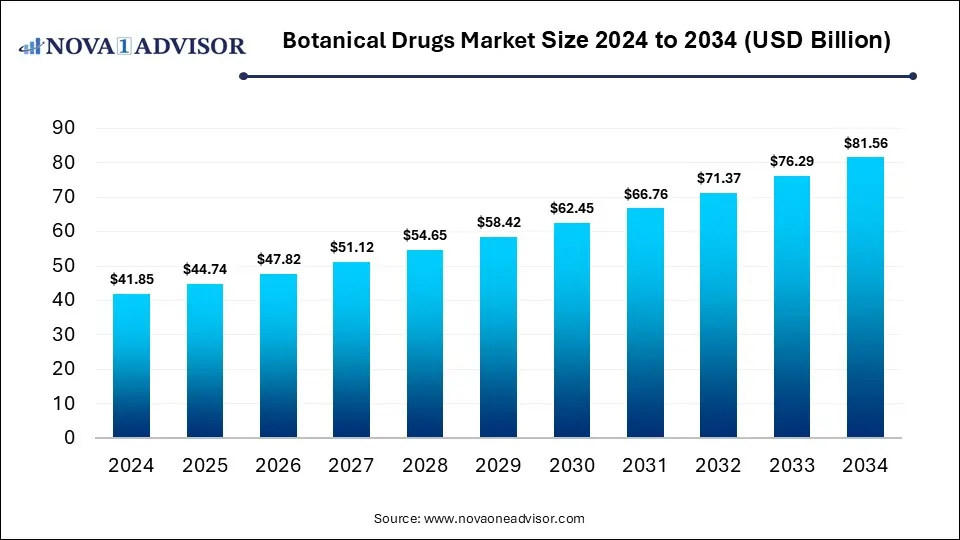

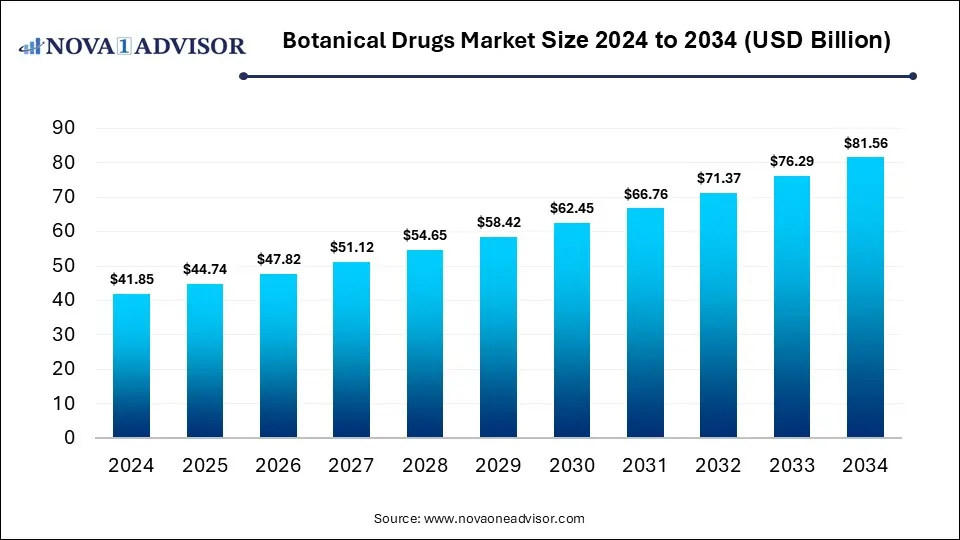

Botanical Drugs Market Size Trends Analysis and Forecast till 2034

The global botanical drug market size was estimated at USD 41.85 billion in 2024 and is expected to reach USD 81.56 billion by 2034, expanding at a CAGR of 6.9% during the forecast period of 2025 to 2034. The growth of the market is driven by rising demand for natural therapies, increased chronic disease prevalence, and growing consumer preference for plant-based, clinically validated treatments.

Key Takeaways

- By region, North America dominated the botanical drug market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth over the forecast period.

- By source, the plant-based segment dominated the market in 2024.

- By source, the fungi-based segment is expected to grow at the fastest rate in the coming years.

- By type, the prescription segment held a significant share of the market in 2024.

- By type, the OTC segment is expected to expand at the fastest CAGR during the forecast period.

- By form, the tablets segment held the largest share of the market in 2024.

- By form, the liquids segment is expected to grow at the highest CAGR between 2025 and 2034.

- By therapeutic indication, the cardiovascular diseases segment led the market in 2024.

- By therapeutic indication, the respiratory diseases segment is likely to grow at the fastest CAGR in the upcoming period.

- By distribution channel, the retail pharmacies segment contributed the largest market share in 2024.

- By distribution channel, the online pharmacies segment is expected to expand at a rapid pace over the projection period.

How is AI Impacting the Botanical Drug Market?

AI is significantly transforming the botanical drug market by accelerating drug discovery, standardization, and clinical validation processes. Through machine learning and data analytics, researchers can now analyze vast datasets from traditional medicine, phytochemical databases, and clinical studies to identify promising plant-based compounds more efficiently. AI is also helping improve formulation accuracy and optimize extraction techniques, ensuring consistency in potency and quality, a longstanding challenge in botanical drug development. Moreover, predictive modeling enables faster identification of potential drug interactions and side effects, reducing time and cost in the R&D cycle. Overall, AI is bridging the gap between traditional knowledge and modern pharmaceutical standards, driving innovation and scalability in the botanical drug industry.

Market Overview

The botanical drug market comprises pharmaceutical products derived from plants and natural sources, developed through standardized extraction and formulation methods to meet regulatory standards for safety and efficacy. Botanical drugs offer multiple therapeutic benefits, including anti-inflammatory, antioxidant, and immunomodulatory effects, making them valuable in treating conditions such as cardiovascular diseases, respiratory disorders, gastrointestinal issues, and menopausal symptoms. Their natural origin, perceived safety, and lower side effect profile contribute to growing consumer and clinician preference, especially in chronic disease management. The market is experiencing rapid growth due to increasing demand for plant-based therapeutics, rising awareness of traditional medicine, technological advancements in extraction and standardization, and supportive regulatory frameworks.

Indian government body, the Ministry of Ayush has established the National Medicinal Plant Board (NMPB) to promote the cultivation and development of medicinal plants and coordinate efforts across ministries. NMPB supports MSMEs through various schemes, including the Central Sector Scheme for Conservation, Development, and Sustainable Management of Medicinal Plants, which focuses on their cultivation and protection.

What are the Major Trends in the Botanical Drug Market?

- Rising Integration of Traditional Medicine with Modern Science: Pharmaceutical companies are increasingly combining traditional plant-based remedies with modern clinical research to develop scientifically validated botanical drugs. This fusion enhances credibility and expands therapeutic applications in mainstream healthcare.

- Adoption of Advanced Extraction and Standardization Techniques: Technologies such as supercritical fluid extraction, chromatography, and molecular fingerprinting are improving the quality, consistency, and potency of botanical formulations. This ensures regulatory compliance and boosts consumer trust in botanical drugs.

- AI-Driven Drug Discovery and Formulation: Artificial intelligence and machine learning are being used to analyze phytochemical databases and traditional medicine texts, speeding up the identification of active compounds and optimizing formulations.

- Expansion into Chronic Disease Treatment: Botanical drugs are gaining popularity in managing chronic conditions such as cardiovascular disease, diabetes, arthritis, and menopause-related symptoms due to their long-term safety profiles. This trend is driven by increased patient preference for natural therapies.

Report Scope of Botanical Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 44.74 Billion |

| Market Size by 2034 |

USD 81.56 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Source, By Type, By Form, By Therapeutic Indication, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Preference for Natural and Plant-Based Therapies

Rising consumer preference for natural and plant-based therapies is one of the key factors driving the growth of the botanical drug market. Many individuals perceive botanical drugs as safer alternatives to synthetic pharmaceuticals, largely due to their natural origin and reduced risk of severe side effects. This shift in consumer mindset is particularly evident in the management of chronic and lifestyle-related conditions, where long-term use is often necessary. As awareness of holistic health and wellness grows, patients are increasingly seeking treatments that align with clean-label and eco-conscious values. This growing demand is encouraging pharmaceutical companies to invest in the research, development, and commercialization of standardized, clinically backed botanical drugs.

- A cross-sectional survey of 1,067 Malay women across Malaysia found that 55.5% used herbs for health, with raw herbs being the most preferred (69.5%). While 67.9% believed herbal remedies are generally safe for women, 91.8% acknowledged they may not be safe during pregnancy (p<0.001). Herbal use was significantly higher among married women (3.9x) and those with incomes below RM 3000 (USD 729), who were 6.2 times more likely to use herbs (p<0.001).

Increasing Government Support and Favorable Regulatory Guidelines

Increasing government support and favorable regulatory guidelines are significantly driving the growth of the market. Regulatory bodies like the U.S. FDA, EMA, and authorities in Asia Pacific are establishing clearer pathways for the approval of botanical drugs, encouraging pharmaceutical companies to invest in botanical drugs. Governments are also funding research initiatives and integrating traditional medicine systems into national healthcare strategies, which enhances credibility and access to plant-based therapies. This regulatory clarity reduces market entry barriers, speeds up drug development timelines, and builds confidence among stakeholders.

- On November 27, 2024, Brazil’s health regulator Anvisa launched three public consultations to revise the regulatory framework for herbal medicines. The initiative, supported by a Regulatory Impact Analysis Report, aims to ensure safe access to herbal products, promote biodiversity conservation, and boost the local pharmaceutical industry.

Growing Awareness and Acceptance of Traditional Medicine Systems

Growing awareness and acceptance of traditional medicine systems such as Ayurveda, Traditional Chinese Medicine (TCM), and Kampo are fueling the growth of the market. As global consumers and healthcare professionals increasingly recognize the therapeutic value of time-tested herbal remedies, demand for plant-based treatments has surged. This growing trust in traditional systems is prompting pharmaceutical companies to develop standardized botanical drugs that blend traditional knowledge with modern clinical validation. Government initiatives in countries like India and China further support this trend by promoting traditional medicine in national healthcare frameworks. Consequently, the market is seeing increased investment, innovation, and integration of botanical drugs into both alternative and mainstream medical practices.

- In May 2025, in a landmark move, the Ministry of Ayush and WHO signed an agreement to develop a dedicated Traditional Medicine module under the International Classification of Health Interventions (ICHI), strengthening the global recognition of traditional medicine systems.

Restraints

Complex Regulatory Pathways and Lack of Standardization

Complex regulatory pathways and lack of standardization significantly restrain the growth of the botanical drug market. Unlike synthetic drugs, botanical formulations often face challenges in meeting strict regulatory requirements due to variability in plant sources, extraction methods, and compound consistency. The absence of globally harmonized guidelines leads to delays in approvals and limits international market access for manufacturers. Additionally, inconsistent quality and lack of reproducible clinical data make it difficult to establish the safety and efficacy of many botanical products. These hurdles discourage investment and slow down innovation in the sector, limiting the full commercial potential of botanical drugs.

Limited Clinical Trials and Scientific Evidence

Limited clinical trials and insufficient scientific evidence are also restraining the growth of the market. Many plant-based therapies, though rooted in traditional use, lack the rigorous clinical validation required for regulatory approval and acceptance in mainstream medicine. This gap in evidence undermines the confidence of healthcare professionals and consumers, making them hesitant to adopt botanical drugs over conventional pharmaceuticals. Conducting high-quality clinical trials for botanical products is often complex and costly, especially due to the variability in plant composition and challenges in standardization. As a result, the slow pace of clinical research continues to hinder the market’s expansion and credibility.

Opportunities

Rising Demand for Personalized Medicine

Rising demand for personalized medicine creates significant opportunities in the botanical drug market. As healthcare increasingly shifts toward individualized treatment approaches, botanical drugs, known for their multi-targeted effects and natural origins, offer adaptable solutions tailored to a person’s genetic, metabolic, and lifestyle profiles. Advances in genomics and data analytics allow for better understanding of how individuals respond to specific plant-based compounds, enhancing treatment efficacy and safety. This alignment with personalized care makes botanical therapies more appealing in chronic and preventive health management. Consequently, pharmaceutical companies are exploring ways to integrate botanical formulations into precision medicine models, opening new avenues for innovation and market growth.

Focus on Specific Therapeutic Areas

A growing focus on specific therapeutic areas is creating immense opportunities in the market. Companies are increasingly targeting conditions like cardiovascular diseases, metabolic disorders, menopause symptoms, and mental health issues. This specialization allows for more focused research, better clinical outcomes, and stronger regulatory support due to clearer therapeutic claims. It also helps in building consumer trust, as patients seek natural alternatives for long-term management of chronic conditions. By concentrating efforts on these conditions, botanical drug developers can differentiate their products and tap into underserved niches within the broader pharmaceutical sector.

- In March 2025, DeFloria Inc., a joint venture of Ajna BioSciences and Charlotte’s Web, received FDA clearance to begin Phase 2 trials for AJA001, an oral multi-cannabinoid drug for autism spectrum disorder (ASD). This marks a first in botanical drug development, not just for cannabinoid-based therapies.

Demand for Combination Therapies

The rising demand for combination therapies is opening new opportunities in the market. Botanical ingredients are increasingly being integrated with conventional pharmaceuticals or other natural compounds to enhance therapeutic efficacy and minimize side effects. These combinations can offer synergistic effects, particularly in treating complex, chronic conditions like arthritis, diabetes, and cardiovascular diseases. This approach aligns with personalized and holistic treatment models, making botanical drugs more appealing to both healthcare providers and patients. As a result, pharmaceutical companies are investing in research to develop innovative combination therapies that include plant-based components, expanding the market potential.

What Macroeconomic Factors impact the Growth of the Botanical Drug Market?

GDP and Economic Growth

GDP and economic growth positively impact the market by increasing consumer purchasing power and healthcare spending, which boosts demand for natural and alternative therapies. Strong economic conditions also encourage investment in research and development, enabling innovation and market expansion. However, during economic downturns, limited disposable income and budget constraints may restrain market growth as consumers prioritize essential healthcare needs.

Inflation Rates

Inflation rates negatively impact the market by increasing the costs of raw materials, production, and distribution, which can lead to higher prices for consumers. Elevated prices may reduce affordability and limit demand, especially in price-sensitive markets. However, sustained consumer preference for natural remedies may help mitigate some of the negative impact of inflation on market growth.

Monetary and Fiscal Policies

Monetary and fiscal policies can drive the growth of the market by promoting economic stability, increasing healthcare funding, and encouraging investments in research and innovation. Supportive policies such as tax incentives, subsidies, and grants help reduce costs for manufacturers and improve market accessibility.

Segment Outlook

By Source

Why Did the Plant-Based Segment Dominate the Botanical Drug Market in 2024?

The plant-based segment dominated the market while holding the largest share in 2024 due to the widespread use of plants in traditional and modern medicine, backed by a growing body of clinical research. Plants offer a vast and diverse source of bioactive compounds with proven therapeutic benefits, making them a preferred choice for drug development. Consumer preference has also shifted toward natural and plant-derived remedies, driven by concerns over synthetic drug side effects. Additionally, regulatory support and easier standardization of plant-based formulations have further propelled their market dominance. The scalability and global availability of medicinal plants have made them more commercially viable compared to algae- or fungi-based sources.

The fungi-based segment is expected to grow at the fastest rate during the projection period due to increasing research into the therapeutic potential of medicinal mushrooms. Fungi are rich in bioactive compounds with proven anti-inflammatory, immunomodulatory, and anticancer properties, making them valuable for treating a range of chronic conditions. Growing consumer interest in natural and functional health solutions has further fueled demand for fungi-derived therapies. Advances in biotechnology and extraction methods have improved the standardization and scalability of fungal ingredients. Additionally, the rising popularity of mycotherapy and support from integrative medicine practices are accelerating the segment’s growth trajectory.

By Type

What Made Prescription the Dominant Segment in 2024?

The prescription segment dominated the botanical drug market with a significant share in 2024. This is mainly due to the growing acceptance of plant-based therapies within healthcare systems. Many botanical drugs have undergone rigorous clinical trials and received regulatory approval, making them eligible for prescription use in treating chronic conditions like cardiovascular disease, arthritis, and menopause symptoms. Physicians increasingly recommend these therapies as complementary or alternative options to conventional drugs, boosting their credibility and adoption.

Additionally, the prescription model ensures proper dosage, monitoring, and adherence, which enhances patient safety and treatment outcomes. This regulatory backing and clinical validation have positioned prescription botanical drugs as a trusted option in modern medicine.

The OTC segment is expected to expand at the fastest CAGR in the upcoming period due to increasing consumer preference for convenient, self-care solutions that support wellness without the need for prescriptions. Growing awareness of natural and plant-based health benefits is driving demand for easily accessible, non-prescription products. The rise of e-commerce and online pharmacies has further expanded consumer access to OTC botanical drugs. Additionally, a shift toward preventive healthcare and holistic approaches encourages consumers to seek natural remedies for common ailments. This combination of accessibility, convenience, and growing health consciousness is fueling the segment’s growth.

How Does the Tablets Segment Dominate the Botanical Drug Market in 2024?

The tablets segment dominated the market by holding the largest share in 2024 due to their convenience, precise dosing, and long shelf life, making them a preferred choice for both manufacturers and consumers. Tablets are easy to produce at scale and offer consistent quality and stability compared to other forms like powders or liquids. Their portability and ease of use support better patient compliance, especially for chronic treatments. Additionally, tablets allow for controlled release formulations, enhancing the effectiveness of botanical ingredients. These advantages have solidified tablets as the leading delivery form in the market.

The liquids segment is expected to grow at the highest CAGR during the forecast period. This is primarily due to their ease of consumption and faster absorption compared to solid forms. Liquids are especially favored by children, elderly patients, and those with swallowing difficulties, expanding their user base. The rising demand for convenient, ready-to-use formats and customizable dosages also contributes to this growth. Additionally, advances in formulation technology have improved the stability and taste of liquid botanical products. These factors make liquids an increasingly popular choice among consumers and manufacturers alike.

By Therapeutic Indication

How Does the Cardiovascular Segment Lead the Botanical Drug Market in 2024?

The cardiovascular diseases segment led the market in 2024 due to the high global prevalence of heart-related conditions and the growing demand for natural, safer alternatives to conventional treatments. Botanical drugs with cardioprotective properties, such as those derived from herbs like garlic, hawthorn, and turmeric, have gained widespread acceptance for managing blood pressure, cholesterol, and inflammation. Increased awareness of the side effects associated with synthetic drugs has driven patients and healthcare providers to explore plant-based options. Additionally, ongoing research and clinical evidence supporting the efficacy of botanical therapies in cardiovascular health have boosted their credibility and adoption.

The respiratory diseases segment is likely to grow at the fastest CAGR in the coming years, owing to increasing prevalence of conditions like asthma, bronchitis, and allergies worldwide. Consumers are seeking natural, effective alternatives to traditional respiratory medications, driven by concerns over side effects and long-term drug use. Botanical ingredients such as eucalyptus, licorice, and mullein, known for their anti-inflammatory and expectorant properties, are gaining popularity. Additionally, rising awareness about respiratory health amid pollution and respiratory infections is boosting demand. Advances in formulation and increasing acceptance of herbal remedies by healthcare providers further support the segment’s growth.

By Distribution Channel

Why Did Retail Pharmacies Contribute the Largest Market Share in 2024?

The retail pharmacies segment accounted for the largest share of the botanical drug market in 2024. This is primarily due to their widespread availability and trusted status as a primary point of access for consumers seeking health products. Retail pharmacies offer convenient, immediate purchase options and personalized customer service, which build consumer confidence in botanical therapies. Their established distribution networks ensure broad geographic reach, including urban and rural areas. Additionally, many retail pharmacies have expanded their natural health and wellness product lines, making botanical drugs more visible and accessible. This combination of trust, convenience, and accessibility solidified retail pharmacies as the leading distribution channel.

The online pharmacies segment is expected to expand at a rapid pace over the projection period due to increasing consumer preference for convenient, contactless shopping and access to a wider product range. Online platforms offer competitive pricing, detailed product information, and customer reviews that help buyers make informed decisions. The rise of digital health awareness and e-commerce adoption, especially among younger and tech-savvy consumers, is fueling this growth. Additionally, online pharmacies provide discreet purchasing options and home delivery, enhancing accessibility for people in remote or underserved areas.

By Region

What Made North America the Dominant Region in the Botanical Drug Market?

North America maintained dominance in the botanical drug market while capturing the largest share in 2024. This is mainly due to high consumer awareness and acceptance of natural and alternative therapies alongside conventional medicine. The region benefits from a well-established healthcare infrastructure, strong regulatory frameworks, and significant investment in research supporting the safety and efficacy of botanical drugs. Additionally, increasing prevalence of chronic diseases and a growing aging population have boosted demand for plant-based treatments. Robust distribution networks, including pharmacies and online platforms, further enhance market accessibility.

The U.S. maintained a stronghold on the North America botanical drug market due to its large healthcare sector, advanced regulatory framework, and high consumer demand for natural and alternative therapies. Strong research and development capabilities, along with significant investments in clinical studies, have supported the growth and acceptance of botanical drugs. The U.S. also benefits from widespread health awareness, a growing aging population, and a well-established distribution network that includes pharmacies and online retailers. Additionally, regulatory bodies like the FDA provide clear guidelines that facilitate market entry and consumer confidence. These factors have made the U.S. the leading country in the market in North America.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth in the coming years due to the strong cultural acceptance and long-standing use of traditional herbal medicine across countries like China, India, and Japan. Rapid urbanization, rising disposable incomes, and increasing health awareness are driving demand for natural and preventive healthcare solutions. Growing investments in research and development, along with expanding e-commerce and retail infrastructure, are enhancing accessibility. Additionally, government support and integration of traditional medicine into mainstream healthcare systems further boost market expansion.

China is a major contributor to the Asia Pacific botanical drug market due to its deep-rooted history and widespread use of traditional Chinese medicine (TCM), which heavily relies on botanical ingredients. The country benefits from strong government support, including policies promoting the integration of TCM into mainstream healthcare. Rapid urbanization, increasing healthcare spending, and growing consumer preference for natural remedies further drive market growth. Additionally, China’s advanced manufacturing capabilities and expanding export of botanical products contribute significantly to the region’s market.

India is emerging as a key player in the market within Asia Pacific due to its rich heritage in traditional medicine systems like Ayurveda, Unani, and Siddha, which provide a strong foundation for botanical drug development. The country has abundant biodiversity and a vast repository of medicinal plants, making it a natural hub for research and production. Government initiatives, such as support from the Ministry of AYUSH and investments in medicinal plant cultivation and standardization, are further accelerating market growth. Additionally, rising domestic and global demand for natural and plant-based therapies is driving Indian pharmaceutical and biotech companies to invest in botanical drug R&D and exports.

At a Geneva ceremony, India committed US$85 million over 10 years (2022–2032) to support the WHO Global Traditional Medicine Centre. The funding will strengthen the evidence base for traditional medicine through research on policies, practices, products, and public use.

Region-Wise Breakdown of the Botanical Drug Market

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Factors |

Key Challenges |

Market Outlook |

| North America |

USD 17.4 Bn |

5.87% |

Strong regulatory infrastructure; high R&D investment; consumer awareness; large healthcare spending; established pharmaceutical and herbal industries |

Regulatory hurdles for botanical drug approvals; high cost of clinical trials; variability in product quality

|

Dominant region with stable and steep growth, especially in the U.S. |

| Asia Pacific |

USD 12.2 Bn |

7.05% |

Deep traditions of herbal medicine (TCM, Ayurveda etc.); growing healthcare access; rising consumer awareness; increasing disposable incomes; government support/policies favoring traditional medicine |

Infrastructure gaps in some countries; regulatory diversity & uncertainty; supply chain issues; variation in standards of proof for efficacy |

Fastest-growing region |

| Europe |

USD 9.8 Bn |

9.91% |

Strong emphasis on complementary/alternative medicine; established botanical/herbal traditions; supportive consumer base; favorable regulatory environment in some countries |

Regulatory variance between countries; quality and standardization issues; high cost of clinical validation; competition from conventional pharmaceuticals |

Significant growth |

| Latin America |

USD 3.4 Bn |

4.64% |

Rich biodiversity; rising health awareness; growing demand for natural remedies; improvements in regulatory frameworks and local manufacturing |

Low investment in clinical drug development; weaker regulatory infrastructure; less developed distribution networks; limited R&D capacity |

Emerging region with moderate growth |

| MEA |

USD 2.1 Bn |

3.6% |

Increasing interest in affordable healthcare; rising awareness of plant‑based medicines; growing middle class; improvement in healthcare infrastructure in some countries |

Issues around regulatory harmonization; scarcity of high‑quality raw materials; lower accessibility; challenges in logistics and quality assurance |

Considerable and steady growth prospects |

Botanical Drug Market Value Chain Analysis

1. Raw Material Sourcing

This stage involves the cultivation, harvesting, and procurement of botanical ingredients such as medicinal plants, herbs, fungi, or algae. Quality, consistency, and sustainability of raw materials are critical, as variations can impact the efficacy and safety of the final drug product. With rising global demand, sourcing is often done from biodiversity-rich regions like Asia-Pacific and Latin America.

2. Extraction and Processing

After sourcing, raw botanicals undergo extraction to isolate active compounds using techniques such as solvent extraction, steam distillation, or supercritical COâ‚‚ extraction. This stage also includes standardization to ensure consistent levels of bioactive ingredients in every batch.

3. Drug Development and Formulation

In this phase, the extracted botanical compounds are developed into specific drug formulations such as tablets, capsules, liquids, or topical applications. Formulation science ensures the right dosage, release mechanism, and shelf stability. Botanical drugs also undergo preclinical and clinical studies to establish safety, efficacy, and pharmacokinetics. Unlike dietary supplements, botanical drugs require stricter compliance with pharmaceutical development protocols.

4. Regulatory Approval

Botanical drugs must comply with regulatory requirements, which vary by country. In the U.S., for example, drugs must meet FDA’s Botanical Drug Development Guidance, while in the EU, EMA standards apply. This stage involves submitting safety and efficacy data, Good Manufacturing Practice (GMP) documentation, and other compliance records. The process is often lengthy and resource-intensive, but crucial for market authorization and credibility.

5. Manufacturing

Once approved, drugs are manufactured under GMP-certified facilities to ensure quality, safety, and consistency. This includes scaling up from lab-scale production to commercial manufacturing, with strict quality control protocols. Manufacturing may be done in-house or outsourced to contract manufacturing organizations (CMOs), especially for complex formulations or global distribution. Traceability, contamination control, and documentation are essential in this stage.

6. Distribution and Logistics

This stage involves the storage, transportation, and delivery of finished botanical drugs to various distribution channels such as retail pharmacies, hospitals, or online platforms. Efficient logistics are key to maintaining product integrity, especially for temperature-sensitive formulations. Global distribution also requires regulatory documentation and customs compliance for cross-border trade.

7. Marketing and Sales

Companies invest in educational marketing to inform healthcare providers and consumers about the benefits and proper use of botanical drugs. This includes digital campaigns, medical detailing, webinars, and product sampling.

8. Post-Market Surveillance

Once the drug is in use, manufacturers must monitor for adverse events, consumer feedback, and long-term safety or efficacy outcomes. This includes pharmacovigilance programs and ongoing quality audits. Regulatory bodies may require periodic reporting or label updates based on post-market data. A strong surveillance system helps build trust and ensures continued compliance and product improvement.

Botanical Drug Market Companies

1. Buchang Pharmaceuticals (China)

Buchang is a major leader in traditional Chinese medicine (TCM), with a pipeline of over 200 botanical drug varieties under development, including dozens of new drug TCMs. Their scale, domestic manufacturing, and regulatory alignment in China give them a strong advantage in bringing botanical therapies to market.

2. China TCM (China)

China TCM (traditional Chinese medicine institutions) support an extensive infrastructure of medical institutions and practitioners, which amplifies the integration of botanical drugs into mainstream care. They also contribute significantly via research, large scale production, and distribution networks that help botanical medicines reach broad populations.

3. Dr. Willmar Schwabe GmbH & Co. KG (Germany)

Schwabe invests heavily in R&D for botanical and herbal medicines, especially in standardized extracts and evidence based phytotherapy. Their global presence and manufacturing quality (e.g., standardized extracts) help set benchmarks for efficacy and quality in the market.

4. Tsumura & Co. (Japan)

Tsumura specializes in Kampo (Japanese herbal medicine) and produces herbal formulations studied clinically, with strong trust among practitioners and consumers. They help bridge traditional medicine and modern pharmaceutical standards in formulation and regulation.

5. Bionorica SE (Germany)

Bionorica is known for herbal medicines, particularly in Europe, focusing on plant derived compounds in respiratory, cardiovascular, and metabolic indications. They invest in clinical trials to validate efficacy of herbal drugs, enhancing acceptance among doctors and regulators.

6. Yunnan Baiyao (China)

Yunnan Baiyao has strong brand recognition and a broad portfolio of herbal remedies, leveraging centuries old traditional knowledge. Its capacity to supply well known formulations at scale gives it substantial market share.

7. Tong Ren Tang (China)

One of China’s oldest TCM companies, Tong Ren Tang has broad credibility, historical legacy, and trust which help in consumer acceptance. They also work in both retail herbal preparations and more modernized botanical drug formats.

8. Weleda (Switzerland / Global)

Weleda is well known for organic / natural botanicals and phytomedicines, often in wellness, skin health, and related therapeutic areas. It helps raise the standard for sustainable sourcing and quality in botanical formulations.

9. Bayer AG

Bayer, a large global pharmaceutical company, is expanding into plant derived drugs and botanical medicines, benefiting from its strong R&D, regulatory expertise, and global footprint. Their involvement helps mainstream botanical drugs into more conventional therapy areas.

10. Pfizer Inc.

Pfizer is active in botanical / plant derived drug market segments; investing in research and possibly acquisitions / partnerships to add botanical therapies to its portfolio. This improves availability of clinically validated botanical therapies in therapeutic areas where Pfizer already operates.

11. Sanofi S.A.

Sanofi is integrating botanical and herbal drug approaches in certain therapeutic domains (e.g. digestive, cardiovascular) and collaborating with traditional medicine institutes. Their strong regulatory knowledge, global reach, and R&D strength make them capable of elevating botanical drugs from niche to mainstream.

12. GlaxoSmithKline plc (GSK)

GSK has a broad healthcare portfolio and is adopting natural based therapies in supplement / botanical drug spaces, leveraging their scientific and clinical trial infrastructure. Their reputation and distribution help in trust building and commercialization.

13. Nature’s Way Products, LLC

Nature’s Way is a well established provider of herbal supplements and botanical products, emphasizing high quality, rigorous testing, and a diverse product line for wellness and therapeutic support. Their strength is in consumer trust and accessibility via OTC / retail channels.

14. Gaia Herbs, Inc.

Gaia Herbs specializes in organic, sustainably sourced herbs and extracts, with strong branding around purity and transparency. Their focus on formulation quality and sustainable practices helps appeal to informed consumers and supports premium botanical drug/ supplement offerings.

15. Jaguar Health, Inc.

Jaguar Health is more of a specialist / niche player in botanical drug or plant derived therapeutics, often in lesser served therapeutic areas. They drive innovation through focusing on botanicals with interesting bioactive potential and exploring new delivery forms.

Recent Development

- In August 2025, Welcure Drugs & Pharmaceuticals Ltd announced plans to invest ₹70–80 crore in setting up an agro-pharma research lab focused on botanical and Ayurvedic product development. To fund the project and other needs, the company aims to raise up to ₹80 crore through a QIP in multiple tranches.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the botanical drugs market.

By Source

- Algae-Based

- Fungi-Based

- Plant-Based

By Type

By Form

- Capsules

- Powders

- Liquids (Solution)

- Tablets

- Others

By Therapeutic Indication

- Cardiovascular Diseases

- Gastrointestinal Disorders

- Respiratory Diseases

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)