Zika Virus Vaccines Market Size and Trends

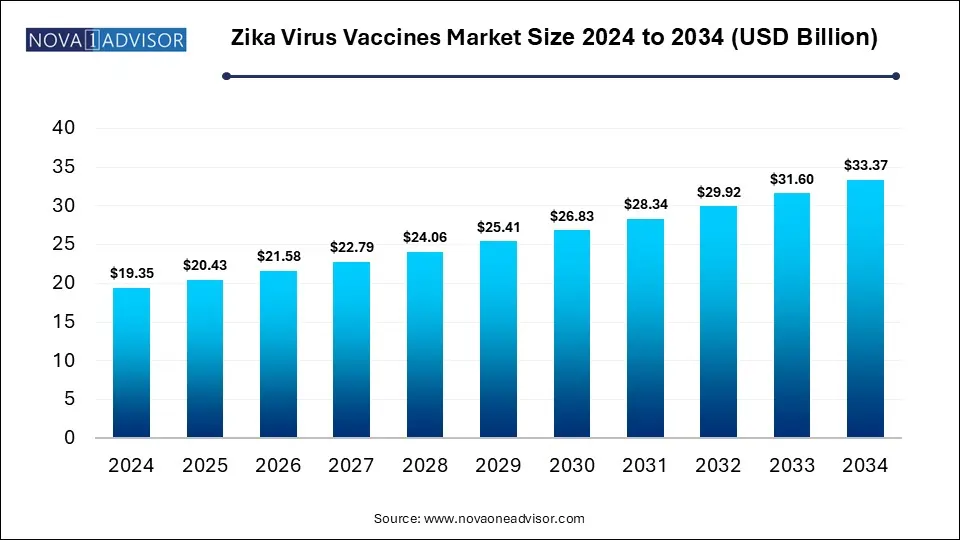

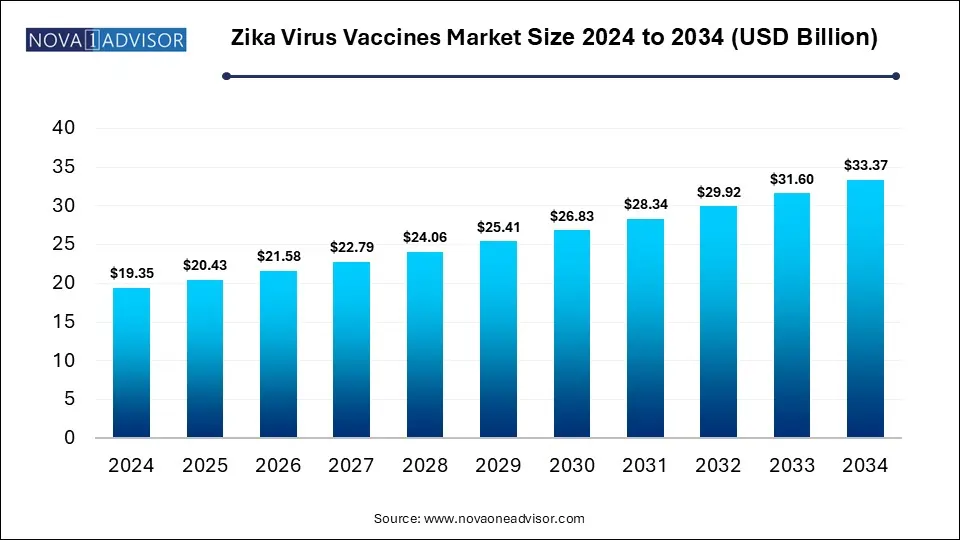

The global Zika virus vaccines market size is calculated at USD 19.35 billion in 2024, grow to USD 20.43 billion in 2025, and is projected to reach around USD 33.37 billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034. The market is growing due to increasing outbreaks in tropical regions and rising global health concerns. Advancements in vaccine technologies and strong government support are further accelerating development efforts.

Key Takeaways

- Asia Pacific is expected to grow at a significant rate in the Zika virus vaccines market in 2024.

- Latin America is expected to grow rapidly in the market during the forecast period.

- By type, the preventive vaccines segment dominated the market with a revenue share in 2024.

- By type, the therapeutic vaccines segment is expected to grow at the fastest CAGR in the market during the studied years.

- By end use, the hospitals segment held the largest market share.

How Zika Virus Vaccines Market Evolving?

Zika virus vaccines are immunizations designed to protect against infection caused by the Zika virus by stimulating the body’s immune response. They aim to prevent complications such as birth defects and neurological disorders linked to the virus. The Zika virus vaccines market is advancing due to heightened global awareness and the urgent need for preventive measures against virus-related complications. Ongoing clinical trials, international collaboration, and innovations in vaccine platforms are accelerating development. Governments and health organizations are actively supporting research efforts, especially in regions prone to outbreaks. As a result, the market is witnessing steady progress towards the introduction and distribution of effective vaccines on a global scale.

For Instance, In 2024, Tech Mahindra, in partnership with StaTwig, introduced "VaccineLedger," a blockchain-powered platform aimed at enhancing vaccine supply chain visibility. This system enables real-time tracking of vaccine batches, helping to prevent issues like counterfeiting, stockouts, and expired doses. It also supports demand forecasting and strengthens supply chain efficiency, ensuring compliance with regulatory distribution standards.

What are the Key trends in the Zika Virus Vaccines Market in 2024?

- In May 2025, Valneva SE’s VLA11601 was recognized by both the U.S. FDA and the European Union as the leading Zika virus vaccine candidate. This second-generation inactivated vaccine stands out as the most advanced in development, especially as no current vaccine is officially considered effective or preventive against the Zika virus.

- In January 2025, Bharat Biotech revealed its intention to manufacture Zika virus vaccines at its newly established ₹1,500 crore facility in Odisha, aiming to boost overall vaccine production capabilities across multiple vaccine types.

How Can AI Affect the Zika Virus Vaccines Market?

AI can significantly influence the Zika virus vaccines market by accelerating vaccine research, optimizing clinical trial design, and predicting outbreak patterns. It enables faster identification of viral mutations, supports the development of targeted vaccine candidates, and enhances decision-making in manufacturing and distribution. AI-driven models can also streamline regulatory processes by analyzing large datasets efficiently, reducing time to market. Overall, AI contributes to more efficient, cost-effective, and precise vaccine development and deployment strategies.

Report Scope of Zika Virus Vaccine Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 20.43 Billion |

| Market Size by 2034 |

USD 33.37 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Moderna Inc., Valneva SE., Inovio Pharmaceuticals, Inc., Emergent BioSolutions Inc., Novavax, Inc., Johnson & Johnson., Pfizer Inc., Bharat Biotech International Ltd., GeoVax Labs, Inc., Takeda Pharmaceutical Company Limited, GlaxoSmithKline plc. |

Market Dynamics

Driver

Public Health Concerns to Increase Demand in the Market

Rising public health concerns are fueling the demand for the Zika virus vaccine market, as the virus poses serious threats to vulnerable populations, especially pregnant women and infants. Increased global focus on disease prevention and epidemic preparedness has prompted authorities to invest in vaccine development. Heightened awareness campaigns and the need to avoid future outbreaks are further motivating both public and private sectors to accelerate the availability of reliable Zika vaccination solutions.

Restraint

Limited Number of Active Outbreaks

A low incidence of active Zika cases hampers the vaccine market by diminishing the sense of immediate need for immunization. This often leads to reduces momentum in research, limited allocation of resources, and slower advancements of clinical trials, Without widespread outbreaks, public and private stakeholders may shift focus to more pressing health threats, making it challenging to sustain consistent investment and interest in developing and distributing Zika virus vaccines.

Opportunity

Advancement of Vaccine Technology

Emerging vaccine technology offers a promising opportunity for the Zika virus vaccine market by simplifying the development process and allowing for quicker adjustment to viral mutations. These advanced platforms support efficient production and can enhance immune responses, making the vaccine more effective. With ongoing innovation in biotechnology and strong research backing, these tools can help overcome past limitations in Zika vaccine development and position the market for significant growth in the coming years.

Segmental Insights

How will the Preventive Vaccines Segment Dominate the Zika Virus Vaccines Market in 2024?

In 2024, the preventive vaccine segment led the Zika virus vaccine market due to growing awareness about the virus’s severe health impacts, especially in pregnant women and infants. Public health campaigns and government efforts focused on disease prevention drove demand for vaccines effective treatment options further emphasized the need for preventive measures, making this segment the most sought-after and widely supported by both healthcare providers and policymakers.

The therapeutic vaccine segment is projected to grow rapidly as efforts intensify to address the health issues caused by existing Zika infections, such as neurological and developmental disorders. Unlike preventive options, therapeutic vaccines aim to support recovery and reduce disease severity, making them valuable in managing complications. Ongoing innovation in immune-based treatments and increased funding for therapeutic research are encouraging the development of such vaccines, driving momentum in this emerging area of the Zika vaccine market.

How will the Hospitals Segment Dominate the Zika Virus Vaccines Market in 2024?

Hospitals accounted for the largest share of the Zika virus vaccines market as they serve as trusted healthcare hubs where patients seek both preventive care and treatment. Their established systems for vaccine storage, handling, and patient monitoring ensure safe and efficient immunization. Moreover, hospitals often collaborate with public health agencies during outbreak responses, making them critical for implementing mass vaccination programs and managing high patient volumes in affected regions.

Regional Insights

How is Asia Pacific Contributing to the Expansion of the Zika Virus Vaccines Market?

Asia-Pacific is projected to grow rapidly in the market in 2024 due to increasing awareness of mosquito-borne diseases, growing healthcare investments, and a rise in government-led vaccination efforts. Countries like India and Southeast Asian nations are witnessing heightened focus on infectious disease control, along with expanding pharmaceutical manufacturing capabilities. Favorable climate conditions for mosquito breeding also elevate the risk of outbreaks, prompting regional health authorities to prioritize preventive measures and vaccine accessibility.

How is Latin America approaching the Zika Virus Vaccines Market in 2024?

Latin America is expected to experience strong growth in the market due to its vulnerability to mosquito-borne diseases and recurring outbreaks in recent years. The region's proactive approach to strengthening disease surveillance, improving public health response, and expanding access to vaccines is fueling demand. Additionally, increased regional funding for infectious disease control and partnerships with international health organizations are accelerating vaccine development and distribution efforts, making Latin America a key growth area during the forecast period.

Top Companies in the Zika Virus Vaccines Market

- Moderna Inc.

- Valneva SE.

- Inovio Pharmaceuticals, Inc.

- Emergent BioSolutions Inc.

- Novavax, Inc.

- Johnson & Johnson.

- Pfizer Inc.

- Bharat Biotech International Ltd.

- GeoVax Labs, Inc.

- Takeda Pharmaceutical Company Limited

- GlaxoSmithKline plc.

Recent Developments in the Zika Virus Vaccines Market

- In April 2024, Valneva initiated a Phase 1 clinical trial in the U.S. to assess the safety and immune response of its second-generation, adjuvanted inactivated Zika vaccine candidate, VLA1601, involving 150 adult participants. Initial results are anticipated in early 2026. Meanwhile, Moderna is progressing with its mRNA-based vaccine, mRNA-1893, which is undergoing Phase 2 trials in the U.S. and Puerto Rico, with completion expected by July 2024.

- In 2024, significant progress was made in Zika virus vaccine research and development. In February, Indian Immunologicals collaborated with the Indian Council of Medical Research (ICMR) to clinically develop a codon-deoptimized live attenuated Zika vaccine, with ICMR supporting Phase I trials. In June, Valneva began Phase 1 trials for its second-generation candidate, VLA1601. Alongside vaccine advancements, the global market for Zika therapeutics is also expanding, driven by innovations in RNA-based treatment approaches.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Zika Virus Vaccines Market.

By Type

- Therapeutic Vaccines

- Preventive Vaccines

By End Use

- Hospitals

- Clinics

- Research Institutes

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)