Europe Dental Services Market Size, Share, Growth, Report 2025 to 2034

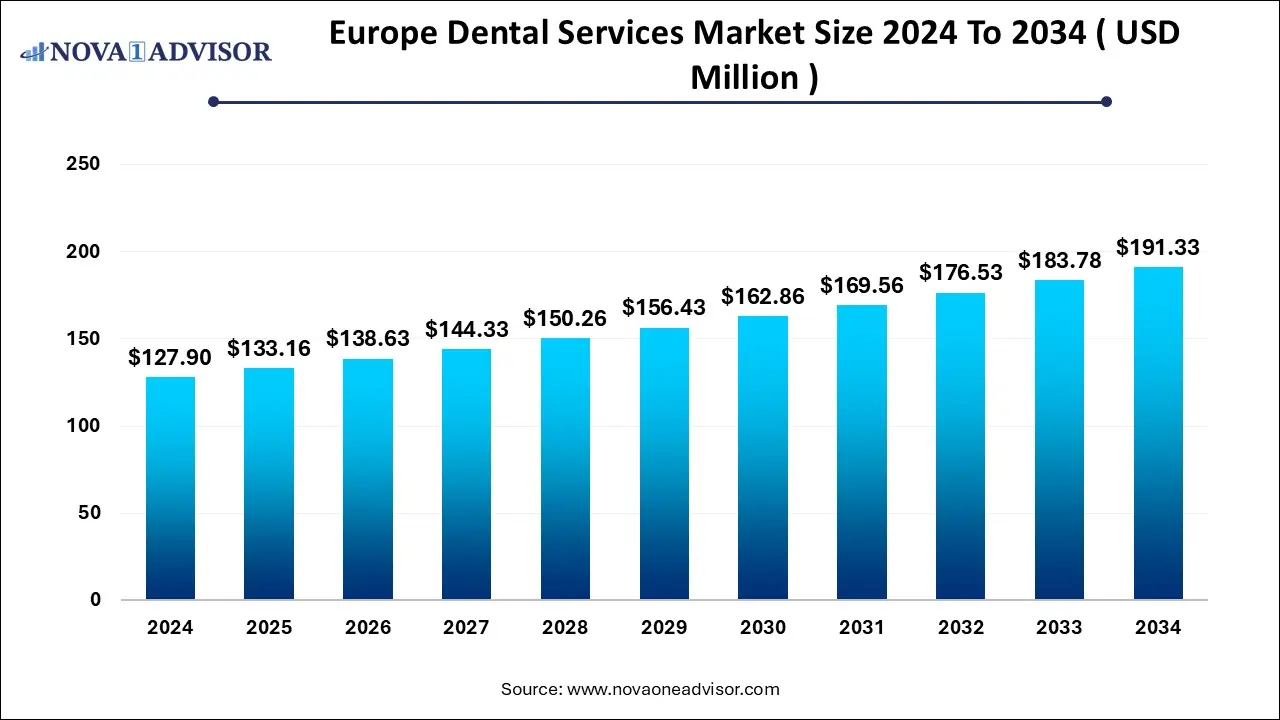

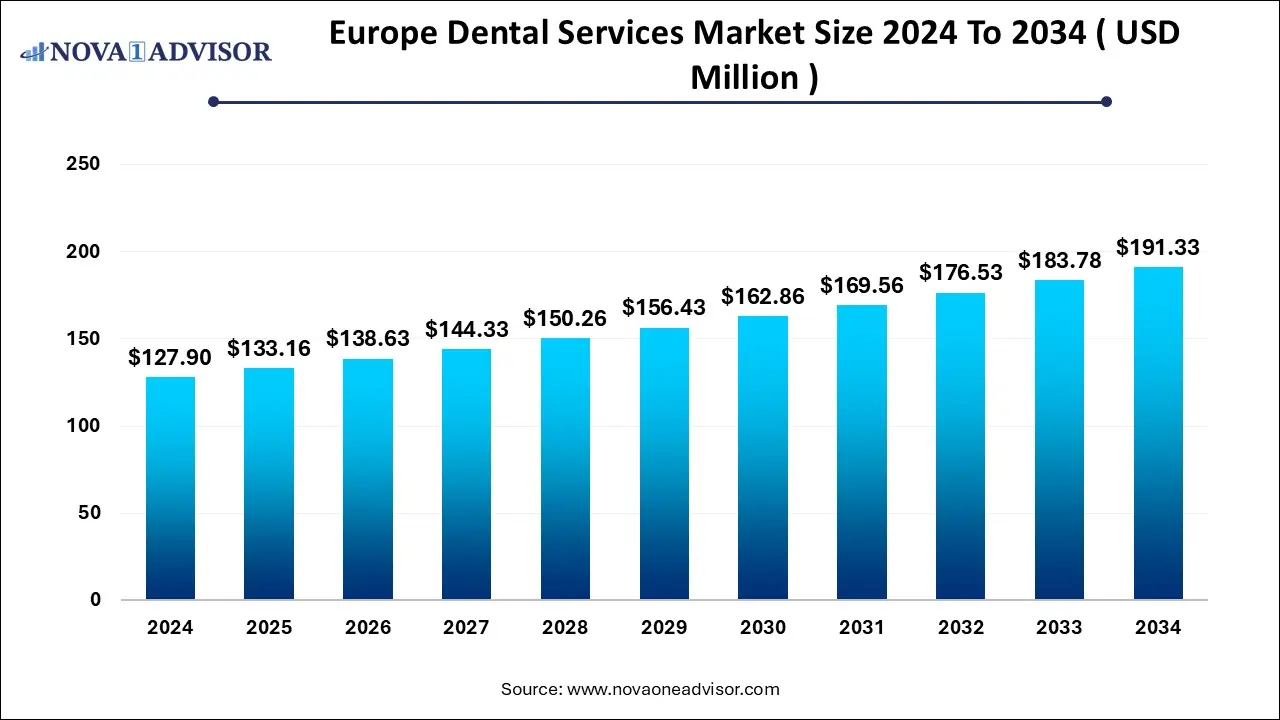

The Europe dental services market size accounted for USD 127.90 million in 2024 and is predicted to hit around USD 191.33 million by 2034, growing at a CAGR of 4.11% from 2025 to 2034.

Key Takeaways

- By type, the dental consumables segment dominated the market in 2024.

- By type, the dental equipment segment is estimated to witness the fastest growth over the forecast period.

- By procedure type, non cosmetic procedures led the market as of this year.

- By procedure type, cosmetic procedures are seen to be the fastest growing segment.

- By end user, hospitals held the largest market share in 2024.

- By end user, dental clinics are expected to grow at the fastest rate throughout the forecast period.

Market Summary

The Dental Services Market is currently experiencing rapid growth and development, driven by various factors that continue to influence consumer behavior. The increasing awareness of oral health and hygiene among the population, rise of personalized treatments and technological advancements are key drivers for growth. Over the past few decades, there has been a growing recognition of the link between oral health and systemic health, leading to an increased focus on preventive dental care. Additionally, the integration of advanced technologies, such as tele-dentistry and digital imaging, has enhanced patient experiences and streamlined operations within dental practices.

What are Dental Services?

Dental services refer to the range of healthcare services that are provided by dental professionals in order to diagnose, treat and prevent oral health problems, thus improving overall quality of life. These types of services include a variety of treatments, including routine checkups, cleanings, restorative procedures and specialized treatments for oral diseases. Dental services are crucial for maintaining good oral hygiene, preventing tooth decay and ensuring the overall health of the mouth, gums and teeth. These services can be offered in general dentistry or through specialized areas such as orthodontics, periodontics and oral surgery.

What are the Key Trends in the Market?

- Aging Population: Due to a rapidly aging global population, more dental restorations and prosthetic services such as implants and dentures are being witnessed in the market.

- Increasing Demand for Cosmetic Dentistry: People are focusing more on appearances and aesthetics and thus, procedures such as teeth whitening, veneers, and aligners are gaining popularity.

- Favorable Regulatory Environment: Robust regulatory frameworks and high standards of healthcare encourage global investments as well as drive up innovation in the dental industry.

- Integration of Artificial Intelligence: The integration of AI and ML tools in diagnostics, treatment planning and patient management helps in enhancing the efficiency and accuracy of dental services.

- Focus on Minimally Invasive Procedures: The market is witnessing an increasing demand for minimally invasive dental procedures, driven by patient demand for faster recovery and less discomfort.

What is the Impact of AI in this Field?

Artificial intelligence and machine learning continue to revolutionize the European dental services market by greatly enhancing patient treatment outcomes. AI and ML tools, both assist in screening and early detection of , thus enabling dentists to take timely action. They can also analyze and interpret imaging data as well as reduce manual errors.

AI-powered diagnostic tools nowadays are helping dentists detect misalignments, cavities and oral cancer at much earlier stages. Algorithms are able to analyze complex imaging data with impressive accuracy and offer assessments in real time. This has been a game-changing aspect to ensure prevention and deploy proactive treatment plans. AI can also offer tailored education, treatment plans in order to provide extra support to patients. AI-driven chatbots and virtual assistants are also gaining traction in today’s market. They are already being used to answer frequently asked questions, provide post treatment care instructions and offer personalized recommendations based on the patient’s unique dental profile. Through all these factors, we can say that the next generation of AI solutions are not set to replace dentists, but are there only to amplify their expertise, acting as a trusted ally and allowing them to make more data-driven decisions while simultaneously educating and their patients, thus making their.

Report Scope of Europe Dental Services Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 133.16 Million |

| Market Size by 2034 |

USD 191.33 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 4.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Procedure, By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Colosseum Dental Group, European Dental Group (EDG), my dentist, Portman Dental Care, Praktikertjänst, Riverdale Healthcare, GSD Dental Clinics, Dentalgia, MB2 Dental Solutions |

Market Dynamics

Driver

Rapidly Aging Population

A rapidly aging demographic is a key driver that is propelling the dental services market forward. As people age, they often require more extensive dental care and treatments, such as dentures, implants and periodontal procedures. This shift in demographic creates a steady demand for quality dental services. Moreover, the elderly population is becoming more aware and conscious about their oral health, and thus, seek preventive and restorative dental care in order to maintain their quality of life. Dentists are also increasingly focused on catering to the unique needs of older patients, addressing issues related to gum disease, tooth decay and tooth loss. This factor is likely to continue to drive the growth of this market, creating opportunities for providers to offer specialized services tailored to the aging population's requirements.

The market is also driven by the growing awareness regarding preventive oral care among the general population. Patients are increasingly getting aware that maintaining good oral health through regular check-ups and hygiene practices can prevent costly and painful dental issues in the future. This awareness has led to a shift in consumer behavior, as more individuals continue to seek routine dental examinations and cleanings.

Restraint

High Costs Pose as a Challenge

Despite various growth prospects, the Europe dental services market does have its fair share of restraints. High costs pose to be a barrier to accessing dental services for a large portion of the population. Many dental procedures especially cosmetic, orthodontic and implant based are only partially covered by insurance or there are chances that they are excluded altogether.

Even regular routine care such as cleanings, fillings and X-rays can be quite expensive for individuals, especially if they do not have any health insurance. This problem is more prevalent in rural areas or among low-income groups. All these financial barriers slow down market entry, making widespread adoption quite challenging.

Opportunity

Rise in Cosmetic Dental Procedures and Personalized Treatment

The rise in cosmetic dentistry procedures, particularly for treatments such as teeth whitening, veneers, and aligners, is opening up new opportunities within the dental services market. This growth and development is primarily fueled by a convergence of consumer desires and advancements in dental technology and techniques. Moreover, advancements in dental technology have made these procedures more accessible and less invasive. Teeth whitening treatments have become quite efficient in these recent years. They have become less time-consuming, encouraging individuals to try this procedure for a brighter and whiter smile. Veneers and aligners have also gained traction, benefiting from innovations that provide patients with more comfortable and convenient treatment options.

There is also a growing focus on personalized treatment plans that are tailored to individual patient needs. This trend highlights a broader movement towards patient-centered care, emphasizing on comfort and satisfaction. Practitioners and dental personnel are seen increasingly adopting strategies that prioritize the unique preferences and requirements of each patient.

Segmental Analysis

By Type Insights

Which type segment dominated the market in 2024?

The dental consumables segment dominated the market in 2024. This dominance is because dental consumables are generally single-use materials that are used in dental practice. The most widely used consumables include chemicals, tray liners, surgical gloves, cotton wool rolls, face masks and restorative dental products. The growing demand for cosmetic dentistry and the increasing prevalence of dental disorders are driving the consumption of these products.

The dental equipment segment is estimated to witness the fastest growth over the forecast period. Dental equipment is an essential requirement for dental professionals. This segment includes examination instruments such as dental mirrors and probes, retractors, dental lasers and even dental chairs. The development of innovative dental lasers and other therapeutic equipment has enhanced the efficacy and precision of dental treatments, boosting this segment forward.

By Procedure Type Insights

Which procedure type led the market as of this year?

The non-cosmetic dentistry segment led the market as of this year. This segment includes dental treatments that provide core oral health care, they treat issues such as tooth decay, gum disease, and general dental maintenance. As individuals prioritize regular dental visits to maintain their oral health, this segment is expected to sustain its growth.

The cosmetic dentistry sector is seen to be a fast-growing segment throughout the forecast years. Any elective procedure that is meant to enhance the appearance of teeth and the smile, such as whitening, shaping, and placing veneers, is included in this segment. This segment has gained a lot of popularity due to the growing awareness of aesthetics, particularly among the youth because of social media.

By End User Insights

Which end user held the largest market share in 2024?

The hospital segment held the largest market share in 2024. This is attributed to the upgradation of healthcare infrastructure and the availability of dental services in the hospital setting, which helps to lure in bigger patient loads. Dental departments within hospitals offer a comprehensive range of services, including oral surgery, various treatments and emergency dental care. The integration of dental services within hospital settings ensures the availability of multidisciplinary care, enhancing the quality and accessibility of all dental treatments.

Dental Clinics are expected to grow at the fastest rate throughout the forecast period. This growth is because specialized centers provide a plethora of dental services that allow convenient, personalized care, which becomes the top choice for several patients. The increasing focus on patient-centric care and the adoption of advanced dental technologies are driving the growth of this particular segment.

Some of The Prominent Players in The Europe Dental Services Market Include:

Recent Developments

- In May 2025, Planmeca presented a vast range of new product innovations at the International Dental Show 2025, the leading trade fair in dental industry. At IDS 2025, they presented a new generation of products across all major categories: dental units, imaging, CAD/CAM, and software. It is a range of bold new solutions that are set to pave the way for dental innovation for the next 20 years, and even beyond.

- In June 2024, Proclinic Group, a leading provider of comprehensive dental solutions in Europe backed by Miura Partners, has acquired VS Dental, an Italian dental products distributor based in Verona. This acquisition enables Proclinic Group to strengthen its presence in Italy, a mature and growing European market. Additionally, the company will expand its logistics capabilities, optimizing its distribution service to 24/48 hours in Italy through its new warehouse.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Europe dental services market.

By Type

-

- Dental Restoration Products

- Dental Implants

- Endosteal Implants

- Superperiostal Implants

- Transosteal Implants

-

- Crowns

- Bridges

- Abutments

- Dentures

- Others

-

- Clear Aligners

- Conventional Braces

- Endodontics

- Others

- Dental Equipment

-

- Dental Radiology Equipment

- Dental Lasers

- Dental Surgical Navigation Systems

- CAD/CAM Equipment

- Dental Chairs

- Others

By Procedure

- Cosmetic Dentistry

- Non-Cosmetic Dentistry

By End User

- Dental Clinics

- Hospitals

- Research Institute

- Others