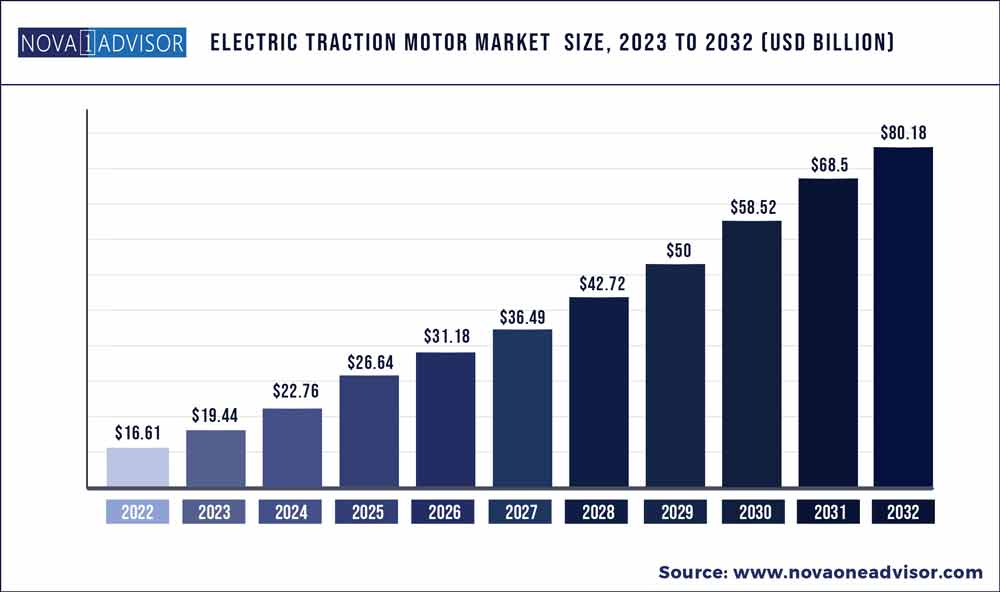

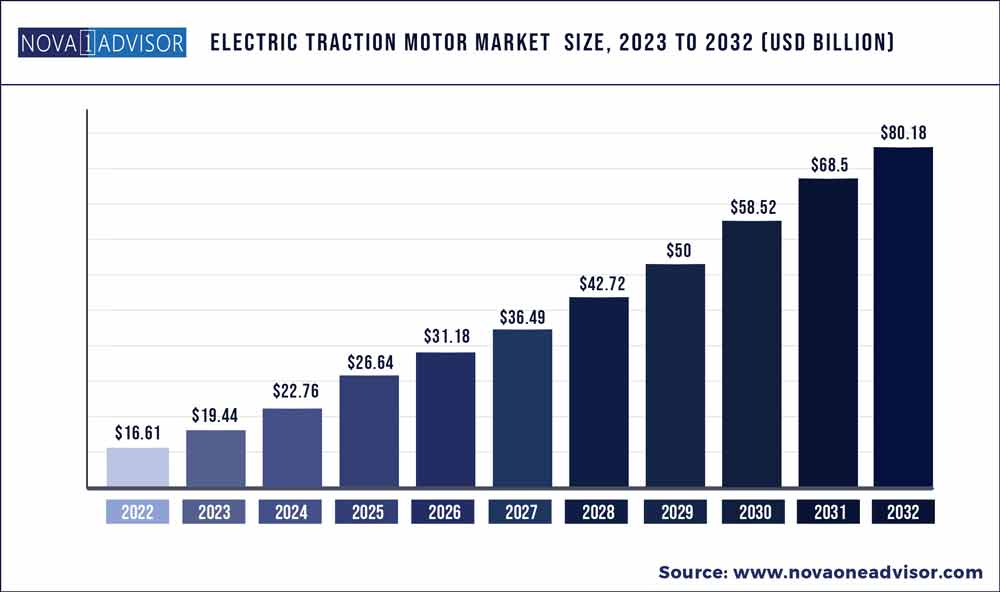

The global electric traction motor market size was exhibited at USD 16.61 billion in 2022 and is projected to hit around USD 80.18 billion by 2032, growing at a CAGR of 17.05% during the forecast period 2023 to 2032.

Key Pointers:

- By type, AC segment has contributed highest revenue share of over 89% in 2022.

- DC segment has generated market share of around 14% in 2022.

- Asia Pacific hit revenue share up to 49% in 2022.

The electric traction motor market was severely affected by COVID-19. The most significant near-term impact on electric traction motors that are already contracted or in the manufacturing process will be felt through supply chains, by 2023. Industry executives are anticipating delivery and construction slowdowns, either because nations have shuttered industries to slow the spread of coronavirus or because the workers have tested positive. Many components and parts for manufacturing electric traction motors come from China, US, and some parts of Europe.

Electric Traction Motor Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 19.44 Billion

|

|

Market Size by 2032

|

USD 80.18 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 17.05%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Vehicle Type, Type, Power Rating, Application

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Schneider Electric SE, The Curtiss-Wright Corporation, Prodrive Technologies, Toshiba Corporation, General Electric Co., CG Power and Industrial Solutions Ltd., Aisin, ABB, Ltd., Alstom S.A.,Siemens AG, Delphi Automotive LLP, Voith GmbH, Mitsubishi Electric Corporation, Bombardier Inc., American Traction Systems, VEM Group, Caterpillar Inc., TTM Rail - Transtech Melbourne Pty Ltd., Kawasaki Heavy Industries Ltd., Traktionssysteme Austria GmbH, Hyundai Rotem Company, Hitachi, Ltd., Ansaldo Signalling, Magna International

|

Electric traction motor Market Dynamics

Driver: Increasing stringency of emission regulations to push OEMs to manufacture and sell electric and hybrid vehicles

Growing concerns about the harmful effects of various means of transportation on the environment, such as air pollution, are increasing day by day. The rising concerns about environmental pollution have forced automotive manufacturers to develop vehicles that comply with regional regulatory standards. According to the International Energy Agency (IEA), in 2020, the worldwide electric car fleet grew to 10 million vehicles, with battery electric vehicles (BEVs) accounting for two-thirds of the total. In 2020, Europe saw the highest gain, with registrations doubling to 1.4 million (10% sales share), making it the world's leading electric car market for the first time. China came in second with 1.2 million registrations (5.7% of total sales), and the US came in third with 295,000 registrations (2% sales share). The demand for electric and hybrid vehicles has increased due to various reasons. Government incentives, zero emissions, advancements in battery technology, and enhanced user experience have contributed to the growth of electric and hybrid vehicles. The increasing stringency of emission norms has resulted in the increased sales of electric vehicles such as BEVs, HEVs, and PHEVs.

The electrification of vehicles has resulted in the replacement of mechanical linkages with automated systems. For example, the increasing usage of 48-volt electrical systems in cars has accentuated the need for high-performing electric traction motors to adhere to the power requirements. The increased number of electric vehicles has directly influenced the motor industry, which, in turn, augurs the growth of the electric traction motor market.

Restraint: High initial deployment cost of electric traction motors in rail industry

The initial cost involved in deploying railways such as locomotives, metros, trams, and others is very high. It requires substantial initial investments to set up field-level devices and equipment with updated technologies. An additional cost is also needed for setting up the advanced infrastructure for arranging transmission networks and managing new and existing systems. The post-deployment high operational and maintenance costs are also a huge concern for railway authorities. Railway Budget constraint acts as a restraining factor for deploying advanced railway technologies and solutions by the government as well as private players. Therefore, the high initial cost of deploying railways with advanced systems and solutions such as electric traction motors is expected to hamper the growth of the electric traction motor market in the coming years.

Opportunities: Increasing demand for electric vehicles

The number of electric and hybrid vehicles is rapidly growing due to fluctuating fuel prices and the rising need to minimize CO2 emissions. According to the Automotive Fuel Economy Survey, nearly 40% of American car owners identified fuel economy as a top aspect in making their vehicles more efficient. According to the International Energy Agency (IEA), around 10 million electric cars were sold worldwide in 2020, an increase of 63% from the previous year. China accounts for over 95% of the global electric 2/3-wheeler stock. According to the World Health Organization (WHO), China is taking significant steps to deal with air pollution, which is responsible for approximately 1 million deaths per year. The country is focusing on controlling air pollution and reducing carbon emissions by making necessary changes in its automotive sector to meet the air quality standards set by the government. Apart from China holding a major share of electric cars on the road, the demand for electric vehicles is on the rise in most countries across the globe.

Traction motors are the key components used in hybrid and fully electric vehicles for converting electrical energy into mechanical energy. Electric traction motors are installed in electric vehicles for initial propulsion and for providing rotational torque to the vehicle. Developments in hybrid vehicle technologies have led to a considerable increase in the demand for traction motors. Electric traction motors, such as permanent magnet synchronous motors, are widely used in electric vehicles due to their compact size and lower weight than induction motors. The rising awareness about the harmful effects of carbon emissions by vehicles is another major factor supporting the growth of the electric traction motor market. According to the IEA, globally, 82,000 new electric buses were registered in 2020, up 10% from the previous year, for a total stock of 600,000. Although electric buses are rapidly being purchased in Europe, India, and Latin America, China accounts for 98% of electric bus stock. Therefore, the rising demand for electric vehicles is expected to drive the growth of the electric traction motor market in the coming years.

Challenges: Motor failure due to overheating

Excessive heat due to overheating can result in motor failure by weakening the winding insulation in electric motors. Overheating occurs due to overload, poor power conditions, highly effective service factors, frequent turning on-off of the motor, and lack of air circulation around the motor. Electric motors also tend to overheat in high-temperature environments. Around 30% of all motor failures occur due to insulation failure, and approximately 60% happen due to overheating. Permanent magnet motors are challenged with significant reliability issues; these motors lose their magnetism if exposed to high temperatures. The permanent magnets of these motors get demagnetized, resulting in decreased torque performance. Thus, electric motors need to operate in ideal conditions to overcome this challenge. Hence, proper cooling and ventilation systems must be installed in areas where electric motors are operational.

Market Ecosystem

The AC segment is expected to be the largest market, by type, during the forecast period

By type electric traction motor market is segmented into AC and DC. The AC segment is expected to be the largest segment by type for electric traction motors market, during the forecast period. These motors are widely used in rail industries, electric vehicles, and industrial machinery for their propulsion. AC motors are easier to control and more efficient as compared to DC motors,.

The 200–400 kW segment is expected to be the second largest market, by power rating during the forecast period

By power rating electric traction motor market is segmented into 200 kW, 200-400 kW, and above 400 kW. The 200-400 kW segment is expected to be the second largest segment by power rating of the electric traction motor market, during the forecast period. The wide array of applications in metro systems, high-speed trains, and subway trains employing these electric traction motors is one of the major driving factors for this segment.

The railways segment is projected to be the fastest growing segment by application for electric traction motor market, during the forecast period

By application electric traction motor market is classified into railways, electric vehicles, and others. Others include conveyor belts, elevators, and industrial machinery. The electric vehicle segment is expected to be the fastest growing segment, during the forecast period. The increasing number of electric vehicles worldwide is leading to a higher demand for efficient traction motors. Major end users of traction motors are Mercedes, Tesla, BMW, Jaguar Land Rover, Daimler, and Toyota.

Asia Pacific is projected to be the fastest growing region for electric traction motor market during the forecast period

The global electric traction motor market has been segmented by region into North America, South America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific is projected to be the fastest growing market for electric traction motors from 2023 to 2032. The rising population within the region has led to a significant increase in the demand for transportation connectivity, which has correspondingly driven investments in the railway sector and is likely to further increase the demand for the electric traction motor market.

Some of the prominent players in the Electric Traction Motor Market include:

- Schneider Electric SE

- The Curtiss-Wright Corporation

- Prodrive Technologies

- Toshiba Corporation

- General Electric Co.

- CG Power and Industrial Solutions Ltd.

- Aisin

- ABB, Ltd.

- Alstom S.A.

- Siemens AG

- Delphi Automotive LLP

- Voith GmbH

- Mitsubishi Electric Corporation

- Bombardier Inc.

- American Traction Systems

- VEM Group

- Caterpillar Inc.

- TTM Rail - Transtech Melbourne Pty Ltd.

- Kawasaki Heavy Industries Ltd.

- Traktionssysteme Austria GmbH

- Hyundai Rotem Company

- Hitachi, Ltd.

- Ansaldo Signalling

- Magna International

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Electric Traction Motor market.

By Vehicle Type

- Plug-in Hybrid Electric Vehicles

- Mild Hybrid Vehicles

- Full Hybrid Vehicles

By Type

By Power Rating

- Below 200 KW

- 200 KW To 400 KW

- Above 400 K W

By Application

- Railways

- Electric Vehicles

- Elevators

- Conveyors

- Industrial Machinery

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)