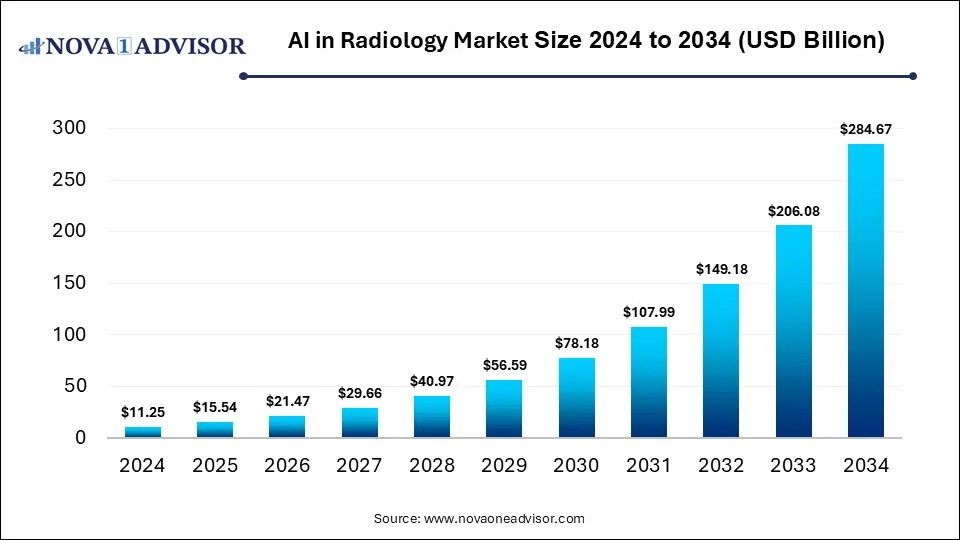

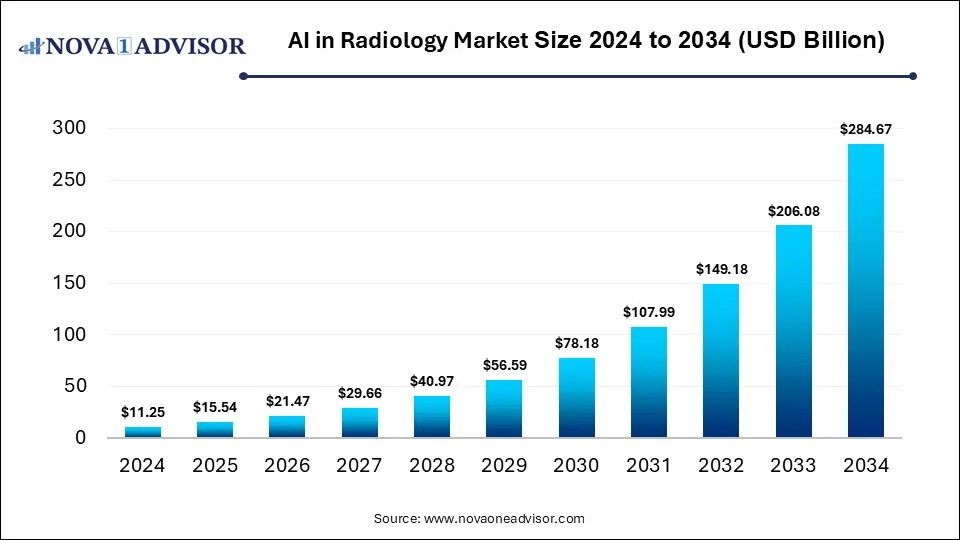

AI In Radiology Market Size and Growth 2025 to 2034

The global AI in radiology market size was estimated at USD 11.25 billion in 2024 and is expected to reach USD 284.67 billion in 2034, expanding at a CAGR of 38.14% during the forecast period of 2025 and 2034. The market growth is driven by the rising demand for early disease detection, advances in algorithmic image analysis, cost pressures on healthcare, and increasing regulatory and infrastructure support.”

AI In Radiology Market Key Takeaways

- By region, North America held the largest share of the AI in Radiology market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By modality, the CT (computed tomography) segment led the market in 2024.

- By modality, the X-ray segment is expected to expand at the highest CAGR over the projected timeframe.

- By application, the neurology segment led the market in 2024.

- By application, the breast screening segment is expected to expand at the highest CAGR over the projection period.

- By technology, the deep learning segment led the market in 2024.

- By deployment mode, the cloud-based segment held the dominant share in 2024.

- By end user, the hospitals segment led the market in 2024.

Impact of AI on the AI in Radiology Market

AI is significantly enhancing diagnostic accuracy, efficiency, and workflow automation. Advanced algorithms can rapidly analyze vast volumes of medical imaging data, enabling early detection of diseases such as cancer, stroke, and neurological disorders with high precision. This not only reduces the workload for radiologists but also shortens diagnosis time, leading to faster treatment decisions. AI is also facilitating the development of personalized imaging protocols and predictive analytics, improving patient outcomes. As regulatory approvals and healthcare IT infrastructure advance, AI adoption in radiology continues to accelerate across both developed and emerging markets.

- In December 2024, Gen AI is being explored to synthesize and pre-draft radiology reports, saving radiologists time on repetitive tasks, improving efficiency, and reducing burnout.

Market Overview

The market growth is attributed to the rising incidence of chronic diseases, increasing demand for early diagnosis, advancements in imaging technology, and expanding regulatory support for AI-based tools. As healthcare systems seek cost-effective and scalable solutions, AI in radiology is becoming a critical component of modern diagnostic services. The AI in radiology refers to the integration of artificial intelligence technologies, such as machine learning, deep learning, and computer vision, into radiological imaging processes to enhance diagnosis, interpretation, and workflow.

AI offers significant advantages across applications like oncology, neurology, and cardiology by enabling faster, more accurate image analysis, early disease detection, and reduced human error. It also helps automate repetitive tasks, optimize imaging protocols, and support clinical decision-making, leading to improved patient outcomes and operational efficiency. Regulatory bodies have recognized the potential of AI to enhance medical device capabilities and are providing clearer pathways for its integration.

- For instance, the U.S. FDA has been increasingly involved in providing guidance and clearance for AI-powered medical devices, leading to more standardized and validated AI applications in the clinical environment.

What are the Major Trends in the AI in Radiology Market?

- Rising Adoption of Deep Learning in Imaging

Deep learning algorithms are increasingly being used for complex image analysis tasks such as tumor detection, segmentation, and classification, improving diagnostic accuracy and consistency across imaging modalities.

- Shift Toward Cloud-Based AI Solutions

Healthcare providers are adopting cloud-based AI platforms for easier integration with PACS/EHR systems, scalability, and remote access, especially beneficial for smaller clinics and underserved regions.

- Growth in AI-Powered Decision Support Tools

AI is evolving beyond image interpretation to provide radiologists with real-time decision support, offering risk scores, diagnostic suggestions, and treatment pathway recommendations based on imaging and clinical data.

- Integration with Multi-Modal Data Sources

There is a growing trend of integrating imaging data with genomic, lab, and clinical data using AI to support precision medicine approaches, particularly in oncology and personalized treatment planning.

- Regulatory Advancements and Clinical Validation

Regulatory bodies like the FDA and EMA are streamlining approval processes for AI tools, encouraging investment and faster market entry; at the same time, clinical validation studies are becoming more rigorous to ensure safety and efficacy.

Report Scope of AI In Radiology Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 15.54 Billion |

| Market Size by 2034 |

USD 284.67 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 38.14% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Modality, By Application, By Technology, By Component, By Deployment Mode, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Demand for Early and Accurate Diagnosis

Rising demand for timely detection of diseases like cancer, stroke, and cardiovascular conditions to improve treatment outcomes and reduce healthcare costs is a major factor driving the growth of the AI in radiology market. AI-powered imaging tools can analyze medical scans with high precision, identifying subtle abnormalities that may be missed by the human eye, thus enabling earlier intervention. This capability is especially critical in high-risk and ageing populations, where early diagnosis directly impacts survival rates. Additionally, the increasing volume of diagnostic imaging exams has overwhelmed radiology departments, making AI a vital tool to enhance speed and accuracy without compromising quality. As healthcare systems prioritize proactive and preventative care, AI's role in supporting early, reliable diagnosis continues to gain momentum.

- In December 2024, AGFA HealthCare and Rad AI formed a strategic partnership to streamline radiology workflows. By integrating Rad AI's reporting tools and FHIRcast technology into AGFA’s Enterprise Imaging platform, the collaboration enhances speed, accuracy, and interoperability, setting a new standard in AI-powered radiology.

Technological Advancements in AI Algorithms

Advances in AI algorithms, including ML and deep learning, are likely to drive market growth. These sophisticated algorithms can detect patterns, anomalies, and early signs of disease with a level of precision that enhances diagnostic confidence and reduces interpretation errors. Continuous improvements in model training, data labelling, and algorithm explainability are also making AI tools more robust and reliable for clinical use. Moreover, the ability of advanced AI systems to learn from vast datasets and adapt to new imaging modalities supports a wide range of applications across oncology, neurology, cardiology, and more. As these technologies evolve, they are becoming integral to modern radiology workflows, driving greater adoption across healthcare systems worldwide.

Restraint

High Initial Implementation Costs

The market growth is hindered by particularly for smaller healthcare facilities and those in developing regions. Deploying AI solutions often requires substantial investments in advanced hardware, software integration, data storage infrastructure, and cybersecurity measures. Additionally, there are ongoing costs related to training radiologists and IT staff, as well as maintaining and updating AI systems to ensure compliance and performance. For many institutions with limited budgets, these upfront expenses can outweigh the long-term benefits, delaying adoption. As a result, the market faces slower penetration in cost-sensitive environments, despite the proven clinical advantages of AI in imaging.

Opportunities

Development of Specialized AI Applications

The market is creating emerging opportunities for addressing specific diagnostic needs with high precision and efficiency. Tailored AI tools, for example, those focused on breast cancer screening, lung nodule detection, or stroke assessment, are designed to meet the unique requirements of each clinical use case, improving diagnostic accuracy and patient outcomes. These niche solutions are gaining traction among healthcare providers seeking targeted tools that integrate seamlessly into existing workflows. Additionally, specialization allows companies to differentiate themselves in a competitive market and secure regulatory approvals more quickly for focused applications.

- In April 2024, Bayer and Google Cloud entered into a partnership to accelerate the development and deployment of AI-powered healthcare applications for radiologists using Google Cloud's generative AI tools

Expansion in Emerging Markets

The market is creating immersive opportunities, growing healthcare needs, increasing disease burden, and ongoing investments in medical infrastructure. Many developing countries face a shortage of skilled radiologists and diagnostic facilities, making AI-driven imaging solutions an attractive option to improve access and efficiency. As governments and private sectors in these regions prioritize digital health transformation, there is rising interest in scalable, cost-effective AI tools that can enhance diagnostic accuracy even in resource-limited settings. Additionally, the proliferation of smartphones, cloud computing, and internet connectivity is enabling remote deployment and tele-radiology services powered by AI.

How Macroeconomic Variables Influence the AI in Radiology Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. enabling greater investments in healthcare infrastructure, technology adoption, and digital transformation. As countries experience economic development, governments and private healthcare providers are more likely to allocate budgets for advanced diagnostic tools, including AI-based imaging solutions. Conversely, in regions with stagnant or declining GDP, limited healthcare spending can restrain adoption due to cost sensitivity and prioritization of essential services over innovative technologies.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the AI in radiology market by tightening healthcare budgets and shifting focus toward cost containment. As operating costs rise, hospitals and healthcare systems may delay or scale back investments in advanced technologies like AI, prioritizing essential services instead. Additionally, financial pressures in the broader healthcare ecosystem can limit funding for innovation, slowing down the adoption of AI-driven radiology solutions despite their long-term efficiency benefits.

Exchange Rates

Exchange rate fluctuations can negatively affect, especially in developing countries that rely on importing AI software, hardware, or imaging equipment from abroad. A weaker local currency increases the cost of these imported technologies, making them less affordable for healthcare providers and delaying adoption. This financial barrier can limit market expansion in regions with unstable currencies, despite the growing demand for advanced diagnostic solutions.

Segment Outlook

Modality Insights

Why Did the CT (Computed Tomography) Segment Lead the Market in 2024?

The CT (computed tomography) segment led the AI in radiology market in 2024 due to its AI algorithms are especially suited to handle its large, high‑resolution, volumetric datasets, enabling accurate detection of lesions, vascular abnormalities, tumors, etc. Its dominance is boosted by advances like low‑dose imaging, improved image reconstruction, motion correction and lesion‑tracking across longitudinal scans, which address key clinical concerns (radiation exposure, speed, clarity). Also, CT is used broadly across critical fields such as oncology, cardiology, and neurology, where prompt, detailed imaging is needed for diagnosis, staging, monitoring and treatment planning, giving AI‑enabled CT solutions wide applicability.

The X-ray segment is expected to expand at the highest CAGR in the coming years. This is mainly due to widespread use, lower cost, and increasing accessibility across both developed and emerging healthcare systems. AI integration with X-ray imaging enables rapid detection of common conditions such as pneumonia, fractures, tuberculosis, and even COVID-19, making it highly valuable in high-volume, frontline settings. The relatively simple image structure of X-rays also allows AI algorithms to perform efficiently with high accuracy, even with limited data. Moreover, the rising demand for portable and mobile X-ray devices, especially in rural and remote areas, is further accelerating the need for AI-enhanced diagnostic tools that can support non-specialist users.

Application Insights

Why Did the Neurology Segment Dominate the AI in Radiology Market in 2024?

The neurology segment dominated the market with the largest share in 2024. This is because of the high global burden of neurological disorders (stroke, Alzheimer’s, Parkinson’s, multiple sclerosis), which require early detection and ongoing monitoring. Advanced imaging AI tools are particularly well-suited for neurology because they can analyze complex brain scans (MRI, CT) to detect subtle structural or functional changes, quantify lesion volume or brain atrophy, and accelerate emergencies like stroke. Regulatory support, research funding, and clinical validation are more mature for neuroimaging-based AI applications compared to many other specialities, which has helped neurology pull ahead. Finally, neurology applications tend to involve significant patient impact (high morbidity/mortality, long treatment courses), so healthcare payers and providers are more willing to invest in AI tools that improve diagnostic accuracy, speed, and patient outcomes in this area.

- In May 2025, Philips and NVIDIA, the two tech giants, are partnering to develop a foundational AI model for MRI, leveraging NVIDIA's AI computing platform.

The breast screening segment is expected to grow at the fastest CAGR during the projection period, owing to the global rise in breast cancer cases and the increasing emphasis on early detection through routine mammography. AI tools are proving highly effective in enhancing the accuracy and efficiency of breast imaging by identifying microcalcifications and subtle lesions that may be missed by radiologists, thus reducing false negatives and recall rates. Governments and healthcare organizations are expanding national screening programs, particularly in developed and emerging markets, which is boosting demand for AI-assisted mammography. Additionally, growing clinical validation and FDA approvals of AI algorithms for breast cancer detection are increasing confidence and adoption among healthcare providers.

Technology Insights

Why Did the Deep Learning Segment Lead the Market in 2024?

The deep learning segment led the AI in radiology market in 2024 due to its ability to learn hierarchical feature representations automatically, enabling high accuracy in detecting subtle abnormalities, lesion segmentation, classification, and pattern recognition tasks across different imaging modalities like CT, MRI, and X-ray. Because deep learning models scale well with increasing volumes of imaging data and improvements in computational hardware (GPUs, TPUs, cloud resources), they outperform more traditional machine learning approaches in many high-complexity diagnostic tasks. Moreover, regulatory approvals and clinical validation studies are increasingly favoring deep learning based tools, boosting confidence among providers and pushing their adoption.

The natural language processing (NLP) segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the much of the clinical/contextual data in radiology lives in unstructured form, radiology reports, clinical notes, patient histories, and NLP can extract, summarize, and structure that data efficiently. By doing so, NLP can enhance workflows, help reduce radiologist workload, and improve diagnostic decision-making by linking imaging findings with relevant clinical context. Also, there is a rising demand for interoperability and integration with electronic health records (EHRs) and hospital information systems, which drives the adoption of NLP technologies to make sense of textual data across systems. Moreover, regulatory and reimbursement trends are increasingly recognizing value in reporting accuracy, traceability, and documentation, all areas where NLP contributes significantly.

Deployment Mode Insights

Why Did the Cloud-Based Segment Lead the Market in 2024?

The cloud-based segment led the AI in Radiology market in 2024 due to its scalability and cost advantages: healthcare providers can avoid large upfront capital expenditure on hardware, instead relying on cloud providers for storage, compute, updates, and maintenance. Cloud solutions also integrate more easily with existing hospital IT systems like PACS, RIS, and EHRs, which help streamline diagnostics and reporting workflows. Further, cloud deployment makes it easier for smaller clinics, diagnostic centers, and facilities in resource-constrained settings to access advanced AI capabilities without needing high local compute infrastructure.

The on-promises segment is expected to expand at the highest CAGR in the coming years. This is mainly due to their lower upfront capital and maintenance costs, making advanced AI tools more accessible for smaller hospitals, diagnostic centers, or clinics in regions that lack strong IT budgets. Cloud deployment also supports remote access, tele radiology, collaboration, and sharing of imaging data across locations, which is increasingly important in global healthcare systems, especially for underserved or geographically dispersed populations. Further, cloud platforms are becoming more secure and compliant, addressing data privacy concerns, which builds trust and adoption across healthcare providers. Finally, the agility of cloud environments allows AI vendors to update models, deploy improvements, and integrate with other systems (like PACS, RIS, EHR) more rapidly, helping clinical workflows stay up to date.

End-Use Insights

Why Did the Hospitals Segment Lead the Market in 2024?

The hospitals segment led the AI in radiology market in 2024, as they handle very high volumes of imaging studies, including CT, MRI, X-ray, and more, which gives them both the demand and the scale needed for AI tools to deliver value. They also tend to have robust infrastructure (PACS, RIS, EHR systems), technical staff, and financial resources to invest in AI deployment, integration, and validation. Hospitals are under pressure to reduce diagnostic backlogs, improve accuracy, and speed up reporting, especially for acute and high-impact cases (e.g. stroke, oncology) where delays can be critical. Moreover, hospitals benefit from economies of scale: once AI is deployed across large facilities or networks, the per-study cost falls, making ROI more attractive.

The diagnostic imaging centers segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing need for workflow efficiency, faster turnaround times, and competitive differentiation in a highly service-driven environment. These centers often operate with tighter resources compared to large hospitals, making AI solutions attractive for automating routine tasks, optimizing image interpretation, and reducing radiologist workload. The scalability and cost-effectiveness of cloud-based AI tools are particularly beneficial for standalone or smaller imaging centers that lack extensive IT infrastructure. Additionally, the growing demand for outpatient imaging services and preventive screenings, especially in urban and semi-urban areas- is driving the adoption of AI to handle higher patient volumes without compromising quality.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the AI in radiology market while holding the largest share in 2024. The region’s growth is primarily attributed to its strong regulatory framework and approvals, especially from the U.S. FDA, which has cleared a large number of clinical AI algorithms, many focused on medical imaging, creating trust and enabling quicker adoption. The region also benefits from high healthcare expenditure, well-developed healthcare infrastructure, and widespread deployment of advanced imaging modalities (CT, MRI, etc.), which provide both the demand and technical readiness for AI tools. Research and innovation ecosystems are strong in North America, accelerating development, clinical validation, and commercialization of AI in radiology.

The U.S. is a major contributor to the North American AI in radiology market due to its advanced healthcare infrastructure, high adoption of medical imaging technologies, and strong presence of leading AI and healthcare technology companies. The U.S. also benefits from a supportive regulatory environment, with the FDA actively approving AI-powered radiology tools, which accelerates commercialization and clinical use. Additionally, significant investments in healthcare AI research, partnerships between hospitals and tech firms, and the need to address radiologist shortages further boost adoption.

- In September 2022, the National Institutes of Health (NIH) announced a $130 million investment to accelerate AI adoption in biomedical research.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for AI in radiology. This is due to a combination of rising disease burden, expanding healthcare infrastructure, and strong government support. For instance, the increasing prevalence of chronic diseases like cancer, cardiovascular and neurological disorders in countries such as China, India, and Japan is driving demand for accurate and early diagnostics. Governments in the region are investing in healthcare digitization, AI-friendly regulation, and infrastructure upgrades, making it easier to deploy AI tools in imaging centers and hospitals. Also, urbanization, higher access to digital technologies, and growing numbers of radiology centers (including private diagnostic clinics) are enabling adoption even in non-metro and semi-urban settings.

China is a major player in the Asia Pacific AI in radiology market due to strong government programs such as Healthy China 2030 and the State Council’s AI Development Plan, which have accelerated approvals for AI based diagnostic tools and funded many hospital pilot projects. In China, major hospitals in cities like Beijing, Shanghai, and Guangzhou are already applying AI for lung CT screening, stroke detection, and cancer diagnosis at scale. This leadership is reinforced by sizable investment, large patient volumes, and growing pressure to improve diagnostic speed and accuracy.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 4.7 Billion |

5.87% |

Strong regulatory support (FDA approvals), high healthcare spending, and mature imaging infrastructure |

High cost of implementation, limited reimbursement, and regulatory hurdles |

Dominant region |

| Asia Pacific |

USD 3.3 Billion |

7.65% |

Increasing healthcare expenditure, rising disease burden |

Infrastructure gaps in some areas, lack of trained radiologists/AI talent |

Fastest growth |

| Europe |

USD 2.6 Billion |

11.03% |

Strong regulatory oversight, public healthcare systems are pushing for diagnostic efficiency |

Regulatory delays, stringent data protection laws |

Steady growth |

| Latin America |

USD 0.9 Million |

5.24% |

Increasing awareness, some public-private partnerships |

Economic instability, currency risk |

Gradual growth |

| Middle East & Africa |

USD 0.6 Million |

2.92% |

Investments under national healthcare modernization programs |

Infrastructure gaps, regulatory differences |

strong potential in certain countries |

AI in Radiology Market Value Chain Analysis

1. Research & Development (R&D) and Algorithm Design

This stage involves the development of AI algorithms, data labeling, training of deep learning models, and clinical validation. It requires large volumes of annotated radiology images and close collaboration between radiologists, data scientists, and software engineers to ensure clinical accuracy and performance.

- Key Players: Google Health (DeepMind), IBM Watson Health, Arterys, and Qure.ai

2. Data Acquisition & Management

AI in radiology depends heavily on high-quality imaging data such as X-rays, CTs, and MRIs. This stage includes the collection, anonymization, preprocessing, and storage of medical images, ensuring compliance with data protection laws (like HIPAA, GDPR). Integration with Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS) is critical.

- Key Players: Change Healthcare, Agfa-Gevaert Group, Philips Healthcare, GE HealthCare, and Sectra

3. AI Model Integration & Software Development

In this stage, AI algorithms are integrated into software platforms that radiologists and healthcare providers can use within their existing workflow. The focus is on user-friendly interfaces, interoperability with PACS/RIS/EHR systems, and real-time image analysis and decision support.

- Key Players: Siemens Healthineers, Aidoc, Infervision, RadNet, and Lunit

4. Regulatory Approval & Compliance

AI-based radiology tools must meet stringent regulatory standards before deployment. This includes FDA 510(k) clearance, CE marking in Europe, and approvals from other regional health authorities. Validation studies, ethical considerations, and post-market surveillance are essential here.

- Key Players: Zebra Medical Vision, Aidoc, and Lunit

AI in Radiology Market Companies

Siemens Healthineers is a global leader in imaging technology and has integrated AI into its radiology solutions through platforms like AI-Rad Companion, which supports automated image interpretation across modalities. The company leverages its vast installed base in hospitals and advanced R&D to offer seamless AI integration into radiology workflows.

GE HealthCare offers AI-enabled imaging solutions such as the Edison AI platform, which helps clinicians improve diagnosis accuracy and operational efficiency. Its wide range of medical imaging systems and software platforms give it a strong foundation for embedding AI tools at scale.

Philips integrates AI across its diagnostic imaging systems, especially in areas like oncology, cardiology, and neurology, using its IntelliSpace AI Workflow Suite. It collaborates with hospitals and startups to develop AI applications focused on clinical decision support and workflow automation.

Aidoc specializes in AI-powered radiology solutions that support real-time decision-making for acute conditions like pulmonary embolism, stroke, and brain hemorrhage. Its tools are FDA-cleared and widely adopted across hospitals in the U.S. and Europe, making it a top provider in clinical AI deployment.

Zebra Medical Vision develops deep learning algorithms for detecting a wide range of conditions from imaging data, including cardiovascular diseases, cancers, and bone health issues. Its solutions are used by hospitals to automate diagnosis and improve early detection, with several regulatory approvals.

Qure.ai focuses on developing affordable, high-performing AI tools for radiology, especially in low-resource settings. Its solutions for chest X-rays and head CT scans are deployed across multiple countries, supporting faster triage and diagnosis in both public and private healthcare.

Lunit provides AI-based solutions like Lunit INSIGHT, which assists in detecting abnormalities in chest X-rays and mammograms. The company partners with major imaging OEMs (e.g., GE, Philips) and hospitals to deploy its AI globally, particularly in cancer screening programs.

Infervision is a China-based AI radiology company that develops tools for lung cancer detection, stroke diagnosis, and COVID-19 screening. Its solutions are integrated into clinical systems across Asia, and it's expanding rapidly into Europe and the U.S. through strategic partnerships.

- Arterys (now part of Tempus)

Arterys offers cloud-native AI solutions for radiology, particularly in cardiac MRI, chest CT, and oncology. As part of Tempus, it leverages advanced data analytics and cloud platforms to support precision diagnostics and cross-institutional data sharing.

iCAD focuses on AI-powered cancer detection and risk assessment, especially in breast cancer screening through mammography. Its ProFound AI platform improves cancer detection rates and reduces false positives, contributing to higher efficiency in radiology practices.

Recent Developments

- In September 2025, Tempus received FDA clearance for an upgrade to its AI-powered cardiac imaging platform that enables the generation of T1 and T2 inline maps, enhancing cardiac MRI analysis.

- In July 2025, the FDA authorized over 1,250 AI-based medical devices had been authorized, with 956 of those in the radiology speciality.

- In January 2025, Philips CT 5300 launched an AI-enabled CT system featuring advanced AI reconstruction, cardiac motion correction, and smart workflows.

Segments Covered in the Report

By Modality

- CT (Computed Tomography)

- MRI (Magnetic Resonance Imaging)

- X-ray

- Ultrasound

- Mammography

- PET (Positron Emission Tomography)

By Application

- Oncology

- Neurology

- Cardiology

- Chest Imaging

- Musculoskeletal

- Others

By Technology

- Machine Learning

- Deep Learning

- Natural Language Processing (NLP)

- Computer Vision

By Component

- Software

- Standalone Software

- Integrated Software

- Hardware

- Services

-

- Installation & Integration

- Support & Maintenance

- Consulting

By Deployment Mode

By End User

- Hospitals

- Diagnostic Imaging Centers

- Research & Academic Institutions

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global AI in Radiology Market Size (USD Billion) by Modality, 2024–2034

- Table 2: Global AI in Radiology Market Size (USD Billion) by Application, 2024–2034

- Table 3: Global AI in Radiology Market Size (USD Billion) by Technology, 2024–2034

- Table 4: Global AI in Radiology Market Size (USD Billion) by Component, 2024–2034

- Table 5: Global AI in Radiology Market Size (USD Billion) by Deployment Mode, 2024–2034

- Table 6: Global AI in Radiology Market Size (USD Billion) by End User, 2024–2034

- Table 7: North America Market Size (USD Billion) by Modality, 2024–2034

- Table 8: North America Market Size (USD Billion) by Application, 2024–2034

- Table 9: North America Market Size (USD Billion) by Technology, 2024–2034

- Table 10: North America Market Size (USD Billion) by Component, 2024–2034

- Table 11: North America Market Size (USD Billion) by Deployment Mode, 2024–2034

- Table 12: North America Market Size (USD Billion) by End User, 2024–2034

- Table 13: U.S. Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 14: Canada Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 15: Mexico Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 16: Europe Market Size (USD Billion) by Modality, 2024–2034

- Table 17: Europe Market Size (USD Billion) by Application, 2024–2034

- Table 18: Germany Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 19: France Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 20: UK Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 21: Italy Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 22: Asia Pacific Market Size (USD Billion) by Modality, 2024–2034

- Table 23: Asia Pacific Market Size (USD Billion) by Application, 2024–2034

- Table 24: China Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 25: Japan Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 26: India Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 27: South Korea Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 28: Southeast Asia Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 29: Latin America Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 30: Brazil Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 31: Middle East & Africa Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 32: GCC Countries Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 33: Turkey Market Size (USD Billion) by Modality & Application, 2024–2034

- Table 34: Africa Market Size (USD Billion) by Modality & Application, 2024–2034

List of Figures

- Figure 1: Global Market Share by Modality, 2024

- Figure 2: Global Market Share by Application, 2024

- Figure 3: Global Market Share by Technology, 2024

- Figure 4: Global Market Share by Component, 2024

- Figure 5: Global Market Share by Deployment Mode, 2024

- Figure 6: Global Market Share by End User, 2024

- Figure 7: North America Market Share by Modality, 2024

- Figure 8: North America Market Share by Application, 2024

- Figure 9: North America Market Share by Technology, 2024

- Figure 10: North America Market Share by Component, 2024

- Figure 11: North America Market Share by Deployment Mode, 2024

- Figure 12: North America Market Share by End User, 2024

- Figure 13: U.S. Market Share by Modality, 2024

- Figure 14: U.S. Market Share by Application, 2024

- Figure 15: Canada Market Share by Modality, 2024

- Figure 16: Canada Market Share by Application, 2024

- Figure 17: Mexico Market Share by Modality, 2024

- Figure 18: Mexico Market Share by Application, 2024

- Figure 19: Europe Market Share by Modality, 2024

- Figure 20: Europe Market Share by Application, 2024

- Figure 21: Germany Market Share by Modality, 2024

- Figure 22: Germany Market Share by Application, 2024

- Figure 23: France Market Share by Modality, 2024

- Figure 24: France Market Share by Application, 2024

- Figure 25: UK Market Share by Modality, 2024

- Figure 26: UK Market Share by Application, 2024

- Figure 27: Italy Market Share by Modality, 2024

- Figure 28: Italy Market Share by Application, 2024

- Figure 29: Asia Pacific Market Share by Modality, 2024

- Figure 30: Asia Pacific Market Share by Application, 2024

- Figure 31: China Market Share by Modality, 2024

- Figure 32: China Market Share by Application, 2024

- Figure 33: Japan Market Share by Modality, 2024

- Figure 34: Japan Market Share by Application, 2024

- Figure 35: India Market Share by Modality, 2024

- Figure 36: India Market Share by Application, 2024

- Figure 37: South Korea Market Share by Modality, 2024

- Figure 38: South Korea Market Share by Application, 2024

- Figure 39: Southeast Asia Market Share by Modality, 2024

- Figure 40: Southeast Asia Market Share by Application, 2024

- Figure 41: Latin America Market Share by Modality, 2024

- Figure 42: Latin America Market Share by Application, 2024

- Figure 43: Brazil Market Share by Modality, 2024

- Figure 44: Brazil Market Share by Application, 2024

- Figure 45: Middle East & Africa Market Share by Modality, 2024

- Figure 46: Middle East & Africa Market Share by Application, 2024

- Figure 47: GCC Countries Market Share by Modality, 2024

- Figure 48: GCC Countries Market Share by Application, 2024

- Figure 49: Turkey Market Share by Modality, 2024

- Figure 50: Turkey Market Share by Application, 2024

- Figure 51: Africa Market Share by Modality, 2024

- Figure 52: Africa Market Share by Application, 2024