Gene Panel Market Size and Growth Analysis Report 2034

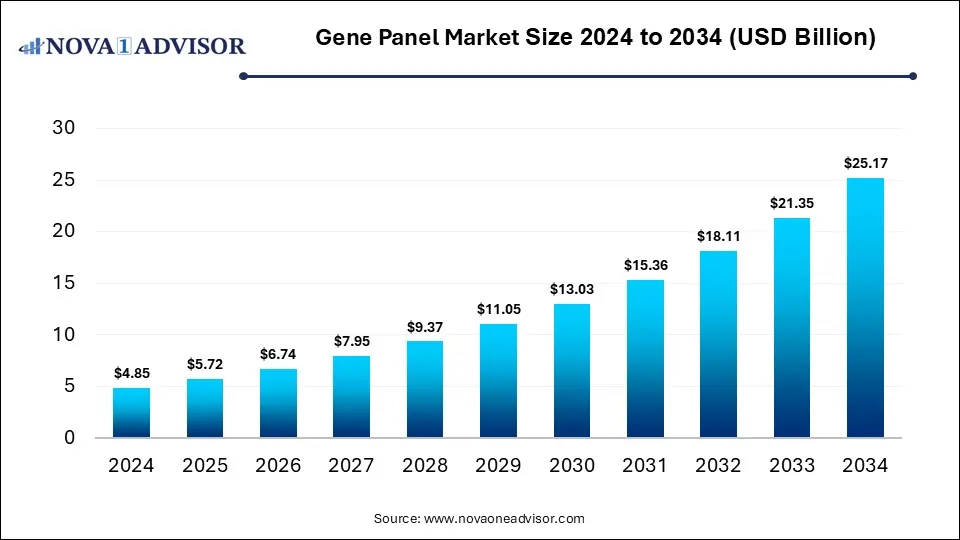

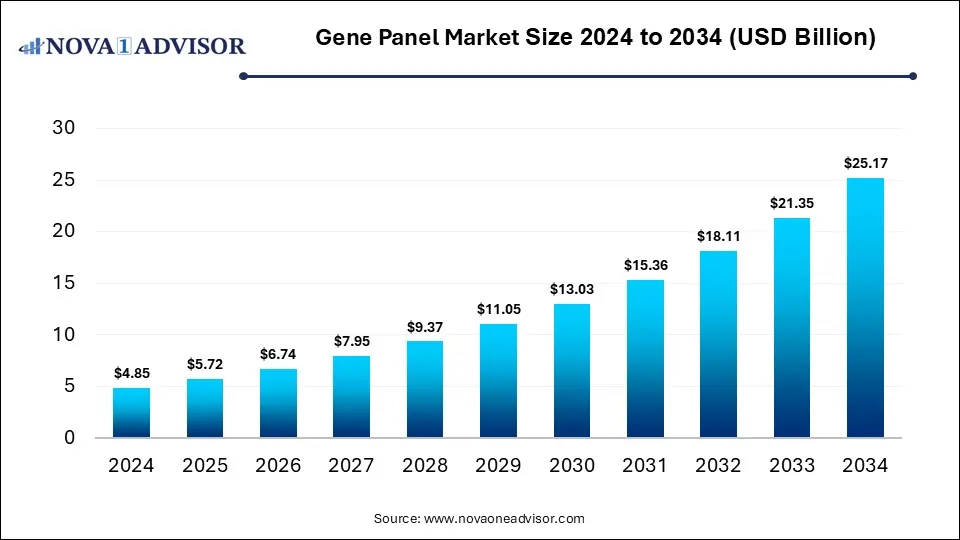

The global gene panel market size was USD 4.85 billion in 2024, calculated at USD 5.72 billion in 2025 and is expected to reach around USD 25.17 billion by 2034, expanding at a CAGR of 17.9% from 2025 to 2034. The gene panel market growth can be linked to the rising cases of cancer and genetic disorders, demand for precision medicine, continuous improvements in next-generation sequencing (NGS), and increased awareness of genetic testing.

Gene Panel Market Key Takeaways

- North America gene panel market dominated the global gene panel market with a share of 37% in 2024.

- The gene panel market in the U.S. dominated the North America gene panel market with a share of 72% in 2024

- Asia Pacific gene panel market is projected to register the fastest CAGR of 19.6% over the forecast period

- Test kits dominated the market and accounted for revenue share of 60.19% in 2024

- Testing services are expected to witness the fastest growth at a CAGR of 18.0% over the forecast period

- Amplicon-based approach dominated the market and accounted for a share of 80% in 2024.

- The hybridization-based approach is expected to grow at a significant rate over the forecast period

- Predesigned gene panels dominated the market and accounted for revenue share of 67% in 2024

- Customized gene panels are expected to register substantial growth over the forecast period.

- Cancer risk assessment accounted for the largest market share of 55% in 2024.

- The diagnosis of congenital diseases is expected be the fastest-growing market application with a 20.4% CAGR over the forecast period.

- The academic & research institutes segment had the highest revenue share in 2024, accounting for 43% of the total revenue.

- The pharmaceutical & biotechnology companies segment is projected to witness the most lucrative growth rate of 22.8% between 2025 and 2034.

Market Overview

The gene panel market has emerged as a transformative segment in molecular diagnostics, offering focused, high-resolution insights into genetic variations associated with a multitude of conditions. A gene panel refers to a test that analyzes multiple genes simultaneously for mutations, deletions, duplications, or other genetic alterations. As precision medicine becomes the standard in oncology, rare disease diagnosis, reproductive health, and pharmacogenetics, gene panels have gained widespread clinical and research relevance.

Unlike whole genome or exome sequencing, gene panels offer targeted testing that is faster, more cost-effective, and easier to interpret. These panels range from small (focusing on a few genes related to specific syndromes) to large panels encompassing dozens or hundreds of genes involved in complex diseases like cancer. In clinical practice, gene panels are now regularly employed to identify hereditary cancer risk (e.g., BRCA1/2, Lynch syndrome), guide targeted therapies (e.g., EGFR, KRAS in lung cancer), or support newborn screening and congenital disease diagnosis.

The rise of next-generation sequencing (NGS) platforms and bioinformatics tools has significantly boosted the accessibility and accuracy of gene panel tests. Furthermore, growing awareness among clinicians, advances in genomics, and favorable reimbursement policies in key markets like the U.S. are accelerating the adoption of gene panels in both clinical and direct-to-consumer settings. As healthcare systems globally push toward early detection, personalized therapy, and preventive care, gene panels are becoming indispensable tools in the modern diagnostic arsenal.

Major Trends in the Market

-

Expansion of Multi-Cancer Early Detection Panels: Companies are developing large panels for simultaneous screening of multiple cancer types.

-

Rise of Pharmacogenomic Panels: Tailored drug-gene panels are being used to predict patient responses to common medications.

-

AI Integration in Variant Interpretation: Machine learning algorithms are being adopted to improve clinical interpretation of panel results.

-

Customized Panels for Rare and Pediatric Diseases: Personalized panels are addressing the unmet diagnostic needs in rare genetic conditions.

-

Regulatory Support and CLIA Approvals: Increasing number of laboratory-developed tests (LDTs) are receiving CLIA certification and FDA attention.

-

Direct-to-Consumer (DTC) Genetic Panels: Consumer demand for health-related insights is driving the DTC gene panel space.

-

Integration with Electronic Health Records (EHRs): Genomic reports from panels are being integrated into EHRs for longitudinal patient management.

-

Expansion of Liquid Biopsy-based Panels: Non-invasive gene panel tests using circulating tumor DNA (ctDNA) are gaining traction in oncology.

How is AI Impacting the Gene Panel Market?

The integration of artificial intelligence (AI) in gene panel can improve the analysis and understanding of genetic data generated through gene panel tests. AI algorithms can be applied for interpretation of genetic variants for identification of disease-causing traits as well as for integrating genetic data with different sources of information like clinical data and environmental factors, further offering better understanding of an individual’s health risk. Personalized reports developed by AI-powered systems can help in providing tailored solutions for health management.

Gene Panel Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 5.72 Billion |

| Market Size by 2034 |

USD 25.17 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 17.9% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product & Services, Technique, Design, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

BGI, Illumina, Inc., Agilent Technologies, Inc, Eurofins Scientific, QIAGEN, OriGene Technologies, Inc., Bioneer Corporation, GenScript, Eurogentec, Twist Bioscience., BioCat GmbH, Thermo Fisher Scientific Inc, Novogene Co., Ltd, GENEWIZ, Inc., Integrated DNA Technologies, Inc, F. Hoffmann-La Roche Ltd, ArcherDX, Inc. and GATC Biotech AG |

Market Driver: Rising Prevalence of Genetic and Hereditary Disorders

One of the central drivers fueling the gene panel market is the rising burden of genetic and hereditary conditions globally. In cancer care, nearly 10% of all malignancies are linked to inherited mutations, necessitating the use of germline and somatic mutation panels. Similarly, rare diseases—of which over 80% have a genetic basis—affect nearly 400 million people worldwide. These conditions are often difficult to diagnose without genetic testing, and gene panels offer a practical approach to uncovering pathogenic mutations quickly and affordably.

In oncology, multi-gene panels are routinely used to guide treatment plans. For example, breast cancer panels help determine the utility of PARP inhibitors, while lung cancer panels screen for actionable targets like EGFR, ALK, and ROS1 mutations. Outside cancer, conditions like cystic fibrosis, Duchenne muscular dystrophy, and inherited cardiomyopathies also benefit from gene panel diagnostics. This broad application landscape is encouraging hospitals, diagnostics labs, and clinicians to invest in gene panel solutions as first-line tools for precision diagnostics.

Market Restraint: Interpretation Complexity and Data Management

Despite the growing utility of gene panels, interpretation of genetic variants remains a substantial challenge. Many panel tests detect variants of uncertain significance (VUS), which do not have clear clinical implications. This creates ambiguity in diagnosis and decision-making, particularly in large panels that may include lesser-known genes. The lack of standardized guidelines for interpreting VUSs leads to inconsistencies in reporting and clinical recommendations.

Furthermore, managing and storing genomic data—especially in high-throughput environments—requires robust informatics infrastructure. Small laboratories or clinics may not have the technical capabilities to handle large datasets, annotate variants, and provide actionable reports. This complexity can slow down test adoption, create compliance risks, and increase costs, particularly for healthcare systems with limited digital maturity.

Market Opportunity: Emergence of Comprehensive Panels in Preventive Genomics

A major growth opportunity lies in the expansion of comprehensive gene panels for population-scale preventive genomics. With decreasing sequencing costs and increasing public interest in proactive health, comprehensive panels that screen for hereditary cancer risk, cardiovascular predisposition, pharmacogenomic variants, and metabolic disorders are gaining popularity. These panels not only provide insights into disease risk but also enable interventions before clinical symptoms appear.

For example, companies like Invitae and Helix are offering preventive panels to consumers and healthcare systems, often bundled with genetic counseling services. Employers and insurers are also exploring genetic screening as part of employee wellness programs. The use of comprehensive panels in proactive health screening has the potential to reshape preventive medicine, especially when paired with AI tools for risk prediction and real-world health data.

Gene Panel Market By Product & Service Insights & Trends

Testing services dominated the market, accounting for the highest revenue share in 2024. The dominance of this segment is attributed to the growing outsourcing of genetic testing to specialized diagnostic labs and commercial service providers. Many hospitals and small-scale clinics lack in-house sequencing infrastructure, leading to greater reliance on external laboratories that offer comprehensive test panels and reporting. Players like Fulgent Genetics, Invitae, and Color Genomics have built scalable platforms to deliver gene panel testing as a service, supported by digital portals, counseling, and secure data sharing.

Test kits are the fastest-growing segment, especially with the miniaturization of sequencing platforms and decentralization of diagnostics. As NGS systems become more affordable and portable, healthcare providers and research institutes are increasingly adopting test kits for in-house use. Companies like Thermo Fisher and QIAGEN are offering customizable, pre-configured gene panel kits compatible with their sequencing platforms, enabling faster turnaround times and data control. These kits are especially popular in academic research and regional diagnostic labs.

Gene Panel Market By Techniques Insights & Trends

Amplicon-based approaches currently dominate the market, as they offer faster and more cost-effective workflows for targeted sequencing. This method is especially suitable for detecting mutations in a small set of known genes, such as in BRCA panels or pharmacogenetic screening. The shorter library preparation times, lower DNA input requirement, and compatibility with high-throughput platforms make amplicon-based panels ideal for clinical laboratories.

Hybridization-based approaches are growing rapidly, as they enable broader genomic coverage and better detection of large indels, copy number variations, and rare mutations. These panels are favored in oncology and rare disease diagnostics, where mutation diversity is higher. Companies are enhancing probe design to improve capture efficiency and specificity, enabling accurate detection across large gene sets. For instance, Agilent’s SureSelect technology has become a preferred choice for hybrid capture-based panels in research and clinical settings.

Gene Panel Market By Design Insights & Trends

Predesigned gene panels dominate the market, primarily due to their validation, regulatory clearance, and ease of use. Commercially available panels for cancer, cardiovascular risk, or pharmacogenomics are widely adopted across clinical labs due to standardized workflows and evidence-backed gene lists. These panels save time and reduce interpretation burden for clinicians while ensuring compliance with regulatory guidelines. For example, Illumina’s TruSight Oncology and Thermo Fisher’s Oncomine panels are frequently used in clinical oncology.

Customized panels are the fastest-growing segment, as precision medicine demands increasingly tailored testing solutions. Research institutions, biotech startups, and clinical labs are designing custom panels targeting rare diseases, ethnically specific mutations, or novel drug targets. Advances in bioinformatics and panel design tools are making custom panel development faster and more affordable, enabling greater flexibility in diagnostics and translational research.

Gene Panel Market By Application Insights & Trends

Cancer risk assessment led the application segment, as multi-gene panels have become central to identifying hereditary cancer predispositions. Tests analyzing BRCA1/2, TP53, CHEK2, and MLH1 mutations are now standard for patients with personal or family histories of cancer. These tests not only guide treatment decisions (e.g., risk-reducing mastectomy, chemotherapy options) but also inform family member screening. The growing adoption of multi-cancer early detection programs further boosts this segment.

Pharmacogenetics is the fastest-growing application, driven by the demand for personalized prescribing. Gene panels that evaluate CYP2D6, CYP2C19, and other drug-metabolizing enzymes are increasingly used to predict patient responses to antidepressants, statins, blood thinners, and chemotherapeutics. The U.S. FDA has approved several drugs with pharmacogenomic labeling, and clinical guidelines (e.g., CPIC) are promoting gene-informed therapy. This has encouraged hospitals and insurers to include pharmacogenetics in their care models, significantly expanding panel usage.

Gene Panel Market By End Use Insights & Trends

Hospital & diagnostic laboratories dominate the end-use segment, as these institutions perform the bulk of clinical genetic testing. Hospital-based labs increasingly offer comprehensive panels for oncology, neurology, and prenatal care, while diagnostic labs serve as referral centers for complex cases. These settings demand high-throughput, clinically validated, and regulatory-compliant panel solutions, leading to partnerships with established vendors.

Pharmaceutical & biotechnology companies are rapidly expanding their use of gene panels, particularly in clinical trials and drug development. Companion diagnostics, patient stratification, and biomarker discovery rely heavily on gene panel data. Companies are integrating NGS-based gene panel analysis to enrich their trial cohorts and identify responders/non-responders early, increasing trial efficiency. Collaborations between pharma and genomic service providers are also enabling large-scale genomic profiling initiatives.

Gene Panel Market By Regional Insights & Trends

North America dominates the gene panel market, accounting for the highest revenue share, with the U.S. at the forefront due to its advanced healthcare system, early adoption of genomics, and strong reimbursement landscape. The region is home to major players like Illumina, Thermo Fisher, Guardant Health, and Invitae, all of whom have extensive gene panel offerings across diagnostics, oncology, and consumer genomics. Support from the NIH, FDA fast-tracking of companion diagnostics, and initiatives like All of Us have fostered a robust genomic ecosystem.

- For instance, in May 2025, BillionToOne, Inc., a molecular diagnostics company, expanded its offering with launch of UNITY Fetal Risk Screen, which is the company’s first-and-only cell-free DNA testing for single-gene conditions, available as early as nine weeks into pregnancy. The new panel provides accurate fetal risk assessment for up to 14 prevalent and actionable recessive and X-linked conditions, from a single maternal blood sample.

Asia-Pacific is the fastest-growing region, driven by rising healthcare expenditure, government-funded genomics initiatives, and increasing prevalence of genetic diseases. Countries like China, Japan, and South Korea are investing heavily in precision medicine. Chinese companies like Burning Rock and BGI are making significant strides in oncology gene panel diagnostics, while Japan is expanding hereditary cancer testing through public-private partnerships. As awareness grows and regulatory pathways mature, Asia-Pacific is poised to become a major hub for gene panel innovation and adoption.

- For instance, in September 2024, Nucleome Informatics, a Hyderabad-based provider of genomic services, launched its DrSeq IRD panel, which is a breakthrough genetic test for diagnosis of Inherited Retinal Diseases (IRDs.) The DrSeq IRD test comprises of 850 genes along with thousands of known and novel variants, further offering superior diagnostic accuracy.

China Gene Panel Market Trends

China is leading the gene panel market in Asia Pacific region, driven by factors such as the rising incidences of genetic disorders in the large population, increased investments in research and development activities, advancing healthcare infrastructure, and huge number of ongoing clinical trials. Growing awareness among the public and healthcare professionals regarding the advantages of genetic testing is expanding the market potential. Moreover, supportive government initiatives such as genomic projects as well as rising strategic partnerships among companies and research institutes are accelerating the development and commercialization of gene-based therapies and genetic testing innovations.

Gene Panel Market Top Key Companies:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- QIAGEN N.V.

- BGI Genomics Co., Ltd.

- Eurofins Scientific SE

- GENEWIZ, Inc.

- Novogene Corporation

- Personalis, Inc.

- F. Hoffmann-La Roche Ltd.

Recent Developments

- In June 2025, GoPath Diagnostics, a leader in molecular and digital pathology services, launched its genetic test panel, named DiabetesNow, which is a comprehensive genetic test designed specifically for supporting the diagnosis, classification, and management of diabetes.

- In April 2025, 1Cell.Ai, formerly known as OneCell Diagnostics, introduced its comprehensive multi-modal cancer diagnostic panel, Oncolncytes. The new panel launched by the AI-powered precision oncology leader integrates different types of data such as Circulating Tumor DNA (ctDNA). Circulating Tumor Cells (CTCs) at single cell resolution, Proteomics (150 proteins at the single cell level) and RNA transcriptomics.

- In October 2024, NGeneBio launched its new precision diagnostic panel, Oncoaccupanel RNA in South Korea. The RNA diagnostic panel is designed specifically for detection of oncogenic fusion genes, usually found in solid tumors.

Gene Panel Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Gene Panel market.

By Product & Services

- Test Kits

- Testing Services

By Technique

- Amplicon-based Approach

- Hybridization-based Approach

By Design

- Predesigned Gene Panel

- Customized Gene Panel

By Application

- Cancer Risk Assessment

- Syndrome Specific

- High Penetrance

- High & Moderate Penetrance

- Comprehensive Cancer Risk

- Diagnosis of Congenital Diseases

- Pharmacogenetics

- Other Applications

By End Use

- Academic & Research Institutes

- Hospital & Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)