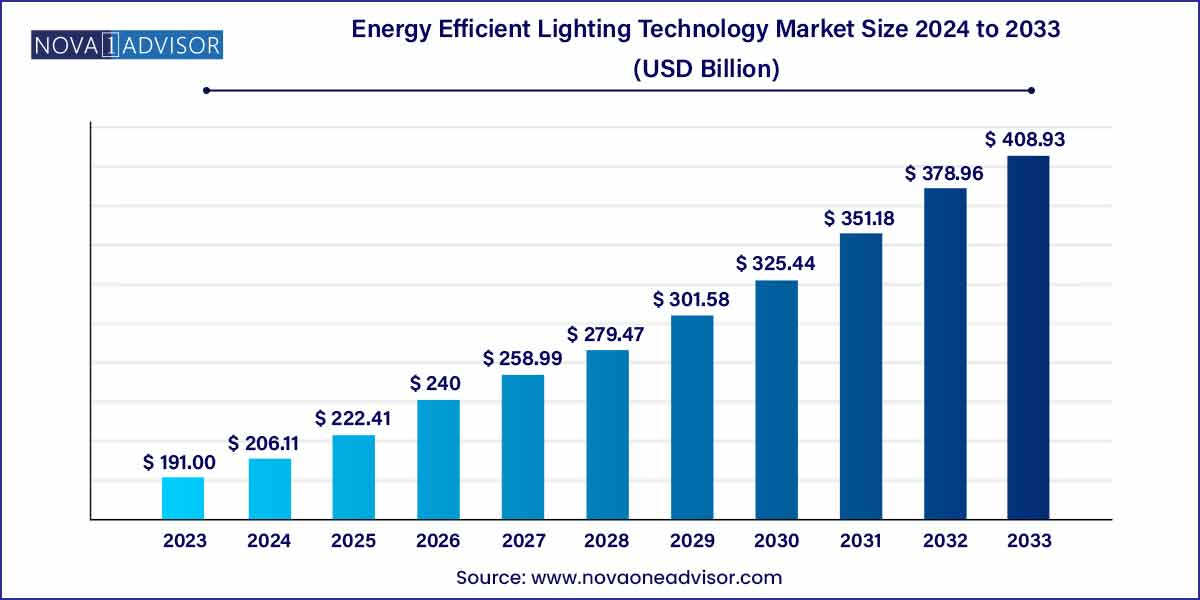

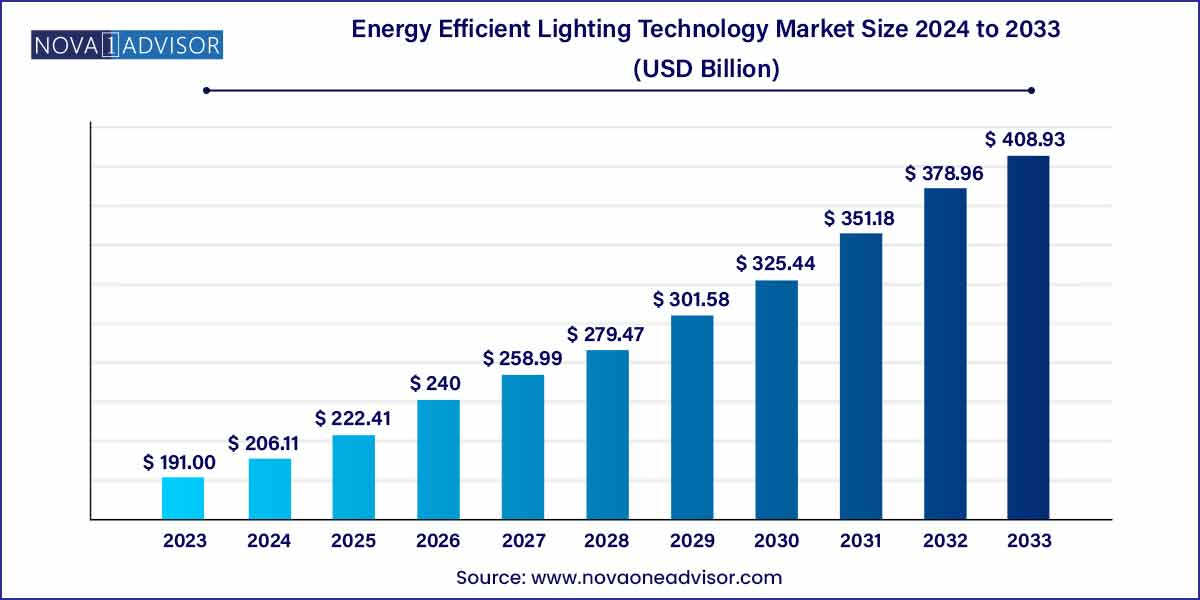

The global energy efficient lighting technology market size was exhibited at USD 191.0 billion in 2023 and is projected to hit around USD 408.93 billion by 2033, growing at a CAGR of 7.91% during the forecast period 2024 to 2033.

Market Overview

The global Energy Efficient Lighting Technology Market has emerged as a key pillar in the sustainable technology revolution. With increasing awareness about energy conservation, regulatory mandates, and technological advancements, the demand for energy-efficient lighting solutions is witnessing remarkable growth. The market encapsulates lighting technologies that provide higher illumination output while consuming significantly lower power compared to traditional lighting systems. It includes advancements like LED lighting, gas discharge lamps, incandescent lamps with energy-saving mechanisms, and sophisticated arc lamps.

Rapid urbanization, the expansion of smart cities, and the global commitment to reducing carbon emissions are significantly influencing market dynamics. Governments across continents have imposed stringent regulations to phase out inefficient lighting, replacing them with energy-saving alternatives. Furthermore, falling prices of energy-efficient lighting products, notably LEDs, have democratized access across both developed and emerging economies.

Various industries such as residential, commercial, and governmental organizations are increasingly incorporating these solutions to cut down on operational costs and to meet environmental standards. As consumers become more environmentally conscious and technology-savvy, the Energy Efficient Lighting Technology Market is expected to continue its strong growth trajectory over the next decade.

Major Trends in the Market

-

Shift towards Smart Lighting Systems: Integration of IoT with lighting solutions enabling remote control, automation, and data analytics.

-

Adoption of Human-Centric Lighting: Lighting designed to mimic natural light patterns, positively affecting mood, health, and productivity.

-

Government Incentives and Regulatory Push: Subsidies, rebates, and regulations promoting the adoption of energy-efficient lighting technologies.

-

Development of Organic LEDs (OLEDs): Emerging as a flexible, thinner, and efficient alternative to traditional LEDs in specialized applications.

-

Retrofit Installations: Growing trend of retrofitting existing lighting infrastructure rather than replacing it, to save costs and resources.

-

Focus on Sustainability and Circular Economy: Emphasis on recyclable materials and energy-efficient production processes in lighting manufacturing.

-

Increased Investment in R&D: Companies are heavily investing in research and innovation to produce more efficient, durable, and cost-effective lighting products.

Energy Efficient Lighting Technology Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 191.0 Billion |

| Market Size by 2033 |

USD 408.93 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.91% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Appliocation, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Bajaj Electricals Ltd., Cree Inc., Eaton Corporation, General Electric Company, OSRAM Licht Group, Apple Inc., Nichia Corporation, Toshiba Lighting & Technology Corporation, LIGMAN Lighting Co., Bridelux Inc. |

Segments Insights:

Type Insights

Light Emitting Diode (LED) dominated the type segment in the Energy Efficient Lighting Technology Market, and it continues to set the benchmark for innovation and adoption rates. LEDs offer unparalleled energy savings, longer lifespans, and decreasing costs, making them the go-to choice across sectors. Their application spans from residential bulbs to large commercial installations and street lighting. The technology also enables color tuning and smart control features, aligning perfectly with the modern demand for customization and automation.

Meanwhile, the Gas Discharge Lamps segment is the fastest-growing, especially in specialized applications such as industrial warehouses and public outdoor lighting. These lamps offer high-intensity lighting, which is critical in expansive environments. High-Intensity Discharge (HID) variants like Metal Halide and High-Pressure Sodium lamps continue to find favor in developing regions where large-scale, affordable solutions are required. Their robust build and cost-effectiveness make them suitable for harsh outdoor conditions and expansive coverage.

Application Insights

The Commercial sector dominated the application segment, leveraging the cost savings associated with energy-efficient lighting on a large scale. Shopping malls, corporate offices, hotels, and retail outlets are increasingly focusing on sustainability as part of their brand image and operational strategy. Furthermore, commercial spaces benefit substantially from smart lighting systems that adjust according to occupancy, maximizing efficiency. Government regulations also mandate certain commercial establishments to adhere to green building standards, further boosting adoption.

In contrast, the Residential sector is experiencing the fastest growth rate. Driven by declining LED costs, increased awareness, and enhanced product availability, more households are replacing their traditional bulbs with energy-efficient alternatives. Energy-efficient lighting now extends beyond simple illumination, offering features like adjustable brightness, smartphone connectivity, and mood-based settings. The proliferation of smart homes and DIY installation kits is making energy-efficient lighting an integral component of modern residential living.

Regional Analysis

North America dominated the Energy Efficient Lighting Technology Market, accounting for the largest market share. The region benefits from stringent energy efficiency regulations, early technology adoption, and a strong consumer base ready to invest in sustainable technologies. The United States and Canada have been at the forefront, with initiatives such as the U.S. "Lighting Energy Efficiency in Parking (LEEP) Campaign," promoting high-efficiency lighting in commercial and industrial spaces. Major companies headquartered in this region, coupled with substantial government incentives and R&D investments, bolster market leadership.

Asia-Pacific is the fastest-growing regional market, propelled by rapid urbanization, massive infrastructure projects, and government initiatives favoring energy conservation. Countries like China, India, and Japan are witnessing significant growth in residential and commercial construction, creating immense demand for energy-efficient lighting. The "Ujala Scheme" in India, for example, has distributed millions of LED bulbs at subsidized rates, catalyzing adoption in one of the largest consumer bases globally. Local manufacturing, coupled with foreign investments, continues to strengthen the market’s growth trajectory across the Asia-Pacific region.

Recent Developments

-

March 2025: Signify N.V., a global leader in lighting, announced the launch of their new "UltraEfficient" LED bulb range that uses 60% less energy compared to standard LED products. This marks a significant step toward ultra-sustainability.

-

February 2025: Cree LED, a division of Smart Global Holdings, unveiled their XLamp® Element G LEDs designed for outdoor and high-bay applications, offering enhanced performance and efficiency.

-

January 2025: Zumtobel Group partnered with Siemens to integrate IoT solutions into their lighting systems, targeting smart city projects across Europe.

-

December 2024: Osram introduced their new generation of Quantum Dot LED modules aimed at improving color rendering for specialized commercial lighting applications.

-

November 2024: General Electric (GE) Lighting, a Savant company, announced a new line of Cync™ smart bulbs with enhanced connectivity features including Matter standard support, pushing boundaries in smart home integrations.

Some of the prominent players in the energy-efficient lighting technology market include:

- Bajaj Electricals Ltd.

- Cree Inc.

- Eaton Corporation

- General Electric Company

- OSRAM Licht Group

- Apple Inc.

- Nichia Corporation

- Toshiba Lighting & Technology Corporation

- LIGMAN Lighting Co.

- Bridelux Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global energy efficient lighting technology market.

By Type

- Incandescent Lamp

- Light Emitting Diode

- Arc Lamp

- Gas Discharge Lamps

By Application

- Residential

- Commercial

- Government

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)