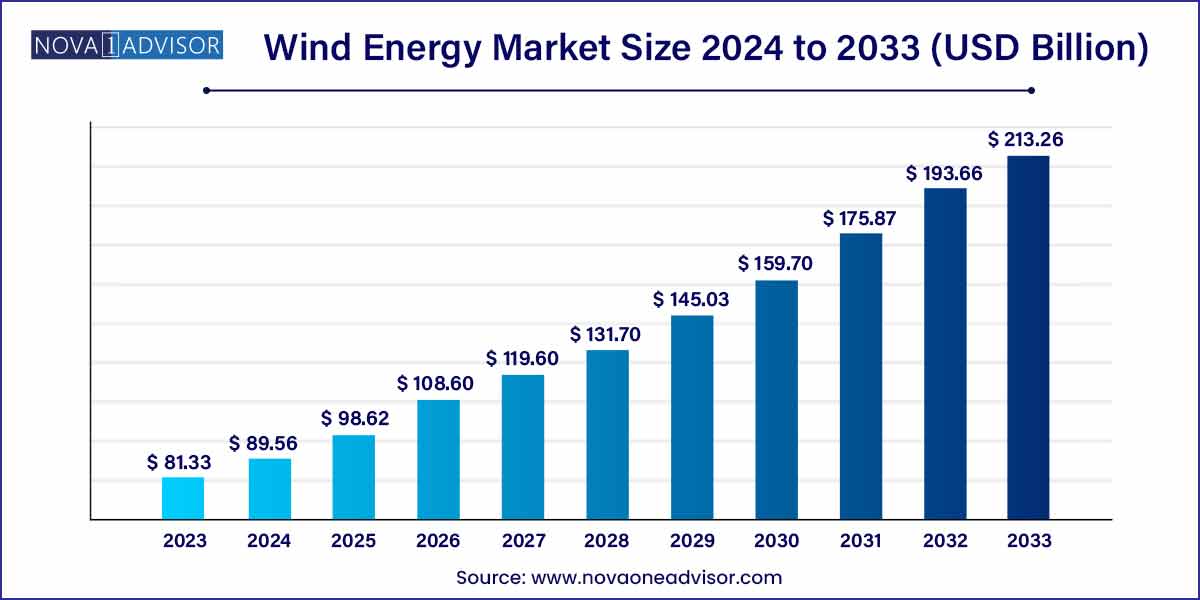

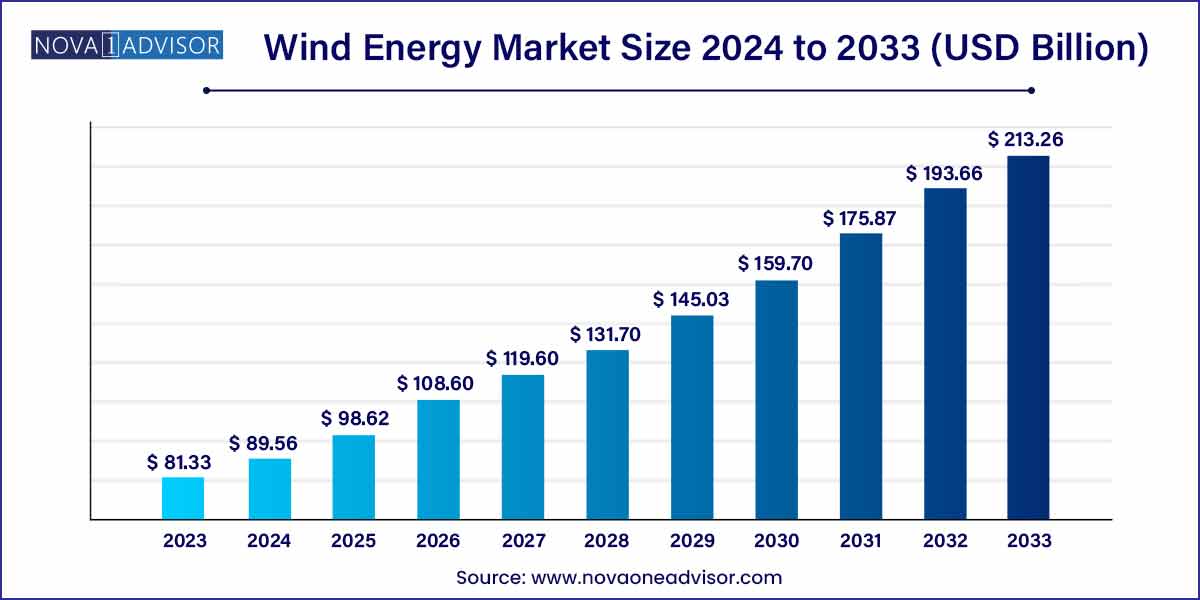

The global wind energy market was valued at US$ 81.33 billion in 2023 and is projected to be worth around US$ 213.26 billion by 2033, with a registered CAGR of 10.12% from 2024 to 2033.

Wind energy market by Overview

The Wind Energy Market has evolved into one of the most promising sectors within the renewable energy industry. With the rising global emphasis on reducing carbon footprints, minimizing dependence on fossil fuels, and achieving net-zero emission goals, wind energy stands out as a powerful alternative. Utilizing the kinetic energy of wind through sophisticated turbine technologies, this market offers a sustainable method of generating electricity on a massive scale.

The increasing viability of both onshore and offshore wind projects, backed by governmental incentives, declining costs of wind turbines, and improved energy storage solutions, has dramatically reshaped the market landscape. Technological innovations, such as larger rotor blades, floating offshore platforms, and digital monitoring systems, have contributed to greater efficiency and reliability. As nations invest in building greener economies, the Wind Energy Market is poised for unprecedented growth, promising a cleaner, more resilient global energy supply in the decades to come.

Growth Factors

Wind energy is a kind of renewable energy. The method of using wind to generate electricity is known as wind energy. Wind turbines are used to transform the wind’s kinetic energy into the mechanical energy. The mechanical power can also be used for specific purposes such as water pumping.

The offshore and onshore wind turbines can be used to generate electricity. Onshore wind energy is related with land-based turbines, whereas offshore wind energy is associated with turbines that are positioned in the sea or ocean. Offshore wind turbines, on the other hand, are more efficient and effective in producing electricity as compared to onshore wind turbines.

Due to the implementation of rigorous environmental rules, the market will continue to move away from traditional energy sources and towards renewable energy technology. The product penetration will be influenced by increasing offshore prospects along with the development of a strong industrial and commercial sector infrastructure.

The global wind energy market is predicted to rise due to a significant increase in demand for renewable energy sources. The governments all around the world are encouraging sustainable energy sources, which, unlike traditional power sources, may cut carbon emissions. In addition, offshore wind energy turbine eliminates the constraint of sea depth, making it easier to choose the ideal location for electricity generation.

The government regulatory authorities and agencies in the developed and developing regions are concentrating on reducing reliance on traditional energy sources in order to reduce carbon emissions, which is encouraging the generation of electricity using renewable energy sources such as solar and wind. The increased need for energy in a variety of industries such as healthcare, food and beverage, and residential, has boosted the growth of the wind energy market during the forecast period.

The offshore wind farms are also becoming more popular as a source of energy among wind energy market players. Offshore wind power projects are expected to open up the growth opportunities for deep water projects, where the high speed produces a much more advantageous operating environment, driving the demand for offshore locations. The renewable energy sources have been widely supported by governments all around the globe.

The countries all over the world are concentrating their efforts on growing investment in offshore wind energy projects in order to collect energy from the environment’s natural wind resources, ultimately boosting the growth of the global wind energy market. Offshore wind power installation is a difficult undertaking since it necessitates the transportation of large and heavy equipment to the project site, raising the overall cost of the wind energy projects. However, due to technological advancements for offshore installation of wind turbines, the overall cost has decreased, making offshore wind a viable renewable energy choice.

Wind Energy Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 81.33 Billion |

| Market Size by 2033 |

USD 213.26 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.12% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Location, Application, Component, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Vestas, Dongfang Electric Corporation, ENERCON GmbH, Goldwind, Nordex SE, Sinovel, GE Renewable, Suzlon Group, Ming Yang Smart Energy Group Co., Siemens Gamesa Renewable Energy S.A. |

Segments Insights:

By Location

Onshore wind energy dominated the market, accounting for the lion's share of installations worldwide. Onshore projects are quicker to develop, cost-effective, and benefit from well-established grid infrastructure. Countries like China, the U.S., and Germany have massive onshore capacities, supporting national energy grids and rural electrification programs. Onshore wind's lower capital expenditure requirements and shorter development cycles make it a popular choice among both government and private investors.

However, the Offshore segment is the fastest-growing, particularly across Europe, Asia-Pacific, and North America. Technological innovations in floating wind turbines have enabled access to deeper waters where wind speeds are higher and steadier. Offshore farms, like Hornsea One in the U.K., are setting new benchmarks in scale and output. The absence of land use conflicts and the proximity to coastal urban centers further fuel the rapid expansion of offshore wind installations.

By Application

The Utility segment dominated the Wind Energy Market, leveraging large-scale wind farms to feed national and regional electricity grids. Utility-driven projects, often in partnership with government agencies, aim to meet renewable energy targets and diversify energy portfolios. Wind power's ability to supply baseload electricity with improved turbine efficiencies makes it highly attractive for utilities seeking long-term, low-carbon energy sources.

Meanwhile, the Non-Utility segment is growing faster, particularly with the rise of decentralized power generation models. Independent power producers (IPPs), corporations, and local communities are investing in smaller wind installations to power manufacturing plants, tech campuses, and even residential clusters. Corporate sustainability initiatives and localized energy independence movements are key drivers of this growth.

By Component

Turbines dominated the component segment, comprising the most critical and costly part of a wind energy system. Turbine technology advancements, including larger rotors, improved gearboxes, and smarter control systems, have played a pivotal role in increasing energy yields. Leading companies are investing heavily in R&D to enhance turbine efficiency and lifespan, recognizing their central role in project viability.

On the other hand, Electrical Infrastructure is witnessing the fastest growth. As the complexity of wind projects increases, especially offshore, the need for robust electrical systems including substations, undersea cables, and grid integration solutions is paramount. Technological advancements in smart grids and HVDC (High Voltage Direct Current) transmission systems are revolutionizing how wind energy is transported and distributed.

By Rating

The ≤2 MW segment dominated in earlier years, especially suitable for smaller, localized projects or initial adopters in emerging markets. These turbines are cost-effective, easier to maintain, and require minimal land, making them ideal for rural electrification and community-based initiatives.

The >10–12 MW segment is now the fastest-growing. Ultra-large turbines are essential for maximizing the output of offshore projects where installation costs are high. Giants like GE's Haliade-X (14 MW) and Siemens Gamesa’s SG 14-222 DD are leading examples of this trend. Larger turbines mean fewer installations are needed to achieve capacity targets, significantly improving project economics and reducing environmental footprints.

Regional Analysis

Europe remains the dominant region in the Wind Energy Market, underpinned by ambitious renewable energy targets, extensive offshore development, and a mature regulatory environment. Nations like Germany, Denmark, and the U.K. have established comprehensive wind infrastructure, and the European Union's "Fit for 55" package aims to cut greenhouse gas emissions by 55% by 2030, further propelling investments.

Asia-Pacific is the fastest-growing region, with China alone accounting for over 40% of global new wind capacity additions in recent years. India, Japan, South Korea, and emerging economies in Southeast Asia are also rapidly expanding their wind portfolios. The combination of vast coastal lines, strong political will, and substantial energy demand growth ensures Asia-Pacific will be a key engine of market expansion moving forward.

Some of the prominent players in the wind energy market include:

- Vestas

- Dongfang Electric Corporation

- ENERCON GmbH

- Goldwind

- Nordex SE

- Sinovel

- GE Renewable

- Suzlon Group

- Ming Yang Smart Energy Group Co.

- Siemens Gamesa Renewable Energy S.A.

Recent Developments

-

April 2025: Vestas Wind Systems announced the launch of its V236-15.0 MW offshore wind turbine prototype, the world's most powerful to date.

-

March 2025: Siemens Gamesa signed a major agreement with Equinor for the supply of turbines for the Empire Wind 1 and 2 projects off the U.S. East Coast.

-

February 2025: GE Renewable Energy completed successful testing of the Haliade-X 14 MW turbine, preparing it for full commercial deployment.

-

January 2025: Ørsted inaugurated the Greater Changhua 1 & 2a offshore wind farms in Taiwan, marking its largest project outside Europe.

-

December 2024: Goldwind secured a contract for a 500 MW onshore project in Inner Mongolia, China, focusing on developing next-gen smart wind turbines.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global wind energy market.

By Location

By Application

By Component

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

By Rating

- ≤ 2 MW

- >2≤ 5 MW

- >5≤ 8 MW

- >8≤10 MW

- >10≤ 12 MW

- 12 MW

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)