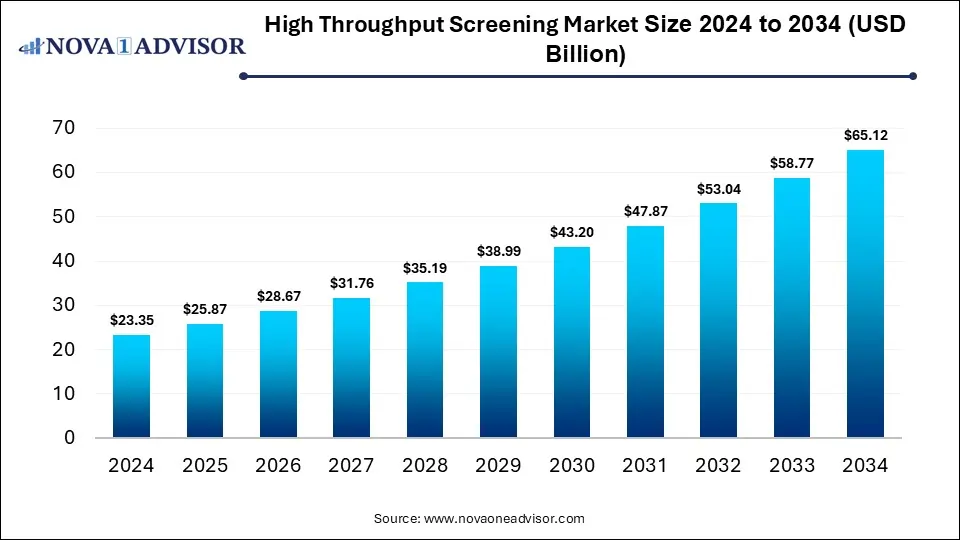

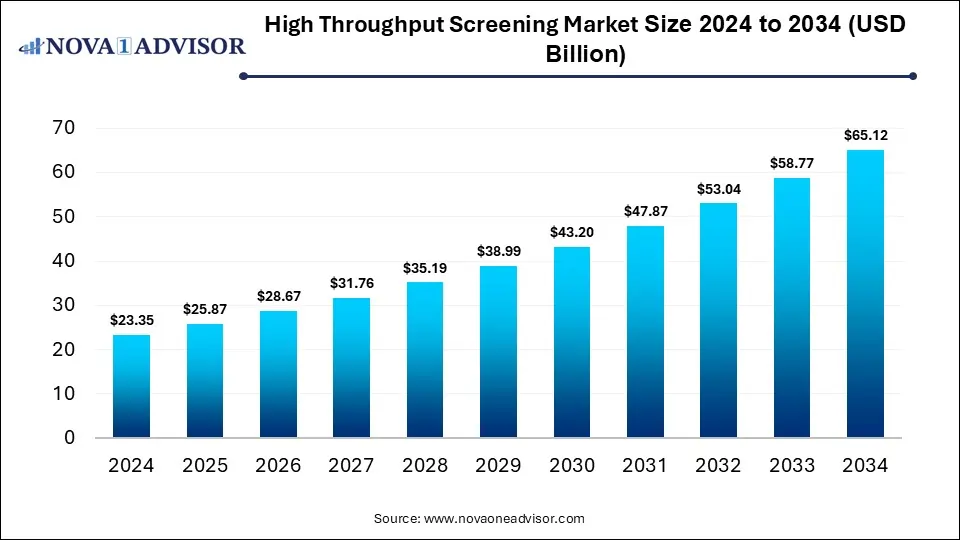

High Throughput Screening Market Size and Growth 2025 to 2034

The global high throughput screening market size is calculated at USD 23.35 billion in 2024, grows to USD 25.87 billion in 2025, and is projected to reach around USD 65.12 billion by 2034, growing at a CAGR of 10.8% from 2025 to 2034. The market is growing due to rising demand for rapid drug discovery and advancements in automation, AI, and robotics that improve efficiency. Increasing investments in pharmaceutical R&D and personalized medicine are further accelerating adoption.

Key Takeaways

- North America dominated the high throughput screening market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product and services, the consumables products segment held the largest market share in 2024.

- By product and services, the services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the cell-based assay technology segment led the market with the largest revenue share in 2024.

- By technology, the lab-on-a-chip segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end-user, the pharmaceutical & biopharmaceutical companies segment held the highest market share.

- By end-user, the academic & research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the drug discovery programs segment held the highest revenue shares in 2024.

- By application, the biochemical screening segment is expected to grow at the fastest CAGR in the market during the forecast period.

How is the High Throughput Screening Market Evolving?

High throughput screening is a drug discovery technique that uses automation and advanced technologies to rapidly test thousands of compounds against specific biological targets to identify potential drug candidates. The high throughput screening market is evolving through the adoption of novel screening libraries, label-free technologies, and integration with genomics and proteomics research. Collaboration between pharmaceutical companies, academic institutes, and CROs are driving innovation, while cloud-based platforms and big data analytics are improving data management and decision-making. Moreover, the increasing development of more sophisticated HTS models is broadening its application beyond traditional drug discovery into diverse therapeutic areas.

What are the Key trends in the High Throughput Screening Market in 2024?

- In April 2024, Metrion Biosciences partnered with Enamine Ltd. to strengthen its high-throughput screening (HTS) services by incorporating access to Enamine’s extensive compound libraries, expanding its drug discovery capabilities. (Source: https://metrionbiosciences.com/)

- In February 2024, SCIEX introduced the Echo MS+ system at SLAS 2024, combining Acoustic Ejection Mass Spectrometry with Open Port Interface (OPI) sampling. Integrated with the ZenoTOF 7600 or Triple Quad 6500+ platforms, the system enhances high-throughput screening by providing accurate qualitative and quantitative results across a broader range of workflows. (Source: https://sciex.com/)

How Can AI Affect the High Throughput Screening Market?

AI is reshaping the market by integrating predictive modeling with multi-omics data, allowing deeper biological insights and identification of novel drug targets. It enables adaptive screening strategies where algorithms refine experiments in real time, improving efficiency. AI-driven image analysis is also enhancing high-content screening by detecting subtle cellular changes. Additionally, its role in automating data curation and linking HTS results with clinical outcomes is expanding the scope of HTS beyond early-stage drug discovery.

Report Scope of High Throughput Screening Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 25.87 Billion |

| Market Size by 2034 |

USD 65.12 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.8% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Products and Services, Technology, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Agilent Technologies, Inc.; Danaher Corporation; Thermo Fisher Scientific Inc.; PerkinElmer Inc.; Bio-Rad Laboratories, Inc.; Aurora Biomed Inc.; Tecan Trading AG; Promega Corporation; Charles River Laboratories.; Creative Biolabs |

Market Dynamics

Driver

Rising Pharmaceutical and biotech R&D Investments

Rising pharmaceutical and biotech R&D investments drive the high throughput screening market by enabling the expansion of large compound libraries, the development of novel assay formats, and the adoption of cutting-edge platforms. Increased funding allows researchers to conduct broader and more diverse screening, improving the chances of identifying first-in-class molecules. It also supports partnerships with CROs and academic institutions, fostering innovation and accelerating the translation of discoveries into pipelines, ultimately strengthening HTS as a core tool in modern drug development strategies.

- For Instance, In May 2024, Bio-Rad Laboratories expanded its research portfolio by launching new StarBright Red dyes (715, 775, and 815) and extending its StarBright Violet series with 29 additional validated antibodies, enhancing tools essential for HTS and related life-science applications. (Source: https://www.bio-rad.com/)

Restraint

High Cost of Instruments and Maintenance

The high cost of instruments and maintenance restrains the high throughput screening market because it reduces flexibility in research budgets, often diverting funds away from exploratory studies or parallel projects. Smaller organizations may struggle to scale operations, as expensive HTS systems require dedicated infrastructure and facility upgrades. Additionally, long procurement cycles and financial risk associated with uncertain research outcomes discourage some institutions from adopting HTS, thereby slowing its penetration across developing regions and early-stage biotech firms.

Opportunity

Expansion into Personalized and Precision Medicine

Expansion into personalized and precision medicine presents a future opportunity in the high throughput screening market because it encourages the development of companion diagnostics and customized assay platforms. As healthcare shifts towards individualized treatments, demand grows for screening technologies that can evaluate drug responses across diverse genetic profiles and microenvironments. This creates space for HTs providers to design specialized tools and services, fostering partnerships with pharma and biotech firms focused on precision therapies, and ultimately broadening HTS applications beyond traditional drug discovery.

- For Instance, In September 2024, UCLA researchers used high-throughput screening on patient-derived sarcoma organoids, testing hundreds of FDA-approved drugs in 3D. This approach identified effective therapies for 59% of samples, closely matching actual patient responses, highlighting its potential for personalized treatment.(Source: https://newsroom.ucla.edu/)

Segmental Insights

How does the Consumables Products Segment dominate the High Throughput Screening Market in 2024?

The consumables segment dominated the market in 2024 because these products are integral to daily laboratory operations and have a high turnover rate. Continuous innovation in specialized assay kits, microplates, and detection reagents to support complex screening models, including 3D culture and organoids, further meets multiple demands. Moreover, consumables are adaptable across multiple HTS platforms and applications, ensuring steady usage of instruments, which positions this segment as the largest contributor to the market.

The services segment is projected to grow rapidly in the high throughput screening market as organizations increasingly seek flexible, scalable solutions without investing in expensive infrastructure. CROs and specialized service providers offer expertise in niche assay development, validation, and complex multi-omics screening, enabling faster and more accurate results. Rising collaboration between biotech firms and service providers, along with the growing use of remote cloud-based screening platforms, further fuels demand for outsourced HTS services during the forecast period.

Why Did the Cell-based Assay Technology Segment Dominate the Market in 2024?

The cell-based segment dominated the high throughput screening market in 2024 because it allows simultaneous evaluation of multiple cellular functions and responses, offering a comprehensive view of compound effects. Its compatibility with advanced imaging, automated platforms, and miniaturized formats enhances throughput and efficiency. Growing focus on disease modeling, personalized medicine, and complex biological targets has increased reliance on cell-based assays, making them the preferred technology for capturing more predictive and relevant biological data, driving the largest revenue share in the market.

The lab-on-a-chip segment is projected to grow fastest in the market due to its ability to combine multiple analytical processes on a single platform, reducing experimental time and space requirements. Its potential for parallel testing, integration with AI-driven analysis, and adaptability to 3D cell culture maket it an attractive fit for advanced drug discovery. Increasing interest from biotech startups and research institutions seeking cost-effective, scalable, and rapid screening solutions is further accelerating its adoption during the forecast period.

How does the Pharmaceutical & Biopharmaceutical Companies Segment Dominate the Synthetic Biology Market?

The pharmaceutical & biopharmaceutical companies segment dominated the high-throughput screening market because these firms require large-scale, efficient screening solutions to support multiple therapeutic pipelines simultaneously. Their focus on innovation, regulatory compliance, and accelerated time-to-market drives continuous investment in HTS infrastructure and services. Moreover, partnerships with contract research organizations and the adoption of advanced assay technologies allow these companies to expand their capabilities, maintain a competitive advantage, and address growing demand for novel drugs, securing the largest market share.

The academic & research institutes segment is projected to grow fastest in the high-throughput screening market as these organizations increasingly focus on innovative research areas like genomics, proteomics, and rare diseases. Growing collaboration with biotech startups and CROs provides access to advanced HTS platforms without heavy capital investments. Additionally, the demand for training and skill development in cutting-edge screening technologies is rising, prompting institutes to adopt HTS systems, which accelerates research output and drives rapid market growth during the forecast period.

How does the Drug Discovery Programs Segment dominate the Market in 2024?

The drug discovery programs segment dominated the high throughput screening market in 2024 as it enables systematic and large-scale testing of compounds to uncover novel therapeutic candidates. Rising demand for faster identification of lead molecules, coupled with the adoption of advanced assay technologies and automation, has strengthened HTS use in research pipelines. Additionally, the growing emphasis on multi-target drugs and complex disease modeling has increased reliance on HTS, driving higher revenue generation within drug discovery applications compared to other market segments.

The biochemical screening segment is projected to grow fastest in the high throughput screening market because it enables precise, high-speed evaluation of molecular interactions and enzymatic activities essential for early drug development. Advancements in label-free detection methods and multiplexing capabilities allow more efficient and sensitive assays. Furthermore, increasing use in identifying novel biomarkers, studying metabolic pathways, and supporting high-throughput toxicology testing is expanding its applications across pharmaceutical, biotech, and academic research, driving strong CAGR during the forecast period.

Regional Insights

How is North America contributing to the Expansion of the High Throughput Screening Market?

North America led the market in 2024 because of its well-established life sciences ecosystem and concentration of top-tier contract research organizations (CROs) offering specialized HTS services. The region benefits from early access to advanced technologies, a large skilled workforce, and strong regulatory support for innovative drug discovery approaches. Growing demand for biologics, personalized therapies, and rare disease research has further accelerated HTS adoption, enabling North America to capture the highest revenue share compared to other regions.

How is Asia-Pacific Accelerating the High Throughput Screening Market?

Asia Pacific is anticipated to grow at the fastest CAGR in the market due to increasing investments in pharmaceutical and biotech R&D, rising number of contract research organizations (CROs), and expanding life sciences infrastructure. The region’s large patient population, cost-effective research environment, and growing focus on drug discovery and precision medicine are driving HTS adoption. Additionally, government initiatives supporting innovation and collaborations with global pharmaceutical companies are accelerating the implementation of advanced HTS technologies across Asia Pacific.

Top Companies in the High Throughput Screening Market

Recent Developments in the High Throughput Screening Market

- In May 2025, Applied Industrial Technologies completed the acquisition of IRIS Factory Automation, expanding its offerings with automation solutions for material handling and traceability processes.(Source: https://www.sahmcapital.com/)

- In April 2024, Metrion Biosciences partnered with Enamine Ltd. to expand its high-throughput screening (HTS) services by integrating Enamine’s compound libraries, strengthening its drug discovery and development capabilities. (Source: https://metrionbiosciences.com/)

High Throughput Screening Market Report Segmentation

By Products and Services

-

- Reagents & Assay Kits

- Laboratory Equipment

-

- Liquid Handling Systems

- Detection Systems

- Other Instruments

- Services

- Software

By Technology

-

- Fluorometric Imaging Plate Reader Assays

- Reporter based Assays

- 3D - Cell Cultures

- 2D - Cell Cultures

- Reporter-based Assays

- Perfusion Cell Culture

- Lab-on-a-chip Technology (LOC)

- Label-free Technology

- Ultra High Throughput Screening

By Application

- Drug Discovery Programs

- Chemical Biology Programs

- Biochemical Screening

- Cell & Organ-based Screening

By End Use

- Pharmaceutical & Biopharmaceutical Companies

- Academic & Research Institutes

- Contract Research Organizations (CROs)

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)