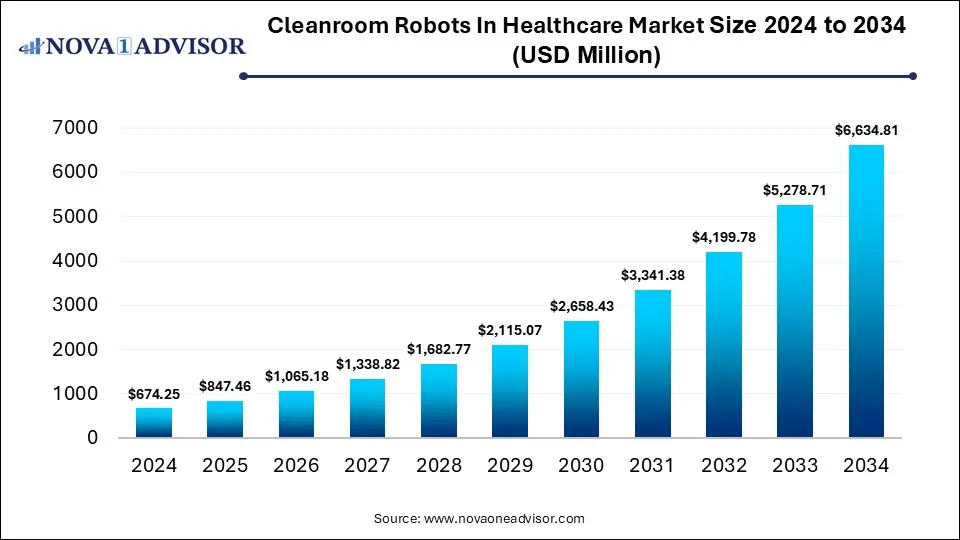

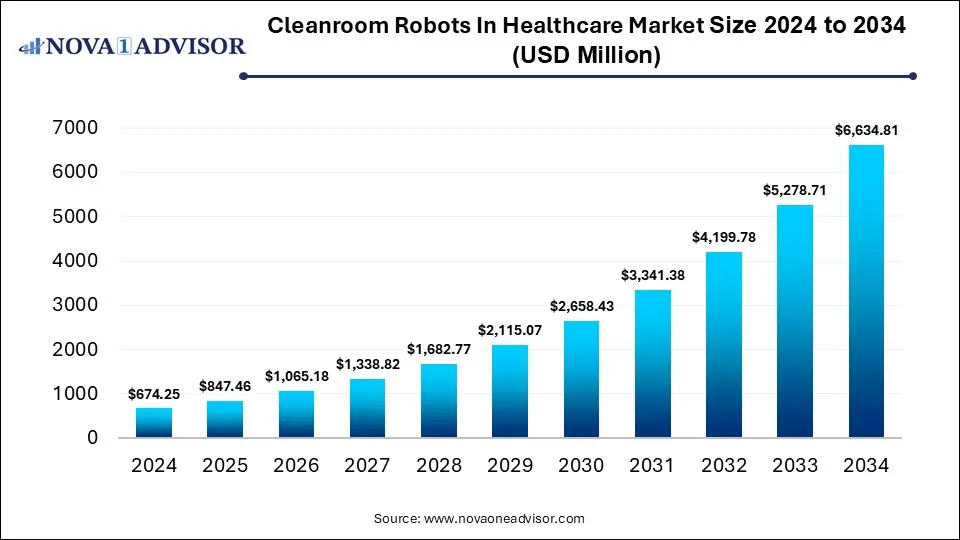

Cleanroom Robots In Healthcare Market Size Trends Analysis and Forecast till 2034

The global cleanroom robots in healthcare market size was valued at USD 674.25 million in 2024, and is predicted to be worth around USD 6,634.81 billion by 2034, registering a CAGR of 25.69% during the forecast period 2025 to 2034.

Growth Factors:

The growing adoption of robots in cleanroom settings, product innovations catering to the market trends, and increased demand for robotic automation in pharmaceutical manufacturing are some of the key factors contributing to the market growth. Robots help in avoiding the risk of contamination in cleanrooms, especially during drug manufacturing procedures.

The collaborative robots type segment is likely to witness the fastest growth during the forecast period due to the features such as rapid installation, cost savings, flexibility, and better safety around manufacturing units. The motors component segment is likely to grow at the fastest rate in the coming years as the robots are attached to the motors and provide a working mechanism to the robots for smoother functioning.

In pharmaceutical and biotechnology manufacturing settings, human operators are the source of contamination. As the risk of contamination is the most challenging factor, automated robots offer seamless operations by eliminating or decreasing manual interventions. The cleanroom technology proved to be useful while dealing with COVID-19 patients as it helped reduce the spread of the virus across the hospitals to a greater extent. Hospitals relied on cleanroom robots to protect the hospital staff.

Report Scope of Cleanroom Robots In Healthcare Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 847.46 Million |

| Market Size by 2034 |

USD 6,634.81 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 25.69% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Component, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

ABB Ltd.; Denso Corporation; FANUC Corporation; Kawasaki Heavy Industries, Ltd.; Yaskawa Electric Corporation; Aerotech, Inc.; Nachi Fujikoshi Corporatio |

By Type Analysis

The traditional industrial robots segment dominated the market with a revenue share of over 60.0% in 2024. Industrial robots are extensively useful in intensive production operations that require continuous movements.

The collaborative robots segment is likely to grow at the fastest rate from 2025 to 2034. The collaborative robots are designed to work interactively with humans. They offer benefits such as rapid installation, reduced production costs, space-saving, flexibility, and improved safety in the workspace.

By Component Analysis

The robotic arms segment dominated the market for cleanroom robots in healthcare and held a revenue share of over 45.0%. The armed operations of robots are the most crucial task for the working and functioning of the robots in cleanroom environments.

The motors segment is likely to register the fastest growth rate over the forecast period owing to the importance of technical components required for smooth robotic operations. The robots rely on motors for the working mechanism.

By End-use Analysis

The pharmaceuticals and medical devices segment dominated the market for cleanroom robots in healthcare with a revenue share of over 50.0%. This is attributed to the higher adoption of robots in the cleanroom settings in the manufacturing companies due to the contamination control benefits.

The hospitals and diagnostics end-use segment is anticipated to grow at the fastest rate of 28.2% over the forecast period. The cleanroom robots played an instrumental role in dealing with COVID-19 patients as they were used for isolating the patients to slow down the spread of the coronavirus virus.

By Regional Analysis

North America dominated the market with a revenue share of over 45.0% owing to the growing adoption of robotics and artificial intelligence-based solutions in the healthcare sector and the increasing number of market players in the region.

Asia Pacific is projected to witness promising growth from 2025 to 2034. This growth can be attributed to the increase in the number of healthcare providers, high unmet needs, booming economy, and overall improving healthcare infrastructure, especially in developing countries such as China and India.

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Cleanroom Robots in Healthcare market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Cleanroom Robots in Healthcare Market include:

Key Players

- ABB Ltd.

- Denso Corporation

- FANUC Corporation

- Kawasaki Heavy Industries, Ltd.

- Yaskawa Electric Corporation

- Aerotech, Inc.

- Nachi Fujikoshi Corporation

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

Market Segmentation

By Type

- Traditional Industrial Robots

- Collaborative Robots

By Component

- Robotic Arms

- End Effectors

- Drives

- Controllers

- Sensors

- Power Supply

- Motors

- Others

By End-use

- Hospitals & Diagnostics

- Pharmaceuticals & Medical Devices

- Others

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

List of Figure

List of Tables

- Global Cleanroom Robots in Healthcare Market Size (USD Million), 2024–2034

- Global Market Share by Type, 2024 & 2034

- Global Market Share by Component, 2024 & 2034

- Global Market Share by End-use, 2024 & 2034

- North America Market Size, by Country, 2024–2034

- U.S. Market Size, by Type, 2024–2034

- U.S. Market Size, by Component, 2024–2034

- U.S. Market Size, by End-use, 2024–2034

- Canada Market Size, by Type, 2024–2034

- North America Market Size, by Component, 2024–2034

- Europe Market Size, by Country, 2024–2034

- Germany Market Size, by Type, 2024–2034

- France Market Size, by Type, 2024–2034

- U.K. Market Size, by Type, 2024–2034

- Rest of Europe Market Size, by Type, 2024–2034

- Europe Market Size, by Component, 2024–2034

- Asia Pacific Market Size, by Country, 2024–2034

- China Market Size, by Type, 2024–2034

- Japan Market Size, by Type, 2024–2034

- India Market Size, by Type, 2024–2034

- Southeast Asia Market Size, by Type, 2024–2034

- Rest of Asia Pacific Market Size, by Type, 2024–2034

- Asia Pacific Market Size, by Component, 2024–2034

- Asia Pacific Market Size, by End-use, 2024–2034

- Latin America Market Size, by Country, 2024–2034

- Brazil Market Size, by Type, 2024–2034

- Rest of Latin America Market Size, by Type, 2024–2034

- Latin America Market Size, by Component, 2024–2034

- Middle East & Africa Market Size, by Country, 2024–2034

- GCC Market Size, by Type, 2024–2034

- North Africa Market Size, by Type, 2024–2034

- South Africa Market Size, by Type, 2024–2034

- Rest of MEA Market Size, by Type, 2024–2034

- MEA Market Size, by Component, 2024–2034

- MEA Market Size, by End-use, 2024–2034

- Company Market Share of Key Players, 2024

- Competitive Landscape: Key Strategies of Major Players, 2024–2034

- Global Cleanroom Robots in Healthcare Market Outlook, 2024–2034 (USD Million)

- Global Market Share, by Type, 2024

- Global Market Share, by Component, 2024

- Global Market Share, by End-use, 2024

- Global Market Share, by Type, 2034

- Global Market Share, by Component, 2034

- Global Market Share, by End-use, 2034

- North America Market Share, by Country, 2024

- U.S. Market Share, by Type, 2024

- Europe Market Share, by Country, 2024

- Germany Market Share, by Component, 2024

- Asia Pacific Market Share, by Country, 2024

- China Market Share, by Type, 2024

- Latin America Market Share, by Country, 2024

- Brazil Market Share, by Component, 2024

- Middle East & Africa Market Share, by Country, 2024

- GCC Market Share, by Type, 2024

- Competitive Positioning of Key Players, 2024

- Comparative Growth Rate of Cleanroom Robots in Healthcare Market across Regions, 2025–2034

- COVID-19 Impact Assessment on Cleanroom Robots Adoption in Healthcare