Digital Biomarkers Market Size and Trends

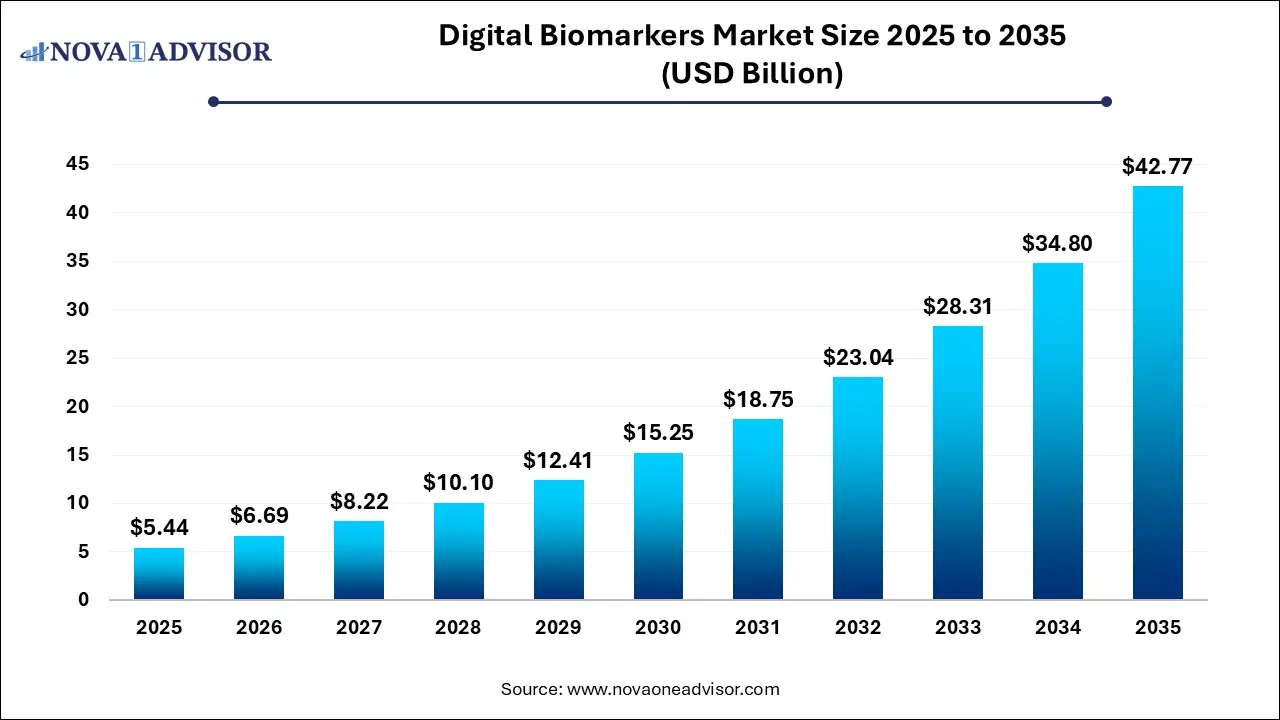

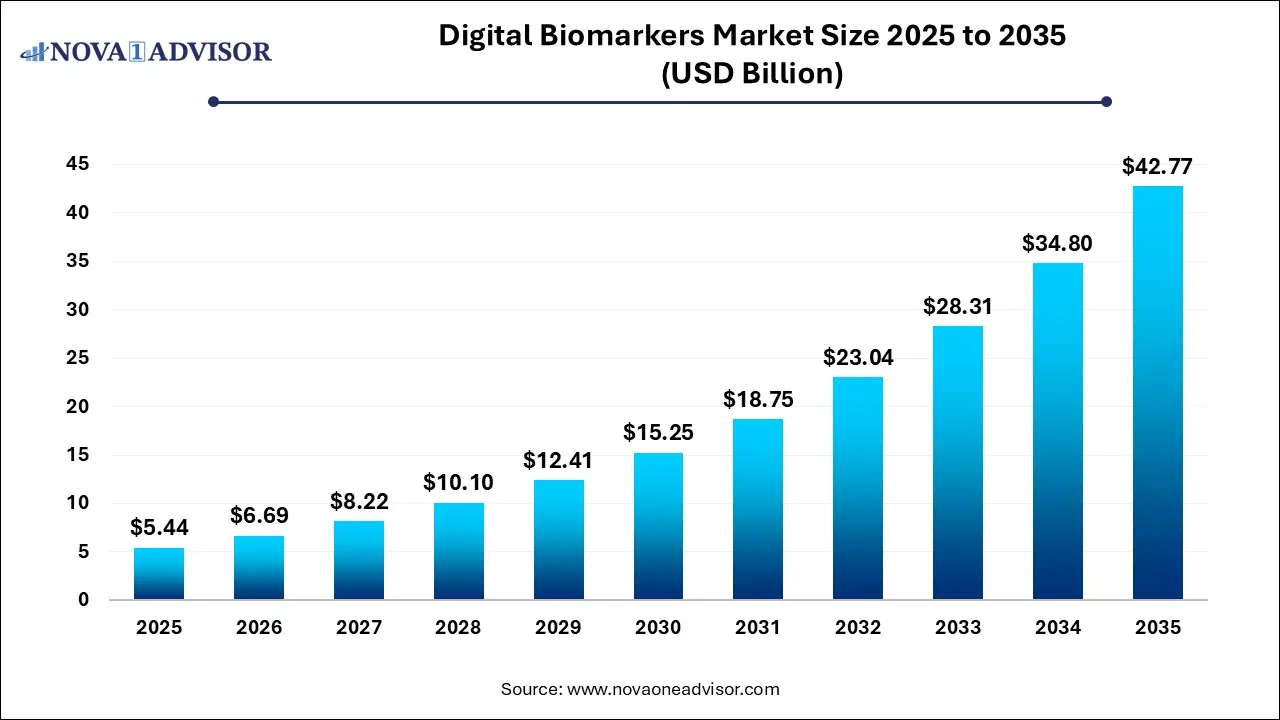

The digital biomarkers market size was exhibited at USD 5.44 billion in 2025 and is projected to hit around USD 42.77 billion by 2035, growing at a CAGR of 22.9% during the forecast period 2026 to 2035.

Digital Biomarker Market Key Takeaways:

- Based on type, the wearable segment dominated the market with the largest revenue share of 40.6% in 2025.

- The mobile-based applications segment is anticipated to grow with the fastest CAGR of 24.7% over the forecast period.

- Based on clinical practice, diagnostic digital biomarkers dominated the market with the largest revenue share in 2025.

- The monitoring digital biomarkers segment is anticipated to witness the fastest growth over the forecast period.

- Based on therapeutic area, the cardiovascular and metabolic disease segment dominated the market with the largest revenue share in 2025.

- The neurological disorders segment is expected to record the fastest growth over the forecast period.

- Based on end use, healthcare companies dominated the market with the largest revenue share of 52.0% in 2025.

- The payers segment is expected to grow at the fastest CAGR over the forecast period.

- North America accounted for the largest market share of 59.4% in 2025.

Market Overview

The digital biomarkers market represents one of the most transformative developments in the intersection of healthcare, life sciences, and digital technologies. Unlike traditional biomarkers that rely on biological samples such as blood or tissue, digital biomarkers are defined as objective, quantifiable physiological and behavioral data collected through digital devices such as wearables, smartphones, implantables, and ambient sensors. These technologies enable continuous, real-time monitoring of health metrics and provide actionable insights for diagnosis, monitoring, and therapeutic interventions.

The growing availability of Internet of Things (IoT) infrastructure in healthcare, the proliferation of smart wearables, and increasing consumer health awareness are collectively accelerating the adoption of digital biomarkers. Pharmaceutical companies, payers, and healthcare providers are recognizing the potential of these tools in remote patient monitoring, clinical trial optimization, drug development, and personalized medicine.

Digital biomarkers are particularly gaining momentum in therapeutic areas like neurology, cardiology, psychiatry, and respiratory disorders, where traditional methods often fall short in providing dynamic and longitudinal health data. With regulatory agencies like the FDA and EMA beginning to approve digital biomarker-integrated trials and therapies, the market is entering a phase of rapid maturity and standardization.

Impact of AI on the Digital Biomarkers Market?

Artificial Intelligence: The Next Growth Catalyst in Digital Biomarkers

AI is profoundly impacting the digital biomarkers industry by providing the sophisticated analytical power needed to interpret the vast, continuous streams of data generated by digital health technologies like wearables and smartphones. Machine learning algorithms and deep learning models are essential for identifying complex, subtle patterns in this high-dimensional data that correlate with disease states, an impossible task for traditional methods. This ability to unlock hidden insights is accelerating the discovery and validation of novel digital biomarkers, which in turn enables more objective, real-time, and remote patient monitoring across various conditions, especially in neurology and oncology.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI) with Digital Biomarkers: AI enables predictive analytics and pattern recognition, enhancing diagnostic and prognostic accuracy.

-

Use in Decentralized Clinical Trials (DCTs): Digital biomarkers facilitate remote patient enrollment, engagement, and real-time health monitoring.

-

Rise of Multi-modal Biomarkers: Combining data from wearables, voice analysis, imaging, and apps to develop composite digital endpoints.

-

Shift Toward Preventive and Personalized Care: Digital biomarkers are enabling risk profiling and early disease intervention strategies.

-

Validation and Regulatory Acceptance: Increased collaboration between tech developers and regulatory bodies is promoting standardization.

-

Consumerization of Health Monitoring: Patient-driven health data collection through apps and smart devices is creating a more informed population.

-

Expanding Role in Mental Health Monitoring: Voice, keystroke, and facial expression analytics are being explored to monitor depression, anxiety, and cognitive decline.

Report Scope of Digital Biomarker Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 6.69 Billion |

| Market Size by 2035 |

USD 42.77 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 22.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Clinical Practice, Therapeutic Area, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

ActiGraph LLC; AliveCor Inc.; Koneksa; Altoida Inc.; Amgen Inc.; Biogen Inc.; Empatica Inc.; Vivo Sense; IXICO plc; Adherium Limited ;Neurotrack Technologies, Inc.; Aural Analytic; Huma; Sonde Health; Inc.; Clario; Imagene AI; Brainomix |

Market Driver: Growing Demand for Remote and Real-Time Health Monitoring

One of the strongest drivers in the digital biomarkers market is the rising global demand for real-time and remote health monitoring. This demand is particularly fueled by aging populations, increasing prevalence of chronic diseases, and healthcare systems striving to reduce costs and hospital readmissions.

Digital biomarkers allow clinicians to track a patient’s physiological parameters continuously such as heart rate variability, gait, speech patterns, or sleep cycles without needing the patient to be physically present. This shift is critical in managing long-term diseases like heart failure, Parkinson’s disease, diabetes, and mental health disorders, where fluctuations in health status can be sudden and critical.

Furthermore, the COVID-19 pandemic emphasized the need for non-invasive, remote solutions to maintain care continuity while minimizing infection risks. As telehealth infrastructure expands globally, digital biomarkers are emerging as essential data sources for virtual care models.

Market Restraint: Data Privacy and Security Challenges

Despite the rapid adoption of digital biomarkers, data privacy and cybersecurity remain major concerns restraining market growth. Digital biomarkers often involve continuous monitoring, producing large volumes of sensitive health data that are transmitted across various devices and cloud platforms. Any breach of this data can compromise patient trust, lead to legal consequences, and affect clinical decisions.

Different regions have distinct regulatory standards like HIPAA in the U.S., GDPR in the EU, and evolving frameworks in Asia and the Middle East. These varying guidelines make cross-border data sharing and global deployments complex. Moreover, device manufacturers and app developers must ensure interoperability, encryption, anonymization, and compliance with ethical standards, which adds to development time and cost.

The lack of harmonized international standards and increasing incidences of healthcare cyberattacks could slow adoption unless robust data governance models are put in place.

Market Opportunity: Use of Digital Biomarkers in Drug Development and Clinical Trials

A significant growth opportunity lies in the integration of digital biomarkers into drug development pipelines and clinical trials. Traditional clinical trials often suffer from high dropout rates, infrequent data collection, and recruitment barriers. Digital biomarkers offer a way to collect continuous, real-world data that improves participant engagement, compliance, and trial accuracy.

Pharmaceutical companies are partnering with digital health firms to deploy digital endpoints that can quantify treatment responses, side effects, and patient-reported outcomes. These markers can also help in early detection of safety issues, improving trial safety and reducing time to market. For example, gait and tremor analysis via smartphones can be used in trials evaluating Parkinson’s disease drugs.

Moreover, regulatory bodies are beginning to accept digital endpoints as co-primary or exploratory endpoints, signaling a paradigm shift in how trials are designed and validated. This creates a fertile ground for market players to offer scalable solutions tailored to clinical research needs.

Digital Biomarker Market By Type Insights

Wearables dominate the type segment, owing to their widespread availability, user acceptance, and ability to collect a wide array of physiological signals such as heart rate, temperature, oxygen saturation, motion, and sleep cycles. Smartwatches, fitness bands, and chest straps are widely used in both consumer health and professional monitoring, making this segment a key revenue contributor.

Mobile-based applications are the fastest-growing segment, propelled by smartphone penetration and app-based wellness ecosystems. Apps designed for mental health, cardiac monitoring, and medication adherence are increasingly incorporating digital biomarker capabilities, such as voice tracking for depression or keyboard typing patterns for neurodegenerative disease detection.

Digital Biomarker Market By Clinical Practice Insights

Monitoring digital biomarkers hold the largest market share, particularly in managing chronic conditions like cardiovascular disease, COPD, and diabetes, where continuous or episodic measurement of biometrics helps clinicians optimize care pathways. Wearables and connected sensors are widely used to track vital signs and activity metrics, improving patient outcomes and compliance.

Predictive and prognostic digital biomarkers are the fastest-growing segment, as AI and data analytics make it possible to forecast disease onset or progression. These tools are especially critical in oncology, neurology, and psychiatry, where early intervention significantly influences prognosis.

Digital Biomarker Market By Therapeutic Area Insights

Cardiovascular and metabolic disorders dominate the therapeutic area segment, driven by the global burden of heart disease, hypertension, and diabetes. Devices that measure ECG, blood pressure, and blood glucose are routinely integrated into digital biomarker platforms, aiding both real-time monitoring and early risk detection.

Neurological disorders are the fastest-growing therapeutic area, as digital biomarkers increasingly support the detection and tracking of Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, and epilepsy. Parameters like speech changes, eye movement, motor function, and memory can be monitored remotely, transforming how clinicians manage and study these conditions.

Digital Biomarker Market By End-use Insights

Healthcare providers dominate the end-use segment, using digital biomarkers to enhance patient monitoring, personalize treatment plans, and integrate with electronic health records (EHRs). Hospitals, specialty clinics, and virtual care platforms are increasingly deploying remote biomarker-based solutions for long-term patient engagement.

Healthcare companies (pharma and medtech) are the fastest-growing segment, as drug manufacturers increasingly adopt digital biomarkers to streamline clinical trials, track therapeutic responses, and improve patient stratification. Partnerships between pharmaceutical giants and tech firms are multiplying in this space.

Digital Biomarker Market By Regional Insights

North America leads the global digital biomarkers market, primarily due to advanced healthcare infrastructure, widespread technology adoption, and a strong ecosystem of startups, academic institutions, and regulatory clarity. The U.S., in particular, benefits from a favorable reimbursement landscape, early adopters in digital health, and substantial investment from both private and government sources.

Asia-Pacific is the fastest-growing region, fueled by the rapid expansion of digital health platforms in countries like China, India, Japan, and South Korea. Rising healthcare digitalization, smartphone penetration, and government-backed chronic disease management programs are driving demand for scalable, cost-effective biomarker solutions. The region also presents a large pool of tech-savvy populations and diverse disease burdens, making it a prime growth market.

U.S. Digital Biomarkers Market Trends

The proliferation of wearable technology and digital biomarkers has transitioned healthcare from reactive treatment to continuous, real-time monitoring. By leveraging AI to analyze vast datasets, providers can now offer highly personalized medicine tailored to the specific needs of patients with chronic and neurological conditions. This digital evolution is further supported by the rise of decentralized clinical trials and favorable FDA regulatory clarity, which facilitate faster innovation and remote research capabilities.

China Digital Biomarkers Market Trends

China’s rapid expansion of wearable devices and mobile apps is becoming the primary engine for continuous, real-time health data collection. This surge is specifically revolutionizing the management of chronic and neurological conditions by providing clinicians with the objective, longitudinal insights needed for early detection and personalized treatment. By integrating AI and big data analytics, healthcare providers can now transform raw sensor data into actionable diagnostics, significantly reducing hospital readmissions through proactive remote monitoring.

How Did Europe Notably Grow in the Digital Biomarkers Market?

Europe’s sophisticated healthcare infrastructure seamlessly integrates real-time data into clinical workflows across Germany, France, and the UK. This growth is underpinned by a supportive regulatory environment where EMA-validated endpoints and GDPR-compliant platforms foster both innovation and high patient trust.

Germany Digital Biomarkers Market Trends

Germany's critical need for continuous monitoring of rising cardiovascular and neurological conditions across the aging global population. This demand is met by a surge in wearable technology and mobile app adoption, which now serve as the primary engines for collecting objective, real-world health data. By integrating AI and machine learning, healthcare providers can transform this data into high-accuracy diagnostics and streamlined drug development processes.

Value Chain Analysis of the Digital Biomarkers Market

Data Collection/Sensor Technology Development

This foundational stage involves developing and manufacturing the hardware (wearables, sensors, smartphones, etc.) used to capture raw physiological and behavioral data.

- Key Players: Apple Inc., Fitbit (part of Google), Philips Healthcare, AliveCor, Empatica Inc., BioSensics, Oura Health Oy, and Medtronic plc.

Data Integration & Analytics (Biomarker Development)

Once collected, vast amounts of raw data must be securely integrated, processed, and transformed into meaningful insights or biomarkers using advanced algorithms and machine learning.

- Key Players: Evidation Health, Inc., Koneksa Health Inc., IXICO plc, IBM Watson Health, Verily Life Sciences, and Huma.

Clinical Validation & Regulatory Approval

Digital biomarkers must undergo rigorous clinical trials and validation processes to prove their efficacy and reliability as objective indicators for diagnosis, monitoring, or treatment response, ensuring they meet regulatory standards (e.g., FDA or EMA).

- Key Players: Biogen Inc., F. Hoffmann-La Roche Ltd., Eli Lilly and Company, Amgen Inc., Pfizer Inc., and academic research institutions often collaborate at this stage.

Drug Development & Clinical Trials Application

Validated digital biomarkers are then integrated into the broader drug development process, particularly in decentralized clinical trials (DCTs), to monitor patient outcomes in real-world settings, improve trial efficiency, and inform precision medicine.

- Key Players: Pharmaceutical companies like Novartis AG, Merck & Co., GSK plc, Roche, and specialized clinical research organizations (CROs) like Clario and Clinical Ink Inc. are key users and drivers here.

Digital Biomarkers Market Companies

- ActiGraph LLC: ActiGraph provides medical-grade wearable sensors and a robust CentrePoint data platform to capture continuous activity and sleep data for clinical research.

- AliveCor Inc.: AliveCor pioneered the use of AI-enabled mobile ECG technology with its Kardia devices, allowing for the remote detection of arrhythmias like atrial fibrillation.

- Koneksa: Koneksa specializes in the validation and integration of digital biomarkers into clinical trials, focusing on respiratory, neuroscience, and oncology areas.

- Altoida Inc.: Altoida uses augmented reality (AR) and AI on smartphones to assess brain health by analyzing a user's "digital footprint" during cognitive tasks.

- Amgen Inc.: Amgen contributes by integrating digital biomarkers into its clinical trial pipelines to objectively measure patient responses to therapies in real-world settings.

- Biogen Inc.: Biogen leverages digital biomarkers, such as those collected via the Konectom smartphone app, to monitor neurological function in patients with Multiple Sclerosis and Parkinson's.

- Empatica Inc.: Empatica develops medical-grade wearables like the EmbracePlus and the Aura platform to monitor autonomic nervous system data for seizure detection and respiratory infection monitoring.

- VivoSense: VivoSense specializes in the analysis of high-resolution sensor data to develop customized digital endpoints that reflect the real-world experiences of patients. Their contribution involves validating physiological biomarkers that are used by pharmaceutical companies to prove the efficacy of new treatments in rare diseases.

- IXICO plc: IXICO provides advanced AI-based neuroimaging and digital biomarker services that enable the precise measurement of disease progression in clinical trials for dementia and Huntington’s.

- Adherium Limited: Adherium focuses on respiratory digital biomarkers through its Hailie® platform, which tracks medication adherence and inhaler technique for asthma and COPD patients.

- Neurotrack Technologies, Inc.: Neurotrack provides digital cognitive assessment tools that use eye-tracking technology and AI to screen for memory loss and cognitive impairment.

- Aural Analytics: Aural Analytics focuses on clinical-grade speech biomarkers, using AI to analyze patterns in voice and language to detect neurological conditions like ALS and stroke.

- Huma: Huma provides a hospital-at-home platform that collects digital biomarkers from various connected devices to monitor patients with chronic conditions like heart failure and COVID-19. By 2025, they have become a leader in integrating predictive AI into their "Digital Twin" technology to identify patients at risk of deterioration.

- Sonde Health, Inc.: Sonde Health utilizes vocal biomarkers to monitor mental health and respiratory symptoms, analyzing short voice samples for changes in prosody and acoustics. Their API-based technology allows healthcare organizations to screen for depression and anxiety by detecting "hidden" acoustic signals in a user’s speech.

- Clario: Clario acts as a leading eClinical technology provider that integrates a wide range of digital biomarkers, from cardiac to respiratory, into global clinical trials.

- Imagene AI: Imagene AI specializes in digitized pathology biomarkers, using AI to identify genomic signatures and molecular profiles directly from biopsy images. Their contribution allows for rapid, cost-effective precision oncology, helping clinicians match patients with the most effective targeted therapies in minutes.

- Brainomix: Brainomix develops AI-powered imaging biomarkers for stroke and lung disease, automating the interpretation of CT scans to speed up treatment decisions.

- Kinsa Inc.: Kinsa uses its network of smart thermometers to collect aggregated, real-time fever and illness data across the U.S. to track the spread of infectious diseases.

- Feel Therapeutics: Feel Therapeutics focuses on digital biomarkers for mental health by using a specialized wearable (the Feel Emotion Sensor) to monitor physiological signals of stress and emotion.

Digital Biomarker Market Recent Developments

-

March 2025 – Biogen partnered with Apple to launch a study using wearable-based cognitive biomarkers to monitor early signs of Alzheimer’s disease.

-

February 2025 – Evidation Health received funding to develop a behavioral digital biomarker platform focused on depression and sleep disorders using passive smartphone data.

-

January 2025 – Verily (Alphabet Inc.) unveiled Verily Baseline, a digital health platform that integrates multiple biomarkers for clinical research and chronic disease management.

-

December 2024 – Philips launched an AI-enabled wearable for heart failure monitoring, integrating digital biomarkers with clinical decision support.

-

November 2024 – Mindstrong Health expanded its mental health platform with new smartphone-based biomarkers to predict relapse in bipolar disorder.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the digital biomarkers market

By Type

- Wearable

- Mobile Based Applications

- Sensors

- Others

By Clinical Practice

- Diagnostic Digital Biomarkers

- Monitoring Digital Biomarkers

- Predictive And Prognostic Digital Biomarkers

- Other's (Safety, Pharmaco dynamics/ Response, Susceptibility)

By Therapeutic Area

- Cardiovascular And Metabolic Disorders (CVMD)

- Respiratory Disorders

- Psychiatric Disorders

- Sleep & Movement Disease

- Neurological Disorders

- Musculoskeletal Disorders

- Others (Diabetes, Pain Management)

By End-use

- Healthcare Companies

- Healthcare Providers

- Payers

- Others (Patient, caregivers)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)