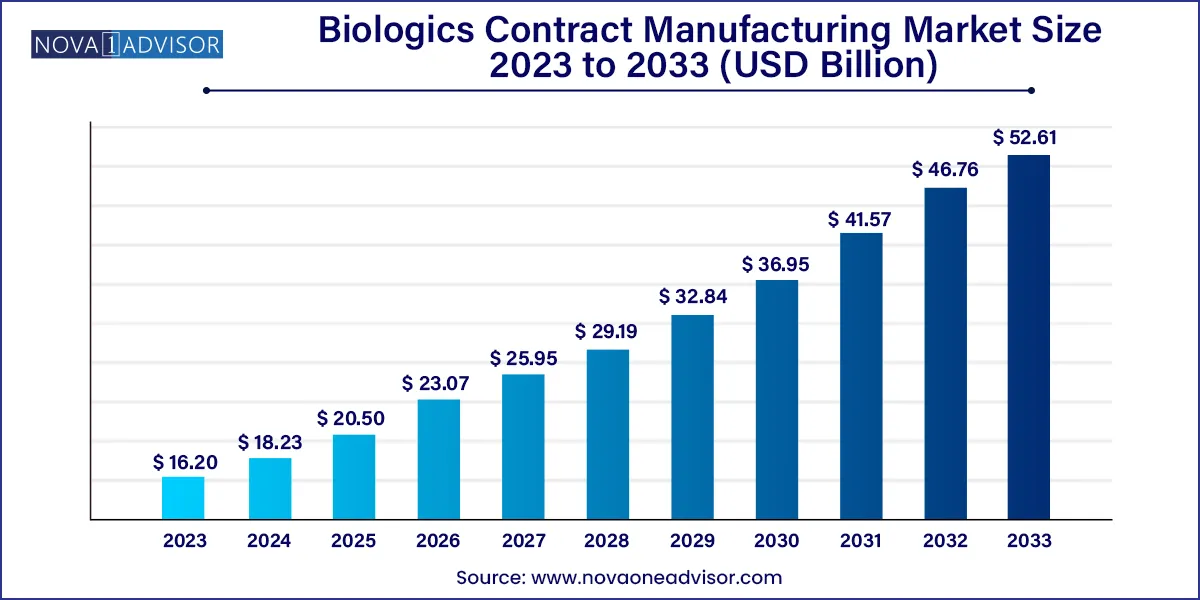

The global biologics contract manufacturing market size was exhibited at USD 16.20 billion in 2023 and is projected to hit around USD 52.61 billion by 2033, growing at a CAGR of 12.5% during the forecast period 2024 to 2033.

Key Takeaways:

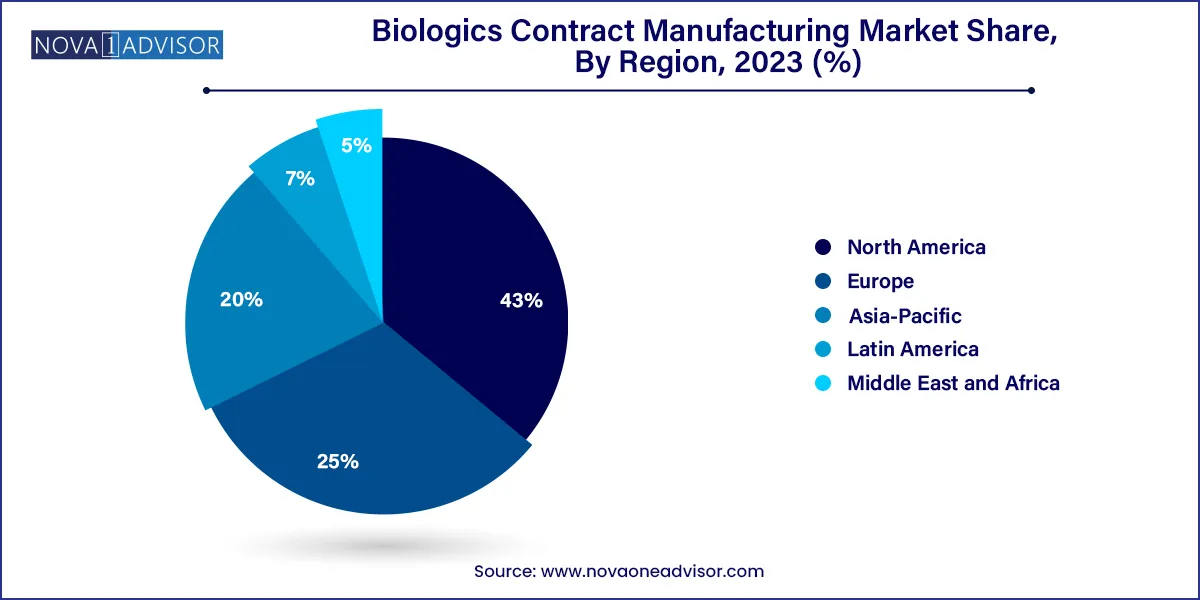

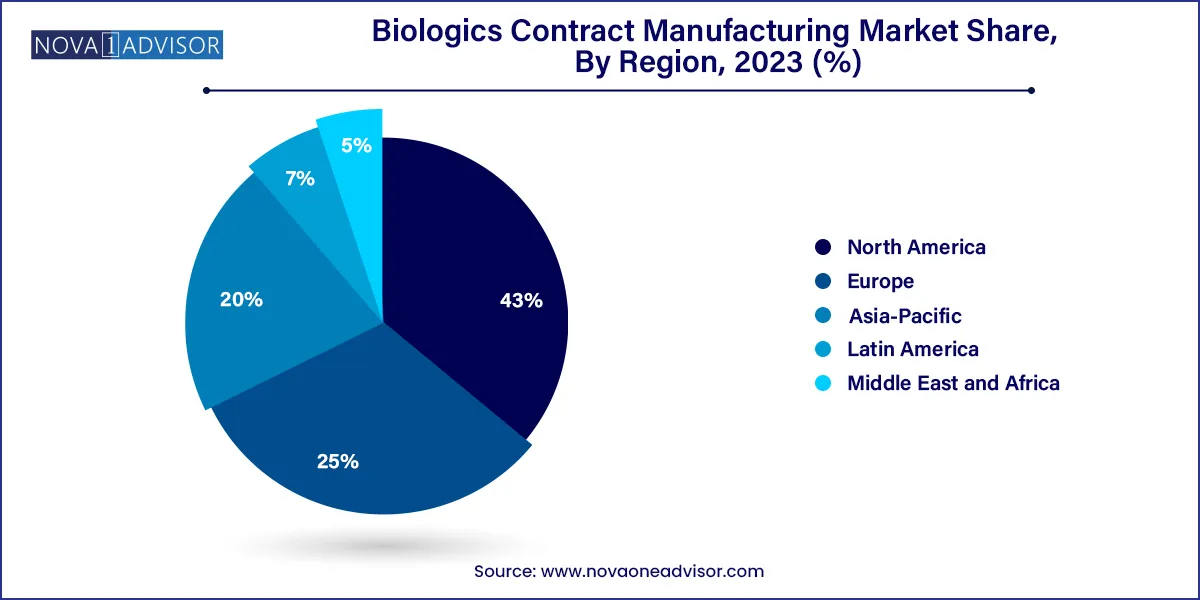

- North America dominated the market in 2023 and accounted for the maximum share of more than 43.00% of the global revenue.

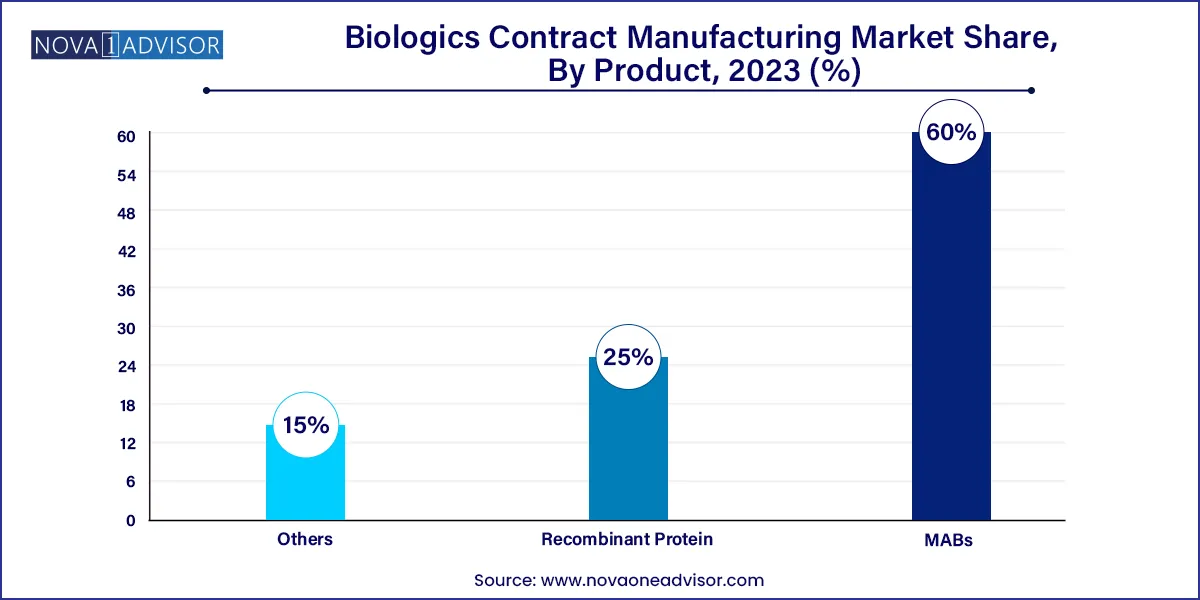

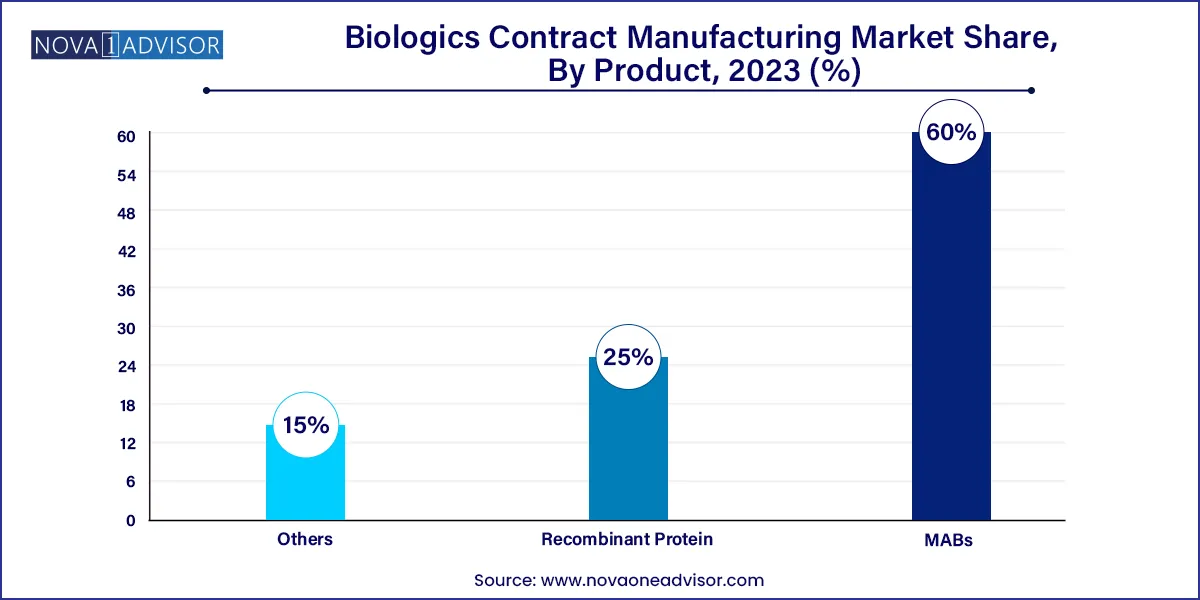

- The MABs segment dominated the global market in 2023 and accounted for the maximum share of more than 60.00%.

Market Overview

The Biologics Contract Manufacturing Market has emerged as a pivotal sector within the pharmaceutical and biotechnology industries. As biologics continue to represent a growing proportion of new therapeutic drugs, demand for specialized manufacturing capabilities has surged. Biologics, including monoclonal antibodies (mAbs), recombinant proteins, and cell and gene therapies, require complex manufacturing processes that are often beyond the technical reach or financial feasibility of many drug developers. Consequently, these companies turn to biologics contract manufacturing organizations (CMOs) to leverage their expertise, scalability, regulatory compliance, and cost efficiencies.

The market is propelled by an increasing number of biologic drugs in the development pipeline, the high costs associated with setting up advanced manufacturing facilities, and the growing trend of outsourcing to focus on core competencies. In addition, advancements in technology, including single-use systems, continuous processing, and modular facilities, are further optimizing biologics production, offering new opportunities for CMOs.

The global biologics CMO market is increasingly characterized by strategic partnerships, expansions, mergers, and acquisitions. Leading players are continuously expanding their capabilities to encompass a wide range of services, from clinical trial material production to full-scale commercial manufacturing, with a keen focus on adhering to Good Manufacturing Practices (GMP).

Major Trends in the Market

-

Rising Demand for Monoclonal Antibodies (mAbs): mAbs dominate biologic pipelines, and CMOs are investing heavily to increase mAbs manufacturing capacities.

-

Shift Towards Single-Use Technologies: Single-use bioreactors and disposable equipment are increasingly preferred for their flexibility, reduced risk of cross-contamination, and lower capital investment.

-

Surge in Cell and Gene Therapy Projects: The booming cell and gene therapy sector requires highly specialized manufacturing, leading to new business opportunities for CMOs.

-

Strategic Partnerships and Mergers: CMOs are engaging in collaborations and acquisitions to enhance service portfolios and geographic reach.

-

Expansion in Emerging Markets: Asia-Pacific and Latin America are witnessing increased investments by CMOs to capitalize on cost advantages and growing local demand.

-

Regulatory Compliance and Quality Assurance: Growing focus on stringent regulatory compliance is making CMOs invest in quality systems and certifications.

-

Integration of Digital Manufacturing: Adoption of digital technologies like IoT, AI, and automation in biologics manufacturing for improved process control and efficiency.

Biologics Contract Manufacturing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 18.23 Billion |

| Market Size by 2033 |

USD 52.61 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Indication, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Wuxi Biologics; Abzena Ltd.; FUJIFILM Diosynth Biotechnologies; BI BioXcellence; Lonza Group AG; Boehringer Ingelheim GmbH; Samsung Biologics; Abbvie; Catalent; Bioreliance; Eurofins CDMO; Thermo Fischer (Patheon) |

Key Market Driver

Increasing Outsourcing by Small and Mid-Sized Biopharma Companies

Small and mid-sized biopharmaceutical companies are significantly contributing to the growth of the biologics CMO market. These companies often lack the infrastructure, expertise, or financial resources to build and maintain in-house manufacturing facilities, especially for complex biologics. Contracting with specialized CMOs enables these firms to access cutting-edge technology, regulatory know-how, and scalable production capacities without heavy capital expenditure. For instance, a mid-sized oncology-focused biotech company seeking to bring a new monoclonal antibody to market can leverage a CMO's experience and manufacturing prowess to expedite clinical trials and commercial launch, maintaining focus on core research and innovation. This trend is expected to intensify with the rising biotech funding and venture capital investments.

Key Market Restraint

High Cost and Complexity of Biologics Manufacturing

Despite the booming demand, biologics manufacturing remains prohibitively expensive and technically challenging. CMOs must invest heavily in state-of-the-art facilities, maintain stringent quality control, and ensure compliance with complex regulatory requirements across different countries. Setting up biologic manufacturing capabilities involves millions of dollars in investment, years of expertise-building, and rigorous inspection processes. Any breach in production standards can lead to costly product recalls and regulatory penalties. For example, in 2023, regulatory authorities in Europe flagged multiple contract manufacturers for quality control lapses, emphasizing the persistent challenges in this space. This creates barriers to entry for new CMOs and limits expansion for existing players.

Key Market Opportunity

Emerging Demand for Biosimilars

With the patent cliffs of major biologics such as Humira and Enbrel, there is a substantial surge in biosimilar development and production. Biosimilars offer cost-effective alternatives to expensive originator biologics, and their development requires sophisticated manufacturing processes to demonstrate similarity without compromising quality. CMOs specializing in biologics are uniquely positioned to capture this growing demand. In 2024, major regulatory bodies like the FDA and EMA fast-tracked approval pathways for biosimilars, making it more lucrative for pharma companies to launch biosimilar products. CMOs offering specialized biosimilar development and manufacturing services stand to benefit immensely from this trend.

Segments Insights:

Indication Insights

Oncology dominated the indication segment within the biologics CMO market in 2024. The high prevalence of cancer globally and the continual introduction of new biologics targeting various types of tumors have maintained oncology's preeminence. Biologics such as checkpoint inhibitors, antibody-drug conjugates (ADCs), and therapeutic vaccines require intricate manufacturing, which many companies prefer to outsource to seasoned CMOs. With nearly 40% of the biologics under clinical development targeting oncology indications, this segment will continue its stronghold over the market in the coming years.

Immunological Disorders are projected to be the fastest-growing indication category. The rising burden of autoimmune diseases such as rheumatoid arthritis, multiple sclerosis, and psoriasis is fueling the demand for biologics that modulate the immune system. Monoclonal antibodies and recombinant proteins are among the most effective therapies for these conditions. Moreover, the expanding understanding of immunopathology is driving novel biologic therapies, making immunological disorders an attractive growth area for CMOs specializing in complex biologics production.

Product Insights

Monoclonal Antibodies (mAbs) dominated the product segment in the biologics contract manufacturing market in 2024. Monoclonal antibodies are the most significant class of therapeutic biologics, widely used in oncology, immunology, and infectious diseases. Their complex structures and stringent production requirements make them ideal candidates for outsourcing to specialized CMOs. Leading companies like Lonza Group and Samsung Biologics have built dedicated large-scale facilities for mAbs production. The robust clinical pipeline, coupled with increasing mAbs approvals, continues to sustain this segment's dominance. Companies increasingly favor outsourcing monoclonal antibody production to CMOs capable of providing end-to-end services from process development to commercial production.

Recombinant proteins are expected to be the fastest-growing segment during the forecast period. Recombinant proteins serve diverse therapeutic areas, including endocrinology and hematology. The increasing development of novel recombinant therapies, such as engineered cytokines and therapeutic enzymes, is propelling this segment's growth. Startups and biotech firms, particularly in the Asia-Pacific region, are heavily investing in recombinant protein therapeutics, creating new opportunities for contract manufacturers. Additionally, innovations in expression systems and purification technologies are making recombinant protein production more cost-efficient and scalable, further encouraging outsourcing activities.

Regional Insight

North America dominated the global biologics contract manufacturing market in 2024, driven largely by the U.S. biotechnology and pharmaceutical industry's robust innovation ecosystem. Major players, such as Catalent, Lonza (with U.S. facilities), and Thermo Fisher Scientific, have heavily invested in biologics manufacturing infrastructure. Regulatory clarity, a strong funding environment, and a dense network of biotech startups and pharma giants contribute to North America's leading position. For instance, in early 2024, Thermo Fisher expanded its biologics manufacturing capacity in St. Louis, Missouri, emphasizing continued growth in the region.

Asia-Pacific is expected to be the fastest-growing region in the biologics CMO market. Countries like South Korea, China, and India are rapidly developing their biomanufacturing capabilities, offering cost-effective services without compromising on quality. Samsung Biologics' expansion projects and Wuxi Biologics' extensive manufacturing network exemplify the region's dynamic growth. Governments across Asia-Pacific are also supporting biopharma industries through funding and regulatory initiatives, further accelerating regional growth.

Some of the prominent players in the Biologics contract manufacturing market include:

- Wuxi Biologics

- Abzena Ltd.

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Boehringer Ingelheim GmbH

- Lonza

- SamsungBiologics

- Abbvie

- Catalent

- Bioreliance

- Thermo Fischer (Patheon)

- Eurofins CDMO

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global biologics contract manufacturing market.

Product

- MABs

- Recombinant Protein

- Others

Indication

- Oncology

- Immunological Disorders

- Cardiovascular Disorders (CVDs)

- Hematological Disorders

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)