Wireless Health Market Size and Forecast 2025 to 2034

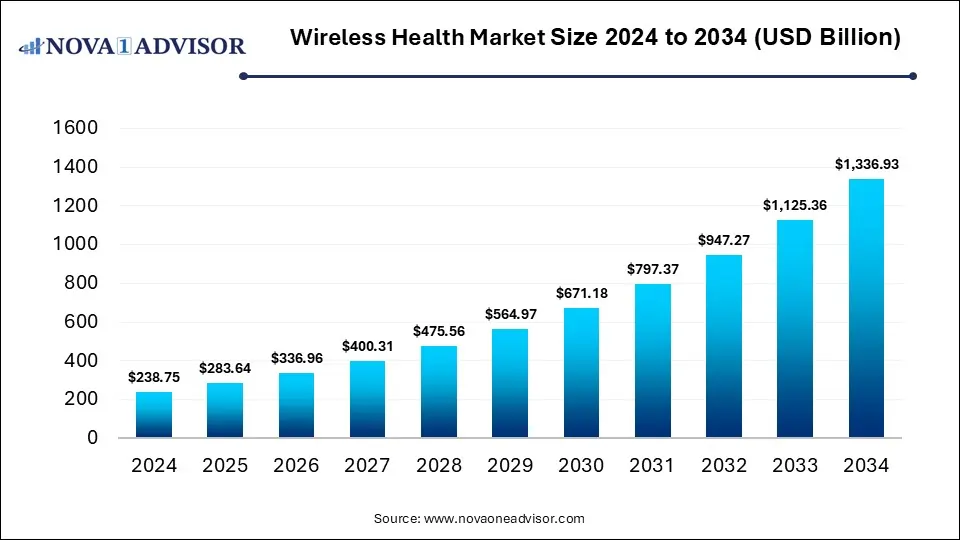

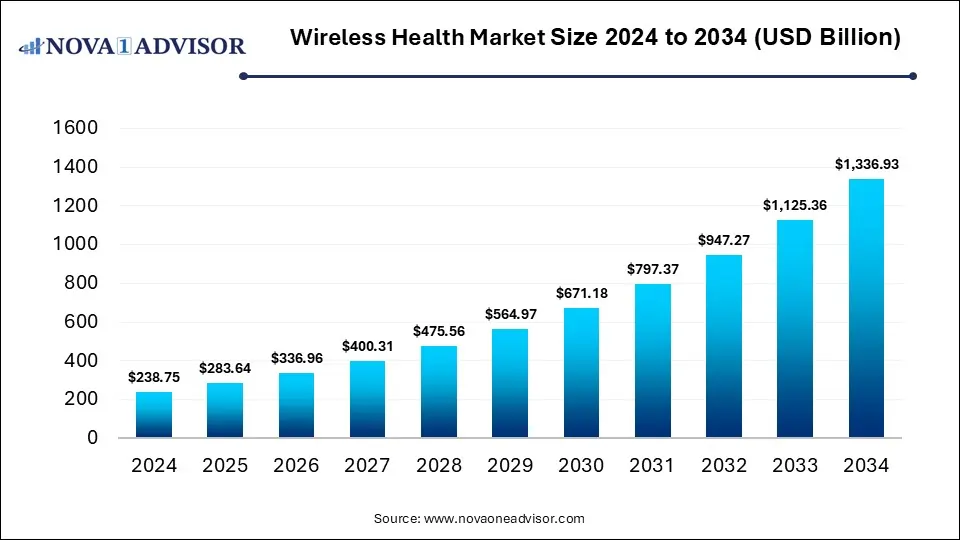

The global wireless health market size was valued at USD 238.75 billion in 2024 and is anticipated to reach around USD 1,336.93 billion by 2034, growing at a CAGR of 18.8% from 2025 to 2034. The growth of the wireless health market is driven by the digitalization of healthcare, increased use of wearable devices and mobile health applications, focus on personalized and preventive care. Advancements in wireless technologies is expanding access to healthcare services such as telemedicine.

Wireless Health Market Key Takeaways

- Wireless Personal Area Networks (WPAN) technologies captured a 37% market share in 2024.

- The Wireless Wide-Area Networks (WWAN) product segment is anticipated to grow a CAGR of 18.7% from 2025 to 2034.

- Software components segment accounted for the largest market revenue share of 41% in 2024.

- The services components segment is expected to grow fastest at a CAGR of 19.0% from 2025 to 2034.

- The patients/Individuals end use segment dominated the market in 2024.

- The providers' segment is projected to grow at a CAGR of 19.1% from 2025 to 2034.

- The patient-specific applications segment accounted for 56% of the market revenue in 2024.

- The provider/payer-specific applications segment is anticipated to witness the fastest growth, with a CAGR of 18.7% from 2025 to 2034.

Market Overview

The wireless health market is at the forefront of a healthcare transformation, revolutionizing how medical services are delivered, monitored, and accessed. Driven by a blend of digital health technologies, mobile networks, and consumer wearables, wireless health refers to the integration of wireless communications and sensor-based technologies with healthcare applications to support remote monitoring, real-time data exchange, and continuous patient engagement. This convergence has unlocked unprecedented possibilities for improving patient outcomes, reducing healthcare costs, and personalizing care delivery—especially in underserved and aging populations.

Over the past decade, advancements in broadband connectivity, sensor miniaturization, data analytics, and telecommunication infrastructure have positioned wireless health solutions as critical enablers of next-generation care. From wearable ECG monitors and Bluetooth-enabled glucometers to Wi-Fi-connected hospital beds and IoT-integrated home care systems, the wireless health ecosystem is expansive and dynamic. These technologies empower patients to take charge of their health while enabling providers to monitor chronic conditions remotely, intervene earlier, and reduce unnecessary hospitalizations.

The COVID-19 pandemic further accelerated the adoption of wireless health solutions, with telehealth consultations, remote patient monitoring (RPM), and digital health platforms gaining mainstream acceptance. As healthcare systems worldwide face mounting pressures from aging populations, chronic disease burdens, and limited clinical workforce capacity, wireless health offers scalable, real-time, and cost-effective tools to bridge the gap between providers and patients. Government support, industry collaborations, and rapid innovation will continue to drive the market’s expansion across both developed and developing economies.

Major Trends in the Market

-

Proliferation of Wearable and Connected Devices: The use of smartwatches, fitness trackers, and implantable sensors is rising for continuous health monitoring.

-

5G-Enabled Telemedicine Expansion: Ultra-low latency and high-speed connectivity enable richer, real-time clinical data transmission and diagnostics.

-

Growth of AI-Powered Remote Patient Monitoring (RPM): AI is being integrated into wireless health platforms to predict health anomalies and automate alerts.

-

Interoperability Standards and EHR Integration: Vendors are investing in interoperable platforms to seamlessly link wireless devices with electronic health records (EHR).

-

Consumerization of Healthcare: Patients are increasingly using mobile health apps and self-monitoring tools outside clinical settings.

-

Blockchain in Health Data Security: Blockchain is emerging as a tool for securing real-time wireless health data exchanges and ensuring compliance.

-

Healthcare at Home: Wireless health is enabling home-based care models, reducing the need for prolonged hospital stays and enabling chronic care management.

-

Cloud-Based Analytics Platforms: Cloud infrastructure supports real-time data aggregation, analysis, and remote clinical decision-making.

Integration of artificial intelligence (AI) in wireless health is streamlining health monitoring and management, leading to improved patient care and timely interventions. AI-powered tools can be used for various applications such as real-time health monitoring, predictive modeling and remote monitoring of patients. Emergence of AI-driven telehealth platforms is enabling remote patient care and monitoring, especially in rural and underserved areas. Analysis of medical images and patient data using AI algorithms is leading to faster and more accurate diseases diagnosis.

Wireless Health Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 283.64 Billion |

| Market Size by 2033 |

USD 1,336.93 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 18.8% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, Component, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

IBM; Epic Systems Corporation; Oracle; OMRON Corporation; Qualcomm Technologies, Inc; Qualcomm Technologies, Inc; Veradigm LLC; Koninklijke Philips N.V.; Stryker; ALE International |

Market Driver: Rising Burden of Chronic Diseases and Need for Remote Monitoring

One of the most compelling drivers of the wireless health market is the rising prevalence of chronic conditions such as diabetes, cardiovascular disease, hypertension, and respiratory illnesses. These diseases account for a substantial share of healthcare costs and hospital admissions across the globe. Traditional models of episodic care are increasingly being replaced by continuous monitoring paradigms that emphasize early intervention and ongoing management.

Wireless health tools, including wearable glucose monitors, smart inhalers, and Bluetooth-enabled blood pressure monitors, offer real-time data that allows healthcare professionals to track patient status outside clinical settings. This not only reduces the need for in-person visits but also improves adherence, early diagnosis, and personalized treatment plans. In the U.S., for instance, Centers for Medicare and Medicaid Services (CMS) have expanded reimbursement for RPM devices, making wireless health a viable option for large-scale chronic care management. The ability to seamlessly track, analyze, and respond to patient data remotely is reshaping the very core of healthcare delivery.

Market Restraint: Concerns Over Data Privacy and Cybersecurity

While the promise of wireless health is immense, cybersecurity and data privacy remain significant barriers to widespread adoption. Wireless health devices generate large volumes of sensitive health data that are transmitted over mobile and cloud-based networks. This creates multiple points of vulnerability—from data breaches and unauthorized access to ransomware attacks and identity theft.

Healthcare systems are among the most targeted sectors for cyberattacks, and with the increasing deployment of wireless and IoT devices, the attack surface has widened considerably. Inadequate encryption, outdated firmware, and non-compliance with data protection regulations such as GDPR and HIPAA further amplify these risks. For patients and providers alike, trust in technology is essential. Until robust end-to-end data security frameworks are standardized and enforced, adoption may remain cautious, particularly among older patients and healthcare institutions with limited IT resources.

Market Opportunity: Expansion of Wireless Health in Developing and Remote Regions

An exciting opportunity for wireless health lies in its ability to extend healthcare access to remote, rural, and underserved populations—particularly in developing regions where healthcare infrastructure is limited. Wireless health technologies can overcome barriers of geography and resource constraints by connecting patients with clinicians, enabling remote diagnostics, and supporting mobile health education.

In parts of Asia, Africa, and Latin America, mobile networks already outpace traditional healthcare infrastructure. This sets the stage for rapid adoption of wireless tools that can deliver maternal health support, chronic disease monitoring, and even remote surgical consultations. Non-governmental organizations (NGOs), telecom companies, and health tech startups are increasingly partnering to deliver mobile clinics, SMS-based appointment reminders, and telehealth kiosks powered by wireless networks. As 5G and satellite broadband expand into these regions, the potential for scalable, equitable healthcare through wireless platforms becomes increasingly feasible.

Global Wireless Health Market Report Segmentation Insights

By Product Insights

Wireless Personal Area Networks (WPAN) technologies captured a 37% market share in 2024. due to their widespread use in wearable medical devices, Bluetooth-connected health monitors, and short-range patient-to-device communication systems. WPAN technologies like Bluetooth and ZigBee form the backbone of consumer-centric wireless health tools, enabling continuous data transmission without requiring complex infrastructure. Their low energy consumption, compact size, and seamless integration with smartphones and apps make them highly suitable for both patients and providers. Fitness trackers, glucose monitors, and pulse oximeters commonly leverage WPAN for real-time monitoring and personalized alerts.

The Wireless Wide-Area Networks (WWAN) product segment is anticipated to grow a CAGR of 18.7% from 2025 to 2034. WWAN technologies, including cellular networks, provide large-scale connectivity for remote health applications such as ambulance telemetry, telemedicine consultations, and centralized data aggregation from multiple clinics. As healthcare organizations prioritize coverage and scalability, particularly in rural areas and mobile environments, WWAN adoption is poised to surge across emergency services, disaster response units, and remote patient management platforms.

By Component Insights

Software components segment accounted for the largest market revenue share of 41% in 2024. From AI-based analytics engines to mobile health apps and device firmware platforms, software plays a central role in interpreting patient data, generating alerts, and facilitating provider-patient communication. As more healthcare ecosystems move toward cloud computing, real-time analytics, and AI-assisted diagnostics, software vendors are experiencing exponential demand for their platforms. The push for interoperability across device brands and electronic health records further fuels innovation in this segment.

The services components segment is expected to grow fastest at a CAGR of 19.0% from 2025 to 2034. given the essential role of physical devices such as wearable monitors, implantable sensors, wireless routers, and telemetry-enabled equipment. These components serve as the first point of contact for data acquisition and are crucial for maintaining consistent, reliable, and secure connections. The proliferation of health-oriented smartwatches, ECG patches, wireless infusion pumps, and connected diagnostic tools is driving sustained demand for advanced, durable, and interoperable hardware solutions.

By End Use Insights

The patients/Individuals end use segment dominated the market in 2024. Empowered by wearables, mobile apps, and on-demand care platforms, patients are actively engaging in wellness tracking, chronic condition management, and fitness regimes. Wireless health solutions enable individuals to share real-time data with providers, join digital health communities, and even participate in clinical research studies remotely. The democratization of healthcare through consumer-centric technology is transforming individuals from passive recipients into active stakeholders.

The providers' segment is projected to grow at a CAGR of 19.1% from 2025 to 2034. leveraging wireless health solutions to streamline clinical workflows, improve diagnostics, and support real-time monitoring. Hospitals, clinics, and ambulatory care centers deploy wireless technologies to improve efficiency, reduce readmissions, and enhance the patient experience. Wireless telemetry in ICUs, Bluetooth-enabled diagnostic tools in ERs, and mobile tablets for nurses all contribute to this segment's dominance.

By Application Insights

The patient-specific applications segment accounted for 56% of the market revenue in 2024. owing to the surge in teleconsultation, virtual care coordination, and patient engagement platforms. Wireless technologies now support not only real-time video consultations but also asynchronous messaging, automated reminders, and app-based patient education. This empowers patients to play an active role in their care journey while improving provider efficiency. As consumer expectations rise for convenience and transparency in healthcare, wireless patient communication solutions are rapidly becoming the norm.

The provider/payer-specific applications segment is anticipated to witness the fastest growth, with a CAGR of 18.7% from 2025 to 2034. As healthcare providers increasingly rely on wireless technologies to monitor vital signs such as heart rate, oxygen saturation, temperature, and glucose levels. These tools are particularly vital for managing chronic diseases and monitoring post-surgical recovery or ICU patients remotely. By transmitting real-time data to care teams, physiological monitoring reduces the burden on healthcare facilities and enables timely intervention in critical situations.

By Regional Insights

North America leads the wireless health market, owing to advanced digital infrastructure, high healthcare spending, and strong regulatory support for health technology adoption. The U.S. is home to a thriving health tech ecosystem, with major hospitals integrating wireless telemetry, remote monitoring platforms, and smart diagnostics into standard care. The Centers for Medicare & Medicaid Services (CMS) and the Food and Drug Administration (FDA) have been instrumental in approving and reimbursing wireless health devices. Additionally, tech giants like Apple, Google, and Amazon continue to invest heavily in healthcare IoT and wearables, further fueling innovation and adoption.

U.S. Wireless Health Market Trends

The U.S. is a leading contributor to the growth of the wireless health market in North America. The rising burden of chronic diseases, continuous innovations in wireless technologies such as 5G and low-power wide-area networks (LPWAN), supportive government initiatives and increased public awareness are driving market growth. The country’s well-established healthcare infrastructure and increasing emphasis on personalized and preventive care is facilitating the adoption of wireless health technologies such as wearable devices, portable diagnostic devices and remote patient monitoring systems.

- For instance, on June 24, 2025, the U.S. Secretary of Health and Human Services (HHS), Robert F. Kennedy Jr. announced plans for launching an advertising campaign to encourage Americans to adopt wearable health devices.

Asia-Pacific is the fastest-growing region, driven by expanding mobile penetration, rising chronic disease burden, and proactive government initiatives. Countries such as China, India, and Japan are witnessing a healthcare transformation, fueled by smart hospitals, public health digitization programs, and telemedicine expansion. In India, for instance, the Ayushman Bharat Digital Mission (ABDM) aims to build a digital health ecosystem integrating wireless health platforms. Similarly, China’s Health 2030 agenda and growing urban healthcare infrastructure are creating robust demand for wireless monitoring and diagnostics. With a large tech-savvy population and increasing health awareness, Asia-Pacific is poised to become a global hub for wireless health adoption.

China Wireless Health Market Trends

China is leading the wireless health market in Asia Pacific, driven by factors such as increased healthcare spending, high prevalence of chronic illnesses in the large population, rising disposable incomes and presence of advanced healthcare infrastructure. Early adoption of innovative medical technologies such as wireless health monitoring technologies as well as presence of major market players providing wide range of health tracking solutions and wearable devices such as Fitbit, Medtronic and Apple are expanding the market potential. Moreover, the extensive 5G network coverage, robust IT infrastructure, availability of skilled and supportive government initiatives is supporting the country’s digital healthcare transformation, further driving the adoption of wireless health technologies.

Wireless Health Market Top Key Companies:

The following are the leading companies in the wireless health market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- Epic Systems Corporation

- Oracle

- OMRON Corporation

- Qualcomm Technologies, Inc

- Veradigm LLC

- Koninklijke Philips N.V.

- Stryker

- Alcatel-Lucent

Wireless Health Market Recent Developments

- In July 2025, Omni Health, an upcoming health technology company, launched its Omni Health Ring smart wearable. The AI-powered smart health ring provides personalized insights on daily plan across food, movement, and rest, based on the wearer’s body signals.

- In March 2025, Vave Health introduced its Universal Wireless Probe, which is a handheld device combining linear and phased imaging technology for full-body imaging. The device is aimed at enhancing accuracy, diagnostics and efficiency in different clinical and educational environments.

- In February 2025, Validic, a leading healthcare technology innovation company, launched its full package of Intelligent Digital Care Solutions and Services which will be available in the Amazon Web Services (AWS) marketplace. The solutions and services comprise of the Validic Health IoT platform, Remote Patient Management solution, logistics and device purchasing, and patient service desk.

- In February 2025, India’s largest digital healthcare company, MediBuddy partnered with the Japanese electronics firm, ELECOM. The collaboration focuses in developing and launching advanced smart health Internet of Things (IoT) devices in the Indian market.

Wireless Health Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Wireless Health market.

By Product

- WLAN/ Wi-Fi

- WPAN

- WiMAX

- WWAN

By Component

- Hardware

- Software

- Services

By Application

- Patient-specific

- Physiological monitoring

- Patient communication

- Provider/Payer-specific

By End Use

- Providers

- Payers

- Patients/Individuals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)