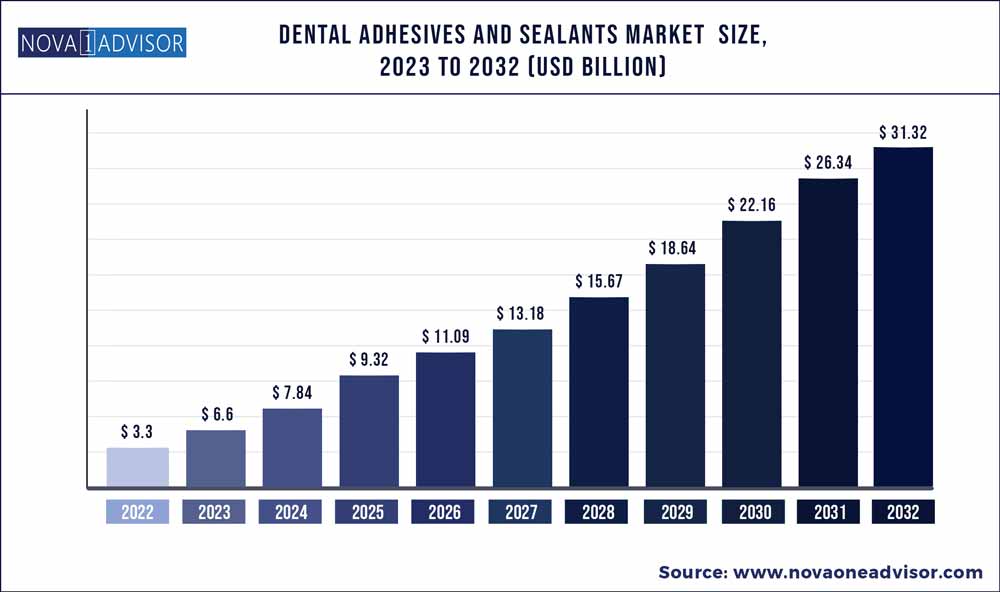

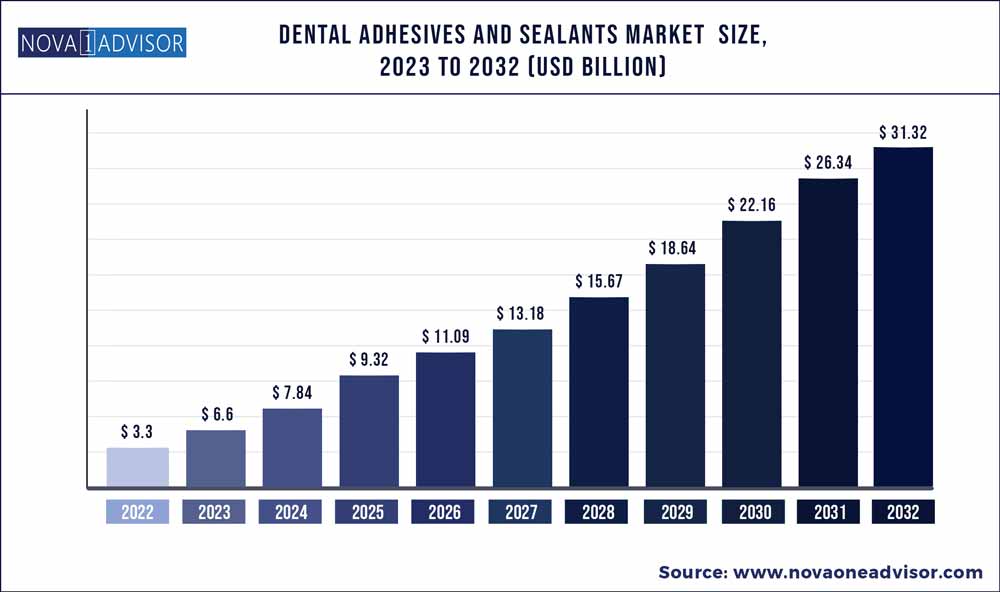

The global dental adhesives and sealants market size was exhibited at USD 3.3 billion in 2022 and is projected to hit around USD 31.32 billion by 2032, growing at a CAGR of 19.4% during the forecast period 2023 to 2032.

Key Pointers:

- The adhesives segment accounted for the largest revenue share of 62.0% in 2022.

- By product, the adhesives segment held the largest market share in 2022 owing to high product availability and demand for cosmetic dentistry

- The resin-based sealant segment accounted for the largest revenue share in 2022 due to the high adoption of these products among dentists

- In Asia Pacific, the market is expected to witness the fastest growth rate over the forecast period owing to the growing geriatric population and increase in oral health awareness in the region.

Dental adhesives and sealants Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 6.6 billion |

| Market Size by 2032 |

USD 31.32 billion |

| Growth Rate from 2023 to 2032 |

CAGR of 19.4% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product, region |

| Key companies profiled |

Dentsply Sirona; 3M ESPE AG; GlaxoSmithKline plc; The Procter & Gamble Company; IvoclarVivadent AG. |

The high demand for dental restorations, an increase in the geriatric population and road accidents, and the wide product range are expected to propel market growth over the forecast period. In addition, technological advancements in dental materials are also expected to increase adoption, thereby contributing to market growth.

The introduction of advanced dental sealants by market players is anticipated to dominate the market strategies adopted for growth. For instance, 3M introduced ‘Clinpro’ sealant which changes its color from pink to off-white upon exposure to light. This color change technology not only improves the accuracy of sealant placement but also aids in determining the amount to be placed. The user-friendliness of such technologies is expected to increase the usage and demand for thin plastic coatings among dentists.

Furthermore, the increasing influence of social media coupled with globalization has led to the convergence of concepts related to beauty, especially those concerning facial features. This has led to a rise in demand for dental cosmetic procedures such as tooth whitening, tooth bonding, and dental veneers, which is anticipated to support market growth. Furthermore, the rapidly aging population in countries such as Japan, the U.K., Germany, and the U.S. is anticipated to increase the requirement for dentures and related products.

North America accounted for the highest market share in 2022 owing to a favorable reimbursement framework, growing prevalence of oral diseases, and high demand for cosmetic dentistry in the country. In addition, the presence of major players in the region also contributed to market growth.

In Asia Pacific, the market is anticipated to witness the highest CAGR over the forecast. The growth of the market in the region is attributed to growing awareness regarding oral health, increasing the aging population, and rising cases of tooth decay due to changing lifestyles.

Some of the prominent players in the Dental adhesives and sealants Market include:

- 3M

- Dentsply Sirona

- GSK

- P&G

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global dental adhesives and sealants market.

By Dental Adhesives And Sealants Product

- Adhesives

- Denture Adhesives

- Restorative Adhesives

- Etch-and-rinse adhesive systems

- Self-etching adhesive systems

- Universal adhesive systems

- Sealants

- Glass ionomer based

- Resin-based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)