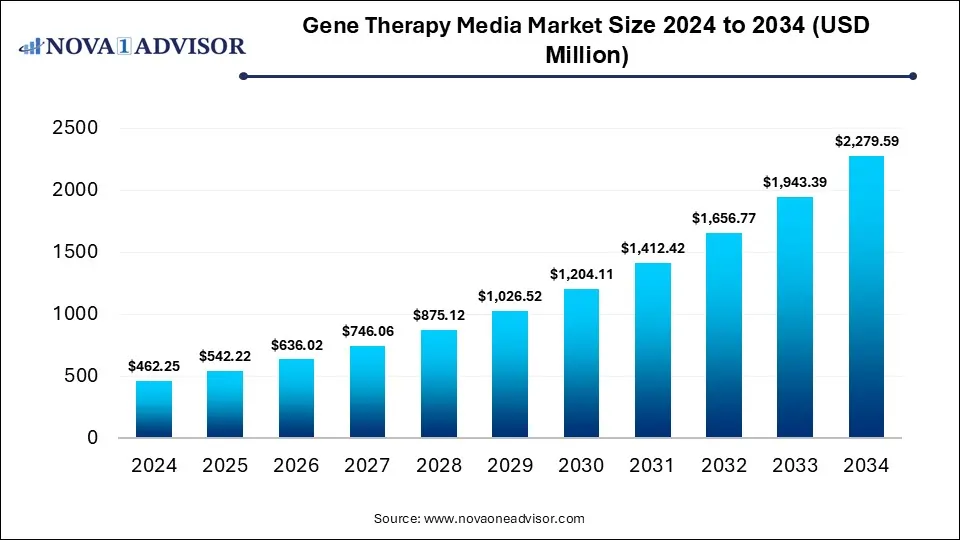

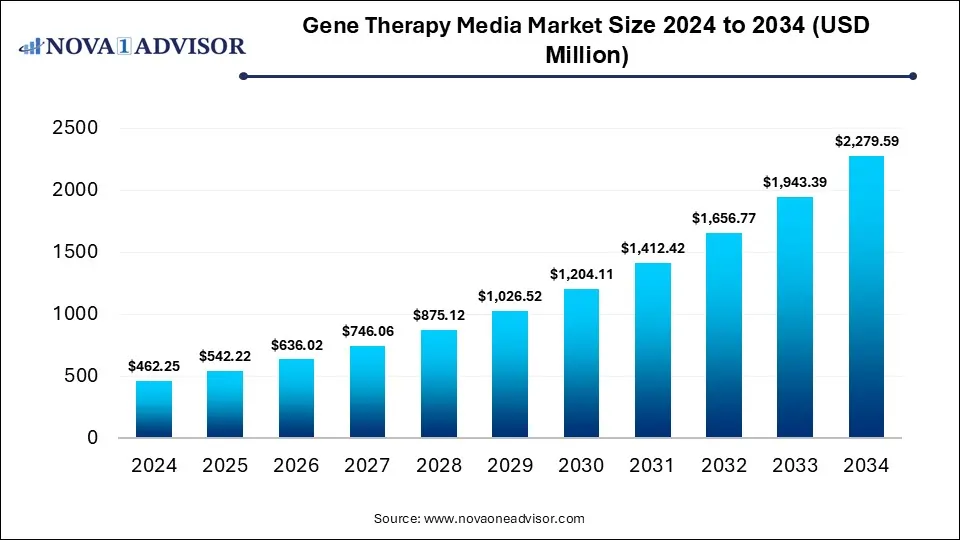

The global gene therapy media market size was estimated at USD 462.25 million in 2024 and is expected to reach USD 2,279.59 million in 2034, expanding at a CAGR of 17.3% during the forecast period of 2025 and 2034. The market growth is driven by the rise in research and development investment, innovation in gene editing tools, and the growing prevalence of genetic disorders and chronic diseases.

- By region, North America held the largest share of the gene therapy media market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2024 and 2034.

- By type, the serum-free media segment led the market in 2024.

- By type, the chemically defined media segment is expected to expand at the highest CAGR over the projected timeframe.

- By cell type, the HEK 293 cell segment led the market in 2024.

- By cell type, the human stem cells segment is expected to expand at the highest CAGR over the projection period.

- By application, the research & development segment led the market in 2024.

- By gene delivery method, the viral vector-based gene therapy segment held the dominant share in 2024.

- By end user, the biopharmaceutical & biotechnology companies segment led the market in 2024.

AI is significantly enhancing process optimization, predictive modelling, and quality control. AI algorithms are being used to analyze large biological datasets, enabling researchers to design more efficient media formulations tailored to specific gene therapy applications. Machine learning also accelerates biomanufacturing by predicting optimal culture conditions and minimizing experimental errors. Additionally, AI-driven automation reduces production time and costs while improving consistency and scalability.

Market Overview

The market growth is attributed to the rising prevalence of genetic diseases, increasing investment in cell and gene therapy research, advancements in bioprocessing technologies, and growing regulatory approvals for gene-based therapeutics. The gene therapy media market refers to the segment focused on the development, production, and supply of specialized culture media used in gene therapy research and manufacturing. These media provide optimal conditions for the growth, transfection, and maintenance of cells used in gene-based treatments, ensuring high-quality vector production and therapeutic efficacy. The key benefits of gene therapy media include enhanced cell viability, improved transgene expression, and reduced contamination risk, which are vital for applications in regenerative medicine, oncology, and rare genetic disorders.

- In July 2024, Dispatch Bio, a startup, emerged with $216 million in funding. It plans to use a combination of gene and cell therapy elements to create solid tumor therapies.

- Rising Adoption of Serum-Free and Chemically Defined Media

Manufacturers are increasingly shifting toward serum-free and chemically defined media to improve consistency, safety, and regulatory compliance, reducing the risks associated with animal-derived components.

- Integration of Automation and Single-Use Technologies

Automation and single-use bioprocessing systems are being adopted to streamline workflows, minimize contamination risks, and improve scalability in gene therapy production.

- Increased Collaboration Between Biopharma and Media Suppliers

Strategic partnerships between biotech firms and media manufacturers are accelerating innovation and ensuring an efficient supply of high-quality media for clinical and commercial gene therapy programs.

| Report Coverage |

Details |

| Market Size in 2025 |

USD 542.22 Million |

| Market Size by 2034 |

USD 2,279.59 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 17.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Cell Type, By Application, By Gene Delivery Method, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Increasing Prevalence of Genetic and Rare Diseases

The market growth is driven by the amplification of the need for effective, long-term treatment options that target the root cause of these conditions. Traditional therapies often only manage symptoms, whereas gene-based treatments offer the potential for permanent cures by correcting defective genes. This growing demand for gene therapies directly boosts the need for high-quality, specialized media required for efficient cell growth, viral vector production, and gene delivery. As research and clinical trials for genetic disorders expand, manufacturers are investing in advanced culture media formulations to enhance therapeutic efficacy and scalability.

Growing Investments in Cell and Gene Therapy Research and Biopharmaceutical R&D

Increasing investments in cell and gene therapy research to accelerate the development and commercialization of advanced therapeutic products is driving the growth of the gene therapy media market. Increased funding from both private and public sectors supports large-scale clinical trials, innovation in viral vector design, and optimization of manufacturing processes, all of which require specialized culture media. These investments enable companies to develop high-performance, GMP-grade media that enhance cell viability, transfection efficiency, and product yield. Moreover, as biopharmaceutical firms expand their pipelines with gene-based therapies, the demand for reliable, consistent, and scalable media solutions continues to rise.

- In February 2024, BioNTech and Autolus Therapeutics formed a strategic partnership to develop and commercialize autologous CAR-T programs. These collaborations pool expertise and financial resources to accelerate drug development.

Restraint

High Cost of Development and Manufacturing of Specialized Media Formulations

Market growth is constrained by the high costs of producing media that meet the stringent requirements of gene therapy, such as being serum-free, chemically defined, and GMP-compliant. These standards require expensive raw materials, advanced bioprocessing equipment, and strict quality control, significantly driving up production costs. This poses a barrier for smaller biotech firms and research institutions seeking large-scale adoption. Additionally, the need for continuous innovation and customization to support various cell types and viral vectors further adds to development expenses.

Opportunities

Expansion of GMP-Grade Media Manufacturing Facilities Across Emerging Markets

The market is creating emerging opportunities for enhancing global production capacity and accessibility. Establishing such facilities in regions like Asia-Pacific and Latin America helps reduce dependency on imports, lower production costs, and improve supply chain efficiency. This expansion also enables local biotech companies and research institutions to access high-quality, regulatory-compliant media for their gene therapy programs, fostering innovation and clinical development. Additionally, it encourages foreign investments and strategic partnerships between global media suppliers and regional manufacturers.

Rising Focus on Personalized Medicine and Regenerative Therapies

The market is creating immersive opportunities, driving demand for highly specialized and customizable media formulations. Personalized and regenerative treatments often require unique cell types or genetic modifications, prompting the need for media that can precisely support specific cellular behaviors and gene expression. This growing demand encourages manufacturers to innovate and develop advanced, chemically defined, and serum-free media tailored for individual therapeutic applications. Moreover, as personalized medicine gains traction in treating complex diseases, biopharmaceutical companies increasingly invest in scalable and efficient media solutions to ensure consistent clinical outcomes.

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. increasing healthcare spending, research funding, and biopharmaceutical investments. Strong economies enable governments and private sectors to allocate more resources toward advanced therapies, infrastructure, and innovation in bioprocessing. Conversely, in regions with slow economic growth, limited budgets and reduced R&D spending can restrain market expansion by hindering access to costly gene therapy technologies and specialized media.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the gene therapy media market by increasing production costs and reducing profit margins for manufacturers. Rising prices of raw materials, energy, and logistics make it more expensive to develop and distribute specialized media formulations. Additionally, regulatory and public pressures to control drug prices limit the ability of biopharmaceutical companies to absorb these costs, thereby slowing investment and innovation in the gene therapy media sector.

Exchange Rates

Exchange rate fluctuations can negatively affect, creating instability in import and export costs for raw materials and finished products. Since many components and media formulations are sourced or distributed internationally, unfavorable currency movements can increase operational expenses and reduce profitability. This volatility can discourage cross-border investments and complicate pricing strategies, ultimately slowing market expansion in regions dependent on imported bioprocessing supplies.

Segment Outlook

Type Insights

Why Did the Serum-Free Media Segment Lead the Market in 2024?

The serum-free media segment led the gene therapy media market in 2024 due to its superior safety, consistency, and regulatory compliance compared to traditional serum-containing media. Serum-free formulations eliminate the risks of contamination and variability associated with animal-derived components, making them ideal for clinical and commercial gene therapy production. These media support better reproducibility and scalability, which are essential for manufacturing viral vectors and maintaining cell quality in gene-based therapies. Additionally, growing regulatory emphasis on defined and traceable materials further accelerates the adoption of serum-free media.

The chemically defined media segment is expected to expand at the highest CAGR in the coming years. This is mainly due to its superior consistency, safety, and regulatory compliance compared to traditional media types. Chemically defined media contain only known components, eliminating the variability and contamination risks associated with serum or animal-derived ingredients. This precision makes them ideal for GMP manufacturing and large-scale production of viral vectors and gene-modified cells, where reproducibility and product quality are critical. Moreover, as regulatory authorities increasingly emphasize the use of well-characterized, traceable materials, demand for chemically defined media continues to rise.

Cell Type Insights

Why Did the HEK 293 Cells Segment Dominate the Gene Therapy Media Market in 2024?

The HEK 293 cells segment dominated the market with the largest share in 2024. This is because of its extensive use in producing viral vectors, particularly adeno-associated viruses (AAV) and lentiviruses, which are critical for gene therapy applications. HEK 293 cells are preferred for their high transfection efficiency, robust growth characteristics, and ability to produce high viral titters in both adherent and suspension cultures. Their compatibility with serum-free and chemically defined media also makes them suitable for scalable and GMP-compliant manufacturing processes. Furthermore, their well-established use in clinical and commercial production ensures regulatory acceptance and process reliability.

- In September 2024, FUJIFILM Biosciences launched BalanCD HEK293 Perfusion A, a solution designed for scalable and efficient viral vector production in gene therapy. Utilizing suspension HEK293 cells and perfusion technology, it maximizes cell growth, viability, and productivity, supporting applications such as viral vector production, transient protein expression, and recombinant protein manufacturing.

The human stem cells segment is expected to expand at the highest CAGR over the projection period because stem cells have unique regenerative capabilities and are increasingly used in advanced gene therapies targeting a wide range of diseases. Their complex growth requirements drive demand for specialized, high-quality media. Additionally, ongoing research and clinical trials focusing on stem cell-based therapies are fueling market growth, creating a strong need for optimized media that support stem cell proliferation, differentiation, and gene modification.

Application Insights.

Why Did the Research & Development Segment Lead the Market in 2024?

The research & development segment led the gene therapy media market in 2024 due to the surge in preclinical and early-stage clinical studies exploring novel gene therapy approaches. Most gene therapy programs are still in the discovery and optimization phases, requiring high-quality, specialized media to support cell growth, transfection, and viral vector production. Academic institutions, biotech startups, and pharmaceutical companies are heavily investing in R&D to improve the safety, efficacy, and delivery of gene therapies. This sustained research activity drives significant demand for flexible, cost-effective, and high-performance media formulations suitable for experimental use.

The commercial manufacturing segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing number of gene therapies progressing from clinical trials to market approval. As more therapies reach commercialization, there is a heightened demand for large-scale, GMP-compliant media that ensure product consistency, safety, and regulatory adherence. Biopharmaceutical companies and contract development and manufacturing organizations (CDMOs) are expanding their production capacities and adopting advanced, serum-free, and chemically defined media to meet these stringent requirements. Additionally, the growing focus on scalable and cost-efficient bioprocessing solutions further accelerates the adoption of optimized media for commercial applications.

Gene Delivery Method Insights.

Why Did the Viral Vector-Based Gene Therapy Segment Lead the Market in 2024?

The viral vector-based gene therapy segment led the gene therapy media market in 2024 due to the proven effectiveness and widespread use in delivering therapeutic genes for treating various genetic and acquired diseases. Viral vectors such as adeno-associated virus (AAV), lentivirus, and retrovirus are highly efficient in transferring genes into target cells, making them the preferred choice for clinical and commercial gene therapies. The production of these vectors requires specialized, high-performance media to support optimal cell growth, transfection efficiency, and viral yield. As a result, demand for advanced serum-free and chemically defined media formulations tailored for viral vector production has surged.

- In January 2023, FUJIFILM Irvine Scientific introduced a chemically defined feed formulation optimized for HEK293 cells to boost AAV production and packaging efficiency (improving titers up to ~67 %) in viral vector workflows.

The non-viral vector-based gene therapy segment is expected to expand at the highest CAGR in the coming years. This is mainly due to advantages in safety, scalability, and cost-effectiveness. Unlike viral vectors, non-viral methods such as plasmid DNA, lipid nanoparticles (LNPs), and CRISPR-based systems minimize the risk of immunogenicity and insertional mutagenesis. These systems are easier to manufacture and modify, allowing faster development and broader applications in personalized and regenerative medicine. As advancements in delivery technologies improve transfection efficiency and gene expression levels, the demand for media optimized for non-viral platforms is increasing rapidly.

End User Insights.

Why Did the Biopharmaceutical & Biotechnology Companies Lead the Market in 2024?

The biopharmaceutical & biotechnology companies led the gene therapy media market in 2024 due to their leading role in developing, scaling, and commercializing advanced gene-based therapeutics. These companies conduct extensive research and large-scale manufacturing of viral vectors, plasmid DNA, and gene-modified cells, driving consistent demand for high-quality, GMP-grade media. Their substantial investments in R&D, process optimization, and regulatory compliance have positioned them as the primary end users of specialized gene therapy media. Additionally, the growing pipeline of gene therapy products and increasing partnerships with CDMOs further boost media consumption for clinical and commercial production.

The contract development & manufacturing organizations (CDMOs) segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing outsourcing of complex gene therapy development and production processes. Many biopharmaceutical and biotechnology companies rely on CDMOs for their expertise, advanced facilities, and GMP-compliant manufacturing capabilities to reduce costs and accelerate time to market. As demand for viral vectors, plasmid DNA, and cell-based therapies rises, CDMOs are expanding their capacities and adopting high-performance, chemically defined media to support large-scale and consistent production. Additionally, strategic partnerships and long-term manufacturing contracts between therapy developers and CDMOs are fueling the need for reliable, scalable media solutions.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the gene therapy media market while holding the largest share in 2024. The region’s growth is primarily attributed to its strong biotechnology infrastructure, significant investment in gene therapy research, and high adoption of advanced biomanufacturing technologies. The region is home to leading biopharmaceutical companies, academic institutions, and contract manufacturing organizations (CDMOs) that drive innovation and large-scale production of viral vectors and gene-modified cells. Supportive government initiatives, favorable regulatory frameworks from agencies like the FDA, and robust funding for clinical trials further strengthen market growth.

The U.S. is a major contributor to the North American gene therapy media market due to its strong presence of leading biopharmaceutical companies, advanced research institutions, and a well-established regulatory framework. The country has a high concentration of gene therapy clinical trials and approved therapies, creating significant demand for specialized cell culture and viral vector media. Substantial government and private investments in biotechnology R&D further accelerate innovation and large-scale manufacturing capabilities.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for gene therapy media. This is due to rapid advancements in biotechnology, increasing investments in cell and gene therapy research, and expanding manufacturing capabilities. Countries such as China, Japan, South Korea, and India are heavily investing in biopharmaceutical infrastructure and establishing GMP-compliant facilities to support large-scale gene therapy production. Government initiatives promoting domestic biomanufacturing and favorable regulatory reforms are further attracting global companies to set up R&D and production centers in the region. Additionally, the rising prevalence of genetic and rare diseases and growing clinical trial activity are fueling demand for high-quality gene therapy media.

China is a major player in the Asia Pacific gene therapy media market due to its rapid advancements in biotechnology, strong government support, and expanding biomanufacturing infrastructure. The country has made significant investments in cell and gene therapy research, establishing multiple GMP-compliant facilities and innovation hubs to support large-scale production. Additionally, favorable regulatory reforms and increasing collaborations between domestic firms and global biopharma companies are accelerating market growth.

Region-Wise Market Outlook

| Region |

Market Size in 2024* |

Projected CAGR ( Next 2025 - 34 ) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 192.3 million |

5.87% |

Strong biotech infrastructure, high R&D investments, favorable FDA support, and numerous gene therapy clinical trials |

High production costs, complex regulatory requirements |

Dominant market share |

| Asia Pacific |

USD 135.0 million |

7.04% |

Rapid biotech expansion, rising investments in GMP facilities, and supportive government policies |

Regulatory inconsistencies, limited skilled workforce |

Fastest growth rate |

| Europe |

USD 107.9 million |

9.94% |

Robust EMA regulations, increasing clinical trials, government funding, and academia-industry collaborations |

High compliance costs and slower approval processes |

Stable Growth |

| Latin America |

USD 37.3 million |

4.7% |

Growing biotech sector, increased awareness of genetic therapies, and collaborations with global companies |

Limited infrastructure, low investment, and a weak regulatory framework |

Growth will be steady |

| Middle East & Africa (MEA) |

USD 23.7 million |

3.36% |

Government initiatives for biotech development, healthcare innovation programs. |

Limited expertise, low R&D funding |

Gradual growth |

1. Raw Material Sourcing and Media Component Manufacturing

This stage involves the procurement and production of high-quality raw materials such as amino acids, vitamins, glucose, growth factors, and serum replacements that serve as core components of gene therapy media. Companies at this level focus on ensuring purity, traceability, and regulatory compliance (e.g., GMP-grade materials) to meet stringent biopharmaceutical standards.

- Key Players: Thermo Fisher Scientific, Merck KGaA, FUJIFILM Irvine Scientific, Cytiva

2. Media Formulation and Development

In this phase, media manufacturers design and optimize cell culture media formulations tailored for specific cell lines (e.g., HEK293, CHO cells) used in gene therapy applications. Companies innovate chemically defined and serum-free media to enhance viral vector yield, reproducibility, and scalability, ensuring robust support for gene therapy production processes.

- Key Players: Sartorius AG, Lonza Group, FUJIFILM Biosciences, Corning Incorporated

3. Process Development and Scale-Up

This stage focuses on optimizing bioprocess parameters, including transfection efficiency, viral vector yield, and culture conditions for large-scale manufacturing. Key companies provide bioreactors, perfusion systems, and automation technologies that enable efficient scaling from lab-scale to commercial production.

- Key Players: Thermo Fisher Scientific, Cytiva, Danaher Corporation, Eppendorf SE

4. Manufacturing and Quality Assurance (GMP Production)

GMP-certified manufacturers ensure the large-scale production of gene therapy media under strict regulatory and quality control conditions. They also conduct validation, sterility testing, and documentation to ensure product consistency and compliance with FDA and EMA standards for clinical and commercial use.

- Key Players: Lonza, Catalent, Oxford Biomedica, Samsung Biologics

5. Distribution and Supply Chain Management

In this phase, companies manage global logistics, warehousing, and temperature-controlled transport of gene therapy media to biopharma firms, CDMOs, and research institutions. Efficient supply chains are crucial to maintain product integrity and reduce time-to-market in the rapidly growing cell and gene therapy sector.

- Key Players: Avantor, Thermo Fisher Scientific, Merck KGaA, VWR International

- Thermo Fisher Scientific Inc.

Thermo Fisher is a global leader in cell culture media and bioprocessing solutions, offering a wide range of chemically defined and serum-free media for gene and cell therapy applications. The company’s Gibco™ brand media and scalable bioproduction systems enable consistent viral vector production and efficient process development for commercial gene therapies.

- Merck KGaA (MilliporeSigma)

Merck provides advanced cell culture media, reagents, and single-use technologies tailored for viral vector manufacturing and gene therapy R&D. Its innovation in chemically defined media and end-to-end bioprocess solutions supports enhanced productivity, scalability, and regulatory compliance in therapy production.

Lonza is a leading CDMO offering both manufacturing services and proprietary media formulations designed for gene and cell therapy processes. The company focuses on optimizing upstream processing through high-performance media that enable efficient viral vector and plasmid DNA production.

- FUJIFILM Irvine Scientific (FUJIFILM Biosciences)

FUJIFILM Irvine Scientific develops specialized media solutions such as BalanCD® for HEK293 and CHO cells, designed to improve viral vector yield and process consistency. Its recent launch of the BalanCD HEK293 Perfusion A medium demonstrates the company’s commitment to supporting continuous and scalable gene therapy manufacturing.

- Cytiva (a Danaher Company)

Cytiva provides integrated bioprocess solutions, including cell culture media, bioreactors, and purification technologies for gene therapy workflows. The company’s HyClone™ media portfolio supports high-density cell culture and viral vector production for both R&D and GMP-scale manufacturing.

Sartorius contributes through its advanced bioprocess equipment, single-use technologies, and performance-optimized cell culture media. The company’s focus on process intensification and digital biomanufacturing helps accelerate scalable, efficient production of gene therapy materials.

Corning offers high-performance cell culture systems and media formulations supporting viral vector production and cell line development. Its innovations in surface technology and media compatibility enhance cell growth, transfection efficiency, and reproducibility in gene therapy research.

- Danaher Corporation (through subsidiaries like Cytiva and Pall Corporation)

Danaher provides end-to-end bioprocess solutions, including custom media development, filtration systems, and scalable manufacturing technologies. Its integrated platforms help streamline viral vector production and ensure regulatory compliance for clinical-grade media.

Avantor supplies high-quality raw materials, reagents, and custom-formulated media for biopharmaceutical and gene therapy applications. The company’s focus on supply chain reliability and global distribution ensures consistent availability of GMP-grade media for manufacturers.

Catalent, a leading CDMO, utilizes proprietary media and bioprocess platforms to enhance viral vector and cell therapy production. Its integration of media optimization and advanced manufacturing technologies supports faster commercialization of gene-based therapies.

Recent Developments

- In August 2024, the FDA approved a new gene therapy for recurrent respiratory papillomatosis.

- June 2024, Lilly announced its intent to acquire Verve Therapeutics in a deal centered on gene-editing technology for heart disease.

- In April 2024, India's President Droupadi Murmu launched India's first indigenous CAR-T cell therapy for cancer. It is considered one of the world's most affordable versions of this treatment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the gene therapy media market.

By Type

- Serum-Free Media

- Chemically Defined Media

- Specialty Media

- Custom/Optimized Media

By Cell Type

- Human Stem Cells

- HEK 293 Cells

- CHO Cells

- Others

By Application

- Research & Development

- Clinical Manufacturing

- Commercial Manufacturing

By Gene Delivery Method

- Viral Vector-Based Gene Therapy

- Non-Viral Vector-Based Gene Therapy

By End User

- Biopharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Contract Development & Manufacturing Organizations (CDMOs)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Gene Therapy Media Market Size (USD Million) by Type, 2024–2034

- Table 2: Global Gene Therapy Media Market Size (USD Million) by Cell Type, 2024–2034

- Table 3: Global Gene Therapy Media Market Size (USD Million) by Application, 2024–2034

- Table 4: Global Gene Therapy Media Market Size (USD Million) by Gene Delivery Method, 2024–2034

- Table 5: Global Gene Therapy Media Market Size (USD Million) by End User, 2024–2034

- Table 6: North America Market Size (USD Million) by Type, 2024–2034

- Table 7: North America Market Size (USD Million) by Cell Type, 2024–2034

- Table 8: North America Market Size (USD Million) by Application, 2024–2034

- Table 9: North America Market Size (USD Million) by Gene Delivery Method, 2024–2034

- Table 10: North America Market Size (USD Million) by End User, 2024–2034

- Table 11: U.S. Market Size (USD Million) by Type & Cell Type, 2024–2034

- Table 12: U.S. Market Size (USD Million) by Application & Gene Delivery Method, 2024–2034

- Table 13: Canada Market Size (USD Million) by Type & Cell Type, 2024–2034

- Table 14: Canada Market Size (USD Million) by Application & Gene Delivery Method, 2024–2034

- Table 15: Mexico Market Size (USD Million) by Type & Cell Type, 2024–2034

- Table 16: Europe Market Size (USD Million) by Type, 2024–2034

- Table 17: Europe Market Size (USD Million) by Cell Type, 2024–2034

- Table 18: Germany Market Size (USD Million) by Type & Application, 2024–2034

- Table 19: France Market Size (USD Million) by Type & Application, 2024–2034

- Table 20: UK Market Size (USD Million) by Type & Application, 2024–2034

- Table 21: Italy Market Size (USD Million) by Type & Application, 2024–2034

- Table 22: Asia Pacific Market Size (USD Million) by Type, 2024–2034

- Table 23: Asia Pacific Market Size (USD Million) by Cell Type, 2024–2034

- Table 24: China Market Size (USD Million) by Type & Application, 2024–2034

- Table 25: Japan Market Size (USD Million) by Type & Application, 2024–2034

- Table 26: India Market Size (USD Million) by Type & Application, 2024–2034

- Table 27: South Korea Market Size (USD Million) by Type & Application, 2024–2034

- Table 28: Southeast Asia Market Size (USD Million) by Type & Application, 2024–2034

- Table 29: Latin America Market Size (USD Million) by Type & Application, 2024–2034

- Table 30: Brazil Market Size (USD Million) by Type & Application, 2024–2034

- Table 31: Middle East & Africa Market Size (USD Million) by Type & Application, 2024–2034

- Table 32: GCC Countries Market Size (USD Million) by Type & Application, 2024–2034

- Table 33: Turkey Market Size (USD Million) by Type & Application, 2024–2034

- Table 34: Africa Market Size (USD Million) by Type & Application, 2024–2034

List of Figures

- Figure 1: Global Market Share by Type, 2024

- Figure 2: Global Market Share by Cell Type, 2024

- Figure 3: Global Market Share by Application, 2024

- Figure 4: Global Market Share by Gene Delivery Method, 2024

- Figure 5: Global Market Share by End User, 2024

- Figure 6: North America Market Share by Type, 2024

- Figure 7: North America Market Share by Cell Type, 2024

- Figure 8: North America Market Share by Application, 2024

- Figure 9: North America Market Share by Gene Delivery Method, 2024

- Figure 10: North America Market Share by End User, 2024

- Figure 11: U.S. Market Share by Type, 2024

- Figure 12: U.S. Market Share by Application, 2024

- Figure 13: Canada Market Share by Type, 2024

- Figure 14: Canada Market Share by Application, 2024

- Figure 15: Mexico Market Share by Type, 2024

- Figure 16: Mexico Market Share by Application, 2024

- Figure 17: Europe Market Share by Type, 2024

- Figure 18: Europe Market Share by Cell Type, 2024

- Figure 19: Germany Market Share by Type, 2024

- Figure 20: Germany Market Share by Application, 2024

- Figure 21: France Market Share by Type, 2024

- Figure 22: France Market Share by Application, 2024

- Figure 23: UK Market Share by Type, 2024

- Figure 24: UK Market Share by Application, 2024

- Figure 25: Italy Market Share by Type, 2024

- Figure 26: Italy Market Share by Application, 2024

- Figure 27: Asia Pacific Market Share by Type, 2024

- Figure 28: Asia Pacific Market Share by Cell Type, 2024

- Figure 29: China Market Share by Type, 2024

- Figure 30: China Market Share by Application, 2024

- Figure 31: Japan Market Share by Type, 2024

- Figure 32: Japan Market Share by Application, 2024

- Figure 33: India Market Share by Type, 2024

- Figure 34: India Market Share by Application, 2024

- Figure 35: South Korea Market Share by Type, 2024

- Figure 36: South Korea Market Share by Application, 2024

- Figure 37: Southeast Asia Market Share by Type, 2024

- Figure 38: Southeast Asia Market Share by Application, 2024

- Figure 39: Latin America Market Share by Type, 2024

- Figure 40: Latin America Market Share by Application, 2024

- Figure 41: Brazil Market Share by Type, 2024

- Figure 42: Brazil Market Share by Application, 2024

- Figure 43: Middle East & Africa Market Share by Type, 2024

- Figure 44: Middle East & Africa Market Share by Application, 2024

- Figure 45: GCC Countries Market Share by Type, 2024

- Figure 46: GCC Countries Market Share by Application, 2024

- Figure 47: Turkey Market Share by Type, 2024

- Figure 48: Turkey Market Share by Application, 2024

- Figure 49: Africa Market Share by Type, 2024

- Figure 50: Africa Market Share by Application, 2024