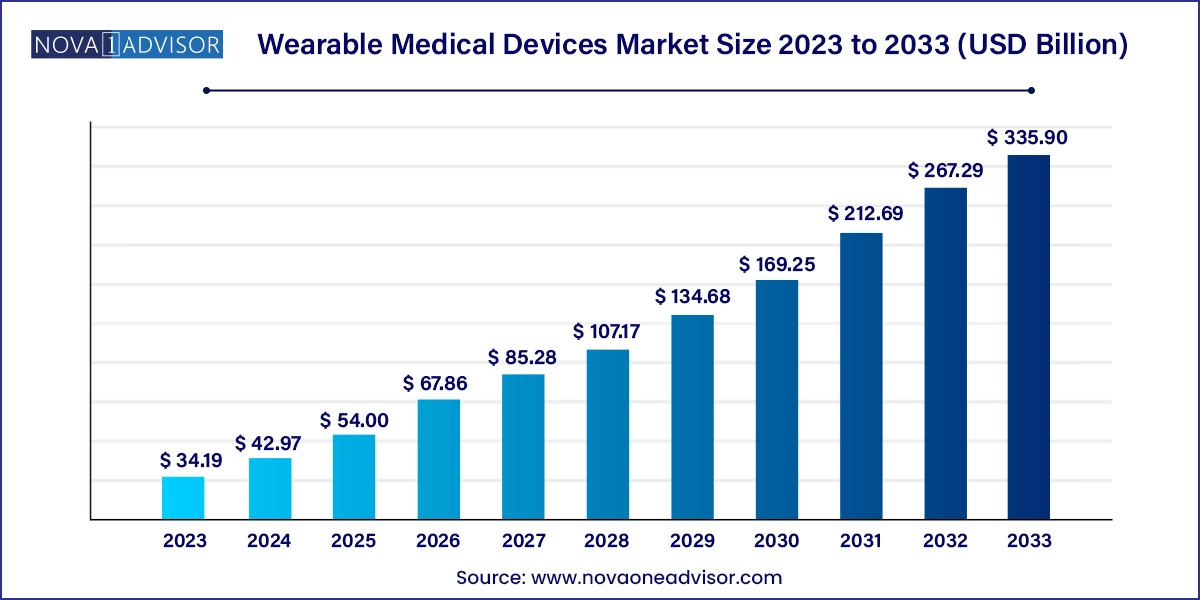

Wearable Medical Devices Market Size and Growth

The global wearable medical devices market size was valued at USD 34.19 billion in 2023 and is projected to surpass around USD 335.90 billion by 2033, registering a CAGR of 25.67% over the forecast period of 2024 to 2033.

Wearable Medical Devices Market Key Takeaways

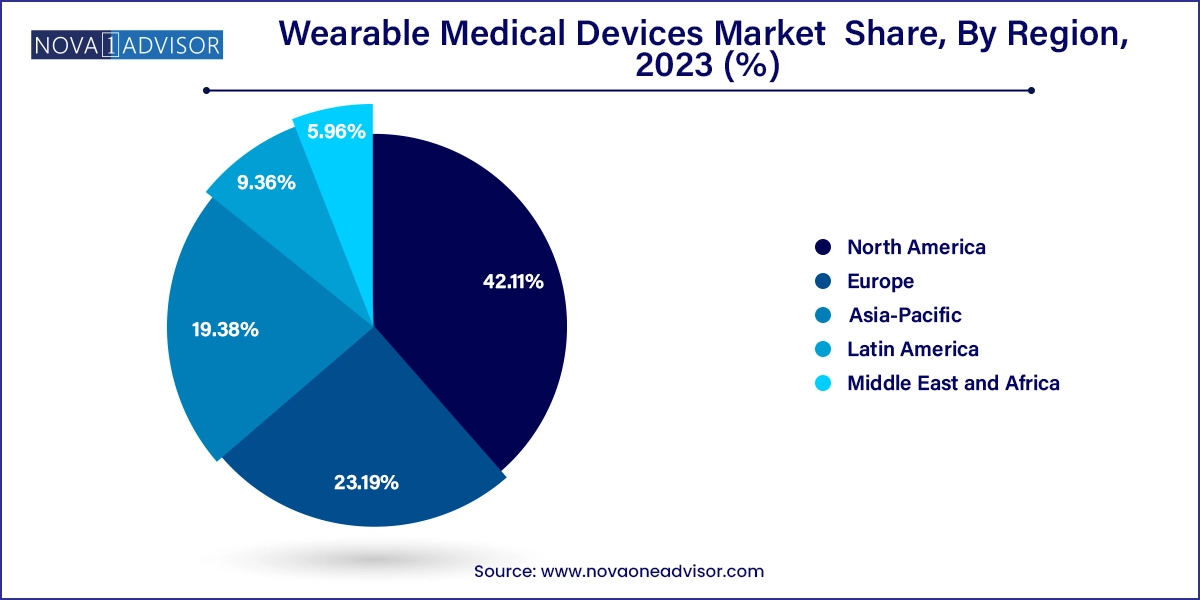

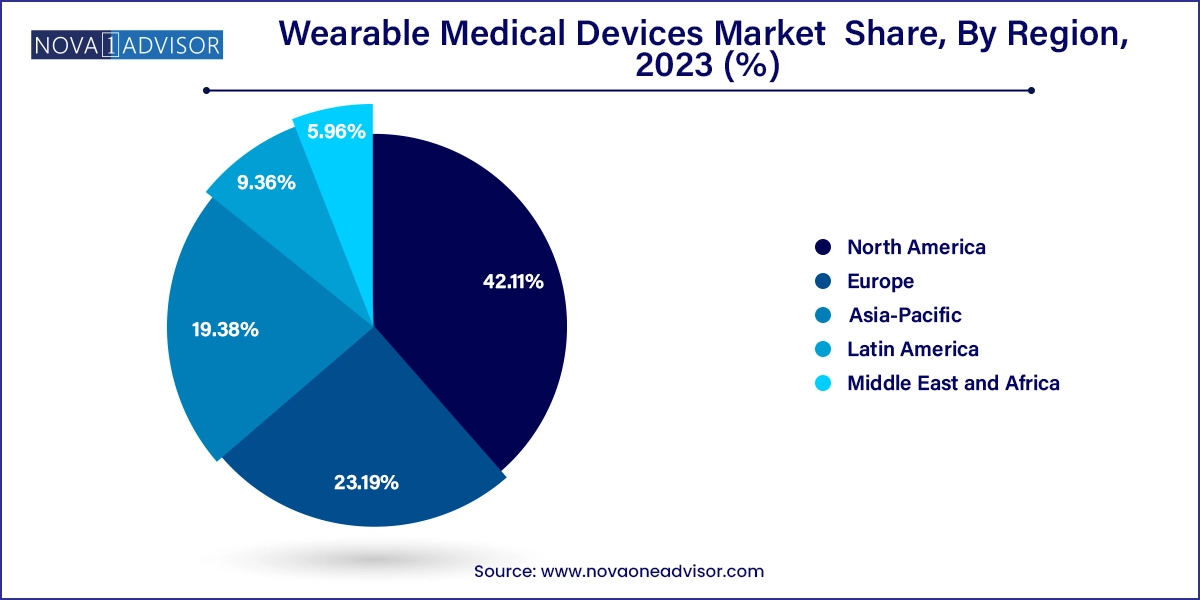

- North America accounted for the largest revenue share 42.11% in 2023

- The market is expected to witness exponential growth in Asia Pacific over the forecast period.

- The diagnostic devices segment dominated the market and accounted for the largest revenue share of 62.02% in 2023.

- The therapeutic device segment is anticipated to witness the fastest CAGR over the forecast period.

- The strap/clip/bracelet segment dominated the market, accounted for the largest revenue share in 2023

- The consumer grade wearable medical devices segment dominated the market and accounted for the largest revenue share in 2023.

- The clinical grade wearable medical devices segment is anticipated to witness the fastest CAGR over the forecast period.

- The pharmacy segment dominated the market for wearable medical devices and accounted for the largest revenue share in 2023.

- The online channel segment is anticipated to witness the fastest CAGR over the forecast period.

Wearable Medical Devices Market Growth

The anticipated growth in industries like remote patient monitoring and home healthcare will impact the market, along with an increased focus on fitness and a health-oriented lifestyle. The market holds significant opportunities driven by technological advancements, merger and acquisition activities, increasing clinical trials, and heightened awareness of personal health monitoring.

Due to sedentary routines, lifestyle-related disorders like diabetes and hypertension are expected to rise, necessitating continuous monitoring of physiological parameters. Portable medical devices enable the amalgamation of healthcare data, providing real-time access for physicians and minimizing errors. The increasing mortality rate from non-communicable diseases emphasizes the need for personalized monitoring and care, contributing to an increased demand for wearable medical products.

The COVID-19 pandemic has expanded the utility of wearable medical devices in healthcare. Innovative products, like the Ava Bracelet, initially designed as a fertility tracker, are now repurposed to detect early signs of viral infections. With monitoring parameters such as heart rate variability, breathing rate, and skin temperature, the bracelet proves valuable in tracking COVID-19 symptoms, presenting a distinctive opportunity during the global health crisis.

The escalating prevalence of chronic diseases and rising mortality rates are causing major concern, prompting healthcare providers to focus on personalized care, particularly through continuous remote patient monitoring. Wearable medical devices, capable of 24-hour wear without disrupting daily routines, are gaining traction due to their various advantages. Consequently, the demand for these devices is expected to surge over the forecast period.

Wearable medical devices are playing a pivotal role in the cardiovascular device market. These innovative technologies, ranging from smartwatches to continuous monitoring devices, offer new avenues for real-time health tracking, early detection of cardiovascular issues, and personalized patient care. The integration of wearable devices in cardiovascular healthcare reflects a transformative shift towards preventive and proactive healthcare solutions, ultimately enhancing patient outcomes and disease management.

Wearable Medical Devices Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 42.97 Billion |

| Market Size by 2033 |

USD 335.90 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 25.67% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, site, application, distribution channel, grade type, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Koninklijke Philips N.V.; Fitbit; Basis Science; Garmin; Covidien; Omron Corp.; Withings; Vital Connect; Polar Electro; Intelesens Ltd.; Everist Genomics; Sotera Wireless |

Wearable Medical Devices Market By Product Insights

The diagnostic devices segment dominated the market and accounted for the largest revenue share of 62.02% in 2023. The increasing prevalence of neurological disorders is a primary driver for the growth of this segment. A report by the World Federation of Neurology in October 2023 revealed that neurological disorders rank as the second highest cause of death and the leading cause of disability globally. The study found that over 40% of the global population currently suffers from neurological conditions, with this burden projected to nearly double by 2050. The top 10 conditions, including Stroke, Neonatal encephalopathy, Migraine, Dementia, Meningitis, Epilepsy, Neurological complications associated with preterm birth, Nervous system cancers, Autism spectrum disorders, and Parkinson’s disease, account for about 90% of total neurological DALYs. Additionally, increasing awareness among the population about the capability of neurological wearables to continuously assess cognitive capabilities during everyday activities is expected to drive the segment further.

The therapeutic device segment is anticipated to witness the fastest CAGR over the forecast period owing to the increasing influx of therapeutic devices. Furthermore, the market is expected to receive a boost from a robust pipeline of therapeutic devices, including intelligent asthma management products, wearable pain reliever devices, and insulin management devices. The segment is categorized into pain management, insulin monitoring, rehabilitation, and respiratory therapy devices, reflecting the diverse range of applications within this burgeoning market.

Wearable Medical Devices Market By Site Insights

The strap/clip/bracelet segment dominated the market, accounted for the largest revenue share in 2023, and is likely to remain dominant over the forecast period. With the capability to monitor parameters like mobility, respiratory rate, and pulse rate, along with bluetooth and cloud connectivity, smartwatches are expected to drive growth in this segment.

Advancements in wrist-worn products, exemplified by Fitbit Ace 3 Next Generation Activity and Sleep Tracker for kids, offer enjoyable fitness tracking by monitoring parameters such as heart rate, skin temperature, and activity counts, contributing to segment expansion. Major players like Samsung and Apple introducing compatible mobile apps for wearable medical instruments further attract individuals to routine health monitoring, fostering overall market growth.

Wearable Medical Devices Market By Grade Type Insights

The consumer grade wearable medical devices segment dominated the market and accounted for the largest revenue share in 2023. These devices offer user-friendly features, focusing on personal health and fitness tracking, making them widely popular among consumers. Convenience, affordability, and increasing health consciousness contribute to the segment's robust performance, establishing it as a key driver in the market.

The clinical grade wearable medical devices segment is anticipated to witness the fastest CAGR over the forecast period. This anticipation is driven by the growing demand for advanced monitoring solutions in clinical settings. The increasing adoption of these devices for continuous patient monitoring, remote healthcare management, and integration with healthcare systems contributes to the segment's rapid growth. As healthcare providers increasingly embrace advanced technologies, the clinical-grade wearable medical devices segment is positioned for significant expansion, catering to the evolving needs of the healthcare industry.

Wearable Medical Devices Market By Distribution Channel Insights

The pharmacy segment dominated the market for wearable medical devices and accounted for the largest revenue share in 2023. This dominance is attributed to the widespread accessibility of pharmacies, offering consumers a convenient avenue to purchase these devices. Pharmacies’ role as health and wellness hubs and their ability to provide informed advice positions them as key contributors to the notable revenue share within the wearable medical devices market.

The online channel segment is anticipated to witness the fastest CAGR over the forecast period. The segment growth is driven by the increasing consumer preference for online shopping. The convenience, accessibility, and diverse product offerings available through e-commerce platforms fuel this trend. As the online retail sector continues to expand, the wearable medical devices market is expected to benefit from a surge in demand facilitated by the seamless and efficient online purchasing experience.

Wearable Medical Devices Market By Application Insights

The home healthcare segment dominated the market for wearable medical devices and accounted for the largest revenue share in 2023. The increasing geriatric population, increasing prevalence rates of target diseases, and growing need to curb healthcare expenditure as an economically viable initiative are some factors responsible for market growth.

The remote patient monitoring segment is anticipated to witness the fastest CAGR over the forecast period. Globally rising geriatric population base and rising incidences of chronic conditions are expected to be high-impact rendering drivers for the growth of remote patient monitoring devices over the forecast period.

Wearable Medical Devices Market By Regional Insights

North America accounted for the largest revenue share 42.11% in 2023, owing to the growing prevalence of cardiovascular disorders, diabetes, and cancer within this region. High adoption of remote patient monitoring and home care devices for regular, continuous, and long-term monitoring of patients and reducing the frequency of hospital visits are anticipated to fuel market growth over the forecast period.

The market is expected to witness exponential growth in Asia Pacific over the forecast period. Significant factors boosting market growth are favorable government initiatives for using such wearable medical instruments, increasing geriatric population base, and increasing healthcare expenditure in this region. Japan held the largest share of the remote patient monitoring devices market in the Asia Pacific region in 2023. It is expected to maintain its dominance over the forecast period due to rapid technological advancements and the growing requirement for home care devices and round-the-clock monitoring. Japanese firms place a high value on health, skincare, and all human consumables.

Wearable Medical Devices Market Recent Developments

- In January 2024,Sennheiser collaborated with Polar Electro to launch the Momentum Sport earbuds, marking the first time Polar's bio-sensing capabilities extend beyond its products. These German-engineered earbuds deliver high-quality sound and integrate Polar's fitness technology, incorporating features such as a body temperature sensor and a Photoplethysmography (PPG) heart rate sensor for monitoring hydration levels during workouts. Users can access the comprehensive data analytics ecosystem through the Polar Flow training app, which offers expert-tier performance tracking, training analytics, voice guidance, and smart coaching. This collaboration is poised to impact the wearable medical devices market by expanding bio-sensing capabilities into audio devices for enhanced fitness monitoring and guidance.

- In January 2024, Garmin unveiled the Lily 2 series, representing the next evolution of its petite and stylish smartwatches and introducing enhanced health, wellness, and connectivity features. The Lily 2 and Lily 2 Classic models boast an advanced redesign, featuring metal watch cases, concealed displays with distinctive patterned lenses, and a range of fashionable color options. With a substantial battery life of up to five days in smartwatch mode, users can delve into new functionalities such as sleep score tracking, dance fitness activities, and Garmin Pay contactless payments. This announcement is expected to impact the wearable medical devices market by introducing refined and fashionable smartwatches with advanced health and wellness features.

- In January 2024, Garmin unveiled significant enhancements to its Garmin Connect app and website, aiming to deliver a more streamlined and personalized homepage experience centered around health and fitness metrics for users to monitor their individual goals. Specific customers utilizing Garmin smartwatches, cycling computers, and accessories can participate in the beta version of Garmin Connect, with wider availability anticipated later this year. This update is poised to impact the wearable medical devices market by offering users a more user-friendly platform focused on health and fitness tracking, enhancing the overall wearable device experience.

- In June 2023, Google introduced its latest Feature Drop, incorporating a series of updates for Fitbit devices. Notable additions include a variety of exercise modes in the Exercise menu for Luxe, Charge 5, and Inspire 3, a menstrual health tile for period tracking and cycle state viewing for Versa 4 and Sense 2, and the inclusion of a Daily Readiness Score, providing insights into whether the body requires rest or a workout, accessible across all Fitbit devices. This development is anticipated to impact the wearable medical devices market by enhancing the functionality and features of Fitbit devices, catering to a broader range of user health and wellness needs.

- In January 2023, Masimo and Royal Philips broadened their collaboration, utilizing the Masimo W1 advanced health tracking watch to enhance patient monitoring in the realm of home telehealth. The integration of Philips's enterprise patient monitoring ecosystem with the W1 watch is set to propel advancements in telehealth and telemonitoring capabilities. This expansion is poised to impact the wearable medical devices market by fostering innovative solutions for remote patient monitoring and enhancing the synergy between health-tracking wearables and telehealth systems.

- In April 2023, Garmin revealed an extended regional availability of the Dexcom Connect IQ apps, catering to consumers managing Type 1 or Type 2 diabetes with the Dexcom G6 or Dexcom G7 Continuous Glucose Monitoring System. These applications empower users to conveniently monitor their glucose levels and trends directly on a compatible smartwatch or cycling computer. This announcement is expected to impact the wearable medical devices market by providing enhanced accessibility to glucose monitoring solutions for individuals with diabetes, further integrating health monitoring into daily wearable technology.

Wearable Medical Devices Market Top Key Companies:

- Koninklijke Philips N.V.

- Fitbit

- Basis Science

- Garmin

- Covidien (Medtronic)

- Omron Corp.

- Withings

- Vital Connect

- Polar Electro

- Everist Genomics

- Intelesens Ltd.

- Sotera Wireless

Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Wearable Medical Devices market.

By Product

- Diagnostic Devices

- Vital Sign Monitoring Devices

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

- Sleep Monitoring Devices

- Sleep trackers

- Wrist Actigraphs

- Polysomnographs

- Others

- Electrocardiographs Fetal And Obstetric Devices

- Neuromonitoring Devices

- Electroencephalographs

- Electromyographs

- Others

- Therapeutic Devices

- Pain Management Devices

- Neurostimulation Devices

- Others

- Insulin/Glucose Monitoring Devices

- Rehabilitation Devices

- Accelometers

- Sensing Devices

- Ultrasound Platform

- Others

- Respiratory Therapy Devices

- Ventilators

- Positive Airway Pressure (PAP) Devices

- Portable Oxygen Concentrators

- Others

By Site

- Handheld

- Headband

- Strap/Clip/Bracelet

- Shoe Sensors

- Others

By Application

- Sports & Fitness

- Remote Patient Monitoring

- Home Healthcare

By Grade Type

Consumer-Grade Wearable Medical Devices

Clinical Wearable Medical Devices

By Distribution Channel

- Pharmacies

- Online Channel

- Hypermarkets

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)