Full Service CRO Market Size, Share, Growth, Report 2025 to 2034

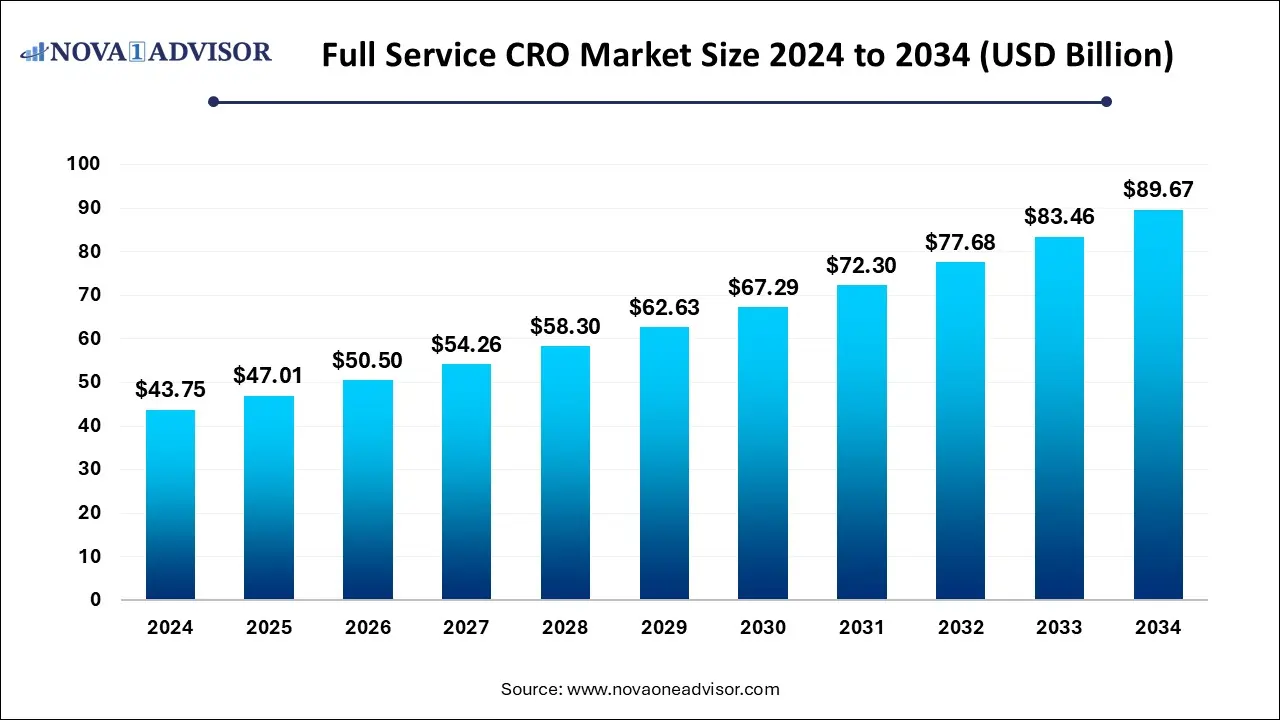

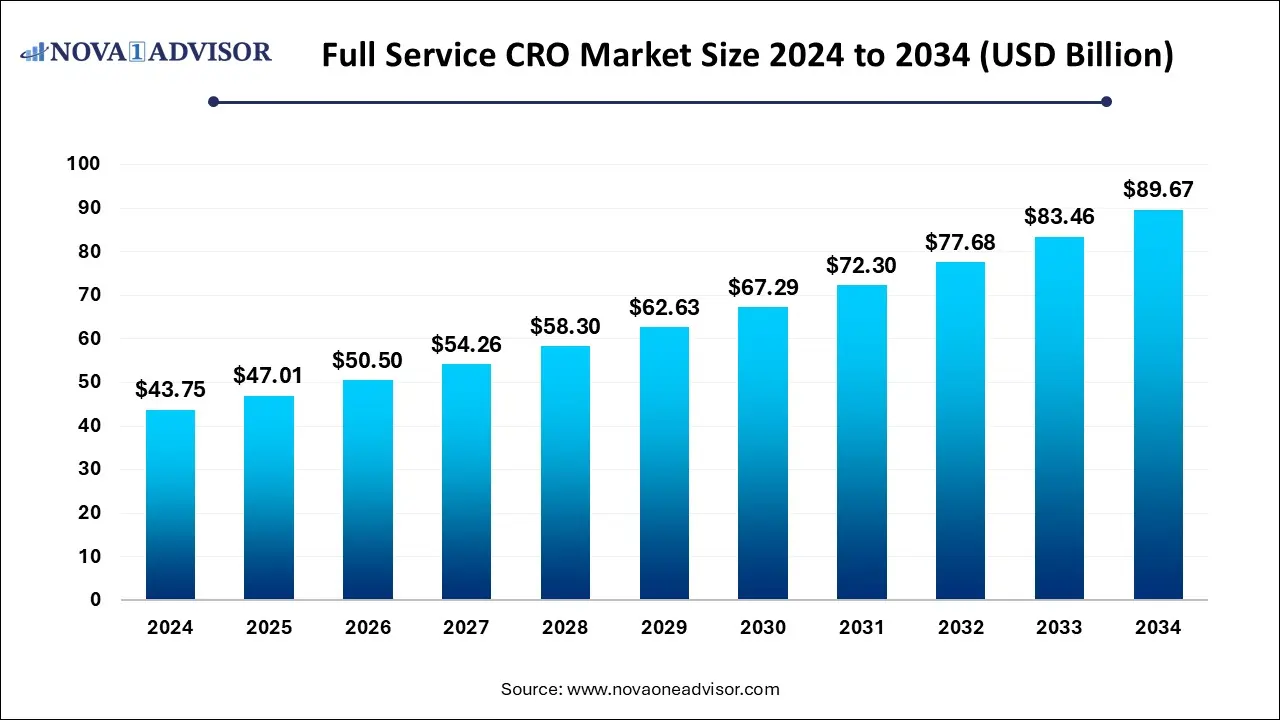

The global full service CRO market size was estimated at USD 43.75 billion in 2024 and is expected to reach USD 89.67 billion in 2034, growing at a CAGR of 7.44% during 2025-2034. Market growth is driven by increasing demand for integrated clinical research solutions, rising R&D outsourcing by pharmaceutical and biotech companies, expanding clinical trial complexity, cost-efficiency considerations, and advances in digital and data-driven trial management technologies.

Full Service CRO Market Key Takeaways

- By region, North America held the largest share of the full service CRO market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By service type, the clinical research services segment led the market in 2024.

- By service type, the data management & biostatistics segment is expected to expand at the highest CAGR over the projected timeframe.

- By phase of development, the phase III segment led the market in 2024.

- By phase of development, the phase I segment is expected to expand at the highest CAGR over the projection period.

- By therapeutic area, the oncology segment led the market in 2024.

- By end user, the pharmaceutical companies segment led the market in 2024.

Artificial Intelligence: The Next Growth Catalyst in Full Service CRO

AI is significantly revolutionizing the full service CRO market by enhancing efficiency, accuracy, and decision-making across clinical trial processes. AI enables faster patient recruitment through predictive analytics, improves trial design using real-world data, and enhances monitoring with automated data analysis and anomaly detection. It also accelerates drug development timelines by optimizing protocol design and reducing manual errors. Moreover, AI-driven insights are helping CROs deliver more personalized and adaptive trial strategies, ultimately lowering costs and improving trial success rates. This integration of AI is positioning full-service CROs as strategic innovation partners in the life sciences industry.

- According to the International Journal of Medical Informatics, AI and advanced analytics are also being used for patient recruitment, site selection, predictive modeling, and data surveillance.

Strategic Overview of the Global Full Service CRO Industry

The market growth is fueled by the increasing outsourcing of clinical trials, rising drug development costs, the expanding biologics pipeline, and the adoption of advanced technologies such as AI and decentralized trials. The full service CRO market refers to companies that provide comprehensive clinical research and development services to pharmaceutical, biotechnology, and medical device firms, covering every stage from preclinical studies to post-market surveillance. Full-service CROs offer advantages such as cost efficiency, faster trial execution, regulatory compliance, and access to global expertise and infrastructure. These organizations help streamline complex clinical processes, allowing sponsors to focus on core R&D and product innovation.

Market Outlook

- Market Growth Overview: The full service CRO market is expected to grow significantly between 2025 and 2034, driven by the increasing R&D expenditure and growing volume of clinical trials. Pharmaceutical and biotechnology companies are investing heavily in developing innovative drugs, biologics, and therapies, leading to a surge in the number and complexity of clinical studies.

- Sustainability Trends: Sustainability trends are fueling innovation in the market through decentralized and hybrid clinical trials (DCTs). CROs are increasingly offering hybrid or fully decentralized trial models that utilize remote monitoring, telemedicine, wearable sensors, and home health services to lessen patient burden, accelerate enrollment, and reach more diverse populations.

- Major Investors: Key investors in the market include private equity firms, strategic acquirers, and growth-equity investors. Private equity firms are essential because they fund mergers and acquisitions that enable CROs to expand their service offerings, global reach, and technological capabilities. Strategic investors, like Thermo Fisher Scientific through its acquisition of PPD, integrate CROs into wider healthcare ecosystems, thereby strengthening comprehensive research and analytics services. Growth-equity and venture investors support specialized CROs focusing on emerging areas like cell and gene therapies or decentralized clinical trials.

- Startup Economy: The startup economy in the market is an ecosystem of emerging, more agile service providers and niche entrants in the full-service contract research organization (CRO) space that are rapidly scaling, innovating, and reshaping traditional models. These startups often introduce new technology platforms (such as AI-driven trial design, decentralized trial execution, and real-world evidence analytics), focus on specific therapeutic or geographic niches, and challenge legacy full-service CROs by offering more flexible, cost-efficient, and digitally enabled solutions.

Report Scope of Full Service CRO Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 47.01 Billion |

| Market Size by 2034 |

USD 89.67 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.44% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Service Type, By Phase of Development, By Therapeutic Area, By End User, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Number of Clinical Trials

The rising number of clinical trials is driving market growth as drug developers seek to manage the increasing complexity of studies and regulatory demands more efficiently. With expanding pipelines, especially in areas like oncology and rare diseases, sponsors rely on CROs for integrated solutions spanning trial design to regulatory submissions. This growing dependency on outsourcing accelerates market expansion, as CROs provide the scalability, expertise, and global reach needed to streamline development timelines.

- According to the American Society of Gene & Cell Therapy (ASGCT), over 4,000 gene, cell, and RNA therapies are in development, marking a significant rise across all clinical phases, including an 11% increase in Phase I programs.

Rising Complexity of Clinical Trials

The rising complexity of clinical trials is a key driver fueling the growth of the full service CRO market. Modern trials increasingly involve adaptive designs, biomarker-based patient selection, and integration of advanced technologies such as genomics, digital health tools, and real-world evidence. These complex protocols require specialized expertise, global infrastructure, and regulatory knowledge that full-service CROs are uniquely equipped to provide. By outsourcing to CROs, pharmaceutical and biotech companies can efficiently manage intricate trial logistics, ensure compliance across multiple regions, and maintain high data quality.

Growth in Complex Therapies

The growth in complex therapies such as cell and gene therapies, biologics, and personalized medicine is another key driver of the full service CRO market. These advanced therapies require specialized expertise, infrastructure, and regulatory compliance, which many pharmaceutical and biotech companies prefer to outsource to experienced full-service CROs. CROs provide end-to-end support, from preclinical studies and manufacturing to clinical trials and post-market surveillance, ensuring faster and more efficient development processes. As the pipeline for complex and rare disease treatments expands, demand for comprehensive, high-quality CRO services continues to rise, fueling market growth.

Restraint

Talent Shortages and Operational Capacity Constraints

The market growth is hindered by a persistent shortage of skilled professionals, including clinical research associates (CRAs), biostatisticians, data managers, and regulatory experts, who are essential for executing complex clinical trials. This talent gap leads to project delays, reduced operational efficiency, and higher labor costs, limiting CROs’ ability to meet client timelines and quality standards. Moreover, the rapid increase in trial volumes and global studies has further strained existing capacities, creating bottlenecks in trial management and data processing.

Opportunities

Growth of Cell & Gene Therapies, Rare Diseases, and Precision Medicine

The rapid expansion of cell and gene therapies, rare disease research, and precision medicine is generating substantial opportunities for the full service CRO market. These advanced therapeutic areas demand specialized trial designs, sophisticated laboratory capabilities, and expertise in managing complex biological materials and regulatory pathways. Full-service CROs providing integrated solutions, encompassing biomarker analysis, companion diagnostics, logistics, and patient monitoring, are becoming indispensable partners for sponsors developing these next-generation treatments. Moreover, rare disease trials with small patient populations and decentralized structures further heighten the reliance on CROs with global reach and adaptive operational models.

Integration of Real-World Evidence (RWE) And Analytics-Driven Services

The market is presenting significant opportunities as pharmaceutical and biotechnology companies increasingly aim to demonstrate the real-world effectiveness, safety, and value of their therapies. CROs are capitalizing on data from electronic health records, insurance claims, and patient registries, integrating these sources with advanced analytics, AI, and machine learning to optimize trial design, enhance patient recruitment, and accelerate insights. This data-driven approach not only strengthens decision-making across clinical development but also supports post-marketing surveillance and regulatory submissions. As a result, CROs offering integrated RWE and analytics capabilities are emerging as preferred partners, unlocking new revenue streams and reinforcing their competitive edge.

How Macroeconomic Variables Influence the Full Service CRO Market?

Economic Growth and GDP

Economic growth and rising GDP typically stimulate market expansion by driving greater investments in healthcare, pharmaceuticals, and biotechnology R&D. A strong economy allows companies to allocate larger budgets toward clinical research, innovation, and outsourcing to full-service CROs. Conversely, during economic slowdowns, reduced funding and tighter budgets, particularly among smaller biotech firms, can temporarily restrain market growth.

Inflation & Drug Pricing Pressures

Inflation and drug pricing pressures negatively affect the growth of the market by rising operational and labor costs increase the overall expense of conducting clinical trials. Pharmaceutical and biotech companies facing pricing pressures tend to cut R&D budgets or delay projects, reducing outsourcing opportunities for CROs. However, in some cases, these cost challenges can also encourage companies to outsource more work to CROs to achieve efficiency and reduce internal expenses.

Exchange Rates

Exchange rate fluctuations have both positive and negative impacts on the market. Favorable currency conditions, particularly in emerging economies, can attract greater outsourcing from global pharmaceutical companies seeking cost-effective research solutions. However, volatile or unfavorable exchange rate movements can elevate financial risks, disrupt cross-border contracts, and constrain profitability for multinational CROs operating across diverse regions.

Segment Outlook

By Service Type Insights

Why Did the Clinical Research Services Segment Dominate the Full Service CRO Market in 2024?

The clinical research services segment dominated the market with the largest share in 2024. This is due to their central role in managing all phases of clinical trials, which represent the largest and most resource-intensive part of drug development. Pharmaceutical and biotechnology companies increasingly outsource these services to CROs to reduce operational costs, shorten development timelines, and ensure regulatory compliance. This segment benefits from the growing complexity of global trials, rising demand for patient recruitment, and the need for specialized expertise in trial design and monitoring. Moreover, advancements in digital platforms and decentralized clinical trial models further strengthen the dominance of clinical research services.

The data management & biostatistics segment is expected to grow at the fastest CAGR during the projection period, driven by increasing complexity and volume of data generated during clinical trials. With the rise of digital and decentralized trial models, CROs are adopting advanced data analytics, AI, and real-world evidence tools to ensure accuracy, efficiency, and regulatory compliance. Sponsors rely on CROs for robust data integration and statistical analysis to accelerate decision-making and enhance trial outcomes. Furthermore, the growing use of electronic data capture (EDC) systems and cloud-based platforms is driving demand for specialized biostatistical expertise, making this segment a key driver of innovation and growth in the CRO industry.

By Phase of Deployment Insights

How Does the Phase III Segment Lead the Market in 2024?

The phase III segment led the full service CRO market in 2024 as it represents the most extensive, costly, and time-intensive stage of clinical development. These trials involve large patient populations across multiple regions to confirm the efficacy and safety of new drugs before regulatory approval. Pharmaceutical and biotechnology companies increasingly outsource Phase III studies to full-service CROs to leverage their global infrastructure, regulatory expertise, and operational efficiency. The growing number of complex and late-stage clinical programs, particularly in oncology and rare diseases, further strengthens the demand for comprehensive CRO support.

The phase I segment is projected to grow at the highest CAGR in the coming years. This is mainly because of increasing focus on early-stage research for innovative therapies such as biologics, cell and gene therapies, and rare disease treatments. As smaller biotech firms and startups drive much of this innovation, they rely heavily on full-service CROs for specialized expertise, infrastructure, and regulatory guidance. Advancements in adaptive trial designs, real-time data monitoring, and digital platforms are also accelerating the execution of Phase I studies. Additionally, the growing emphasis on first-in-human and proof-of-concept studies to shorten development timelines is boosting demand for CRO partnerships in early-phase research.

- In October 2024, Premier Research partnered with Interius BioTherapeutics on a Phase I clinical trial involving the first in-human test of an in vivo Chimeric Antigen Receptor (CAR) gene therapy.

By Therapeutic Area Insights

What Made Oncology the Dominant Segment in the Market in 2024?

The oncology segment dominated the full service CRO market in 2024 due to its increasing global prevalence of cancer and the high volume of oncology drugs in the development pipeline. Cancer trials are typically complex, long-term, and require specialized expertise, making full-service CROs essential for managing study design, patient recruitment, biomarker analysis, and regulatory compliance. Pharmaceutical and biotech companies are heavily investing in oncology R&D, driving continuous demand for CRO partnerships to accelerate the approval of new therapies. Moreover, advancements in immuno-oncology, targeted therapies, and precision medicine have further expanded the scope of oncology research.

The rare & genetic diseases segment is expected to expand at the highest CAGR in the coming years. This is primarily due to a surge in research focused on orphan drugs and personalized genetic therapies. Advances in genomics, gene editing, and molecular diagnostics have opened new opportunities for treating previously untreatable conditions, driving demand for specialized CRO expertise. Full-service CROs play a crucial role in managing small patient populations, complex study designs, and regulatory pathways unique to rare disease trials. Additionally, strong regulatory incentives, such as orphan drug designations and expedited approval processes, are encouraging greater biopharma investment in this area, fueling rapid market expansion.

By End User Insights

Why Did the Pharmaceutical Companies Segment Dominate the Market in 2024?

The pharmaceutical companies segment led the full service CRO market in 2024 as large drug manufacturers increasingly outsource their R&D and clinical trial operations to optimize costs and improve efficiency. With growing pressure to accelerate drug development timelines and manage complex global trials, pharmaceutical firms rely heavily on CROs for their end-to-end expertise, regulatory compliance, and technological capabilities. Full-service CROs provide integrated solutions that streamline processes from preclinical research to post-marketing surveillance. Additionally, strategic partnerships between pharma companies and CROs enable innovation and data-driven decision-making.

The biotechnology firms segment is expected to grow at the highest CAGR in the coming years. This is mainly due to the growing number of small- and mid-sized biotech companies developing innovative therapies, such as biologics, cell and gene therapies, and precision medicines. These firms often lack the internal infrastructure, regulatory expertise, and resources needed for large-scale clinical development, making them highly dependent on full-service CROs. CRO partnerships enable biotech firms to access advanced technologies, global trial networks, and end-to-end support from preclinical research to commercialization.

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America maintained dominance in the full service CRO market while holding the largest share in 2024. The region’s dominance is attributed to its strong pharmaceutical and biotechnology industry presence, advanced R&D infrastructure, and high clinical trial activity. The region is home to leading CROs such as IQVIA, Labcorp, and PPD, which offer comprehensive, technology-driven research services to global clients. Favorable regulatory frameworks, well-established healthcare systems, and increased investment in innovative therapies such as biologics and gene therapies further support market leadership. Additionally, the region’s early adoption of digital and decentralized trial models enhances efficiency.

- In March 2024, Lindus Health launched its “All-In-One CNS, Neurology and Psychiatry CRO” offering, which bundles end-to-end trial services (from design to data delivery) in neurological/psychiatric indications and uses its in-house Citrus™ eClinical platform.

U.S. Full Service CRO Market Trends

The U.S. is a major contributor to the market in North America due to its robust pharmaceutical and biotechnology industries. The country hosts many of the world’s leading CROs, research institutions, and regulatory agencies, creating a well-integrated ecosystem for clinical research. High R&D spending, strong government support for drug innovation, and a large number of ongoing clinical trials drive continuous growth. Additionally, the U.S. leads in adopting advanced technologies such as AI, data analytics, and decentralized trials, further strengthening its dominance in the regional CRO market.

What Makes Asia Pacific the Fastest-Growing Area in the Market?

Asia Pacific is expected to grow at the fastest rate in the coming years. This is due to its cost-effective research environment, expanding healthcare infrastructure, and increasing participation in global clinical trials. Countries such as China, India, and South Korea offer large, diverse patient populations that enable faster recruitment and data generation. Supportive government policies, improving regulatory frameworks, and rising investments from pharmaceutical and biotech companies are further driving market expansion. Additionally, the growing presence of international CROs and the adoption of advanced digital trial technologies are enhancing the region’s capabilities.

China Full Service CRO Market Trends

China is a key player in the Asia Pacific full service CRO market due to its rapidly expanding pharmaceutical industry, strong government support for clinical research, and large patient population. The country offers significant cost advantages, streamlined regulatory reforms, and advanced research infrastructure that attract global biopharma companies. Major domestic CROs like WuXi AppTec and Tigermed have established strong global footprints, further enhancing China’s leadership in the region. Additionally, the nation’s growing expertise in biotechnology and adoption of digital trial technologies continue to strengthen its position as a key hub for full-service CRO operations.

How is the Opportunistic Rise of Europe in the Full Service CRO Market?

Europe is experiencing a notable growth in the market due to its strong clinical research infrastructure, robust regulatory standards, and high concentration of pharmaceutical and biotechnology companies. The region benefits from a well-established network of research institutions and experienced investigators, enabling high-quality, multi-country clinical trials. Increasing investment in precision medicine, rare disease research, and advanced therapies is driving demand for comprehensive CRO services. Additionally, the growing adoption of digital health technologies, real-world evidence studies, and decentralized trial models is enhancing efficiency and expanding CRO capabilities across Europe.

UK Full Service CRO Market Trends

The Uk is leading the market in Europe due to its robust life sciences ecosystem, advanced research infrastructure, and supportive regulatory environment. The presence of major CROs, world-class academic institutions, and a high concentration of clinical trial sites positions the UK as a preferred hub for global drug development. Moreover, the country’s strong focus on innovation, through AI, data analytics, and decentralized trial models, continues to enhance clinical efficiency and precision.

How is the Opportunistic Rise of South America in the Full Service CRO Market?

South America is emerging as a key growth hub in the market due to its expanding patient population, diverse genetic pool, and lower operational costs compared to North America and Europe. The region offers favorable regulatory reforms, improving clinical infrastructure, and a growing number of accredited research centers, making it increasingly attractive for global sponsors. Moreover, rising investments from multinational CROs and local partnerships are enhancing trial quality and capacity. This combination of cost-efficiency, speed, and patient accessibility positions Latin America as a strategic destination for clinical research outsourcing.

What Factors Support the Growth of the Middle East and Africa Full Service CRO Market?

The growth of the Middle East and Africa (MEA) full service CRO market is supported by several key factors. Expanding healthcare infrastructure, rising pharmaceutical R&D investments, and government initiatives to attract clinical trials are driving demand. The region’s large, diverse patient populations and relatively lower operational costs make it attractive to global sponsors seeking cost-efficient, fast trial execution. Additionally, increasing adoption of digital technologies, improvements in regulatory frameworks, and strategic collaborations with international CROs are further strengthening market opportunities.

Full Service CRO Market Value Chain Analysis

1. Preclinical Research & Discovery Support

This stage includes early drug discovery, target validation, and safety testing through in vitro and in vivo studies. Full-service CROs help pharmaceutical and biotech companies optimize preclinical workflows and cut early-stage R&D costs.

- Key Players: Charles River Laboratories, WuXi AppTec, ICON plc.

2. Clinical Development (Phase I–IV Trials)

Clinical development is the central part of the CRO value chain, involving all stages of human trials. CROs offer comprehensive services such as patient recruitment, site management, data collection, and monitoring to maintain trial integrity and compliance.

- Key Players: IQVIA, Labcorp Drug Development, PPD (part of Thermo Fisher Scientific), ICON plc.

3. Data Management & Biostatistics

This stage involves collecting, processing, and analyzing large amounts of clinical data to generate valuable insights and regulatory reports. It guarantees data quality, integrity, and compliance with international standards like GCP and FDA 21 CFR Part 11.

- Key Players: Parexel, Syneos Health, Medpace.

4. Regulatory Affairs & Compliance

During this phase, CROs help clients prepare and submit documentation for regulatory approvals while ensuring compliance with international standards. They offer expertise in navigating complex regulations across regions like the FDA (U.S.), EMA (Europe), and NMPA (China).

- Key Players: Parexel, ICON plc, IQVIA.

5. Pharmacovigilance & Post-Market Surveillance

This final stage ensures continuous safety monitoring and real-world performance evaluation of approved drugs. CROs gather adverse event data, perform risk-benefit analyses, and assist with regulatory reporting to protect patient safety.

- Key Players: Labcorp, IQVIA, Syneos Health.

Full Service CRO Market Companies

IQVIA is one of the largest full-service CROs globally, combining advanced analytics, technology solutions, and clinical research expertise. The company helps biopharmaceutical clients accelerate drug development through real-world data integration and AI-driven trial optimization.

Labcorp offers end-to-end clinical trial services, from preclinical testing to post-market monitoring. Its global laboratory network and bioanalytical expertise enable faster, data-driven decision-making and regulatory compliance across all phases of clinical research.

ICON provides comprehensive clinical development and commercialization solutions, specializing in oncology, rare diseases, and advanced therapies. The company’s technology-enabled services and strategic acquisitions have strengthened its leadership in global full-service CRO operations.

Parexel is a leading provider of clinical, regulatory, and consulting services to pharmaceutical and biotech companies. Its strong focus on patient-centric and decentralized trials enhances recruitment efficiency and supports faster study delivery.

Syneos Health integrates clinical development with commercial strategy, offering full-service solutions from Phase I to post-launch activities. Its hybrid model helps clients reduce time-to-market and optimize patient engagement through digital innovation.

- Charles River Laboratories

Charles River plays a key role in the preclinical and early development stages, offering toxicology, pathology, and discovery services. Its deep scientific expertise and global facilities support faster transition of molecules from lab to clinical trials.

- PPD (Part of Thermo Fisher Scientific)

PPD delivers comprehensive clinical trial management and laboratory services with a focus on operational excellence and global reach. Backed by Thermo Fisher’s resources, it enhances client support in large-scale clinical research and data management.

Medpace specializes in full-service clinical development with strong expertise in biotechnology, particularly in rare and complex disease areas. Its integrated approach and in-house scientific teams ensure efficient trial execution and data quality.

WuXi AppTec provides end-to-end R&D services spanning drug discovery, development, and manufacturing. Its global infrastructure and cost-effective model make it a preferred partner for small and mid-sized biotech firms seeking full-service CRO support.

- PRA Health Sciences (Acquired by ICON plc)

Before its merger with ICON, PRA Health Sciences was known for its expertise in digital and decentralized clinical trials. Its integration with ICON has strengthened the combined entity’s technology capabilities and global service portfolio.

Recent Developments

- In February 2025, MMS Holdings, a data-focused CRO, launched KerusCloud®, a cloud-based statistical modeling platform, and enhanced its end-to-end REMS (Risk Evaluation and Mitigation Strategies) services via proprietary technology.

- In August 2025, IQVIA, a leading global provider of clinical research services, announced a strategic partnership with Pfizer aimed at accelerating real-world evidence-enabled clinical trials across multiple therapeutic areas.

- In November 2024, Novotech, the global full-service CRO, announced a long-term strategic partnership with Beijing Biostar Pharmaceuticals to advance clinical research, leveraging Novotech’s expertise and platforms to support Biostar’s therapeutic development programs.

Exclusive Analysis on the Full Service CRO Market

The global full service CRO market is undergoing a paradigm evolution, driven by a confluence of technological sophistication, therapeutic diversification, and strategic outsourcing realignment across the biopharmaceutical value chain. As sponsors pivot from functional partnerships to integrated, end-to-end engagements, the competitive dynamic increasingly rewards CROs capable of harmonizing clinical operations, regulatory affairs, data intelligence, and patient-centric delivery within a unified framework.

The market’s growth trajectory is underpinned by the inexorable rise of complex therapies, particularly in oncology, rare diseases, and advanced biologics, which necessitate specialized scientific depth and global trial orchestration capabilities. Concurrently, the infusion of AI-enabled analytics, decentralized trial models, and real-world evidence (RWE) is expanding CROs' strategic remit from executional partners to innovation enablers within the drug development ecosystem.

Structurally, the sector is benefiting from the macroeconomic resurgence in biopharma R&D investment, increasing regulatory harmonization, and the expanding footprint of emerging-market sponsors seeking Western-standard development expertise. This creates a compelling growth canvas for full-service CROs that can bridge multi-regional regulatory, operational, and digital infrastructures.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the full service CRO market.

By Service Type

- Clinical Research Services

- Preclinical Services

- Laboratory Services

- Regulatory & Medical Writing Services

- Data Management & Biostatistics

- Pharmacovigilance & Safety Services

- Project Management & Consulting

By Phase of Development

- Preclinical Phase

- Phase I

- Phase II

- Phase III

- Phase IV (Post-Marketing)

By Therapeutic Area

- Oncology

- Cardiology

- Neurology

- Infectious Diseases

- Metabolic & Endocrine Disorders

- Immunology & Inflammation

- Rare & Genetic Diseases

By End User

- Pharmaceutical Companies

- Biotechnology Firms

- Medical Device Companies

- Academic & Research Institutions

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)