Women’s Health Diagnostics Market Size and Research

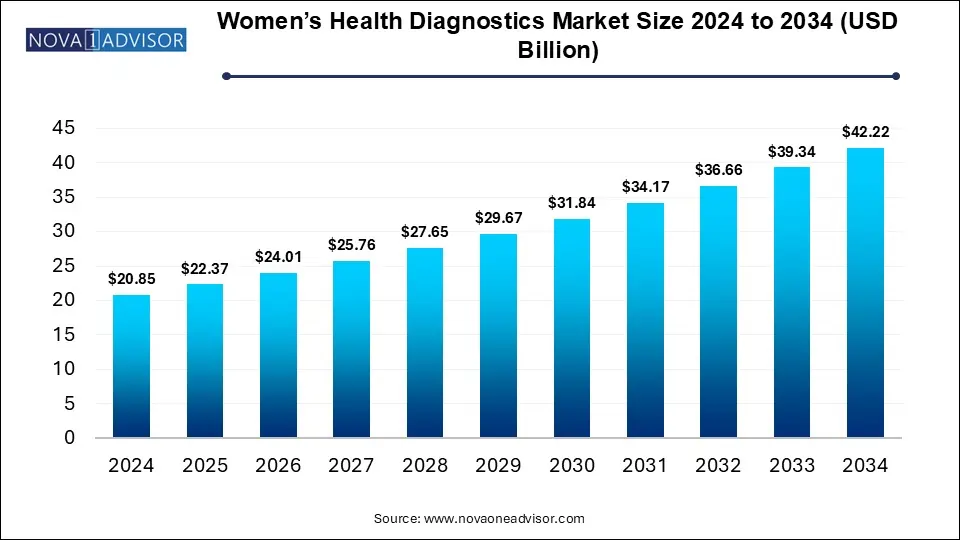

The women's health diagnostics market accounted for USD 20.85 billion in 2024 and is expected to reach around USD 42.22 billion by 2034, growing with a CAGR of 7.31% from 2025 to 2034. This market is growing due to increasing awareness, advancements in diagnostic technologies, and the rising prevalence of women's health disorders.

Women’s Health Diagnostics Market Key Takeaways

- North America dominated the market with the largest market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By application, the cancer segment dominated the market with the highest market share in 2024.

- By application, the prenatal segment is expected to witness significant growth in its market share during the predicted timeframe.

- By end user, the hospital segment dominated the women's health diagnostic market with the largest share in 2024.

- By end user, the home care segment dominated the market with the largest market share.

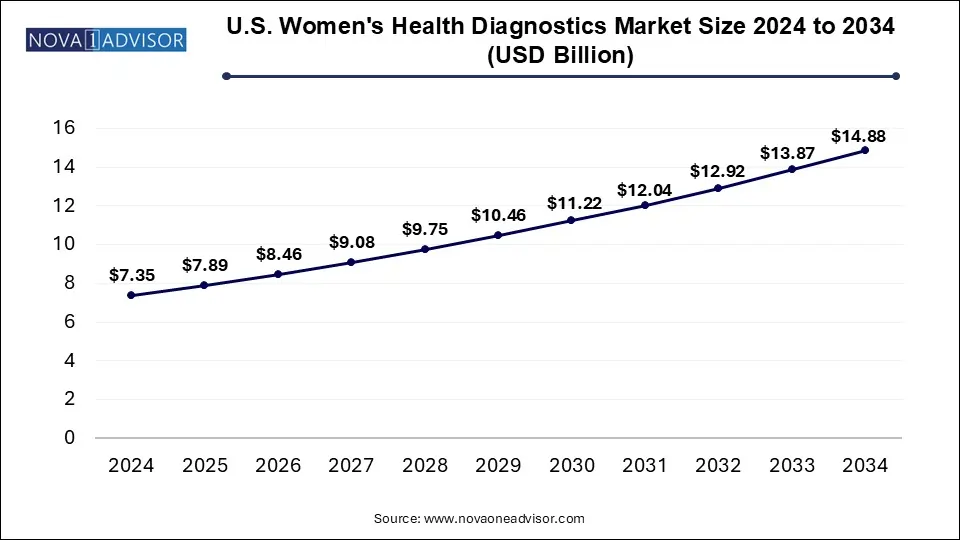

U.S. Women’s Health Diagnostics Market Size and Growth 2025 to 2034

The U.S. Women’s Health Diagnostics Market size was valued at USD 7.35 billion in 2024 and is expected to reach around USD 14.88 billion by 2034, growing at a CAGR of 6.62% from 2025 to 2034.

North America will dominate the women's health diagnostic market in 2024, driven by the presence of top diagnostic companies, a well-established healthcare infrastructure, and high awareness levels. The area gains from extensive insurance coverage robust government support for women's health initiatives and growing use of cutting-edge diagnostic tools. By developing at-home testing solutions AI-powered imaging and molecular diagnostics companies like Hologic Quest Diagnostics and Thermo Fisher Scientific significantly influence the market. For instance, the Hologics 3D mammography system has greatly increased the United States' rates of breast cancer detection. S. The market is also being supported by growing investments in precision medicine and more partnerships between diagnostic companies and healthcare providers.

Asia Pacific is seeing rapid growth in the women's health diagnostics market, driven by growing investments in healthcare, improved access to diagnostic services, and growing awareness of early disease detection. While rapid urbanization and changing lifestyles are increasing the prevalence of conditions like osteoporosis and infertility nations like China India and Japan are also expanding their national screening programs for breast and cervical cancer. With the introduction of affordable diagnostic solutions designed for emerging markets, companies such as Abbott Fujifilm Holdings and Roche Diagnostics are actively growing in the region. For instance, the HPV DNA test developed by Roche has become a common cervical cancer screening tool in Asia. Further propelling market expansion is the increasing accessibility of healthcare due to the growing use of wearable technology telemedicine and home-based diagnostics.

Women’s Health Diagnostics Market Overview

The global women’s health diagnostics market is growing due to increased awareness about reproductive and maternal health, the rising prevalence of conditions like breast cancers, osteoporosis, and STDs, and technological advancements in diagnostics tools. AI-powered imaging digital health solutions and at-home diagnostic kits are transforming the industry. Demand is being further increased by government programs and healthcare expenditures. High diagnostic costs and restricted access in rural areas are still problems though. In the upcoming years, it is anticipated that ongoing research and innovation will increase the accessibility and effectiveness of diagnostics.

Women’s Health Diagnostics Market Growth Factors

Increasing Focus on Preventive Healthcare

The market is expanding as a result of routine screening programs for osteoporosis breast and cervical cancer and pregnancy-related disorders. Both public and private entities are funding screening initiatives and advancing awareness campaigns.

Digital Health Innovations

The industry is changing due to mobile-based diagnostic apps wearable smart devices for women's health monitoring and AI-driven imaging. Healthcare is becoming more accessible thanks to smartphone-enabled ultrasounds home-based testing kits and virtual consultations, particularly in underserved and isolated areas. Real-time health tracking is made possible by these technologies which enhance early detection and treatment results. Furthermore, machine learning algorithms are being used to improve precision medicine applications by analyzing medical images more accurately and lowering diagnostic errors.

Report Scope of Women’s Health Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 22.37 Billion |

| Market Size by 2034 |

USD 42.22 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.31% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Revenue, Competitive Landscape, Growth Factors, and Trends |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Hologic, Inc.; Quest Diagnostics Incorporated; Abbott; BD; Ge Healthcare; Koninklijke Philips N.V.; Aspira Women's Health; Thermo Fisher Scientific Inc.; Cardinal Health, Inc. |

Drivers

Rising Prevalence of Women’s Health Disorders

Major factors driving the market include rising rates of ovarian and breast cancer, infertility, osteoporosis, and sexually transmitted diseases. The WHO estimates that over 2 to 3 million women worldwide are impacted by breast cancer annually. Initiatives for early diagnosis and growing awareness are driving market growth.

Advancements in Diagnostic Technologies

Advances in non-invasive prenatal testing AI-powered imaging and molecular diagnostics are improving the accuracy of diagnoses. Because they are convenient and reasonably priced home-based and telehealth-enabled diagnostic solutions are becoming more popular.

Market Opportunity

Growing demand for personalized diagnostics

Advances in biomarker research and genetic testing are making personalized diagnostics possible. Healthcare providers can improve patient outcomes by customizing treatments based on lifestyle and genetic factors thanks to precision medicine approaches. For diseases like ovarian and breast cancer, the advancement of companion diagnostics is improving targeted treatments even more. Doctors can now prescribe drugs based on a patient's genetic profile which lowers side effects and increases treatment effectiveness thanks to growing investments in pharmacogenomics.

Market Challenge

High Cost of Advanced Diagnostic Tests

Accessibility is restricted by the high expense of molecular diagnostics and imaging tests particularly in low-income areas despite technological advancements. The cost of liquid biopsies genetic testing and MRI scans keeps them from being widely used. Increasing telehealth adoptions, lowering regulatory barriers, and broadening insurance coverage can all aid in overcoming this difficulty. Furthermore, collaborations between public health organizations and diagnostic companies are essential to lowering the cost of screening programs and expanding their accessibility.

Segmental Insights

Women’s Health Diagnostics Market By Application

Cancer segment dominated the market with the largest share in 2024, driven by the rising incidence of breast ovarian, and cervical cancers. Growing awareness of government-sponsored screening programs and developments in molecular diagnostics and AI-assisted imaging are all contributing to its expansion. Leading companies like Hologic Roche Diagnostics and GE Healthcare are providing innovative solutions that improve patient outcomes and early cancer detection such as Hologics Genius 3D Mammography system and Roches Cobas HPV test. The market is predicted to continue to dominate with ongoing advancements in liquid biopsy and AI-powered screening technologies.

Prenatal segment is expected to grow at the fastest rate in the market during the forecast period, driven by increasing maternal health awareness, rising infertility rates, and growing demand for non-invasive prenatal testing. Developments in fetal imaging hormone analysis and genetic screening are greatly accelerating market growth. With cutting-edge products like Illuminas VeriSeq NIPT Solution and Nateras Panorama test which offer incredibly accurate early-stage pregnancy screening companies like Illumina Natera and PerkinElmer dominate the market. The market is expanding even faster due to the quick uptake of hormone monitoring and at-home fertility tracking devices

Women’s Health Diagnostics Market By End User

Hospitals segment dominated the market with the largest share in 2024, because of their sophisticated diagnostic systems, wide access to medical technology, and ability to integrate with other healthcare providers. Prominent healthcare organizations including Apollo Hospitals Mayo Clinic and Cleveland Clinic are making significant investments in precision medicine molecular diagnostics and AI-powered imaging for women's health. For instance, hospitals frequently use Siemens Healthiness AI-Rad Companion for breast cancer imaging which greatly enhances early detection and lowers diagnostic errors. Women's health departments and hospital-based screenings are becoming more and more popular, which is helping to grow this market.

Home care segment is expected to grow at the fastest rate in the market during the forecast period, driven by the increasing demand for convenient, self-testing solutions and the rise of telehealth services. Women's health diagnostics is being revolutionized by developments in wearable technology at-home diagnostic kits and remote monitoring tools. With cutting-edge at-home solutions like the Abbott i-STAT handheld device which allows quick blood testing at home and Everly Wells at-home hormone and fertility tests companies like LetsGetChecked and Abbott are dominating the market. The rapid expansion of this market is primarily due to the move toward personalized healthcare and the growing accessibility of remote diagnostics.

Some of The Prominent Players in The Women’s Health Diagnostics Market Include:

- F. Hoffmann-La Roche Ltd.

- Hologic, Inc.

- Quest Diagnostics Incorporated

- Abbott

- BD

- Ge Healthcare

- Koninklijke Philips N.V.

- Aspira Women's Health

- Thermo Fisher Scientific Inc.

- Cardinal Health, Inc.

Women’s Health Diagnostics Market Recent Developments

- January 2025 – Roche launched an AI-powered mammography screening tool to enhance early breast cancer detection. The tool aims to improve diagnostic efficiency and reduce false positives.

- May 2024 – Abbott introduced a home-based HPV testing kit, expanding access to cervical cancer screening. This innovation is expected to increase early detection rates and improve patient outcomes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Women’s Health Diagnostics Market

By Application

- Cancer

- Infectious diseases

- Osteoporosis

- Pregnancy & fertility

- Prenatal

By End User

- Hospitals

- Laboratory

- Home care

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)