U.S. Medical Aesthetic Devices Market Size and Research

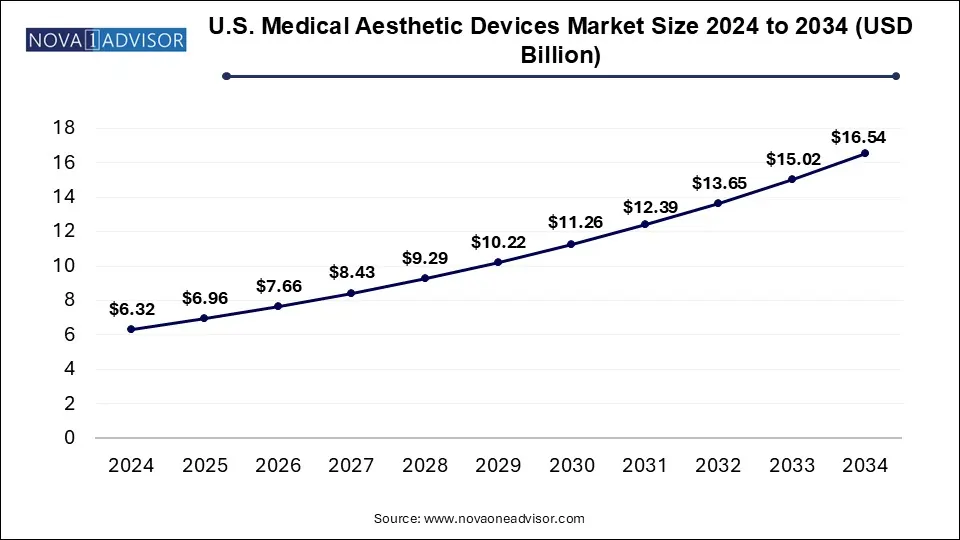

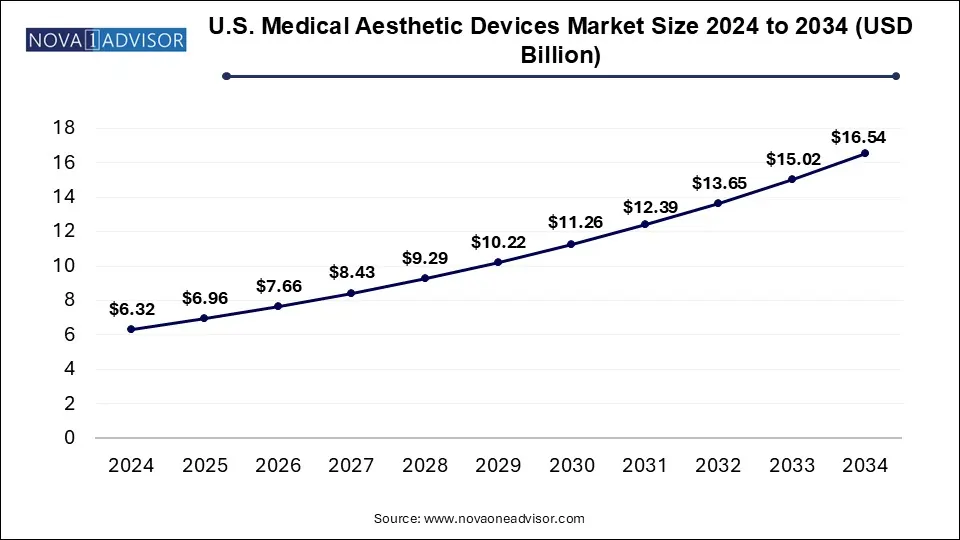

The U.S. medical aesthetic devices market size was valued at USD 6.32 billion in 2024 and is expected to be worth around USD 16.54 billion by 2034, growing at a CAGR of 10.1 during the forecast period from 2025 to 2034. Technological advancement and rising consumer awareness drive the U.S. medical aesthetic devices market.

U.S. Medical Aesthetic Devices Market Key Takeaways

- By type insight, the aesthetic implants segment is expected to grow fastest during the forecast period.

- By application insight, the non-surgical segment dominated the market.

- By end-user insight, the hospitals segment held a dominant market share.

U.S. Medical Aesthetic Devices Market Overview

The medical aesthetic devices market denotes a wide variety of advanced medical instruments and equipment incorporated with technologies for application in cosmetic and aesthetic procedures. The U.S. medical aesthetics devices market growth is being fueled by rising demand for cosmetic procedures intending to improve the physical appeal of an individual. These devices are for surgical and other non-surgical treatments, which aim at facial deformities, and contouring the body, or skin rejuvenating. Millions of aesthetic procedures are done each year, with the most popular treatments being facelifts, liposuction, breast augmentation, nose reshaping, and eyelid surgeries. New advances in non-invasive skin tightening and fat-reduction technology would create additional avenues for future growth. The demand for such therapies will continue to stay high in the forthcoming years on account of the increased incidence of facial deformities and congenital dental problems, along with the growing trends of preference for minimally invasive procedures. Awareness and acceptance of aesthetic procedure use only further drive market expansion.

U.S. Medical Aesthetic Devices Market Growth Factors

- An increasing need as a result of a change in demographics towards aesthetic procedures.

- Advancements in minimally invasive and non-invasive treatments for aesthetic purposes making these procedures more accessible.

- Increased treatment and device demand due to cultural acceptance of aesthetic procedures.

- Innovative technologies in aesthetic devices improve the safety, efficacy, and variety of treatments available today.

Report Scope of U.S. Medical Aesthetic Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.96 Billion |

| Market Size by 2034 |

USD 16.54 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type of Device, By Application, By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Cynosure, Alma Lasers, Lumenis Inc., Bausch Health Companies Inc. (Solta Medical Inc.), Abbvie, Lumenis Ltd., Dentsply Sirona, Inc., Dentsply Sirona, Inc., PhotoMedex, Inc., Straumann and Others. |

Driver

The Growing Demand for Non-Invasive Aesthetic Procedures

The medical aesthetic devices market is growing rapidly with a rising non-invasive demand. The increasing demand for medical aesthetic devices can also be attributed to factors such as technological advancements in laser, radiofrequency, and ultrasound devices, greater consumer awareness about surgical and non-surgical procedures, and desires for natural-looking results. Patients tend to opt for non-invasive treatments and procedures requiring little downtime because they are aware that subtle, natural results can be attained. Affordability and accessibility influence the demand for certain treatments, pulling in a greater clientele. Aesthetic treatments have gained even more interest, with the rise of the middle-class populace in developing countries, increasing disposable incomes, and demand for anti-aging interventions such as Botox, dermal fillers, and laser treatments and enhancing newer trends such as customization for each patient's skin type and need.

Opportunity

Technological Innovations Transforming Medical Aesthetic Devices

Advancements in technology in the field of medical aesthetics such as AI, VR/AR, and laser technology are working towards making their treatment more accurate, accessible, and minimally invasive. These allow modifying procedures according to the patient data to improve the accuracy of cures with AI and ML. Augmented reality along with virtual reality decreases the invasiveness by contributing to preprocedural planning and patient education. Performance of the devices is improved along with the patient monitoring done through IoTs while telemedicine increases access to aesthetics consults. This brings to creating personalized implants and medical equipment through 3D printing technology and therefore, enhances patient experience. Such technologies in turn will increase the accuracy, safety, and customization even more as the sector unfolds.

The Challenge of Rising Consumer Expectations in Medical Aesthetics

The medical aesthetics industry is compelled to come up with new inventions in the market due to increasing consumer expectations and heightened social pressure from social media. Consumers demand treatments that are much safer, more effective, and more advanced; idealized beauty images darling by social media have prompted people to recognize this need. Therefore, a push for companies to invest in research and development for cutting-edge solutions becomes crucial. To stay ahead, aesthetic companies need to strike a balance between innovation with safety, personalization, and ethics.

Segment Analysis

U.S. Medical Aesthetic Devices Market By Type Insight

The aesthetic implants segment is expected to spawn rapid growth owing to the increasing demand for body contouring procedures, mainly breast augmentation surgery. Technological advancements in implants and cosmetic procedures are the key factors driving this segment's growth, therefore forming a substantial area for expansion of the medical aesthetic market.

U.S. Medical Aesthetic Devices Market By Application Insight

The non-surgical part of the U.S. market was the major share in 2024 and is projected to gain more significance owing to the burgeoning demand for minimally invasive aesthetic procedures. Growth is propelled by more availability in medical spas and beauty centers, less recovery time as compared to surgical options, and growing awareness about the benefits of non-surgical treatments, such as convenience and less downtime.

U.S. Medical Aesthetic Devices Market By End-User Insight

The segment of hospitals and clinics was leading the market in 2024 due to the state-of-the-art devices, proficient professionals, and easy accessibility. The environment provided by hospitals assures safety from harm making patients confident regarding the treatment procedures. The rapid emergence of dermatology clinics has also affected the market with specialized services and more patients who are seeking aesthetic enhancement. This demand is anticipated to continue as patients will always seek safe cosmetic interventions.

Some of The Prominent Players in The U.S. Medical Aesthetic Devices Market Include:

- Cynosure

- Alma Lasers

- Lumenis Inc.

- Bausch Health Companies Inc. (Solta Medical Inc.)

- Abbvie

- Lumenis Ltd.

- Dentsply Sirona, Inc.

- Dentsply Sirona, Inc.

- PhotoMedex, Inc.

- Straumann

U.S. Medical Aesthetic Devices Market Recent developments

- In November 2024, Cartessa Aesthetics partnered with South Korean aesthetics leader Classys to introduce EVERESSE by Volnewmer, a world-class monopolar radiofrequency technology, to the US market, marking Classys's official entry into the American market.

- In October 2024, Evolus, a performance beauty company, has received EU Medical Device Regulation (MDR) certification for four injectable hyaluronic acid gels under the brand Estyme®, doubling its addressable market outside the U.S. to $1.8 billion.

- In October 2024, Elevai Labs, a leader in medical aesthetics, is conducting a clinical study to evaluate the effectiveness of its topical exosome products, Elevai Empower and Elevai Enfinity, in enhancing facial skin appearance.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. Medical Aesthetic Devices Market

By Type

-

- Energy-based Aesthetic Device

- Laser-based Aesthetic Device

- Radiofrequency (RF)-based Aesthetic Device

- Light-based Aesthetic Device

- Ultrasound Aesthetic Device

- Non-energy-based Aesthetic Device

- Botulinum Toxin

- Dermal Fillers and Aesthetic Threads

- Microdermabrasion

- Others

-

- Facial Implants

- Breast Implants

- Others

By Application

By End-user

- Hospitals and Clinics

- Medical Spas and Beauty Centers