Immunofluorescence Assay Market Size and Forecast 2026 to 2035

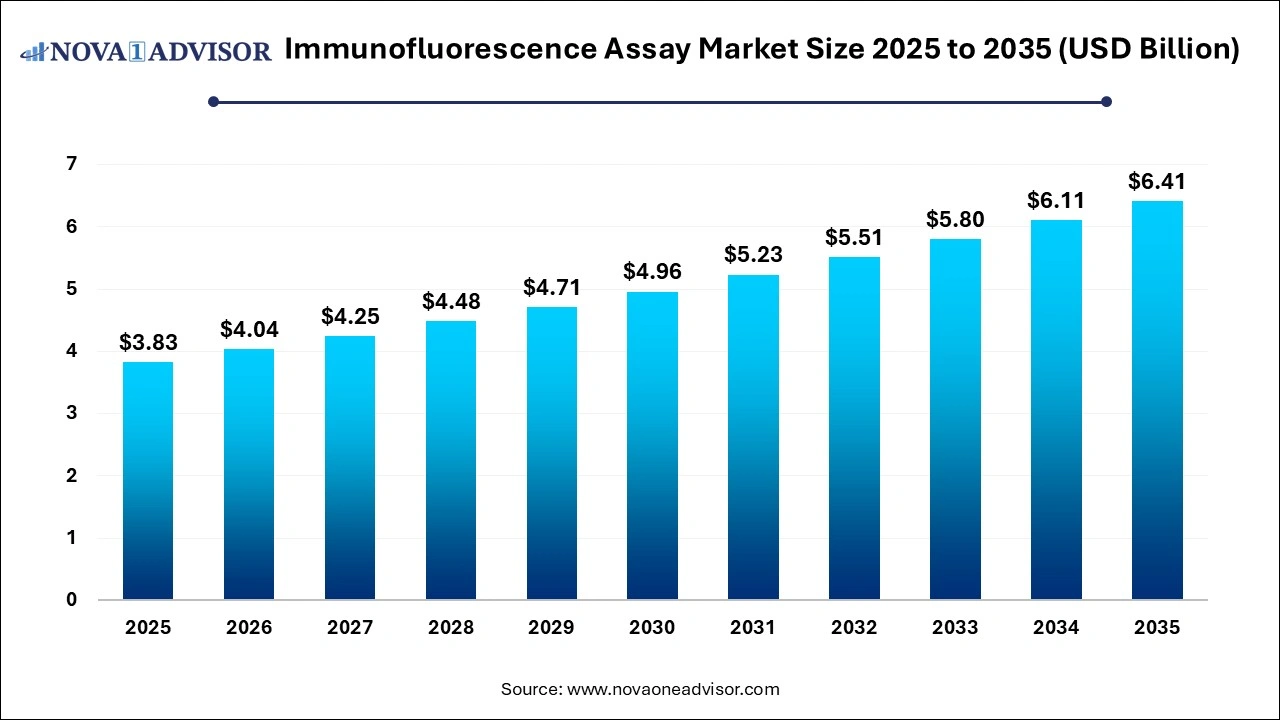

The global immunofluorescence assay market was valued at USD 3.83 billion in 2025 and is projected to hit around USD 6.41 billion by 2035, growing at a CAGR of 5.28% during the forecast period 2026 to 2035. The growth of the market is driven by the rising prevalence of chronic diseases, ongoing technological advancements, and expanding scope of applications of immunofluorescence assays. Increasing investments in R&D further contribute to market expansion.

Immunofluorescence Assay Market Key Takeaways

- By region, North America held the largest share of the immunofluorescence assay market in 2025.

- By region, Asia Pacific is expected to experience the fastest growth between 2026 to 2035.

- By product, the antibodies segment dominated the market in 2025.

- By product, the kits & reagents segment is likely to grow at the fastest CAGR during the forecast period.

- By type, the indirect immunofluorescence segment led the market in 2025.

- By type, the direct immunofluorescence segment is expected to grow at a notable rate in the upcoming period.

- By application, the infectious diseases segment led the market while holding the largest share in 2025.

- By application, the autoimmune diseases segment is expected to expand at the highest CAGR over the projection period.

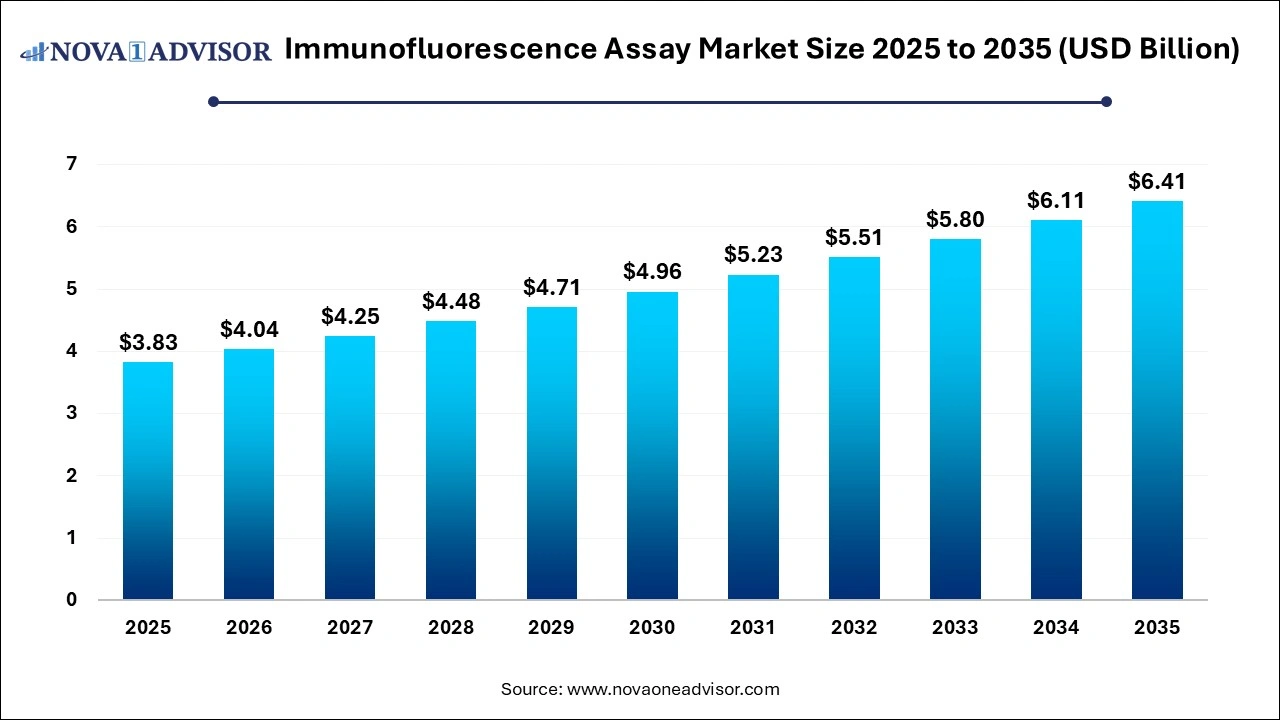

- By end-user, the pharmaceutical & biopharmaceutical companies segment contributed the largest market share in 2025.

- By end-user, the academic & research institutes segment is likely to grow at the fastest rate in the coming years.

Impact of AI on the Immunofluorescence Assay Market

AI is significantly transforming the immunofluorescence assay market by enhancing the accuracy, speed, and efficiency of data analysis. Machine learning algorithms and image recognition technologies enable automated interpretation of complex fluorescent signals, reducing human error and subjectivity. This leads to faster diagnostics and more consistent results, especially in high-throughput screening and research applications. AI-powered tools also facilitate the integration of large datasets from multi-omics studies, helping identify novel biomarkers and improve disease understanding. Additionally, AI aids in optimizing assay design and reagent development, accelerating innovation in the field.

Immunofluorescence Assay Market Overview

The immunofluorescence assay market involves diagnostic and research tools that use fluorescent-labeled antibodies to detect specific antigens in cells or tissues. These assays offer high sensitivity and specificity, making them valuable in applications such as infectious disease detection, cancer diagnostics, and autoimmune disorder screening. Their ability to provide rapid, visual results with precise localization of target molecules drives their widespread use. Growth in this market is fueled by rising prevalence of chronic diseases, advances in fluorescence imaging technologies, and increasing demand for personalized medicine and biomarker discovery. Expanding healthcare infrastructure and research investments globally further support market expansion.

Major Immunofluorescence Assay Market Trends

- Growth of Multiplex Assays: Multiplex immunofluorescence enables simultaneous detection of multiple biomarkers, improving efficiency and providing comprehensive insights in research and diagnostics.

- Rising Adoption in Personalized Medicine: Immunofluorescence assays are increasingly used to tailor treatments based on individual biomarker profiles, supporting precision medicine approaches.

- Advancements in Fluorescent Labeling Technologies: New dyes and labeling methods improve signal stability and brightness, enhancing assay sensitivity and enabling better visualization of targets.

- Expansion in Emerging Markets: Increasing healthcare investments and growing awareness in regions like Asia Pacific are driving rapid adoption of immunofluorescence assays.

Report Scope of Immunofluorescence Assay Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.04 Billion |

| Market Size by 2035 |

USD 6.41 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.28%

|

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Type, Application, End-user |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Inova Diagnostics, Inc.; Bio-Rad Laboratories, Inc.; Abcam plc; PerkinElmer Inc.; Merck KGaA; Cell Signaling Technology, Inc.; Medipan GmbH; Sino Biological, Inc.; Danaher Corporation |

Immunofluorescence Assay Market Dynamics

Drivers

Rising Prevalence of Chronic and Infectious Diseases

With the rising prevalence of chronic and infectious diseases worldwide, the demand for accurate and timely diagnostic tools is increasing. Immunofluorescence assays offer high sensitivity and specificity, making them ideal for detecting disease-specific biomarkers in conditions such as cancer, autoimmune disorders, and viral or bacterial infections. These assays enable early diagnosis, disease monitoring, and treatment planning, which are critical for managing long-term health conditions. As global health systems focus more on rapid diagnostics and personalized care, the reliance on immunofluorescence-based testing continues to grow.

Increasing Demand for POC IFA Tests

The rising demand for point-of-care (POC) immunofluorescence assay (IFA) tests is significantly driving the growth of the immunofluorescence assay market. These tests enable rapid, accurate diagnostics outside traditional laboratory settings. These portable and easy-to-use tests are particularly valuable in emergency care, remote locations, and resource-limited environments where timely decision-making is critical. POC IFA tests help detect infections, autoimmune conditions, and other diseases on-site, reducing the need for centralized testing and improving patient outcomes. The increasing focus on decentralized healthcare and personalized treatment is driving investment in miniaturized, automated IFA platforms. This shift is expected to expand market reach and accelerate the adoption of immunofluorescence technology globally.

- In July 2023, Anbio launched the AF-100S, a compact, handheld fluorescent immunoassay (FIA) device designed for point-of-care diagnostics. It offers rapid, accurate results with high sensitivity and specificity. The AF-100S processes up to 240 tests per hour and runs on a lithium battery supporting 800 tests per charge or 20 days standby. Ideal for clinics, urgent care, ERs, and ambulances, it supports a broad range of assays including hormones, enzymes, and infectious diseases.

High Demand for Immunodiagnostics

The rising demand for immunodiagnostics is driving the growth of the immunofluorescence assay market. As healthcare systems worldwide prioritize early disease detection and precise biomarker analysis, immunodiagnostics, particularly those leveraging immunofluorescence, are gaining traction for their high sensitivity and specificity. This demand is especially prominent in areas like oncology, infectious diseases, and autoimmune conditions, where accurate visualization at the cellular level is critical. Additionally, the shift toward personalized medicine and companion diagnostics further amplifies the need for advanced immunofluorescence-based testing platforms.

Restraints

High Costs and Requirement of Technical Expertise

The high cost of instruments and reagents is a significant barrier to the widespread adoption of immunofluorescence assays, especially in low- and middle-income regions. Advanced imaging systems, fluorescent dyes, and specialized kits often require substantial investment, limiting accessibility for smaller labs and clinics. Additionally, the operation and interpretation of immunofluorescence assays demand skilled personnel with technical expertise in fluorescence microscopy and molecular diagnostics. This requirement for trained professionals creates a workforce gap and increases operational costs.

Limited Quantitative Capabilities and Competition from Alternative Technologies

Limited quantitative capabilities restrain the growth of the immunofluorescence assay market, as these assays primarily provide qualitative or semi-quantitative results, making them less suitable for applications requiring precise numerical data. This limitation reduces their appeal in clinical settings where exact biomarker quantification is essential for diagnosis and treatment monitoring. Additionally, growing competition from alternative technologies, such as flow cytometry, ELISA, and next-generation sequencing, offers more robust quantification and scalability. These alternatives are often favored for high-throughput or automated workflows, especially in advanced diagnostics and research. As a result, the preference for more quantitative and automated solutions can hinder the broader adoption of immunofluorescence assays.

Opportunities

Growing Demand for Advanced Diagnostics and Personalized Medicine

The growing demand for advanced diagnostics and personalized medicine creates immense opportunities in the market. Immunofluorescence assays offer precise, visual localization of biomarkers, making them highly valuable for individualized disease profiling and targeted treatment planning. As healthcare shifts toward personalized approaches, these assays help identify patient-specific molecular markers, enabling clinicians to tailor therapies more effectively. Advances in immunofluorescence technologies, including multiplexing and high-resolution imaging, further support complex diagnostic needs in oncology, autoimmune diseases, and infectious conditions. Moreover, pharmaceutical and biotech companies increasingly rely on these assays for companion diagnostics and drug development.

Development of Automated Systems

The development of automated systems is creating significant opportunities in the immunofluorescence assay market by improving efficiency, consistency, and scalability of testing processes. Automation reduces manual errors and variability, enabling high-throughput analysis that is especially valuable in clinical laboratories and large research facilities. These systems also simplify complex workflows, making immunofluorescence assays more accessible to labs with limited technical expertise. Additionally, integration with digital imaging and AI-powered interpretation enhances diagnostic accuracy and speeds up result delivery. As demand for faster, standardized, and more reliable diagnostics grows, automation is expected to play a key role in expanding market adoption.

- In July 2024, AliveDx launched LumiQ, an automated immunofluorescence assay (IFA) solution for autoimmune diagnostics. LumiQ streamlines the entire IFA workflow, from slide preparation to image capture, boosting efficiency and reliability. It offers confident positive/negative classifications and pattern interpretation, reducing human error and improving diagnostic consistency. This complements AliveDx’s MosaiQ microarray technology, providing a comprehensive, turnkey diagnostic solution.

Immunofluorescence Assay Market Segment Insights

By Product Insights

Why Did Antibodies Dominate the Immunofluorescence Assay Market in 2025?

The antibodies segment dominated the market with a major revenue share in 2025. The dominance of antibodies stems from their central role in detecting specific antigens with high sensitivity and specificity. As the core component of immunofluorescence assays, antibodies are essential for both direct and indirect immunofluorescence techniques across diagnostic and research settings. The growing prevalence of chronic and infectious diseases has increased the demand for reliable biomarker detection, further boosting antibody usage.

Advancements in antibody engineering, such as monoclonal and recombinant antibodies, have improved assay performance and consistency. Pharmaceutical companies and academic institutes continue to invest heavily in antibody-based research, especially in areas like cancer, autoimmune disorders, and infectious disease diagnostics. This widespread applicability and continued innovation made antibodies the leading product.

The kits & reagents segment is expected to expand at the fastest CAGR over the projection period due to their ability to simplify complex assay procedures, making them ideal for both clinical and research laboratories with limited technical expertise. Growing demand for standardized, reproducible results, especially in high throughput testing environments, is driving the adoption of these pre-formulated kits. Furthermore, ongoing advancements in reagent formulations, such as improved fluorescent dyes and stabilizers, are enhancing sensitivity and shelf life, which further fuel segmental growth.

By Type Insights

How Does the Indirect Immunofluorescence Segment Lead the Market?

The indirect immunofluorescence segment led the immunofluorescence assay market in 2025 and is likely to maintain its upward trajectory in the upcoming period. This is mainly due to its superior sensitivity and versatility compared to the direct method. By using a secondary fluorescently labeled antibody to amplify the signal, indirect immunofluorescence enables clearer detection of low-abundance antigens, making it highly effective for diagnostic applications. This method is widely preferred in autoimmune disease testing, infectious disease diagnosis, and cancer research because it provides stronger, more specific signals. Its well-established protocols and broad adoption in clinical and research labs also contribute to its market dominance.

- In June 2023, Revvity’s EUROIMMUN has launched the UNIQO 160, a fully automated indirect immunofluorescence test (IIFT) system for autoimmune disease diagnostics. It streamlines the entire IIFT process, from sample prep to image analysis—boosting efficiency and consistency.

The direct immunofluorescence segment is expected to expand at a notable growth rate in the coming years, owing to its speed and simplicity, offering a one-step staining process that reduces assay time and minimizes errors. This makes it highly valuable in clinical settings requiring quick diagnostics, such as intraoperative procedures and point-of-care testing. Additionally, advances in fluorescent labeling technologies have improved the sensitivity and specificity of direct assays, broadening their applicability. The growing demand for quantitative and real-time imaging in research and personalized medicine is also driving their adoption.

By Application Insight

What Made Infectious Diseases the Dominant Segment in the Immunofluorescence Assay Market in 2025?

The infectious diseases segment dominated the market, holding the largest share in 2025. This is mainly due to the critical need for rapid and accurate detection of pathogens in clinical diagnostics. Immunofluorescence assays provide high sensitivity and specificity, making them ideal for identifying a wide range of viral, bacterial, and parasitic infections. The ongoing emergence and re-emergence of infectious diseases worldwide have heightened demand for reliable diagnostic tools to support timely treatment and outbreak control.

The ability of these assays to deliver quick results helps healthcare providers make prompt decisions, improving patient outcomes. Increasing investments in infectious disease research and expanding diagnostic infrastructure, especially in response to global health threats, have further augmented the segment.

The autoimmune diseases segment is expected to grow at the highest CAGR during the assessment period due to the rising prevalence of autoimmune disorders globally, such as lupus, rheumatoid arthritis, and multiple sclerosis. Immunofluorescence assays are crucial for detecting autoantibodies and diagnosing these complex conditions with high accuracy. Advances in assay technologies have improved sensitivity and specificity, making them more reliable for early diagnosis and disease monitoring. Additionally, increasing awareness and better screening programs are driving demand for these tests in both clinical and research settings.

By End-User Insights

How Did Pharmaceutical & Biotechnology Companies Contribute the Largest Market Share in 2025?

The pharmaceutical & biopharmaceutical companies segment held the largest share of the immunofluorescence assay market in 2025 due to their extensive use of these assays in drug discovery, development, and validation processes. Immunofluorescence assays play a critical role in identifying biomarkers, understanding disease mechanisms, and evaluating drug efficacy and toxicity. The growing focus on personalized medicine and targeted therapies has further increased reliance on precise, high-throughput diagnostic tools provided by these companies. Additionally, substantial investments in R&D and expanding pipelines of biologics and biosimilars have driven demand for immunofluorescence technologies. Their collaborations with academic institutions and CROs also amplify assay utilization.

The academic & research institutes segment is expected to expand at the fastest growth rate in the upcoming period, owing to increasing investments in biomedical research and rising focus on understanding disease mechanisms at the molecular level. These institutes use immunofluorescence assays extensively for studying cellular processes, biomarker discovery, and drug target validation. Advances in imaging technologies and multi-omics approaches are also driving demand for more sophisticated and precise assays. Furthermore, expanding collaborations with pharmaceutical companies and increased funding for research projects are boosting assay adoption in academia.

Immunofluorescence Assay Market Regional Insights

What Made North America the Dominant Region in the Immunofluorescence Assay Market in 2025?

North America registered dominance in the immunofluorescence assay market, accounting for the largest share in 2025. The dominance of the region in the market is attributed to its advanced healthcare infrastructure, significant R&D investments, and strong presence of key market players. The region benefits from widespread adoption of cutting-edge diagnostic technologies and robust funding for biomedical research. Additionally, high prevalence of chronic and infectious diseases drives demand for accurate and efficient diagnostic assays. Supportive regulatory frameworks and well-established reimbursement policies also facilitate market growth.

The U.S. is a major contributor to the North America immunofluorescence assay market due to its well-established healthcare system and leadership in biomedical research and innovation. The country hosts numerous pharmaceutical and biotechnology companies that extensively use immunofluorescence assays for drug development and diagnostics. Strong government funding for healthcare and research, along with advanced laboratory infrastructure, supports rapid adoption of cutting-edge technologies. Additionally, favorable regulatory policies and high healthcare spending drive market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth in the immunofluorescence assay market due to rising healthcare awareness, expanding diagnostic infrastructure, and increasing government investments in healthcare and research. Rapid urbanization and a growing prevalence of chronic and infectious diseases are boosting demand for advanced diagnostic tools. Additionally, improving access to healthcare services and increasing adoption of innovative technologies in emerging markets like China, India, and Japan are key growth drivers. The presence of a large patient population and rising pharmaceutical R&D activities further fuel market expansion in the region.

China is a major contributor to the immunofluorescence assay market in Asia Pacific due to its rapidly expanding healthcare infrastructure and strong government support for diagnostic innovation. The country has seen a significant rise in chronic and infectious diseases, increasing the demand for advanced diagnostic tools like immunofluorescence assays. Additionally, China’s growing biotechnology and pharmaceutical sectors are heavily investing in R&D, fueling the adoption of these assays in both clinical and research settings. The presence of local manufacturers and international collaborations also supports market growth by improving accessibility and affordability of diagnostic products.

Region-Wise Market Growth

| Region |

Market Size (2024) |

Projected CAGR (2025-2034) |

Key Growth Drives |

Key Challenges |

Market Outlook |

| North America |

USD 1,593.0 Bn |

4.8% |

High-tech adoption, robust R&D, aging population |

Regulatory complexity, saturated market |

Mature & steady growth |

| Asia Pacific |

USD 1,118.8 Bn |

7.76% |

Large population, healthcare investment, automation |

Price sensitivity, infrastructure gaps |

Fastest-growing region |

| Europe |

USD 894.3 Bn |

10.98% |

Universal healthcare, chronic disease burden |

Reimbursement caps, slow regulatory updates |

Stable |

| Latin America |

USD 309.0 Bn |

5.18% |

Expanding healthcare access, demand for POC tests |

Political instability, limited lab infrastructure |

High potential |

| MEA |

USD 196.3 Bn |

3.72% |

Urbanization, investment in diagnostic capacity |

Infrastructure & workforce limitations |

Emerging & underpenetrated |

Immunofluorescence Assay Market Value Chain Analysis

The value chain of the immunofluorescence assay market consists of multiple interconnected stages, from raw material sourcing to end-user application. Each stage plays a crucial role in ensuring sensitivity, accuracy, reproducibility, and regulatory compliance of immunofluorescence-based diagnostics and research tools.

-(1).webp)

Competitive Landscape

1. Thermo Fisher Scientific Inc.

A global leader in life sciences, Thermo Fisher provides a wide range of high-quality antibodies, fluorophores, and imaging systems, supporting advanced immunofluorescence research across diagnostics and drug discovery.

2. Bio-Rad Laboratories, Inc.

Bio-Rad offers validated antibodies and imaging platforms, playing a vital role in delivering reproducible and reliable immunofluorescence results, especially in clinical diagnostics and academic research.

3. Abcam plc

Abcam specializes in recombinant antibodies and labeling reagents, helping researchers achieve high sensitivity and specificity in immunofluorescence staining, particularly for cell and tissue analysis.

4. PerkinElmer, Inc. (now part of Revvity)

PerkinElmer supports the market with advanced imaging systems and multiplexed assay technologies, enabling high-throughput and quantitative immunofluorescence applications in drug development and biomarker research.

5. Danaher Corporation (Leica Microsystems, Molecular Devices)

Danaher, through its subsidiaries, provides cutting-edge confocal microscopes and imaging platforms, facilitating high-resolution immunofluorescence for diagnostics and clinical research.

6. Merck KGaA (MilliporeSigma in the U.S.)

MilliporeSigma offers a broad portfolio of fluorescent dyes, antibodies, and labeling kits, serving the needs of both basic research and clinical diagnostics in immunofluorescence.

7. Cell Signaling Technology (CST)

CST is renowned for its highly specific, validated antibodies optimized for immunofluorescence, contributing significantly to cancer and cell biology research.

8. Agilent Technologies, Inc.

Agilent provides automated staining systems and fluorescent probes, supporting high-throughput and standardized immunofluorescence assays in pathology labs and research settings.

9. Roche Diagnostics (Ventana Medical Systems)

Roche, through Ventana, offers automated immunohistochemistry and immunofluorescence solutions, widely used in clinical diagnostics, especially oncology.

Roche Diagnostics Division’s Regional Revenue Insights

In 2024, Roche’s Diagnostics Division reported total sales of CHF 14,324 million, reflecting a 4% increase at constant exchange rates (CER) compared to 2023. The Europe, Middle East, and Africa (EMEA) region contributed CHF 4,822 million (up 5% CER), driven by higher sales of immunodiagnostic products, clinical chemistry, and advanced staining solutions. North America generated CHF 4,335 million in sales (up 6% CER), with notable growth in immunodiagnostics and companion diagnostics compensating for reduced COVID-19–related sales. Within this region, the US alone accounted for CHF 3,852 million (up 4%). China saw modest growth of 1% to CHF 2,402 million, although macroeconomic pressures dampened performance in the second half of the year. Latin America experienced the strongest growth at 22% CER, reaching CHF 1,068 million, fueled by robust uptake across diagnostic solutions. Despite the overall reduction in COVID-19–related sales, Roche’s Diagnostics Division demonstrated solid core growth across most regio

Recent Developments

- In November 2024, Bruker Corporation has announced a breakthrough in its CellScape™ Precise Spatial Proteomics platform with the introduction of EpicIF technology. EpicIF enhances photobleaching, expands fluorophore compatibility nearly 10-fold, and doubles throughput, all while preserving tissue integrity. This advancement simplifies assay development and builds on CellScape’s high-resolution, high-dynamic-range imaging for precise, multiplexed immunofluorescence using directly-labeled primary antibodies.

- In January 2023, Cipla Ltd. has launched Cippoint, a CE IVD-approved immunofluorescence-based point-of-care testing device offering rapid (3–15 minutes) and accurate diagnostics for diabetes, thyroid, cardiac markers, infectious diseases, and more. Designed with an automated, user-friendly interface, Cippoint is ideal for use in rural and remote areas, bridging gaps in India’s diagnostic ecosystem. This device aims to empower smaller healthcare centers with reliable, affordable testing to improve patient outcomes.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Immunofluorescence Assay Market.

By Product

- Antibodies

- Kits and reagents

- Instruments

- Consumables and Accessories

By Type

- Indirect Immunofluorescence

- Direct Immunofluorescence

By Application

- Cancer

- Infectious Diseases

- Autoimmune Diseases

- Others

By End-user

- Academic Research Institutes

- Pharmaceutical & Biopharmaceutical Companies

- CROs

- Hospital and Diagnostic Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

-(1).webp)