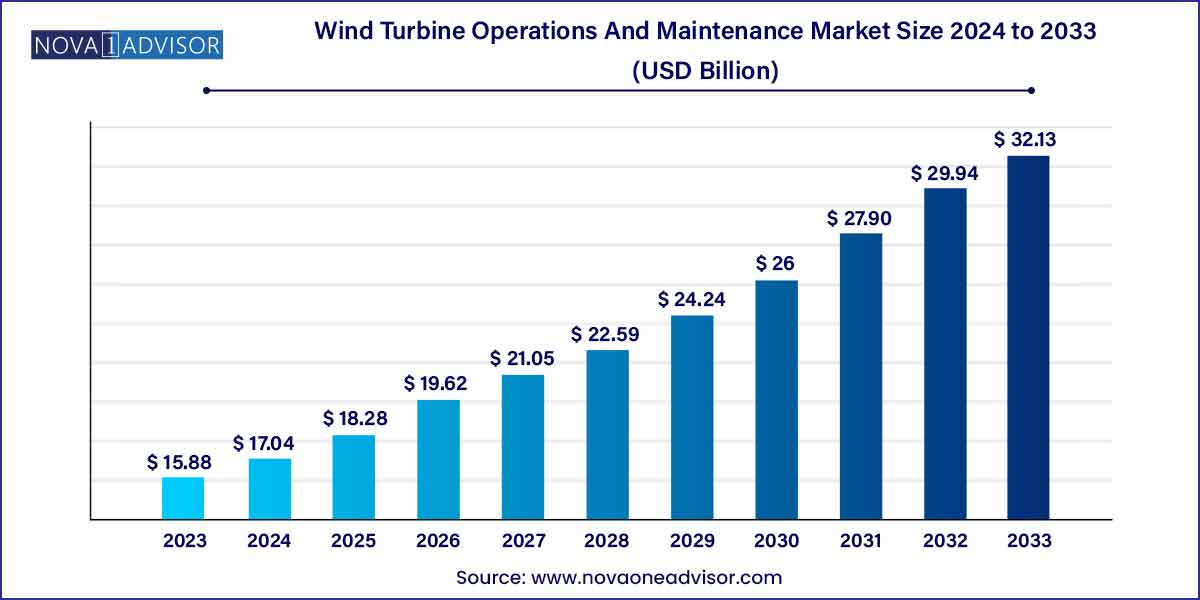

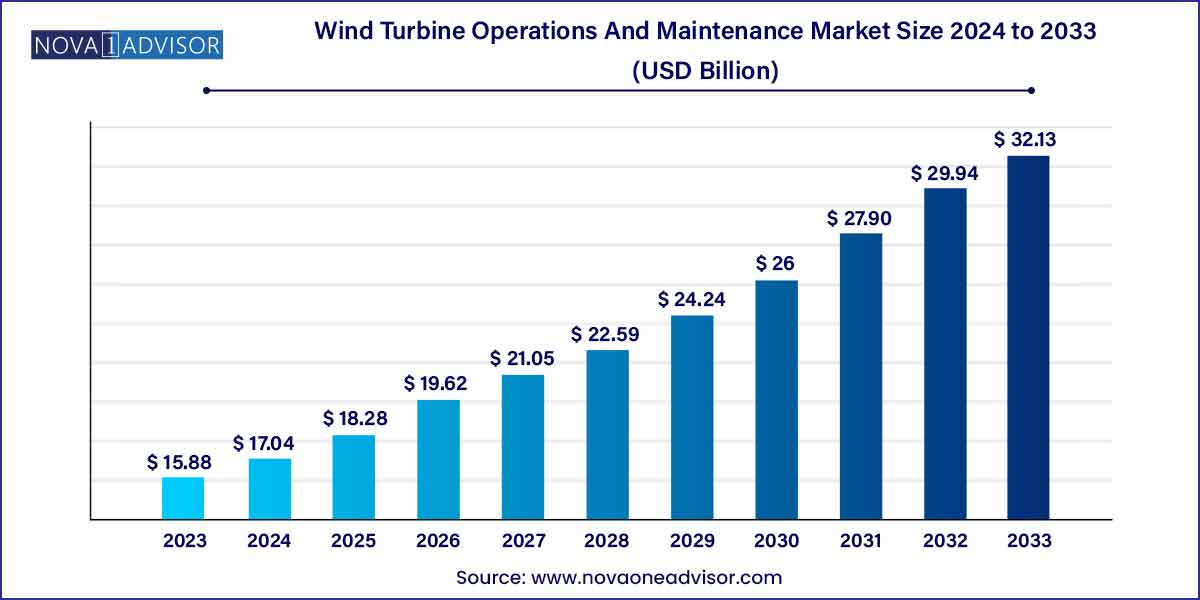

The global wind turbine operations and maintenance market size was exhibited at USD 15.88 billion in 2023 and is projected to hit around USD 32.13 billion by 2033, growing at a CAGR of 7.3% during the forecast period of 2024 to 2033.

Key Takeaways:

- The onshore segment accounted for the largest revenue share of 91.2% in 2023.

- Asia Pacific dominated the market and accounted for the largest revenue share of 42.6% in 2023

Market Overview

The wind turbine operations and maintenance (O&M) market plays an indispensable role in ensuring the efficiency, longevity, and reliability of wind energy projects worldwide. As the global transition towards clean energy accelerates, wind energy stands as one of the primary pillars of decarbonization strategies. Consequently, the operations and maintenance services that support these assets have become critical to maximizing return on investment, minimizing downtime, and ensuring energy output meets expectations.

Wind turbines, given their complex mechanical and electronic systems, are subject to wear and tear from continuous operation under varying climatic conditions. Regular maintenance—both preventive and corrective—is necessary to maintain optimal performance. O&M services encompass a broad range of activities, including blade inspections, gearbox maintenance, generator repairs, software updates, and real-time monitoring using advanced data analytics.

In 2024, the market is witnessing substantial growth fueled by the aging fleet of wind turbines, the expansion of offshore wind farms, and technological innovations such as predictive maintenance and autonomous inspection drones. Major wind turbine manufacturers and third-party service providers are increasingly offering comprehensive maintenance packages, ensuring the market’s continued expansion over the coming decade.

Major Trends in the Market

-

Predictive Maintenance through AI and IoT: Leveraging real-time data analytics to predict component failures and schedule maintenance proactively.

-

Growth of Offshore Wind O&M: Expanding offshore wind projects driving demand for specialized maintenance solutions in harsh marine environments.

-

Use of Robotics and Drones for Inspections: Adoption of automated systems to perform high-risk inspections, improving safety and reducing costs.

-

Service Agreements Evolution: Movement from basic service agreements to full-scope, performance-based contracts.

-

Technological Upgrades and Retrofits: Increasing retrofitting of older turbines with modern technology to enhance performance and extend life.

-

Rise of Independent Service Providers (ISPs): Growing market share of ISPs offering flexible and cost-competitive O&M services.

-

Focus on Blade Maintenance Innovations: Development of new blade coating materials and repair techniques to mitigate leading-edge erosion.

-

Digital Twins Implementation: Using digital replicas of turbines to optimize maintenance schedules and predict performance issues.

Wind Turbine Operations And Maintenance Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 15.88 Billion |

| Market Size by 2033 |

USD 31.13 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Siemens Gamesa Renewable Energy, S.A.; Suzlon Group; GENERAL ELECTRIC; ENERCON GmbH. |

Driver: Aging Wind Fleet Requiring Extensive Maintenance

A primary driver of the wind turbine O&M market is the aging fleet of installed wind turbines across the globe. Many turbines, particularly in Europe and North America, are surpassing or nearing the end of their initial design lifespans (typically 20-25 years).

As turbines age, the frequency and complexity of maintenance tasks increase substantially. Key components such as gearboxes, blades, bearings, and generators experience mechanical fatigue, making proactive maintenance critical to avoid catastrophic failures. Rather than decommissioning aging turbines, many operators are choosing life extension programs that include comprehensive O&M strategies, repowering, and retrofitting with modern components. This trend significantly drives demand for both scheduled maintenance and corrective interventions, ensuring a robust market outlook.

Restraint: High Costs of Offshore O&M Activities

One of the major restraints for the market is the high cost associated with offshore wind turbine operations and maintenance. Offshore turbines are located in remote and often harsh marine environments, where access is limited by weather conditions and where specialized vessels and personnel are required for maintenance activities.

Offshore maintenance costs can be two to three times higher than onshore maintenance. Transport logistics, safety protocols, and equipment requirements drive up operational expenses. Moreover, prolonged downtime due to challenging access conditions can exacerbate revenue losses for operators. Despite technological advancements like autonomous underwater vehicles (AUVs) and remotely operated drones, the economic burden remains a significant barrier to scaling offshore wind O&M efficiently.

Opportunity: Integration of Digital Technologies for Predictive Maintenance

A significant opportunity emerging in the market is the integration of digital technologies for predictive maintenance. Leveraging artificial intelligence (AI), machine learning (ML), Internet of Things (IoT) sensors, and big data analytics allows operators to transition from reactive and scheduled maintenance models to predictive maintenance frameworks.

Predictive maintenance systems continuously monitor turbine performance parameters—such as vibration, temperature, torque, and acoustics—to identify anomalies that could indicate imminent failures. Early detection enables preemptive repairs, reduces unscheduled downtime, extends component lifespans, and optimizes maintenance schedules. Major players like Siemens Gamesa and Vestas are investing heavily in digital solutions, creating "smart wind farms" that maximize operational efficiency. This technological shift opens vast growth opportunities for specialized software providers and system integrators within the O&M market ecosystem.

Application Insights

Onshore wind turbine operations and maintenance dominated the application segment, representing the majority share in 2024. Onshore wind farms have historically led the global wind energy market due to lower capital expenditures, easier site access, and shorter installation timelines compared to offshore projects. Consequently, the bulk of O&M activities are directed toward onshore assets. Onshore maintenance operations are relatively straightforward, benefiting from the accessibility of sites via standard road transportation and lower exposure to harsh environmental conditions. Providers offer a wide array of services ranging from routine inspections to complex component overhauls, ensuring sustained turbine performance across varying terrain and climates.

Offshore wind O&M is the fastest-growing segment, driven by the rapid expansion of offshore wind capacity, particularly in Europe, Asia-Pacific, and North America. Offshore wind farms offer the advantage of higher capacity factors and larger turbines, but they also demand specialized O&M strategies. Remote monitoring, subsea inspections, blade cleaning via robotic arms, and heavy-lift vessel operations are all essential for offshore maintenance. Governments' aggressive offshore wind targets, like the United Kingdom's "Offshore Wind Sector Deal" and the U.S. "Ocean Wind" projects, are fueling investments in offshore-specific O&M infrastructure and technologies, creating new business models and innovation avenues.

Regional insights

Europe dominated the wind turbine O&M market owing to its pioneering role in the development and deployment of wind energy, both onshore and offshore. Countries like Germany, Denmark, Spain, and the United Kingdom have significant installed wind capacities, much of which is aging and requires intensive maintenance. Europe's early leadership in offshore wind, particularly in the North Sea, has spurred the creation of an entire ecosystem of specialized O&M services, vessels, and digital solutions. Supportive regulatory frameworks, government subsidies, and stringent environmental targets drive continued growth and innovation within the region. For instance, Denmark aims for 100% renewable energy by 2050, making O&M services a vital pillar of its energy strategy.

Asia-Pacific is the fastest-growing region in the wind turbine O&M market, led by China, India, Japan, South Korea, and emerging players like Vietnam and Taiwan. The sheer volume of new installations, combined with government-led initiatives promoting renewable energy, is propelling the need for efficient O&M solutions. China's "14th Five-Year Plan" includes major targets for wind power expansion, which in turn necessitates robust maintenance frameworks. Offshore wind developments in Taiwan and South Korea, supported by favorable policies and foreign investments, are further catalyzing the growth of specialized O&M service providers focused on marine environments. Rapid urbanization, economic growth, and environmental concerns make Asia-Pacific a key focus area for market players.

Recent Developments

-

April 2025: Vestas launched its "VestasPredict" predictive maintenance platform leveraging AI to optimize turbine service schedules and enhance operational efficiency.

-

March 2025: Siemens Gamesa announced a new offshore O&M service center in Taichung, Taiwan, strengthening its presence in the Asia-Pacific offshore market.

-

February 2025: GE Vernova introduced autonomous drone inspection services, reducing turbine inspection times by 30%.

-

January 2025: Nordex Group secured a long-term service agreement with a major utility in Spain to provide full-scope maintenance for a 500 MW wind portfolio.

-

December 2024: Deutsche Windtechnik expanded its presence in North America with a new O&M operations hub in Texas, targeting the growing U.S. wind market.

Some of the prominent players in the Wind turbine operations and maintenance market include:

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Group

- GENERAL ELECTRIC

- ENERCON GmbH

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global wind turbine operations and maintenance market.

Application

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)