Whole Genome Sequencing Market Size and Trends

The whole genome sequencing market size was exhibited at USD 2.24 billion in 2024 and is projected to hit around USD 16.50 billion by 2034, growing at a CAGR of 22.10% during the forecast period 2025 to 2034.

The growth of the whole genome sequencing market is driven by the rising demand for personalized medicine, increased investments by various governments in genomics research and decreasing costs of advanced sequencing technologies. Rising initiatives by various genomic data companies for advancing sequencing architecture are expanding the market.

Whole Genome Sequencing Market Key Takeaways:

- Based on product & service, the consumables segment dominated the market with the largest revenue share of 62.0% in 2024.

- The services segment is expected to witness the fastest CAGR of 25.11% during the forecast period.

- Based on type, the large whole genome sequencing held the largest market share in 2024.

- The small whole genome sequencing segment is projected to experience the fastest CAGR of 24.77% during the forecast period.

- Based on workflow, the sequencing segment held the largest market share of 53% in 2024.

- The data analysis segment is projected to witness the fastest CAGR of 23.78% during the forecast period.

- The human whole genome sequencing segment dominated the market with the largest revenue share of 64% in 2024.

- The microbial whole genome sequencing market segment is projected to witness the fastest CAGR of 23.55% from 2024 to 2033.

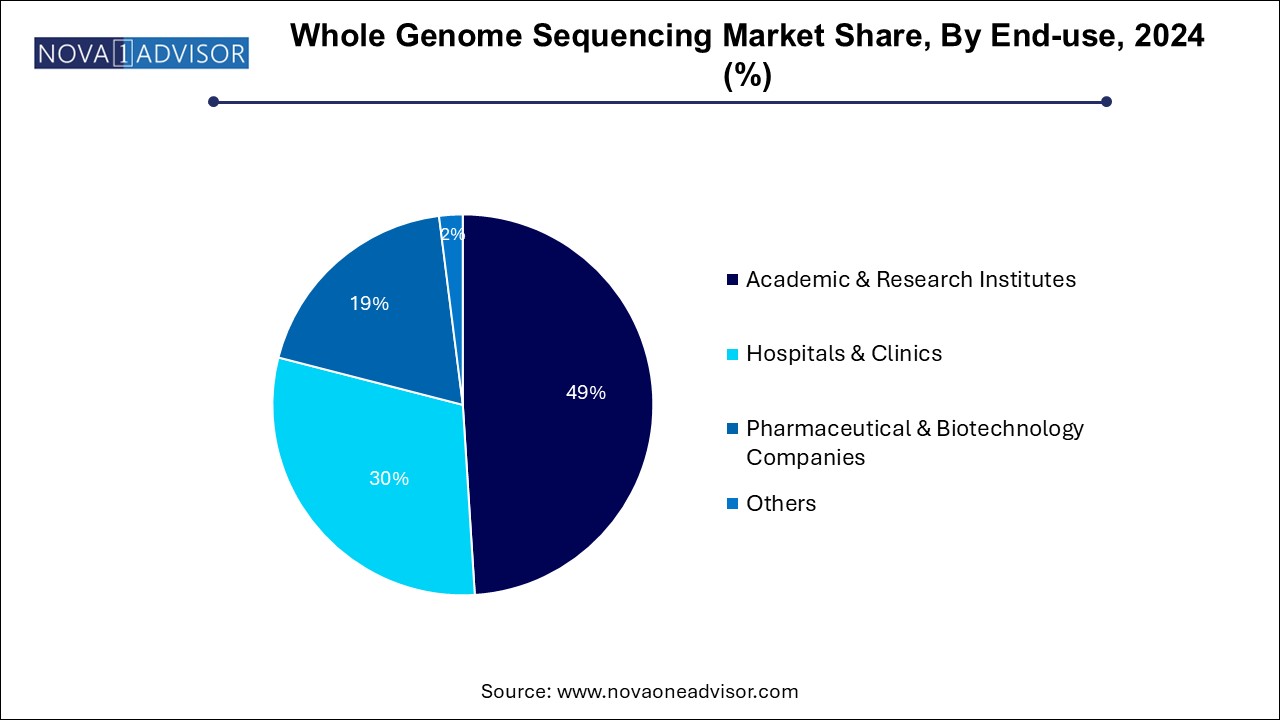

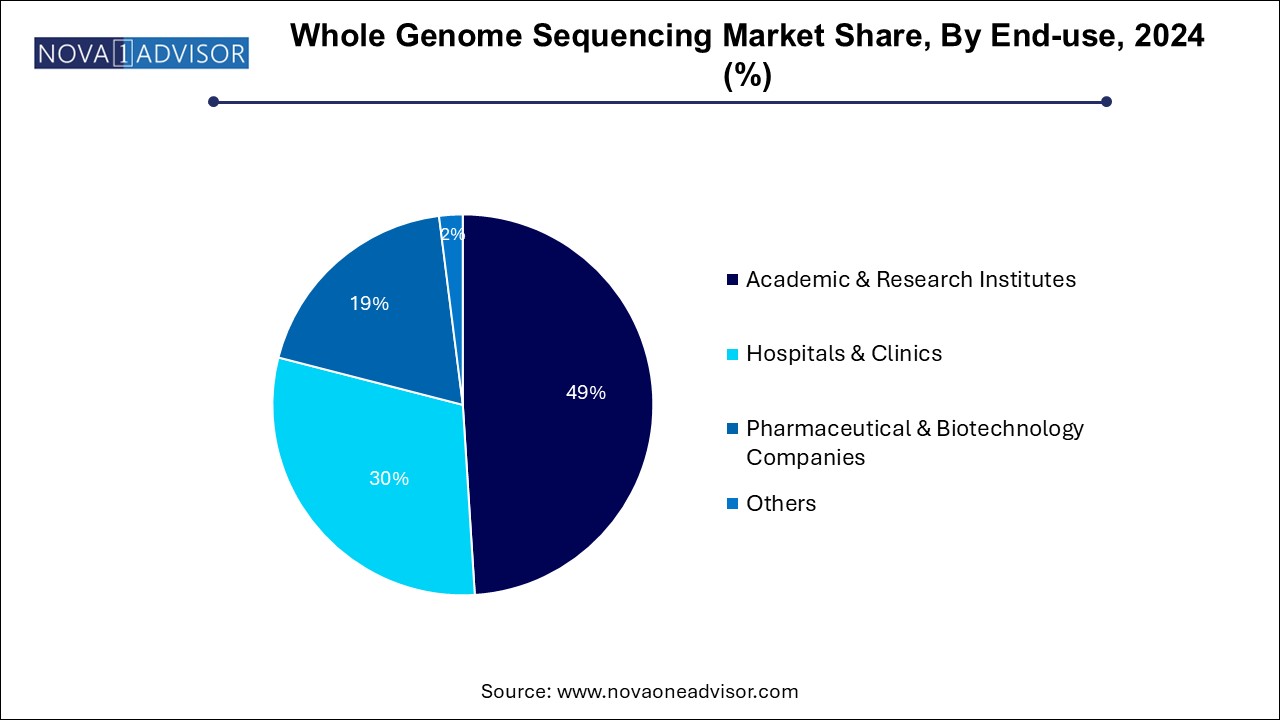

- The academic & research institutes segment held the largest market share of 49% in 2024.

- The hospitals & clinics segment is projected to witness the fastest CAGR of 24.64% during the forecast period.

- North America whole genome sequencing market accounted for the largest market share of 52% in 2024.

Market Overview

The global Whole Genome Sequencing (WGS) market is undergoing rapid transformation as advancements in genomics, computational biology, and personalized medicine converge to unlock new possibilities in disease research, clinical diagnostics, agriculture, and evolutionary biology. WGS, which involves determining the complete DNA sequence of an organism’s genome at a single time, provides unparalleled insights into gene function, mutation patterns, epigenetic markers, and inheritance traits.

WGS has evolved from being a high-cost, research-specific technology to a practical and increasingly accessible tool in healthcare and biotechnology. It enables comprehensive analysis of structural variants, single nucleotide polymorphisms (SNPs), and complex genomic rearrangements that often go undetected with targeted sequencing. This holistic approach to genome profiling is proving instrumental in areas such as oncology, rare genetic disorder diagnosis, pathogen surveillance, and personalized drug development.

Technological progress—especially the transition from first-generation to next-generation sequencing (NGS) and now third-generation platforms—has significantly lowered the cost of WGS and enhanced data output. Companies like Illumina, PacBio, and Oxford Nanopore Technologies are leading this charge by delivering high-throughput, high-fidelity platforms that support routine whole genome sequencing in both clinical and research settings.

Moreover, national genomic initiatives, such as the UK's Genomics England program and the U.S. All of Us Research Program, are boosting public funding and policy support for integrating genome sequencing into public health frameworks. These developments are expected to expand the market further by driving demand across academic institutes, hospitals, and biotechnology firms alike.

Major Trends in the Market

-

Adoption of Long-read Sequencing Technologies

Long-read sequencing platforms from companies like PacBio and Oxford Nanopore are gaining popularity for their ability to resolve structural variants and complex genomic regions with higher accuracy.

-

Integration of Artificial Intelligence (AI) in Data Analysis

AI and machine learning tools are being used to accelerate genome annotation, variant calling, and phenotype prediction from large datasets.

-

Rise of Clinical WGS in Rare Disease and Oncology Diagnostics

Hospitals and clinical labs are increasingly deploying WGS for diagnosing rare genetic disorders and profiling tumor genomes for precision therapy.

-

Global Expansion of National Genomics Programs

Government-led initiatives are promoting population-scale genome sequencing projects to improve public health and support genetic research.

-

Cloud-based Genomic Data Storage and Sharing

Cloud computing is enabling scalable storage and faster collaborative analysis of genomic datasets, enhancing cross-institutional research.

-

Customized WGS Panels and Hybrid Approaches

Demand is increasing for semi-targeted WGS platforms that combine deep genome coverage with targeted analysis for disease-specific applications.

-

Sustainability and Low-footprint Sequencing Instruments

New WGS platforms are being designed for smaller laboratories with a focus on energy efficiency, compact design, and minimal waste generation.

Where is AI Finding Applications in the Whole Genome Sequencing Market?

Integration of AI and accelerated computing are transforming workflows in digital biology, leading to new avenues in whole genome sequencing. Approximately 100 gigabytes of raw data are generated during whole genome sequencing of an individual which creates the need of complex algorithms such as natural language processing and deep learning for accelerating genome sequencing analysis workflows. AI algorithms can assist in predicting disease risk and for guiding treatment decisions based on assessment of genetic makeup of patients, allowing development of personalized treatment strategies and proactive health interventions.

- For instance, in June 2025, at the 2025 BIO International Convention in Boston, BioAro Inc., a Canada-based biotechnology company, launched PanOmiQ Research, a powerful, AI-driven multi-omics and drug discovery solution. The new launch is major update to the company’s breakthrough AI-powered whole genome sequencing (WGS) solution, PanOmiQ platform which was unveiled in February 2025.

Report Scope of Whole Genome Sequencing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.74 Billion |

| Market Size by 2034 |

USD 16.50 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.10% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product & Service, Type, Workflow, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Illumina, Inc.; Thermo Fisher Scientific, Inc.; Oxford Nanopore Technologies; Pacific Biosciences of California, Inc.; BGI; QIAGEN; Agilent Technologies; ProPhase Labs, Inc. (Nebula Genomics); Psomagen; Azenta US, Inc.; (GENEWIZ) |

Key Market Driver: Rising Adoption of Precision Medicine and Personalized Healthcare

A significant driver accelerating the growth of the WGS market is the surge in demand for precision medicine—a healthcare model that tailors treatment strategies based on individual genetic profiles. WGS offers a comprehensive view of a patient’s genetic makeup, allowing clinicians to identify disease susceptibilities, predict drug responses, and design targeted therapies.

For example, in oncology, WGS enables in-depth tumor profiling to identify actionable mutations and guide immunotherapy decisions. Similarly, in pediatric care, WGS has emerged as a game-changer for diagnosing rare genetic conditions where conventional diagnostic approaches fail. Hospitals such as Boston Children’s Hospital and the UK’s Great Ormond Street are integrating WGS into their routine workflows to improve clinical outcomes.

The expanding application of pharmacogenomics—analyzing how genes affect a person’s response to drugs—is also encouraging pharmaceutical companies to leverage WGS during drug discovery and clinical trials. This trend underscores WGS’s pivotal role in transitioning healthcare from reactive to predictive, preventative, and personalized.

Key Market Restraint: Data Interpretation Challenges and Ethical Concerns

Despite its potential, one of the primary restraints of the WGS market lies in the interpretation of large and complex genomic datasets. Sequencing a genome is technically straightforward today, but translating raw data into clinically actionable insights requires sophisticated bioinformatics tools, well-trained personnel, and standardized protocols.

Moreover, the lack of uniform guidelines for variant classification and reporting across institutions may result in inconsistent conclusions. False positives or variants of unknown significance can lead to diagnostic uncertainty or overtreatment.

Ethical concerns related to incidental findings—genetic information unrelated to the primary diagnostic query—also pose dilemmas for clinicians. Issues surrounding data ownership, patient consent, and the long-term storage and sharing of genomic data are being actively debated by regulators, further complicating widespread adoption in clinical settings.

Key Market Opportunity: Expansion of WGS Applications in Agriculture and Environmental Genomics

While human health remains the dominant domain of WGS, significant opportunities are emerging in agriculture and environmental biology. In plant genomics, WGS is being used to identify traits related to drought tolerance, pest resistance, and crop yield, enabling faster and more efficient breeding programs. For instance, researchers have sequenced the genomes of staple crops such as wheat, rice, and maize to improve genetic diversity and resilience against climate change.

In animal breeding, WGS helps monitor genetic diseases, enhance productivity, and preserve biodiversity. Meanwhile, in microbial genomics, WGS is used for pathogen surveillance, antibiotic resistance tracking, and vaccine development—a use case highlighted during the COVID-19 pandemic.

Environmental genomics is another frontier where WGS is supporting biodiversity assessments, ecosystem monitoring, and pollution tracking by analyzing microbial communities in soil, water, and air. These diverse applications are expected to open new revenue streams for WGS service providers and technology developers.

Whole Genome Sequencing Market By Product & Service Insights

Based on product & service, the consumables segment dominated the market with the largest revenue share of 62% in 2024. These include reagents, kits, and flow cells that are essential for preparing samples, conducting sequencing runs, and post-run cleanup. Due to the repetitive nature of consumable usage in every sequencing process, they generate recurring revenue streams for companies. The frequent procurement required for consumables, even in well-established labs, creates a stable and expanding demand. Companies like Illumina and Thermo Fisher Scientific capitalize heavily on consumable sales through proprietary sequencing chemistries.

The services segment is expected to witness the fastest CAGR of 25.11% during the forecast period. Propelled by the increasing trend of outsourcing sequencing projects to specialized service providers. Many research institutions, hospitals, and biopharma companies opt to partner with genomics service companies for reasons such as cost-efficiency, lack of internal sequencing infrastructure, and need for high-throughput analysis. Companies like BGI Genomics and Novogene have built large-scale sequencing centers capable of handling population-level genomic studies, attracting demand from both research and clinical sectors.

Whole Genome Sequencing Market By Type Insights

Based on type, the large whole genome sequencing held the largest market share in 2024. As it covers the complete genome, including coding and non-coding regions, providing unparalleled resolution for research and diagnostics. Large WGS is particularly valuable in cancer genomics, inherited disease analysis, and evolutionary biology studies. These comprehensive datasets are essential for discovering novel variants, complex structural rearrangements, and epigenetic markers that may be missed in smaller genomic scopes.

The small whole genome sequencing segment is projected to experience the fastest CAGR of 24.77% , driven by its rising use in microbial genomics and smaller eukaryotic organisms. It is increasingly applied in pathogen surveillance, metagenomics, and antimicrobial resistance research. The relatively lower cost, faster turnaround time, and simplified analysis pipeline make it attractive for clinical microbiology and environmental monitoring applications.

Whole Genome Sequencing Market By Workflow Insights

Based on workflow, the sequencing segment held the largest market share of 53% in 2024. The actual sequencing step involves reading millions to billions of DNA fragments and converting them into digital nucleotide sequences. Advances in sequencing chemistry and optics have led to higher accuracy, faster run times, and scalable throughput, solidifying sequencing as the core value generator in the workflow chain.

The data analysis segment is projected to witness the fastest CAGR of 23.78% during the forecast period. As interpretation of sequencing data becomes more complex and clinically relevant. Sophisticated software platforms and bioinformatics pipelines are required for variant calling, genome assembly, annotation, and visualization. Cloud-based platforms such as Illumina’s BaseSpace and DNAnexus are gaining traction for their scalability, collaborative features, and integration with AI-based analytics. The growing need for automated, reproducible, and regulatory-compliant analysis tools is expected to accelerate growth in this segment.

Whole Genome Sequencing Market By Application Insights

The human whole genome sequencing segment dominated the market with the largest revenue share of 64% in 2024. Primarily due to its wide-scale adoption in medical research, rare disease diagnostics, and personalized medicine. National-level initiatives such as Genomics England (100,000 Genomes Project) and NIH’s All of Us Program have driven large-scale human WGS adoption, advancing disease gene discovery and population genomics. The integration of WGS into clinical workflows is gaining momentum for diseases like cystic fibrosis, cardiovascular syndromes, and hereditary cancers.

The microbial whole genome sequencing market segment is projected to witness the fastest CAGR of 23.55% from 2024 to 2033. With its role in infection control, pathogen characterization, and public health surveillance becoming increasingly prominent. During the COVID-19 pandemic, real-time sequencing of SARS-CoV-2 played a critical role in identifying new variants and guiding containment strategies. The growth of global AMR (antimicrobial resistance) monitoring programs is also driving microbial WGS usage in healthcare, veterinary, and food safety sectors.

Whole Genome Sequencing Market By End-use Insights

The academic & research institutes segment held the largest market share of 49.0% in 2024. Driven by ongoing basic science investigations into genetics, evolution, epigenetics, and disease mechanisms. These institutions account for a large share of sequencing instrument installations and are major consumers of WGS reagents and software tools. Public and private grants continue to fund genome sequencing projects across universities, consortiums, and national research bodies.

The hospitals & clinics segment is projected to witness the fastest CAGR of 24.64% during the forecast period. As WGS becomes more prevalent in diagnostic and therapeutic decision-making. From neonatal intensive care units using rapid WGS for diagnosing genetic disorders to oncology centers guiding targeted therapies, clinical adoption is expanding rapidly. Integration with EHRs and reimbursement policy improvements are making WGS more viable for routine clinical practice.

Whole Genome Sequencing Market By Regional Insights

North America whole genome sequencing market accounted for the largest market share of 52% in 2024. Major genomic research organizations like the Broad Institute and NIH support cutting-edge WGS initiatives. The presence of leading players such as Illumina, Thermo Fisher, and Pacific Biosciences strengthens the region's dominance through innovation and market accessibility. Additionally, favorable reimbursement policies for genetic testing and population genomics projects contribute to widespread adoption across medical and academic institutions.

U.S. Whole Genome Sequencing Market Trends

U.S. is a major contributor to the market in North America. Rising disposable incomes, reduced costs of sequencing technologies, and growing emphasis on genetic testing for diagnosis of rare diseases and cancer are contributing to the market growth. Emergence of innovative technologies such as nanopore sequencing and single-cell sequencing as well as utilization of AI and machine learning methodologies are enhancing capabilities and workflows of genomic analysis in U.S. Furthermore, increased spending on genomics research, expanding omics applications, government support and demand for personalized medicine are fuelling the market expansion.

- For instance, in March 2025, Precision Medicine Institute of the Children’s Hospital Colorado (Children’s Colorado), launched its innovative in-house whole-genome sequencing lab.

Asia Pacific is the Fastest-growing Region

Asia Pacific is witnessing exponential growth in the WGS market, driven by government-backed genomics programs, increasing healthcare investments, and the expansion of biotech ecosystems. Countries like China, India, and Singapore are launching national genome sequencing initiatives aimed at personalized medicine, rare disease detection, and agricultural improvement. BGI Genomics, one of the largest global sequencing service providers, is based in China and plays a crucial role in democratizing access to affordable sequencing services. The region's large patient pool, cost-effective talent base, and expanding clinical genomics infrastructure position it as a powerhouse for future market growth.

China Whole Genome Sequencing Market Trends

China is leading the whole genome sequencing market in Asia Pacific region. The country’s huge population with increasing chronic disease burden is driving the demand for substantial genomic research and testing activities. Supportive government initiatives such as the “Healthy China 2030” which aims at expanding genomic research for prevention of diseases and development of innovative treatments is bolstering the market growth. Furthermore, presence of key market players, increased adoption of whole genome sequencing technologies in clinical diagnostics settings, rising investments in R&D as well as focus on personalized medicine are boosting the market growth.

India Whole Genome Sequencing Market Trends

India is witnessing significant growth in the Asia Pacific whole genome sequencing market. Increased efficiency and speed as well as reduced costs of whole genome sequencing with continuous technological advancements are improving access for clinical and research applications. Rising expenditure for advancing healthcare infrastructure, widespread acknowledgement of genomic data by regulatory bodies and healthcare providers, increased demand for personalized medicine approach and expansion of direct-to-consumer (DTC) genetic testing services are driving the market growth. Additionally, increased support by the Ministry of Science & Technology for promoting genomic research and targeted medicine as well as Indian government initiatives such as the Genome India Project and ‘One Day One Genome Initiative’ are bolstering the market growth.

- For instance, in January 2025, at the Genome India Data Conclave, the Indian Genomic Data Set was revealed and Union Minister Dr. Jitendra Singh introduced the “Framework for Exchange of Data Protocols (FeED)” and the Indian Biological Data Centre (IBDC) Portals, further enabling access to 10,000 whole genome samples for researchers across India and the world.

Some of the prominent players in the whole genome sequencing market include:

Whole Genome Sequencing Market Recent Developments

- In June 2025, MGI Tech Co., Ltd., entered into a partnership with the Asia Pathogen Genomics Initiative for improving pathogen genomics sequencing efforts through a shared commitment to support public initiatives across Asia.

- In April 2025, Ultima Genomics, Inc., launched its "Count on Us" initiative through which it will offer over 3 trillion DNA sequencing reads free of cost for researchers across the U.S. and Canada.

- In October 2024, Illumina, an international genomics company, signed a Memorandum of Understanding (MoU) with the National Taiwan University (NTU) Hospital for launching a large-scale “Whole Genome Sequencing (WGS) Project”.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the whole genome sequencing market

Product & Service

- Instruments

- Consumables

- Services

Type

- Large Whole Genome Sequencing

- Small Whole Genome Sequencing

Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

Application

- Human Whole Genome Sequencing

- Plant Whole Genome Sequencing

- Animal Whole Genome Sequencing

- Microbial Whole Genome Sequencing

End Use

- Academic & Research Institutes

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)