Insulin Patch Pumps Market Size and Trends

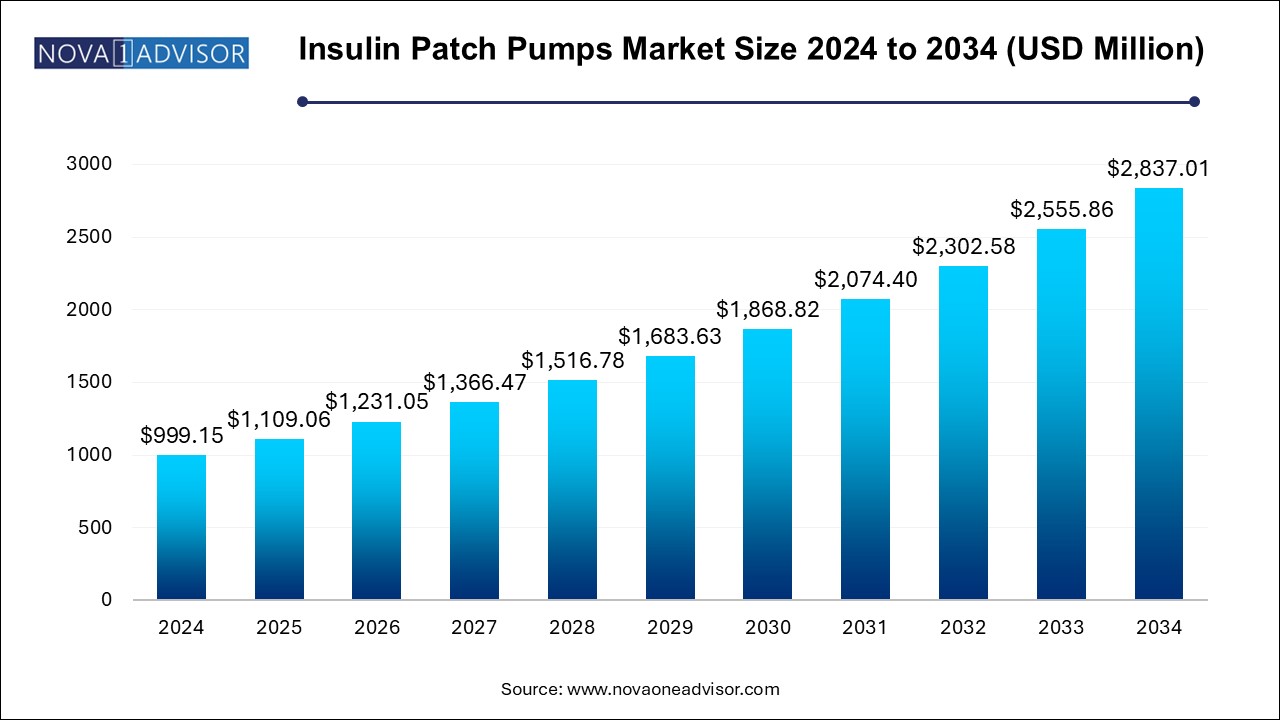

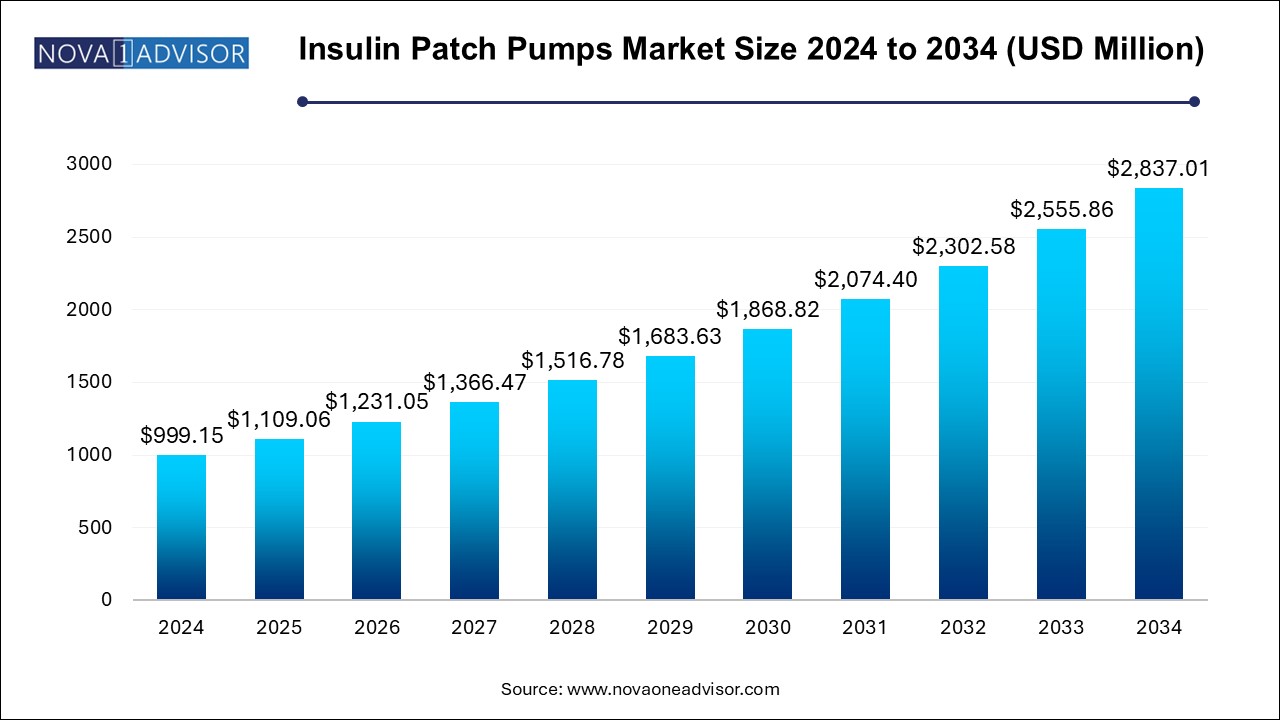

The insulin patch pumps market size was exhibited at USD 999.15 million in 2024 and is projected to hit around USD 2,837.01 million by 2034, growing at a CAGR of 11.0% during the forecast period 2024 to 2034.

Insulin Patch Pumps Market Key Takeaways:

- The reusable insulin patch pump segment dominated the market in 2024 with a revenue share of 64.4% and is expected to maintain its dominance over the forecast period.

- The basal and bolus segment dominated the market in 2024 with a share of 56.2% and is expected to retain its position over the forecast period.

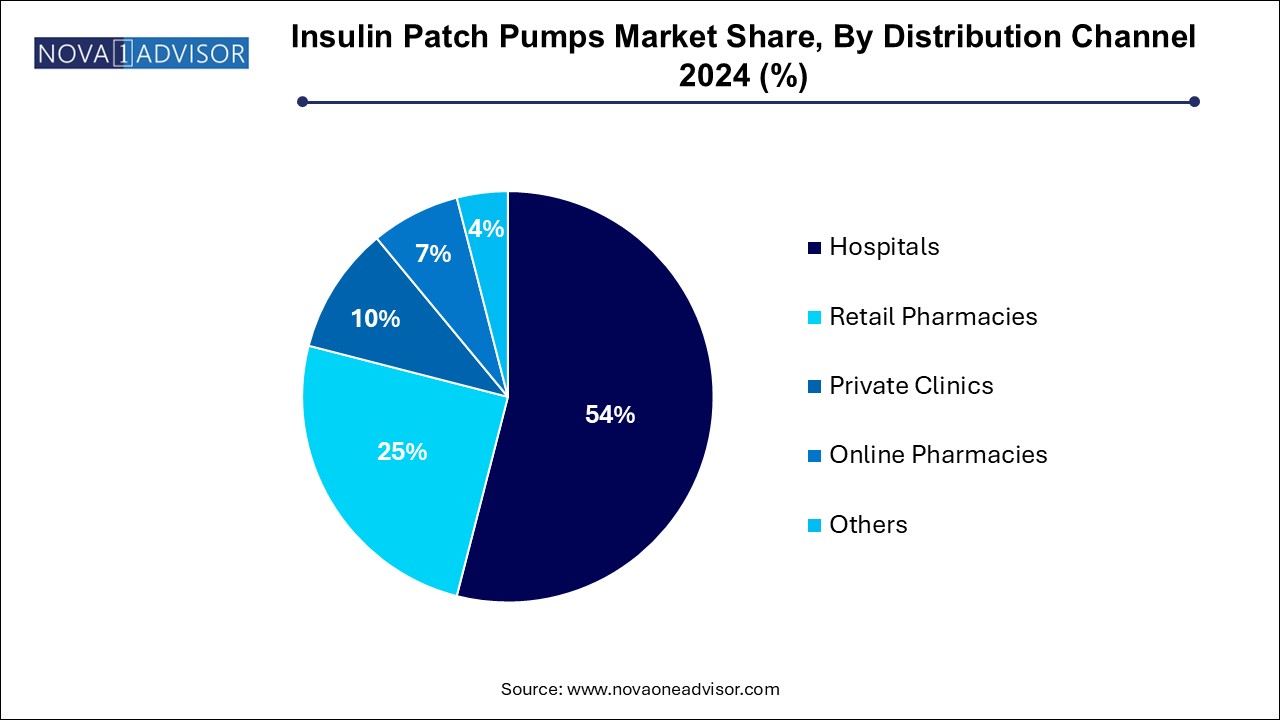

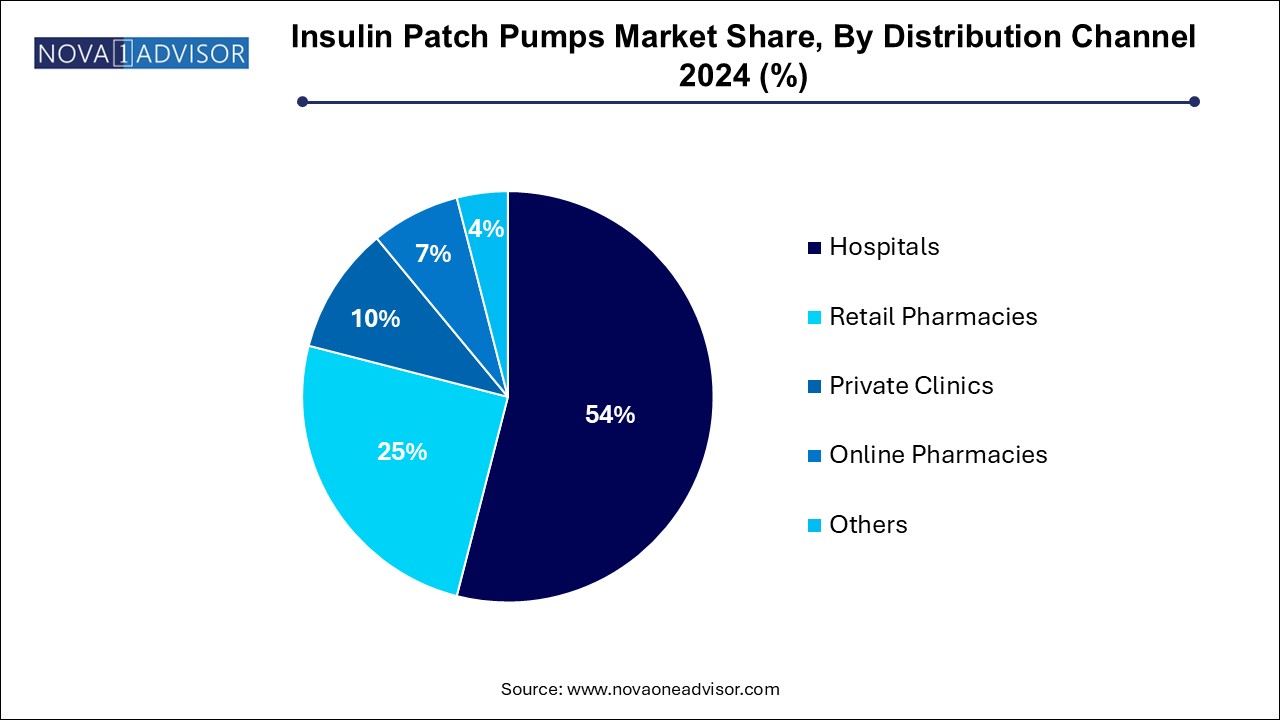

- The hospital segment dominated the market in 2024 with a share of 54.0% owing to factors such as the increasing number of specialty hospital pharmacies and the expansion of the integrated delivery network.

- North America dominated the market with a revenue share of over 35.0% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

Market Overview

The global insulin patch pumps market is witnessing a period of dynamic transformation, underpinned by the surging global prevalence of diabetes and the growing emphasis on patient-centric drug delivery solutions. Insulin patch pumps, also known as wearable insulin delivery systems, represent a groundbreaking advancement in diabetes management, enabling continuous subcutaneous insulin infusion without the bulkiness of traditional pumps. These compact, discreet devices offer greater freedom and flexibility to patients, fostering improved adherence to insulin therapy and, consequently, better glycemic control.

The market's expansion is fueled by technological innovations, rising healthcare expenditure, and a heightened awareness of diabetes care options. With Type 1 diabetes patients increasingly opting for wearable, automated systems over multiple daily injections, and even a notable segment of Type 2 diabetes patients transitioning to pump therapy, the adoption of insulin patch pumps is gaining significant momentum. Moreover, collaborations between medtech companies and digital health innovators are accelerating the development of smart patch pumps integrated with mobile applications and data analytics capabilities.

Several key players are actively investing in product innovation, miniaturization, and automation to meet consumer demands for ease of use, convenience, and cost-effectiveness. Additionally, initiatives by governments and non-government organizations to promote diabetes self-management education are further contributing to the widespread adoption of insulin patch pumps globally.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI): Patch pumps equipped with AI algorithms are being developed to predict blood sugar fluctuations and adjust insulin doses accordingly, creating "smart" diabetes management systems.

-

Increasing Adoption of Tubeless Designs: Tubeless patch pumps, offering a hassle-free experience without dangling tubing, are seeing soaring demand, particularly among younger patients.

-

Rising Popularity of Reusable Patch Pumps: Cost-conscious consumers and eco-friendly healthcare trends are driving interest in reusable insulin patch pumps.

-

Advances in Bluetooth and Mobile App Connectivity: New-generation patch pumps allow real-time data tracking and remote monitoring by healthcare providers via smartphone apps.

-

Partnerships between Pharma and Tech Firms: Cross-industry collaborations are leading to rapid advancements in closed-loop (automated) insulin delivery systems.

-

Insurance Coverage Expansion: An increasing number of health insurance plans in developed countries now cover insulin patch pumps, making them accessible to a broader patient base.

-

Focus on Pediatric Diabetes Care: Child-specific insulin patch pump designs are becoming a significant area of innovation and marketing.

Report Scope of Insulin Patch Pumps Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,109.06 Million |

| Market Size by 2034 |

USD 2,837.01 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 11.0% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Delivery Mode, Product Type, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Medtronic plc; F. Hoffmann-La Roche Ltd.; Insulet Corporation; CeQur; Terumo; Tandem Diabetes Care; Medtrum; Debiotech |

Driver: Rising Diabetes Prevalence Globally

One of the most influential drivers propelling the insulin patch pumps market is the alarming rise in diabetes prevalence worldwide. According to the International Diabetes Federation (IDF), approximately 537 million adults were living with diabetes in 2021, a number expected to soar to 643 million by 2030. Type 1 diabetes, in particular, requires lifelong insulin therapy, making efficient delivery systems crucial.

The burgeoning diabetic population demands solutions that offer convenience, minimal invasiveness, and reliable glycemic control criteria that insulin patch pumps are uniquely positioned to meet. As sedentary lifestyles, unhealthy diets, obesity, and genetic predispositions continue to escalate, the corresponding need for effective diabetes management tools like patch pumps becomes increasingly urgent. Healthcare providers are recognizing these trends and increasingly recommending patch pumps over traditional insulin pens and syringes, thereby driving robust market growth.

Restraint: High Cost of Devices

Despite their evident advantages, insulin patch pumps remain relatively expensive compared to conventional insulin delivery methods. The high upfront cost of the devices, coupled with the recurring expenses for supplies and maintenance, can deter many potential users, especially in low- and middle-income countries. For instance, a single disposable patch pump can cost several hundred dollars monthly, posing a significant financial burden on uninsured patients.

Even in regions with insurance coverage, bureaucratic hurdles and partial reimbursement schemes can limit widespread adoption. This cost barrier is particularly critical in the pediatric segment, where parents may find it financially challenging to afford consistent usage. The necessity for regular device replacement due to battery depletion or adhesive failure further exacerbates the affordability issue, potentially hampering market expansion.

Opportunity: Technological Advancements in Automated Insulin Delivery

An exciting opportunity lies in the ongoing advancements in fully automated insulin delivery systems. Also referred to as "artificial pancreas" systems, these devices combine continuous glucose monitoring (CGM) with insulin patch pumps and sophisticated algorithms that autonomously adjust insulin dosing in real-time. Companies like Insulet Corporation and Tandem Diabetes Care are investing heavily in research and development to bring such closed-loop systems to the mainstream market.

The integration of AI and machine learning can lead to personalized, predictive insulin delivery, reducing the risk of hypoglycemia and hyperglycemia. By eliminating much of the manual effort traditionally associated with diabetes management, these technologies promise to significantly improve the quality of life for patients. Furthermore, regulatory approvals for next-generation patch pumps featuring predictive low glucose suspend (PLGS) or hybrid closed-loop functionalities represent a major growth avenue for market players.

Insulin Patch Pumps Market By Product Type Insights

Disposable insulin patch pumps dominated the product type segment owing to their convenience, ease of use, and low maintenance requirements. Designed for single-use over a few days, disposable pumps eliminate the need for cleaning and disinfection, reducing infection risks. They are particularly appealing to elderly patients and children who may find reusable devices cumbersome. Leading brands such as Insulet's Omnipod have popularized the disposable patch pump concept, reinforcing its market leadership.

Conversely, reusable insulin patch pumps are projected to experience the fastest growth in the coming years. Reusable models offer significant cost savings over the long term, an increasingly critical factor amid rising healthcare expenditures. Sustainability-conscious consumers are also driving demand for reusable options, given their lower environmental impact compared to disposable alternatives. Moreover, advances in reusable patch pump design are addressing earlier concerns about bulkiness and user-friendliness, enhancing their market appeal.

Insulin Patch Pumps Market By Delivery Mode Insight

The basal & bolus delivery mode dominated the insulin patch pumps market due to its ability to closely mimic the natural insulin secretion patterns of a healthy pancreas. Patients benefit from background basal insulin infusion combined with bolus doses before meals, leading to superior glycemic control. Basal & bolus patch pumps offer programmable basal rates and user-initiated bolus doses, enabling tailored insulin delivery based on individual lifestyle and metabolic needs. Their flexibility appeals strongly to both Type 1 and insulin-dependent Type 2 diabetes patients, driving their widespread adoption.

Meanwhile, the bolus-only delivery segment is expected to exhibit the fastest growth over the forecast period. Bolus patch pumps cater to Type 2 diabetes patients who primarily require prandial (mealtime) insulin coverage. Their simplicity and cost-effectiveness make them attractive for newly diagnosed individuals and those seeking an entry-level insulin therapy device. As healthcare providers emphasize early insulin intervention to prevent diabetes complications, bolus patch pumps are gaining rapid traction.

Insulin Patch Pumps Market By Distribution Channel Insights

Hospitals accounted for the largest share of insulin patch pump distribution due to their pivotal role in initial diabetes diagnosis, education, and therapy initiation. In hospital settings, patients receive comprehensive training on using patch pumps under professional supervision, fostering greater confidence and adherence. Additionally, hospitals often facilitate insurance authorizations and device procurement, streamlining access for newly diagnosed patients.

On the other hand, online pharmacies are anticipated to register the fastest growth rate in this segment. The COVID-19 pandemic catalyzed a digital shift in healthcare purchasing behavior, and this trend continues as patients prioritize convenience and home delivery services. E-commerce platforms now offer a wide array of diabetes management supplies, including insulin patch pumps, often bundled with promotional discounts and subscription options. As digital health adoption expands, online pharmacies are poised to become a critical sales channel for insulin patch pump manufacturers.

Insulin Patch Pumps Market By Regional Insights

North America dominates the global insulin patch pumps market, accounting for the largest revenue share. The region's supremacy stems from its high diabetes prevalence, advanced healthcare infrastructure, strong reimbursement frameworks, and robust R&D ecosystem. The United States, in particular, has witnessed a surge in wearable insulin technology adoption, supported by favorable FDA approvals and widespread insurance coverage. Notable initiatives like the "Diabetes Prevention Program" and increased patient awareness campaigns further solidify North America's market leadership. Key players like Insulet Corporation and Tandem Diabetes Care are headquartered in the U.S., ensuring continual innovation and market responsiveness.

In contrast, Asia Pacific is expected to be the fastest-growing regional market for insulin patch pumps. Factors contributing to this growth include rising diabetes rates driven by urbanization, dietary changes, and sedentary lifestyles, especially in countries like China and India. Moreover, increasing healthcare investments, improving diagnostic rates, and growing middle-class populations are fostering demand for advanced diabetes management technologies. Government initiatives promoting wearable health technologies and the rapid digital transformation of healthcare services provide additional momentum. Strategic collaborations between multinational companies and local healthcare providers are further facilitating patch pump penetration across Asia Pacific.

Some of the prominent players in the insulin patch pumps market include:

- Medtronic plc

- F. Hoffmann-La Roche Ltd.

- Insulet Corporation

- CeQur

- Terumo

- Tandem Diabetes Care

- Medtrum

- Debiotech

Recent Developments

-

In March 2025, Insulet Corporation announced FDA clearance for its "Omnipod 6" system, an advanced tubeless insulin patch pump featuring an integrated predictive low glucose suspend (PLGS) algorithm.

-

In February 2025, Medtrum Technologies Ltd launched "NanoPatch," a compact disposable patch pump with Bluetooth-enabled mobile app connectivity in European markets.

-

In January 2025, Tandem Diabetes Care acquired Swiss-based Sigi Patch Pump, aiming to expand its product portfolio with a focus on lightweight, rechargeable wearable insulin pumps.

-

In December 2024, CeQur secured $115 million in funding to scale production of its "Simplicity" wearable insulin patch, targeting mass-market affordability and insurance reimbursement.

-

In November 2024, Roche Diabetes Care announced a partnership with Apple Health to integrate insulin patch pump data with the Apple Health ecosystem, enabling seamless glucose-insulin monitoring.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the insulin patch pumps market

By Delivery Mode

- Basal

- Bolus

- Basal & Bolus

By Product Type

By Distribution Channel

- Hospitals

- Retail Pharmacies

- Private Clinics

- Online Pharmacies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)