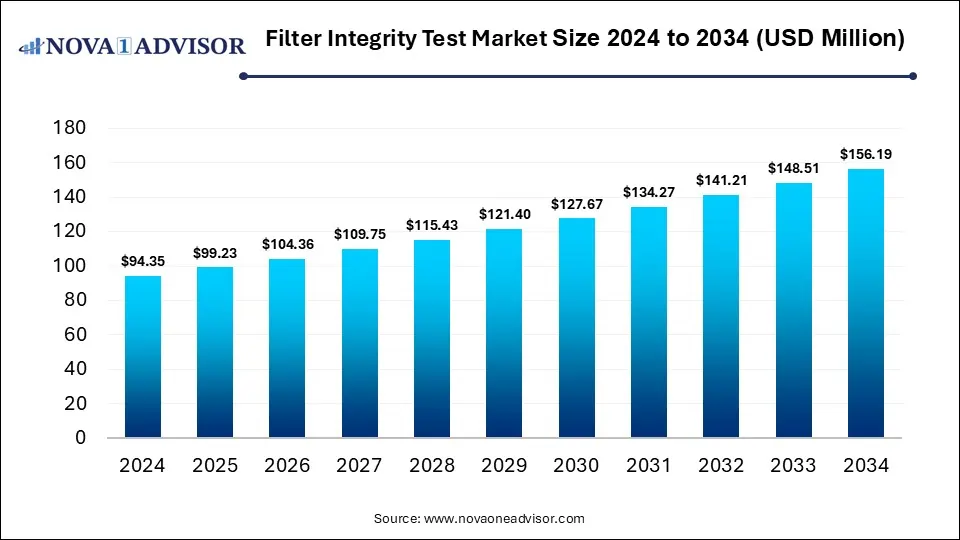

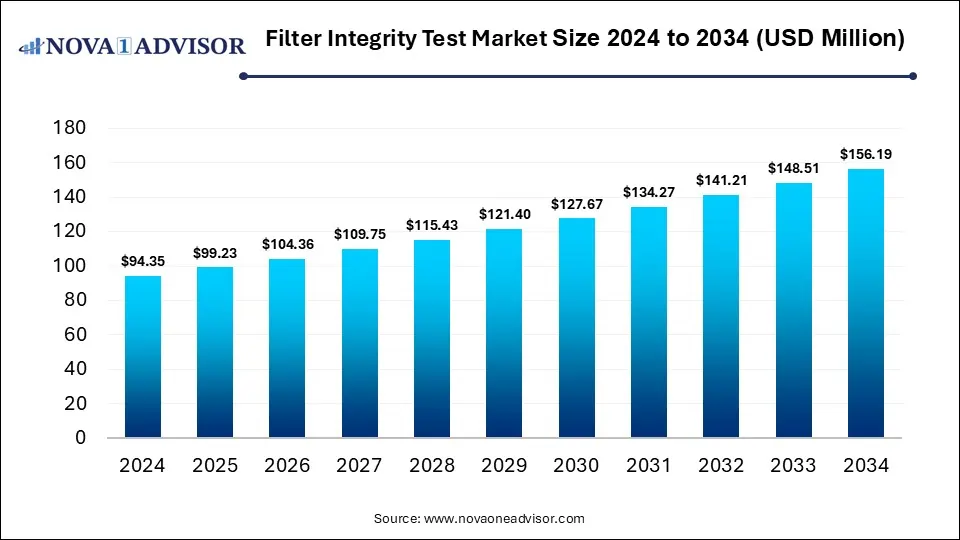

Filter Integrity Test Market Size and Forecast 2025 to 2034

The global Filter Integrity Test market gathered revenue around USD 94.35 million in 2024 and market is set to grow USD 156.19 million by the end of 2034 and is estimated to expand at a modest CAGR of 5.17% during the prediction period 2025 to 2034.

Growth Factors:

The introduction of stringent regulations pertaining to the evaluation of the integrity of filter products has driven the adoption of filter integrity test systems within biopharmaceutical, food & beverages, and other end-use settings. The tests are highly adopted by the aforementioned end-users to ensure the structural integrity of a sterilizing filter in order to meet all regulatory requirements as well as manufacturer’s specifications, which in turn, has spurred the revenue generation in this market.

The availability of fully automated testing systems has provided emerging key players with lucrative growth avenues. Automated systems are portable and easy-to-use and provide reliable data, thereby enable in saving time as well as reducing labor and other handling costs. Furthermore, advancements such as the touch screen user interface simplify the test process and accelerate the testing capabilities.

Numerous incidences of post-use filter failure are detected during the filtration process leading to the removal or reprocessing of filtered products. Implementation of pre-use/post-sterilization integrity testing minimizes such post-use failure detections in the product, consequently improving the quality of filtration. This has further boosted the adoption of such tests in the market.

This research report purposes at stressing the most lucrative growth prospects. The aim of the research report is to provide an inclusive valuation of the Filter Integrity Test market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Filter Integrity Test market report aids in comprehending market structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Filter Integrity Test market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Report Scope of Filter Integrity Test Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 99.23 Million |

| Market Size by 2034 |

USD 156.19 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 5.17% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Test Method, Mode, Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck KGaA; Sartorius AG; Parker Hannifin Corp; PALL Corporation; Donaldson Company, Inc.; Pentair Ltd.; 3M; Meissner Filtration Products, Inc.; Beijing Neuronbc Laboratories Co., Ltd.; Surway Filter; Analytical Technologies Limited; Thermo Fisher Scientific, Inc. |

Test Method Outlook

Forward Flow (Diffusion) Test dominated the market.

This method is widely accepted due to its accuracy and reliability in detecting filter defects. It is the most commonly recommended test by regulators like the FDA and EMA, making it the preferred choice for pharmaceutical manufacturers. Forward flow tests are also compatible with a wide variety of filter types and applications, further driving adoption. The dominance of this segment can also be attributed to its high sensitivity in detecting flaws that could compromise sterility.

On the other hand, the Pressure Hold Test is projected to be the fastest-growing method. This method is simpler in execution and less prone to operational variability, making it attractive in industries with limited technical expertise. Its cost-effectiveness and ability to detect gross leaks effectively make it popular among small- and medium-scale facilities. With rising emphasis on affordability and operational efficiency, the segment is expected to gain momentum.

Filter Integrity Test Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Forward Flow (Diffusion) Test |

33.02 |

34.53 |

36.12 |

37.76 |

39.47 |

41.28 |

43.15 |

45.11 |

47.16 |

49.31 |

51.54 |

| Bubble Point Test |

23.59 |

24.71 |

25.88 |

27.11 |

28.4 |

29.74 |

31.15 |

32.63 |

34.17 |

35.79 |

37.49 |

| Pressure Hold Test |

16.98 |

17.96 |

18.99 |

20.08 |

21.24 |

22.46 |

23.75 |

25.11 |

26.55 |

28.07 |

29.68 |

| Water Intrusion Test |

11.32 |

11.91 |

12.52 |

13.17 |

13.85 |

14.57 |

15.32 |

16.11 |

16.95 |

17.82 |

18.74 |

Mode Outlook

Automated Mode dominated the market.

Automation has reduced operator-related variability and ensured compliance with regulatory requirements. In biopharmaceutical manufacturing, where consistent results are critical, automated systems are preferred for their accuracy, speed, and audit-ready data. The growing preference for automation reflects the broader shift in the life sciences industry toward digitalization and efficiency-driven processes.

Meanwhile, the Manual Mode segment is anticipated to grow moderately, especially in emerging economies where cost constraints limit access to advanced systems. Manual methods still serve as a steppingstone for small industries and remain useful in low-volume applications. However, as global companies continue to push toward automation, manual testing is expected to maintain only a niche role.

Filter Integrity Test Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Automated |

61.33 |

65.49 |

69.92 |

74.63 |

79.65 |

84.98 |

90.65 |

96.67 |

103.08 |

109.9 |

117.14 |

| Manual |

33.02 |

33.74 |

34.44 |

35.12 |

35.78 |

36.42 |

37.02 |

37.6 |

38.13 |

38.61 |

39.05 |

Type Outlook

Liquid Filter Integrity Test dominated the market.

Liquid filtration plays a central role in pharmaceutical and biopharmaceutical manufacturing, particularly in sterile drug and vaccine production. Testing liquid filters ensures product safety by confirming that filters have retained microorganisms effectively. The dominance of this segment is attributed to its widespread use in the largest end-user sector: pharmaceuticals.

In contrast, the Air Filter Integrity Test is forecast to grow at the fastest pace. The rise in cleanroom operations, especially in biotechnology and electronics manufacturing, is fueling this demand. As cleanroom environments require highly reliable air filtration systems, companies are adopting FIT solutions to validate filter performance in HVAC and HEPA systems. With industries increasingly prioritizing contamination-free environments, this segment is expected to see rapid growth.

Filter Integrity Test Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Liquid Filter Integrity Test |

56.61 |

59.34 |

62.2 |

65.19 |

68.34 |

71.63 |

75.07 |

78.68 |

82.47 |

86.43 |

90.59 |

| Air Filter Integrity Test |

37.74 |

39.89 |

42.16 |

44.56 |

47.09 |

49.77 |

52.6 |

55.59 |

58.74 |

62.08 |

65.6 |

End-use Outlook

Biopharmaceutical & Pharmaceutical Industry dominated the market.

This dominance is linked to the stringent sterility requirements enforced by regulatory authorities. Every batch of sterile drug products must undergo validated filtration, making FIT indispensable. The expansion of biologics pipelines, personalized medicine, and advanced therapy medicinal products (ATMPs) further cements the sector’s reliance on FIT systems. For instance, major drug manufacturers such as Pfizer and Roche have invested heavily in automated FIT solutions to streamline sterile manufacturing processes.

The Food & Beverage Industry is projected to be the fastest-growing segment. With increasing awareness about foodborne illnesses and the demand for high-quality, contaminant-free products, FIT is becoming an integral part of quality assurance in this industry. The beverage industry, particularly in brewing and bottled water, relies on sterile filtration to ensure consumer safety. As global food safety standards tighten, adoption in this sector is set to accelerate.

Filter Integrity Test Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Biopharmaceutical & Pharmaceutical Industry |

51.9 |

54.28 |

56.78 |

59.38 |

62.1 |

64.95 |

67.92 |

71.03 |

74.28 |

77.67 |

81.22 |

| Food & Beverage Industry |

28.3 |

29.97 |

31.72 |

33.58 |

35.55 |

37.63 |

39.83 |

42.16 |

44.62 |

47.23 |

49.98 |

| Others |

14.15 |

14.98 |

15.86 |

16.79 |

17.78 |

18.82 |

19.92 |

21.08 |

22.31 |

23.61 |

24.99 |

Regional Analysis

North America dominated the market.

The region’s leadership stems from the presence of major pharmaceutical and biopharmaceutical players, coupled with stringent regulatory frameworks from the FDA. Companies in the U.S. are early adopters of advanced automated FIT systems, supported by well-established R&D ecosystems. Moreover, government investments in vaccine development and biotechnology have fueled demand for robust sterility assurance practices.

Asia-Pacific is the fastest-growing region.

This growth is driven by rising pharmaceutical manufacturing hubs in countries like China, India, and South Korea. Cost advantages, coupled with increasing regulatory alignment with international standards, are attracting global companies to establish manufacturing bases in the region. For example, India’s growing biosimilars market and China’s investments in biopharmaceutical infrastructure are significantly boosting FIT adoption. As Asia-Pacific continues to position itself as a global biomanufacturing leader, its demand for advanced integrity testing solutions is expected to surge.

Filter Integrity Test Market Size 2024 to 2034 (USD Million)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

30.2 |

31.45 |

32.78 |

34.13 |

35.55 |

37.04 |

38.55 |

40.14 |

41.8 |

43.51 |

45.3 |

| Europe |

26.42 |

27.59 |

28.8 |

30.07 |

31.4 |

32.78 |

34.22 |

35.72 |

37.28 |

38.91 |

40.61 |

| Asia Pacific |

25.47 |

27.19 |

29.01 |

30.95 |

33.01 |

35.2 |

37.54 |

40.01 |

42.65 |

45.45 |

48.41 |

| Latin America |

6.6 |

7.05 |

7.51 |

8.01 |

8.54 |

9.1 |

9.7 |

10.34 |

11.01 |

11.73 |

12.5 |

| Middle East and Africa (MEA) |

5.66 |

5.95 |

6.26 |

6.59 |

6.93 |

7.28 |

7.66 |

8.06 |

8.47 |

8.91 |

9.37 |

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Filter Integrity Test Market include: Merck KGaA; Sartorius AG; Parker Hannifin Corp; PALL Corporation; Donaldson Company, Inc.; Pentair Ltd.; 3M; Meissner Filtration Products, Inc.; Beijing Neuronbc Laboratories Co., Ltd.; Surway Filter; Analytical Technologies Limited; Thermo Fisher Scientific, Inc.

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

By Test Method

- Forward Flow (Diffusion) Test

- Bubble Point Test

- Pressure Hold Test

- Water Intrusion Test

- Others

By Mode

By Type

- Liquid Filter Integrity Test

- Air Filter Integrity Test

By End-use

- Biopharmaceutical & Pharmaceutical Industry

- Food & Beverage Industry

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Highlights of the Report:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

Research Methodology

In the study, a unique research methodology is utilized to conduct extensive research on the growth of the Filter Integrity Test market, and reach conclusions on the future growth parameters of the market. This research methodology is a combination of primary and secondary research, which helps analysts ensure the accuracy and reliability of the conclusions.

Secondary resources referred to by analysts during the production of the Filter Integrity Test market study are as follows - statistics from government organizations, trade journals, white papers, and internal and external proprietary databases. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, marketing/product managers, and market intelligence managers, all of whom have contributed to the development of this report as a primary resource.

Comprehensive information acquired from primary and secondary resources acts as a validation from companies in the market, and makes the projections on the growth prospects of the Filter Integrity Test markets more accurate and reliable.

Secondary Research

It involves company databases such as Hoover's: This assists us recognize financial information, structure of the market participants and industry competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to face interviews, online surveys, and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions and Questionnaire based research etc.

In order to validate our research findings and analysis we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

- CEOs, VPs, market intelligence managers

- Procuring and national sales managers technical personnel, distributors and resellers

- Research analysts and key opinion leaders from various domains

Key Points Covered in Filter Integrity Test Market Study:

- Growth of Filter Integrity Test in 2024

- Market Estimates and Forecasts (2025-2034)

- Brand Share and Market Share Analysis

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise, Country-wise, and Region-wise Analysis

- Competition Mapping and Benchmarking

- Recommendation on Key Winning Strategies

- COVID-19 Impact on Demand for Filter Integrity Test and How to Navigate

- Key Product Innovations and Regulatory Climate

- Filter Integrity Test Consumption Analysis

- Filter Integrity Test Production Analysis

- Filter Integrity Test and Management