Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market Size and Growth

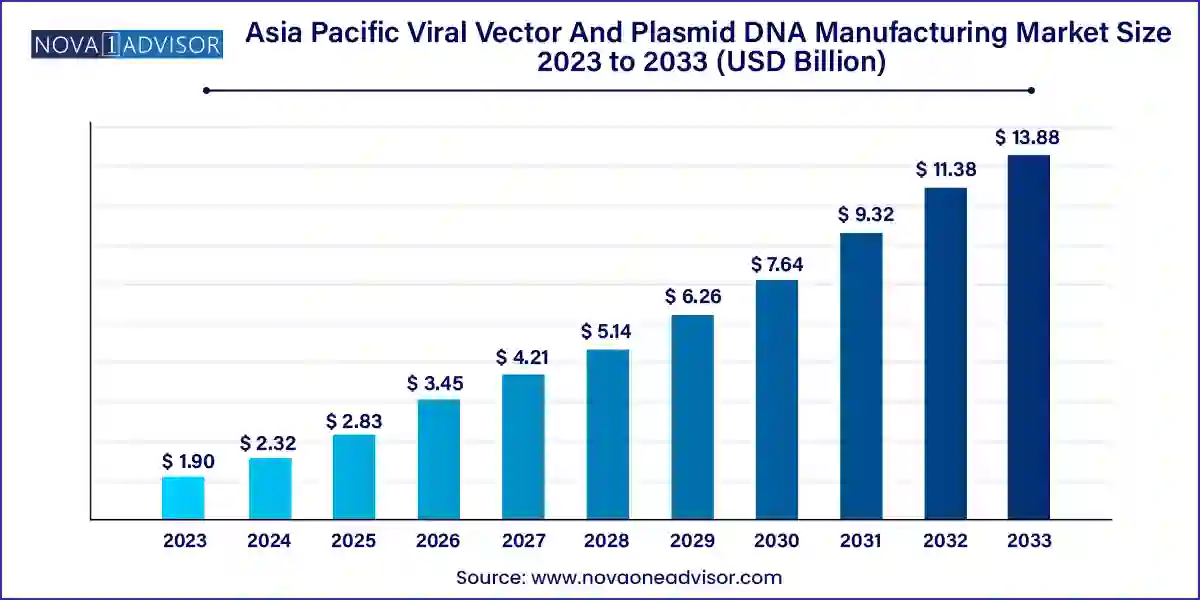

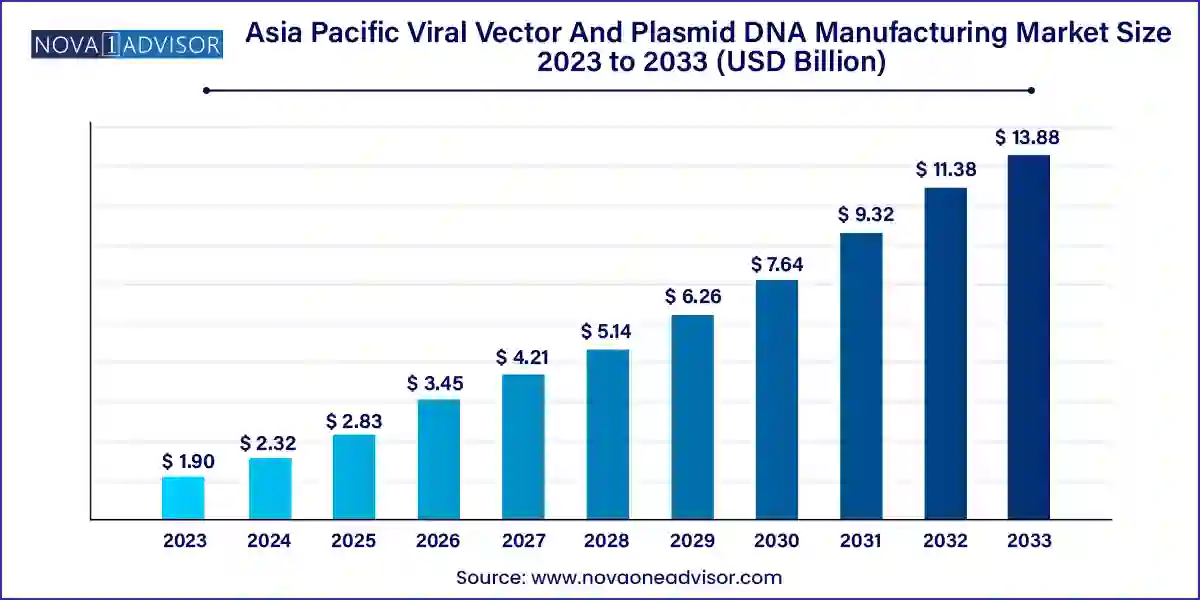

The Asia Pacific viral vector and plasmid DNA manufacturing market size was exhibited at USD 1.90 billion in 2023 and is projected to hit around USD 13.88 billion by 2033, growing at a CAGR of 22.0% during the forecast period 2024 to 2033.

Key Takeaways:

- The adeno-associated virus (AAV) segment led the market with the largest revenue share of 20.1% in 2023.

- The lentivirus segment is projected to grow at the fastest CAGR of 22.0% during the forecast period.

- The downstream processing segment dominated the market with a revenue share of 53.6% in 2023.

- The upstream processing segment is expected to grow at a CAGR of 21.0% over the forecast period.

- The vaccinology segment accounted for the largest revenue share of 22.0% in 2023.

- The cell therapy segment is expected to grow at a CAGR of 24.2% over the forecast period.

- The research institutes segment dominated the market with a revenue share of 57.7% in 2023.

- The pharmaceutical and biotechnology companies segment is expected to grow at a CAGR of 22.2% over the forecast period.

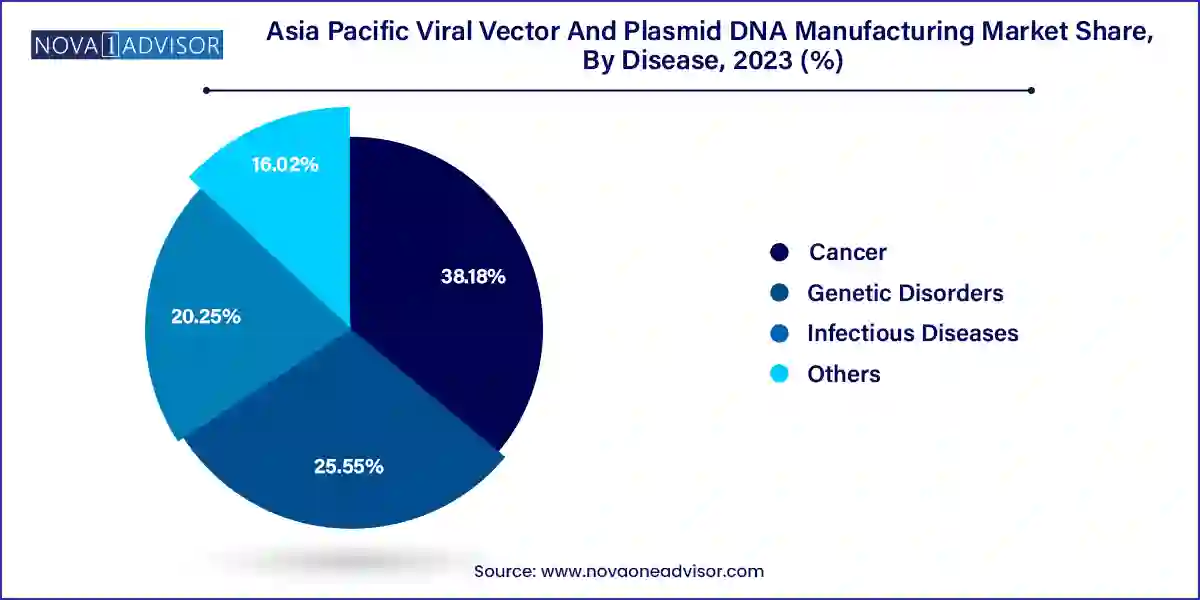

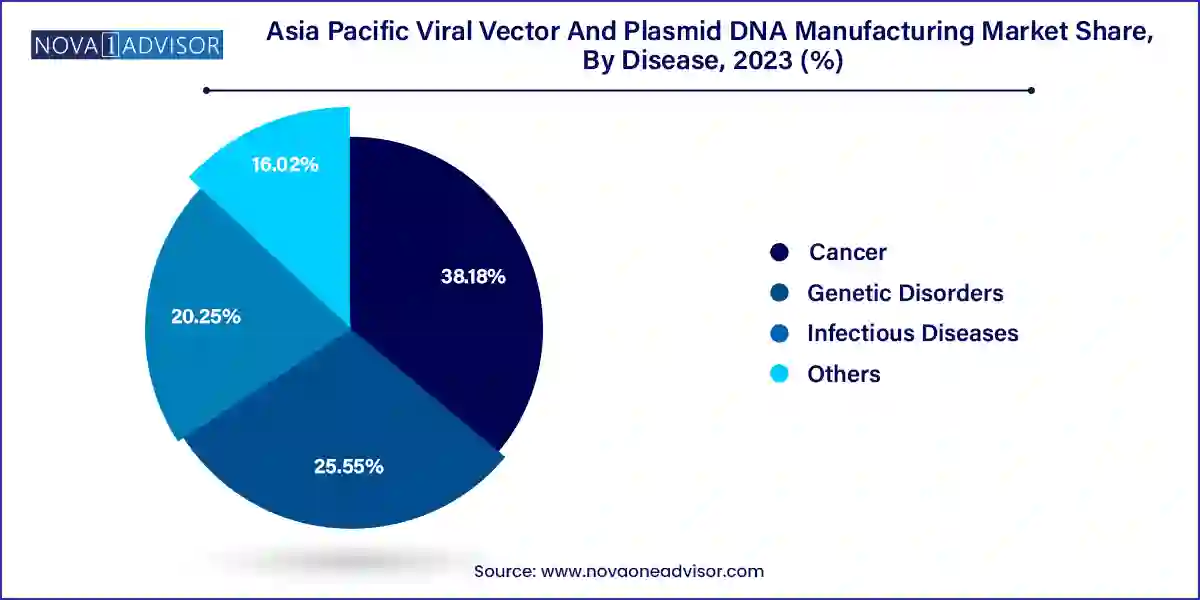

- The cancer segment held the largest revenue share of 38.18% in 2023.

- The genetic disorders segment is expected to grow at a CAGR of 22.0% during the forecast period.

Market Overview

The Asia Pacific viral vector and plasmid DNA manufacturing market has evolved into a vital segment of the region’s advanced biotechnology and life sciences landscape. With the surge in gene therapy, cell therapy, and personalized medicine applications, viral vectors and plasmid DNA have become indispensable tools for delivering genetic material into cells. As a result, the region is witnessing exponential growth in the demand for scalable, regulatory-compliant, and GMP-certified production of these biotechnological components.

In the Asia Pacific region, governments are heavily investing in biopharmaceutical infrastructure, particularly in countries like China, Japan, India, and South Korea. Initiatives such as China’s "Made in China 2025" strategy and India’s "National Biopharma Mission" reflect the increasing regional commitment to self-sufficiency in biotech manufacturing. These programs are further fueled by the growing number of clinical trials for gene-based therapies, academic research collaborations, and the regional expansion of multinational CDMOs (Contract Development and Manufacturing Organizations).

The rise in rare genetic diseases, cancer, and infectious diseases across the region has compelled both public and private stakeholders to focus on localized vector and plasmid production. For example, the COVID-19 pandemic highlighted the critical role of plasmid DNA in vaccine development, pushing forward innovation in DNA-based vaccine platforms like those deployed in India and Thailand. As regulatory frameworks mature and regional biomanufacturers scale their operations, Asia Pacific is increasingly being recognized as both a high-potential market and a global manufacturing hub for advanced therapeutic vectors.

Major Trends in the Market

-

Rapid CDMO expansion in the region: Asia Pacific is seeing a boom in contract manufacturing services, with companies scaling vector production to meet global demands.

-

Increased focus on lentivirus and AAV vectors for gene therapies: Gene therapy pipelines targeting rare diseases are accelerating demand for these vectors.

-

Academic-industry collaboration: Universities are entering public-private partnerships to develop scalable manufacturing for clinical and commercial needs.

-

Adoption of single-use bioreactors and modular platforms: These technologies are reducing contamination risk and increasing flexibility in small-batch production.

-

Surge in demand for plasmids in mRNA and DNA vaccine development: Especially in India and China, where domestic vaccine initiatives rely on plasmid backbone systems.

-

Government-backed biotech zones and incentives: Countries are offering tax breaks, grants, and land to biomanufacturing firms setting up viral vector production facilities.

-

Focus on regulatory harmonization across Asia Pacific: Efforts to streamline approval processes for gene therapy products and manufacturing facilities are underway.

Report Scope of Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.32 Billion |

| Market Size by 2033 |

USD 13.88 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 22.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Vector Type, Workflow, Application, End-use, Disease |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

Asia Pacific |

| Key Companies Profiled |

FUJIFILM Holdings Corporation; Wuxi Biologics; Takara Bio Inc.; Astellas Pharma, Inc. (Audentes Therapeutics); Lonza; Charles River Laboratories (Cobra Biologics); Virovek Incorporation; BioMarin |

Key Market Driver: Expansion of Gene and Cell Therapy Clinical Trials

A key driver propelling the Asia Pacific viral vector and plasmid DNA manufacturing market is the expansion of gene and cell therapy clinical trials. There is a marked increase in R&D activity across the region, particularly targeting cancer, monogenic disorders, and rare genetic diseases. Vectors such as adeno-associated viruses (AAVs), lentiviruses, and plasmids are essential vehicles for delivering therapeutic payloads in these therapies.

For instance, Japan has seen a rise in regenerative medicine trials under the fast-track approval system provided by the Pharmaceuticals and Medical Devices Agency (PMDA). Meanwhile, China hosts hundreds of gene therapy trials, many of which rely on AAVs and lentiviral systems. This surging clinical demand places enormous pressure on upstream and downstream manufacturing capabilities, creating a ripe environment for CDMO growth. Companies like GenScript ProBio and WuXi Advanced Therapies have expanded operations to offer GMP-compliant vector and plasmid services tailored to clinical-stage requirements, accelerating time-to-market and supporting regional innovation.

Key Market Restraint: Complex Manufacturing and Regulatory Challenges

Despite robust demand, the manufacturing of viral vectors and plasmid DNA is highly complex, posing a considerable barrier for many emerging biotech firms. The production process involves intricate steps including upstream amplification, downstream purification, and stringent quality control to ensure batch consistency, sterility, and biological activity. Each vector type also presents unique production challenges for example, lentiviral vectors are sensitive to environmental stress, while AAVs require high-purity capsid ratios.

Furthermore, regulatory compliance remains fragmented across the Asia Pacific region. While Japan and Singapore offer well-structured regulatory pathways for ATMPs (Advanced Therapy Medicinal Products), other nations are still developing standardized protocols for quality assurance and GMP certification in viral vector production. This lack of harmonization increases time-to-market and can deter foreign investment. Additionally, intellectual property concerns in some jurisdictions discourage biotech innovators from outsourcing sensitive manufacturing tasks. To maintain growth momentum, the region must streamline regulatory frameworks, invest in skilled talent, and support standardization efforts across borders.

Key Market Opportunity: Domestic Manufacturing Initiatives and Import Substitution

A compelling opportunity within the Asia Pacific viral vector and plasmid DNA manufacturing market lies in the drive toward domestic manufacturing and reduced reliance on imports. Historically, many Asian biotech companies and research institutions depended on North American and European manufacturers for clinical-grade vectors and plasmids. However, recent geopolitical developments, pandemic-related supply disruptions, and strategic bio-sovereignty policies are prompting countries to localize production.

India’s Biotech Parks, China’s National Gene Therapy Innovation Centers, and Australia’s mRNA and gene therapy hubs are being funded to build domestic capacities. Notably, Thailand’s Government Pharmaceutical Organization is working to establish DNA vaccine and plasmid DNA production infrastructure to serve ASEAN markets. This push for self-reliance not only improves national preparedness for future pandemics but also creates growth opportunities for regional CDMOs and biotech startups. As more therapies move toward commercialization, demand for scalable, GMP-grade vector and plasmid manufacturing is expected to surge, presenting a high-margin, long-term opportunity for domestic producers.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market By Vector Type Insights

Plasmids dominated the Asia Pacific market by vector type, driven by their extensive application across gene therapy, vaccine development, and research. Plasmids are crucial in serving as templates for viral vector generation and are also used directly in DNA vaccines. The COVID-19 pandemic served as a catalyst in this regard, with India deploying ZyCoV-D, the world’s first DNA-based vaccine using plasmid technology. Plasmid production has also seen technological innovation, such as antibiotic-free selection systems and improved yield optimization in fermentation-based platforms. As DNA-based therapies and vaccines gain traction, plasmids will continue to hold the lion’s share in vector manufacturing.

Adeno-associated virus (AAV) vectors are the fastest-growing segment, particularly due to their widespread use in gene therapy for ophthalmic, neuromuscular, and CNS disorders. AAVs offer low immunogenicity and long-term expression, making them the vector of choice for many monogenic disease treatments. The surge in AAV-based clinical trials across Japan and China has pushed demand for scalable AAV manufacturing platforms. Companies like Takara Bio and AGC Biologics have responded by launching proprietary AAV platforms in the region, supported by regulatory acceleration programs. As clinical success stories multiply, this segment is expected to experience sustained double-digit growth.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market By Workflow Insights

Upstream manufacturing currently dominates the market, encompassing vector amplification and harvesting processes that ensure high yield and biological activity. Biotech companies are investing in optimized cell lines (e.g., HEK293, Sf9) and transfection methods to enhance upstream efficiency. Countries like South Korea and Japan are emphasizing the use of disposable bioreactors and perfusion systems to reduce contamination risk and facilitate faster changeovers between batches. With increased outsourcing, CDMOs are scaling upstream capabilities to serve multiple clients, including early-stage gene therapy developers.

Downstream manufacturing is the fastest-growing workflow segment, driven by the critical importance of purification and fill-finish operations in ensuring product safety and compliance. Downstream processing technologies such as chromatography, filtration, and ultracentrifugation are being refined to accommodate large-scale commercial batches. For example, GenScript ProBio, in March 2024, announced the expansion of its Nanjing facility, adding high-capacity downstream suites dedicated to AAV and plasmid purification. With regulatory bodies enforcing higher quality standards for clinical and commercial applications, downstream process innovation will play a central role in the market’s future trajectory.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market By Application Insights

Gene therapy remains the dominant application, as vector-based delivery systems are foundational to delivering functional genes in monogenic and acquired disorders. Asia Pacific countries have significantly ramped up R&D in this area, with multiple trials underway in ophthalmology, hemophilia, and spinal muscular atrophy. Regulatory fast tracks in Japan (SAKIGAKE designation) and China’s priority review system have made it easier to bring gene therapies to market, thereby sustaining demand for viral vectors and plasmids used in development.

Vaccinology is the fastest-growing application segment, especially in light of recent investments in pandemic preparedness. The development of DNA and viral vector vaccines during COVID-19 demonstrated the utility of these platforms in producing scalable and safe vaccines. India’s Zydus Cadila and Thailand’s BioNet both leveraged plasmid and viral vector technology in their respective vaccine candidates. Ongoing concerns about emerging infectious diseases (e.g., Nipah virus, avian flu) are prompting governments to fund R&D for next-gen vaccine platforms, accelerating this segment's growth potential in the near future.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market By End-use Insights

Pharmaceutical and biopharmaceutical companies are the largest end-users, accounting for the majority share of demand in vector and plasmid manufacturing. These entities often lack in-house capacity and prefer outsourcing to CDMOs with established GMP facilities. The region’s biotech ecosystem is flourishing, with startups focused on novel gene therapies and immunotherapies that rely on viral vector platforms. Companies such as WuXi AppTec and VGXI serve multiple clients across early and late-stage development, creating a broad-based demand pipeline.

Research institutes are the fastest-growing end-user segment, supported by government funding, academic grants, and public-private collaborations. Institutions in Japan, China, and Australia are leading preclinical research on genetic disorders, CNS therapies, and cancer immunotherapies, all of which require access to high-quality vectors and plasmids. As translational research accelerates and academic centers increasingly act as innovation hubs, the demand from this segment is set to expand rapidly.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market By Disease Insights

Cancer leads the disease segment, fueled by the increasing adoption of CAR-T and TCR therapies that require high-quality lentiviral and retroviral vectors. Solid tumors and hematological cancers are key focus areas for ongoing research and clinical trials in the Asia Pacific, particularly in China and India. The complex, multi-step nature of oncology therapeutics demands robust manufacturing capabilities, driving growth across both vector and plasmid production lines.

Genetic disorders are the fastest-growing disease segment, due to the rising diagnosis rates of rare diseases and inherited conditions across the region. Government-backed genome sequencing programs in China and South Korea are helping identify genetic mutations early, enabling patient selection for gene therapy trials. AAVs are the preferred vectors in this segment, as seen in ongoing trials for Duchenne muscular dystrophy and spinal muscular atrophy in Japan. This growth is expected to continue as national health programs emphasize rare disease care and precision medicine.

Country Insights

China – Dominant Market

China dominates the Asia Pacific viral vector and plasmid DNA manufacturing market, driven by massive government investment, favorable policy frameworks, and the presence of major CDMOs. China accounts for a significant share of regional gene therapy trials, and companies like WuXi AppTec, GenScript, and ASKBio China have established expansive GMP-certified vector production facilities. The government’s push toward biopharma self-reliance, along with relaxed clinical trial timelines and rapid technology adoption, make China a manufacturing and innovation leader in this space.

India – Fastest Growing Market

India represents the fastest-growing market, backed by increasing biotech entrepreneurship, expanding clinical trials, and recent moves to localize advanced therapy manufacturing. Initiatives like the National Biopharma Mission and production-linked incentives (PLIs) for biopharma are drawing investments into vector and plasmid production. Companies such as Biological E., Zydus, and Bharat Biotech are investing in viral vector and DNA manufacturing for both vaccines and gene therapy pipelines. With low-cost manufacturing and a skilled talent pool, India is well-positioned to become a regional CDMO hub.

Asia Pacific Viral Vector And Plasmid DNA Manufacturing Market By Recent Development

-

March 2024 – GenScript ProBio expanded its Nanjing viral vector facility to include new downstream purification capabilities for AAV and plasmid DNA manufacturing, aimed at meeting growing global demand for gene therapy products.

-

February 2024 – AGC Biologics announced the establishment of a new plasmid DNA center of excellence in Japan, focused on supporting clinical and commercial mRNA vaccine and gene therapy developers.

-

January 2024 – WuXi Advanced Therapies partnered with a South Korean biotech firm to co-manufacture lentiviral vectors and plasmids for CAR-T trials across the Asia Pacific.

-

November 2023 – Takara Bio launched a next-generation AAV vector production platform optimized for CNS delivery, specifically targeting rare neurological disorders in Japan and Southeast Asia.

Some of the prominent players in the Asia Pacific viral vector and plasmid DNA manufacturing market include:

- FUJIFILM Holdings Corporation

- Wuxi Biologics

- Takara Bio Inc.

- Astellas Pharma, Inc. (Audentes Therapeutics)

- Lonza

- Charles River Laboratories (Cobra Biologics)

- Virovek Incorporation

- BioMarin

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Asia Pacific viral vector and plasmid DNA manufacturing market

Vector Type

- Adenovirus

- Retrovirus

- Adeno-Associated Virus (AAV)

- Lentivirus

- Plasmids

- Others

Workflow

-

- Vector Amplification & Expansion

- Vector Recovery/Harvesting

Application

- Antisense & RNAi Therapy

- Gene Therapy

- Cell Therapy

- Vaccinology

- Research Applications

End-use

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

Disease

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

Country

-

- Japan

- China

- India

- South Korea

- Australia

- Thailand