UK Imaging Services Market Size and Research

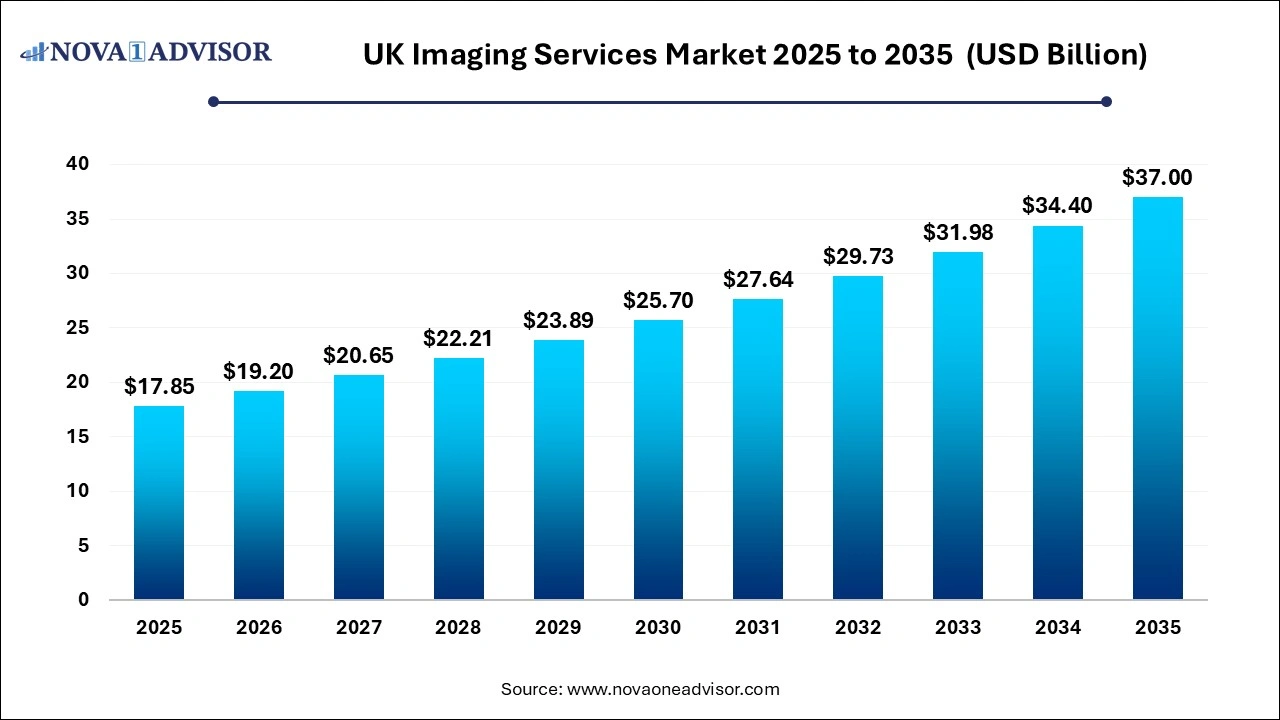

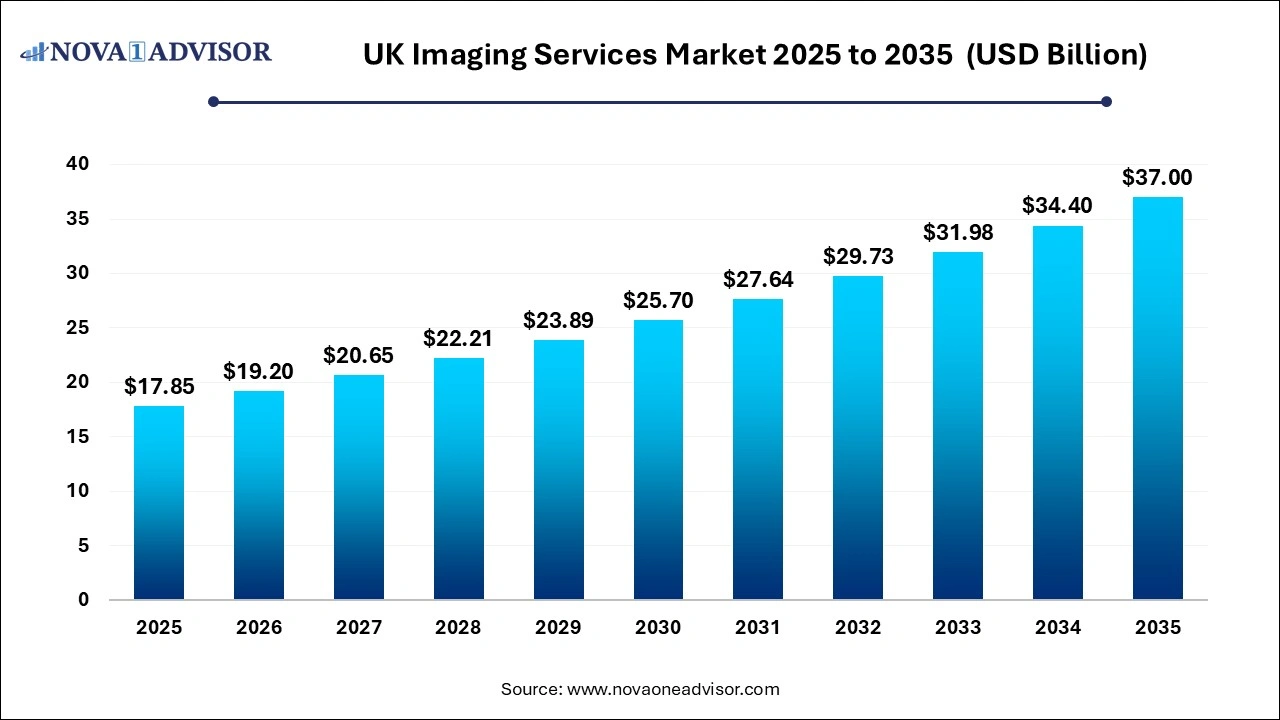

The UK imaging services market size was exhibited at USD 17.85 billion in 2025 and is projected to hit around USD 37.00 billion by 2035, growing at a CAGR of 7.56% during the forecast period 2026 to 2035. The UK imaging services market expansion is driven by the rising incidences of chronic diseases, increasing demand for advanced imaging modalities across various healthcare settings, improvements in cloud services and adoption sophisticated diagnostic imaging tools.

UK Imaging Services Market Key Takeaways:

- The MRI segment held the largest market share of 33% in 2025.

- The CT scan segment is expected to witness the fastest growth during the forecast period of 7.75%.

- The hospital segment held the largest share of 50% in 2025.

- The diagnostic imaging centers segment is expected to grow at a fastest CAGR over the forecast period.

Market Overview

The UK Imaging Services Market stands as a vital pillar in the country’s healthcare delivery system, providing diagnostic, monitoring, and screening solutions essential for clinical decision-making. Imaging services encompass a wide array of modalities, including X-rays, ultrasound, CT scans, MRI scans, and nuclear medicine. These technologies are used in diagnosing diseases ranging from fractures and infections to cancer, cardiovascular anomalies, and neurological disorders. In the UK, imaging services are provided through a mix of National Health Service (NHS) hospitals, private diagnostic centres, mobile imaging units, and increasingly, community-based hubs.

With an aging population, increasing prevalence of chronic diseases, and a greater focus on early disease detection, demand for imaging services across the UK has been on a steady rise. The COVID-19 pandemic, while initially reducing elective imaging procedures, has also underscored the critical importance of diagnostic services in healthcare preparedness. As elective procedures rebound and patient backlogs are addressed, the market has entered a phase of accelerated recovery and innovation.

A key feature of the UK imaging services market is its dual-structure, wherein the NHS provides the majority of services, supplemented by a robust and growing private sector. Public-private partnerships (PPPs) have become increasingly common, especially in addressing service bottlenecks and reducing NHS waiting times. Simultaneously, technological advancements in imaging modalities — such as faster MRI scans, AI-assisted image interpretation, and portable ultrasound devices — are enhancing diagnostic accuracy, reducing scan-to-report turnaround time, and facilitating early intervention.

Government efforts to digitize healthcare, investments in AI-based radiology platforms, and an increased focus on patient-centric care are reshaping the imaging services landscape in the UK. With strong policy support, infrastructure upgrades, and rising awareness of preventive healthcare, the imaging services market in the UK is expected to expand significantly over the next decade.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI): AI tools are being integrated into diagnostic workflows for faster image interpretation, automated reporting, and triaging of high-risk cases.

-

Shift Toward Community Diagnostic Centres (CDCs): The NHS is establishing decentralized imaging hubs to reduce pressure on hospital imaging departments and improve patient access.

-

Growing Private Sector Involvement: Private diagnostic providers are partnering with NHS trusts and expanding standalone centres to meet increasing imaging demand.

-

Portable and Point-of-Care Imaging Devices: The rise of mobile and handheld ultrasound machines is enabling bedside diagnostics, particularly in emergency and rural settings.

-

Digital Imaging and Teleradiology: Cloud-based PACS (Picture Archiving and Communication Systems) and remote reporting services are gaining traction to manage high scan volumes.

-

Cancer Screening Initiatives: National programs for breast, colorectal, and lung cancer screening are driving demand for high-resolution and high-volume imaging.

-

Staffing and Radiologist Shortages: Skill shortages are prompting increased reliance on AI, automation, and international recruitment to support diagnostic capacity.

-

Equipment Modernization Programs: NHS and private providers are investing in newer-generation CT and MRI machines to replace aging infrastructure and improve image quality.

Artificial intelligence (AI) is increasingly being deployed in UK imaging services for optimizing workflows and advancing image analysis. Automation of tasks such as image reconstruction, protocol selection and quality control with the use of AI is improving the efficiency, streamlining operations and reducing workload for radiologists. Analysis of medical images through AI algorithms can facilitate early detection of diseases such as diabetic foot disease, lung cancer and heart disease, leading to timely intervention and enhanced patient life outcomes. Diagnostic companies, healthcare providers and technology providers in the UK are actively collaborating and investing in R&D activities for implementation of AI in imaging modalities.

Report Scope of UK Imaging Services Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 19.20 Billion |

| Market Size by 2035 |

USD 37.00 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.56% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Modality, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Alliance Medical; InHealth Group; Neuromed Diagnostic Imaging Center; UNILAB; Medica Group; TIC Health; The Clinic; Affidea Group; Vista Health; Medical Imaging Partnership |

The primary growth driver for the UK imaging services market is the rising burden of chronic and age-related diseases that necessitate early diagnosis and continuous monitoring. According to the UK Office for National Statistics (ONS), over 18% of the UK population is aged 65 and above a figure projected to increase steadily through the forecast period. This demographic shift is associated with higher incidences of musculoskeletal disorders, cardiovascular diseases, neurodegenerative conditions, and cancers all of which rely heavily on imaging diagnostics for accurate diagnosis, treatment planning, and follow-up.

Imaging modalities such as MRI for neurological assessment, CT for cardiac imaging, and ultrasound for vascular conditions are becoming essential tools for managing the aging population’s health needs. The increasing complexity of medical conditions also calls for multi-modality diagnostic approaches, boosting the demand for integrated imaging service providers. As the UK transitions toward more personalized and preventive models of care, imaging will remain a central pillar, contributing not only to diagnosis but also to treatment monitoring and outcome evaluation.

Key Market Restraint: Radiologist Workforce Shortage

Despite growing demand, the UK imaging services market faces a critical constraint in the form of radiologist and imaging technician shortages. According to the Royal College of Radiologists (RCR), the NHS in England faces a shortfall of thousands of radiologists, with many departments under significant operational stress. This workforce gap results in delayed reporting times, longer patient waiting lists, and suboptimal utilization of installed imaging equipment.

The shortage is exacerbated by increasing scan complexity, growing scan volumes, and a high attrition rate due to burnout and retirement. While AI and teleradiology solutions are helping mitigate the impact to some extent, the need for skilled professionals remains central to service delivery. Recruitment from overseas, expanded training capacity, and better workforce retention strategies are urgently required. Until these systemic workforce challenges are addressed, service scalability and quality assurance may remain constrained across various modalities.

One of the most promising opportunities in the UK imaging services market is the government-backed expansion of Community Diagnostic Centres (CDCs). In response to long NHS waiting lists and limited hospital imaging capacity, the Department of Health and Social Care launched a national plan to establish over 160 CDCs across England by 2025. These centres are designed to provide MRI, CT, ultrasound, and X-ray services outside of hospital settings, making diagnostic services more accessible and patient-centric.

This decentralization strategy offers tremendous opportunities for both public and private imaging service providers. NHS trusts can reduce hospital congestion and improve care coordination, while private providers can bid for service contracts, offer equipment leasing, or operate centres under public-private partnership models. With CDCs being equipped with advanced, high-throughput machines and digital infrastructure, they also open avenues for remote diagnostics, AI implementation, and integrated chronic disease management. This shift is expected to reshape how imaging services are accessed and delivered across the UK.

UK Imaging Services Market By Modality Insights

The MRI segment held the largest market share of 33% in 2025. driven by increasing demand for non-invasive, high-resolution imaging of soft tissues, brain structures, spinal injuries, and musculoskeletal disorders. MRI’s ability to diagnose complex conditions such as multiple sclerosis, tumors, and joint abnormalities has expanded its use in neurology, orthopedics, and oncology. Recent technological advancements, including 3T MRI, silent MRI, and cardiac MRI, have further broadened clinical applications. The NHS's ongoing MRI fleet modernization programs, coupled with growing private sector investment, are accelerating the installation of next-generation MRI scanners across UK facilities.

X-rays dominated the modality segment due to their wide application, affordability, and rapid image acquisition. X-ray imaging remains the first-line diagnostic tool for a broad range of clinical conditions, including fractures, infections, and respiratory issues. It is used across emergency departments, outpatient clinics, and dental settings, making it the most commonly performed diagnostic imaging procedure in the UK. The availability of digital radiography systems has further enhanced the efficiency and throughput of X-ray services, particularly within NHS community settings and mobile diagnostic units.

UK Imaging Services Market By End-use Insights

Hospitals hold the dominant position in the end-use segment, given their role as primary healthcare providers across the UK. NHS hospitals account for the bulk of imaging procedures, serving both emergency and elective care patients. These facilities house comprehensive imaging departments capable of multi-modality scanning, supported by specialist radiologists and interventional teams. Hospital-based imaging also benefits from direct integration with surgical and therapeutic services, enabling seamless care delivery. Moreover, hospitals are central to medical education and research, making them ideal for piloting AI and machine learning applications in radiology.

Diagnostic Imaging Centres are the fastest-growing segment, as the UK healthcare system seeks to expand capacity beyond traditional hospital settings. Private and independent imaging providers are increasingly setting up standalone facilities in urban, suburban, and even rural areas. These centres often operate extended hours, offer fast turnaround times, and serve both NHS-referred and self-paying patients. Their agility in adopting new technologies, delivering high-quality imaging, and partnering with insurers and corporates is driving growth. The integration of these centres within the NHS CDC program further amplifies their role in modernizing diagnostic services in the UK.

Country-Level Analysis

As a single-country focus market, the United Kingdom offers a unique landscape shaped by its publicly funded National Health Service (NHS), a growing private healthcare sector, and strong policy backing for diagnostic modernization. England accounts for the majority of imaging service utilization, followed by Scotland, Wales, and Northern Ireland. NHS England’s push for diagnostics transformation — through investments in digital infrastructure, AI, and mobile scanning units — is central to market dynamics. Simultaneously, Scotland has launched initiatives to improve rural diagnostic access through mobile MRI vans and teleradiology partnerships.

Urban centers like London, Manchester, and Birmingham serve as diagnostic hubs, with a concentration of teaching hospitals, specialist clinics, and private imaging chains. Meanwhile, rural and underserved regions are benefiting from community imaging programs and mobile diagnostics. With aging infrastructure and workforce limitations posing persistent challenges, the UK government is incentivizing innovation, outsourcing, and private partnerships to bridge the diagnostic care gap. These strategies, coupled with a well-regulated but innovation-driven market environment, position the UK as one of the most active imaging services markets in Europe.

UK Imaging Services Market Recent Developments

- In July 2025, University Hospital Southampton NHS Foundation Trust (UHS) transformed its breast imaging services with installation of UK’s first next generation 3D mammography system, MAMMOMAT B.brilliant mammography system from Siemens Healthineers. The news system offers fastest scan time of less than five seconds through its 50° wide-angle tomosynthesis, flying focal spot technology and improves image quality with Premia AI reconstruction.

- In March 2025, Synapse Medical UK, a division of Uniphar Medtech, entered into a landmark partnership with Agfa Radiology Solutions. Through this collaboration Synapse Medical UK will deliver full end-to-end sales and technical service offering for the comprehensive medical imaging product portfolio of Agfa Radiology Solutions across Scotland.

- In January 2025, GE HealthCare and Nuffield Health signed a $246.6 million deal for strengthening diagnostic imaging services across Nuffield Health’s hospitals in the UK.

- In August 2024, CVC DIF announced the acquisition of medneo Group’s medneo UK which is a leading mobile diagnostic company providing specialized mobile MRI and CR scanners, and imaging services.

Some of the prominent players in the UK imaging services market include:

- Alliance Medical

- InHealth Group

- Neuromed Diagnostic Imaging Centre

- UNILAB

- Medica Group

- TIC Health

- The radiology Clinic

- Affidea Group

- Vista Health

- Medical Imaging Partnership

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the UK imaging services market

Modality

- X-rays

- CT Scans

- MRI Scans

- Ultrasound

- Nuclear Medicine Scans

End-use

- Hospitals

- Diagnostic Imaging Centers

- Others