Capacitor Market Market Size, Growth and Trends 2026 to 2036

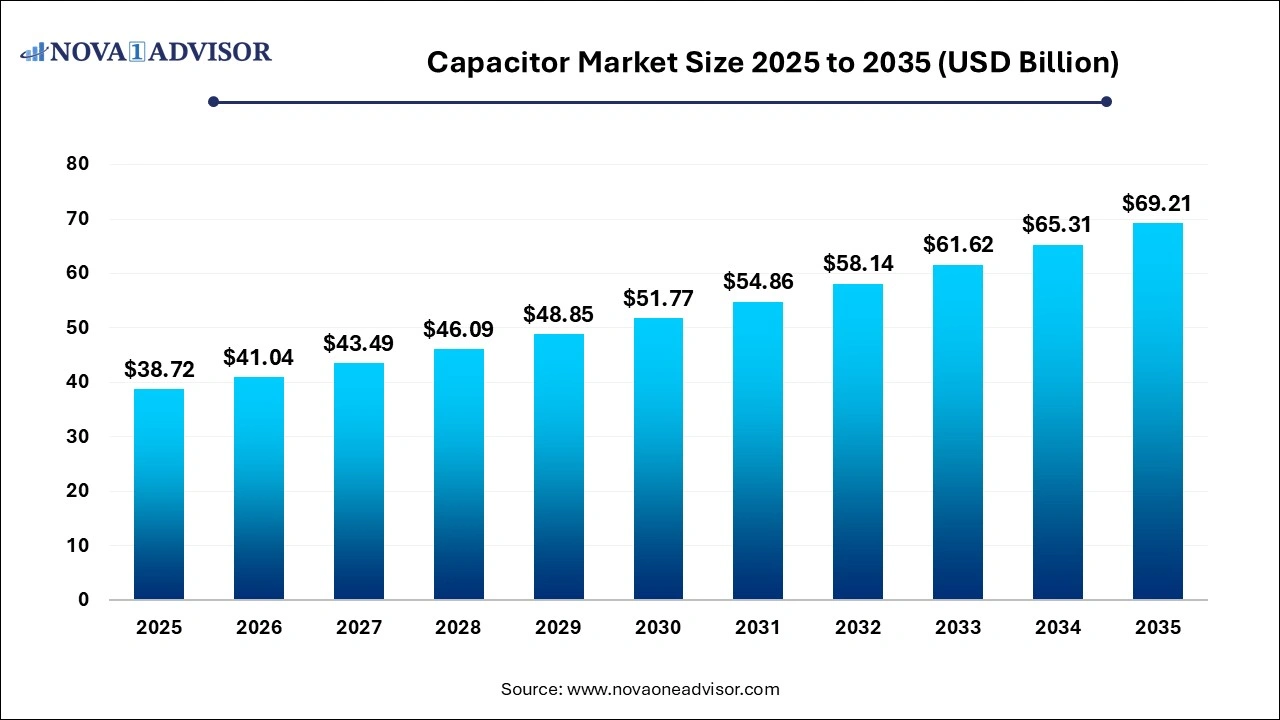

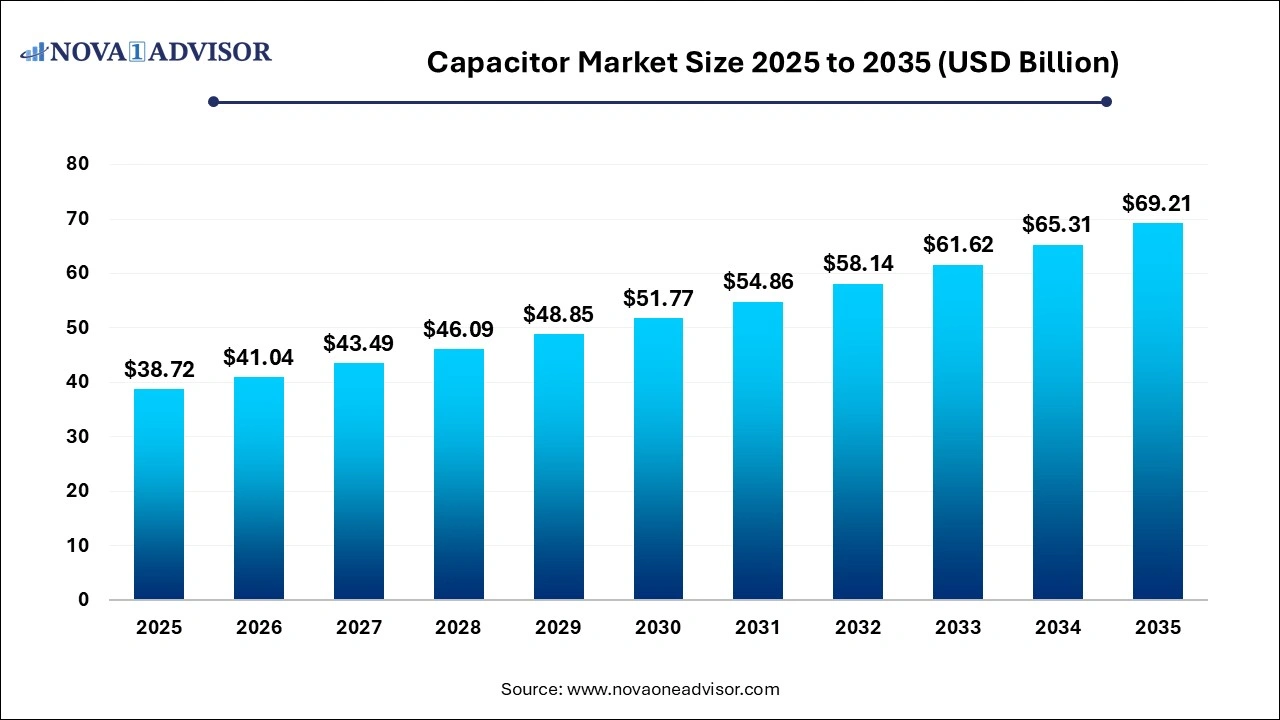

The global capacitor market size was exhibited at USD 38.72 billion in 2025 and is projected to hit around USD 69.21 billion by 2035, growing at a CAGR of 5.98% during the forecast period 2026 to 2036.

Key Takeaways:

- By geography, North America accounts for the rapidly growing demand for the capacitor market.

- By product, the offline/standby segment captured the majority of the market.

- By type, the ceramic capacitors segment is anticipated to hold the most significant market share in 2025.

- By type, the double-layer/super capacitor segment is expected to grow at the fastest CAGR in the Capacitor market during the forecast period.

- By application, the consumer electronics segment dominated the capacitor market.

- By application, the automotive electronics segment is expected to hold the fastest-growing Capacitor market in the coming years.

Report Scope Capacitor Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 11.06 Billion |

| Market Size by 2035 |

USD 18.66 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.98% |

| Base Year |

2025 |

| Segments Covered |

By Type, By Application |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Samsung Electro-Mechanics, Panasonic Corporation, Shenzhen Sunlord Electronics Co., Ltd., TDK Corporation, Abracon LLC, API Technologies Company, Eaton Corporation PLC, Hitachi AIC, Inc., Nichicon Corporation, KEMET Electronics Corporation, Kyocera Corporation, VINATech Co., Ltd., Vishay Intertechnology, Inc. |

Capacitor Market Segment Insights

By Type Insights

The ceramic capacitor segment is driven by its superior frequency stability and reliability have made them indispensable for EV powertrains, where they manage complex filtering and decoupling tasks in increasingly high-voltage architectures. Furthermore, advancements in thin-layer manufacturing have enhanced their capacitance-to-volume ratio, offering a highly cost-effective and versatile alternative to traditional dielectric materials.

The Double-Layer/Super Capacitor segment is driven by the transition to electric mobility, where they are critical for regenerative braking and high-cycle power assistance. By offering superior power density and faster charging cycles compared to traditional batteries, these components are increasingly utilized to stabilize renewable energy grids and power compact IoT architectures. As manufacturing scales, their enhanced reliability and ability to withstand extreme voltage fluctuations make them a primary driver for advanced energy storage innovation.

By Application Insights

The consumer electronics segment is driven by the rising transition to 5G technology, and high-resolution displays have necessitated advanced multilayer ceramic capacitors (MLCCs) that offer superior signal filtering and increased energy density. Furthermore, the rapid proliferation of internet-connected devices in emerging economies continues to drive massive production volumes and manufacturing innovation.

The automotive electronics segment is driven by the integration of ADAS and autonomous driving technologies, necessitating high-density capacitors for real-time sensor data processing and high-speed connectivity. As the industry migrates toward 800V architectures, the market is pivoting toward specialized, high-reliability, and high-voltage components capable of withstanding extreme thermal stress.

Capacitor Market Regional Insights

How Did the North America Dominat in the Capacitor Market?

The North America region is experiencing a massive shift towards electric vehicals in the region has significantly boosted demand for advanced, higher-performance capacitors. The rising need for renewable energy integration and aging infrastructure upgrade necessitates high-voltage and power-conditioning capacitors, and regional innovation in research and development technologies.

U.S. Capacitor Market Trends

U.S. acceleration of EV and the massive reshoring of the high-tech supply chain under initiatives like the Inflation Reduction Act. Manufacturers are successfully scaling high-voltage MLCCs and specialized supercapacitors to manage the 48V subsystems and solid-state architectures required for next-generation automotive and grid infrastructure. This technical evolution, characterized by extreme miniaturisation and high-density integration, is critical for supporting the relentless growth of the 5G, AI, and renewable energy sectors.

Asia Pacific Capacitor Market Trends:

Asia Pacific’s status as the manufacturing hub for 5G, IoT, and consumer electronics. The region's market dominance is further solidified by the rapid scaling of electric vehicle (EV) production, with China alone projected to lead a regional surge toward. This growth is supported by aggressive investments in renewable energy grids and the high-volume manufacturing of miniaturised MLCCs and supercapacitors for power quality management.

China Capacitor Market Trends:

China is aggressively pivoting toward high-reliability MLCCs and temperature-resistant film capacitors to support the intense power densities required for EV inverters and industrial automation. This shift is bolstered by substantial domestic R&D investments aimed at achieving self-sufficiency in high-end segments and reducing import dependency.

Some of the prominent players in the Capacitor Market include:

- Samsung Electro-Mechanics

- Panasonic Corporation

- Shenzhen Sunlord Electronics Co., Ltd.

- TDK Corporation

- Abracon LLC

- API Technologies Company

- Eaton Corporation PLC

- Hitachi AIC, Inc.

- Nichicon Corporation

- KEMET Electronics Corporation

- Kyocera Corporation

- VINATech Co., Ltd.

- Vishay Intertechnology, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2035. For this study, Nova one advisor, Inc. has segmented the global Capacitor market.

By Type

- Ceramic Capacitor

- Film/Paper Capacitor

- Aluminum Capacitor

- Tantalum/ Niobium Capacitor

- Double-Layer/Super Capacitor

- Other

By Application

- Industrial

- Automotive Electronic

- Consumer Electronic

- Energy

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)