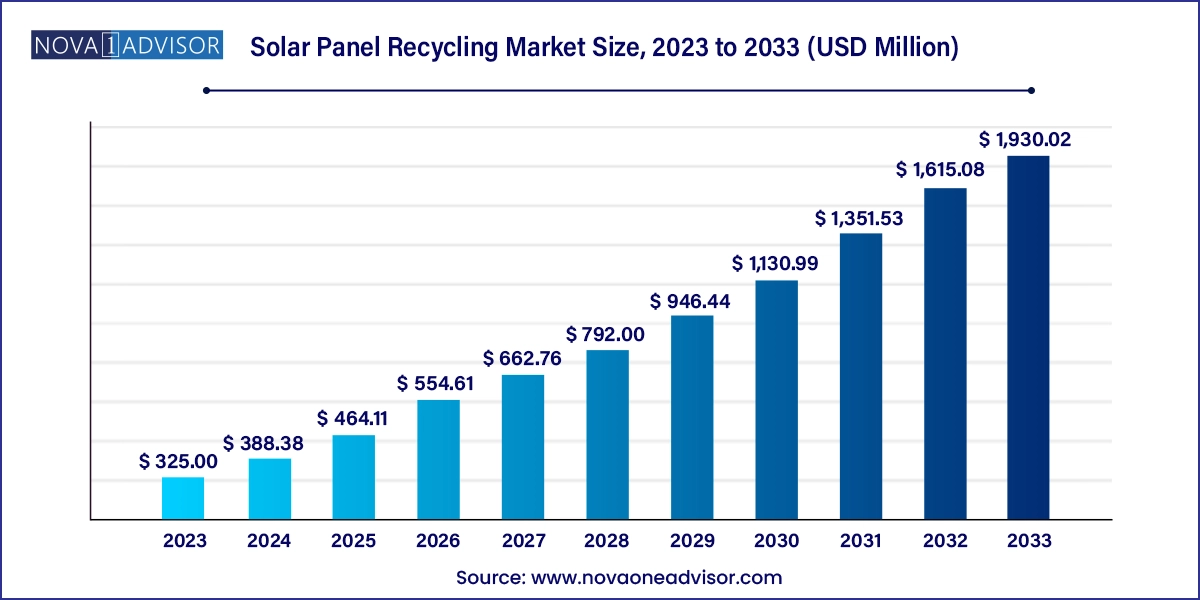

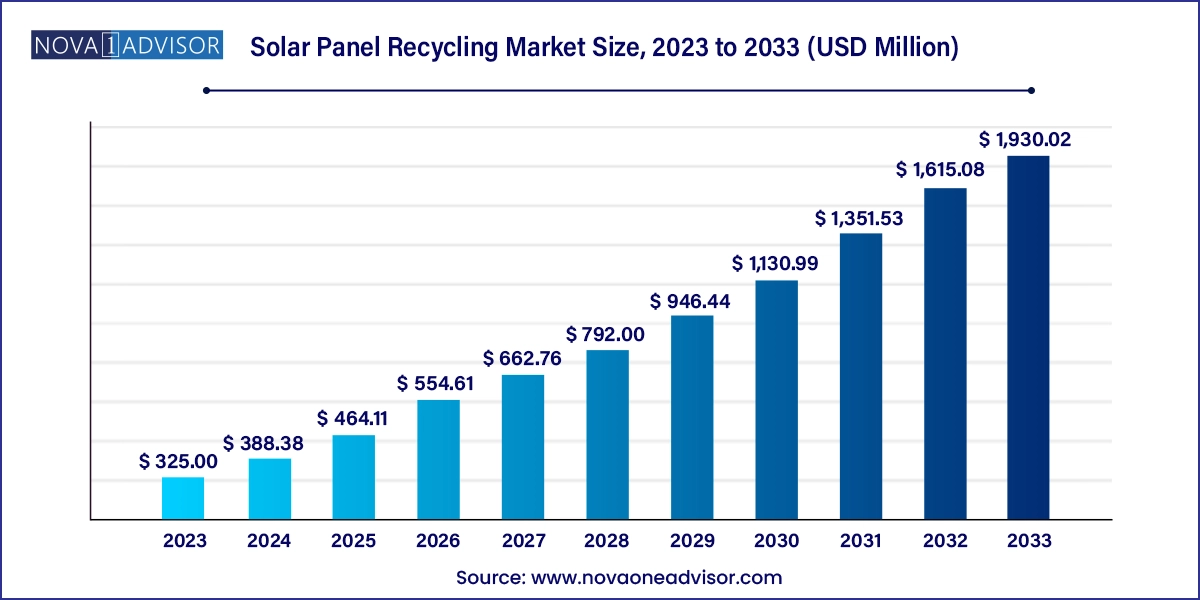

Solar Panel Recycling Market Size and Growth

The solar panel recycling market size was exhibited at USD 325.00 million in 2023 and is projected to hit around USD 1,930.02 million by 2033, growing at a CAGR of 19.5% during the forecast period 2024 to 2033. on account of the rising preference for renewable sources of energy tracked by promising environmental standards.

Solar Panel Recycling Market Key Takeaways:

- The mechanical process accounted for the largest revenue share of more than 63% in 2023 and is likely to expand further at a significant growth rate from 2024 to 2033.

- The early loss segment accounted for over USD 102.3 million in 2023.

- The monocrystalline solar panel recycling product type accounted for the largest revenue share of over 55% in 2023.

- Europe accounted for the largest revenue share in 2023. It is estimated to expand further at a significant growth rate from 2024 to 2033.

Market Overview

The solar panel recycling market is emerging as a vital component of the global renewable energy ecosystem. As the deployment of solar photovoltaic (PV) systems accelerates, driven by the shift toward clean and sustainable energy sources, an equally important challenge has surfaced: the sustainable disposal and recovery of decommissioned solar panels. With an average lifespan of 25–30 years, a growing wave of solar panels installed during the early 2000s is now approaching end-of-life, triggering a need for effective recycling solutions.

Solar panels consist of valuable materials such as glass, silicon, aluminum, silver, and rare metals like indium and tellurium. Recycling these materials is both an environmental necessity and a potential economic opportunity. If left unmanaged, discarded solar panels contribute to e-waste, with toxic components posing long-term hazards. As a result, countries with ambitious solar targets are now implementing end-of-life strategies, regulatory frameworks, and circular economy initiatives to address this rising concern.

According to conservative estimates, by 2050, over 78 million tonnes of solar panel waste could accumulate globally. Proper recycling can recover up to 95% of panel materials, supporting resource conservation and reducing the environmental footprint of solar energy. As sustainability becomes central to energy and manufacturing policies, the solar panel recycling market is expected to see robust growth across developed and developing economies alike.

Major Trends in the Market

-

Circular economy integration: Solar manufacturers are shifting toward circular design and lifecycle planning to integrate recycling at the design stage.

-

Legislative momentum: Europe and parts of Asia have introduced or expanded solar waste regulations, including extended producer responsibility (EPR).

-

Emergence of advanced recycling techniques: Companies are investing in laser-based and hybrid recycling systems that improve material recovery efficiency.

-

Second-life opportunities: Panels that are underperforming but functional are being reused in secondary markets or refurbished for off-grid applications.

-

Growth of solar installations driving future demand: With record solar deployments globally, the volume of decommissioned panels is projected to spike in the next decade.

-

Public-private recycling initiatives: Partnerships between governments, recyclers, and manufacturers are enabling pilot projects for solar e-waste management.

-

Material recovery innovation: Companies are exploring ways to efficiently extract rare and valuable materials like silver and indium from thin film panels.

-

AI and automation in recycling plants: Use of robotics and AI-powered sorting technologies is gaining ground in large-scale recycling operations.

Report Scope of Solar Panel Recycling Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 388.38 Million |

| Market Size by 2033 |

USD 1,930.02 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 19.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Process, Product, Shelf life, Regionn |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

The U.S.; Canada; Mexico; The U.K.; Germany; France; China; India; Japan; UAE; Qatar; Brazil |

| Key Companies Profiled |

First Solar, Inc.; Echo Environmental, LLC; Silcontel Ltd.; Canadian Solar; Silrec Corp.; SunPower Corp.; Reiling GmbH & Co. KG; Trina Solar; Aurubis; Envaris; SiC Processing GmbH; Yingli Energy Co. Ltd.; Hanwha Group |

Solar Panel Recycling Market By Process Insights

Mechanical recycling dominated the solar panel recycling market in 2024. This process involves physical dismantling, shredding, and sorting to separate recyclable materials like glass, metal frames, and plastics. Mechanical methods are widely used due to their simplicity and relatively low cost, especially for polycrystalline and monocrystalline panels. These techniques recover bulk materials efficiently and serve as the standard for large-scale panel recycling in Europe and North America.

Laser-based recycling is the fastest-growing segment. Laser processes use high-precision beams to cut and separate components without damaging underlying materials. This technique is gaining popularity for thin-film panels and modules with embedded rare elements. Laser recycling also enables higher recovery rates for high-value materials like indium, gallium, and tellurium. With the increasing complexity of solar modules and rising demand for material purity, laser recycling is expected to become integral in advanced recycling facilities over the next decade.

Solar Panel Recycling Market By Shelf life Insights

Normal loss panels constituted the dominant shelf life category. These are panels retired at the end of their expected 25–30-year lifespan. The recycling of such panels is more predictable and aligns well with scheduled maintenance and grid upgrades. Large utility companies and municipalities typically plan these replacements, allowing for organized collection and recycling.

Early loss panels are growing faster due to quality defects, accidents, and environmental damage. These panels are often discarded prematurely due to microcracks, delamination, or extreme weather events. Regions prone to storms, hail, or flooding, such as the southern United States or parts of Southeast Asia, report higher rates of early panel failure. As module replacements increase, the recycling sector must adapt to irregular volumes and mixed-quality inputs, offering specialized processes for unanticipated waste streams.

Solar Panel Recycling Market By Product Insights

Polycrystalline panels were the most recycled type by product. These panels have historically dominated solar installations due to their affordability and durability. As a result, they represent the largest share of decommissioned modules. Polycrystalline panels consist of large volumes of aluminum, glass, and silicon—materials that are relatively easy to recover using existing recycling techniques. Countries like India and China, where polycrystalline adoption was high, are already seeing early waves of these panels entering recycling channels.

Thin film panels are the fastest-growing segment in recycling. Although they represent a smaller market share, thin film modules are increasing in installations for utility-scale and building-integrated photovoltaics. Their recycling is more complex due to their diverse material compositions (e.g., cadmium telluride, copper indium gallium selenide), but they also offer greater economic incentives due to the higher value of the recoverable elements. With rising demand for lightweight and flexible solar modules, thin film recycling infrastructure is expected to expand significantly.

Solar Panel Recycling Market By Regional Insights

Europe held the largest share of the solar panel recycling market in 2024. The region leads in environmental regulation and extended producer responsibility (EPR) policies, particularly under the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive. This legislation mandates that manufacturers finance and manage the end-of-life treatment of PV modules. Countries such as Germany, France, and the Netherlands have implemented robust collection and recycling networks.

The presence of companies like PV Cycle, which operates dedicated recycling programs for solar panels across Europe, ensures high collection efficiency and material recovery. Moreover, EU targets to become climate-neutral by 2050 include provisions for circular energy systems, boosting investment in solar recycling R&D and infrastructure.

Asia Pacific is projected to be the fastest-growing region in the coming years. China, India, Japan, and Australia are among the top solar adopters globally, accounting for massive panel deployments over the last 15 years. As these installations age, the region faces an impending wave of solar e-waste. China alone is expected to account for over 20 million tonnes of waste panels by 2040.

Countries like Japan have already begun integrating recycling standards, while India’s Ministry of New and Renewable Energy (MNRE) has proposed solar waste management frameworks. With growing environmental awareness, regional governments and solar manufacturers are beginning to invest in localized recycling solutions. The emergence of start-ups and joint ventures focused on PV module processing in Asia is likely to accelerate growth in this market.

Some of the prominent players in the solar panel recycling market include:

- First Solar Inc.

- Echo Environmental, LLC

- SILCONTEL LTD

- Canadian Solar

- Silrec Corporation.

- SunPower Corporation

- Reiling GmbH & Co. KG

- Trina Solar

- Aurubis

- Envaris

- SiC Processing GmbH

- Yingli Energy Co. Ltd.

- Hanwha Group

Recent Developments

-

First Solar (February 2025): Expanded its recycling plant in Ohio to process over 90% of material from its thin film modules, in line with its closed-loop manufacturing initiative.

-

PV Cycle (January 2025): Announced a new European-wide partnership with manufacturers to develop standardized logistics for retired solar panels under EPR regulations.

-

Reclaim PV Recycling (December 2024): Launched a second facility in Brisbane, Australia, to handle both monocrystalline and polycrystalline panel recycling.

-

Envaris GmbH (March 2025): Developed a hybrid recycling technique combining thermal and mechanical methods for higher efficiency in recovering silicon wafers.

-

Veolia (April 2024): Signed an agreement with the French government to scale its solar panel recycling operations to handle the projected 150,000-tonne waste volume by 2035.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the solar panel recycling market

Process

Product

- Monocrystalline

- Polycrystalline

- Thin Film

Shelf Life

Regional

- North America

- Europe

- Asia Pacific

- Central and South America

- The Middle East and Africa