AI In Medical Imaging Market Size and Forecast 2025 to 2034

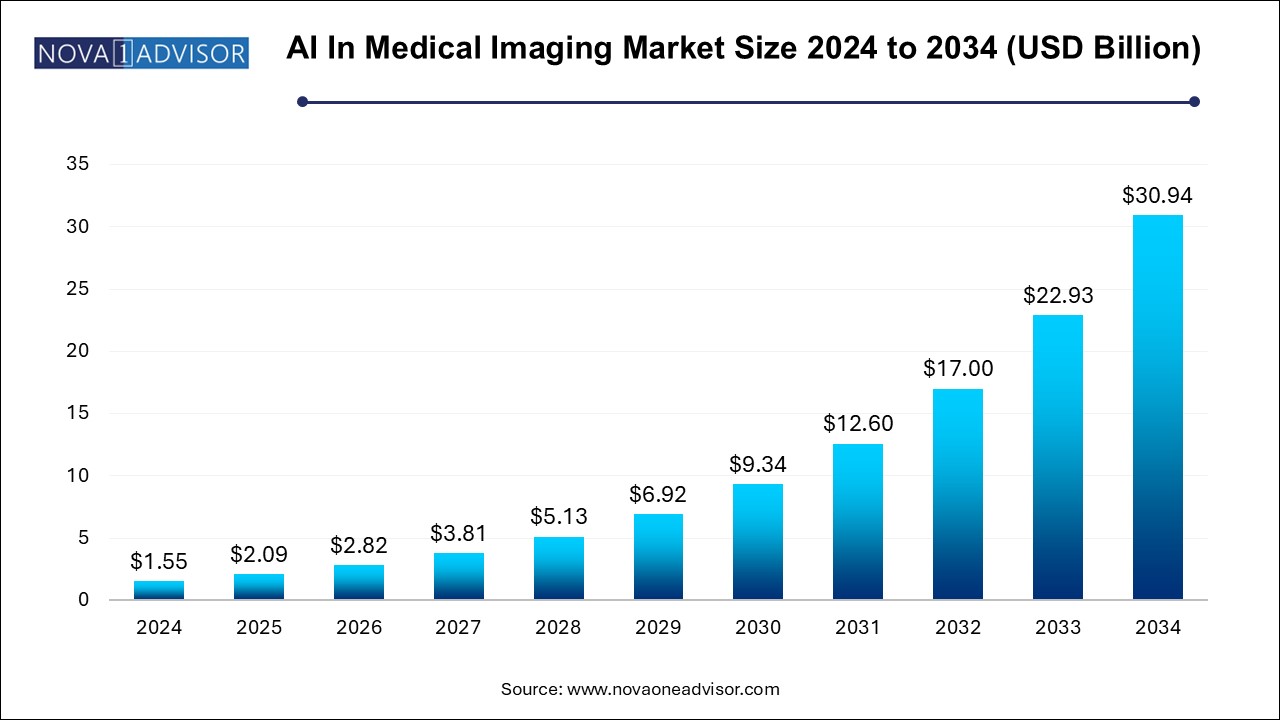

The AI in medical imaging market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 30.94 billion by 2034, growing at a CAGR of 34.9% during the forecast period 2025 to 2034.

AI In Medical Imaging Market Key Takeaways:

- Based on technology, the deep learning segment held the largest share of 57.94% in 2024.

- Based on application, the neurology segment held the largest market share in 2024.

- The CT scan segment held the largest market share in 2024.

- The hospitals segment dominated the market with the largest share of 53.0% in 2024.

- The AI in medical imaging market in North America dominated the global industry in 2024 and accounted for the largest revenue share of over 43.00% in 2024.

U.S. AI in Medical Imaging Market Size and Growth 2024 to 2034

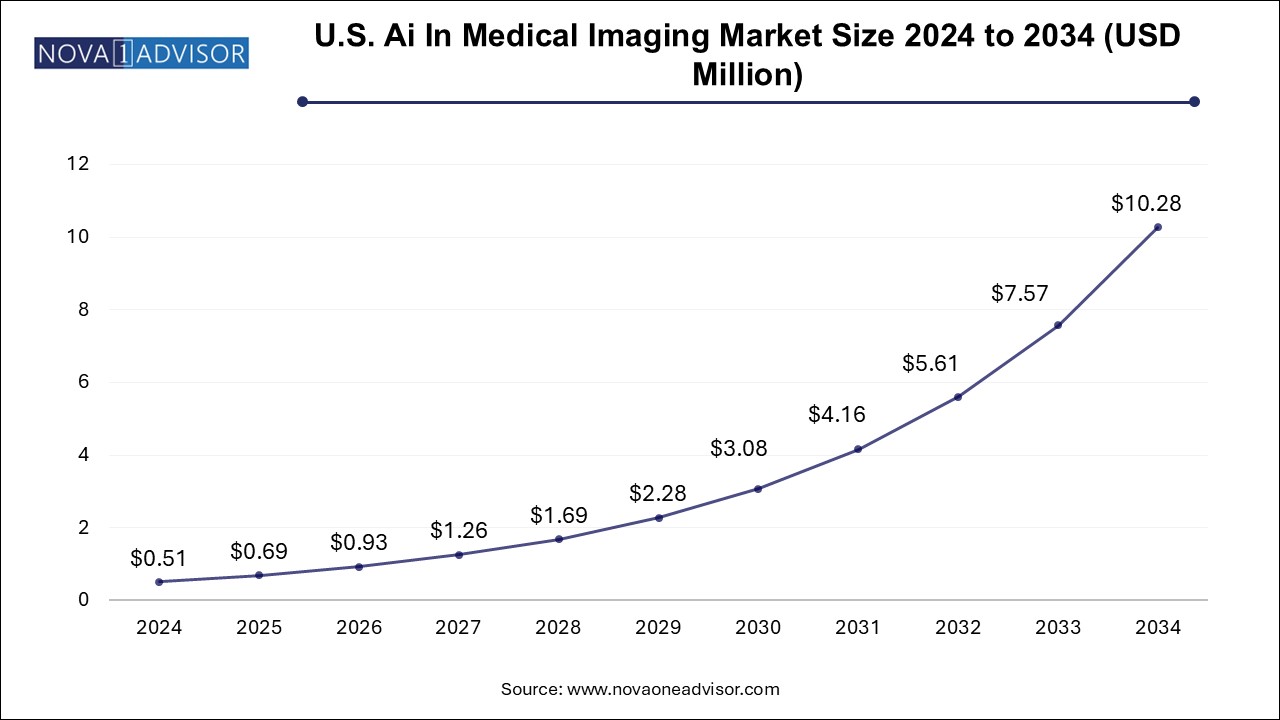

The U.S. AI in medical imaging market size is evaluated at USD 0.510 million in 2024 and is projected to be worth around USD 10.28 million by 2034, growing at a CAGR of 31.39% from 2025 to 2034.

What led North America to dominate the AI in medical imaging market?

North America is the global leader in the AI in medical imaging market, owing to a combination of advanced healthcare infrastructure, strong R&D capabilities, and supportive regulatory frameworks. The U.S. Food and Drug Administration (FDA) has approved more than 500 AI-enabled medical devices as of early 2025, many of which are imaging-focused. This regulatory clarity has allowed vendors to innovate and commercialize products rapidly.

The presence of major AI developers like IBM Watson Health, Aidoc, Zebra Medical Vision, and Arterys, as well as imaging equipment OEMs such as GE Healthcare and Siemens Healthineers with regional R&D hubs, fuels continued growth. U.S. academic medical centers and teleradiology providers are also adopting AI tools for research, education, and clinical service delivery.

U.S. AI in medical imaging market trends

The rising adoption of AI-based MRI systems in the hospitals and diagnostics centers to deliver superior images of organs has driven the market growth. Also, collaborations among tech companies and healthcare providers to develop AI-integrated imaging solutions is playing a vital role in shaping the industrial landscape.

Why is Asia-Pacific the fastest-growing region in the AI in medical imaging market?

Asia-Pacific is the fastest-growing region, driven by increasing demand for imaging services, a rising middle class, and rapid digitization of healthcare systems. Countries like China, India, Japan, and South Korea are witnessing massive investments in AI startups, public health diagnostics, and smart hospital infrastructure. China’s “Healthy China 2030” initiative and India’s digital health mission are creating conducive environments for AI adoption in diagnostics.

AI is being used in tuberculosis screening, stroke detection, breast cancer diagnosis, and prenatal ultrasound across urban and rural areas. Domestic tech giants like Alibaba, Ping An, and Lunit are developing region-specific AI models optimized for local demographics and imaging protocols. With large population datasets, supportive governments, and cost-effective engineering talent, Asia-Pacific is expected to become a global AI hub in imaging.

China AI in medical imaging market analysis

The growing prevalence of cardiovascular diseases coupled with rising sales of AI-enabled MRI machines has boosted the market expansion. Additionally, rapid investment by government for deploying AI-integrated imaging solutions in public hospitals along with technological advancements in the healthcare sector is shaping the industry in a positive direction.

Why Europe is a significant contributor of the AI in medical imaging market?

Europe is a significant contributor of the AI in medical imaging industry. The rising cases of neurovascular diseases in several countries such as Germany, Italy, UK, France and some others has propelled the industrial expansion. Moreover, the increasing investment by healthcare companies for developing AI-based imaging solution along with the presence of numerous AI companies is expected to drive the growth of the AI in medical imaging market in this region.

Germany AI in medical imaging tools market analysis

The growing adoption of AI-enabled diagnostics solutions for delivering detailed anatomy of several body parts has boosted the market expansion. Also, partnerships among AI developers and healthcare providers to deploy AI-based imaging solutions in modern hospitals is playing a prominent role in shaping the industrial landscape.

What is the role of Latin America in the AI in medical imaging industry?

Latin America has played a prominent role in the AI in medical imaging market. The growing demand for AI-enabled imaging solutions in several nations such as Argentina, Brazil, Venezuela and some others has driven the market expansion. Also, rapid investment by government for deploying AI in the healthcare sector is expected to boost the growth of the AI in medical imaging market in this region.

Argentina AI in medical imaging market trends

The rising emphasis of the healthcare sector to adopt AI-enabled imaging solutions for enhancing the capabilities of neurological sector is accelerating the market expansion. Additionally, the rise in number of AI startups coupled with rapid digitalization of the healthcare sector is contributing to the industry in a positive manner.

Why Middle East and Africa held a notable share of the AI in medical imaging market?

Middle East and Africa held a notable share of the industry. The rising use of AI-based imaging tools in the diagnostics centers in numerous countries including UAE, Saudi Arabia, South Africa and some others has boosted the market growth. Additionally, the presence of numerous market players coupled with technological advancements in the AI sector is expected to propel the growth of the AI in medical imaging market in this region.

UAE AI in medical imaging market analysis

The growing demand for high-quality imaging solutions from the healthcare centers to enhance diagnosis methodology has boosted the market expansion. Additionally, the rapid investment by AI developers to designing AI-enabled imaging solutions for the healthcare sector is playing a prominent role in shaping the industrial landscape.

Market Overview

The AI in medical imaging market represents one of the most transformative innovations in healthcare, where artificial intelligence is enhancing diagnostic precision, accelerating clinical workflows, and augmenting decision-making across radiology and imaging departments. Leveraging deep learning algorithms, computer vision, and natural language processing (NLP), AI is reshaping how imaging data produced from CT, MRI, X-rays, ultrasounds, and nuclear imaging modalities is processed, interpreted, and integrated into patient care.

Medical imaging data is voluminous and complex, often requiring detailed examination across hundreds of slices or scans. AI algorithms are capable of rapidly analyzing these datasets with high accuracy, highlighting abnormalities, quantifying disease progression, and even predicting future complications. In scenarios like stroke detection, pulmonary embolism, or early breast cancer, AI can identify anomalies in seconds, far faster than traditional radiologist workflows.

The increasing demand for imaging due to aging populations, chronic diseases, and expanded access to healthcare has resulted in rising workloads for radiologists globally. AI addresses this bottleneck by automating routine tasks, flagging critical findings, and facilitating triage, thereby improving throughput and reducing diagnostic errors. In parallel, AI applications in imaging are expanding into non-diagnostic areas like image acquisition enhancement, protocol standardization, and longitudinal data analytics.

With regulatory approvals accelerating, large-scale clinical validation growing, and partnerships forming between AI startups and global OEMs like GE Healthcare, Siemens Healthineers, and Philips, the AI in medical imaging market is poised for exponential growth. From research centers to rural clinics, AI-powered imaging is redefining the frontiers of precision medicine and diagnostic care.

AI in medical imaging market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rapid investment by healthcare brands to develop AI-integrated imaging platforms coupled with technological advancements in the healthcare sector globally.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and service launches. Several AI companies such as HeartFlow, Inc., Enlitic, Inc., Canon Medical Systems USA, Inc., Viz.ai, Inc. and some others have started investing rapidly for developing advanced AI solutions for enhancing healthcare imaging.

- Startup Ecosystem: Various startup brands are engaged in developing AI-enabled tools for the healthcare sector. The prominent startup companies dealing in AI-based medical imaging comprises of Qure.ai, Spring Health, Tempus and some others.

Major Trends in the Market

-

Proliferation of FDA-Approved AI Imaging Tools: Regulatory bodies have begun approving AI tools for clinical use, validating their safety and effectiveness.

-

Integration with PACS and Radiology Information Systems (RIS): Seamless AI-PACS integration is streamlining adoption and improving workflow compatibility.

-

Growth in AI for Triage and Workflow Prioritization: AI tools are helping radiologists by flagging urgent cases, such as brain bleeds or pulmonary embolisms.

-

Expansion of AI in Point-of-Care Ultrasound (POCUS): AI is aiding non-radiologist clinicians in acquiring and interpreting ultrasound images at the bedside.

-

Advancements in Explainable AI (XAI): Efforts to make AI outputs interpretable are improving clinician trust and regulatory compliance.

-

Cloud-Based Imaging AI Platforms: AI-as-a-Service models allow hospitals to adopt AI without large capital investments in IT infrastructure.

-

Multimodal AI Combining Imaging with EMR/Lab Data: AI platforms are now synthesizing imaging with electronic health record (EHR) data for comprehensive clinical insights.

Report Scope of AI In Medical Imaging Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.09 Billion |

| Market Size by 2034 |

USD 30.94 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 34.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Technology, Application, Modalities, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

GE HealthCare; Microsoft; Digital Diagnostics Inc.; TEMPUS; Butterfly Network, Inc.; Advanced Micro Devices, Inc.; HeartFlow, Inc.; Enlitic, Inc.; Canon; Medical Systems USA, Inc.; Viz.ai, Inc., EchoNous, Inc.; eartVista Inc.; Exo Imaging, Inc.; Nano-X Imaging Ltd. |

AI In Medical Imaging Market By Technology Insights

Deep learning dominates the AI in medical imaging market due to its superior performance in image recognition, segmentation, and classification tasks. Convolutional Neural Networks (CNNs) and U-Net architectures are extensively used to process high-resolution imaging data such as CT, MRI, and mammograms. These models learn from thousands of annotated cases to detect anomalies like tumors, hemorrhages, and fractures. Vendors such as Aidoc, Zebra Medical Vision, and Arterys have developed deep learning models that are now FDA-approved for clinical use across various modalities.

However, Natural Language Processing (NLP) is the fastest-growing technology segment. NLP is used to extract insights from radiology reports, clinical notes, and pathology records, often unstructured in nature. When combined with imaging, NLP enables the creation of rich patient profiles for clinical decision support. It also plays a role in auto-generating structured reports, identifying missed findings in retrospective analysis, and supporting clinical trial matching. As imaging becomes increasingly integrated with EHRs, NLP’s ability to synthesize narrative and quantitative data is becoming invaluable.

AI In Medical Imaging Market By Application Insights

Neurology has emerged as the dominant application segment due to the prevalence of conditions like stroke, dementia, multiple sclerosis, and traumatic brain injury, which all rely heavily on MRI and CT imaging. AI tools have demonstrated impressive accuracy in identifying ischemic strokes, brain hemorrhages, gliomas, aneurysms, and other critical findings. Stroke triage algorithms have been particularly impactful, reducing door-to-needle time for thrombolysis or thrombectomy procedures. Companies like Viz.ai and RapidAI have built large neurology-focused AI product portfolios that are now being adopted in stroke centers globally.

On the other hand, cardiology is the fastest-growing application segment. AI-powered echocardiography, cardiac MRI, and CT angiography tools are gaining traction in detecting valvular heart disease, coronary artery stenosis, myocardial infarction, and left ventricular dysfunction. These tools assist cardiologists in quantifying ejection fraction, identifying perfusion defects, and planning interventions. With cardiovascular disease being the leading cause of death worldwide, early detection and risk stratification through imaging are becoming strategic priorities, and AI is at the forefront of this transformation.

AI In Medical Imaging Market By Modalities Insights

X-ray imaging dominates the market in terms of volume and AI adoption, primarily because of its widespread availability, cost-effectiveness, and utility across various conditions. AI algorithms for chest X-rays are used for detecting pneumonia, tuberculosis, pleural effusion, lung nodules, rib fractures, and cardiomegaly. Chest X-rays are often the first imaging modality used in emergency and outpatient settings, making AI-assisted diagnosis highly scalable and impactful.

Meanwhile, ultrasound is the fastest-growing modality in AI applications. The expansion of point-of-care ultrasound (POCUS) and handheld devices has democratized access to sonographic imaging across emergency rooms, rural clinics, and ambulances. AI tools now assist in probe guidance, image quality assessment, and anatomical landmark identification, enabling even novice users to perform scans accurately. Applications include obstetric monitoring, cardiac assessments, trauma evaluations, and liver disease staging. Vendors such as Butterfly Network and Clarius are integrating AI directly into devices to make ultrasound a smart, autonomous diagnostic tool.

AI In Medical Imaging Market By End Use Insights

Hospitals represent the largest end-use segment, especially tertiary and academic medical centers that have the infrastructure, IT support, and budgets to adopt AI imaging platforms. These institutions are typically early adopters, using AI for a range of tasks including emergency triage, inpatient monitoring, and surgical planning. Integration with hospital PACS, EHR, and RIS systems is typically more feasible in these environments, and AI can be leveraged to reduce bottlenecks and improve patient flow.

However, diagnostic imaging centers are the fastest-growing end users of AI imaging technologies. These centers face high volumes and competition, making speed and accuracy critical differentiators. AI tools offer productivity gains through auto-triage, faster reporting, and error reduction, making them attractive to private imaging facilities. As reimbursement models evolve to favor outcomes and efficiency, imaging centers are expected to invest more in AI platforms that improve turnaround and diagnostic precision.

Some of the prominent players in the AI in medical imaging market include:

- GE HealthCare

- Microsoft

- Digital Diagnostics Inc.

- TEMPUS

- Butterfly Network, Inc.

- Advanced Micro Devices, Inc.

- HeartFlow, Inc.

- Enlitic, Inc.

- Canon Medical Systems USA, Inc.

- Viz.ai, Inc.

- EchoNous, Inc.

- HeartVista Inc.

- Exo Imaging, Inc

- Nano-X Imaging Ltd.

AI In Medical Imaging Market Recent Developments

- In January 2024, GE HealthCare announced an acquisition agreement with MIM Software from Cleveland, a global provider of medical imaging analysis and AI solutions in molecular radiotherapy, radiation oncology, urology, and diagnostic imaging. The acquisition aims to integrate MIM Software's imaging analytics and digital workflow capabilities across diverse care areas, enhancing innovation and distinguishing GE HealthCare's solutions to positively impact patients and healthcare systems globally

- In November 2024, GE HealthCare announced its AI suite named MyBreastAI at the RSNA 2024 conference. This innovative product helps streamline radiologists' workflows, offering them advanced tools to identify and diagnose breast cancer at earlier stages, ultimately contributing to improved patient outcomes

- In November 2024, Canon Medical Systems introduced two out of four new computed tomography scanners, utilizing the upgraded Aquilion CT platform and incorporating artificial intelligence algorithms for improved image quality and simplified scanner workflows

- In September 2024, COTA, a company working on real-world oncology data and analytics, introduced Vista, a vast automated EHR dataset, to expedite cancer research and implement reliable generative artificial intelligence in cancer care. Vista utilizes automated data abstraction, machine learning algorithms, and medical expert oversight to extract clinically pertinent information from electronic medical records, providing biopharmaceutical companies with timely insights for the accelerated development of life-saving therapies

- In July 2022, the FDA gave Philips SmartSpeed AI-based software its 510(k) approval, enabling it to offer ground-breaking high-speed, high-resolution MR imaging. Its broad compatibility enables quicker and higher-quality scans for almost all patients with various illnesses, including those with implants (97% of clinical protocols). In addition, the intelligent MR acceleration software offers three times quicker scans, which increases MR department efficiency with high-quality picture resolution

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the AI in medical imaging market

By Technology

- Deep Learning

- Natural Language Processing (NLP)

- Other

By Application

- Neurology

- Respiratory and Pulmonary

- Cardiology

- Breast Screening

- Orthopedics

- Others

By Modalities

- CT Scan

- MRI

- X-rays

- Ultrasound

- Nuclear Imaging

By End Use

- Hospitals

- Diagnostic Imaging Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)