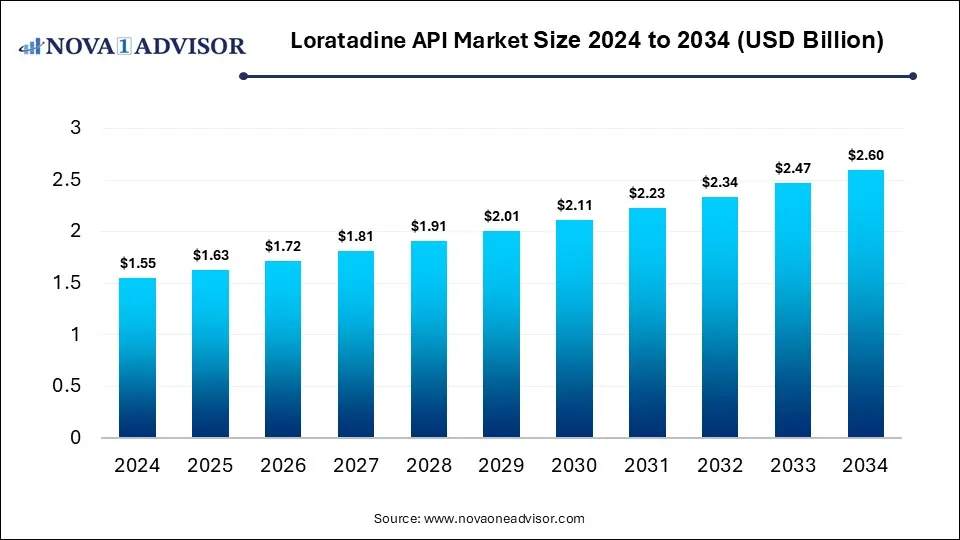

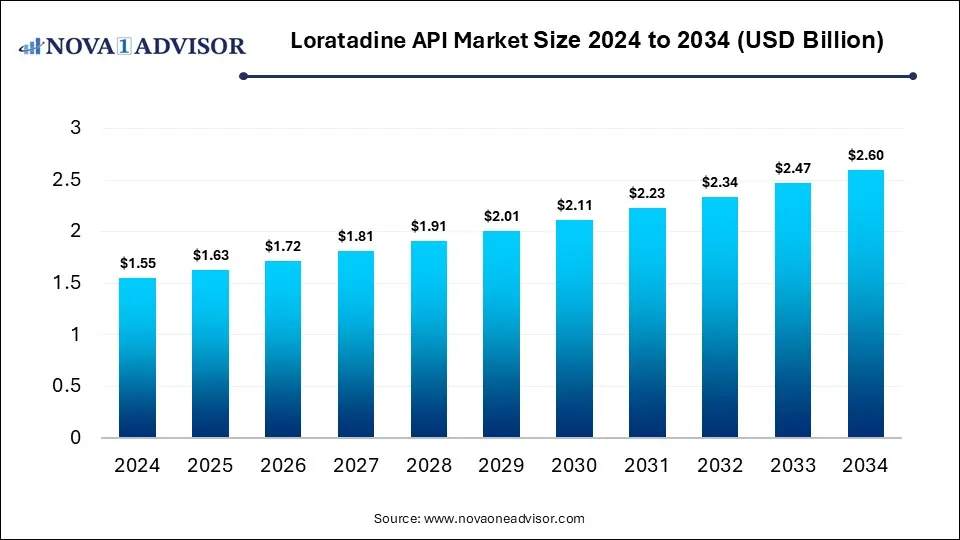

Loratadine API Market Size and Growth 2025 to 2034

The global loratadine API market size was estimated at USD 1.55 billion in 2024 and is expected to reach USD 2.60 billion in 2034, expanding at a CAGR of 5.3% during the forecast period of 2025 and 2034. The market growth is driven by rising allergy prevalence, increasing over-the-counter (OTC) drug usage, and patent expirations that are boosting generic production.

Loratadine API Market Key Takeaways

- By region, North America held the largest share of the loratadine API market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product, the powder segment led the market in 2024.

- By product, the granules segment is expected to expand at a significant CAGR over the projected timeframe.

- By purity grade, the USP standard grade segment led the market in 2024.

- By purity grade, the EP standard grade segment is expected to expand at the highest CAGR over the projection period.

- By end-user, the pharmaceutical companies segment led the market in 2024.

- By distribution channel, the direct sales segment held the dominant share in 2024

Impact of AI on the Loratadine API Market

AI is significantly impacting the market by optimizing drug manufacturing processes, improving quality control, and enhancing predictive maintenance in production facilities. Through machine learning algorithms, manufacturers can analyze large datasets to refine synthesis routes, reduce waste, and improve yield efficiency. AI is also streamlining supply chain management by forecasting demand more accurately, ensuring the timely availability of raw materials and finished APIs. Additionally, AI-driven tools are being used in R&D to accelerate formulation development and ensure regulatory compliance. These advancements are helping companies reduce costs, improve consistency, and increase scalability in loratadine API production.

Market Overview

The market growth is attributed to the rising global incidence of allergic conditions, increasing demand for over-the-counter antihistamines, and expanded access to generics in emerging markets. Additionally, strong R&D efforts and improved manufacturing capabilities are driving further market expansion. The market revolves around the production and distribution of the active pharmaceutical ingredient (API) used in loratadine-based antihistamine medications, primarily for treating allergies and hay fever. While not directly related to viral vectors or plasmid DNA, the advancements in biopharmaceutical manufacturing, including those technologies, are improving overall pharmaceutical production efficiency, including APIs, by enabling better precision, scalability, and quality control. Loratadine API benefits from these innovations through more consistent batch production and faster time-to-market for generic formulations.

What are the Major Trends in the Loratadine API Market?

- Rising Demand for Generic Antihistamines

The expiration of branded drug patents has increased the production of generic loratadine, leading to higher demand for its API. Generic formulations offer cost-effective allergy relief and are increasingly adopted in both developed and emerging markets.

- Expansion in Emerging Markets

Countries in the Asia-Pacific, Latin America, and Africa are witnessing growing cases of allergic rhinitis and seasonal allergies. Increasing healthcare access and OTC drug availability in these regions are fueling loratadine API consumption.

- Process Optimization Through AI & Automation

API manufacturers are integrating AI and automation to enhance production efficiency, reduce batch inconsistencies, and minimize manufacturing costs. These technologies are streamlining R&D and improving quality control across the supply chain.

- Increased Regulatory Scrutiny and Quality Standards

Stricter regulations from agencies like the FDA and EMA are pushing manufacturers to meet higher quality standards. This is encouraging investment in Good Manufacturing Practice (GMP) facilities and transparent supply chains.

- Shift Toward Sustainable Manufacturing

Environmental concerns and regulatory pressure are leading API producers to adopt greener synthesis methods and reduce solvent waste. This shift is particularly notable among major players focused on long-term sustainability goals.

Report Scope of Loratadine API Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.63 Billion |

| Market Size by 2034 |

USD 2.60 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product / Type / Grade, By Purity Grade, By End User, By Distribution Channel, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Rising Usage of Over-The-Counter (OTC) Drugs

A major factor driving the growth of the loratadine API market is the increasing consumer demand for accessible and affordable allergy treatments. Loratadine, being a non-sedating antihistamine with a strong safety profile, is widely available without a prescription in many countries, making it a preferred choice for self-medication. As more individuals turn to OTC options for managing common conditions like seasonal allergies and hay fever, pharmaceutical companies are boosting production of loratadine-based products, thereby increasing the need for its API. Additionally, the trend of self-care and rising health awareness further supports the consistent demand for OTC formulations.

Patent Expiry and Generic Drug Proliferation

Patent expiry and generic drug proliferation are key catalysts fueling the growth of the market. When the patent protection on branded loratadine formulations expires, it opens the market for multiple generic manufacturers to enter, significantly increasing the production and availability of cost-effective loratadine APIs. This surge in generic drug manufacturing leads to higher demand for raw APIs as companies scale up production to meet growing global consumer needs. Moreover, generics typically lower treatment costs, boosting accessibility and consumption, particularly in emerging markets, thereby driving overall market expansion. The combined effect of patent expiry and generic proliferation intensifies competitive pricing and volume growth, underpinning sustained momentum in the loratadine API sector.

Restraint

Price Pressure from Generic Competition

Market growth faces challenges due to shrinking profit margins for manufacturers. Following patent expirations, the influx of multiple generic drug producers increases supply, driving prices down and making it difficult for API manufacturers to sustain profitability. This heightened competition often compels companies to reduce production costs, potentially impacting investments in quality enhancement, innovation, and capacity expansion. Smaller and mid-sized API producers, in particular, may find it hard to compete with large-scale manufacturers offering lower prices, which can lead to industry consolidation.

Opportunities

Technological Advancements in API Manufacturing

Advances in manufacturing technologies create immense opportunities in the market by improving production efficiency, reducing costs, and enhancing product quality. Innovations such as continuous manufacturing, process automation, and advanced analytics allow manufacturers to scale operations while maintaining compliance with strict regulatory standards. These technologies also enable faster production cycles and more consistent output, which are essential in meeting the growing global demand for loratadine-based antihistamines. Moreover, the integration of green chemistry and sustainable practices helps companies reduce environmental impact, making their operations more attractive to partners and regulators. Overall, these advancements position API manufacturers to be more competitive and responsive in an increasingly dynamic pharmaceutical market.

Diversification into Combination Therapies

Growth in emerging markets is unlocking significant opportunities for the loratadine API market by expanding its use beyond standalone allergy treatments. Pharmaceutical companies are increasingly combining loratadine with other active ingredients like decongestants or corticosteroids to develop more comprehensive therapies that address multiple symptoms simultaneously, thereby appealing to a broader patient base. This trend drives increased demand for loratadine API as manufacturers create formulations tailored for complex conditions such as allergic rhinitis and chronic sinusitis. Moreover, combination products often command premium pricing and stronger market differentiation, which in turn fosters innovation and investment in loratadine API production. The proven safety and efficacy of combination therapy is unlocking new growth prospects.

- The combination of loratadine and betamethasone in an oral solution has been demonstrated to be a safe and effective initial short-term treatment for managing symptoms of severe perennial allergic rhinitis in school-aged children.

How Macroeconomic Variables Influence the Loratadine API Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth, increasing healthcare spending and improving access to medications. Higher disposable incomes enable consumers to afford allergy treatments, including OTC products containing loratadine. However, in slower-growing economies, limited healthcare budgets may restrain market expansion due to affordability challenges.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the Loratadine API market by squeezing profit margins for manufacturers and increasing costs for consumers. Rising production and raw material expenses can lead to higher API prices, which may reduce demand, especially in price-sensitive markets. Additionally, pricing pressures from payers and regulators can limit the ability of companies to pass on costs, further challenging market growth.

Exchange Rates

Exchange rate fluctuations can both positively and negatively affect. A favourable exchange rate can make exports more competitive, boosting sales for API manufacturers in international markets. Conversely, unfavourable currency shifts can increase the cost of imported raw materials or reduce profit margins, thereby restraining market growth.

Segment Outlook

Product Insights

Why Did the Powder Segment Lead the Market in 2024?

The powder segment led the loratadine API market in 2024, driven by its widespread use in manufacturing solid oral dosage forms such as tablets and capsules, which constitute the majority of loratadine-based drug formulations globally. Powder APIs offer superior ease of handling, blending, and scalability for large-volume pharmaceutical production, making them the preferred choice among generic drug manufacturers. Their compatibility with conventional processing methods and broad regulatory acceptance further reinforce their dominance across both developed and emerging markets. Additionally, the cost-effectiveness and long shelf life of powder APIs enhance their appeal for bulk procurement.

The granules segment is expected to expand at a significant CAGR in the coming years. This is mainly due to their enhanced stability, ease of handling, and superior flow properties compared to powders. Granules facilitate more efficient manufacturing processes, reduce dust generation, and improve dosing accuracy, making them highly preferred in large-scale pharmaceutical production. Additionally, granulated forms support better formulation flexibility and improved bioavailability, which are critical factors driving their increased adoption in loratadine API applications.

Purity Grade Insights

What Made USP Standard Grade the Dominant Segment in the Loratadine API Market?

The USP standard grade segment dominated the market with the largest share in 2024. This is mainly due to its widespread regulatory acceptance and consistent quality standards. These grades are mandated or preferred by major pharmaceutical companies, particularly in regulated markets such as North America and Europe, where compliance with pharmacopeial standards like USP is essential for product approval and market access. The dominance of USP-grade APIs is further driven by the growing demand for high-purity ingredients in both branded and high-volume generic drugs, especially allergy medications like loratadine. Manufacturers favor these grades because they ensure batch-to-batch consistency, reduce regulatory risks, and facilitate export readiness across multiple global markets.

The EP standard grade segment is expected to expand at the fastest CAGR during the forecast period, fueled by increasing regulatory alignment and rising demand across European and other international markets. As more pharmaceutical companies target Europe and regions accepting European Pharmacopoeia standards, the need for EP-compliant APIs has surged. This grade guarantees strict quality, safety, and consistency, making it attractive for both generic and branded drug manufacturers seeking approval in highly regulated environments. Furthermore, improving healthcare standards in emerging economies are prompting local producers to adopt EP-grade APIs to boost product credibility and enhance export potential.

End-User Insights

Why Did Pharmaceutical Companies Hold the Largest Market Share in 2024?

The pharmaceutical companies segment held the largest share of the loratadine API market in 2024, as they are the primary end-users driving large-scale demand for APIs to manufacture tablets, capsules, syrups, and other finished dosage forms. These companies supply both branded and generic loratadine medications across prescription and over-the-counter (OTC) channels, accounting for a significant portion of global API consumption. Their dominance is further reinforced by established production infrastructure, strong regulatory compliance capabilities, and extensive global distribution networks. With allergic conditions on the rise and increasing consumer preference for non-sedating antihistamines, pharmaceutical companies are scaling up production, securing bulk quantities of loratadine API to meet growing demand.

The research institutions / academia segment is expected to expand at the highest CAGR in the coming years due to increasing investments in pharmaceutical research and drug development. These institutions are actively engaged in exploring new formulations, bioequivalence studies, and novel delivery systems for loratadine, fueled by growing academic-industry collaborations and government funding aimed at advancing allergy treatment solutions. Additionally, the rising focus on generic drug development and improving production efficiencies is driving demand for high-quality APIs in research settings, further accelerating growth in this segment.

Distribution Channel Insights.

Why Did the Direct Sales Segment Lead the Market in 2024?

The direct sales segment led the loratadine API market in 2024 due to the fact that most pharmaceutical companies prefer to source APIs directly from manufacturers to ensure quality, traceability, and regulatory compliance. This direct procurement model allows for better pricing negotiations, bulk purchasing, and streamlined supply chain management, which are crucial for large-scale production of loratadine-based medications. Additionally, direct relationships with API suppliers enable manufacturers to maintain consistent product standards and respond quickly to changes in demand or regulatory requirements. With increasing scrutiny on API quality and source transparency, direct sales channels offer greater control and assurance.

The online pharmacies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the rising consumer preference for convenient, contactless access to medications. As digital health adoption increases, more patients are turning to e-pharmacies for over-the-counter allergy treatments like loratadine, driving up demand across online platforms. The expansion of e-commerce infrastructure, smartphone penetration, and supportive regulations in many countries have made it easier for consumers to purchase medications online. Additionally, online pharmacies often offer competitive pricing, home delivery, and subscription options, which enhance customer retention and recurring demand.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the loratadine API market while holding the largest share in 2024. This is primarily due to the high prevalence of allergic conditions, a well-established pharmaceutical infrastructure, and the widespread use of over-the-counter (OTC) antihistamines. Stringent regulatory standards, led by the U.S. FDA, create strong demand for high-purity APIs such as USP-grade loratadine, further reinforcing the market’s value. Major pharmaceutical companies based in the U.S. and Canada maintain consistent, large-scale production of loratadine-based medications, driving steady API procurement. Additionally, a mature healthcare system, high consumer awareness, and easy accessibility to allergy treatments via pharmacies and online channels contribute to sustained regional demand.

The U.S. is a key contributor to the North American loratadine API market, fueled by the high prevalence of seasonal allergies and robust demand for OTC antihistamines. Its well-established pharmaceutical industry, strict FDA regulations, and preference for USP-grade APIs underpin its dominant role. Moreover, the presence of leading generic drug manufacturers and advanced distribution networks supports large-scale API procurement and utilization.

- In 2021, nearly 1 in 3 U.S. adults (31.8%) and over 1 in 4 children (27.2%) reported seasonal allergies, eczema, or food allergies, totaling more than 100 million people, according to CDC data.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for loratadine API. This is due to a combination of rising allergy prevalence, expanding healthcare access, and increasing demand for affordable generic medications. Rapid urbanization and worsening air quality in countries like India and China have led to a surge in allergic conditions, boosting consumption of antihistamines such as loratadine. Additionally, the region is home to some of the world’s largest API manufacturers, supported by government initiatives to promote pharmaceutical exports and reduce dependency on imports. Growing investments in healthcare infrastructure and a rising middle-class population further fuel over-the-counter medication usage.

India is a major player in the Asia Pacific loratadine API market due to its strong pharmaceutical manufacturing base and cost-effective production capabilities. As one of the world’s largest producers and exporters of generic drugs and APIs, India benefits from a robust infrastructure, skilled workforce, and government support through initiatives like the Production-Linked Incentive (PLI) scheme. Indian manufacturers produce large volumes of loratadine API, not only for domestic use but also for export to regulated markets such as the U.S. and Europe. This combination of high production capacity, competitive pricing, and favorable regulatory environment positions India at the forefront of the regional market growth.

- The Indian government's proactive measures, such as the Production Linked Incentive (PLI) Scheme for Bulk Drugs, have catalyzed domestic API production. By March 2025, the scheme attracted investments exceeding ₹4,570 crore, leading to the establishment of production capacities for 25 critical APIs, including Loratadine.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 0.6 Million |

6.5% |

High allergy prevalence; strong OTC culture; high demand for quality / USP‑grade APIs; robust pharmaceutical infrastructure; high consumer awareness |

Regulatory costs/compliance burdens; price pressure due to generic competition; saturation in some product categories; slow growth due to maturity |

Dominant market |

| Asia Pacific |

USD 0.5 Million |

6.5% |

Rapid urbanization, rising pollution, growing allergy incidence, and expanding healthcare access |

Price sensitivity; regulatory variability across countries |

Fastest‑growing region |

| Europe |

USD 0.4 Million |

8.69% |

Stringent regulatory standards are pushing demand for EP‑grade APIs |

Regulatory complexity & approval delays; price regulation |

Significant growth |

| Latin America |

USD 0.1 Million |

6.5% |

Increasing demand due to allergy prevalence |

Limited manufacturing base; import dependence |

Steady growth |

| Middle East & Africa |

USD 0.1 Million |

0% |

Growing awareness of allergies; improving healthcare infrastructure |

Low local production capacity; regulatory challenges; import costs |

Gradual growth, with strong potential |

Loratadine API Market Value Chain Analysis

1. Raw Material Sourcing

This initial stage involves procuring the essential chemical precursors and raw materials required for synthesizing loratadine. The quality and availability of these raw materials directly impact the purity and yield of the final API, making supplier reliability critical to maintaining consistent production standards.

2. API Manufacturing

At this core stage, the loratadine active pharmaceutical ingredient is synthesized through complex chemical processes involving multiple reaction steps, purification, and quality control. Advanced manufacturing capabilities and adherence to regulatory standards such as GMP ensure high-purity APIs that meet pharmacopeial specifications (e.g., USP, EP).

3. Quality Control and Testing

Rigorous testing for identity, potency, purity, and contaminants is performed to ensure that the loratadine API complies with regulatory guidelines. This stage is essential for maintaining batch-to-batch consistency, reducing risks of recalls, and meeting the stringent requirements of pharmaceutical companies and regulatory authorities.

4. Formulation Development

Pharmaceutical manufacturers use loratadine API to develop various drug formulations such as tablets, capsules, and syrups. This stage involves blending the API with excipients, optimizing bioavailability, and ensuring stability and efficacy, thus bridging the gap between API production and finished dosage forms.

5. Packaging and Distribution

The finished API is packaged under controlled conditions to maintain stability during transportation and storage. Efficient logistics and distribution networks are vital to deliver high-quality loratadine API to pharmaceutical manufacturers worldwide, ensuring timely availability for large-scale drug production.

6. End-User (Pharmaceutical Companies)

Pharmaceutical companies, both branded and generic, represent the primary consumers of loratadine API. They drive demand through large-scale production of loratadine-based allergy medications, with a focus on regulatory compliance, market access, and meeting growing patient needs across prescription and OTC channels.

Loratadine API Market Companies and their Offering

Tier I – Market Leaders

A leading Indian manufacturer and exporter, Morepen commands a significant share of the global Loratadine API market, especially in the U.S., with strong production capacity and consistent quality.

Cadila is a major global supplier of Loratadine API, leveraging its extensive manufacturing infrastructure and regulatory approvals to serve international markets.

Ultratech is recognized for producing high-quality Loratadine API with a growing export footprint across regulated markets.

Hetero has a robust API production line, including Loratadine, serving both domestic and international generic pharmaceutical companies.

As a global pharmaceutical giant, Mylan has a strong presence in the generic API market, contributing substantial volumes of Loratadine API worldwide.

- Changzhou Yabang Pharmaceutical Co., Ltd.

This Chinese company is a key manufacturer with sizable production of Loratadine API, primarily serving Asian and emerging markets.

- Shaanxi Hanjiang Pharmaceutical Group

Shaanxi Hanjiang plays a critical role in Loratadine API supply in China and other Asian countries, with growing international exports.

Tier II – Established Regional Players

- Teva Pharmaceutical Industries Ltd.

Teva is a global leader in generic pharmaceuticals, providing Loratadine API mainly for its generic product lines distributed worldwide.

Bayer leverages its strong brand and R&D capabilities to maintain a steady supply of Loratadine API for its OTC antihistamine products.

Marksans contributes to the Loratadine API market primarily in India and select international markets, focusing on cost-effective production.

Wockhardt supplies Loratadine API with a focus on compliance and quality, catering to regulated markets.

Aurobindo has expanded its Loratadine API production to support its global generic drug portfolio, serving multiple international clients.

Tier III – Emerging and Niche Players

Lannett provides niche volumes of Loratadine API primarily to U.S. pharmaceutical manufacturers, focusing on specialized formulations.

Bionpharma serves a smaller segment of the market with Loratadine API, targeting niche clients requiring customized solutions.

Perrigo, known for OTC products, sources and supplies Loratadine API to support its portfolio of allergy medications.

- Taro Pharmaceutical Industries Ltd.

Taro contributes Loratadine API mostly for its generic product lines, with a focus on North American markets.

PD Partners is an emerging Indian API supplier with a growing footprint in Loratadine production catering to regional pharmaceutical companies.

- Lohitha Lifesciences Pvt Ltd

Lohitha is a niche manufacturer focused on serving smaller markets with specialized Loratadine API products.

| Tier |

Company Examples |

Estimated Market Share |

| I |

Morepen Laboratories, Cadila Pharmaceuticals, Ultratech India, Hetero Drugs, Mylan, Changzhou Yabang, Shaanxi Hanjiang |

80–85% |

| II |

Teva, Bayer, Marksans Pharma, Wockhardt Bio Ag, Aurobindo Pharma |

15–20% |

| III |

Lannett, Bionpharma, Perrigo, Taro, PD Partners, Lohitha Lifesciences |

1–2% |

Recent Developments

- In April 2025, Morepen Laboratories received approval from China’s NMPA (CDE) for its loratadine API, enabling entry into the large Chinese pharma market. The company holds over 80% of the U.S. generics loratadine market and has exported to the U.S. for 25+ years, with API exports valued at ₹650 crore. Loratadine is a widely used second-generation antihistamine for allergic conditions.

- In November 2024, Marksans Pharma received final approval from the U.S. Food and Drug Administration (FDA) for its generic version of loratadine tablets. This 10 mg over-the-counter (OTC) product is used for treating allergic rhinitis and is a generic equivalent of Bayer Healthcare's Claritin.

Expert Analysis on the Loratadine API Market

The loratadine API market is poised for substantial growth driven by escalating global prevalence of allergic disorders and a sustained shift towards second-generation antihistamines due to their favorable safety and efficacy profiles. The expanding patient base for chronic urticaria, allergic rhinitis, and other hypersensitivity conditions underpins robust demand trajectories. Furthermore, the growing penetration of generic pharmaceuticals, particularly in emerging economies, catalyzes market expansion by enhancing drug affordability and accessibility.

Strategically, regulatory approvals, such as Morepen Laboratories’ recent clearance by China’s NMPA, underscore burgeoning opportunities for manufacturers to consolidate market share within high-growth regions. The increasing emphasis on cost-effective API sourcing, coupled with supply chain optimization and geographical diversification, provides incumbents and new entrants with avenues to bolster competitive advantage.

Moreover, advancements in API manufacturing technologies and process efficiencies present substantial potential for margin enhancement and capacity augmentation. The ongoing trend of outsourcing API production by global pharma players to specialized contract manufacturers further amplifies market growth prospects.

Nevertheless, evolving regulatory landscapes necessitate vigilant compliance strategies, while patent expirations across various markets unlock latent generic opportunities. Collectively, these dynamics render the Loratadine API market a fertile domain for investment and innovation, with significant upside potential over the medium to long term.

Segments Covered in the Report

By Product / Type / Grade

- Powder

- Granules

- Other physical forms

By Purity Grade

- USP Standard Grade

- EP Standard Grade

- Medicine Standard Grade / Other grades

By End User

- PharmaceuticalCcompanies

- Contract Manufacturing Organisations (CMOs)

- Research Institutions / Academia

- Hospitals / Clinics

- Retail Pharmacies / OTC channels

By Distribution Channel

- Direct sales

- Wholesalers / Distributors

- Online Pharmacies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Loratadine API Market Size (USD Billion) by Product/Type/Grade, 2024–2034

- Table 2: Global Loratadine API Market Size (USD Billion) by Purity Grade, 2024–2034

- Table 3: Global Loratadine API Market Size (USD Billion) by End User, 2024–2034

- Table 4: Global Loratadine API Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 5: North America Market Size (USD Billion) by Product/Type/Grade, 2024–2034

- Table 6: North America Market Size (USD Billion) by Purity Grade, 2024–2034

- Table 7: North America Market Size (USD Billion) by End User, 2024–2034

- Table 8: North America Market Size (USD Billion) by Distribution Channel, 2024–2034

- Table 9: U.S. Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 10: Canada Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 11: Mexico Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 12: Europe Market Size (USD Billion) by Product/Type/Grade, 2024–2034

- Table 13: Europe Market Size (USD Billion) by Purity Grade, 2024–2034

- Table 14: Germany Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 15: France Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 16: UK Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 17: Italy Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 18: Asia Pacific Market Size (USD Billion) by Product/Type/Grade, 2024–2034

- Table 19: Asia Pacific Market Size (USD Billion) by Purity Grade, 2024–2034

- Table 20: China Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 21: Japan Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 22: India Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 23: South Korea Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 24: Southeast Asia Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 25: Latin America Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 26: Brazil Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 27: Middle East & Africa Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 28: GCC Countries Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 29: Turkey Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

- Table 30: Africa Market Size (USD Billion) by Product/Type/Grade, Purity Grade & End User, 2024–2034

List of Figures

- Figure 1: Global Market Share by Product/Type/Grade, 2024

- Figure 2: Global Market Share by Purity Grade, 2024

- Figure 3: Global Market Share by End User, 2024

- Figure 4: Global Market Share by Distribution Channel, 2024

- Figure 5: North America Market Share by Product/Type/Grade, 2024

- Figure 6: North America Market Share by Purity Grade, 2024

- Figure 7: North America Market Share by End User, 2024

- Figure 8: North America Market Share by Distribution Channel, 2024

- Figure 9: U.S. Market Share by Product/Type/Grade, 2024

- Figure 10: U.S. Market Share by Purity Grade, 2024

- Figure 11: U.S. Market Share by End User, 2024

- Figure 12: U.S. Market Share by Distribution Channel, 2024

- Figure 13: Canada Market Share by Product/Type/Grade, 2024

- Figure 14: Canada Market Share by Purity Grade, 2024

- Figure 15: Canada Market Share by End User, 2024

- Figure 16: Canada Market Share by Distribution Channel, 2024

- Figure 17: Mexico Market Share by Product/Type/Grade, 2024

- Figure 18: Mexico Market Share by Purity Grade, 2024

- Figure 19: Mexico Market Share by End User, 2024

- Figure 20: Mexico Market Share by Distribution Channel, 2024

- Figure 21: Europe Market Share by Product/Type/Grade, 2024

- Figure 22: Europe Market Share by Purity Grade, 2024

- Figure 23: Germany Market Share by Product/Type/Grade, 2024

- Figure 24: Germany Market Share by Purity Grade, 2024

- Figure 25: France Market Share by Product/Type/Grade, 2024

- Figure 26: France Market Share by Purity Grade, 2024

- Figure 27: UK Market Share by Product/Type/Grade, 2024

- Figure 28: UK Market Share by Purity Grade, 2024

- Figure 29: Italy Market Share by Product/Type/Grade, 2024

- Figure 30: Italy Market Share by Purity Grade, 2024

- Figure 31: Asia Pacific Market Share by Product/Type/Grade, 2024

- Figure 32: Asia Pacific Market Share by Purity Grade, 2024

- Figure 33: China Market Share by Product/Type/Grade, 2024

- Figure 34: China Market Share by Purity Grade, 2024

- Figure 35: Japan Market Share by Product/Type/Grade, 2024

- Figure 36: Japan Market Share by Purity Grade, 2024

- Figure 37: India Market Share by Product/Type/Grade, 2024

- Figure 38: India Market Share by Purity Grade, 2024

- Figure 39: South Korea Market Share by Product/Type/Grade, 2024

- Figure 40: South Korea Market Share by Purity Grade, 2024

- Figure 41: Southeast Asia Market Share by Product/Type/Grade, 2024

- Figure 42: Southeast Asia Market Share by Purity Grade, 2024

- Figure 43: Latin America Market Share by Product/Type/Grade, 2024

- Figure 44: Latin America Market Share by Purity Grade, 2024

- Figure 45: Brazil Market Share by Product/Type/Grade, 2024

- Figure 46: Brazil Market Share by Purity Grade, 2024

- Figure 47: Middle East & Africa Market Share by Product/Type/Grade, 2024

- Figure 48: Middle East & Africa Market Share by Purity Grade, 2024

- Figure 49: GCC Countries Market Share by Product/Type/Grade, 2024

- Figure 50: GCC Countries Market Share by Purity Grade, 2024

- Figure 51: Turkey Market Share by Product/Type/Grade, 2024

- Figure 52: Turkey Market Share by Purity Grade, 2024

- Figure 53: Africa Market Share by Product/Type/Grade, 2024

- Figure 54: Africa Market Share by Purity Grade, 2024