Life Science Cloud Market Size, Share, Growth, Report 2025 to 2034

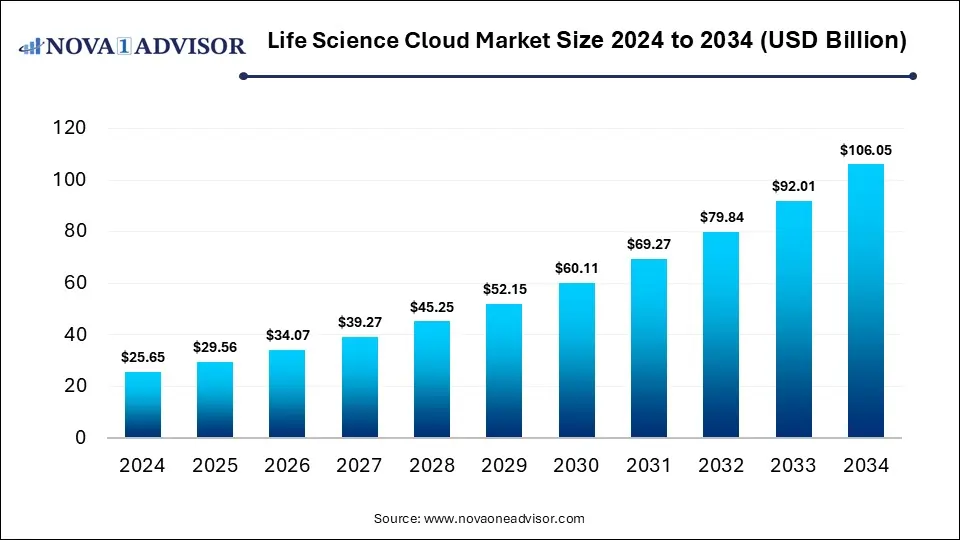

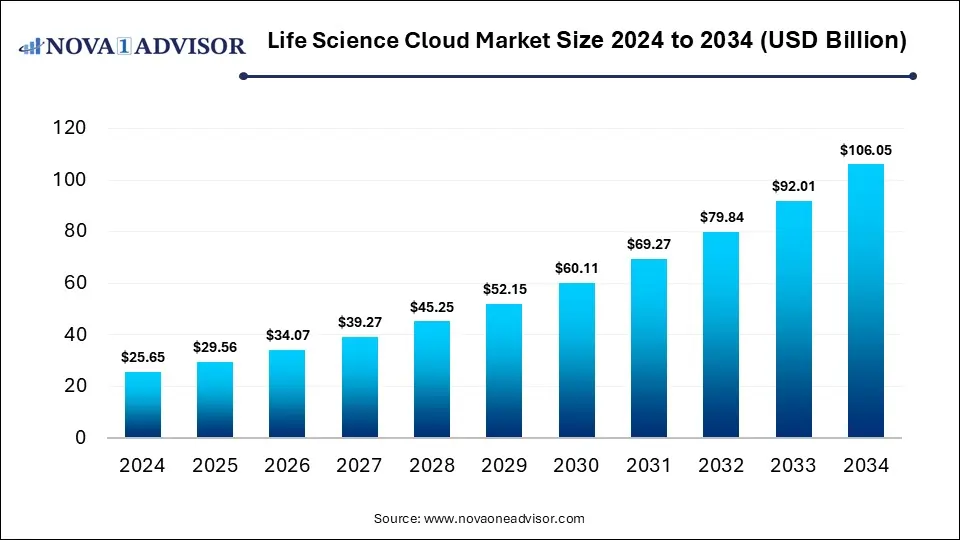

The global life science cloud market size was estimated at USD 25.65 billion in 2024 and is projected to hit USD 106.05 billion in 2034, growing at a CAGR of 15.25% during 2025-2034. Market expansion is fueled by increasing adoption of AI and big data analytics, rising digitization of R&D, regulatory compliance requirements, and the demand for secure, scalable cloud platforms to speed up drug discovery and clinical development.

Life Science Cloud Market Key Takeaways

- By region, North America held the largest share of the life science cloud market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By type, the software as a service (SaaS) segment led the market in 2024.

- By type, the platform as a service (PaaS) segment is expected to expand at the highest CAGR over the projected timeframe.

- By application, the clinical research segment led the market in 2024.

- By application, the genomics & precision medicine segment is expected to expand at the highest CAGR over the projection period.

- By deployment model, the public cloud segment led the market in 2024.

- By end user, the pharmaceutical & biotechnology companies segment led the market in 2024.

Artificial Intelligence: The Next Growth Catalyst in Life Science Cloud

AI is profoundly transforming the life science cloud market by improving data processing, predictive modeling, and automation in drug discovery, clinical trials, and patient analytics. AI-driven cloud platforms allow researchers to extract actionable insights from large genomic and clinical datasets, speeding up innovation and shortening the time-to-market for new therapies. Using machine learning algorithms, life science companies can optimize trial design, find biomarkers, and make better decisions in real time. Additionally, integrating AI with cloud infrastructure boosts scalability, security, and collaboration among global research teams.

- In October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-driven, cloud-based platform that unifies diverse data sets to accelerate insight generation. It enables life sciences organizations to integrate insights across Oracle Health applications, identify market needs, and optimize therapeutic launches—advancing Oracle’s goal of bridging clinical research and care.

Strategic Overview of the Global Life Science Cloud Industry

The market is driven by increasing digital transformation in life sciences, rising adoption of AI and big data analytics, and the growing need for compliant and interoperable data ecosystems. Overall, the life science cloud is becoming essential in speeding up scientific discoveries and enhancing patient outcomes worldwide. The life science cloud market involves integrating cloud computing technologies into pharmaceutical, biotechnology, and healthcare research settings to manage, store, and analyze large amounts of biomedical and clinical data. It allows seamless collaboration, real-time data access, and advanced analytics across research, development, and regulatory activities. Key benefits include greater scalability, improved data security, cost efficiency, and quicker innovation in fields such as genomics, precision medicine, and clinical trials.

Market Outlook

- Market Growth Overview: The life science cloud market is expected to grow considerably between 2025 and 2034, fueled by organizations increasingly transitioning from traditional IT systems to cloud-based infrastructures for better agility and scalability. This shift enables real-time collaboration, seamless data integration, and advanced analytics across R&D, clinical trials, and regulatory processes. Cloud platforms support automation, AI-powered insights, and virtual research environments, speeding up drug discovery and enhancing decision-making.

- Sustainability Trends: Sustainability trends are driving innovation in the market through the rise of multi-cloud and hybrid cloud strategies. Companies are deploying multi-cloud and hybrid infrastructures to balance data sovereignty, security, and cost efficiency while ensuring flexibility across research and manufacturing ecosystems. The expansion of genomics and precision medicine applications, along with a surge in genomics and personalized medicine research, demands scalable cloud solutions to handle massive datasets. This enables more accurate patient stratification and targeted therapies.

- Major Investors: Major investors in the market include leading technology firms, venture capital groups, and strategic pharmaceutical players that are fueling innovation and digital transformation. Companies such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are investing heavily in scalable cloud infrastructures and AI-driven analytics tailored for life science applications. Venture capital firms like Accel, Sequoia Capital, and Andreessen Horowitz are funding startups that leverage cloud computing for genomics, drug discovery, and healthcare data management. Additionally, pharmaceutical giants such as Roche, Pfizer, and Novartis are investing in cloud-based R&D platforms to enhance data integration, accelerate clinical trials, and improve collaboration with research partners.

- Startup Economy: The startup economy in the market is rapidly expanding, driven by the convergence of biotechnology, data science, and cloud computing innovation. Emerging startups are developing specialized platforms for genomics data analysis, AI-driven drug discovery, and clinical data management, offering flexible and cost-efficient cloud-based solutions. These startups are attracting significant venture capital and strategic investments from major tech players and pharmaceutical companies seeking digital innovation.

Report Scope of Life Science Cloud Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 29.56 Billion |

| Market Size by 2034 |

USD 106.05 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.25% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Application, By Deployment Model, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Need for Efficient Data Management and Scalability

The need for efficient data management and scalability is a key driver of the life science cloud market, as organizations in biotechnology, pharmaceuticals, and healthcare generate massive volumes of complex data from genomics, clinical trials, and real-world evidence. Traditional IT infrastructures often lack the flexibility and capacity to process and store such data efficiently, making cloud platforms an essential solution. Cloud technologies enable seamless data integration, real-time analytics, and scalable storage, allowing researchers to manage growing datasets with greater accuracy and speed. This scalability not only reduces operational costs but also supports global collaboration and innovation.

Rising Adoption of AI, Machine Learning, And Big Data Analytics

The rising adoption of AI, machine learning (ML), and big data analytics is a major catalyst for the growth of the life science cloud market, enabling organizations to extract actionable insights from vast and complex biomedical datasets. Cloud platforms provide the computational power and flexibility required to run AI and ML algorithms that accelerate drug discovery, optimize clinical trial design, and enhance patient outcome predictions. By integrating big data analytics, life science companies can efficiently process genomics, proteomics, and clinical information to identify novel therapeutic targets and improve R&D efficiency. This convergence of AI and cloud technologies also facilitates automation and predictive modeling, reducing time-to-market for new treatments.

- In October 2025, HPE and NVIDIA announced expanded solutions to help organizations in regulated industries, like life sciences, build secure, private AI infrastructure.

Restraint

Data Privacy and Security Concerns

The market growth is hindered by the highly sensitive nature of clinical, genomic, and patient health data involved. Regulatory frameworks such as HIPAA, GDPR, and GxP impose strict compliance requirements, making it challenging for organizations to migrate large-scale operations to the cloud without risk. Breaches or unauthorized access to confidential research and patient information can lead to reputational damage and legal liabilities, discouraging full adoption. Additionally, inconsistencies in global data protection laws create barriers for cross-border data sharing and collaboration. These challenges collectively slow down cloud adoption in life sciences, compelling organizations to invest heavily in cybersecurity and compliance infrastructure.

Opportunities

Expansion of Precision Medicine and Genomic Research

The growth of precision medicine and genomics research is opening huge opportunities in the Life Science Cloud market, as these fields depend greatly on advanced computing power and scalable data storage. Cloud platforms help researchers process and analyze large genomic datasets quickly, supporting personalized treatment development based on individual genetic profiles. This improves collaboration among global research teams and accelerates discoveries into disease mechanisms and drug responses. Additionally, integrating AI and big data analytics into cloud environments enables real-time interpretation of genomic data, leading to breakthroughs in diagnostics and therapies.

Growth in Hybrid and Multi-Cloud Models

Hybrid models enable organizations to leverage the best features of both public and private cloud environments. These models allow life science companies to securely manage sensitive data in private clouds while utilizing public clouds for high-performance computing, data sharing, and analytics. This flexibility enhances scalability, cost-efficiency, and regulatory compliance, key factors for research, drug discovery, and clinical trials. Moreover, hybrid and multi-cloud strategies facilitate interoperability and collaboration across global research ecosystems, driving faster innovation and accelerating time-to-market for new therapies and solutions.

How Macroeconomic Variables Influence the Life Science Cloud Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. By increasing investments in healthcare infrastructure, research, and digital transformation. Strong economies enable pharmaceutical, biotechnology, and healthcare organizations to adopt advanced cloud solutions for data management and analytics. Conversely, in periods of economic slowdown, reduced R&D budgets and cautious IT spending may temporarily restrain market expansion.

Inflation & Drug Pricing Pressures

It negatively affects the growth of the life science cloud market by tightening budgets for pharmaceutical and biotech companies. Rising operational and production costs force organizations to delay or limit investments in advanced cloud technologies. However, some firms may still adopt cloud solutions to enhance efficiency and reduce long-term IT and R&D costs amid financial constraints.

Exchange Rates

Exchange rate fluctuations can negatively affect multinational companies operating across different currency zones. Fluctuating exchange rates can increase the cost of cloud services, software licenses, and cross-border collaborations. This financial uncertainty often leads organizations to delay or scale back cloud adoption plans, particularly in emerging markets.

Life Science Cloud Market Segment Outlook

By Type Insights

Why Did the Software-as-a-Service (SaaS) Segment Dominate the Life Science Cloud Market in 2024?

The software-as-a-service (SaaS) segment dominated the market, accounting for the largest share in 2024. This is due to its scalability, cost-efficiency, and ease of deployment across various research and clinical applications. Life science organizations increasingly adopt SaaS solutions for data management, electronic lab notebooks, and analytics to streamline operations and enhance collaboration. The subscription-based model allows continuous software updates, seamless integration with AI and machine learning tools, and reduced IT maintenance costs. Moreover, SaaS platforms enable secure, compliant data sharing across global research teams, making them essential for accelerating drug discovery and clinical development processes.

- In February 2024, IQVIA and Revvity launched new SaaS products that incorporate AI to enhance data management and unify clinical trial data. These tools help reduce trial delays, improve patient monitoring, and speed up clinical study processes.

The platform-as-a-service (PaaS) segment is expected to grow at the fastest CAGR during the projection period, driven by its ability to provide a flexible and scalable environment for developing, testing, and deploying specialized life science applications. PaaS allows researchers and developers to build customized tools for genomics, bioinformatics, and clinical analytics without the complexity of managing underlying infrastructure. Its integration with AI, big data, and automation improves research efficiency and speeds up innovation in drug discovery and precision medicine.

By Application Insights

How Does the Clinical Research Segment Lead the Market in 2024?

The clinical research segment led the life science cloud market in 2024 due to the rising need for efficient data management and real-time collaboration in multi-site clinical trials. Cloud-based platforms enable smooth integration of patient data, trial results, and regulatory documents, enhancing accuracy and compliance. They also support remote monitoring, virtual trials, and faster data analysis, which boost overall research efficiency. Additionally, the growing adoption of decentralized and adaptive trial designs further increases demand for cloud solutions.

The genomics & precision medicine segment is projected to grow at the highest CAGR in the coming years. This is mainly due to the exponential growth in genomic data and the need for advanced analytics to derive meaningful insights. Cloud platforms enable the storage, processing, and sharing of massive genomic datasets, which are critical for developing personalized treatments and diagnostics. The integration of AI and machine learning with cloud-based genomics tools further accelerates discoveries by identifying complex genetic patterns and disease correlations. Moreover, rising investments in precision medicine initiatives and collaborations among research institutions, biotech firms.

By Deployment Model Insights

What Made Public Cloud the Dominant Segment in the Market in 2024?

The public cloud segment led the life science cloud market in 2024 due to its cost savings, scalability, and easy access for organizations of all sizes. It enables pharmaceutical, biotechnology, and research institutions to quickly deploy computing resources without large upfront infrastructure investments. Public cloud providers like AWS, Microsoft Azure, and Google Cloud offer advanced analytics, AI tools, and compliance-ready solutions designed for life science applications. Furthermore, the increasing need for global collaboration and real-time data sharing in research and clinical trials boosts the adoption of public cloud platforms across the industry.

The hybrid cloud segment is expected to expand at the highest CAGR in the coming years. This is primarily due to its ability to combine the flexibility of public cloud with the security of private cloud infrastructure. This model allows life science organizations to manage sensitive patient and research data securely while leveraging public cloud resources for large-scale analytics and collaboration. Hybrid cloud environments also support regulatory compliance by enabling controlled data access and storage within specific regions. Furthermore, the increasing adoption of AI-driven research, multi-site clinical trials, and precision medicine initiatives is driving the demand.

By End User Insights

Why Did the Pharmaceutical & Biotechnology Companies Segment Dominate the Market in 2024?

The pharmaceutical and biotechnology companies segment led the life science cloud market in 2024, driven by extensive adoption of cloud technologies to accelerate drug discovery, development, and commercialization. These organizations leverage cloud-based platforms to manage massive research datasets, run complex simulations, and ensure compliance with global regulatory standards. Cloud solutions also enable seamless collaboration among global research teams, contract partners, and regulatory bodies, enhancing operational efficiency and innovation. Moreover, growing investments in digital transformation and AI-driven R&D initiatives.

The contract research organizations (CROs) segment is expected to grow at the highest CAGR in the coming years. This is mainly due to the rising trend of pharmaceutical and biotech companies outsourcing clinical and research activities. Cloud-based platforms enable CROs to efficiently manage multi-site trials, integrate large datasets, and ensure real-time collaboration with sponsors and regulatory agencies. These solutions improve operational efficiency, reduce costs, and accelerate timelines for drug development. Additionally, the growing adoption of decentralized and virtual trial models further drives CROs to implement advanced cloud technologies for secure, compliant, and data-driven research operations.

By Regional Analysis

What Made North America the Dominant Region in the Market?

North America maintained dominance in the life science cloud market while holding the largest share in 2024. The region’s dominance is attributed to its strong technological infrastructure, high cloud adoption rates, and significant investments in life science research and digital transformation. The region is home to leading pharmaceutical and biotechnology companies, as well as major cloud service providers such as AWS, Microsoft, and Google Cloud, which drive innovation and collaboration. Supportive government initiatives and strict regulatory frameworks, such as HIPAA and FDA compliance standards, further encourage secure cloud deployment in research and healthcare.

U.S. Life Science Cloud Market Trends

The U.S. is a major contributor to the market in North America due to its advanced healthcare infrastructure and strong presence of global pharmaceutical, biotechnology, and cloud technology companies. High R&D spending, rapid digital transformation in life sciences, and government support for cloud adoption in healthcare and research further strengthen the U.S. market leadership. Moreover, the widespread use of AI, big data analytics, and precision medicine initiatives has accelerated cloud integration across research institutions and clinical organizations in the country.

What Makes Asia Pacific the Fastest-Growing Area in the Market?

Asia Pacific is expected to grow at the fastest rate in the coming years. This is due to increasing investments in pharmaceutical R&D, biotechnology, and digital healthcare infrastructure. Governments across countries like China, India, and Japan are promoting cloud adoption through digital transformation initiatives and supportive regulatory frameworks. The rapid expansion of clinical trials, growing collaboration between global and regional life science firms, and rising demand for precision medicine are fueling market growth. Additionally, the availability of cost-effective cloud solutions and a large pool of skilled IT and healthcare professionals further accelerate the region’s adoption of life science cloud technologies.

China Life Science Cloud Market Trends

China is a key player in the Asia Pacific life science cloud market due to its strong government support for digital healthcare transformation and rapid advancements in biotechnology and pharmaceutical research. The country has heavily invested in cloud infrastructure and AI-driven healthcare initiatives, fostering innovation in genomics, clinical research, and precision medicine. Additionally, collaborations between global cloud providers and local life science organizations have accelerated the adoption of secure and scalable cloud platforms, positioning China as a regional leader in this market.

How is the Opportunistic Rise of Europe in the Life Science Cloud Market?

Europe is experiencing robust growth in the market due to increasing digital transformation across the pharmaceutical, biotechnology, and healthcare sectors. The region’s strong regulatory environment, including GDPR compliance, is driving the adoption of secure and transparent cloud solutions for data management and research. Growing investments in genomics, clinical trials, and precision medicine are further boosting demand for advanced cloud infrastructure. Moreover, collaborations between life science companies, research institutions, and cloud providers are fostering innovation and accelerating the development of AI- and analytics-driven healthcare solutions across Europe.

UK Life Science Cloud Market Trends

The UK is leading the market in Europe due to its advanced healthcare infrastructure, strong biotechnology sector, and early adoption of digital and cloud technologies. The country’s focus on genomics research, data-driven healthcare, and AI integration has accelerated cloud adoption across pharmaceutical and research organizations. Additionally, supportive government initiatives such as the UK Life Sciences Vision and investments in digital health innovation further strengthen its leadership in the regional market.

Life Science Cloud Market Value Chain Analysis

1. Research & Development (R&D) and Data Generation

This stage involves generating massive amounts of biological and clinical data through laboratory research, genomics, and clinical trials. Companies like Illumina and Thermo Fisher Scientific provide sequencing platforms, laboratory instruments, and analytical tools that create the raw data later processed in cloud environments. These technologies form the foundation for cloud-based life science analytics and informatics solutions.

- Key Players: Illumina, Thermo Fisher Scientific, PerkinElmer, Agilent Technologies

2. Cloud Infrastructure and Storage

This stage focuses on providing secure, scalable, and high-performance computing environments for storing and managing large datasets. Leading cloud providers like AWS, Microsoft, and Google offer specialized infrastructure for life sciences, enabling data integration, processing, and analytics. These platforms also ensure compliance with healthcare data standards such as HIPAA, GDPR, and GxP.

- Key Players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud

3. Platform and Software Development

In this stage, companies develop platforms and software solutions that enable research collaboration, data analysis, and process automation. Solutions include cloud-based laboratory information management systems (LIMS), clinical data management, and bioinformatics platforms. These applications help organizations streamline workflows, reduce costs, and enhance innovation through integrated analytics and visualization tools.

- Key Players: Oracle, SAP, Veeva Systems, Dassault Systèmes (BIOVIA), DNAnexus

4. Data Analytics and AI Integration

This stage involves leveraging advanced analytics, artificial intelligence (AI), and machine learning (ML) to extract insights from complex life science datasets. Companies such as IBM and SAS provide powerful analytics platforms that enable predictive modeling, clinical decision support, and drug discovery acceleration. AI integration at this level enhances precision medicine, patient stratification, and real-world evidence generation.

- Key Players: IBM Watson Health, SAS Institute, TIBCO Software, Palantir Technologies

5. Service Delivery and Application in End Markets

The final stage focuses on implementing and managing cloud-based life science solutions across pharmaceutical, biotechnology, CRO, and healthcare organizations. Service providers like IQVIA and Accenture offer end-to-end cloud migration, consulting, and data management services. They ensure efficient deployment, regulatory compliance, and optimization of cloud ecosystems for clinical trials, R&D, and commercialization.

- Key Players: IQVIA, Accenture, Cognizant, Wipro, Deloitte

Life Science Cloud Market Companies

- Amazon Web Services (AWS)

AWS provides scalable cloud infrastructure, storage, and analytics platforms specifically designed for life sciences, enabling secure data management, genomics analysis, and AI-driven research. Its compliance-ready solutions and partnerships with pharmaceutical and biotech firms make it a preferred choice for global R&D operations.

Microsoft Azure offers a comprehensive cloud ecosystem with advanced data analytics, AI, and machine learning tools tailored for life science applications. It supports secure collaboration, clinical data management, and precision medicine research through HIPAA- and GDPR-compliant environments.

- Google Cloud Platform (GCP)

Google Cloud contributes to the market through its powerful data processing, AI, and bioinformatics capabilities, supporting genomics and clinical analytics. Its open-source tools and partnerships with healthcare organizations help accelerate drug discovery and personalized medicine initiatives.

- IBM Cloud (IBM Watson Health)

IBM Cloud integrates AI and analytics through its Watson Health platform to deliver data-driven insights for clinical research and precision medicine. It supports life science companies with cognitive computing solutions that enhance decision-making, patient outcomes, and R&D efficiency.

Oracle offers cloud-based solutions for clinical data management, pharmacovigilance, and regulatory compliance in the life sciences sector. Its Life Sciences Cloud Suite enables secure data integration, streamlined clinical operations, and improved trial management.

Veeva Systems specializes in cloud solutions for pharmaceutical and biotech companies, focusing on regulatory, clinical, and commercial operations. Its platforms help streamline drug development, ensure compliance, and enhance collaboration across the life science value chain.

SAP provides integrated cloud-based data management and analytics solutions for life sciences to optimize R&D, supply chain, and patient engagement processes. Its Life Sciences Cloud accelerates digital transformation and enhances transparency across global operations.

- Dassault Systèmes (BIOVIA)

Dassault Systèmes, through its BIOVIA platform, delivers scientific informatics and laboratory management solutions in the cloud. It enables research teams to collaborate, model biological systems, and manage complex scientific data effectively.

DNAnexus offers a secure cloud platform for genomic data analysis and management, supporting large-scale research and clinical programs. Its platform enables collaboration among biopharma companies, academic institutions, and healthcare organizations for data-driven discoveries.

IQVIA provides cloud-based analytics, data integration, and clinical research services that help pharmaceutical and biotech companies optimize R&D and market strategies. Its extensive real-world data network and AI capabilities make it a key enabler of evidence-based research and precision medicine.

Recent Developments

- In October 2024, Honeywell and Salesforce expanded their partnership to offer a comprehensive software suite for the health sciences sector. The integrated platform combines Honeywell's TrackWise Quality software with Salesforce LSC and Agentforce.

- In September 2025, Salesforce has introduced Life Sciences Cloud, an agent-first platform that unifies teams across the clinical-to-commercial journey to accelerate patient access to therapies. The Customer Engagement module offers a secure, mobile experience for engaging healthcare professionals and improving care quality. Fidia and Pfizer will leverage the platform to streamline end-to-end engagement and speed therapies to market.

Exclusive Analysis on the Life Science Cloud Market

The global life science cloud market is a strategic inflection point, underpinned by the confluence of digital transformation, data-intensive research modalities, and regulatory modernization across the biopharmaceutical and healthcare ecosystem. As life science enterprises increasingly migrate from on-premises legacy architectures to scalable, interoperable, and compliance-embedded cloud frameworks, the market is witnessing an accelerated recalibration of R&D productivity and operational agility.

From an analyst’s perspective, the market’s growth vector is being catalyzed by exponential data proliferation in genomics, multi-omics, and real-world evidence (RWE), compelling stakeholders to adopt high-performance computational platforms capable of enabling predictive insights and precision-driven therapeutics. The integration of AI, machine learning, and advanced analytics atop cloud-native infrastructures is not merely facilitating data harmonization; it is redefining the paradigm of scientific discovery through automation, intelligent modeling, and collaborative innovation across global research networks.

Segments Covered in the Report

By Type

- Software-as-a-Service (SaaS)

- Platform-as-a-Service (PaaS)

- Infrastructure-as-a-Service (IaaS)

By Application

- Clinical Research

- Drug Discovery and Development

- Genomics & Precision Medicine

- Regulatory Compliance and Data Management

- Pharmacovigilance

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Healthcare Providers

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

-

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA